Finance

How Is A Credit Default Swap Valued At AIG

Published: March 4, 2024

Learn how credit default swaps are valued at AIG and gain insights into the finance industry. Understand the intricacies of this financial instrument and its impact.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Credit Default Swaps

Credit Default Swaps (CDS) are financial derivatives that allow investors to protect against the risk of a borrower defaulting on their debt. In essence, a CDS is a contract between two parties, the buyer and the seller. The buyer makes periodic payments to the seller, and in return, receives a payoff if the underlying financial instrument, such as a bond or loan, defaults. This financial tool gained notoriety during the 2007-2008 financial crisis, as it was widely used to hedge against the risk of mortgage-backed securities defaulting.

CDS can be likened to insurance policies, where the buyer is essentially purchasing protection against the possibility of a credit event, such as a default or bankruptcy. The seller, often a financial institution, assumes the risk of the underlying debt instrument and receives the periodic payments from the buyer. This concept of transferring risk from one party to another is at the core of CDS.

CDS can be utilized for various purposes, including speculation, hedging, and arbitrage. Investors may use CDS to speculate on the creditworthiness of a particular entity, or to hedge their existing credit exposure. Additionally, CDS can be employed in arbitrage strategies to capitalize on pricing differentials between the CDS market and the underlying bond market.

Understanding the mechanics and purpose of CDS is crucial in comprehending their valuation and the impact they have on the financial markets. As such, delving into the intricacies of CDS valuation, particularly in the context of a prominent entity like AIG, is essential for gaining insights into the complexities of modern finance.

Understanding Credit Default Swaps

Credit Default Swaps (CDS) are financial instruments that provide protection against the default of a borrower. They are essentially insurance contracts on debt instruments, where the buyer of the CDS makes regular payments to the seller and, in return, receives a payout if the underlying debt defaults. This mechanism allows investors to mitigate the risk of credit losses in their investment portfolios.

One key aspect of CDS is that the buyer does not need to own the underlying debt instrument. This feature makes CDS a valuable tool for investors seeking to hedge against the credit risk of specific entities or portfolios without owning the actual debt. The ability to trade CDS without owning the underlying debt also facilitates speculation on the creditworthiness of companies or sovereign entities.

It’s important to note that CDS are not limited to corporate debt; they can also be based on municipal bonds, sovereign debt, or asset-backed securities. This versatility allows market participants to manage credit exposure across a wide range of financial instruments.

The pricing of CDS is influenced by several factors, including the creditworthiness of the reference entity, the term of the contract, prevailing market interest rates, and overall market sentiment. The cost of a CDS, known as the spread, represents the annual premium as a percentage of the notional amount of the contract. Higher spreads indicate a higher perceived risk of default for the reference entity.

While CDS can serve as a valuable risk management tool, they have also been a subject of controversy. During the financial crisis of 2007-2008, the widespread use of CDS to hedge against mortgage-backed securities default contributed to the complexity of the crisis. The interconnectedness of financial institutions through CDS contracts amplified the impact of mortgage market distress, leading to systemic risk concerns.

Understanding the role and function of CDS is crucial for comprehending their valuation and the broader implications they have on the financial system. With this foundational knowledge, we can delve into the intricacies of valuing CDS, particularly in the context of a significant player like AIG.

Valuation of Credit Default Swaps

The valuation of Credit Default Swaps (CDS) involves assessing the probability of default of the reference entity and estimating potential losses in the event of default. Several methodologies are employed to determine the fair value of CDS, with the most common approach being the use of credit spreads and probability of default.

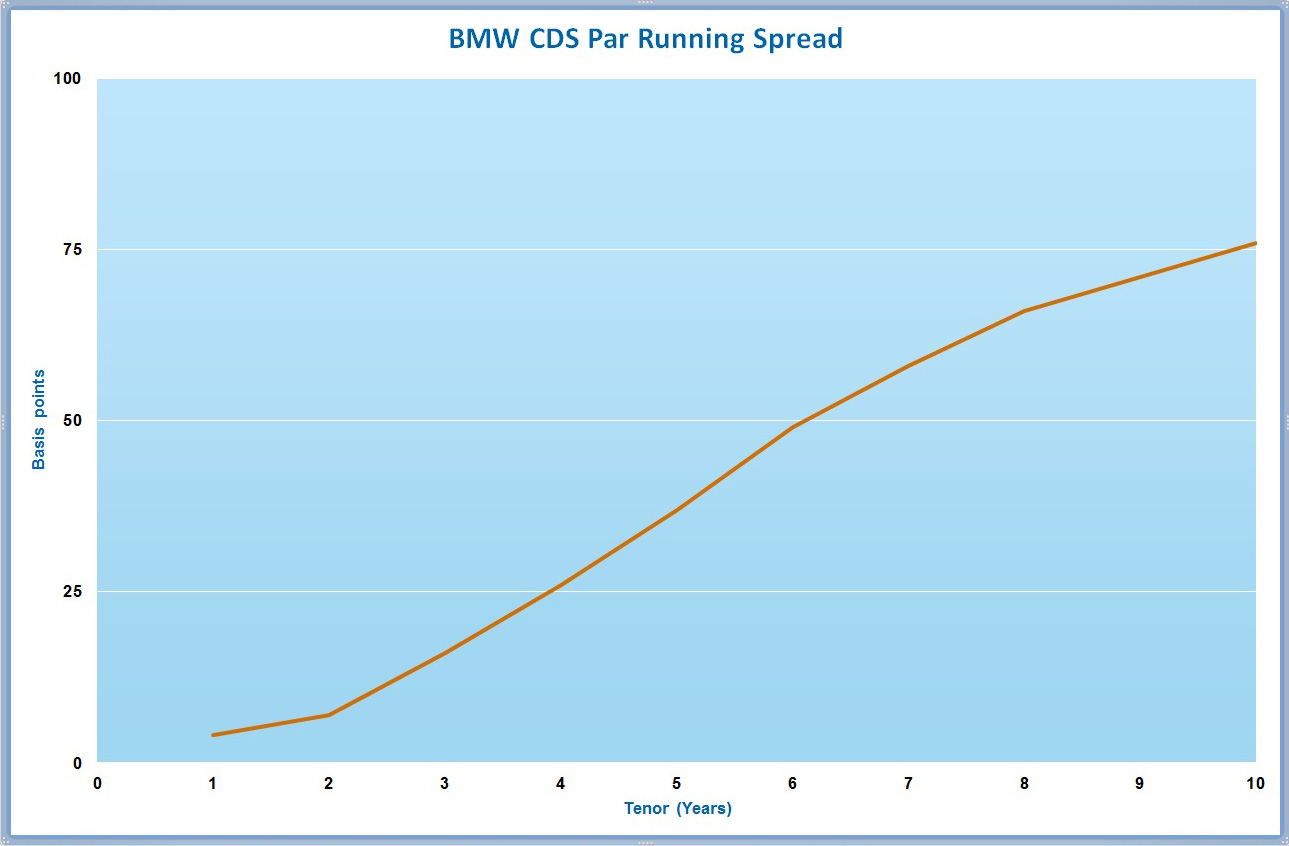

Credit spreads, expressed in basis points, represent the additional yield demanded by investors to hold a bond issued by the reference entity compared to a risk-free asset of similar maturity. The CDS spread reflects the cost of protection against the default of the reference entity and is a key input in the valuation process. The higher the credit spread, the greater the perceived risk of default, leading to a higher CDS valuation.

Another critical component in CDS valuation is the probability of default, which quantifies the likelihood of the reference entity failing to meet its debt obligations. This probability is derived from credit rating agencies’ assessments, market indicators, and fundamental analysis of the reference entity’s financial health. By incorporating the probability of default into the valuation model, market participants can gauge the potential payout in the event of a credit event.

Furthermore, the term structure of CDS contracts plays a significant role in their valuation. CDS with longer maturities typically command higher premiums due to the extended protection period and increased uncertainty regarding the reference entity’s creditworthiness over time. Valuing CDS with varying maturities requires a nuanced understanding of yield curves and interest rate dynamics to accurately capture the time value of money and the evolving risk profile of the reference entity.

It’s important to note that CDS valuation is not solely based on the credit risk of the reference entity. Market factors, such as liquidity conditions, supply and demand dynamics, and macroeconomic trends, also influence CDS pricing. The interconnected nature of financial markets underscores the need to consider broader market conditions when valuing CDS contracts.

Overall, the valuation of CDS is a multifaceted process that integrates credit risk, market dynamics, and time considerations. Understanding the intricacies of CDS valuation provides valuable insights into the pricing of credit risk and its impact on investment decisions and risk management strategies.

AIG’s Credit Default Swap Valuation

As a global insurance and financial services organization, American International Group (AIG) played a significant role in the credit default swap (CDS) market leading up to the 2007-2008 financial crisis. AIG Financial Products, a subsidiary of AIG, was heavily involved in underwriting and selling CDS contracts, particularly insuring mortgage-backed securities and collateralized debt obligations.

During the crisis, AIG faced substantial challenges related to the valuation and settlement of its CDS portfolio. As the credit quality of the underlying mortgage assets deteriorated and the housing market experienced a severe downturn, the probability of default for the referenced securities increased, leading to heightened valuation concerns for AIG’s CDS obligations.

The valuation of AIG’s CDS portfolio was compounded by the interconnected nature of the financial system, as the company’s distress had the potential to trigger systemic repercussions. The sheer magnitude of AIG’s CDS exposure and the uncertainty surrounding the underlying collateral’s performance amplified the complexity of valuing the CDS contracts. Market participants and regulators closely monitored AIG’s CDS valuation process, recognizing the broader implications of its financial stability on the global economy.

Amidst the crisis, AIG’s CDS valuation became a focal point of discussions and negotiations with counterparties and government entities. The determination of fair value for the CDS contracts was pivotal in assessing AIG’s solvency and devising a viable resolution to mitigate systemic risk. Valuation methodologies, including credit spread analysis, probability of default assessments, and stress testing, were employed to gauge the potential exposure and financial impact of AIG’s CDS obligations.

The resolution of AIG’s CDS valuation challenges ultimately involved a combination of government intervention, financial restructuring, and risk mitigation strategies. The U.S. government’s assistance, including the establishment of the Troubled Asset Relief Program (TARP) and the Federal Reserve’s intervention, aimed to stabilize AIG and address the systemic implications of its CDS exposure.

Through a series of agreements, asset sales, and restructuring initiatives, AIG navigated the complexities of its CDS portfolio and worked towards stabilizing its financial position. The valuation and management of AIG’s CDS obligations underscored the critical role of risk assessment, transparency, and regulatory oversight in mitigating systemic risk and preserving financial stability.

In the aftermath of the crisis, AIG’s experience with CDS valuation served as a catalyst for regulatory reforms and risk management enhancements within the financial industry, emphasizing the imperative of robust valuation practices and prudent risk governance.

Conclusion

Credit Default Swaps (CDS) represent a vital component of the financial landscape, offering investors a means to hedge against credit risk and speculate on the creditworthiness of entities. Understanding the intricacies of CDS valuation is essential for comprehending their impact on the financial markets and the broader economy.

The valuation of CDS involves a multifaceted process that integrates credit risk assessment, market dynamics, and time considerations. By analyzing credit spreads, probability of default, and the term structure of CDS contracts, market participants can gauge the fair value of these instruments and make informed investment and risk management decisions.

The case of American International Group (AIG) exemplifies the complexities associated with CDS valuation, particularly in the context of a significant market participant facing systemic implications. AIG’s experience underscored the critical role of transparent valuation practices, risk governance, and regulatory oversight in mitigating systemic risk and preserving financial stability.

The aftermath of the 2007-2008 financial crisis prompted regulatory reforms and risk management enhancements within the financial industry, emphasizing the imperative of robust valuation methodologies and prudent risk assessment. The lessons learned from AIG’s CDS valuation challenges have contributed to a heightened focus on transparency, accountability, and risk mitigation strategies in the realm of derivatives and financial instruments.

As the financial landscape continues to evolve, the valuation of CDS remains a focal point for investors, regulators, and market participants. The ongoing refinement of valuation practices and risk management frameworks is essential for maintaining the integrity and stability of the financial system, mitigating systemic risk, and fostering investor confidence.

In conclusion, the valuation of Credit Default Swaps is a dynamic and intricate process that necessitates a comprehensive understanding of credit risk, market dynamics, and regulatory considerations. By embracing transparency, robust valuation methodologies, and prudent risk governance, market participants can navigate the complexities of CDS valuation and contribute to the resilience and stability of the global financial ecosystem.