Finance

How Does 1199 Pension Work

Published: November 27, 2023

Learn how the 1199 pension plan works and gain valuable insights into managing your finances for a secure retirement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The 1199 Pension Plan is a retirement savings program specifically designed for healthcare workers in the United States. Established in 1960 by the 1199SEIU United Healthcare Workers East, the plan offers a secure financial future for eligible members. With over 400,000 active participants and a strong track record of consistent returns, the 1199 Pension Plan has become a popular choice for healthcare professionals.

Ensuring financial stability during retirement is a significant concern for individuals in the healthcare industry. The demanding nature of the work and the long hours put in by healthcare workers make it essential to have a robust pension plan in place. The 1199 Pension Plan addresses this need by providing a reliable and comprehensive retirement solution.

In this article, we will explore the eligibility criteria, contribution methods, calculation of benefits, vesting rules, and options for receiving pension benefits through the 1199 Pension Plan. We will also discuss the advantages of participating in this plan and answer some frequently asked questions for a better understanding of how the plan works.

Eligibility for 1199 Pension

To be eligible for the 1199 Pension Plan, individuals must meet specific requirements outlined by the plan. The plan covers healthcare workers across a range of professions, including nurses, home care workers, pharmacists, lab technicians, and more.

Eligibility requirements typically include the following:

- Working for an employer that contributes to the 1199 Pension Plan

- Being an active employee and meeting the minimum hours worked threshold

- Being a member in good standing of 1199SEIU United Healthcare Workers East

- Meeting the age and service requirements as defined by the plan

The specific age and service requirements vary based on the provisions of each collective bargaining agreement or employer-sponsored plan. It is important to review the plan documents or consult with your union representative to determine your eligibility.

Additionally, certain eligibility rules may apply if you experience a break in employment or change employers. It is crucial to stay informed about any updates or changes to the plan’s eligibility criteria to ensure that you can enroll and receive the pension benefits you are entitled to.

Once you meet the eligibility criteria and become a participant in the 1199 Pension Plan, you can begin making contributions and building your retirement savings.

Contribution to 1199 Pension

The 1199 Pension Plan operates on a defined contribution basis, where both the employee and the employer contribute to the plan. These contributions, made on a regular basis, help build the retirement savings of participants.

As a participant in the 1199 Pension Plan, a portion of your salary will be deducted automatically and contributed towards your pension. The specific contribution amount may vary depending on your individual circumstances, such as your salary level and employment agreement.

The employer also makes contributions to the plan on behalf of eligible employees. These employer contributions provide an additional boost to the overall retirement savings and help ensure a more secure financial future for participants.

It is important to note that the contributions made to the 1199 Pension Plan are tax-deferred. This means that the funds contributed are not subject to income tax at the time of contribution, allowing your investment to grow on a tax-deferred basis. However, taxes will be due when you begin receiving distributions from the plan during retirement.

The contributions made to the 1199 Pension Plan are generally invested in a diversified portfolio of assets, such as stocks, bonds, and mutual funds, with the goal of generating growth and maximizing returns over the long term. The plan administrators carefully manage and monitor the investment options available within the plan to ensure the best possible outcomes for participants.

It is important to regularly review your contributions to the 1199 Pension Plan to ensure they align with your retirement goals. Consider consulting with a financial advisor who specializes in retirement planning to help you make informed decisions about your contribution levels and investment options.

Calculation of 1199 Pension Benefits

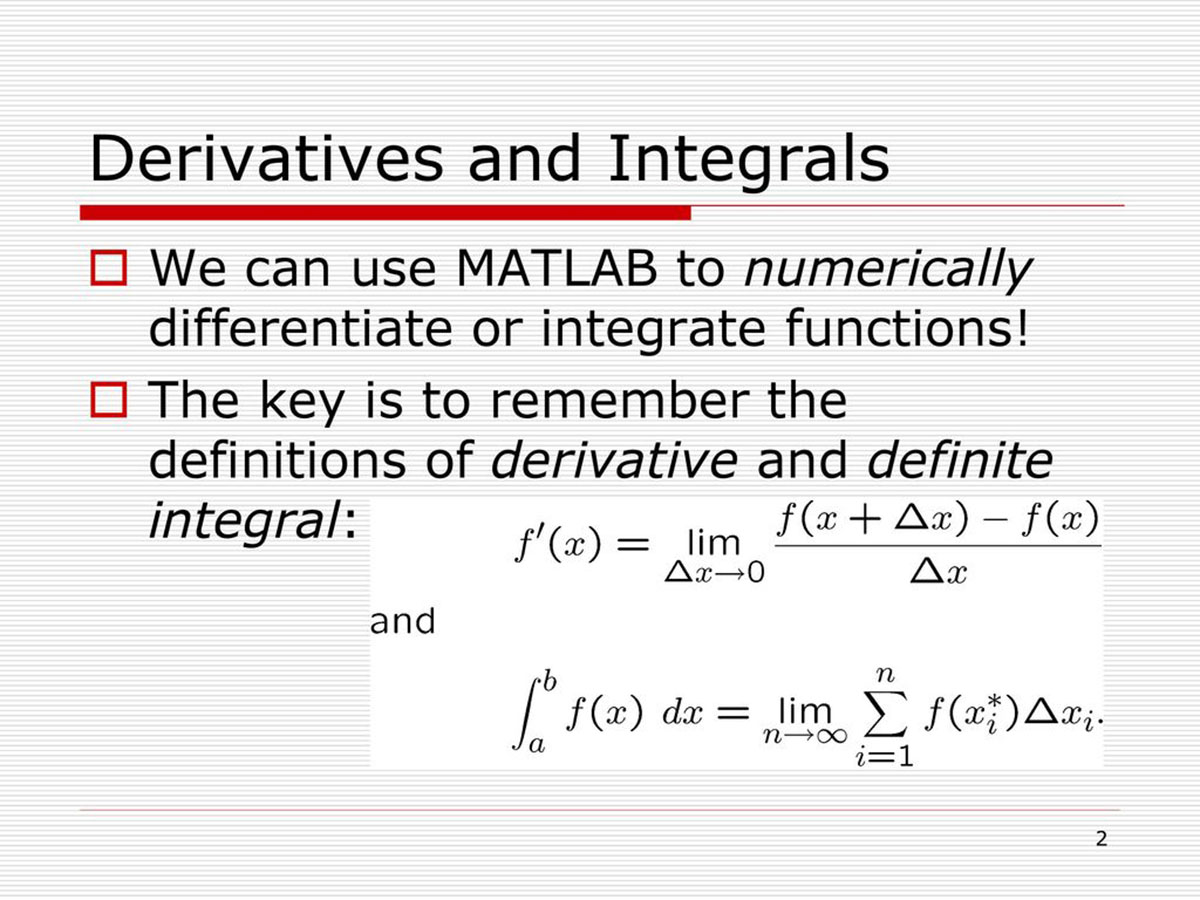

The calculation of pension benefits under the 1199 Pension Plan is based on a formula that takes into account various factors, including your years of credited service and your average salary during the years of highest earnings.

The plan typically uses a formula called a “benefit accrual rate” to determine the pension benefit you will receive upon retirement. This rate is applied to your average salary during your highest earning years and multiplied by your years of service in the plan.

For example, let’s say the benefit accrual rate is 1.5% and you have worked for 25 years with an average salary of $60,000 during your highest earning years. Using the formula, your annual pension benefit would be calculated as follows:

Annual Pension Benefit = Benefit Accrual Rate x Average Salary x Years of Service

Annual Pension Benefit = 1.5% x $60,000 x 25 = $22,500

It’s important to note that the benefit accrual rate and the number of years of credited service may vary depending on your specific employment agreement or collective bargaining agreement.

When calculating your pension benefit, the plan may also take into account other factors such as early retirement adjustment, Social Security integration, and forms of payment elections.

It’s advisable to review the plan documents or consult with the plan administrator to better understand the specific calculation method used and the factors that may impact your pension benefits.

By regularly monitoring your credited years of service and keeping track of your average salary during your highest earning years, you can estimate and plan for your future pension benefits under the 1199 Pension Plan.

Vesting in 1199 Pension

Vesting refers to the ownership of your pension benefits. In the context of the 1199 Pension Plan, vesting determines your right to receive pension benefits upon retirement. To be vested means that you have earned the right to receive the benefits accrued in your account, even if you leave your current employer or the plan.

The 1199 Pension Plan typically follows a vesting schedule based on your years of credited service. This means that the longer you remain in the plan, the more vested you become in your pension benefits. Vesting schedules may vary based on your specific employment agreement or collective bargaining agreement.

Typically, the 1199 Pension Plan has a “graded” or “graded cliff” vesting schedule, which means that your vesting percentage increases gradually over time until you are fully vested. For example, the vesting schedule might be structured as follows:

- 0-2 years of service: 0% vested

- 2-3 years of service: 25% vested

- 3-4 years of service: 50% vested

- 4-5 years of service: 75% vested

- 5+ years of service: 100% vested

Once you reach 100% vesting, you are entitled to receive the full benefits accrued in your account, regardless of your future employment status. It is important to track your years of credited service and understand the vesting schedule to determine when you will be fully vested in your pension benefits.

If you leave your current employer before reaching full vesting, you may be eligible for a partial refund of your contributions, depending on the rules and regulations governing the 1199 Pension Plan. However, it is generally more beneficial to stay in the plan and continue building your pension benefits until you reach full vesting.

Understanding the vesting requirements and keeping track of your years of service is crucial to ensure you receive the maximum benefits from the 1199 Pension Plan. Consult the plan documents or reach out to the plan administrator for specific details about the vesting rules applicable to your situation.

Options for Receiving 1199 Pension Benefits

When it comes to receiving pension benefits from the 1199 Pension Plan, participants have several options to choose from based on their individual preferences and financial needs. These options offer flexibility in how retirement income is distributed. It’s important to carefully consider these options and their implications before making a decision.

Here are some common options for receiving 1199 Pension benefits:

- Lump Sum Payment: Participants can choose to receive their pension benefits in a one-time lump sum payment. This option provides immediate access to the full value of the accrued benefits, which can be beneficial for those who prefer greater control over their retirement funds.

- Monthly Annuity: An annuity provides a guaranteed stream of income for life. Participants receive regular monthly payments based on their accrued benefits and other factors like age and life expectancy. This option offers financial security and the peace of mind of a steady income source throughout retirement.

- Joint and Survivor Annuity: This option allows participants to receive monthly payments for their lifetime, with the provision that a surviving spouse or beneficiary will continue to receive a portion of the pension benefits after the participant’s death. This ensures financial support for loved ones even after the participant passes away.

- Partial Lump Sum Option (PLOP): PLOP allows participants to receive a portion of their pension benefits as a lump sum, while the remaining balance is converted into a monthly annuity. This option provides a combination of immediate access to funds and regular income.

Each of these options has advantages and considerations to be aware of. It is crucial to review the plan documents, consult with a financial advisor, and consider your financial goals, lifestyle, and future retirement needs before selecting the most appropriate option for you.

Additionally, participants may have the option to roll over their pension benefits to an Individual Retirement Account (IRA) or another qualified retirement plan. This provides flexibility in managing and investing retirement savings.

Remember, once you select a pension benefit option, it is generally difficult to change it in the future. Therefore, it is crucial to make an informed decision based on careful consideration and expert advice.

Benefits of 1199 Pension

The 1199 Pension Plan offers numerous benefits to healthcare workers who participate in the plan. These benefits are designed to provide financial security and peace of mind during retirement. Here are some key advantages of the 1199 Pension Plan:

- Retirement Income: The 1199 Pension Plan ensures a reliable and regular stream of income during retirement. Participants can choose from various options, such as monthly annuity payments or lump sum distributions, to suit their financial needs and preferences.

- Tax Advantages: Contributions made to the 1199 Pension Plan are tax-deferred, meaning you don’t pay taxes on the contributions or the investment earnings until you start receiving distributions. This allows your retirement savings to grow faster and provides potential tax savings during your working years.

- Employer Contributions: The 1199 Pension Plan includes contributions from your employer, which boosts your retirement savings. These contributions increase the overall value of your pension benefits and provide an additional layer of financial security.

- Professional Management: The investments within the 1199 Pension Plan are managed by experienced professionals. This ensures that your retirement savings are invested in a diversified and balanced portfolio, optimizing the potential for growth and minimizing risk.

- Portability: If you change employers within the healthcare industry, you can often transfer your pension benefits from one employer’s plan to another, as long as both participate in the 1199 Pension Plan. This portability allows you to continue building your retirement savings seamlessly, regardless of where you work.

- Survivor Benefits: The 1199 Pension Plan offers options for providing ongoing financial support to your loved ones after your death. Joint and survivor annuity options can ensure that your spouse or beneficiary continues to receive a portion of the pension benefits, providing long-term security.

- Union-backed Plan: The 1199 Pension Plan is administered by 1199SEIU United Healthcare Workers East, a strong and renowned labor union. Being part of a union-backed plan brings added stability and assurance that your retirement benefits are well-managed and protected.

These benefits make the 1199 Pension Plan an attractive choice for healthcare workers looking to secure their financial future after retirement. By participating in the plan, you can enjoy the peace of mind knowing that you have a reliable and comprehensive pension plan in place.

Frequently Asked Questions (FAQs)

1. Who is eligible for the 1199 Pension Plan?

Eligibility for the 1199 Pension Plan is typically based on working for an employer that contributes to the plan, being an active employee, and meeting the age and service requirements set by the plan. Specific eligibility criteria may vary based on your employment agreement or collective bargaining agreement.

2. How are pension benefits calculated under the 1199 Pension Plan?

Pension benefits under the 1199 Pension Plan are calculated using a formula that considers factors such as years of credited service and average salary during the years of highest earnings. The benefit accrual rate is multiplied by the average salary and years of service to determine the annual pension benefit.

3. What are the options for receiving pension benefits?

Participants in the 1199 Pension Plan have options such as lump sum payment, monthly annuity payments, joint and survivor annuity, and partial lump-sum options. Each option has different implications, and it’s important to carefully consider your financial needs and goals before making a decision.

4. Can I transfer my pension benefits if I change employers?

If both your previous and new employers participate in the 1199 Pension Plan, you can often transfer your pension benefits from one employer’s plan to another. This allows you to continue building your retirement savings seamlessly, ensuring the portability of your benefits.

5. Can I take a loan against my 1199 Pension?

The 1199 Pension Plan generally does not allow participants to take loans against their pension benefits. The plan is designed to provide a secure retirement income stream, and taking loans from the plan may negatively impact your future financial security.

6. What happens if I leave the 1199 Pension Plan before retirement?

If you leave the plan before retirement, you may be eligible for a partial refund of your contributions. However, it is often more beneficial to stay in the plan and continue building your pension benefits until you reach full vesting.

7. Can I contribute additional funds to my 1199 Pension?

Under the 1199 Pension Plan, the contributions made are typically determined by your salary and the employer’s contribution rate. Additional voluntary contributions are generally not allowed. However, it’s advisable to review the plan documents or consult with the plan administrator for specific rules and options available to you.

Remember, these answers aim to provide general information, and it’s important to consult the plan documents or reach out to the plan administrator for specific details regarding your situation.

Conclusion

The 1199 Pension Plan offers healthcare workers a valuable retirement savings program, providing financial security and peace of mind during their golden years. With eligibility based on employment in the healthcare industry and contributions from both the employee and the employer, this plan allows participants to build a substantial retirement nest egg.

Through a carefully calculated formula, the 1199 Pension Plan determines the pension benefits participants will receive upon retirement. Vesting schedules ensure that participants gradually earn ownership of their pension benefits over time. Options for receiving benefits, such as lump sum payments or monthly annuities, offer flexibility to meet individual financial needs.

The 1199 Pension Plan comes with numerous advantages, including tax advantages, professional investment management, and survivor benefits, all of which contribute to a financially secure retirement. The plan’s partnership with 1199SEIU United Healthcare Workers East brings the added assurance of a union-backed retirement plan.

By understanding the eligibility criteria, contributions, benefit calculations, vesting rules, and distribution options of the 1199 Pension Plan, healthcare workers can make informed decisions about their retirement savings. It is crucial to review the plan documents, consult with the plan administrator, and consider individual financial goals to make the most appropriate choices.

Ultimately, the 1199 Pension Plan provides healthcare professionals with a reliable and comprehensive retirement solution, ensuring a stable income in the years after their dedicated service to the healthcare industry. By participating in this plan, individuals can enjoy the well-deserved rewards of a fulfilling and financially secure retirement.