Finance

How Does A Bad Credit Surety Bond Work

Published: January 13, 2024

Learn how bad credit impacts surety bonds in the finance industry and discover how these bonds work to protect businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of surety bonds, where financial security meets business obligations. Surety bonds play a vital role in various industries, providing a guarantee that specific obligations will be fulfilled. However, what happens when someone with bad credit needs a surety bond? Is it possible to obtain one? The answer lies in bad credit surety bonds.

Bad credit surety bonds are designed for individuals or businesses with less-than-perfect credit histories. While traditional surety bonds require a solid credit score and financial standing, bad credit surety bonds offer an alternative solution for those who have faced financial challenges in the past.

These bonds have gained popularity as they provide a second chance for individuals to meet their obligations and demonstrate their reliability. In this article, we delve into the world of bad credit surety bonds, exploring how they work, their benefits, and the alternatives available.

So, let’s unravel the mysteries surrounding bad credit surety bonds and shed some light on the options available for individuals with less-than-ideal credit scores. Whether you’re a business owner, contractor, or professional seeking financial security, this article will provide key insights into the realm of bad credit surety bonds.

Understanding Bad Credit Surety Bonds

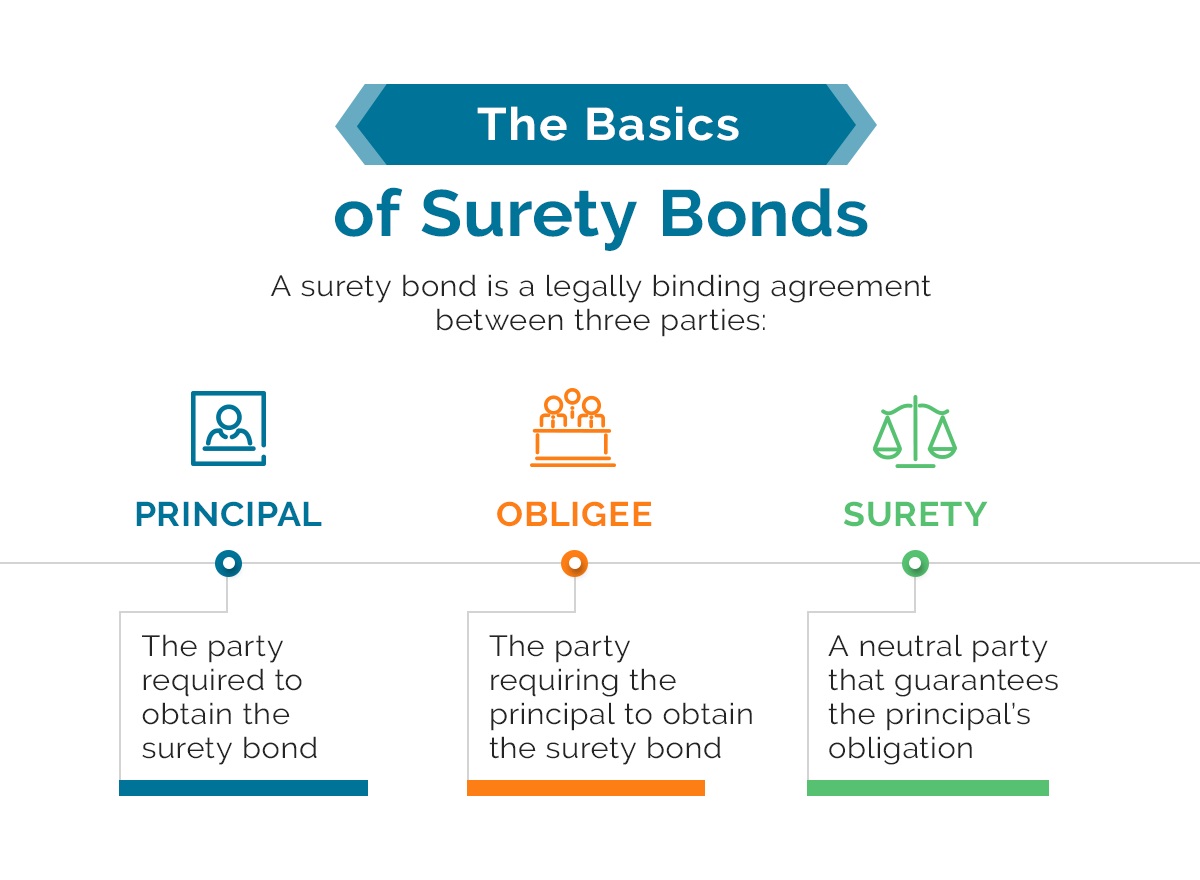

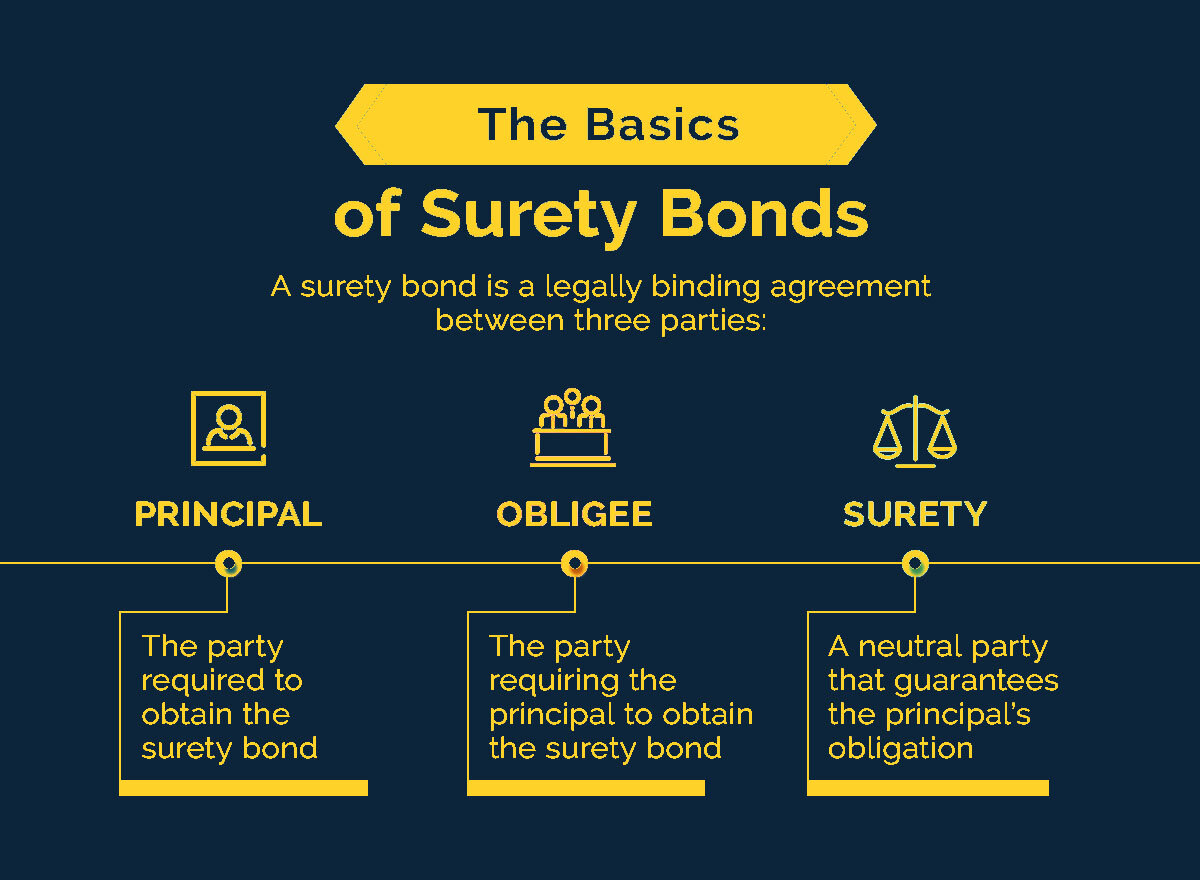

Before diving into the specifics of bad credit surety bonds, it’s important to understand the concept of surety bonds in general. A surety bond is an agreement between three parties: the principal (the party that needs the bond), the obligee (the party requiring the bond), and the surety company (the entity providing the bond).

The purpose of a surety bond is to guarantee that the principal will fulfill their contractual obligations to the obligee. In the event that the principal fails to fulfill their obligations, the surety company steps in to compensate the obligee for any losses incurred. This financial security provides assurance to the obligee and facilitates trust in business relationships.

Now, when it comes to bad credit surety bonds, the focus shifts to the creditworthiness of the principal. Applicants with bad credit histories, characterized by a low credit score, past bankruptcies, or late payments, may find it challenging to obtain traditional surety bonds. However, bad credit surety bonds cater to these individuals by considering factors beyond credit scores.

Bad credit surety bonds present an opportunity for those with less-than-perfect financial backgrounds to still obtain the necessary bond coverage. These bonds provide a pathway for individuals to rebuild their credit, regain trust, and fulfill their contractual obligations.

It’s important to note that bad credit surety bonds typically come with higher premiums compared to traditional bonds. The higher premiums act as a risk mitigation strategy for the surety company, compensating for the increased potential liability associated with applicants who have bad credit.

While bad credit surety bonds may offer a solution for individuals with less-than-ideal credit scores, it’s crucial to approach the application process with honesty and transparency. Providing accurate information about your financial history will contribute to building trust with the surety company and increase your chances of obtaining a bond.

In the next sections, we will explore how bad credit affects surety bond applicants and delve into the inner workings of bad credit surety bonds. Stay with us to uncover more about this alternative route to financial security.

The Role of Surety Bonds

Surety bonds play a crucial role in various industries by ensuring that contractual obligations are met and providing financial protection to all parties involved. Let’s take a closer look at the key roles of surety bonds:

- Ensuring Performance: One of the primary functions of surety bonds is to guarantee the performance of the principal. Whether it’s a construction project, a public contract, or a professional service agreement, surety bonds ensure that the principal fulfills their obligations as outlined in the contract.

- Protecting Parties: Surety bonds protect the obligee by providing financial compensation in the event of the principal’s failure to meet their obligations. This protection minimizes the risk for the obligee and acts as a safety net against potential financial losses.

- Building Trust: Surety bonds foster trust between the parties involved in a business transaction. By having a bond in place, the principal demonstrates their financial stability and commitment to fulfilling their contractual duties. This trust is critical in establishing and maintaining long-term business relationships.

- Regulatory Compliance: Surety bonds also play a role in ensuring compliance with regulations and laws. Certain industries, such as construction or transportation, require specific licenses or permits that can only be obtained with the appropriate surety bond in place. This ensures that businesses operate within the legal framework and adhere to industry standards.

Overall, surety bonds act as a financial guarantee that provides peace of mind to all parties involved in a business transaction. They offer a layer of protection and reassurance, ensuring that obligations are fulfilled, financial losses are mitigated, and trust is established.

Now that we understand the role of surety bonds, let’s explore how bad credit can impact individuals seeking these bonds and how bad credit surety bonds provide a solution for those facing credit challenges.

How Bad Credit Affects Surety Bond Applicants

When applying for traditional surety bonds, a strong credit history is typically a crucial factor in the approval process. Having good credit demonstrates a level of financial responsibility and stability, giving the surety company confidence in the applicant’s ability to fulfill their contractual obligations.

However, for individuals with bad credit, the picture is quite different. Bad credit, characterized by a low credit score, past financial difficulties, or a history of late payments, can significantly impact the approval process for surety bond applicants. Here are some ways in which bad credit affects surety bond applicants:

- Higher Premiums: Applicants with bad credit may be required to pay higher premiums for their surety bonds. This is because a low credit score indicates a higher risk of default, leading to increased liability for the surety company. Higher premiums help compensate for this added risk.

- Limited Options: Some surety companies may be hesitant to issue bonds to applicants with bad credit, leading to limited options for obtaining a bond. This can make it more challenging for individuals with bad credit to secure the necessary surety bond coverage.

- Stricter Underwriting Requirements: Surety companies may impose stricter underwriting requirements on applicants with bad credit. This can include additional documentation, financial statements, or collateral to mitigate the perceived risk associated with bad credit.

- Potential Denial: In some cases, applicants with severe credit issues may face denial of their surety bond applications altogether. Surety companies have the discretion to reject applicants who pose a significant risk based on their credit history.

It’s important to note that each surety company has its own underwriting guidelines and risk mitigation strategies. While bad credit may pose challenges, it doesn’t necessarily mean that individuals will be automatically denied a surety bond. Factors such as the type of bond, the severity and recency of the credit issues, and the overall financial stability of the applicant are also considered.

Fortunately, for those with bad credit, there is an alternative solution: bad credit surety bonds. In the next section, we will delve into how these bonds work and how they provide an opportunity for individuals with bad credit to obtain the necessary bond coverage.

Bad Credit Surety Bonds: How They Work

Bad credit surety bonds provide a pathway for individuals with less-than-ideal credit scores to still obtain the necessary bond coverage. These bonds work similarly to traditional surety bonds but take into consideration factors beyond credit scores when assessing the risk of the applicant.

Here’s how bad credit surety bonds work:

- Application Process: The applicant begins by completing an application for a bad credit surety bond. This application typically involves providing detailed information about the applicant’s financial history, including credit scores, past bankruptcies, and outstanding debts.

- Underwriting:

The surety company reviews the application and assesses the level of risk associated with providing the bond. While bad credit is a factor, other aspects such as the applicant’s current financial stability, industry experience, and references may also be taken into consideration. - Premium Determination: Upon evaluating the risk, the surety company determines the premium amount that the applicant will need to pay for the bad credit surety bond. This premium is typically higher than the premium for traditional bonds to compensate for the increased risk involved.

- Bond Issuance: If the application is approved and the premium is paid, the surety bond is issued. The bond serves as a financial guarantee that the applicant will meet their contractual obligations as specified in the bond agreement.

- Bond Coverage: The bad credit surety bond provides coverage for the obligee, ensuring that they will receive compensation in the event that the principal fails to fulfill their obligations. It acts as a safeguard against potential financial losses for the obligee.

- Bond Renewal: Bad credit surety bonds typically have a specific term, after which they need to be renewed. During the renewal process, the surety company may re-evaluate the applicant’s credit and financial situation to determine if any changes to the bond’s terms or premium are necessary.

It’s important to note that while bad credit surety bonds offer an alternative for individuals with bad credit, they are not a solution to overcome all financial challenges. Improving creditworthiness over time through responsible financial practices is crucial for long-term financial stability.

In the next section, we will explore the factors that can impact bad credit surety bonds, as well as the benefits they offer for individuals seeking bond coverage despite their credit challenges.

Factors Affecting Bad Credit Surety Bonds

When applying for a bad credit surety bond, there are several factors that can influence the approval process and the terms of the bond. While bad credit is a primary consideration, other factors also come into play. Let’s explore the key factors that affect bad credit surety bonds:

- Type of Bond: The type of bond being applied for can impact the approval process. Certain bonds, such as construction bonds or professional license bonds, may have stricter underwriting requirements, while others, such as contract bonds, may be more forgiving in terms of bad credit history.

- Severity of Credit Issues: Surety companies will consider the severity and recency of the credit issues. While bad credit might be a roadblock, recent financial improvement and steps taken to rectify past issues can demonstrate a commitment to financial responsibility.

- Financial Stability: A strong current financial position, including stable income, existing assets, and low debt-to-income ratio, can offset the impact of bad credit. Surety companies may view a strong financial foundation as a sign of the applicant’s ability to fulfill their bond obligations.

- Industry Experience: Relevant industry experience and a demonstrated track record of successful projects can contribute positively to the evaluation of the applicant’s risk. This can provide assurance to the surety company that the applicant has the skills and knowledge to complete their obligations.

- References: Positive references from clients, contractors, or other individuals within the industry can help strengthen the applicant’s case. These references can vouch for the applicant’s reliability, professionalism, and ability to deliver on their commitments.

- Collateral: In some cases, providing collateral can increase the chances of approval for a bad credit surety bond. Collateral acts as an additional layer of assurance for the surety company, reducing their risk in the event of a bond claim.

It’s important to note that each surety company has its own underwriting guidelines and risk assessment criteria. Factors such as the company’s experience, financial strength, and specific industry focus can also influence their approach to bad credit surety bonds.

By understanding the factors that affect bad credit surety bonds, applicants can take proactive measures to strengthen their position. This may include improving their financial stability, acquiring relevant industry experience, nurturing positive relationships within the industry, and seeking references that can vouch for their capabilities.

Next, let’s explore the benefits that bad credit surety bonds offer to individuals who are seeking bond coverage despite their credit challenges.

Benefits of Bad Credit Surety Bonds

Bad credit surety bonds offer several benefits for individuals who have struggled with their credit history but still need bond coverage. Let’s explore the advantages of obtaining a bad credit surety bond:

- Access to Bond Coverage: The primary benefit of bad credit surety bonds is that they provide access to bond coverage for individuals who may have been denied by traditional surety companies due to their credit history. This allows individuals to participate in projects, obtain necessary licenses, and fulfill contractual obligations.

- Opportunity for Improvement: Obtaining a bad credit surety bond provides an opportunity for individuals to rebuild their credit and improve their financial standing. By fulfilling their contractual obligations, maintaining a good track record, and making timely payments, individuals can demonstrate financial responsibility and work towards repairing their credit score.

- Business Growth: Having a surety bond in place, even with bad credit, instills trust and confidence in clients, contractors, and partners. This can lead to new business opportunities and growth, as potential clients are more likely to choose bonded contractors or professionals for their projects.

- Protection for Obligees: Bad credit surety bonds also provide protection for obligees. In the event that the principal fails to fulfill their obligations, the surety company steps in to compensate the obligee for any financial losses incurred. This safeguard ensures that the obligee is not left in a vulnerable position due to the principal’s inability to fulfill their commitments.

- Alternative to Collateral: Bad credit surety bonds can serve as an alternative to providing collateral. Instead of tying up assets or funds as collateral, individuals can secure a bond that meets the project or contractual requirements, enabling them to allocate their resources more strategically and efficiently.

These benefits make bad credit surety bonds a valuable tool for individuals with less-than-perfect credit scores. They offer a second chance, allowing individuals to overcome previous financial challenges, rebuild their credit, and continue pursuing their professional goals.

Now, let’s explore some alternative options available for individuals who may not qualify for bad credit surety bonds or prefer other routes to meet their bonding needs.

Alternatives to Bad Credit Surety Bonds

While bad credit surety bonds provide a solution for individuals with credit challenges, there may be instances where applicants are unable to obtain these bonds or prefer alternative options. Here are some alternatives to consider:

- Secured Bonds: If an applicant has assets that can be used as collateral, they may explore the option of securing a bond by providing collateral. This can help mitigate the surety company’s risk and increase the chances of bond approval.

- Joint Ventures or Partnerships: For individuals seeking bond coverage for a specific project, forming a joint venture or partnership with a financially stable entity can be an alternative. By partnering with a reputable and financially secure company, the risk associated with bad credit may be alleviated.

- Letter of Credit: A letter of credit from a financial institution can provide assurance to the obligee and act as an alternative to a surety bond. This document guarantees that payment will be made to the obligee in the event that the principal fails to fulfill their obligations.

- Self-Bonding: In some cases, certain government agencies may allow self-bonding, which means an individual can provide their own financial guarantee instead of obtaining a traditional surety bond. This option is often available for companies with a strong financial standing.

- Building Credit: Another alternative is to focus on improving creditworthiness over time. By demonstrating responsible financial behavior, paying off debts, and maintaining a good credit history, individuals can position themselves to obtain traditional surety bonds in the future.

It’s important to carefully consider the specific requirements of each project or contractual obligation and consult with professionals in the industry to determine the most suitable alternative option.

Remember, while bad credit surety bonds and alternative options provide opportunities for individuals with credit challenges to meet their bonding needs, it’s essential to take proactive steps to improve financial stability and creditworthiness over time.

Now, let’s conclude our exploration of bad credit surety bonds and alternative options.

Conclusion

Bad credit surety bonds offer a lifeline for individuals with less-than-ideal credit scores who require bond coverage. These bonds provide an opportunity to overcome past financial challenges, demonstrate financial responsibility, and fulfill contractual obligations. While bad credit may impact the approval process and result in higher premiums, bad credit surety bonds serve as a viable alternative for those who have been denied traditional bonds.

Factors such as the severity of credit issues, financial stability, industry experience, and references can influence the underwriting process for bad credit surety bonds. Additionally, alternatives such as secured bonds, joint ventures, letters of credit, and self-bonding may be considered by individuals who prefer different routes to meet their bonding needs.

Obtaining a bad credit surety bond or exploring alternative options can have several benefits, including access to bond coverage, an opportunity for credit improvement, business growth, and protection for obligees. These advantages provide individuals with the means to participate in projects, obtain licenses, and thrive in their professional endeavors.

It’s important to note that while bad credit surety bonds offer a solution, it’s essential to work towards improving creditworthiness over time through responsible financial practices. This can open doors to traditional surety bonds in the future and further support long-term financial stability.

Overall, bad credit surety bonds and alternative options provide individuals with opportunities to overcome credit challenges and pursue their goals. By understanding the intricacies of these bonds and exploring the available alternatives, individuals can make informed decisions to fulfill their bonding requirements while taking steps towards financial improvement.