Home>Finance>What Is Nonrefundable Portion Of Employee Retention Credit

Finance

What Is Nonrefundable Portion Of Employee Retention Credit

Modified: January 5, 2024

Learn about the nonrefundable portion of the Employee Retention Credit in finance. Enhance your understanding of this crucial aspect of employee retention.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Overview of the Employee Retention Credit

- Understanding the Nonrefundable Portion of the Employee Retention Credit

- Calculation of the Nonrefundable Portion

- Factors Affecting the Nonrefundable Portion

- Limitations and Restrictions on the Nonrefundable Portion

- Examples of the Nonrefundable Portion Calculation

- Conclusion

Overview of the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax credit introduced by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, to provide financial relief to eligible employers who have been adversely affected by the COVID-19 pandemic. This credit is designed to incentivize employers to retain and continue paying their employees.

The ERC is available to both small and large businesses, as well as tax-exempt organizations, who meet specific criteria. Eligible employers can claim a credit against their employment taxes equal to a percentage of qualified wages paid to employees during a certain period.

The credit amount is calculated based on 50% of qualified wages, up to a maximum of $10,000 per employee for all calendar quarters in 2021. This means that the maximum credit amount per employee for the entire year is $5,000.

It is important to note that the ERC is a refundable credit, which means that if the credit exceeds the employer’s tax liability, the excess amount can be refunded to the employer.

To qualify for the ERC, employers must meet one of two criteria:

- The employer’s business was fully or partially suspended due to a government order limiting operations during the pandemic.

- The employer experienced a significant decline in gross receipts.

For businesses with more than 100 full-time employees, the ERC can only be claimed for wages paid to employees who were not providing services due to a government order or experiencing a significant decline in gross receipts. On the other hand, businesses with 100 or fewer full-time employees can claim the credit for all employee wages, whether they were working or not.

The ERC is a valuable opportunity for employers to receive financial relief during these challenging times. By taking advantage of the credit, employers are not only able to support their employees but also mitigate some of the financial burdens caused by the pandemic.

In the following sections, we will delve deeper into the nonrefundable portion of the Employee Retention Credit and its calculation, providing you with a comprehensive understanding of this key aspect of the credit.

Understanding the Nonrefundable Portion of the Employee Retention Credit

When claiming the Employee Retention Credit (ERC), it is important to understand the concept of the nonrefundable portion. The nonrefundable portion refers to the portion of the credit that cannot be refunded to the employer if it exceeds their tax liability.

While the ERC is a refundable credit, the nonrefundable portion is treated as a nonrefundable tax credit. This means that if the nonrefundable portion is greater than the employer’s total tax liability, the excess amount will not be refunded and cannot be carried forward to future tax years.

The nonrefundable portion of the ERC is calculated by subtracting the employer’s total tax liability from the total amount of the credit. The remaining amount, if any, is considered the nonrefundable portion.

For example, if an employer’s total ERC is $10,000 and their tax liability is $8,000, the nonrefundable portion would be $2,000 ($10,000 – $8,000). In this scenario, the employer would receive a credit of $8,000, and the remaining $2,000 cannot be refunded.

It is important for employers to accurately calculate their tax liability and understand the potential nonrefundable portion to effectively plan their financial resources and tax obligations.

The nonrefundable portion of the ERC is subject to certain limitations and restrictions. For instance, it cannot be used to offset the employer’s Federal Insurance Contributions Act (FICA) taxes or certain other payroll taxes. The nonrefundable portion can only be used to offset the employer’s basic income tax liability.

Furthermore, the nonrefundable portion is not eligible for carryback or carryforward. This means that any unused amount cannot be carried back to previous tax years or carried forward to future tax years. It is a “use it or lose it” credit.

Understanding the nonrefundable portion of the ERC is crucial as it helps employers determine the actual benefit they can receive from the credit and plan their cash flow accordingly. By assessing their tax liability and understanding the limitations of the nonrefundable portion, employers can make informed decisions on how to utilize the ERC to support their business during these challenging times.

In the next section, we will explore the calculation factors that can affect the nonrefundable portion of the Employee Retention Credit.

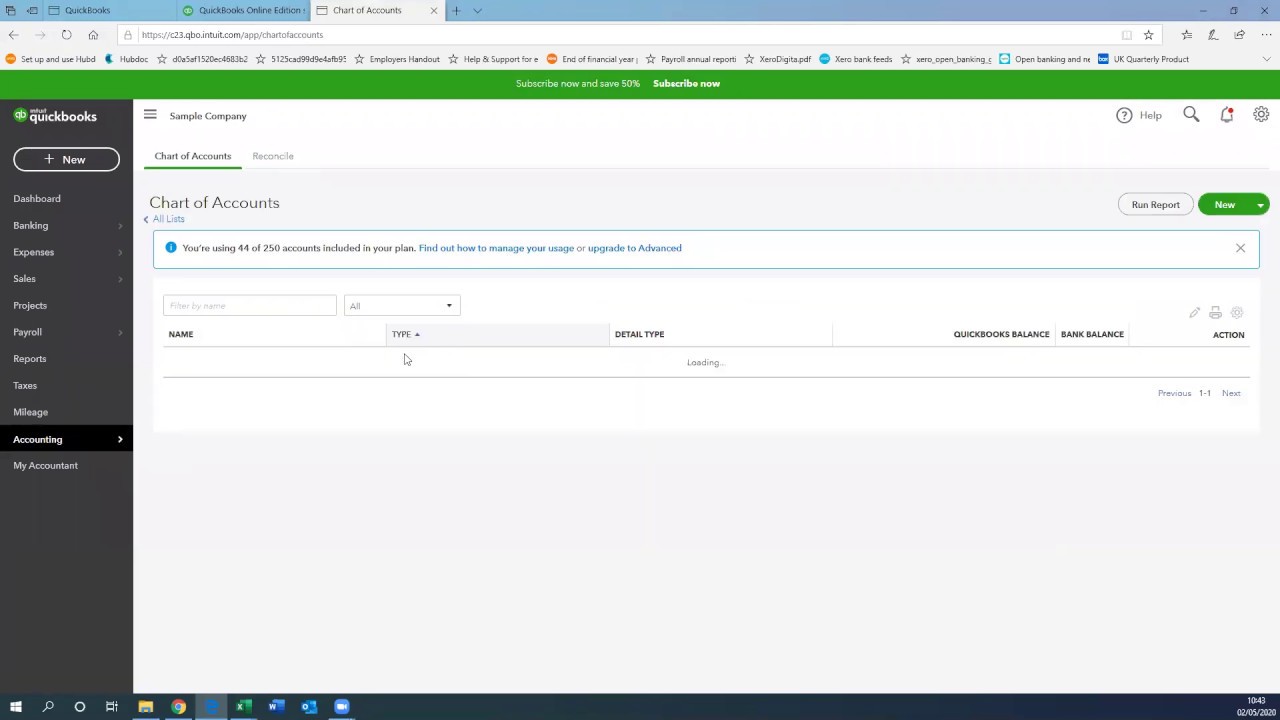

Calculation of the Nonrefundable Portion

The calculation of the nonrefundable portion of the Employee Retention Credit (ERC) involves determining the employer’s total tax liability and subtracting it from the total amount of the credit. The remaining amount, if any, represents the nonrefundable portion.

To calculate the nonrefundable portion of the ERC, employers need to consider the following steps:

- Determine the total amount of the ERC for the applicable period. This is calculated as 50% of qualified wages paid to employees, up to a maximum of $10,000 per employee for all calendar quarters in 2021.

- Calculate the employer’s total tax liability for the applicable period, including income taxes and any other eligible tax credits that can offset the tax liability.

- Subtract the total tax liability from the total amount of the ERC to determine the nonrefundable portion.

Let’s consider an example to further illustrate the calculation:

ABC Company is eligible for the ERC and has a total ERC amount of $20,000 for the applicable period. The company’s total tax liability, including income taxes and other eligible tax credits, is determined to be $15,000. In this case, the nonrefundable portion of the ERC would be $5,000 ($20,000 – $15,000).

It is important to note that if an employer’s total tax liability exceeds the total amount of the ERC, there would be no nonrefundable portion. In other words, the credit would be fully utilized to offset the tax liability.

Additionally, employers should keep in mind that the nonrefundable portion of the ERC cannot be carried forward to future tax years. It is only applicable for the current tax year and cannot be used to offset tax liabilities in the past or future.

Calculating the nonrefundable portion of the ERC allows employers to understand the actual benefit they will receive from the credit. By accurately determining their tax liability and considering the eligibility requirements and limitations, employers can effectively plan their cash flow and make informed decisions regarding the utilization of the ERC.

In the next section, we will explore the various factors that can affect the nonrefundable portion calculation and provide examples to illustrate different scenarios.

Factors Affecting the Nonrefundable Portion

The calculation of the nonrefundable portion of the Employee Retention Credit (ERC) can be influenced by various factors. These factors determine the amount of the credit that can be utilized to offset the employer’s tax liability. Understanding these factors is essential for employers to accurately calculate the nonrefundable portion and plan their financial resources effectively.

The following are some key factors that affect the nonrefundable portion calculation:

- Qualified Wages: The amount of qualified wages paid to employees during the relevant period plays a crucial role in determining the total ERC amount. As the nonrefundable portion is calculated as a percentage of qualified wages, any changes in the wage amount can directly impact the nonrefundable portion.

- Employer’s Tax Liability: The total tax liability of the employer, including income taxes and any other eligible tax credits, determines how much of the ERC can be utilized to offset the tax liability. If the tax liability is less than the total ERC amount, the remaining portion will be considered nonrefundable.

- Other Tax Credits: The utilization of other eligible tax credits can also affect the nonrefundable portion calculation. For example, if an employer has already claimed certain tax credits that reduce their tax liability, it can impact the available amount of the ERC that can be used to offset the liability.

- Per-employee Limit: The ERC has a maximum per-employee limit of $10,000 for all calendar quarters in 2021. If an employer has already reached this limit with their qualified wages, any additional wages paid to that employee during the same period will not be eligible for the credit. This can impact the overall ERC amount and subsequently the nonrefundable portion.

- Business Size: The size of the employer’s business also determines how the ERC can be utilized. For businesses with more than 100 full-time employees, the credit can only be claimed for wages paid to employees who were not providing services due to a government order or experiencing a significant decline in gross receipts. This limitation can affect the calculation of the nonrefundable portion for larger businesses.

It is important for employers to carefully consider these factors when calculating the nonrefundable portion of the ERC. By analyzing their qualified wages, tax liability, other tax credits, per-employee limits, and business size, employers can ensure accurate calculations and optimize the utilization of the ERC.

In the next section, we will provide examples to illustrate the calculation of the nonrefundable portion in different scenarios, providing a practical understanding of how these factors come into play.

Limitations and Restrictions on the Nonrefundable Portion

While the Employee Retention Credit (ERC) provides valuable financial relief to eligible employers, there are certain limitations and restrictions on the nonrefundable portion of the credit. Understanding these limitations is crucial for employers to effectively plan their utilization of the credit and comply with the requirements set forth by the Internal Revenue Service (IRS).

The following are some key limitations and restrictions on the nonrefundable portion of the ERC:

- Offsetting Payroll Taxes: The nonrefundable portion of the ERC cannot be used to offset the employer’s portion of Federal Insurance Contributions Act (FICA) taxes or certain other payroll taxes. It is important to note that the credit can only be applied against the employer’s basic income tax liability.

- Carryback and Carryforward: The nonrefundable portion of the ERC is not eligible for carryback or carryforward. This means that any unused amount of the nonrefundable portion cannot be carried back to previous tax years or carried forward to future tax years. It is a “use it or lose it” credit for the current tax year.

- Interaction with Other Credits: Employers should be aware of how the nonrefundable portion of the ERC interacts with other tax credits. The credit cannot be double-dipped with certain other tax credits, meaning that the same wages cannot be used to claim multiple tax credits simultaneously. Employers should carefully evaluate the eligibility and interactions of various credits to avoid any unintended violations.

- Eligibility Requirements: The nonrefundable portion of the ERC is subject to the eligibility requirements set by the IRS. Employers must meet specific criteria related to business suspension or significant decline in gross receipts to qualify for the credit. Failing to meet these requirements can result in the denial or recapture of the credit.

It is crucial for employers to comprehend and adhere to these limitations and restrictions to ensure the proper utilization of the ERC. Employers should consult with tax professionals or utilize IRS guidance to fully understand the intricacies and stay compliant with the regulations.

By taking into account these limitations and restrictions, employers can effectively plan their utilization of the nonrefundable portion of the ERC while complying with the IRS guidelines. It is recommended to seek professional advice or refer to updated IRS publications for specific details and guidance related to the nonrefundable portion of the credit.

In the next section, we will provide examples to further illustrate the calculation of the nonrefundable portion and its implications in different scenarios.

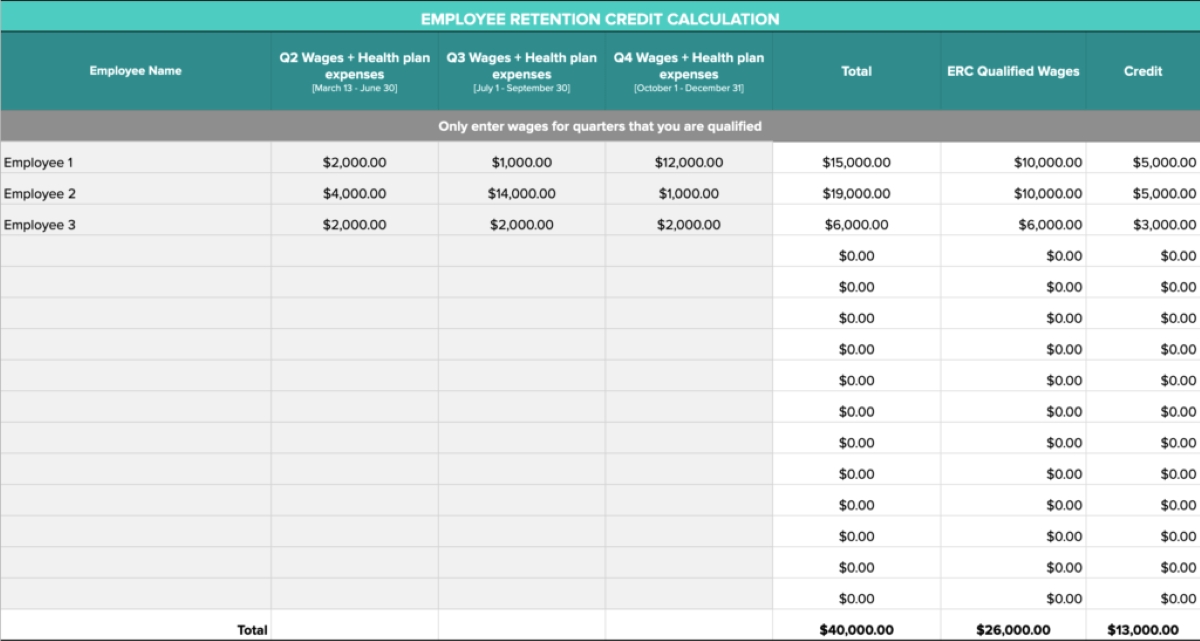

Examples of the Nonrefundable Portion Calculation

To further illustrate the calculation of the nonrefundable portion of the Employee Retention Credit (ERC), let’s consider a few examples in different scenarios. These examples will provide a practical understanding of how the nonrefundable portion is calculated and its implications for eligible employers.

Example 1:

ABC Company, a small business with 50 full-time employees, qualified for the ERC and has a total ERC amount of $15,000 for the applicable period. Their total tax liability, including income taxes, is determined to be $10,000. In this case, the nonrefundable portion of the ERC would be $5,000 ($15,000 – $10,000). The company would receive a credit of $10,000, and the remaining $5,000 cannot be refunded.

Example 2:

XYZ Corporation, a larger business with 200 full-time employees, also qualified for the ERC. They have a total ERC amount of $50,000 for the applicable period. However, their total tax liability, including income taxes and other eligible tax credits, is determined to be $60,000. In this scenario, there would be no nonrefundable portion as the tax liability exceeds the total ERC amount. The full $50,000 credit would be utilized to offset the tax liability, and there would be no excess credit to be refunded.

Example 3:

LMN Non-profit Organization experienced a significant decline in gross receipts and is eligible for the ERC. They have a total ERC amount of $25,000 for the applicable period. However, their total tax liability is determined to be $20,000. In this case, the nonrefundable portion of the ERC would be $0. Since the tax liability is less than the total ERC amount, the entire credit would be utilized to offset the tax liability, and there would be no nonrefundable portion.

These examples demonstrate how the nonrefundable portion of the ERC can vary depending on the employer’s tax liability and the total amount of the credit. It is vital for employers to accurately calculate their tax liability and understand the implications of the nonrefundable portion to plan their financial resources effectively.

By analyzing these examples and considering their specific circumstances, eligible employers can gauge the potential benefit they can receive from the ERC and make informed decisions on how to utilize the credit to support their business during these challenging times.

In the next section, we will conclude our discussion on the nonrefundable portion of the Employee Retention Credit and reiterate its significance for eligible employers.

Conclusion

The nonrefundable portion of the Employee Retention Credit (ERC) is a significant factor for eligible employers to consider when claiming this valuable tax credit. Understanding the calculation and implications of the nonrefundable portion is crucial for optimizing the benefit that can be received from the ERC.

Throughout this article, we explored the key aspects of the ERC, including its overview, the concept of the nonrefundable portion, its calculation, and the factors that can affect it. We also discussed the limitations and restrictions that employers should be aware of when utilizing the nonrefundable portion of the credit.

By accurately calculating the nonrefundable portion, employers can effectively plan their financial resources and determine the amount of the credit that can be utilized to offset their tax liability. Careful consideration of factors such as qualified wages, total tax liability, per-employee limits, and business size can help employers optimize the utilization of the ERC.

It is important for employers to stay up-to-date with the latest guidance and regulations provided by the Internal Revenue Service (IRS) regarding the ERC and the nonrefundable portion. Consultation with tax professionals or referring to official IRS publications can provide further clarity and ensure compliance with the requirements.

In conclusion, the nonrefundable portion of the ERC is a critical component of this tax credit that can provide financial relief to eligible employers affected by the COVID-19 pandemic. By understanding its calculation, limitations, and interactions with other tax credits, employers can maximize the benefits of the ERC and effectively support their business during these challenging times.

As the economic impact of the pandemic continues to evolve, employers should monitor any updates from the IRS and consult with professionals to ensure they are taking advantage of all available financial relief options, including the Employee Retention Credit.