Home>Finance>How Does Depreciation Affect Financial Statements

Finance

How Does Depreciation Affect Financial Statements

Published: December 23, 2023

Discover the impact of depreciation on financial statements in the realm of finance. Understand how this accounting practice affects profitability and asset values.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Depreciation is a fundamental concept in finance that plays a crucial role in the preparation of financial statements. It is an accounting method used to allocate the cost of tangible assets over their useful lives. By recognizing the gradual decline in value of these assets, depreciation allows businesses to accurately represent the true cost of their operations and generate reliable financial statements.

In this article, we will delve into the world of depreciation and its impact on financial statements. We will explore various aspects, such as different depreciation methods, the recognition of depreciation expense, and how it affects the income statement, balance sheet, and cash flow statement. Understanding depreciation is essential for both investors and business owners, as it provides insights into the financial health of a company and its ability to generate sustainable profits.

Depreciation captures the wear and tear, obsolescence, and aging of tangible assets such as buildings, machinery, vehicles, and equipment. It is important to note that depreciation only applies to tangible assets and not to intangible assets like patents or copyrights, which are amortized over their useful lives.

By allocating the cost of an asset over its useful life, depreciation helps businesses to spread the cost of the asset evenly throughout the period it is expected to generate revenue. This systematic approach ensures that the expenses incurred in acquiring and maintaining the asset are matched with the revenue it generates, providing a more accurate representation of profitability.

Depreciation also has a significant impact on the financial performance of a company, as it affects key financial statements such as the income statement, balance sheet, and cash flow statement. By understanding how depreciation is recorded in each of these statements, stakeholders can gain valuable insights into the financial position, profitability, and cash flow dynamics of a company.

Overview of Depreciation

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It reflects the decline in value of the asset as it ages, becomes obsolete, or experiences wear and tear. The process of depreciation allows businesses to accurately account for the cost of acquiring and maintaining their assets.

There are several key components of depreciation that are important to understand:

- Cost: Depreciation is based on the cost of the asset, which includes its purchase price, shipping fees, installation costs, and any other expenses directly related to its acquisition.

- Useful Life: The useful life of an asset is the estimated period over which it is expected to generate revenue and be in service. This can vary depending on the nature of the asset, industry standards, and technological advancements.

- Salvage Value: The salvage value, also known as the residual value or scrap value, is the estimated worth of an asset at the end of its useful life. It represents the amount the business expects to receive when disposing of or selling the asset.

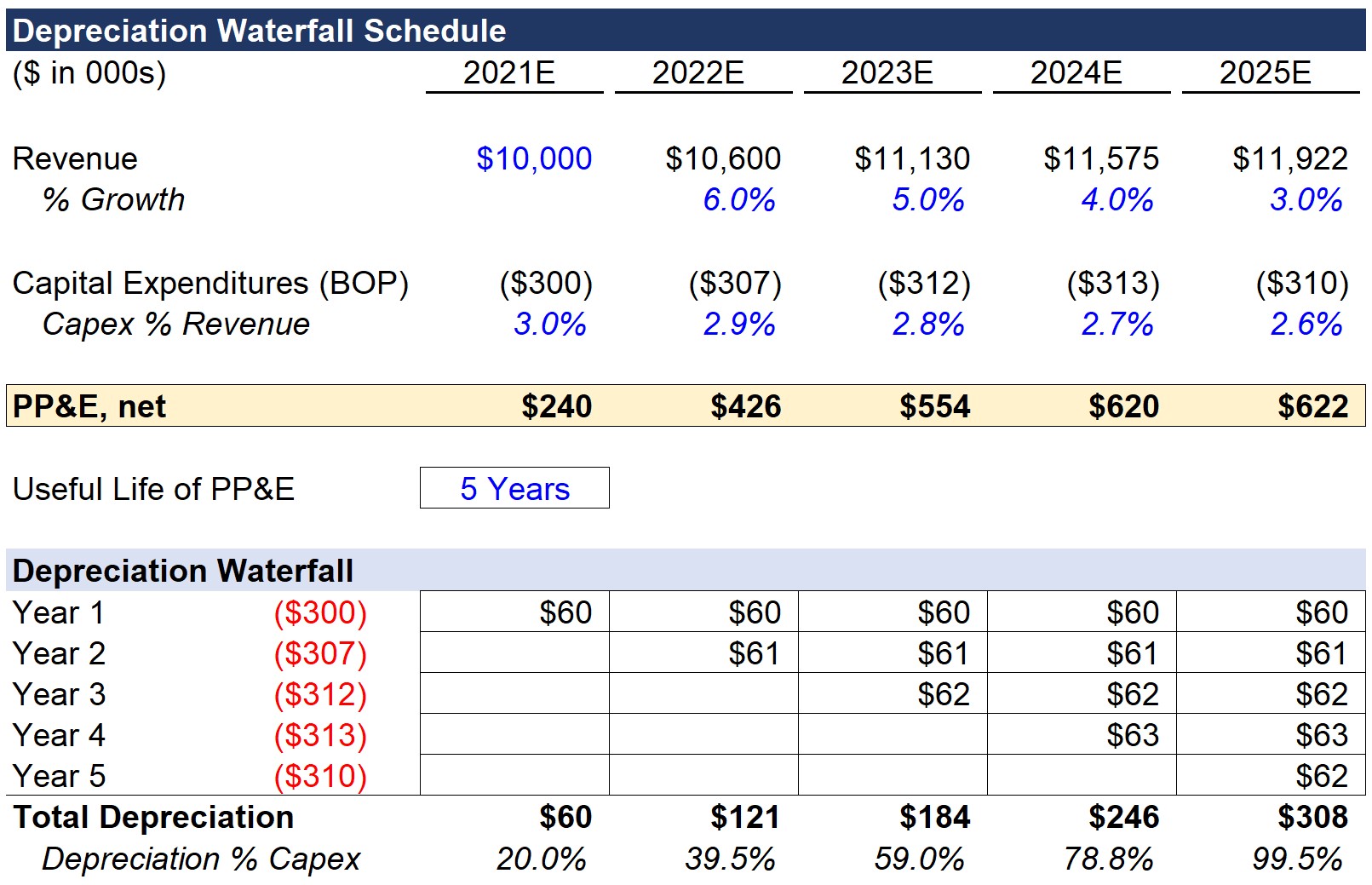

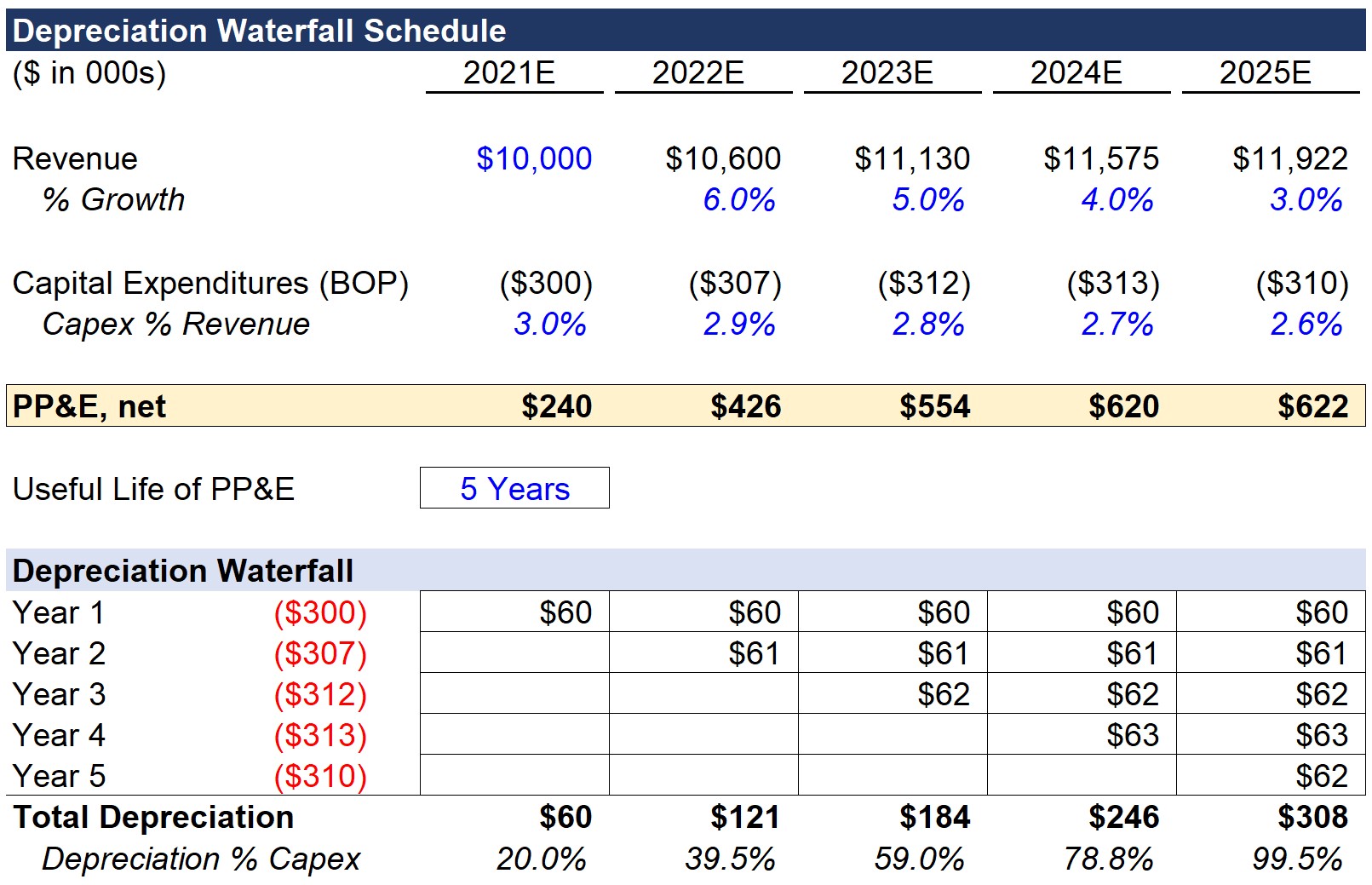

Depreciation is typically calculated using one of several methods, including straight-line depreciation, declining balance depreciation, and sum-of-years’ digits depreciation. Each method has its own formula and application, providing businesses with flexibility in choosing the most suitable approach for their specific circumstances.

Straight-line depreciation is the most commonly used method. It evenly allocates the cost of an asset over its useful life. The formula for straight-line depreciation is:

Depreciation Expense = (Cost – Salvage Value) / Useful Life

Declining balance depreciation, on the other hand, results in higher depreciation expenses in the early years and lower expenses in later years. This method assumes that assets experience more significant wear and tear in their early years. The formula for declining balance depreciation depends on the chosen depreciation rate and is applied to the remaining asset value each year.

Sum-of-years’ digits depreciation is a method that combines elements of both straight-line and declining balance depreciation. It assigns higher depreciation expenses to the early years of an asset’s useful life and gradually reduces them over time. The formula for sum-of-years’ digits depreciation considers the useful life of the asset and calculates a depreciation fraction for each year.

By understanding the various methods of depreciation and their impact, businesses can make informed decisions about how to allocate the cost of their assets and accurately reflect their financial positions.

Depreciation Methods

Depreciation methods determine how the cost of an asset is allocated over its useful life. There are several commonly used depreciation methods, each with its own advantages and considerations. Let’s explore some of the most widely used methods:

- Straight-Line Depreciation: This is the simplest and most commonly used method. It evenly distributes the cost of an asset over its useful life. The formula for straight-line depreciation is:

- Declining Balance Method: The declining balance method allows for a higher depreciation expense in the early years of an asset’s life and gradually reduces it over time. This method is based on the assumption that assets are more productive and experience higher wear and tear in their initial years.

- Double Declining Balance Method: This method applies a depreciation rate that is double the straight-line rate to the remaining asset value each year. It results in higher depreciation expenses in the early years, decreasing as the asset ages.

- 100%-150% Declining Balance Method: This method applies a depreciation rate greater than the double-declining balance rate but capped at 150% of the straight-line rate. It is a more gradual approach compared to the double declining balance method.

- Units of Production Method: This method allocates the cost of an asset based on its usage or production. It considers the amount of output or the number of units produced by the asset. The depreciation expense is calculated by dividing the total cost of the asset by its estimated total production or usage.

- Sum-of-Years’ Digits Method: This method combines elements of both the straight-line and declining balance methods. It assigns greater depreciation expenses to the early years of an asset’s life and gradually reduces them over time.

Depreciation Expense = (Cost – Salvage Value) / Useful Life

This method assumes that the asset’s utility and value decrease at a constant rate throughout its useful life.

This method can be further categorized into two sub-methods:

This method is often used for assets that are subject to varying levels of usage or production, such as manufacturing equipment or vehicles.

The formula for sum-of-years’ digits depreciation involves calculating a depreciation fraction for each year based on the remaining useful life. The depreciation expense is then determined by multiplying this fraction with the depreciable amount (cost – salvage value).

It’s important for businesses to carefully consider the nature of their assets, their usage patterns, and the specific requirements of their industry when selecting a depreciation method. This ensures that the financial statements accurately reflect the true value and utilization of the company’s assets over time.

Depreciation Expense

Depreciation expense is the amount recorded on the income statement to allocate the cost of an asset over its useful life. It represents the decrease in the value of the asset due to wear and tear, obsolescence, or aging. By recognizing depreciation expense, businesses can accurately reflect the true cost of using their assets to generate revenue.

The depreciation expense is determined based on the chosen depreciation method and the specific details of the asset, such as its cost, useful life, and salvage value. Different methods result in varying expense amounts and distribution patterns over time.

Depreciation expense is typically treated as a non-cash expense, meaning it does not involve an actual outflow of cash. Instead, it is an accounting entry that allocates the cost of the asset over its useful life. This is an important distinction to understand when analyzing a company’s financial statements.

Depreciation expense directly impacts the net income of a company. As it is recorded as an expense on the income statement, it reduces the company’s taxable income and thereby decreases the tax liability. This provides a tax advantage for businesses, as they can deduct the depreciation expense from their taxable income.

It’s important to note that depreciation expense is a non-cash expense and does not affect the company’s cash flow. However, it indirectly impacts cash flow through its impact on the income statement. Lower net income due to depreciation expense can result in lower retained earnings and, in turn, a reduced cash flow available for distribution to shareholders.

Depreciation expense also affects financial ratios and key performance indicators (KPIs). For example, it reduces the company’s profitability metrics such as earnings before interest, taxes, depreciation, and amortization (EBITDA) and net profit margin. Furthermore, it impacts the return on assets (ROA) and return on equity (ROE) ratios, which measure the company’s efficiency in generating profits relative to its assets and shareholders’ equity, respectively.

By accurately recording and recognizing depreciation expense, businesses can provide stakeholders with a more accurate view of their financial performance, profitability, and tax obligations. It is crucial for investors, creditors, and analysts to understand the impact of depreciation on a company’s financial statements to make informed decisions and assessments of its financial health.

Impact on the Income Statement

Depreciation has a significant impact on the income statement of a company. It is recorded as an expense and directly affects the calculation of net income. Let’s explore how depreciation impacts the income statement:

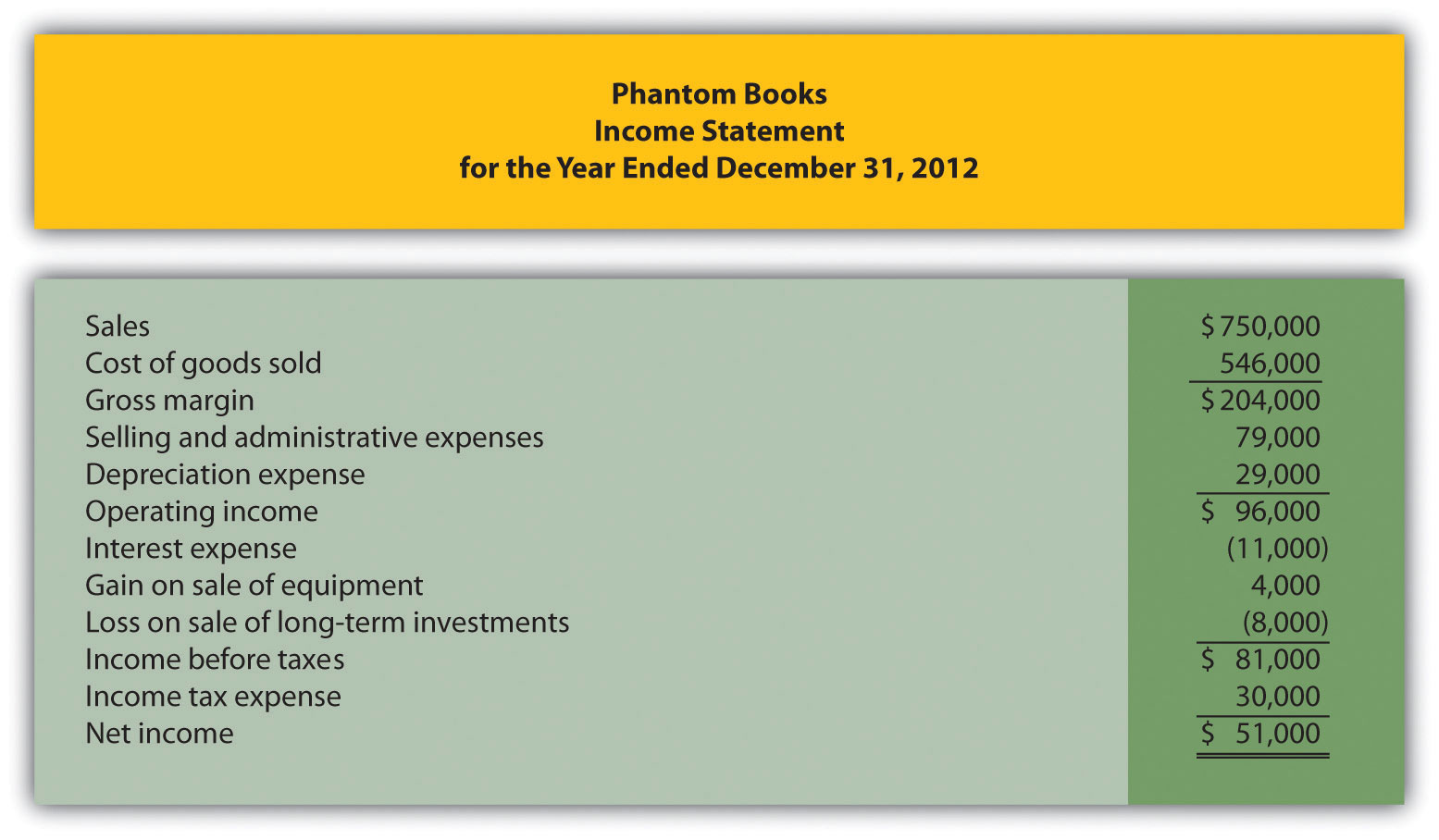

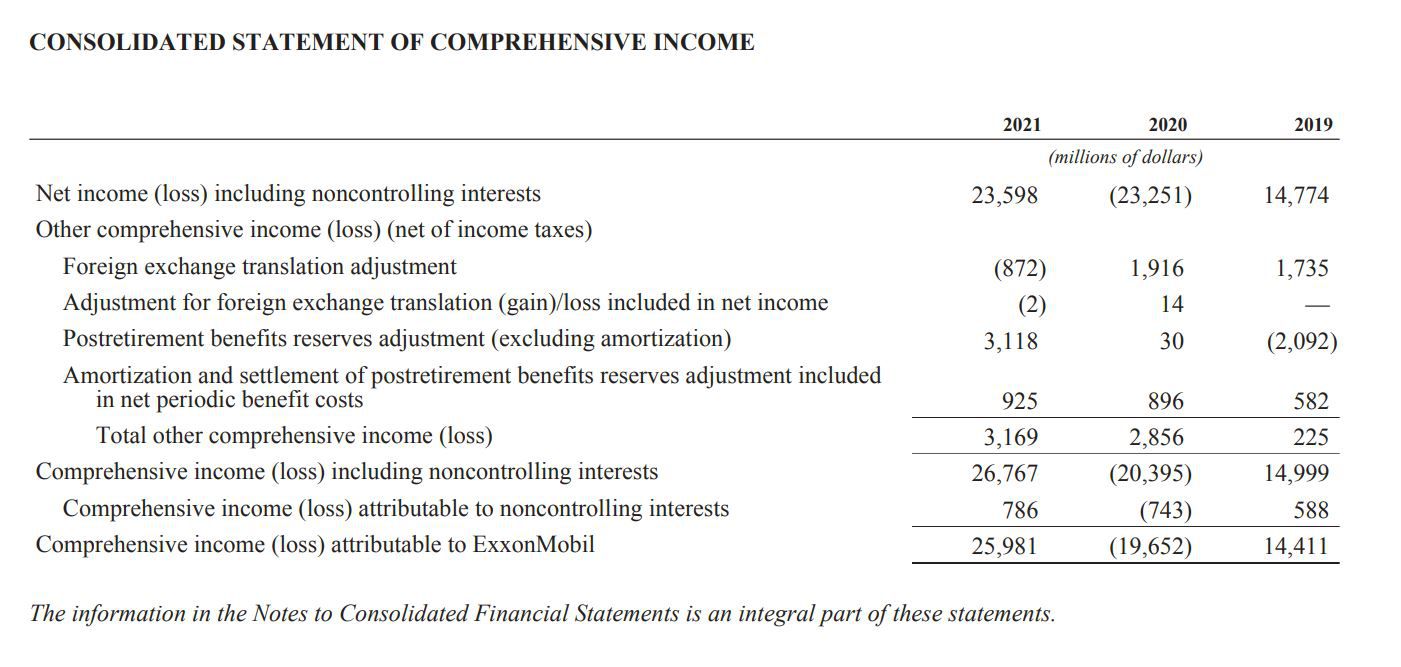

Depreciation expense is reported on the income statement as a separate line item. It is subtracted from the company’s revenue to arrive at the operating income or earnings before interest and taxes (EBIT). This reflects the cost of using the company’s assets to generate revenue, providing a more accurate representation of the profitability of its core operations.

Depreciation expense is a non-cash expense, meaning it does not involve an actual outflow of cash. However, it still reduces the company’s taxable income, resulting in a lower tax liability. This tax advantage reflects the fact that depreciation allows businesses to recover the cost of their assets over time.

By reducing the taxable income, depreciation expense indirectly increases the company’s net income. Lower taxes translate to higher after-tax profits, providing a boost to the bottom line. This highlights the importance of considering the tax implications of depreciation when assessing a company’s financial performance.

Depreciation also impacts financial ratios and performance indicators displayed on the income statement. For example:

- Gross Profit Margin: Depreciation expense reduces the gross profit margin by increasing the cost of goods sold (COGS). This is because depreciation is accounted for as part of the overhead costs associated with producing the goods or services sold.

- Operating Profit Margin: Depreciation expense lowers the operating profit margin by reducing the operating income. This metric measures the profitability of a company’s core operations and is an important indicator of its efficiency.

- Net Profit Margin: Depreciation expense indirectly affects the net profit margin by reducing the tax liability. With lower taxes, the company retains a higher proportion of its revenue as net income.

- Earnings per Share (EPS): Depreciation expense lowers the company’s net income, potentially leading to a decrease in EPS. This ratio is an important measure of a company’s profitability on a per-share basis.

It is important to consider the impact of depreciation on the income statement when analyzing a company’s financial performance. Depreciation provides a more accurate representation of the cost of using assets to generate revenue and helps to assess the profitability and tax obligations of the business.

Impact on the Balance Sheet

Depreciation plays a significant role in shaping the balance sheet of a company. It affects the value of the company’s assets, accumulated depreciation, and shareholders’ equity. Let’s explore how depreciation impacts the balance sheet:

Assets:

Depreciation reduces the value of the assets on the balance sheet. As assets age and become less useful or technologically obsolete, their carrying value is adjusted downward to reflect their diminished worth. The accumulated depreciation, which represents the cumulative amount of depreciation recorded on the assets, is subtracted from the original cost to arrive at the net book value of the asset.

For example, if a company owns a piece of equipment with an original cost of $50,000 and it has been depreciated by $10,000 over its useful life, the accumulated depreciation will be $10,000 and the net book value of the equipment will be $40,000.

Liabilities:

Depreciation does not directly impact a company’s liabilities, as it represents the cost of using assets rather than an obligation owed to external parties. However, depreciation indirectly affects working capital, which is a measure of the company’s short-term liquidity and ability to meet its current obligations. Lower net income resulting from depreciation expense can reduce the available cash flow, potentially impacting the company’s ability to pay its liabilities.

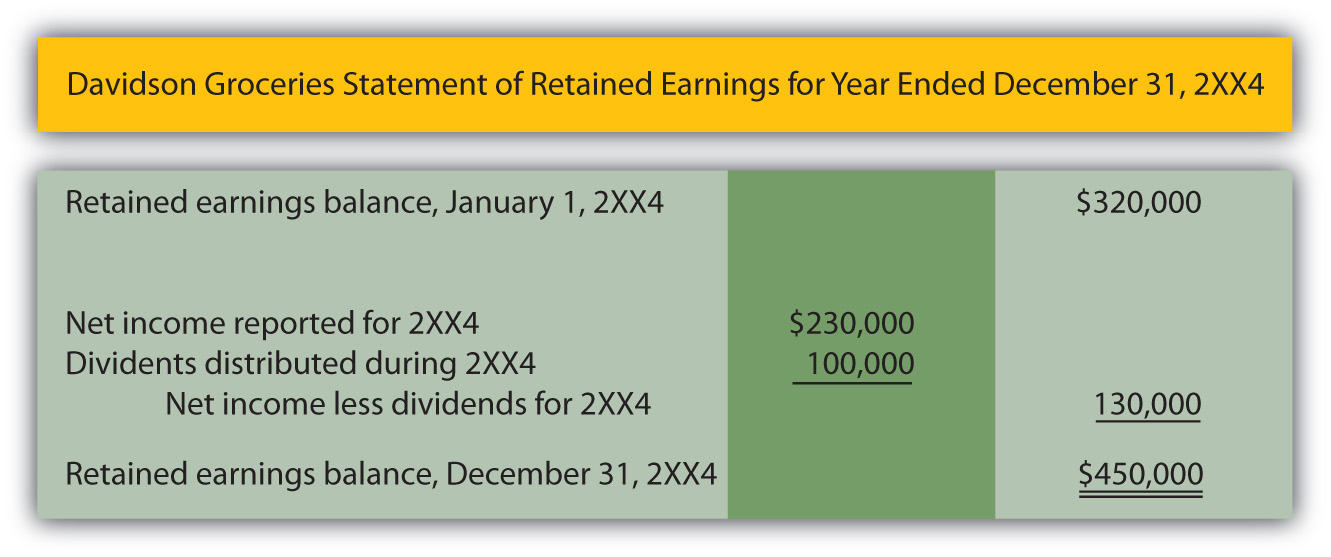

Shareholders’ Equity:

Depreciation has an impact on shareholders’ equity by reducing the net income and retained earnings. Retained earnings represent the portion of the company’s profits that are reinvested in the business rather than distributed to shareholders as dividends. Depreciation expense reduces net income, thereby lowering retained earnings and potentially impacting the equity available to shareholders.

As a result, the balance sheet reflects the impact of depreciation on the company’s assets, shareholders’ equity, and overall financial position. It provides stakeholders with a snapshot of the company’s resources, obligations, and ownership interests at a specific point in time.

Understanding the impact of depreciation on the balance sheet is crucial for assessing the financial health and stability of a company. It helps to evaluate the value of the company’s assets, the allocation of depreciation over time, and the impact on shareholders’ equity.

Impact on Cash Flow Statement

Depreciation has an important impact on the cash flow statement of a company. While depreciation is a non-cash expense, it indirectly affects the cash flow statement through its influence on other financial metrics. Let’s explore the impact of depreciation on the cash flow statement:

Operating Activities:

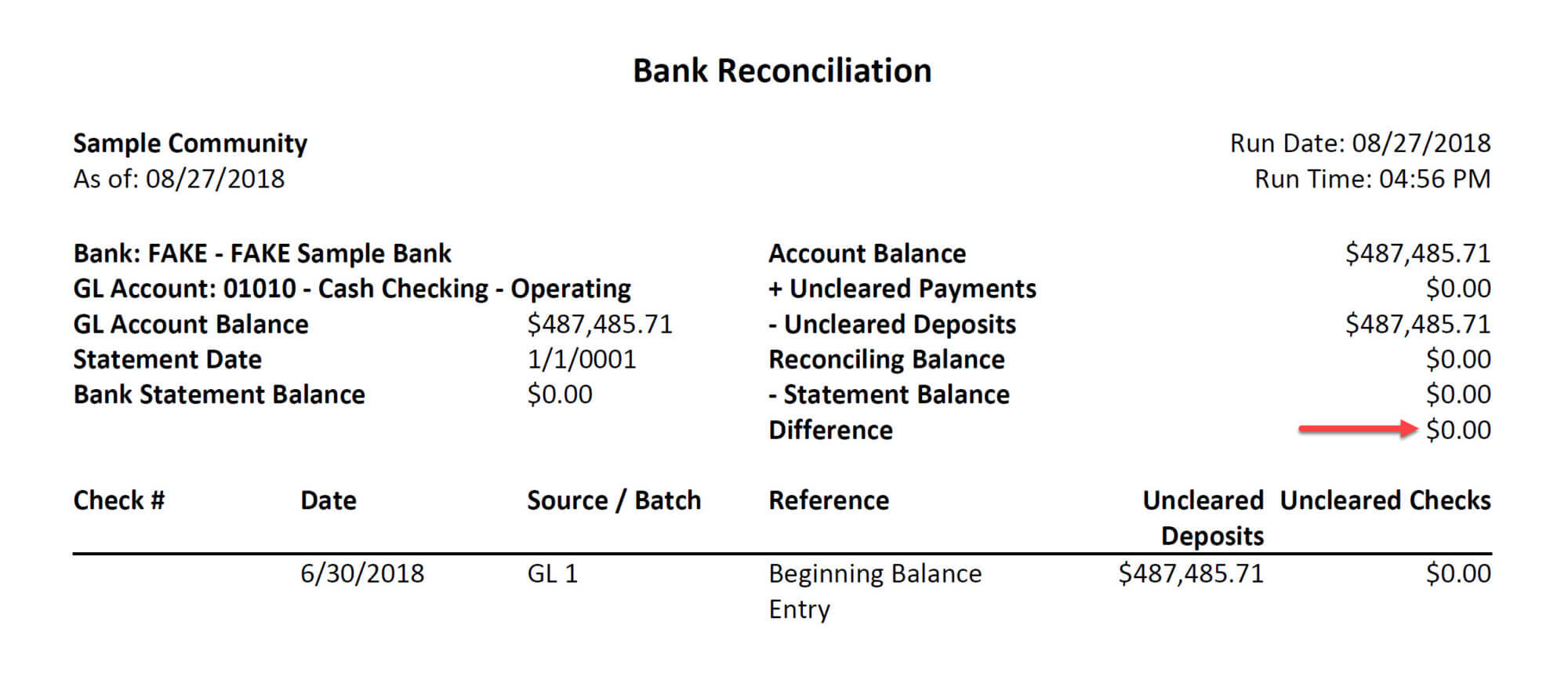

Depreciation expense is added back to the net income in the operating activities section of the cash flow statement. This adjustment is made because depreciation is a non-cash expense and does not involve an actual outflow of cash. Adding back depreciation to the net income helps to reconcile the reported net income with the actual cash flow generated by the company’s operations.

Investing Activities:

Depreciation impacts investing activities indirectly through its impact on the investment in fixed assets. As assets depreciate, the company may need to replace or upgrade them, resulting in cash outflows for new capital expenditures. These cash flows are reflected in the investing activities section of the cash flow statement.

Financing Activities:

Depreciation does not directly impact financing activities, which primarily involve cash flows related to borrowing and repaying debt, issuing and repurchasing stock, and distributing dividends. However, depreciation indirectly affects financing activities through its impact on profitability and retained earnings, which can influence financing decisions and cash flows related to dividends or stock repurchases.

Overall Cash Flow Impact:

While depreciation itself does not directly impact the cash flow of a company, it indirectly affects cash flows through its influence on the income statement and profitability. Lower net income resulting from depreciation expense can reduce operating cash flows, impacting the cash flow available for reinvestment or distribution to shareholders.

Understanding the impact of depreciation on the cash flow statement is essential for assessing a company’s cash flow dynamics and liquidity. It helps stakeholders evaluate the company’s ability to generate cash from its core operations and make informed decisions regarding investment, financing, and dividend distributions.

It’s important to note that the impact of depreciation on the cash flow statement can vary depending on the specific circumstances of the company. It is recommended to analyze the entire cash flow statement, along with other financial statements, to gain a comprehensive understanding of the company’s cash flow position.

Importance of Accurate Depreciation

Accurate depreciation is essential for businesses as it plays a crucial role in providing a realistic representation of the financial position and performance of a company. Let’s explore the importance of accurate depreciation:

Financial Reporting:

Accurate depreciation ensures that financial statements present a true and fair view of a company’s assets and their value. By allocating the cost of assets over their useful lives, depreciation reflects the wear and tear, obsolescence, and aging of these assets. This provides stakeholders, including investors, creditors, and regulators, with reliable and transparent information for decision-making purposes.

Profitability Assessment:

Accurate depreciation is critical for assessing a company’s profitability accurately. Depreciation expense is deducted from revenue on the income statement, reflecting the cost of using the assets to generate revenue. By properly accounting for depreciation, companies can present a more accurate picture of their operating expenses and profitability over time.

Tax Planning and Compliance:

Accurate depreciation is vital for tax planning and compliance. Tax authorities often have specific rules and guidelines concerning the recognition and calculation of depreciation. By accurately recording depreciation expense, businesses can reduce their taxable income and associated tax liabilities within the boundaries of tax regulations.

Cash Flow Management:

Accurate depreciation calculations help businesses manage their cash flow effectively. By understanding the expected future costs associated with the replacement or upgrade of assets, companies can plan and budget for necessary capital expenditures. This ensures that sufficient funds are available to maintain the operational efficiency of the business.

Asset Management:

Accurate depreciation allows businesses to track the value of their assets over time. By properly reflecting the decrease in value of assets, companies can make informed decisions regarding repair, maintenance, renewal, or disposal of assets. This helps optimize asset utilization and minimize costs associated with inefficient or obsolete assets.

Regulatory Compliance:

Accurate depreciation is essential for compliance with accounting standards and regulatory requirements. Companies are obligated to adhere to specific accounting principles and guidelines, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Proper depreciation accounting ensures compliance with these standards, enhancing the credibility and reliability of financial statements.

Investor and Creditor Confidence:

Accurate depreciation fosters investor and creditor confidence in a company’s financial statements. The transparent and reliable representation of asset values and profitability allows stakeholders to make informed decisions regarding investments, loans, or credit extensions. This, in turn, contributes to building trust and credibility in the company’s financial reporting.

Overall, accurate depreciation accounting is vital for generating reliable financial statements, assessing profitability, tax planning, managing cash flow, optimizing asset management, complying with accounting standards, and instilling confidence in stakeholders. Businesses must ensure that they employ sound practices and adhere to relevant guidelines to accurately account for and report depreciation.

Conclusion

Depreciation is a critical concept in finance that has a profound impact on the preparation of financial statements. Understanding the various aspects of depreciation is essential for businesses and stakeholders alike, as it provides insights into the value and utilization of assets, profitability, tax obligations, and cash flow dynamics.

We explored the overview of depreciation, including its definition, methods, and calculation. Different depreciation methods, such as straight-line depreciation, declining balance depreciation, units of production, and sum-of-years’ digits, offer flexibility in allocating the cost of assets over their useful lives.

Depreciation affects key financial statements. It impacts the income statement by reducing net income and influencing profitability ratios. On the balance sheet, it reduces the value of assets and affects shareholders’ equity. Furthermore, depreciation indirectly influences cash flows on the cash flow statement through its impact on operating activities, investing activities, and financing activities.

The importance of accurate depreciation cannot be overstated. Accurate depreciation provides reliable information for financial reporting, enables proper assessment of profitability, aids in tax planning and compliance, facilitates effective cash flow management, optimizes asset management, ensures regulatory compliance, and instills investor and creditor confidence.

Businesses should strive for accuracy in their depreciation calculations and follow relevant accounting standards and guidelines. This will help provide transparent and credible financial statements, assist stakeholders in making informed decisions, and ultimately contribute to the overall success and sustainability of the business.

In conclusion, depreciation is a fundamental concept in finance that allows businesses to account for the cost of using assets over time. By accurately recording and recognizing depreciation, businesses can provide stakeholders with a clear understanding of the financial health, profitability, and cash flow dynamics of the company.