Home>Finance>How Do I Know If My Car Insurance Covers Rentals?

Finance

How Do I Know If My Car Insurance Covers Rentals?

Published: November 17, 2023

Discover if your car insurance policy provides coverage for rentals. Understand your finance options and protect your vehicle on the road.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to car insurance, understanding the coverage you have is essential. Many car owners wonder if their insurance policy covers rental cars in case of an accident or when they need a temporary replacement vehicle. It’s an important question to ask, as rental car expenses can quickly add up if you’re not properly protected.

In this article, we will explore the ins and outs of rental car coverage, helping you understand whether your car insurance policy includes this valuable perk. We’ll guide you through the steps to determine if you’re covered and provide tips on what to do if you find yourself needing a rental car.

Car insurance policies can vary greatly, so it’s crucial to review the specifics of your own policy. Typically, car insurance policies have several types of coverage, including liability coverage, collision coverage, comprehensive coverage, and possible additional options such as rental car coverage. Each coverage type serves a different purpose in protecting you and your vehicle in various situations, so it’s important to know what your policy includes.

Understanding your car insurance policy is like navigating a maze of terms and conditions. However, with a little guidance, you can become well-informed about the specific details and benefits of your coverage, including rental car provisions. Let’s dive in and unravel the mystery behind rental car coverage in car insurance policies.

Understanding Your Car Insurance Policy

Before diving into the specifics of rental car coverage, it’s essential to have a solid understanding of your car insurance policy as a whole. This will help you better comprehend what is included and what isn’t in terms of coverage.

Car insurance policies typically consist of several types of coverage, each serving a unique purpose. Let’s take a closer look at the most common types of coverage:

- Liability Coverage: This is the most basic form of car insurance coverage and is required by law in most states. It protects you against financial loss if you cause an accident that results in injury or property damage to others.

- Collision Coverage: This coverage protects your vehicle in the event of a collision, regardless of who is at fault. It helps cover the cost of repairing or replacing your car.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage: This coverage helps pay for medical expenses if you or your passengers are injured in an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage or any coverage at all.

These are just a few examples of the various types of coverage that may be included in your car insurance policy. But what about rental car coverage?

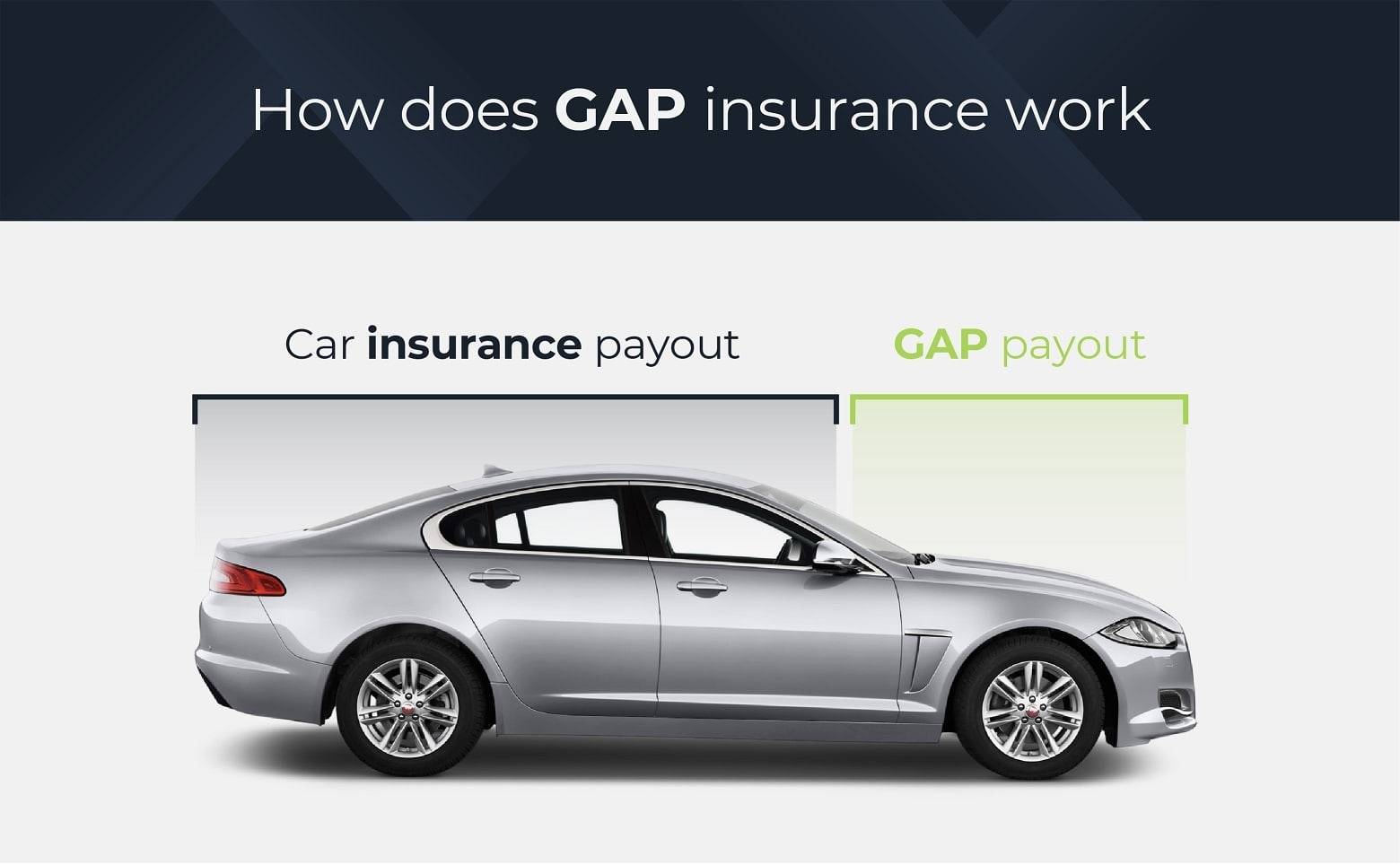

Rental car coverage, also known as rental reimbursement coverage, is an optional component of car insurance that helps cover the cost of renting a replacement vehicle while your car is being repaired after an accident. This coverage is typically subject to a daily limit and a maximum total limit, so it’s essential to review your policy’s specific details.

Now that we have a better understanding of the different types of coverage, let’s move on to exploring rental car coverage in more detail.

Rental Car Coverage Explained

Rental car coverage can be a valuable addition to your car insurance policy, providing peace of mind and financial protection when you need to rent a vehicle. This coverage is designed to help cover the cost of a temporary replacement car while your insured vehicle is being repaired due to an accident or covered incident.

The specifics of rental car coverage can vary depending on your insurance provider and policy, so it’s crucial to review your policy documents or contact your insurance agent to understand the exact terms and conditions. However, here are some key points to consider when it comes to rental car coverage:

- Coverage Limits: Rental car coverage typically has a daily limit, which determines the maximum amount your insurance company will contribute towards the rental car cost per day. Additionally, there is usually a maximum total limit, which sets a cap on the total amount the insurance company will pay for rental car expenses.

- Eligible Rental Vehicles: Not all rental vehicles may be covered under your rental car coverage. Some policies may only cover renting a similar-sized vehicle to your insured car, while others may have restrictions on luxury or high-performance vehicles.

- Coverage Duration: Rental car coverage is usually provided for a limited duration, typically until your insured vehicle is repaired and ready to be picked up. However, the specific duration can vary, so it’s important to review your policy or contact your insurance provider for clarification.

- Deductibles: Like other coverages in your car insurance policy, rental car coverage may have a deductible. This is the amount you need to pay out of pocket before your insurance coverage kicks in. Be sure to check the deductible amount specified in your policy documents.

- Exclusions: It’s essential to understand any exclusions or limitations that may apply to your rental car coverage. Certain circumstances, such as intentional damage, driving under the influence, or using the rental car for business purposes, may not be covered.

Remember, rental car coverage is an optional feature that you can add to your car insurance policy for an additional premium. It’s important to consider your specific needs, budget, and the likelihood of needing a rental car before deciding to include this coverage.

Now that we have a better understanding of what rental car coverage entails, let’s examine how to determine if your car insurance policy includes this coverage.

Determining If Rental Car Coverage is Included

Now that you understand what rental car coverage is, you may be wondering if your car insurance policy includes this valuable provision. There are a few ways to determine if rental car coverage is included in your policy:

1. Checking Your Policy Documents:

The first step is to review your car insurance policy documents. Look for any sections or clauses that mention rental car coverage, rental reimbursement, or temporary transportation coverage. Policy documents are a comprehensive source of information about your coverage, including any add-ons or optional features like rental car coverage.

Pay attention to the specific terms and conditions related to rental car coverage, such as coverage limits, eligible rental vehicles, or any exclusions that may apply. If you have any questions or need clarification, don’t hesitate to reach out to your insurance provider or agent for assistance.

2. Contacting Your Insurance Provider:

If you’re unable to find information about rental car coverage in your policy documents, the next step is to contact your insurance provider directly. They can provide you with up-to-date information about your coverage, including whether or not rental car coverage is included in your policy.

When speaking with your insurance provider, it’s helpful to have your policy number handy and any specific questions you may have about the rental car coverage. Be sure to inquire about any additional premium or cost associated with adding or including rental car coverage in your policy.

Remember to take notes during the conversation and ask for written confirmation, either via email or letter, of the details discussed. This way, you’ll have a record of the information provided by your insurance provider.

By reviewing your policy documents and contacting your insurance provider, you’ll be able to determine if rental car coverage is included in your car insurance policy. If it is not included, you may have the option to add it for an additional premium. Consider your personal circumstances, driving habits, and budget when deciding whether to include this coverage.

Now that you have a better idea of how to determine if your car insurance policy includes rental car coverage, let’s move on to exploring some additional considerations when it comes to renting a car.

Checking Your Policy Documents

When it comes to determining if your car insurance policy includes rental car coverage, one of the first steps is to thoroughly review your policy documents. Your policy documents contain valuable information about your coverage, including any additional features or add-ons like rental car coverage. Here are some key points to consider when checking your policy documents:

1. Coverage Details:

Look for sections that outline the specific details of your coverage. This may include information about liability coverage, collision coverage, comprehensive coverage, and any additional coverage options. Look for any mention of rental car coverage or temporary transportation coverage.

Take note of the coverage limits and any applicable deductibles that may apply. This will give you a clear understanding of the financial protection provided for rental car expenses.

2. Exclusions and Limitations:

Pay attention to any exclusions or limitations that may apply to rental car coverage. Some policies may have restrictions on the type of rental vehicles covered, the duration of coverage, or specific circumstances in which rental car expenses are not covered. Make sure to read these sections carefully to understand any potential limitations.

3. Additional Endorsements:

Check if your policy includes any additional endorsements or riders related to rental car coverage. These endorsements may provide additional details or specifications about the rental car coverage, such as eligible rental car providers or specific steps to follow in case of a rental car claim.

4. Contact Information:

Review the contact information provided in your policy documents. This will include the contact details of your insurance provider or agent. If you have any questions or need further clarification about your rental car coverage, don’t hesitate to reach out to them for assistance.

Remember, reviewing your policy documents is an essential step in understanding your car insurance coverage, including rental car coverage. If you have trouble understanding any of the terms or clauses mentioned in the documents, don’t hesitate to contact your insurance provider for clarification. They will be able to guide you through the policy details and ensure you have a clear understanding of your coverage.

Now that we have covered checking your policy documents, let’s move on to the next step of determining if rental car coverage is included – contacting your insurance provider.

Contacting Your Insurance Provider

If you’re unable to find clear information about rental car coverage in your policy documents, it’s time to contact your insurance provider directly. Speaking with your insurance provider is a crucial step in determining if rental car coverage is included in your policy and understanding the specific details. Here are some key points to consider when contacting your insurance provider:

1. Gather Your Policy Details:

Before reaching out to your insurance provider, gather all the necessary information about your policy. This includes having your policy number handy and any relevant documents or correspondence regarding your coverage.

2. Prepare Your Questions:

Make a list of questions or concerns you have about rental car coverage. This will help ensure that you cover all the necessary points during the conversation. Some questions you may want to ask include:

- Does my car insurance policy include rental car coverage?

- If rental car coverage is included, what are the coverage limits?

- What types of rental vehicles are eligible for coverage?

- Is there a deductible for rental car coverage?

- Are there any specific exclusions or limitations that apply to rental car coverage?

- Is there an additional premium or cost associated with rental car coverage?

3. Contact Your Insurance Provider:

Call the customer service number provided by your insurance provider or contact your insurance agent directly. Explain that you have questions about your car insurance policy and specifically about rental car coverage. Provide them with your policy number and any other necessary details to help them identify your specific policy.

4. Take Notes and Request Confirmation:

During the conversation, take notes about the information provided by your insurance provider. This will help you keep track of the details discussed. If possible, request written confirmation of the information discussed, either via email or letter. Having written confirmation will ensure that you have a record of the information provided by your insurance provider.

By contacting your insurance provider directly, you can get accurate and up-to-date information about your rental car coverage. They will be able to guide you through the specifics of your policy and answer any questions or concerns you may have.

Now that you know how to contact your insurance provider, let’s move on to some additional considerations when it comes to rental car coverage.

Additional Considerations

While determining if your car insurance policy includes rental car coverage is an important step, there are a few additional considerations to keep in mind when it comes to renting a car:

1. Rental Car Coverage from Other Sources:

Before purchasing rental car coverage from your car insurance provider, consider whether you already have coverage through other sources. For example, your credit card may offer rental car insurance as a benefit if you use the card to pay for the rental. Additionally, some travel insurance policies may include rental car coverage. It’s important to understand the extent of coverage provided by these sources and compare them to your car insurance policy to ensure you’re adequately protected.

2. Licensing and Age Requirements:

When renting a car, be aware of any licensing and age requirements imposed by the rental car company. Some rental car companies may have age restrictions for renting certain types of vehicles, and they may require a valid driver’s license and a minimum age to rent a car. Ensure that you meet the necessary requirements before making a reservation.

3. Additional Insurance Options:

While rental car coverage in your car insurance policy may provide necessary protection, rental car companies often offer additional insurance options at the time of rental. These options, such as collision insurance or personal accident insurance, provide extra coverage. Evaluate these options carefully, considering your personal circumstances and the level of coverage you already have through your car insurance policy or other sources.

4. Familiarize Yourself with Rental Policies:

Before driving away in a rental car, take the time to familiarize yourself with the rental policies and terms and conditions provided by the rental company. This includes understanding their insurance coverage, fuel policy, mileage limitations, return requirements, and any potential fees. By knowing the rental policies, you can avoid any surprises or misunderstandings during your rental period.

5. Rental Car Inspection:

When picking up a rental car, thoroughly inspect the vehicle for any pre-existing damages and ensure that these damages are recorded by the rental company. Taking photos or videos of the car before driving it off the lot can serve as evidence of its condition when you received it. This will help protect you from being held responsible for any damages that were present before you rented the vehicle.

By considering these additional factors when renting a car, you can make informed decisions and ensure a smooth and hassle-free rental experience.

Now that we have covered the additional considerations, let’s conclude our exploration of rental car coverage in car insurance policies.

Conclusion

Understanding the rental car coverage provided by your car insurance policy is essential for ensuring you have the appropriate protection in case you need to rent a car. By reviewing your policy documents and contacting your insurance provider, you can determine if rental car coverage is included in your policy and clarify any specific details or limitations.

Remember that rental car coverage is typically an optional add-on to your car insurance policy, so carefully consider your needs and budget before deciding whether to include this coverage. If rental car coverage is not included in your policy, explore alternative options such as coverage provided by your credit card or travel insurance.

When renting a car, familiarize yourself with the rental policies and terms and conditions of the rental company. Thoroughly inspect the vehicle for any pre-existing damages and document them to avoid liability for damages you didn’t cause.

Ultimately, having rental car coverage can provide peace of mind and financial protection during times when you need a temporary replacement vehicle. By understanding your car insurance policy and rental car coverage, you can be better prepared for unforeseen circumstances and make confident decisions.

If you have any further questions or concerns about your car insurance policy or rental car coverage, don’t hesitate to reach out to your insurance provider. They are there to assist you and ensure you have the necessary information to make informed choices.

Remember to regularly review your car insurance policy to stay informed about any changes or updates that may affect your coverage. With the right understanding and preparation, you can confidently navigate the rental car process and protect yourself and your finances in the event of an accident or covered incident.