Finance

How To Reinvest Dividends With TD Ameritrade

Published: January 3, 2024

Learn how to reinvest dividends and maximize your investment growth with TD Ameritrade. Take control of your finances and start investing wisely today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Dividends

- Reinvesting Dividends with TD Ameritrade

- Step 1: Setting up a Dividend Reinvestment Plan (DRIP) Account

- Step 2: Enrolling in the DRIP Program

- Step 3: Selecting the Dividend-Reinvestable Stocks

- Step 4: Confirming the Reinvestment Preferences

- Step 5: Monitoring and Managing Dividend Reinvestments

- Advantages of Reinvesting Dividends with TD Ameritrade

- Considerations and Risks

- Conclusion

Introduction

When it comes to investing, one strategy that can help boost your long-term returns is reinvesting dividends. Dividends are a share of a company’s profits that are distributed to its shareholders. By choosing to reinvest these dividends, you can potentially unlock the power of compound interest and accelerate the growth of your investment portfolio.

TD Ameritrade, a leading online brokerage platform, offers investors the opportunity to reinvest dividends through their Dividend Reinvestment Plan (DRIP). This allows investors to automatically use their dividend payments to purchase additional shares of stock in the same company, rather than receiving the dividends in cash.

In this article, we will explore how you can leverage TD Ameritrade’s DRIP program to reinvest dividends and maximize the growth potential of your investments. We will walk through the steps to set up a DRIP account, enroll in the program, select the dividend-reinvestable stocks, and manage the reinvestment preferences. We will also discuss the benefits of reinvesting dividends with TD Ameritrade and important considerations to keep in mind.

So, whether you’re new to investing or a seasoned investor, read on to discover how you can make the most of your dividend payments by reinvesting them with TD Ameritrade.

Understanding Dividends

Before we dive into how to reinvest dividends with TD Ameritrade, it’s important to have a solid understanding of what dividends are and how they work. Dividends are a portion of a company’s profits that are distributed to its shareholders as a way to reward them for their investment in the company.

Dividends are typically paid out on a regular basis, such as quarterly or annually, and are often expressed as a certain amount per share. For example, if a company pays a dividend of $0.50 per share and you own 100 shares, you would receive a dividend payment of $50.

Dividends can be a valuable source of income for investors, especially those who are seeking a steady stream of cash flow. However, instead of using the dividend payments for personal expenses, reinvesting dividends can be a powerful strategy to potentially increase the value of your investment over time.

By reinvesting dividends, you effectively use the dividend payments to purchase additional shares of stock in the same company. This not only increases your overall share ownership, but it also allows you to take advantage of the power of compound interest. Over time, as you continue to reinvest dividends, your investment can grow exponentially.

It’s important to note that not all companies pay dividends. Some companies, especially those in growth industries, may reinvest their profits back into the business instead of distributing them to shareholders. Therefore, if you’re specifically looking for dividend-paying stocks, make sure to do your research and look for companies with a history of consistent dividend payments and a strong financial track record.

In the next section, we will explore how you can leverage TD Ameritrade’s DRIP program to reinvest dividends and make the most of your investment strategy.

Reinvesting Dividends with TD Ameritrade

TD Ameritrade offers investors a convenient and straightforward way to reinvest dividends through their Dividend Reinvestment Plan (DRIP). This program allows you to automatically reinvest your dividend payments by purchasing additional shares of stock in the same company, rather than receiving the dividends in cash.

Here are the steps to follow to reinvest dividends with TD Ameritrade:

- Step 1: Setting up a Dividend Reinvestment Plan (DRIP) Account: Before you can start reinvesting dividends, you need to have a TD Ameritrade brokerage account. If you don’t have one, you can easily open an account online.

- Step 2: Enrolling in the DRIP Program: Once you have a TD Ameritrade brokerage account, you’ll need to enroll in the DRIP program. This can be done by contacting TD Ameritrade’s customer service or through the online account portal. You may need to provide some basic information and agree to the terms and conditions of the DRIP program.

- Step 3: Selecting the Dividend-Reinvestable Stocks: After enrolling in the DRIP program, you’ll have the option to choose which stocks in your portfolio you want to reinvest dividends. You can select specific stocks or opt to reinvest dividends across all eligible stocks in your account.

- Step 4: Confirming the Reinvestment Preferences: Once you have chosen the dividend-reinvestable stocks, you’ll need to confirm your reinvestment preferences. This includes specifying whether you want fractional shares or whole shares, and any other customization options offered by TD Ameritrade.

- Step 5: Monitoring and Managing Dividend Reinvestments: Once you’re enrolled in the DRIP program, TD Ameritrade will handle the reinvestment process for you automatically. You can continue to monitor and manage your investments through your TD Ameritrade account, keeping track of the dividends earned and the additional shares acquired through reinvestment.

By following these steps, you can take advantage of TD Ameritrade’s DRIP program to reinvest your dividends and potentially accelerate the growth of your investment portfolio.

Next, we will explore the advantages of reinvesting dividends with TD Ameritrade and why it can be a beneficial strategy for long-term investors.

Step 1: Setting up a Dividend Reinvestment Plan (DRIP) Account

In order to reinvest dividends with TD Ameritrade, the first step is to set up a Dividend Reinvestment Plan (DRIP) account. If you already have a TD Ameritrade brokerage account, you’re already one step ahead. If not, you can easily open a brokerage account with TD Ameritrade online.

Here’s how you can set up a DRIP account:

- 1.1 Visit the TD Ameritrade website: Go to the TD Ameritrade website and click on the “Open new account” button. Follow the prompts to create your account, providing the necessary personal information such as your name, address, and social security number.

- 1.2 Choose the type of account: Select the type of account you want to open. TD Ameritrade offers various types of accounts including individual brokerage accounts, joint accounts, retirement accounts, and more. Choose the type of account that aligns with your investment goals and objectives.

- 1.3 Fund your account: Once you’ve selected the account type, you’ll need to fund your account. TD Ameritrade provides multiple options for funding, including electronic bank transfers, wire transfers, and check deposits. Choose the method that is most convenient for you and follow the instructions provided.

- 1.4 Complete the necessary paperwork: As part of the account setup process, you may be required to complete additional paperwork. This could include signing account agreements, tax forms, or other documents. Make sure to carefully review and fill out any required forms to ensure a smooth account setup process.

- 1.5 Verify your identity: To open a brokerage account, you’ll need to verify your identity. TD Ameritrade may require you to provide identification documents such as a driver’s license or passport. Follow the instructions provided by TD Ameritrade to complete the identity verification process.

Once you’ve completed these steps, your TD Ameritrade brokerage account will be set up and ready for dividend reinvestment. You can move on to the next step of enrolling in the DRIP program and selecting the dividend-reinvestable stocks.

It’s important to note that setting up a DRIP account with TD Ameritrade is subject to eligibility requirements and any fees or restrictions imposed by the brokerage. Make sure to familiarize yourself with the terms and conditions of the DRIP program before proceeding.

Now that you have a DRIP account with TD Ameritrade, let’s move on to step two – enrolling in the DRIP program.

Step 2: Enrolling in the DRIP Program

Once you have set up a Dividend Reinvestment Plan (DRIP) account with TD Ameritrade, the next step is to enroll in the DRIP program. Enrolling in the program will allow you to automatically reinvest your dividend payments.

Here’s how you can enroll in the DRIP program with TD Ameritrade:

- 2.1 Contact TD Ameritrade’s customer service: The first option to enroll in the DRIP program is to contact TD Ameritrade’s customer service. You can do this by phone, email, or through their online chat support. Simply inform them that you would like to enroll in the DRIP program and they will guide you through the process.

- 2.2 Use the online account portal: Alternatively, you can enroll in the DRIP program through TD Ameritrade’s online account portal. Log in to your account and navigate to the DRIP section. Follow the instructions provided to enroll in the program.

- 2.3 Provide necessary information: Whether you choose to contact customer service or use the online portal, you may need to provide some information to complete the enrollment process. This could include your account details, investor identification information, and any other necessary documentation.

Once you have completed the enrollment process, you will be officially enrolled in TD Ameritrade’s DRIP program. This means that any eligible dividends received in your account will be automatically reinvested into additional shares of the same company’s stock.

It’s important to note that not all stocks are eligible for the DRIP program, and eligibility requirements can vary. Some stocks may require a minimum number of shares or a minimum dividend payment threshold to be eligible for reinvestment. TD Ameritrade will provide you with information regarding the eligibility of specific stocks in your portfolio.

By enrolling in the DRIP program, you can take advantage of the power of compounding and potentially accelerate the growth of your investments. In the next step, we will explore how to select the dividend-reinvestable stocks in your TD Ameritrade account.

Step 3: Selecting the Dividend-Reinvestable Stocks

After enrolling in TD Ameritrade’s Dividend Reinvestment Plan (DRIP) program, the next step is to choose the dividend-reinvestable stocks in your portfolio. These are the stocks for which you want to automatically reinvest the dividends.

Here’s how you can select the dividend-reinvestable stocks with TD Ameritrade:

- 3.1 Access your TD Ameritrade account: Log in to your TD Ameritrade brokerage account using your login credentials. Navigate to the account dashboard or investment portfolio section.

- 3.2 Identify dividend-paying stocks: Take a look at your investment portfolio and identify the stocks that pay dividends. These are typically established companies with a history of consistently distributing dividends to their shareholders.

- 3.3 Check dividend eligibility: Verify the eligibility of each stock for the DRIP program. TD Ameritrade will provide information on whether each stock is eligible for dividend reinvestment. Keep in mind that not all stocks may be eligible, so make sure to focus on the eligible ones.

- 3.4 Determine the quantity of shares: Decide how many shares of each dividend-reinvestable stock you want to include in the DRIP program. You may choose to include all of your eligible shares or only a portion of them.

- 3.5 Update your reinvestment preferences: Once you have identified the dividend-reinvestable stocks and determined the quantity of shares for each, update your reinvestment preferences in your TD Ameritrade account. This ensures that the dividends from these stocks are automatically reinvested.

It’s important to periodically review and adjust your selection of dividend-reinvestable stocks as your investment objectives and portfolio strategy may change over time. You can make changes to your selections through your TD Ameritrade account as needed.

By selecting dividend-reinvestable stocks, you can ensure a systematic and automated process of reinvesting your dividends, allowing for potential long-term growth and compounding of your investment portfolio.

In the next step, we will discuss how to confirm and customize your reinvestment preferences with TD Ameritrade.

Step 4: Confirming the Reinvestment Preferences

After selecting the dividend-reinvestable stocks in your TD Ameritrade account, the next step is to confirm and customize your reinvestment preferences. This ensures that the dividend payments are reinvested according to your specific requirements.

Here’s how you can confirm and customize your reinvestment preferences with TD Ameritrade:

- 4.1 Access your TD Ameritrade account: Log in to your TD Ameritrade brokerage account using your login credentials. Navigate to the account settings or preferences section where you can manage your DRIP options.

- 4.2 Locate the DRIP options: Look for the specific section or tab in your account settings that is related to the Dividend Reinvestment Plan (DRIP) program. It may be labeled as “DRIP Preferences” or something similar.

- 4.3 Review your preferences: Take the time to carefully review your current DRIP preferences. This includes your choice of reinvesting all or a portion of your dividends, whether to reinvest in fractional shares or whole shares, and any other customization options offered by TD Ameritrade.

- 4.4 Make necessary adjustments: If you wish to make any changes to your preferences, such as adjusting the percentage of dividends to reinvest or updating your reinvestment options, do so at this time. Ensure that your preferences align with your investment goals and risk tolerance.

- 4.5 Save your preferences: After reviewing and adjusting your reinvestment preferences, save your changes. TD Ameritrade will now execute the reinvestment of dividends in accordance with your specified preferences.

It’s important to note that TD Ameritrade provides additional customization options for its DRIP program. These may include features like automatic cash purchase plans, which allow you to automatically invest excess cash from dividends, and dividend sweeps, which enable you to reinvest dividends from one stock into another stock of your choice.

By confirming and customizing your reinvestment preferences, you can tailor the DRIP program to meet your specific investment needs and objectives.

In the next step, we will discuss how to monitor and manage your dividend reinvestments with TD Ameritrade.

Step 5: Monitoring and Managing Dividend Reinvestments

After setting up and confirming your dividend reinvestment preferences with TD Ameritrade, the final step is to monitor and manage your dividend reinvestments. This involves keeping track of your dividends and the additional shares acquired through the reinvestment process.

Here’s how you can effectively monitor and manage your dividend reinvestments with TD Ameritrade:

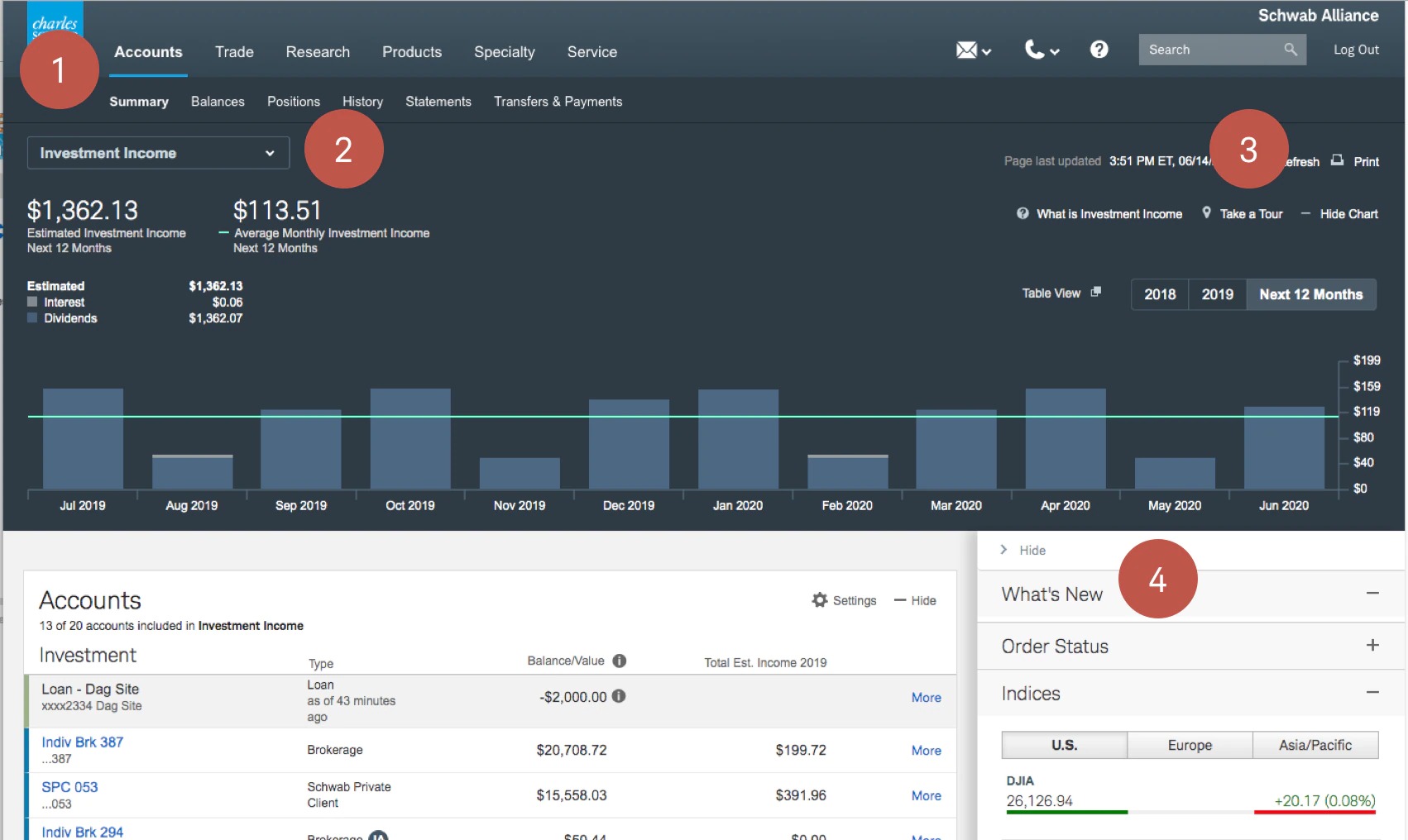

- 5.1 Regularly review your statements: TD Ameritrade provides regular account statements that detail your transactions, including dividend payments and reinvestments. Take the time to review these statements, either online or in physical format, to stay informed about the progress and growth of your dividend reinvestment.

- 5.2 Monitor your dividend income: Keep track of the dividends earned from your dividend-reinvestable stocks. This will give you an understanding of your income stream from these investments and allow you to compare it with previous periods.

- 5.3 Track the additional shares acquired: Pay attention to the number of additional shares you acquire through dividend reinvestment. This will help you gauge the impact of reinvesting dividends on the growth of your investment portfolio over time.

- 5.4 Reassess your portfolio periodically: Regularly reassess your investment portfolio to ensure it aligns with your financial goals and risk tolerance. Consider whether the dividend-reinvestable stocks in your portfolio are still suitable for your investment strategy, and make adjustments as necessary.

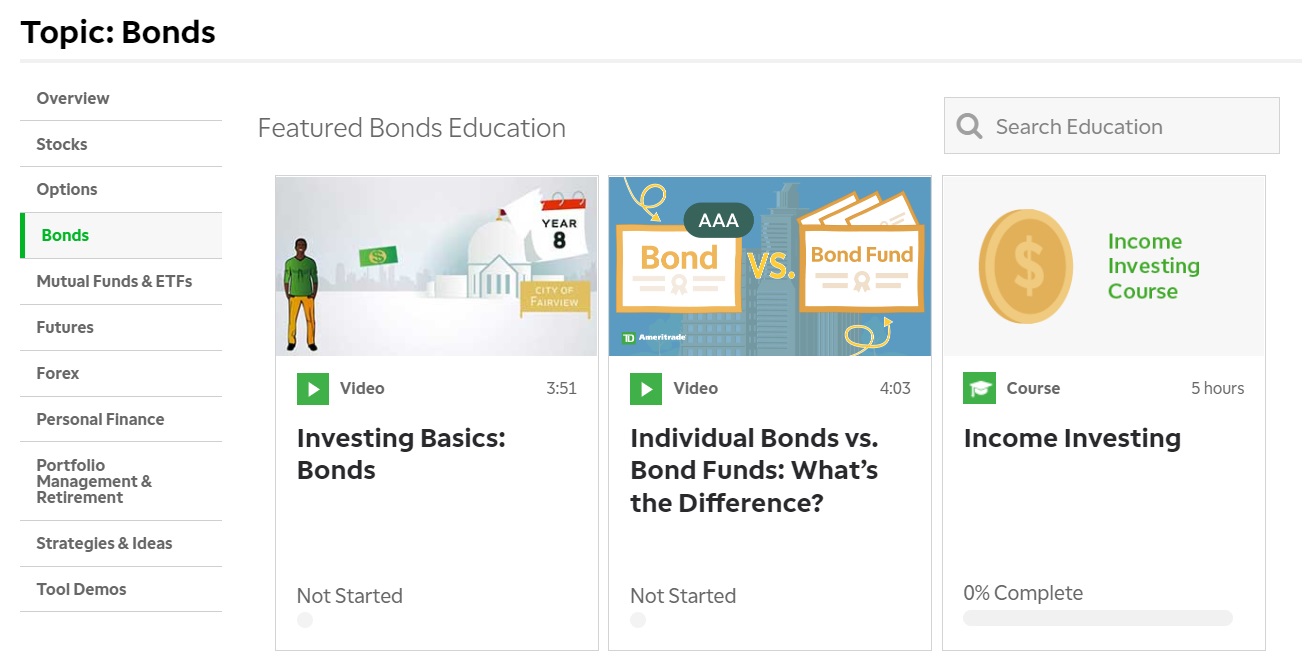

- 5.5 Utilize available research and analysis tools: TD Ameritrade offers a variety of research and analysis tools to help you monitor and evaluate the performance of your dividend-reinvestable stocks. Make use of these tools to stay informed about market trends and the financial health of the companies you have invested in.

By actively monitoring and managing your dividend reinvestments, you can stay informed about the progress of your investments and make informed decisions to optimize your portfolio growth.

Remember that while dividend reinvestment can be a powerful strategy, it’s important to stay focused on your long-term investment goals and to consult with a financial advisor if you have any specific questions or concerns.

Now that you understand how to monitor and manage your dividend reinvestments, let’s move on to discussing the advantages of reinvesting dividends with TD Ameritrade.

Advantages of Reinvesting Dividends with TD Ameritrade

Reinvesting dividends with TD Ameritrade through their Dividend Reinvestment Plan (DRIP) program offers several advantages for investors. Here are some key benefits of choosing to reinvest your dividends:

- Power of compound interest: One of the biggest advantages of reinvesting dividends is harnessing the power of compound interest. By reinvesting your dividends, you acquire additional shares, which in turn generate more dividends. This compounding effect can significantly accelerate the growth of your investment portfolio over time.

- Automatic and hassle-free: TD Ameritrade’s DRIP program allows for automatic reinvestment of dividends. This means you don’t have to manually track and reinvest each dividend payment. The process is streamlined, saving you time and effort in managing your investments.

- Diversification: Reinvesting dividends can help diversify your investment holdings. As you acquire additional shares over time through dividend reinvestment, your portfolio becomes more diversified and less concentrated in a few stocks. Diversification can help reduce risk and potentially enhance long-term returns.

- Long-term accumulation of wealth: By consistently reinvesting dividends, you have the opportunity to accumulate more shares and increase your ownership in quality companies. Over the long term, this can lead to a substantial increase in the value of your investment portfolio and potentially boost your wealth.

- Capitalizing on market downturns: When stock prices are down, reinvesting dividends allows you to acquire more shares at potentially lower prices. This strategy is known as dollar-cost averaging, where you buy more shares when prices are lower, leading to a lower average cost per share over time. This can position you well to benefit from future market upswings.

- Risk mitigation in volatile markets: In turbulent market conditions, dividend-paying stocks tend to offer stability and downside protection compared to non-dividend-paying stocks. By reinvesting dividends in these stocks, you can potentially mitigate risk and maintain a more stable investment portfolio.

It’s important to note that while reinvesting dividends can offer these advantages, there are also potential risks and considerations to keep in mind, which will be discussed in the next section.

By reinvesting your dividends with TD Ameritrade, you can harness the power of compounding, automate your investment process, diversify your portfolio, and potentially enhance your long-term wealth accumulation.

Now that you understand the advantages of reinvesting dividends, let’s explore some important considerations and potential risks to be aware of.

Considerations and Risks

While reinvesting dividends with TD Ameritrade can be a beneficial strategy, it’s important to consider potential risks and factors that may affect your investment decisions. Here are some key considerations to keep in mind:

- Dividend stability: Not all companies maintain a consistent dividend payment history. Companies may reduce or eliminate dividends during challenging economic conditions or to invest in growth opportunities. Before reinvesting dividends, assess the stability and reliability of the dividend payments from the companies in your portfolio.

- Tax implications: Reinvesting dividends can have tax implications, even if the dividends are not received in cash. The reinvested dividends may still be subject to taxes, potentially increasing your overall tax liability. Consult with a tax advisor to understand the tax implications specific to your situation.

- Opportunity cost: While reinvesting dividends can be advantageous, it’s important to consider the opportunity cost. Reinvesting dividends means forgoing the opportunity to use the cash for other purposes, such as investing in other assets or paying off debt. Assess your overall financial situation and investment goals to determine whether reinvesting dividends aligns with your priorities.

- Diversification and concentration: While dividend reinvestment can lead to diversification over time, it’s essential to monitor the concentration of your holdings. If a significant portion of your portfolio is concentrated in a few dividend-reinvestable stocks, you may be exposed to higher risk if those stocks experience negative performance. Regularly review your portfolio and consider balancing your investments to maintain a diversified approach.

- Market volatility: Investing in stocks, including dividend-paying stocks, inherently carries market risk. Stock prices can fluctuate, and the value of your investments may rise or fall. During periods of market volatility, the reinvestment of dividends can still lead to overall portfolio losses, although the potential for rebounding gains remains in the long term.

- Brokerage fees and expenses: TD Ameritrade may charge fees for participating in the DRIP program or for specific transactions associated with dividend reinvestment. Familiarize yourself with the fee structure and potential expenses to ensure they align with your investment goals.

Considering these factors and risks can help you make informed decisions about reinvesting dividends with TD Ameritrade. It’s important to regularly review and assess your investment strategy in light of changing market conditions, personal goals, and risk tolerance.

Now that you have a better understanding of the considerations and risks associated with dividend reinvestment, let’s conclude our discussion.

Conclusion

Reinvesting dividends with TD Ameritrade through their Dividend Reinvestment Plan (DRIP) program can be a valuable strategy for long-term investors. By automatically reinvesting your dividend payments, you have the potential to unlock the power of compound interest, diversify your portfolio, and accelerate the growth of your investments.

In this article, we discussed the step-by-step process of reinvesting dividends with TD Ameritrade, starting from setting up a DRIP account to selecting dividend-reinvestable stocks and customizing your reinvestment preferences. We also explored the advantages of reinvesting dividends, including the power of compound interest, automatic and hassle-free investing, potential diversification benefits, and the ability to accumulate wealth over time.

While there are benefits to reinvesting dividends, it’s important to consider factors such as dividend stability, tax implications, opportunity costs, concentration risk, market volatility, and associated fees. It’s crucial to regularly review your investment strategy and consult with a financial advisor to ensure your investment decisions align with your financial goals and risk tolerance.

TD Ameritrade offers a user-friendly platform and a range of tools and resources to help investors effectively monitor and manage their dividend reinvestments. By staying informed, conducting thorough research, and making informed investment decisions, you can maximize the potential of reinvesting dividends with TD Ameritrade.

Remember, investing involves risks, and past performance is not indicative of future results. It’s important to conduct your own due diligence and seek professional advice when necessary.

Now that you have a comprehensive understanding of how to reinvest dividends with TD Ameritrade, you’re well-equipped to take advantage of this strategy to potentially enhance the growth of your investment portfolio.