Finance

When Do Futures Contracts Roll Over

Published: December 24, 2023

Discover the important details and timing of when futures contracts roll over in the finance industry. Stay up-to-date with our expert insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of futures contract trading! For those new to the field, futures contracts are financial instruments that allow investors to buy or sell an asset at a predetermined price and date in the future. They provide a way for traders to speculate on the price movement of commodities, stocks, currencies, and more, without actually owning the underlying asset.

One important aspect of futures trading that traders need to be familiar with is the concept of rollover. Rollover refers to the process of moving from one contract to another as the current contract approaches its expiration date. This is done to maintain exposure to the desired trading position and avoid the obligation of physical delivery of the asset.

In this article, we will delve deeper into the world of futures contracts rollover. We will explore the factors that influence the timing of rollover, the seasonal patterns observed in commodities rollover, the procedures and costs associated with rollover, and the implications for traders. Additionally, we will discuss strategies that traders can employ to effectively manage the rollover process.

By understanding and mastering the art of rollover, traders can enhance their ability to navigate the futures market and optimize their trading strategies.

What is a Futures Contract?

A futures contract is a standardized agreement between two parties to buy or sell an asset, such as a commodity, currency, or financial instrument, at a specified price and date in the future. Unlike options contracts, which provide the right but not the obligation to buy or sell an asset, futures contracts require both parties to fulfill their obligations at the agreed-upon terms.

These contracts are traded on futures exchanges, where buyers and sellers come together to enter into agreements. The exchange acts as an intermediary, ensuring the smooth functioning of the market and providing a platform for price discovery and liquidity.

Each futures contract specifies certain details, including:

- Underlying Asset: The asset that the contract represents, such as oil, gold, or stock index.

- Contract Size: The quantity of the underlying asset that is represented by one contract.

- Delivery Month: The month in which the contract expires and needs to be settled.

- Delivery Location: The physical location where the asset will be delivered in case the contract is held until expiration.

When trading futures contracts, there are two types of market participants:

- Hedgers: These are individuals or companies that use futures contracts to manage their exposure to price fluctuations in the underlying asset. For example, a farmer may use futures contracts to lock in a price for their upcoming crop, protecting against potential price declines.

- Speculators: Speculators, on the other hand, profit from price movements in the underlying asset without any intention of taking delivery. They aim to buy contracts when they expect prices to rise or sell contracts when they anticipate a decline.

By entering into futures contracts, both hedgers and speculators can participate in the market and take advantage of price movements. Futures trading offers the potential for significant profits but also carries a high level of risk. It requires careful analysis and understanding of market dynamics, as well as the ability to manage risks effectively.

Now that we have covered the basics of futures contracts, let’s explore how rollover plays a crucial role in the trading process.

Rollover in Futures Contract Trading

In futures contract trading, rollover refers to the process of transitioning from one contract to another as the current contract nears its expiration date. This is essential for traders who wish to maintain their trading positions without physically delivering or receiving the underlying asset.

The primary reason for rollover is that futures contracts have a limited lifespan. They are typically traded in monthly or quarterly cycles, with each contract having a specific expiration date. Once a contract expires, traders would need to close their positions and either take physical delivery of the asset (in the case of physical commodities) or settle the contract in cash.

Rather than going through the process of physically delivering or settling each contract they hold, traders often choose to roll over their positions. When rolling over, they close their current contract and establish a new contract with a later expiration date. This allows traders to maintain their desired exposure to the underlying asset while avoiding any obligations related to settlement or physical delivery.

For example, if a trader holds a long position in a crude oil futures contract that is about to expire, they can choose to roll over their position by selling the expiring contract and simultaneously buying a new contract with a later expiration date. By doing so, the trader maintains their exposure to the price of crude oil without needing to take delivery of the physical product.

Rollover is a standard practice in futures trading and is essential for traders who wish to maintain continuous exposure to the market. It provides a seamless transition from one contract to another, allowing traders to stay in their positions without disruption.

Next, we will explore the factors that affect the timing of rollover in futures contract trading.

Factors Affecting Rollover Timing

The timing of rollover in futures contract trading is influenced by several factors. Understanding these factors can help traders make informed decisions about when to roll over their positions. Here are some key factors that affect the timing of rollover:

- Expiration Date: The expiration date of the current contract is a crucial factor in determining when to roll over. Traders typically aim to roll over their positions before the expiration date to avoid any complications or disruptions in their trading strategies.

- Market Liquidity: The liquidity of the futures market for a particular contract is an important consideration. Traders prefer to roll over their positions when the market is highly liquid, as this ensures timely execution of their trades and minimizes slippage.

- Trading Volume: The trading volume of the current and next contract is another factor to consider. Traders may choose to roll over their positions when the volume shifts from the expiring contract to the new contract, indicating a smooth transition and active trading in the market.

- Price Divergence: Price divergence refers to the difference in prices between the expiring and the new contract. Traders keep an eye on the price spread between the two contracts and may choose to roll over when the spread narrows or aligns with their trading strategy.

- Market Conditions: Market conditions, including economic data, news events, and geopolitical factors, can influence the timing of rollover. Traders may decide to roll over their positions based on their assessment of market conditions and their expectations for future price movements.

- Trading Strategy: Each trader has their own trading strategy and approach to rollover. Some traders may prefer to roll over their positions early to avoid any last-minute disruptions, while others may wait for specific market signals or price levels before rolling over.

It is important for traders to analyze these factors and consider their individual trading goals and risk tolerance when determining the timing of rollover. By monitoring market conditions and being aware of the key factors that influence rollover, traders can make well-informed decisions and optimize their trading strategies.

Next, we will explore the seasonal patterns observed in commodities rollover.

Seasonality and Commodities Rollover Patterns

In commodities futures trading, there are often seasonal patterns that can affect the timing of rollover. These seasonal patterns are driven by various factors, such as weather conditions, supply and demand dynamics, and market cycles. Understanding these patterns can provide valuable insights for traders looking to optimize their rollover strategy when trading commodities.

One common example of seasonal patterns can be seen in agricultural commodities. For instance, in the case of corn futures contracts, there tends to be increased volatility and trading activity leading up to the planting and harvesting seasons. Traders who are aware of these patterns may choose to roll over their positions prior to these critical periods, taking advantage of potential price movements.

Moreover, seasonal patterns in energy commodities, such as crude oil and natural gas, are influenced by factors like weather conditions and geopolitical events. For example, during the winter months, there is typically higher demand for heating oil and natural gas, leading to potential price spikes. Traders may consider rolling over their positions before the onset of winter to capitalize on this seasonal demand increase.

Another component to consider in seasonality-driven rollover is the roll yield. Roll yield is derived from the price difference between the expiring contract and the new contract when rolling over. Traders may analyze historical patterns to identify periods when the roll yield is generally positive or negative. By understanding these patterns, traders can aim to roll over their positions during periods that historically offer advantageous roll yields.

It’s important to note that while seasonal patterns can provide guidance, market dynamics can vary from year to year, and unexpected events can disrupt these patterns. Therefore, traders should conduct thorough analysis and consider multiple factors in conjunction with seasonal trends when making rollover decisions.

By recognizing and leveraging seasonal patterns, traders can potentially enhance their trading strategies and seize opportunities that align with the cyclicality of commodities markets.

Next, let’s explore the procedures and costs associated with rollover in futures trading.

Rollover Procedures and Costs

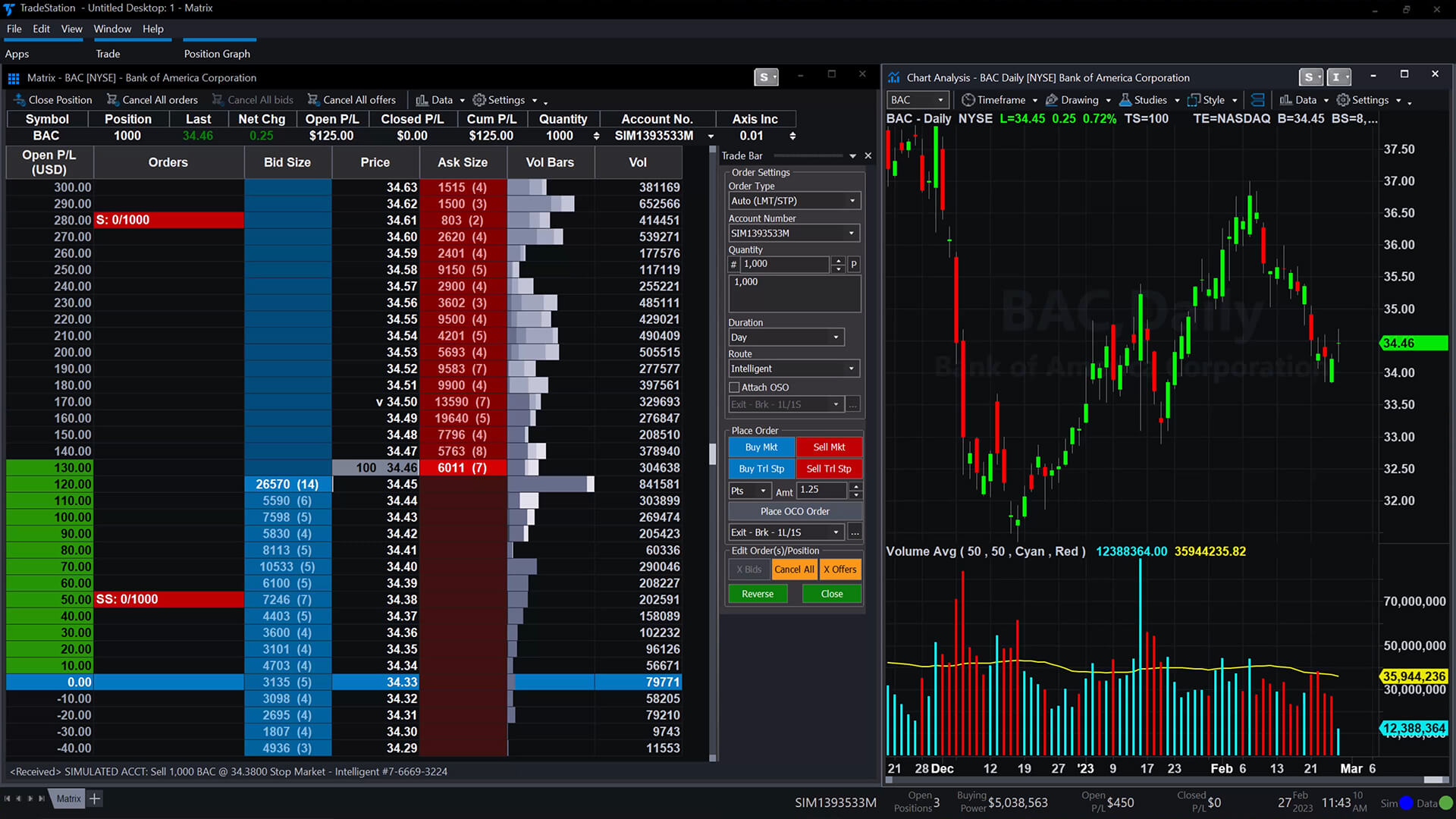

Rollover procedures in futures trading typically involve closing out the existing contract and simultaneously establishing a new contract with a later expiration date. This process can be executed through various methods, depending on the futures exchange and the trading platform used by the trader. Let’s take a closer look at the common rollover procedures and associated costs.

1. Manual Rollover: Traders who prefer a hands-on approach can manually close out their existing contract and manually enter into a new contract with the desired expiration date. This can be done through online trading platforms or by contacting a broker directly. Manual rollovers give traders greater control over the timing and execution of their trades.

2. Automatic Rollover: Some trading platforms offer automatic rollover functionality. With this feature, traders can set specific criteria, such as the number of days before expiration or a predetermined date, to automatically roll over their positions to the next contract. This eliminates the need for manual execution but requires careful setup and monitoring of the parameters.

3. Costs: Rollover costs in futures trading primarily involve transaction fees and potential bid-ask spreads. Transaction fees are charged by the exchange or the trading platform for each contract executed during the rollover process. These fees may vary depending on the volume of contracts traded and the specific platform used. Additionally, bid-ask spreads refer to the price difference between the buy and sell orders in the market at a given time. Traders may incur some costs due to these spreads when closing out the expiring contract and entering into the new contract.

Traders should be mindful of the costs associated with rollover and factor them into their trading strategies. It is recommended to compare fees and spreads across different platforms and exchanges to find the most cost-effective options.

Moreover, it’s crucial for traders to stay updated with the contract specifications and rollover dates provided by the futures exchange. Timely execution of rollover is essential to ensure a seamless transition and avoid any potential disruptions or penalties.

In the next section, we will explore the implications of rollover for traders in the futures market.

Implications of Rollover for Traders

Rollover plays a significant role in futures trading, and understanding its implications is crucial for traders. Here are some key implications of rollover that traders should consider:

1. Continuity of Trading Positions: Rollover allows traders to maintain their desired trading positions without interruption. By transitioning from one contract to another, traders can ensure that their market exposure remains consistent, enabling them to capitalize on potential price movements and implement their trading strategies effectively.

2. Management of Delivery Obligations: Rollover helps traders avoid obligations related to physical delivery or settlement of the underlying asset. It provides a seamless way to exit the expiring contract and enter into a new contract, eliminating the need for traders to take ownership or manage logistical challenges associated with the physical delivery process.

3. Opportunities for Adjustments: Rollover also presents opportunities for traders to make adjustments to their trading positions. For example, traders may choose to adjust their contract size, shift the direction of their position (from long to short or vice versa), or modify their trading strategy based on evolving market conditions and price expectations.

4. Risk Management: Rollover is a critical component of risk management in futures trading. By continuously assessing the market and rolling over positions when necessary, traders can mitigate risks associated with sudden price swings, expiration dates, and changes in market fundamentals.

5. Costs and Transaction Fees: Traders should consider the costs associated with rollover, including transaction fees and bid-ask spreads. These costs can impact overall profitability, and traders should carefully evaluate different platforms and exchanges to minimize expenses.

6. Market Conditions and Volatility: Rollover may be influenced by market conditions and volatility. Traders should stay informed about market events, economic indicators, and geopolitical factors that can impact the timing and execution of rollover. Rapid market movements and increased volatility can affect the roll yield and require traders to adjust their rollover strategy accordingly.

By understanding the implications of rollover, traders can effectively manage their positions, navigate market dynamics, and optimize their trading strategies in the futures market.

In the next section, we will explore strategies for managing rollover in futures trading.

Strategies for Managing Rollover in Futures Trading

Managing the rollover process effectively is crucial for traders in the futures market. Here are some strategies that traders can employ to optimize their rollover approach:

1. Monitor Contract Expiration Dates: It is important for traders to keep track of the expiration dates for the contracts they hold. By staying informed about upcoming expirations, traders can plan their rollover process in advance and avoid any last-minute rush or potential disruptions.

2. Plan Ahead: Traders should develop a rollover plan based on their trading strategy and goals. They can set specific criteria for when to initiate the rollover process, such as a certain number of days before expiration or specific market conditions. By planning ahead, traders can make informed decisions rather than relying on impulsive actions.

3. Consider Market Liquidity: Traders should evaluate the liquidity of the current contract and the new contract before initiating the rollover. It is advisable to roll over positions when the market is highly liquid, ensuring smooth execution and minimizing slippage.

4. Analyze Seasonal Trends: Paying attention to seasonal patterns and trends in the respective commodity markets can provide valuable insights for the timing of rollover. By studying historical data and observing seasonal factors, traders can potentially optimize their rollover strategy and capitalize on anticipated price movements.

5. Monitor Price Divergence: Traders should monitor the price spread between the expiring and new contracts. If the spread significantly deviates from historical norms or aligns with trading strategies, it may present an optimal window for rollover. Traders can take advantage of favorable price differentials during the rollover process.

6. Implement Risk Management Techniques: Traders should continually assess and manage risk during the rollover process. This includes setting stop-loss orders or adjusting position sizes to limit potential losses during periods of heightened market volatility or uncertainty.

7. Utilize Technology: Trading platforms offer various tools and automation features that can streamline the rollover process. Consider leveraging automatic rollover functionality or using alerts and notifications to stay informed about key rollover dates and market conditions.

8. Diversify Rollover Timing: Instead of rolling over all contracts simultaneously, consider diversifying the rollover timeline. By staggering rollover dates, traders can spread out the impact of potential price volatility and minimize concentration risk.

By implementing these strategies, traders can approach rollover in a structured and informed manner. Each trader should assess their own risk appetite, market conditions, and trading objectives to develop a customized rollover strategy that aligns with their needs.

Now, let’s recap what we have discussed in this article.

Conclusion

In conclusion, rollover is an essential aspect of futures contract trading that allows traders to transition from one contract to another as the expiration date approaches. It enables traders to maintain their desired trading positions without physical delivery or settlement obligations.

We explored the factors that affect the timing of rollover, including expiration dates, market liquidity, trading volume, price divergence, market conditions, and individual trading strategies. Being aware of these factors empowers traders to make informed decisions about when to roll over their positions.

In addition, we discussed the seasonal patterns observed in commodities rollover, emphasizing the importance of understanding market cyclicality and leveraging these patterns to optimize trading strategies.

Rollover procedures and costs were also addressed, highlighting the various methods traders can use to execute rollovers and the associated transaction fees and bid-ask spreads. By carefully considering these costs, traders can optimize their profitability.

The implications of rollover for traders were discussed, emphasizing the continuity of trading positions, management of delivery obligations, opportunities for adjustments, risk management, and the impact of market conditions and costs. Understanding these implications is crucial for successful and efficient futures trading.

Lastly, we provided strategies for managing rollover, including monitoring contract expiration dates, planning ahead, considering market liquidity and seasonal trends, monitoring price divergence, implementing risk management techniques, utilizing technology, and diversifying rollover timing. By employing these strategies, traders can navigate the rollover process effectively and optimize their trading outcomes.

In summary, rollover is a critical aspect of futures trading that requires careful attention and planning. By understanding the factors that influence rollover timing, leveraging seasonal patterns, managing costs, and implementing effective strategies, traders can enhance their trading performance and navigate the futures market with confidence.