Finance

How To Buy Credit Default Swaps

Published: March 4, 2024

Learn how to buy credit default swaps and manage financial risks in the world of finance. Understand the process and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Credit Default Swaps

Welcome to the world of finance, where a myriad of investment options awaits those seeking to expand their portfolio. One such option is the credit default swap (CDS), a financial derivative that has gained significant attention in recent years. Understanding how to buy credit default swaps is essential for investors looking to hedge against credit risk or speculate on the creditworthiness of a particular entity. In this comprehensive guide, we will explore the intricacies of credit default swaps, factors to consider before purchasing them, steps to acquire CDS, and the associated risks.

Credit default swaps serve as insurance against the default of a borrower or issuer of a bond. They allow investors to transfer the risk of default to a counterparty in exchange for regular premium payments. This financial instrument can be a valuable tool for managing credit risk, but it also carries inherent complexities and risks that necessitate a thorough understanding before diving in.

Whether you are an experienced investor or a newcomer to the world of finance, the decision to buy credit default swaps should be well-informed and aligned with your investment objectives. By delving into the nuances of CDS, we aim to equip you with the knowledge needed to make sound investment decisions and navigate the intricacies of the financial markets.

Understanding Credit Default Swaps

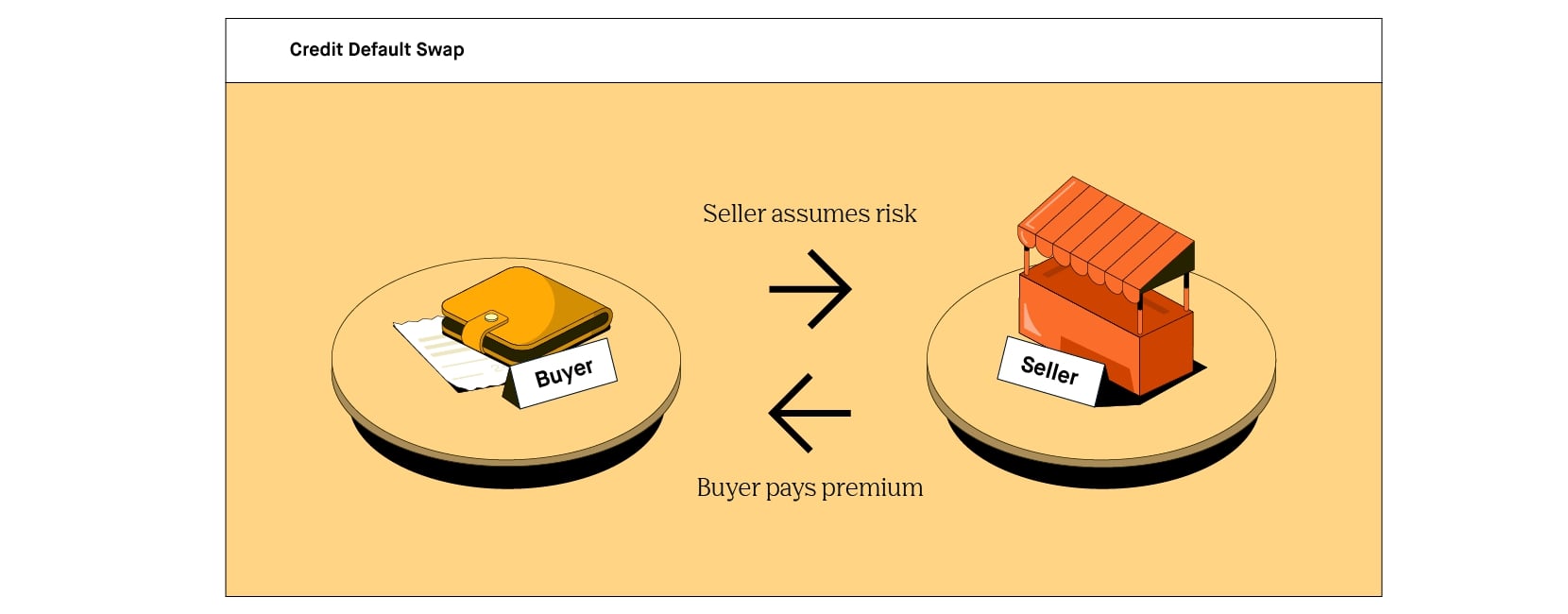

To comprehend credit default swaps (CDS), it is essential to grasp their underlying concept and functionality. A credit default swap is a financial contract between two parties, where the buyer makes periodic payments to the seller in exchange for protection against the default of a specific debt obligation, often a corporate or sovereign bond. In the event of a default, the seller compensates the buyer for the loss incurred due to the default.

At its core, a credit default swap is a form of insurance against credit risk. It allows investors to mitigate potential losses stemming from the default of a borrower or issuer. This risk management tool is particularly valuable for bondholders and investors exposed to credit-sensitive assets, providing a means to hedge against adverse credit events that could erode the value of their investments.

The buyer of a credit default swap essentially pays a premium to the seller, typically expressed as a percentage of the notional value of the underlying debt obligation. In return, the seller agrees to compensate the buyer for the full or partial loss incurred in the event of a default. This arrangement enables investors to transfer the credit risk associated with a specific debt instrument to a willing counterparty, thereby enhancing their overall risk management strategy.

It is important to note that while credit default swaps offer a mechanism for mitigating credit risk, they also introduce counterparty risk, as the protection is contingent upon the seller’s ability to honor the contract in the event of a default. Furthermore, credit default swaps are often traded over-the-counter (OTC), leading to a lack of transparency and standardized terms, which can contribute to complexities in valuation and liquidity.

Understanding the mechanics of credit default swaps is crucial for investors considering their utilization within a diversified investment strategy. By comprehending the principles that underpin CDS, market participants can make informed decisions regarding risk management, portfolio protection, and speculation on credit events.

Factors to Consider Before Buying Credit Default Swaps

Before delving into the realm of credit default swaps (CDS), it is imperative for investors to carefully evaluate several key factors to determine whether CDS align with their investment objectives and risk tolerance. Here are some critical considerations to ponder before venturing into the world of credit default swaps:

- Credit Exposure: Assess the extent of your credit exposure and the specific assets or investments that could be impacted by credit events. Understanding the potential risks and vulnerabilities within your portfolio will aid in determining the relevance of credit default swaps as a risk management tool.

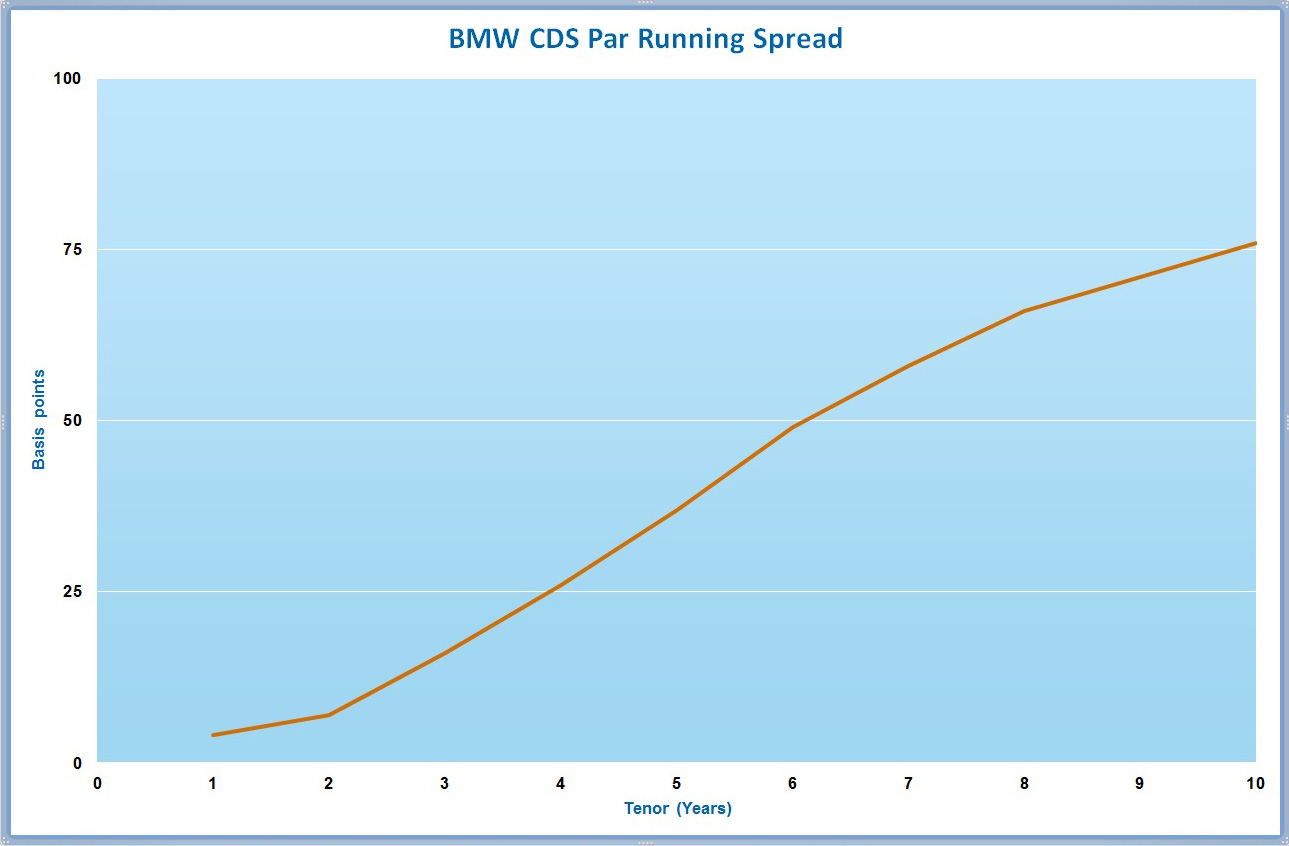

- Cost of Protection: Evaluate the cost of purchasing credit default swaps relative to the potential benefits and risk mitigation they offer. Consider whether the premiums payable for CDS are justifiable in relation to the level of credit protection they afford.

- Counterparty Risk: Recognize the counterparty risk associated with credit default swaps, as the effectiveness of the protection is contingent upon the seller’s ability to fulfill their obligations in the event of a default. Conduct thorough due diligence on the creditworthiness and reliability of the CDS seller.

- Market Conditions: Consider prevailing market conditions, credit spreads, and the overall economic outlook when contemplating the purchase of credit default swaps. Assess whether the current environment warrants the use of CDS as a risk management or speculative tool.

- Regulatory Implications: Stay informed about the regulatory landscape governing credit default swaps, as changes in regulations or reporting requirements can impact the accessibility and cost of utilizing CDS within a portfolio.

By carefully evaluating these factors and conducting thorough research, investors can make well-informed decisions regarding the suitability of credit default swaps within their investment strategy. It is essential to weigh the potential benefits of credit risk mitigation against the associated costs and risks, ensuring that the utilization of CDS aligns with the broader objectives of the investment portfolio.

Steps to Buy Credit Default Swaps

Embarking on the journey to purchase credit default swaps (CDS) entails a series of strategic steps to ensure a well-informed and methodical approach. Here’s a comprehensive guide outlining the essential steps to buy credit default swaps:

- Educate Yourself: Begin by gaining a thorough understanding of credit default swaps, including their mechanics, risks, and potential benefits. Familiarize yourself with the terminology, market conventions, and the role of CDS within the broader landscape of financial derivatives.

- Identify the Underlying Assets: Determine the specific debt obligations or assets for which you seek credit protection through CDS. This could include corporate bonds, sovereign debt, or other credit-sensitive instruments within your investment portfolio.

- Select a Counterparty: Identify potential sellers or counterparties offering credit default swaps. This may involve engaging with financial institutions, broker-dealers, or specialized CDS providers to explore available options for purchasing credit protection.

- Assess Terms and Conditions: Evaluate the terms and conditions of the credit default swaps offered by different counterparties. Compare factors such as premium payments, notional amounts, maturity dates, and the extent of credit protection provided to ensure alignment with your risk management objectives.

- Conduct Due Diligence: Perform comprehensive due diligence on the selected counterparty to assess their creditworthiness, financial stability, and track record in honoring CDS contracts. This step is crucial in mitigating counterparty risk and ensuring the reliability of the credit protection purchased.

- Negotiate and Execute the Contract: Engage in negotiations with the chosen counterparty to finalize the terms of the credit default swap contract. Upon reaching mutual agreement, execute the contract in accordance with the specified terms and conditions, formalizing the arrangement for credit protection.

- Monitor and Manage: Continuously monitor the performance of the credit default swaps within your portfolio, staying attuned to changes in credit spreads, market conditions, and the overall creditworthiness of the underlying assets. Proactively manage your CDS positions to adapt to evolving risk dynamics.

By following these systematic steps, investors can navigate the process of purchasing credit default swaps with clarity and diligence, ensuring that the utilization of CDS aligns with their risk management and investment objectives.

Risks Associated with Credit Default Swaps

While credit default swaps (CDS) offer a mechanism for managing credit risk, it is crucial for investors to recognize and understand the inherent risks associated with these financial derivatives. By comprehensively assessing the potential risks, market participants can make informed decisions regarding the utilization of credit default swaps within their investment strategies. Here are the key risks associated with credit default swaps:

- Counterparty Risk: One of the primary risks associated with credit default swaps is counterparty risk, stemming from the reliance on the seller or counterparty to honor their obligations in the event of a credit event. If the seller defaults or becomes unable to fulfill the terms of the CDS contract, the buyer may be exposed to significant losses.

- Basis Risk: Basis risk arises from the potential mismatch between the underlying asset being hedged and the credit default swap contract. Variations in the correlation or performance of the hedged asset and the CDS can lead to imperfect hedging outcomes, exposing the investor to basis risk.

- Liquidity Risk: Credit default swaps, particularly those traded over-the-counter (OTC), may be subject to liquidity risk, making it challenging to unwind or adjust CDS positions in volatile market conditions. Limited liquidity can impact the ability to enter into or exit CDS contracts at favorable terms.

- Legal and Regulatory Risk: Changes in regulatory requirements, legal interpretations, or jurisdictional nuances can introduce legal and regulatory risks associated with credit default swaps. Shifts in the regulatory landscape may impact the enforceability and operational aspects of CDS contracts.

- Balancing Risk and Reward: Assessing the cost of purchasing credit default swaps against the potential benefits of credit protection involves balancing risk and reward. If the cost of CDS premiums outweighs the perceived benefits of mitigating credit risk, investors may face challenges in optimizing the risk-return profile of their portfolios.

By acknowledging and evaluating these risks, investors can prudently navigate the utilization of credit default swaps within their investment strategies, implementing robust risk management practices and informed decision-making processes to mitigate potential downsides associated with CDS.

Conclusion

As we conclude our exploration of credit default swaps (CDS), it is evident that these financial derivatives offer a unique avenue for managing credit risk, hedging against potential defaults, and speculating on credit events. However, the utilization of credit default swaps necessitates a thorough understanding of their mechanics, associated risks, and the strategic considerations involved in their purchase. By delving into the intricacies of CDS, investors can make informed decisions aligned with their risk management objectives and investment strategies.

When contemplating the purchase of credit default swaps, investors must carefully assess their credit exposure, evaluate the cost of protection, and consider the counterparty risk inherent in CDS contracts. Moreover, staying attuned to market conditions, regulatory implications, and the potential risks associated with credit default swaps is paramount in making sound investment choices.

While credit default swaps provide a valuable tool for managing credit risk, it is essential to recognize the potential risks, including counterparty risk, basis risk, liquidity risk, and legal and regulatory implications. By acknowledging these risks and conducting thorough due diligence, investors can prudently navigate the utilization of credit default swaps within their portfolios.

Ultimately, the decision to buy credit default swaps should be underpinned by a comprehensive understanding of their intricacies, alignment with investment objectives, and a disciplined approach to risk management. By incorporating credit default swaps into a well-structured and diversified investment strategy, investors can effectively address credit risk exposures and optimize their risk-return profiles in the dynamic landscape of financial markets.

As you venture into the realm of credit default swaps, remember that knowledge, diligence, and prudent risk assessment are the cornerstones of sound decision-making. Whether seeking to hedge against credit risk or capitalize on market opportunities, the strategic utilization of credit default swaps demands a holistic understanding and a proactive approach to managing associated risks.