Home>Finance>How Do I Activate The Dividend Reinvestment On My Fraction Of Stocks In Fidelity?

Finance

How Do I Activate The Dividend Reinvestment On My Fraction Of Stocks In Fidelity?

Published: January 19, 2024

Learn how to activate dividend reinvestment on your fraction of stocks in Fidelity and maximize your investment returns. Get expert advice on finance and wealth management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Dividend Reinvestment

- Benefits of Dividend Reinvestment

- Activating Dividend Reinvestment on Fractional Stocks in Fidelity

- Step 1: Logging into your Fidelity Account

- Step 2: Navigating to the Fractional Share Positions

- Step 3: Selecting the Stock Position for Dividend Reinvestment

- Step 4: Enabling Dividend Reinvestment

- Step 5: Confirming Dividend Reinvestment Settings

- Conclusion

Introduction

Welcome to the world of investing! If you are a Fidelity customer and have recently acquired fractional shares of stocks, you might be wondering how to make the most of your investment. One strategy to consider is dividend reinvestment. Dividend reinvestment allows you to automatically use the dividends earned from your stocks to purchase additional shares, thus increasing your overall holdings.

In this article, we will guide you through the process of activating dividend reinvestment on your fraction of stocks in Fidelity. We will explain the benefits of dividend reinvestment and provide step-by-step instructions on how to enable this feature in your Fidelity account.

Dividend reinvestment can be a powerful wealth-building tool. Not only does it provide a convenient way to reinvest your earnings, but it also helps to compound your investment returns over time. By reinvesting dividends, you can potentially accelerate the growth of your portfolio and develop a more robust financial future.

So, whether you are new to investing or simply looking to optimize your portfolio, read on to discover how you can activate the dividend reinvestment feature on your fraction of stocks in Fidelity.

Understanding Dividend Reinvestment

Before we dive into the specific steps of activating dividend reinvestment, let’s take a moment to understand what it means and how it can benefit you as an investor.

Dividend reinvestment is a process where the dividends earned from your stocks are used to automatically purchase additional shares of the same stock or other investments. Instead of receiving the dividends in cash, they are reinvested back into your portfolio. This process is typically offered by brokerage firms like Fidelity as a convenient and automatic way to reinvest your earnings.

One of the major benefits of dividend reinvestment is the power of compounding. When you reinvest your dividends, you purchase more shares, and as a result, the potential for future dividends increases. Over time, this compounding effect can significantly boost your overall investment returns.

Another advantage of dividend reinvestment is the ability to accumulate more shares without incurring additional transaction fees. Since the dividends are reinvested directly into your existing holdings, you bypass the need to make separate purchases, saving on trading costs.

Furthermore, dividend reinvestment provides a disciplined approach to investing. By automatically reinvesting your dividends, you remove the temptation to spend the cash on other expenses. This helps to foster a long-term investment mindset and can lead to greater wealth accumulation.

It is important to note that dividend reinvestment is not without its drawbacks. One potential downside is the lack of diversification. By reinvesting dividends back into the same stock, you may be exposing yourself to concentration risk. Additionally, dividend reinvestment does not guarantee profits, and the value of your investments can still fluctuate based on market conditions.

Now that you have a better understanding of dividend reinvestment and its benefits, let’s move on to the specific steps of activating this feature on your fraction of stocks in Fidelity.

Benefits of Dividend Reinvestment

Dividend reinvestment can offer several advantages for investors. Let’s explore some of the key benefits that this strategy provides:

- Compounded Returns: One of the primary benefits of dividend reinvestment is the power of compounding. By reinvesting your dividends, you can purchase additional shares of the stock, which in turn can generate more dividends. Over time, this compounding effect can significantly boost your overall investment returns.

- Increased Portfolio Value: Dividend reinvestment helps to build wealth by increasing the value of your portfolio. The additional shares acquired through reinvestment contribute to the overall growth of your holdings. This can be particularly beneficial for long-term investors looking to build substantial wealth over time.

- Cost Savings: Dividend reinvestment allows you to acquire more shares without incurring additional transaction costs. Rather than making separate purchases, the dividends are automatically reinvested into the stock or investment, saving you money on commissions and fees.

- Convenience and Automation: Dividend reinvestment is a convenient and automated way to reinvest your earnings. Once you enable this feature, you don’t have to worry about manually reinvesting dividends or deciding where to allocate the funds. It is a hands-off approach that streamlines the investment process.

- Disciplined Investing: By reinvesting dividends, you adopt a disciplined approach to investing. It eliminates the temptation to spend the cash on other expenses and encourages a long-term investment mindset. This can help you stay focused on your financial goals and potentially generate greater wealth accumulation.

While dividend reinvestment offers numerous benefits, it’s important to consider your individual investment goals and risk tolerance. This strategy may not be suitable for every investor, particularly those seeking immediate income. It’s always advisable to consult with a financial advisor or do thorough research before implementing any investment strategy.

Now that we have explored the benefits of dividend reinvestment, let’s move forward and learn how to activate this feature on your fraction of stocks in Fidelity.

Activating Dividend Reinvestment on Fractional Stocks in Fidelity

Now that you understand the benefits of dividend reinvestment, let’s dive into the process of activating this feature on your fraction of stocks in Fidelity.

Before proceeding, ensure that you have an active Fidelity account and have already acquired fractional shares of stocks. Once you have met these requirements, follow the step-by-step guide below:

- Step 1: Logging into your Fidelity account: Visit the Fidelity website and log in to your account using your username and password. If you don’t have an account, you will need to create one.

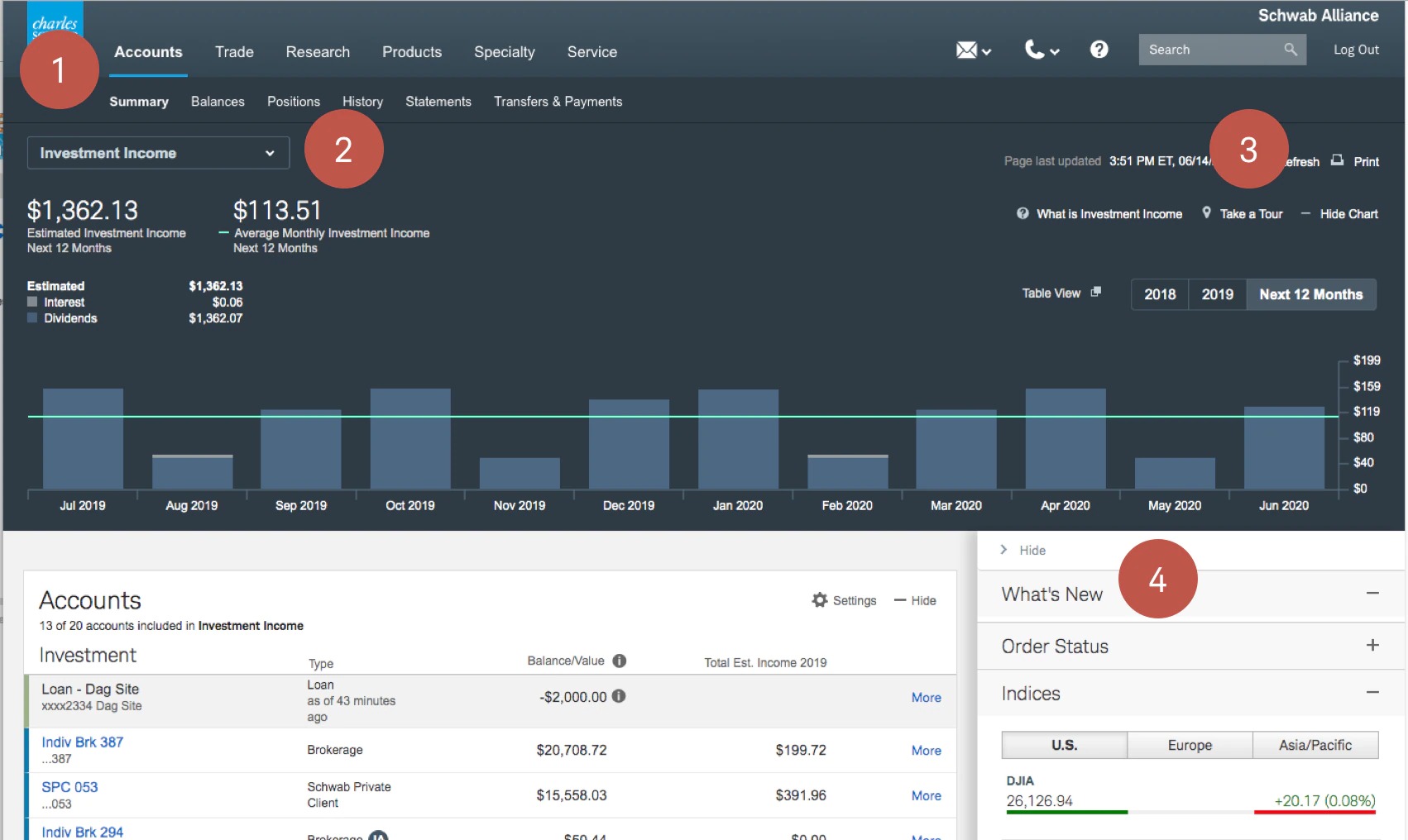

- Step 2: Navigating to the Fractional Share Positions: Once you are logged in, navigate to your account summary page. Look for the section that displays your investment positions and locate the fractional share position on which you wish to activate dividend reinvestment.

- Step 3: Selecting the Stock Position for Dividend Reinvestment: Click on the fractional share position you want to enable dividend reinvestment for. This will take you to a detailed view of that stock’s position.

- Step 4: Enabling Dividend Reinvestment: On the detailed view page, look for the option to enable dividend reinvestment for that specific stock. It may be labeled as “Dividend Reinvestment” or “DRIP” (Dividend Reinvestment Plan). Toggle the switch or check the box next to the option to activate dividend reinvestment.

- Step 5: Confirming Dividend Reinvestment Settings: Once you have enabled dividend reinvestment, review your settings to ensure accuracy. Verify that the selected stock position and any associated instructions or preferences are correctly reflected.

Once you have completed these steps, you have successfully activated dividend reinvestment on your fraction of stocks in Fidelity. The dividends earned from the selected stock will now be automatically reinvested into additional shares of the same stock.

Remember, dividend reinvestment is not an immediate process, and it may take some time for the dividends to be reinvested and reflected in your account. Monitor your account periodically to track the dividends and the subsequent reinvestment.

It’s worth mentioning that not all stocks or investments may be eligible for dividend reinvestment. In some cases, the company may not offer a dividend reinvestment plan or the dividends may be paid in cash only. If you have any questions about the eligibility or process, reach out to Fidelity’s customer support for assistance.

Now that you know how to activate dividend reinvestment on your fraction of stocks in Fidelity, you can harness the power of compounding and potentially accelerate the growth of your investment portfolio.

Step 1: Logging into your Fidelity Account

The first step to activate dividend reinvestment on your fraction of stocks in Fidelity is to log into your Fidelity account. Follow the instructions below:

- Open a web browser and navigate to the Fidelity website.

- Click on the “Log In” button located at the top right corner of the homepage.

- Enter your Fidelity username and password in the designated fields.

- If desired, you can select the option to save your username for future logins by clicking on the checkbox next to “Save Username.” This can help streamline future logins and provide convenience.

- Once you have entered your login credentials, click on the “Log In” button to access your Fidelity account.

Make sure to verify that you have entered your username and password correctly to ensure a successful login. If you encounter any issues during the login process, double-check your credentials or use the “Forgot Username” or “Forgot Password” options to reset your account access.

Remember to keep your username and password confidential and avoid sharing them with anyone. This will help protect the security of your Fidelity account and ensure that only authorized individuals can access your investment information.

Logging into your Fidelity account is the first step towards activating dividend reinvestment on your fraction of stocks. Once logged in, you can proceed to the next steps and navigate to the appropriate sections within your account to complete the process.

Now that you have successfully logged into your Fidelity account, let’s move on to the next step: navigating to the fractional share positions.

Step 2: Navigating to the Fractional Share Positions

After logging into your Fidelity account, the next step in activating dividend reinvestment for your fraction of stocks is to navigate to the fractional share positions. Follow the instructions below:

- Once you are logged into your Fidelity account, you will be directed to the account summary page. This page provides an overview of your investment portfolio.

- Look for the section that displays your investment positions. It may be labeled as “Positions,” “Holdings,” or something similar.

- Within the Positions section, locate the fractional share position you wish to enable dividend reinvestment for. This will generally be listed as the stock symbol along with the fractional share quantity you own.

- Click on the fractional share position to access a more detailed view of that specific stock’s position.

By following these steps, you will be able to navigate to the specific fractional share position you want to enable dividend reinvestment for. This allows you to access the necessary settings to activate dividend reinvestment on that particular stock.

It’s important to note that the layout and organization of Fidelity’s platform may vary slightly depending on the version or interface you are using. If you encounter any difficulties in locating the fractional share positions or need further assistance, you can refer to Fidelity’s help center or contact their customer support for guidance.

Once you have successfully navigated to the fractional share position in your Fidelity account, you can proceed to the next step: selecting the stock position for dividend reinvestment.

Step 3: Selecting the Stock Position for Dividend Reinvestment

After navigating to the fractional share position in your Fidelity account, the next step in activating dividend reinvestment is to select the specific stock position for this feature. Follow the instructions below:

- On the detailed view page of the fractional share position you accessed in the previous step, you will find information about the stock, including its performance, dividend history, and any current dividend settings.

- Review the details of the fractional share position to ensure that it is the correct stock you wish to enable dividend reinvestment for. Take note of the stock symbol, company name, and any other relevant information.

- Next, locate the option to enable dividend reinvestment for that specific stock. This option may be labeled as “Dividend Reinvestment” or “DRIP” (Dividend Reinvestment Plan).

- Often, there will be a toggle switch or a checkbox next to the dividend reinvestment option. Click on the switch or check the box to activate dividend reinvestment for the selected stock.

- As you enable dividend reinvestment, you may also have the option to specify any instructions or preferences related to how the dividends should be reinvested, such as purchasing partial shares or specific allocation percentages. Follow the on-screen prompts or refer to the Fidelity platform guidelines to customize these settings if available.

By following these steps, you will be able to select the stock position in your Fidelity account for dividend reinvestment. Make sure to double-check that you have chosen the correct stock and review any additional settings or preferences associated with dividend reinvestment.

It’s important to note that not all stocks or investments may be eligible for dividend reinvestment. Some stocks may not offer a dividend reinvestment plan, or the dividends may be paid in cash only. If you have any questions about the eligibility or availability of dividend reinvestment for a particular stock, you can reach out to Fidelity’s customer support for clarification.

Now that you have successfully chosen the stock position for dividend reinvestment, we can proceed to the next step: enabling dividend reinvestment.

Step 4: Enabling Dividend Reinvestment

After selecting the stock position for dividend reinvestment in your Fidelity account, the next step is to enable this feature. Follow the instructions below to activate dividend reinvestment:

- On the detailed view page of the fractional share position you accessed earlier, locate the option to enable dividend reinvestment for the selected stock. It may be labeled as “Dividend Reinvestment” or “DRIP” (Dividend Reinvestment Plan).

- Once you have found the dividend reinvestment option, enable it by toggling the switch or checking the box next to the feature. This signifies your decision to reinvest the dividends earned from the selected stock position.

- If prompted, review and select any additional preferences or settings associated with dividend reinvestment. This might include instructions on purchasing partial shares or specifying allocation percentages.

- Ensure that all the information and settings you have chosen are correct before proceeding to the next step.

- Double-check the terms and conditions, if applicable, and confirm that you understand the implications and functionality of dividend reinvestment.

By following these steps, you will successfully enable dividend reinvestment on the selected stock position. As a result, any dividends that the stock earns will be automatically reinvested into additional shares of the same stock.

It’s important to note that the activation of dividend reinvestment may take some time to reflect in your account. Additionally, keep in mind that not all stocks may be eligible for dividend reinvestment. Some companies may not offer this feature, or their dividends may be paid out only in cash. If you have any questions or concerns about the eligibility or availability of dividend reinvestment, you can reach out to Fidelity’s customer support for further assistance.

Now that you have successfully enabled dividend reinvestment, let’s move on to the final step: confirming your dividend reinvestment settings.

Step 5: Confirming Dividend Reinvestment Settings

After enabling dividend reinvestment for your selected stock position in your Fidelity account, the final step is to confirm your dividend reinvestment settings. Follow the instructions below to ensure that your settings are accurate:

- Review the dividend reinvestment confirmation page or section that appears after enabling the feature. This page will provide you with a summary of the stock position you have chosen for dividend reinvestment and any associated instructions or preferences.

- Check the stock symbol, company name, and any other relevant details to verify that you have selected the correct position.

- Review the instructions or preferences you have set for dividend reinvestment, such as partial share purchases or allocation percentages. Ensure that these settings align with your investment goals and preferences.

- If desired, take the opportunity to make any necessary adjustments or modifications to your dividend reinvestment settings. This might include changing the allocation percentages or updating other instructions.

- Once you have reviewed and confirmed the dividend reinvestment settings, click on the “Confirm” button or any similar prompt to finalize your choices.

By completing these steps, you will have successfully confirmed your dividend reinvestment settings. This ensures that the dividends earned from the selected stock position will be reinvested according to your preferences.

It’s important to remember that dividend reinvestment is a long-term strategy, and the effects may not be immediately noticeable. It takes time for dividends to accumulate and be reinvested into additional shares. Therefore, it is recommended to periodically review and monitor your dividend reinvestment activity to track the progress and growth of your investment portfolio.

If you ever need to make changes or adjustments to your dividend reinvestment settings or if you have any questions or concerns, don’t hesitate to contact Fidelity’s customer support for assistance. They will be able to provide you with the necessary guidance and support.

Congratulations! You have successfully completed all the steps to activate dividend reinvestment on your fraction of stocks in Fidelity. Now you can enjoy the potential benefits of compounding returns and watch your investment portfolio grow over time.

Conclusion

Activating dividend reinvestment on your fraction of stocks in Fidelity can be a smart move to maximize the potential of your investments. By automatically reinvesting your dividends, you can benefit from the power of compounding returns, increase the value of your portfolio, and save on transaction costs.

We began by understanding the concept of dividend reinvestment and its benefits. Dividend reinvestment allows you to reinvest your earnings back into your portfolio, fostering long-term growth and wealth accumulation. It offers compounded returns, increased portfolio value, cost savings, convenience, and a disciplined approach to investing.

We then provided a step-by-step guide on how to activate dividend reinvestment in your Fidelity account specifically for fractional share positions. Starting with logging into your Fidelity account, navigating to the fractional share positions, selecting the stock position for dividend reinvestment, enabling dividend reinvestment, and confirming your settings, we walked you through the process to ensure a seamless experience.

Remember, while dividend reinvestment can be a powerful strategy, it may not be suitable for all investors or all stocks. Consider your investment goals, risk tolerance, and conduct thorough research before implementing any investment strategy.

As you embark on your journey of dividend reinvestment, periodically review your account, monitor the progress of your reinvested dividends, and stay informed about the performance of your investments. If you have any questions or need assistance, Fidelity’s customer support is available to help you.

By activating dividend reinvestment, you are taking a proactive step towards building wealth and achieving your financial goals. Enjoy the potential returns and the satisfaction of watching your portfolio grow over time. Happy investing!