Home>Finance>How Does Credit Default Indicate The Probability Of Default Of A Company?

Finance

How Does Credit Default Indicate The Probability Of Default Of A Company?

Published: March 4, 2024

Learn how credit default reflects a company's likelihood of default. Explore the significance of credit default in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Understanding the intricacies of credit default and its impact on a company's probability of default is crucial in the realm of finance. Credit default serves as a key indicator of a company's financial health and stability, providing valuable insights into its ability to meet financial obligations. By delving into the relationship between credit default and the probability of default, we can gain a comprehensive understanding of the factors that influence these critical metrics.

In this article, we will explore the significance of credit default and its correlation with the probability of default for companies. By examining the underlying mechanisms and influential factors, we aim to shed light on the intricate interplay between credit default and the likelihood of a company facing financial distress. Through this exploration, readers will gain a deeper understanding of the pivotal role that credit default plays in assessing the financial robustness of a company.

Join us as we unravel the complexities of credit default and delve into its implications for a company's overall financial well-being. Let's embark on a journey to demystify the correlation between credit default and the probability of default, gaining valuable insights into the dynamics that underpin the financial landscape.

**

Understanding Credit Default

**

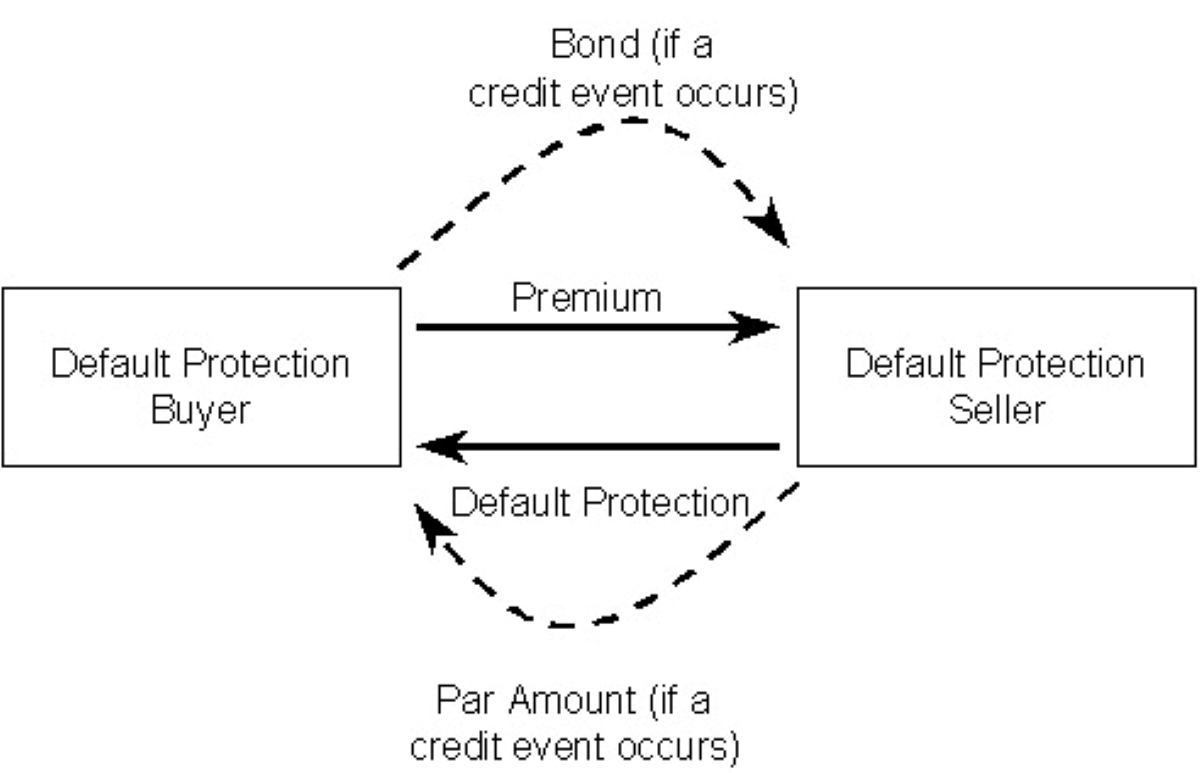

Credit default refers to the failure of a borrower to honor their debt obligations, signaling a breach of the contractual agreement with the lender. When a borrower defaults on a loan or bond, it indicates their inability to make timely interest payments or repay the principal amount. This pivotal event triggers significant repercussions for both the borrower and the lender, influencing the financial dynamics of the involved parties.

From the perspective of the lender, credit default poses a substantial risk, potentially leading to financial losses and a dent in the overall portfolio performance. Lenders meticulously assess the creditworthiness of borrowers to mitigate the risk of default, employing various metrics and financial indicators to gauge the likelihood of timely repayment. On the other hand, borrowers strive to maintain a favorable credit profile to secure access to funding at competitive terms, steering clear of the detrimental consequences associated with default.

The concept of credit default extends beyond individual borrowers, encompassing entities such as corporations and governments. In the corporate sphere, credit default can manifest in the form of a company failing to meet its debt obligations, triggering a ripple effect across various stakeholders, including shareholders, bondholders, and suppliers. Similarly, sovereign credit default pertains to a government’s inability to honor its debt commitments, exerting far-reaching implications on the national economy and financial markets.

Amidst the intricate web of financial transactions and credit relationships, the occurrence of credit default serves as a critical barometer of financial stability and risk exposure. By comprehending the nuances of credit default, stakeholders can make informed decisions and implement risk mitigation strategies, safeguarding their financial interests in an ever-evolving economic landscape.

**

Credit Default and Probability of Default

**

The relationship between credit default and the probability of default is integral to the assessment of a company’s financial viability and risk profile. Credit default acts as a precursor to the probability of default, offering valuable insights into the likelihood of a company failing to meet its financial obligations in the future. This linkage serves as a cornerstone in the realm of credit risk analysis, guiding investors, lenders, and other stakeholders in evaluating the resilience of a company’s financial position.

When a company experiences credit default, it not only signifies a breach of its debt obligations but also raises pertinent questions about its underlying financial health and operational stability. This pivotal event prompts a reassessment of the company’s creditworthiness, prompting stakeholders to scrutinize various financial metrics and indicators to gauge the probability of default. As such, credit default serves as a red flag, prompting heightened vigilance and risk assessment within the financial landscape.

Furthermore, credit default influences the pricing of financial instruments and the cost of capital for companies, reflecting the perceived risk of default. This, in turn, impacts the company’s ability to raise funds and access credit facilities at favorable terms, shaping its financial trajectory and strategic decisions. The interplay between credit default and the probability of default underscores the interconnected nature of financial markets, where risk perceptions and credit events reverberate across diverse stakeholders and asset classes.

By delving into the correlation between credit default and the probability of default, stakeholders can gain a holistic understanding of a company’s risk exposure and financial resilience. This insight empowers investors, creditors, and market participants to make informed decisions, effectively managing their risk exposure and optimizing their investment strategies. Through a nuanced comprehension of this relationship, stakeholders can navigate the intricate terrain of credit risk with prudence and foresight, fortifying their financial positions in an ever-changing economic landscape.

**

Factors Influencing Credit Default

**

Credit default is influenced by a myriad of factors that collectively shape the risk landscape for companies and borrowers. Understanding these influential elements is paramount in comprehending the dynamics that underpin credit default and its ramifications for the financial ecosystem. By dissecting the key factors that influence credit default, stakeholders can gain valuable insights into the risk exposure and financial resilience of entities operating within the complex web of credit relationships.

1. Financial Health and Performance: The financial health and performance of a company serve as pivotal determinants of its susceptibility to credit default. Factors such as profitability, cash flow adequacy, leverage ratios, and liquidity position play a crucial role in assessing the company’s ability to meet its debt obligations. A robust financial performance augurs well for mitigating the risk of credit default, instilling confidence in lenders and investors.

2. Macroeconomic Conditions: The broader macroeconomic environment exerts a significant influence on credit default, with economic downturns and recessionary pressures amplifying the risk of default for companies. Unfavorable macroeconomic indicators, such as rising unemployment, inflationary pressures, and sluggish GDP growth, can elevate the likelihood of credit default across various sectors and industries.

3. Industry Dynamics: The specific dynamics and competitive landscape of an industry can impact the credit default risk for companies operating within it. Industries characterized by intense competition, technological disruptions, or regulatory challenges may face heightened default risks, necessitating a nuanced assessment of industry-specific risk factors.

4. Debt Structure and Covenants: The composition of a company’s debt structure, including the presence of restrictive covenants and debt maturity profiles, influences its susceptibility to credit default. Companies with onerous debt covenants or a mismatch between debt maturities and cash flow generation may face heightened default risks, warranting careful evaluation by stakeholders.

5. Market Sentiment and Investor Perception: The sentiment of market participants and investor perception can impact the risk of credit default, influencing the pricing of credit instruments and the cost of capital for companies. Negative market sentiment and apprehensions about a company’s financial outlook can exacerbate the risk of credit default, necessitating proactive measures to assuage investor concerns.

By assimilating these influential factors into the risk assessment framework, stakeholders can gain a comprehensive understanding of the determinants of credit default and proactively manage their risk exposure. This multifaceted approach enables stakeholders to navigate the intricate terrain of credit risk with acumen, fortifying their financial positions and fostering sustainable growth in a dynamic economic landscape.

**

Conclusion

**

The interplay between credit default and the probability of default underscores the intricate dynamics that shape the risk landscape for companies and borrowers. Credit default serves as a critical barometer of financial stability, signaling the breach of debt obligations and prompting a reassessment of a company’s creditworthiness. This pivotal event reverberates across the financial ecosystem, influencing the pricing of credit instruments, the cost of capital, and the risk perceptions of market participants.

By unraveling the correlation between credit default and the probability of default, stakeholders can gain valuable insights into the risk exposure and financial resilience of entities operating within the complex web of credit relationships. The multifaceted factors that influence credit default, ranging from financial health and macroeconomic conditions to industry dynamics and market sentiment, collectively shape the risk landscape, necessitating a holistic approach to credit risk assessment.

As stakeholders navigate the intricate terrain of credit risk, a nuanced understanding of the determinants of credit default empowers them to make informed decisions, effectively managing their risk exposure and optimizing their investment strategies. By integrating these insights into their risk assessment frameworks, stakeholders can fortify their financial positions, mitigate the impact of credit default, and foster sustainable growth in an ever-changing economic landscape.

In essence, the correlation between credit default and the probability of default underscores the imperative of proactive risk management and astute financial analysis. By embracing a comprehensive understanding of these critical metrics, stakeholders can navigate the complexities of credit risk with prudence and foresight, safeguarding their financial interests and contributing to a resilient and dynamic financial ecosystem.