Finance

How To Get A Life Insurance Policy On A Parent

Published: November 24, 2023

Looking to secure a life insurance policy for your parent? Find out how to navigate the financial aspects of obtaining life insurance coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance on Parents

- Choosing the Right Type of Life Insurance Policy

- Gathering Information and Documentation

- Selecting a Beneficiary

- Determining the Coverage Amount

- Exploring Different Insurance Providers

- Comparing Quotes and Rates

- Applying for the Life Insurance Policy

- Undergoing Medical Examinations

- Completing the Application Process

- Paying the Premiums

- Maintaining the Life Insurance Policy

- Understanding the Claims Process

- Conclusion

Introduction

Life insurance is an essential component of financial planning, providing security and peace of mind for individuals and their loved ones. While many people are familiar with purchasing life insurance for themselves, there may come a time when you need to obtain a life insurance policy on a parent. This could be due to various reasons, such as ensuring financial stability for your parent, protecting their legacy, or covering the costs of their final expenses.

Getting a life insurance policy on a parent involves several important steps and considerations. It is crucial to understand the different types of life insurance policies available, gather the necessary information and documents, choose a suitable beneficiary, and determine the appropriate coverage amount. Additionally, you will need to research and compare different insurance providers, complete the application process, and stay up-to-date with premium payments.

In this comprehensive guide, we will walk you through the process of getting a life insurance policy on a parent. We will provide valuable insights and tips to help you navigate this journey, ensuring you make well-informed decisions that align with your parent’s needs and financial goals. Whether you are just beginning to explore life insurance options or are ready to take the next steps, this guide will equip you with the knowledge and tools to make the best choices for yourself and your parent.

Understanding Life Insurance on Parents

Before diving into the process of obtaining a life insurance policy on a parent, it is important to have a solid understanding of how life insurance works in general. Life insurance is a contract between the policyholder (you) and an insurance company. In exchange for regular premium payments, the insurance company provides a financial benefit to the designated beneficiary upon the death of the insured individual (your parent).

Life insurance on parents serves as a way to protect against the financial impact of their passing. It can help cover funeral expenses, outstanding debts, and provide financial support for dependents. It is important to note that in order to purchase a life insurance policy on a parent, you generally must have an insurable interest, meaning you would suffer financially in the event of their death.

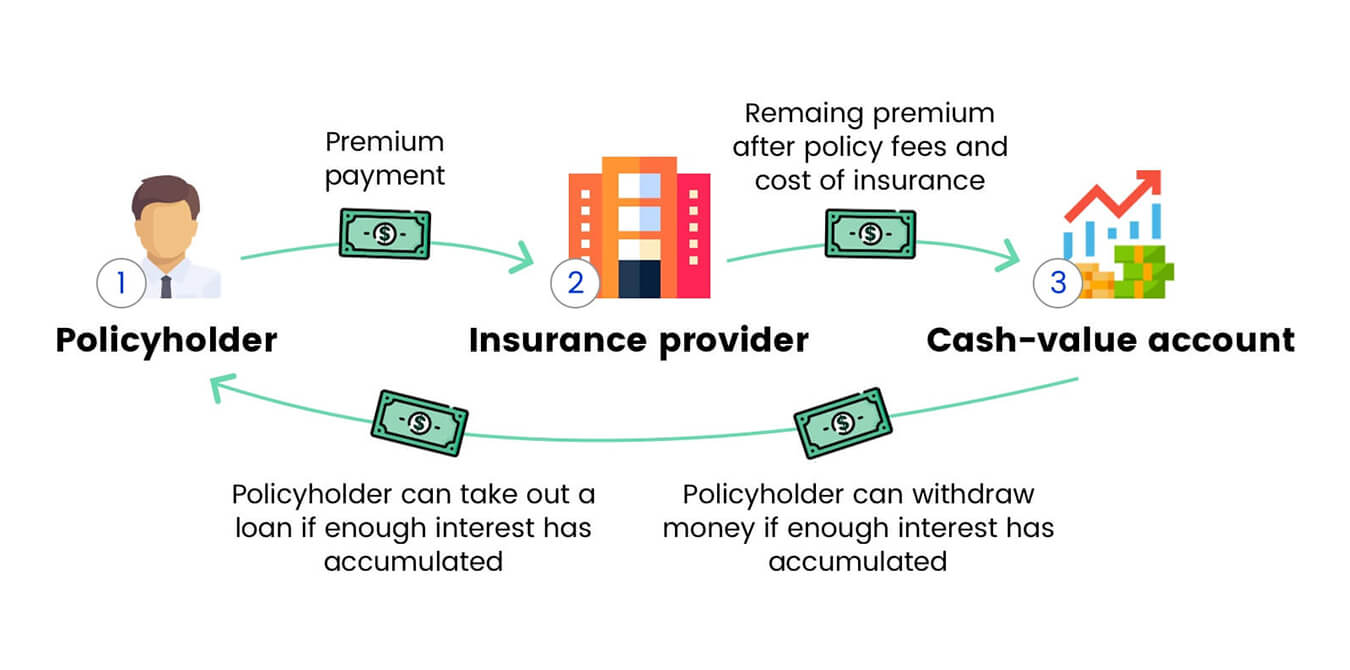

There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. This type of policy is generally more affordable and straightforward, making it a popular choice for many individuals. Permanent life insurance, on the other hand, provides lifelong coverage and often includes a cash value component that can accumulate over time.

When considering life insurance on parents, it is important to assess their current financial situation, outstanding debts, and any potential future financial obligations. This will help you determine the appropriate type and amount of coverage needed. Additionally, it is crucial to have open and honest communication with your parent about their wishes and preferences for their life insurance policy.

Understanding the basics of life insurance and its significance can help you make informed decisions when it comes to obtaining a policy on your parent. As you proceed with the process, keep in mind that each insurance provider may have specific requirements and guidelines. It is essential to do thorough research and seek professional advice to ensure you choose the best policy for your parent’s needs.

Choosing the Right Type of Life Insurance Policy

When it comes to obtaining a life insurance policy on a parent, selecting the right type of policy is crucial. There are various options available, and understanding the differences will help you make an informed decision that aligns with your parent’s needs and financial situation.

The two primary types of life insurance policies to consider are term life insurance and permanent life insurance. Term life insurance provides coverage for a specific duration, such as 10, 20, or 30 years. It is generally more affordable and offers a death benefit payout if the insured individual passes away during the specified term. This type of policy is ideal for individuals looking for temporary coverage to protect against specific financial obligations, such as a mortgage or educational expenses.

On the other hand, permanent life insurance provides lifelong coverage. It includes a death benefit payout as well as a cash value component that can accumulate over time. Permanent life insurance policies, such as whole life or universal life insurance, offer more comprehensive coverage but tend to have higher premiums. They are suitable for individuals who want coverage that lasts a lifetime, potential cash value growth, and the ability to borrow against the policy.

When choosing the right type of policy on a parent, take into consideration their specific needs and financial goals. Assess their age, health condition, and any outstanding debts or financial obligations. If your parent is relatively young and in good health, a term life insurance policy may be more appropriate. However, if your parent is older or has health issues, a permanent life insurance policy might be a better choice.

Furthermore, it is crucial to evaluate the financial impact of the policy premiums on your parent’s budget. Ensure that the premium payments are affordable and sustainable, as failure to pay premiums may result in policy cancellation. Consider discussing the options with a reputable insurance agent or financial advisor who can provide valuable guidance based on your parent’s specific circumstances.

Overall, choosing the right type of life insurance policy is a decision that requires careful consideration. Keep in mind the coverage duration, financial implications, and your parent’s unique situation to make a well-informed choice. Remember, the primary goal is to provide financial protection and peace of mind for both you and your parent.

Gathering Information and Documentation

Obtaining a life insurance policy on a parent requires gathering essential information and documentation. This step is crucial to ensure a smooth application process and accurate assessment of your parent’s insurability. Here are some key pieces of information and documents you will need:

- Personal Information: Collect your parent’s full name, date of birth, contact information, and social security number. You may also need their employment details and income information.

- Health History: Compile a comprehensive overview of your parent’s health history, including any pre-existing medical conditions, surgeries, and ongoing treatments. This information will help the insurance company assess their insurability and determine the appropriate premium rates.

- Medical Records: Request medical records from your parent’s primary healthcare provider or any specialists they have seen. These records will provide crucial information about their health status and any underlying health issues.

- Medication List: Create a list of all medications your parent is currently taking, including the dosage and frequency. This information is important as certain medications can impact the underwriting process and premium rates.

- Lifestyle and Habits: Provide information about your parent’s lifestyle and habits, such as smoking or alcohol consumption. These factors can influence the insurance company’s risk assessment and premium determination.

- Financial Information: Gather details about your parent’s financial situation, including their annual income, assets, and debts. This information will help determine the appropriate coverage amount and affordability of the premiums.

Having all the necessary information and documentation prepared in advance will expedite the application process and ensure accuracy. Keep in mind that some insurance providers may require additional documents or information, so it is essential to review their specific requirements beforehand.

During the application process, it is important to provide honest and transparent information. Misrepresenting or omitting crucial details can lead to policy cancellation or denial of claims in the future. If you are unsure about any information, consult with your parent’s healthcare provider or seek guidance from a licensed insurance agent.

Gathering the required information and documentation shows the insurance company that you are prepared and serious about obtaining a life insurance policy for your parent. It is a crucial step towards securing their financial future and ensuring the peace of mind for both you and your parent.

Selecting a Beneficiary

When getting a life insurance policy on a parent, one of the most important decisions you will need to make is selecting a beneficiary. The beneficiary is the person or entity who will receive the death benefit upon your parent’s passing. This decision requires careful consideration and should align with your parent’s wishes and financial goals.

Here are some important factors to consider when selecting a beneficiary for your parent’s life insurance policy:

- Financial Dependents: If your parent has financial dependents, such as a spouse, children, or other family members who rely on them for support, it is common to designate them as the primary beneficiaries. This ensures that the death benefit will provide the necessary financial support to maintain their livelihood.

- Debt and Obligations: Consider any outstanding debts or financial obligations your parent may have. Designating a beneficiary who can use the death benefit to pay off these debts can prevent financial strain on the estate or other surviving family members.

- Estate Planning: If your parent has specific estate planning goals, such as leaving a legacy or supporting charitable organizations, they can name such entities as beneficiaries. It is important to consult with an estate planning attorney to ensure proper documentation of these wishes.

- Contingent Beneficiaries: In addition to primary beneficiaries, it is wise to name contingent beneficiaries. These individuals or entities will receive the death benefit if the primary beneficiaries are unable to or predecease your parent. Common choices for contingent beneficiaries are other family members or a trust.

- Multiple Beneficiaries: It is possible to designate multiple beneficiaries and assign a percentage of the death benefit to each. This can be useful if your parent wants to distribute the proceeds among multiple family members or entities.

It is important to have open and honest conversations with your parent about their preferences for the beneficiary designation. Respect their wishes and ensure that the chosen beneficiary understands their role and the potential benefits they will receive. Keeping the beneficiary designation up to date is also essential, especially in the event of life changes such as marriage, divorce, or the passing of a beneficiary.

Lastly, it is crucial to review and revise the beneficiary designation periodically. Life circumstances can change, and it is important to ensure that the policy reflects the current wishes and intentions of your parent. Working closely with a reputable insurance agent or legal professional can provide valuable guidance and ensure that the beneficiary selection aligns with your parent’s overall financial and estate planning objectives.

Selecting the right beneficiary for your parent’s life insurance policy is a significant decision that can have long-term financial implications. Take the time to carefully consider the options and seek professional advice to make the best choice for your parent’s circumstances.

Determining the Coverage Amount

When obtaining a life insurance policy on a parent, determining the appropriate coverage amount is a crucial step. The coverage amount refers to the death benefit that will be paid out to the beneficiaries upon your parent’s passing. This amount should adequately cover any financial obligations and provide financial security for your parent’s dependents.

Here are some factors to consider when determining the coverage amount for your parent’s life insurance policy:

- Outstanding Debts: Take into account any outstanding debts your parent may have, such as a mortgage, car loan, or credit card debt. The coverage amount should be sufficient to pay off these debts and prevent burdening the beneficiaries with financial liabilities.

- Final Expenses: Consider the costs associated with your parent’s final arrangements, including funeral and burial or cremation expenses. These costs can vary significantly depending on preferences, location, and other factors.

- Income Replacement: If your parent is a primary income earner or contributes significantly to the household finances, consider the amount of income that would need to be replaced in their absence. The coverage amount should provide financial support to maintain the same standard of living for the surviving family members.

- Educational Expenses: If your parent has children who are still in school or planning to pursue higher education in the future, factor in the cost of their education. The coverage amount should be sufficient to cover tuition fees, books, and other related expenses.

- Dependent Support: If your parent has dependents, such as a spouse, children, or disabled family members, consider their financial needs and how the coverage amount can support them in your parent’s absence.

- Future Financial Goals: Evaluate your parent’s future financial goals, such as leaving a legacy for future generations or supporting charitable causes. The coverage amount can be adjusted to include these objectives.

It is important to strike a balance between the coverage amount and the affordability of the premium payments. Review your parent’s current financial situation and determine a coverage amount that provides adequate protection without creating undue financial strain.

Keep in mind that assessing the appropriate coverage amount may require a professional consultation. Licensed insurance agents or financial advisors can utilize various financial planning tools and techniques to help you determine the optimal coverage amount based on your parent’s specific circumstances.

Regularly review and reassess the coverage amount as your parent’s financial situation and life circumstances change. Life milestones such as marriage, the birth of grandchildren, or retirement may warrant adjustments to ensure that the life insurance policy continues to meet their evolving needs.

Ultimately, the coverage amount of your parent’s life insurance policy should provide financial security and peace of mind for both your parent and their loved ones. Take the time to carefully evaluate the factors mentioned above, seek professional guidance if needed, and choose a coverage amount that aligns with your parent’s goals and obligations.

Exploring Different Insurance Providers

When obtaining a life insurance policy on a parent, it is important to explore different insurance providers to find the one that best suits your parent’s needs. While there are numerous insurance companies in the market, it is essential to evaluate their reputation, financial stability, product offerings, and customer service. Here are some key factors to consider when exploring different insurance providers:

- Reputation and Financial Stability: Look for insurance providers with a solid reputation in the industry and a strong financial standing. This information can usually be found through independent rating agencies, such as A.M. Best or Standard & Poor’s. A reputable and financially stable insurance provider ensures that your parent’s policy will be honored in the event of a claim.

- Product Offerings: Review the different types of life insurance policies offered by each provider. Consider the pros and cons of term life insurance versus permanent life insurance, and determine which aligns best with your parent’s goals and financial situation.

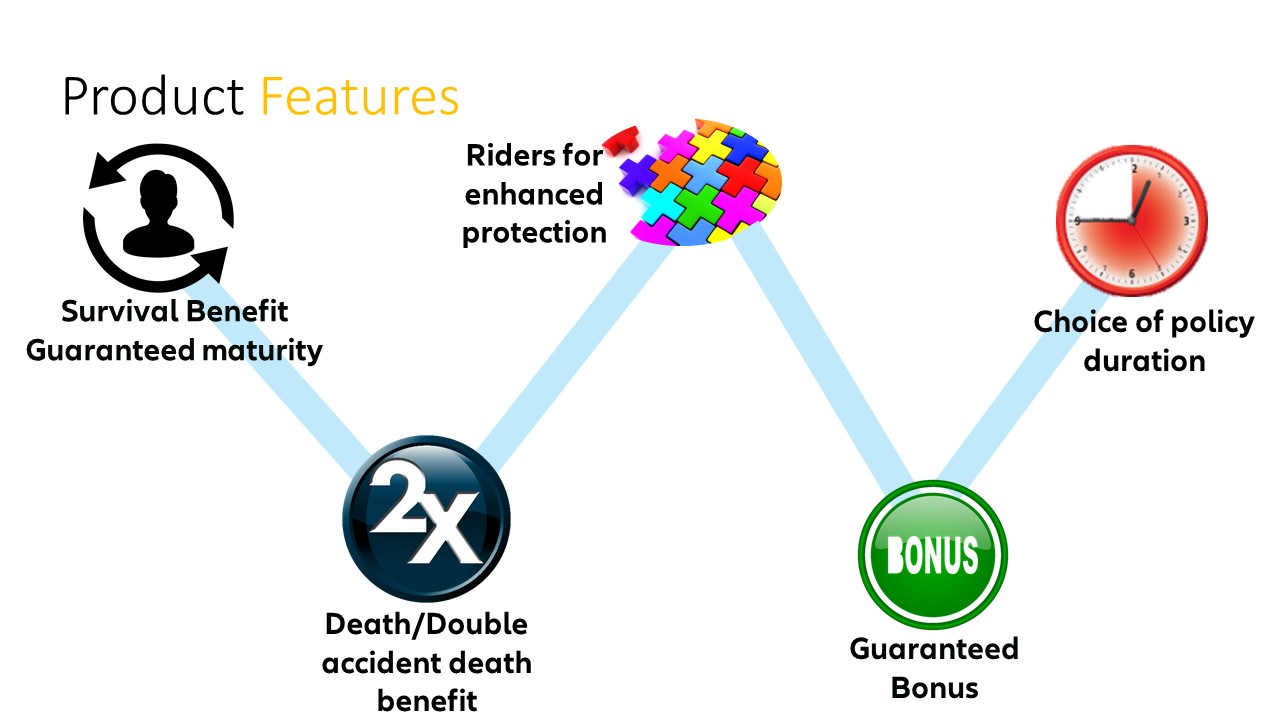

- Policy Features and Riders: Explore the additional features or riders that insurance providers may offer. These can include accelerated death benefits, which allow policyholders to access a portion of the death benefit if they become terminally ill, or waiver of premium riders that waive premium payments in the event of disability. Assess which features are important for your parent’s specific needs.

- Premium Rates: Obtain quotes from various insurance providers to compare premium rates. The cost of premiums can vary significantly between different companies, so it is crucial to find a balance between affordability and the level of coverage provided.

- Customer Service: Evaluate the level of customer service and support provided by each insurance provider. Look for companies with a solid track record of responsive customer service and prompt claims processing. Customer reviews and testimonials can provide valuable insights into the customer experience.

- Underwriting Guidelines: Understand the underwriting guidelines of each insurance provider. Different companies may have varying criteria for assessing an individual’s insurability. If your parent has specific health conditions or lifestyle habits, research whether certain providers are more lenient or specialized in underwriting those particular situations.

By thoroughly exploring different insurance providers and their offerings, you can make an informed decision that best meets your parent’s needs and preferences. Take the time to research and compare options, and don’t hesitate to reach out to insurance agents or brokers who can provide guidance and answer any questions you may have.

Remember, obtaining a life insurance policy on a parent is a significant commitment, and it is important to choose an insurance provider that you trust and feel comfortable with. Assessing multiple providers will help ensure that you find the right match for your parent’s financial security and peace of mind.

Comparing Quotes and Rates

When obtaining a life insurance policy on a parent, comparing quotes and rates from different insurance providers is a crucial step in finding the best coverage at an affordable price. By comparing quotes, you can ensure that your parent receives the most suitable policy that meets their needs and fits within their budget. Here are some key points to consider when comparing quotes and rates:

- Obtain Multiple Quotes: Request quotes from several insurance companies to get a comprehensive view of the market. This will allow you to compare rates and policies side by side, giving you a better understanding of the options available.

- Consider the Coverage Amount: Ensure that the quotes you are comparing provide the same coverage amount. This will allow you to accurately assess the premium rates and determine which company offers the best value for the desired coverage.

- Review the Policy Term: Take note of the term length for each quote. Term life insurance policies typically offer coverage for 10, 20, or 30 years. Be sure the quotes you compare align with the desired term to accurately compare rates.

- Evaluate Premium Costs: Pay close attention to the premium amounts quoted by each insurance provider. Compare the annual, monthly, or quarterly premiums to ensure they are affordable and fit well within your parent’s budget. Remember to consider the long-term affordability of the premiums as well.

- Assess the Financial Stability of the Provider: Consider the financial stability and reputation of each insurance provider. A company with a strong financial standing is more likely to honor their policies and be there to support your parent’s beneficiaries when needed.

- Review Policy Features: Compare any additional features or riders included with each quote. Some companies may offer optional riders that can enhance the policy’s value, such as disability waivers or living benefits. Assess the value of these features when comparing quotes.

- Consider Underwriting Guidelines: Take into account your parent’s health condition and lifestyle when comparing quotes. Some insurance providers may offer more favorable rates for individuals with certain health conditions or specific habits. Research their underwriting guidelines to find the best match for your parent’s situation.

Comparing quotes and rates requires careful analysis and consideration of multiple factors. It is important to strike a balance between affordability and the coverage provided. Remember, it is not solely about finding the cheapest option, but rather choosing a reputable insurance provider that offers a comprehensive policy that suits your parent’s needs.

Working with a knowledgeable insurance agent can greatly assist in comparing quotes and understanding the nuances of different policies. They can provide guidance on policy features, explain any discrepancies in rates, and help make an informed decision based on your parent’s unique circumstances.

By thoroughly comparing quotes and rates, you can confidently select the life insurance policy that offers the best combination of coverage, affordability, and peace of mind for both your parent and their beneficiaries.

Applying for the Life Insurance Policy

Once you have thoroughly researched and compared different insurance providers, it is time to apply for the life insurance policy for your parent. The application process involves several steps, and it is important to follow them diligently to ensure a smooth and successful application. Here are the key steps to apply for a life insurance policy:

- Gather Information: Collect all the necessary information and documents that were discussed earlier in this guide. This includes personal information, health history, medical records, and financial details. Having this information readily available will ensure a more efficient application process.

- Contact the Insurance Provider: Get in touch with the insurance provider you have chosen and inform them about your intention to apply for a life insurance policy on your parent. They will guide you through the application process and provide you with any necessary forms or instructions.

- Fill Out the Application: Complete the application form accurately and thoroughly. Be sure to provide all required information and disclose any relevant details about your parent’s health and lifestyle. It is essential to be honest and transparent during this step, as any misrepresentation or omission of information may lead to policy cancellation or denial of claims in the future.

- Submit the Application: Send the completed application form along with any requested documents (such as medical records or financial documentation) to the insurance provider. Ensure that everything is properly signed and dated.

- Underwriting Process: After submitting the application, the insurance provider will initiate the underwriting process. This involves a review of the application, medical records, and possibly a medical examination. The underwriters will assess the risks associated with insuring your parent and make a determination on insurability and premium rates.

- Medical Examinations: Depending on your parent’s age, health history, and the coverage amount applied for, a medical examination may be required. The insurance provider will arrange this examination at a convenient time and location. The examination typically includes a physical check-up, blood tests, and possibly a urine sample.

- Review and Approval: Once the underwriting process is complete, the insurance provider will review the application and make a decision regarding coverage and premium rates. You will receive notification of the approval or any necessary adjustments to the policy terms.

- Acceptance and Premium Payment: If the application is approved, you will receive an acceptance package outlining the details of the policy, including the coverage amount, premium amounts, and any riders or additional features. Review the policy documents carefully and make the initial premium payment as instructed by the insurance provider.

Throughout the application process, it is important to stay in regular communication with the insurance provider and promptly provide any additional information or documentation they may request. This will help expedite the application and avoid unnecessary delays.

Remember, each insurance provider may have specific requirements and variations in their application process. Following their instructions and seeking guidance from insurance professionals or agents will ensure a smooth and successful application for your parent’s life insurance policy.

Undergoing Medical Examinations

As part of the underwriting process for a life insurance policy on your parent, it is common for insurance providers to require a medical examination. This examination helps assess your parent’s overall health and provides the insurance company with information to determine their insurability and appropriate premium rates. Here is an overview of what to expect during the medical examination:

Appointment Scheduling: Once your parent’s application is submitted, the insurance provider will coordinate with a medical professional to schedule the medical examination. It is important to ensure that your parent is available and prepared for the examination at the given time and date.

Physical Check-up: The medical examination typically begins with a physical check-up. A healthcare professional will perform a routine examination, which may include measuring height, weight, blood pressure, and other vital signs. They may also inquire about your parent’s medical history and any current symptoms they may be experiencing.

Medical History Review: The healthcare professional will review your parent’s medical history, including any pre-existing conditions, past surgeries, and ongoing treatments. It is essential that your parent provides accurate and detailed information during this review.

Lab Tests: Depending on the insurance provider’s requirements and the coverage amount applied for, the medical examination may include various lab tests. This may involve providing blood samples, urine samples, or other tests to check for specific health markers or conditions. The samples will be sent to a laboratory for analysis. The results will be considered in the underwriting process.

Medical Questionnaire: Your parent may be asked to complete a medical questionnaire during the examination. This questionnaire delves into more specific health-related questions, including lifestyle habits, family medical history, and any recent or chronic medical conditions. It is crucial to answer these questions truthfully and to the best of your parent’s knowledge.

EKG and Stress Tests: In some cases, the insurance provider may require additional tests, such as an electrocardiogram (EKG) or a stress test, especially for older individuals or those with a higher coverage amount. These tests help evaluate cardiac health and identify any potential cardiovascular risks.

Duration and Results: The duration of the medical examination varies depending on the extent of the tests required. Typically, it should take around 30 minutes to an hour. Once the examination is complete, the results will be sent to the insurance provider for review as part of the underwriting process.

It is important to prepare your parent for the medical examination by ensuring they are well-rested and have avoided any strenuous activities or excessive alcohol consumption prior to the appointment. Additionally, remind them to bring any necessary documentation or identification to the examination.

It is worth noting that certain insurance providers offer no medical exam or simplified issue policies, which may not require a traditional medical examination. These policies often involve answering a series of health-related questions and are designed for individuals who prefer a quicker and less invasive application process.

By understanding the purpose and process of the medical examination, you can help your parent prepare and ensure their cooperation during this step. Remember, the results of the examination play a significant role in determining your parent’s insurability and premium rates for the life insurance policy.

Completing the Application Process

After your parent has undergone the necessary medical examinations and submitted the required documentation, it’s time to complete the application process for their life insurance policy. This final stage involves a few important steps to ensure that everything is in order before the policy is officially issued. Here’s an overview of what to expect:

Reviewing Policy Details: Once the underwriting process is complete, the insurance provider will review your parent’s application, medical examination results, and any additional information that was provided. They will then determine the final terms and conditions of the policy.

Acceptance Package: If your parent’s application is approved, the insurance provider will send an acceptance package that includes the policy documents and details. It is crucial for both you and your parent to carefully review these documents, ensuring that all the information is accurate and aligns with what was discussed during the application process.

Understanding Policy Terms: Take the time to thoroughly read and understand the terms of the policy, including the coverage amount, premium payments, duration of coverage, exclusions, and any optional riders or features. If there are any questions or concerns, contact the insurance provider or an agent for clarification.

Initial Premium Payment: The acceptance package will outline the amount and deadline for the initial premium payment. It is important to make this payment promptly to activate the policy and ensure coverage is in effect. The payment methods and acceptable forms of payment will be specified in the acceptance package.

Assigning Ownership and Beneficiary: During the completion of the application process, your parent will be asked to designate the ownership and beneficiary of the policy. They will need to provide the necessary details and ensure the designated individuals or entities are accurately listed.

Signature and Submission: Your parent will be required to sign the policy documents and any related forms. Ensure that the signatures are provided where necessary, and all required documents are promptly submitted to the insurance provider. This will finalize the application process.

Policy Issuance: Once the insurance provider receives the signed documents and necessary payments, they will issue the policy. This marks the official start of the coverage as stated in the policy documents. Your parent will receive a copy of the policy, and it is important to keep it in a safe place for future reference.

Throughout the completion of the application process, it is important to communicate openly and promptly with the insurance provider. If there are any changes or updates that need to be made, such as a change in contact information or beneficiary designation, inform the insurance provider as soon as possible.

Remember, the application process may differ slightly between insurance providers. It is essential to carefully follow their specific instructions and guidelines to ensure a smooth and successful completion of the process.

By completing the application process diligently and accurately, your parent’s life insurance policy will be in effect, providing the financial security and peace of mind that comes with having proper coverage.

Paying the Premiums

Paying the premiums is an essential part of maintaining your parent’s life insurance policy and ensuring that the coverage remains in effect. Premiums are the regular payments made to the insurance provider to keep the policy active. It is important to understand the payment terms, frequency, and methods to ensure seamless coverage. Here’s what you need to know about paying the premiums:

Premium Amount: The premium amount is determined during the underwriting process based on various factors, including your parent’s age, health, coverage amount, and policy type. The insurance provider will inform you of the exact premium amount in the policy documents or statements.

Payment Frequency: The premium can typically be paid on a monthly, quarterly, semi-annual, or annual basis. The payment frequency selected depends on your parent’s preference and affordability. It is important to determine the payment frequency that works best for their financial situation.

Payment Methods: Insurance providers offer various payment methods for convenient premium payment. This can include traditional methods such as checks, online payment portals where you can pay with a credit or debit card, or automatic bank withdrawals. Choose the method that is most convenient for your parent.

Grace Period: Insurance providers often offer a grace period after the premium due date. During this time, your parent can make the payment without penalty or immediate risk of policy lapse. The grace period duration and terms can vary between insurance providers, so it’s important to understand the grace period in your parent’s specific policy.

Late Payments: It is essential to pay the premiums on time to avoid any interruption in coverage. Late payments can result in a policy being canceled or temporarily suspended. If your parent anticipates difficulty in paying the premium on time, it is important to contact the insurance provider and discuss alternative payment arrangements or options to avoid policy lapses.

Policy Lapses: If your parent fails to make premium payments within the grace period and the policy lapses, the coverage will no longer be in effect. In such cases, it may be challenging to reinstate the policy, and it may require additional underwriting or even a new application process. It is crucial to make premium payments consistently to ensure ongoing coverage.

Reviewing Premiums: It is recommended to review the premium amounts periodically. Premiums can be affected by factors such as policy adjustments or changes in your parent’s health or lifestyle. As circumstances change, it may be beneficial to discuss with the insurance provider or a licensed agent to review the premium amounts and evaluate if any adjustments are necessary.

Paying the premiums on time is vital to maintain the life insurance coverage for your parent. Set up reminders to ensure no payments are missed, and keep track of payment receipts and statements for record-keeping purposes. Maintaining consistent premium payments helps to provide financial security and peace of mind for both your parent and their beneficiaries.

Maintaining the Life Insurance Policy

Maintaining your parent’s life insurance policy is crucial to ensure continuous coverage and the intended financial protection. While paying the premiums is a vital part of policy maintenance, there are other key aspects to consider. Here are some important points to keep in mind to effectively maintain the life insurance policy:

Regular Premium Payments: Paying the premiums on time is essential to keep the policy active. Set up a reminder system or automatic payments to ensure that premium payments are made consistently. Consider using electronic payment methods for convenience.

Review Coverage Needs: Periodically assess your parent’s coverage needs to ensure they align with their current financial situation and obligations. Life changes such as marriage, the birth of children, or changes in financial responsibilities may warrant adjustments to the coverage amount.

Update Beneficiary Designation: Review and update the beneficiary designation if needed. Life events such as marriage, divorce, or the passing of beneficiaries may require changes to ensure the intended individuals or entities are designated as beneficiaries.

Notify Changes in Contact Information: Inform the insurance provider promptly about any changes in contact information, including address, phone number, or email. This ensures that important policy-related communication reaches your parent in a timely manner.

Annual Policy Reviews: Schedule annual policy reviews with the insurance provider or licensed agent to evaluate the policy’s performance and relevance. This allows you to assess if the coverage still meets your parent’s objectives and to make any necessary adjustments.

Stay Informed: Keep abreast of any changes or updates related to the policy, including policy terms, benefits, or premium rates. Review any correspondence or policy statements sent by the insurance provider and seek clarification if there are any uncertainties.

Stay Healthy: Encourage your parent to prioritize their health and engage in healthy lifestyle choices. Maintaining good health can contribute to favorable premium rates and a smoother insurance experience in the long run.

Keep Records: Maintain organized records of all policy-related documents, premium receipts, and correspondence with the insurance provider. This ensures easy access to information and facilitates smooth claims processing.

Periodic Coverage Assessment: Re-evaluate your parent’s coverage needs periodically, especially during significant life events such as retirement or the payoff of major debts. Determine if any adjustments or additional coverage is required to address changing circumstances.

Seek Professional Guidance: Consult with a licensed insurance agent or financial advisor if there are any uncertainties or if you require assistance in maintaining the policy. They can provide valuable insights and recommendations to ensure that the policy remains appropriate for your parent’s needs.

By actively maintaining the life insurance policy, you can ensure that it continues to provide the intended financial protection and peace of mind for your parent and their beneficiaries. Stay proactive, review the policy regularly, and seek professional guidance when needed to ensure the policy remains effective throughout the years.

Understanding the Claims Process

Understanding the claims process of your parent’s life insurance policy is essential to ensure a smooth and efficient payout to the beneficiaries upon their passing. While it may be a sensitive topic, familiarizing yourself with the claims process will help you navigate this important aspect of the policy. Here’s an overview of what to expect:

Notification of the Insurer: When your parent passes away, notify the insurance provider as soon as possible. Provide the necessary information, including policy details, your parent’s personal information, and a certified copy of the death certificate. Promptly notifying the insurer will initiate the claims process.

Claims Packet: Upon notification, the insurance provider will send a claims packet to the beneficiaries or the policyholder. This packet includes the required forms and instructions for filing a claim. Familiarize yourself with the contents of the packet and follow the instructions meticulously.

Claim Forms and Documentation: Complete the claim forms accurately and provide all necessary documents as outlined in the claims packet. This typically includes the death certificate, policy document, and any additional forms required by the insurance provider. Any missing or incomplete information can delay the claims process.

Review and Verification: The insurance provider will review and verify the claim materials submitted. This includes confirming the authenticity of the death certificate, verifying the policy details and beneficiary designations, and conducting any necessary investigations. The insurer may contact you if they require additional information or documentation.

Claims Decision: Upon completion of the review and verification process, the insurance provider will make a claims decision. This decision determines the eligibility for the death benefit payout. If the claim is approved, the insurer will proceed with the settlement process. If a claim is denied, the insurance provider will provide a written explanation outlining the reasons for denial.

Settlement Options: Once the claim is approved, the beneficiaries will be offered various options for receiving the death benefit. These options may include a lump-sum payout or structured settlement payments over a specified period. Discuss the available options with the insurance provider, as well as any tax implications associated with each option.

Claims Payout: Upon selecting the desired settlement option, the insurance provider will initiate the claims payout. The beneficiaries will receive the death benefit according to the chosen method. It is important to note that the payout may take some time to process, depending on the complexity of the claim and the insurer’s procedures.

Legal Assistance If Needed: In certain cases, legal assistance may be needed to navigate the claims process. This is particularly important if there are disputes or complications regarding the claim or the policy itself. Consult with an attorney specializing in insurance matters if such situations arise.

Stay in Communication: Throughout the claims process, maintain open communication with the insurance provider. Keep records of all correspondence and communicate promptly if there are any updates or changes that may affect the claim or the payout.

Understanding the claims process helps alleviate potential difficulties during an already challenging time. Familiarize yourself with the requirements, follow the instructions diligently, and seek guidance from the insurance provider or professionals if needed. By being prepared and informed, you can navigate the claims process smoothly and ensure that your parent’s beneficiaries receive the appropriate death benefit payout.

Conclusion

Obtaining a life insurance policy on a parent is a significant decision that requires careful consideration and understanding of the process. By following the steps outlined in this guide, you can navigate the journey with confidence, ensuring the financial security and peace of mind for your parent and their beneficiaries.

Understanding the different types of life insurance policies, gathering the necessary information and documentation, and selecting the right coverage amount are crucial initial steps. Exploring and comparing quotes and rates from different insurance providers helps you find the best policy for your parent’s needs and budget.

Once you have chosen an insurance provider, completing the application process and undergoing the necessary medical examinations bring you closer to obtaining the life insurance policy. Making regular premium payments and maintaining open communication with the insurer are essential for sustaining the coverage.

In the event of your parent’s passing, understanding the claims process and promptly filing a claim will help ensure a smooth settlement and payout to the beneficiaries.

Throughout the process, seeking guidance from licensed insurance agents or financial advisors can provide valuable insights and help you make well-informed decisions that align with your parent’s specific circumstances and goals.

Remember, the purpose of the life insurance policy on your parent is to provide financial security and peace of mind. It is a testament to your love and care for them, allowing you to protect their legacy and support their loved ones even after they are gone.

By taking the time to educate yourself, carefully assess options, and make informed decisions, you can create a solid foundation for your parent’s financial future. Your efforts will go a long way in ensuring that their wishes are fulfilled and their loved ones are supported during challenging times.