Home>Finance>What Financial Statements Are Affected By Defined Benefit Plans

Finance

What Financial Statements Are Affected By Defined Benefit Plans

Modified: December 29, 2023

Learn how defined benefit plans impact financial statements and gain a deeper understanding of finance in this informative article.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the impact of defined benefit plans on financial statements. Defined benefit plans are a type of retirement plan where an employer promises to pay employees a specific benefit upon retirement, based on factors such as salary and years of service. These plans can have significant implications for a company’s financial reporting and analysis.

In this article, we will explore the various financial statements that are affected by defined benefit plans, including the balance sheet, income statement, statement of comprehensive income, statement of cash flows, and statement of changes in equity. Understanding how these plans impact each statement is crucial for investors, creditors, and stakeholders in evaluating a company’s financial health and performance.

As a professional in the finance industry, you need to have a deep understanding of how these plans influence financial statements. By grasping the intricacies of reporting defined benefit plans, you can provide meaningful insights and assistance to individuals and organizations.

We will delve into each statement in detail, highlighting the specific areas where defined benefit plans leave their mark. This knowledge will enable you to conduct accurate financial analysis, make informed investment decisions, and assess a company’s ability to meet its pension obligations.

Throughout this article, we will also touch on the importance of proper disclosure and presentation of defined benefit plans in financial statements. Clear and accurate reporting ensures transparency, allowing stakeholders to assess the potential impact of these plans on a company’s financial position and future cash flows. Compliance with accounting standards, such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), is crucial in providing reliable and comparable information.

Whether you are an accountant, financial analyst, auditor, or investor, understanding the impact of defined benefit plans on financial statements is essential in assessing the overall financial health and stability of a company. So, let’s dive into the details and explore how defined benefit plans influence these vital financial reporting documents.

Overview of Defined Benefit Plans

Defined benefit plans are retirement plans sponsored by employers that guarantee a specific benefit to employees upon their retirement. In these plans, the employer assumes the investment and longevity risks associated with providing the promised benefits. Unlike defined contribution plans, where the employer and employee contribute to an individual account, defined benefit plans focus on providing a predetermined benefit based on factors such as salary, years of service, and a formula specified in the plan.

One of the key features of defined benefit plans is that the employer is responsible for funding and administering the plan. The employer’s contributions to the plan are determined through actuarial valuations, which consider factors such as the expected investment returns, mortality rates, salary increases, and other relevant factors. The objective is to ensure that the plan has sufficient assets to meet the future pension obligations to employees.

Employees who participate in a defined benefit plan are typically entitled to receive a regular retirement income, often calculated as a percentage of their final salary or an average salary over a specified period. This income is usually payable for the remainder of their lives, providing a level of financial security during retirement.

Defined benefit plans offer several advantages to employees. They provide a predictable and stable income stream throughout retirement, regardless of market performance. Additionally, these plans often adjust benefits for inflation, ensuring that retirees’ purchasing power is maintained over time. For employers, defined benefit plans can help attract and retain valuable employees by offering a strong retirement benefit package.

However, defined benefit plans also come with certain challenges and risks for employers. As the employer guarantees the retirement benefits, they are exposed to investment risks and fluctuations in interest rates. In times of economic volatility or low-interest-rate environments, the employer may face funding shortfalls, requiring additional contributions to meet pension obligations.

Understanding the nature and characteristics of defined benefit plans is crucial in analyzing a company’s financial position and obligation for providing future retirement benefits. These plans have a direct impact on a company’s financial statements, as they represent a significant liability that must be reported accurately and consistently.

Now that we have an overview of defined benefit plans, let’s explore how these plans impact the various financial statements of a company.

Financial Statements Impacted by Defined Benefit Plans

Defined benefit plans have a significant impact on a company’s financial statements, reflecting the employer’s obligation to provide retirement benefits to its employees. Let’s explore how these plans influence the various financial statements:

- Balance Sheet: Defined benefit plans affect the balance sheet by including the following items:

- Asset: The fair value of plan assets represents the funds set aside to meet future benefit obligations. This amount is reported as a non-current asset.

- Liability: The net defined benefit liability (or asset) reflects the present value of the future pension obligations minus the fair value of the plan assets. It represents the employer’s obligation to cover the pension benefits and is reported as a non-current liability (or asset).

- Income Statement: The income statement is impacted through the recognition of various items:

- Net Interest Expense (or Income): This represents the change in the defined benefit liability (or asset) due to the passage of time and the effect of discounting the future benefit obligations. It is included in finance costs or finance income.

- Net Actuarial Gains (or Losses): These arise from changes in actuarial assumptions, such as discount rates, mortality rates, and salary growth rates. They are recognized in profit or loss and can have a significant impact on reported earnings.

- Past Service Cost: When there are changes to the plan that affect past periods, such as plan amendments or curtailments, the resulting expense is recognized in profit or loss.

- Plan Settlements and Curtailments: These occur when the employer settles the plan’s obligations or reduces future benefits. Any resulting gains or losses are recognized in profit or loss.

- Statement of Comprehensive Income: The statement of comprehensive income includes any actuarial gains or losses that are not recognized in the income statement but directly recorded under other comprehensive income. This allows for a more comprehensive view of the impact of defined benefit plans on a company’s financial position.

- Statement of Cash Flows: Defined benefit plans can affect the statement of cash flows through the payment of pension contributions to fund the plan’s obligations. These payments are classified as operating or financing activities, depending on the nature of the contribution.

- Statement of Changes in Equity: Any gains or losses arising from changes in the defined benefit liability (or asset) and actuarial gains or losses are reported in the statement of changes in equity. These adjustments can impact the overall equity position of the company.

Understanding how defined benefit plans impact these financial statements is crucial for assessing a company’s financial position, performance, and future cash flow obligations. It allows stakeholders to evaluate the potential risks and costs associated with providing retirement benefits to employees.

Now that we have explored the impact on individual financial statements, let’s draw some concluding thoughts on how defined benefit plans influence a company’s overall financial health and reporting.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It reflects the company’s assets, liabilities, and shareholders’ equity. Defined benefit plans have a direct impact on the balance sheet, with specific items that need to be reported accurately:

- Asset: The fair value of plan assets represents the funds set aside to meet future benefit obligations. These assets are typically invested in various financial instruments such as stocks, bonds, and real estate. The amount of plan assets is reported as a non-current asset on the balance sheet. It is essential for the company to disclose the composition and diversification of the plan assets, providing transparency to stakeholders.

- Liability: The net defined benefit liability (or asset) reflects the present value of the future pension obligations minus the fair value of the plan assets. It represents the employer’s obligation to cover the pension benefits. The liability is reported as a non-current liability if it exceeds plan assets, indicating an underfunded plan. On the other hand, if the fair value of plan assets exceeds the pension obligations, a net defined benefit asset is reported on the balance sheet. Proper disclosure and accurate measurement of the liability (or asset) is crucial in assessing the financial health and obligation of the company.

The reporting and disclosure requirements for defined benefit plan assets and liabilities are governed by accounting standards such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Compliance with these standards ensures transparency and comparability of financial statements across different companies and industries.

It is important to note that changes in the fair value of plan assets and actuarial gains or losses are not directly reported on the balance sheet. Instead, these are recognized in the statement of changes in equity or statement of comprehensive income, depending on the accounting framework being used.

Having a clear understanding of how defined benefit plans impact the balance sheet is crucial for investors, creditors, and other stakeholders. The balance sheet provides insights into a company’s financial position and its ability to meet its long-term obligations, including pension liabilities. Analyzing the net defined benefit liability (or asset) can help identify potential risks and financial implications associated with the company’s pension obligations.

In the next section, we will explore how defined benefit plans affect the income statement and the financial implications they have on a company’s profitability and earnings.

Income Statement

The income statement, also known as the profit and loss statement, is a financial statement that shows a company’s revenues, expenses, gains, and losses over a specific period. Defined benefit plans have various impacts on the income statement that need to be considered for accurate financial reporting:

- Net Interest Expense (or Income): Defined benefit plans involve the use of actuarial assumptions and the discounting of the future pension obligations. As time passes, the present value of these obligations changes, leading to a net interest expense or income recognized in the income statement. This expense or income represents the cost or benefit of providing the promised retirement benefits over time and is typically included in finance costs or finance income.

- Net Actuarial Gains (or Losses): Actuarial gains or losses can arise from changes in actuarial assumptions, such as discount rates, mortality rates, and salary growth rates. These changes can have a significant impact on the valuation of the defined benefit liability (or asset). If there are favorable changes, it results in actuarial gains, while unfavorable changes lead to actuarial losses. These gains or losses are recognized in the income statement and can affect reported earnings.

- Past Service Cost: Past service cost represents the expense recognized when there are changes to the pension plan that affect past periods. This can occur due to plan amendments, curtailments, or settlements. The resulting expense is recognized in the income statement as a separate line item.

- Plan Settlements and Curtailments: When a defined benefit plan’s obligations are settled or future benefits are reduced (curtailed), any resulting gains or losses are recognized in the income statement. Plan settlements and curtailments can have a significant impact on reported earnings depending on the size and nature of the changes.

It is important for companies to provide clear and detailed disclosure in the footnotes of the financial statements regarding the components and amounts recognized in the income statement related to their defined benefit plans. This transparency ensures that stakeholders can assess the financial implications of these plans on a company’s profitability and earnings.

Understanding the impact of defined benefit plans on the income statement is essential for investors, analysts, and other stakeholders. It allows for a comprehensive analysis of a company’s financial performance, taking into account the costs associated with providing retirement benefits to employees.

Next, we will explore how defined benefit plans affect the statement of comprehensive income and its role in providing a more holistic view of a company’s financial position.

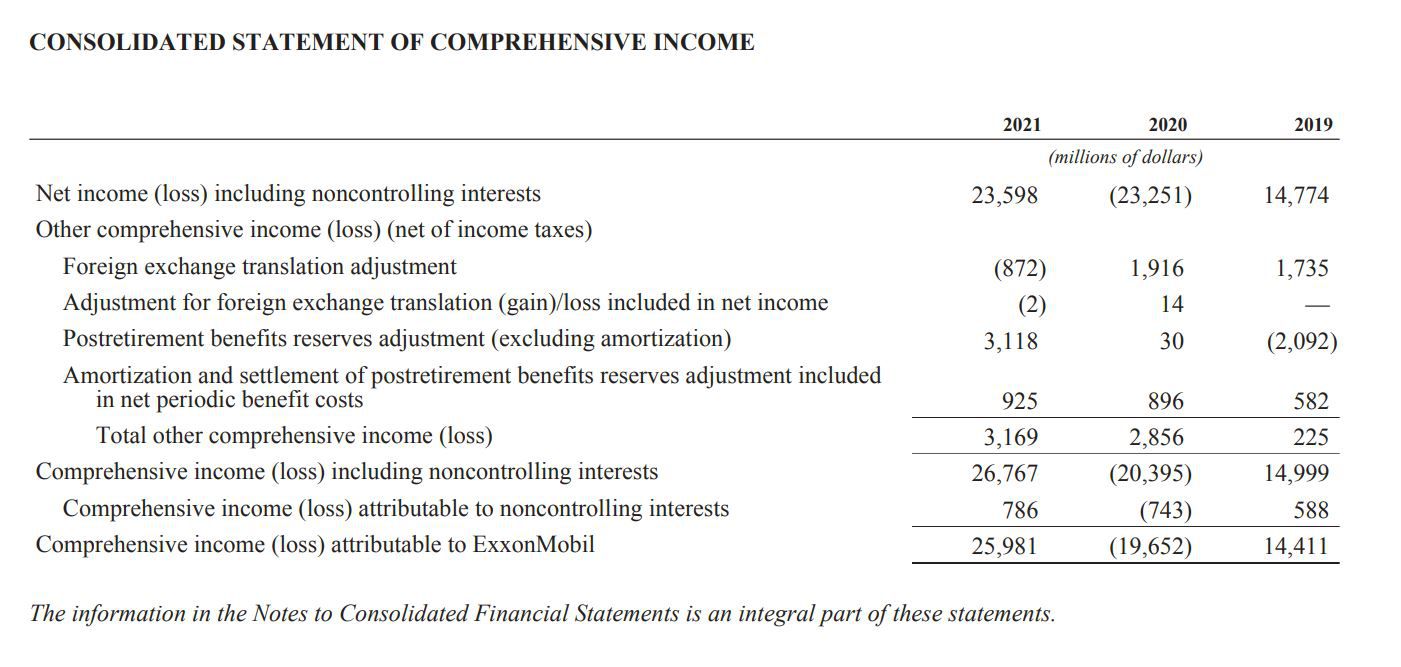

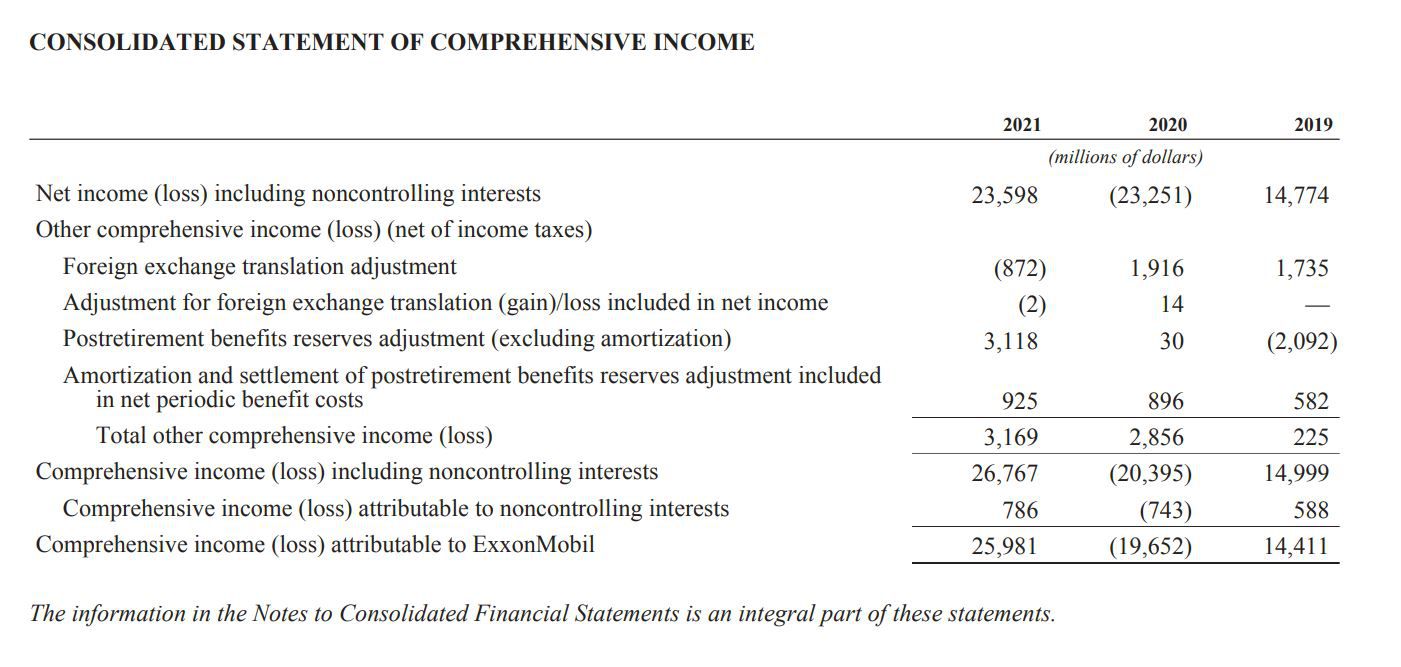

Statement of Comprehensive Income

The statement of comprehensive income is a financial statement that provides a broader view of a company’s financial performance by including both the income statement items and other comprehensive income. It captures the changes in equity that are not directly reported in the income statement. When it comes to defined benefit plans, the statement of comprehensive income plays a crucial role in reflecting their impact.

Defined benefit plans may give rise to actuarial gains or losses that are not recognized in the income statement but directly recorded under other comprehensive income. These actuarial gains or losses arise from changes in actuarial assumptions, such as discount rates, mortality rates, and salary growth rates. Any actuarial gains or losses that are not immediately recognized in the income statement are included in other comprehensive income.

By including these items in the statement of comprehensive income, stakeholders can gain a more comprehensive understanding of the financial impact of defined benefit plans on a company’s overall financial position. It allows for a more holistic view of the company’s performance, taking into account the long-term obligations and risks associated with providing retirement benefits to employees.

Proper disclosure of the components of other comprehensive income related to defined benefit plans is critical for stakeholders in evaluating a company’s financial health. It ensures transparency and helps investors and analysts assess the potential risks and uncertainties related to these plans.

Understanding the implications of defined benefit plans on the statement of comprehensive income is vital for making informed decisions and assessing the long-term financial prospects of a company. It provides a comprehensive view of a company’s financial performance, incorporating both the income statement and other comprehensive income items.

Next, we will explore the impact of defined benefit plans on the statement of cash flows and how they affect a company’s cash flows and liquidity.

Statement of Cash Flows

The statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. It helps stakeholders understand how the company generates and uses cash. When it comes to defined benefit plans, they can have an impact on the statement of cash flows in several ways:

1. Pension Contributions: Defined benefit plans require companies to make regular contributions to fund the future pension obligations. These contributions represent cash outflows and are classified as either operating or financing activities in the statement of cash flows, depending on the nature of the payment.

2. Interest Payments: If the company borrows money to fund the defined benefit plan, it may have to make interest payments on the borrowed funds. These interest payments are considered cash outflows and are typically classified as operating or financing activities in the statement of cash flows.

3. Net Interest Expense: The net interest expense recognized in the income statement, which represents the change in the present value of the defined benefit obligation over time, is not reflected as a cash outflow. It is a non-cash item that gets added back when preparing the statement of cash flows under the indirect method. This adjustment ensures that the cash inflows and outflows are accurately represented.

The statement of cash flows provides valuable insights into a company’s liquidity and cash flow management. Understanding the impact of defined benefit plans on this statement allows stakeholders to assess a company’s ability to meet its pension obligations and manage its cash resources effectively.

Proper disclosure of the cash flows related to defined benefit plans in the footnotes of the financial statements is essential for transparency and accuracy. It helps investors and analysts evaluate the financial implications of these plans on a company’s cash position and the potential cash flow risks associated with meeting future pension obligations.

Now that we have explored the impact on the statement of cash flows, let’s move on to the final section where we discuss the influence of defined benefit plans on the statement of changes in equity.

Statement of Changes in Equity

The statement of changes in equity, also known as the statement of shareholders’ equity, is a financial statement that reflects the changes in a company’s equity during a specific period. It summarizes the transactions and events that impact the equity accounts, including the effects of defined benefit plans.

Defined benefit plans can have an impact on the equity section of the statement of changes in equity in the following ways:

- Actuarial Gains or Losses: Changes in actuarial assumptions, such as discount rates or salary growth rates, can lead to actuarial gains or losses. These gains or losses are included in the statement of changes in equity, directly affecting the overall equity position of the company. They represent the adjustments required to ensure that the pension liability (or asset) is appropriately recognized in the financial statements.

- Adjustments to Retained Earnings: Actuarial gains or losses may need to be adjusted against retained earnings in certain circumstances. This adjustment reflects the impact of changes in pension obligations on the cumulative earnings of the company.

- Dividends and Contributions: Dividends paid to shareholders, as well as contributions made to the defined benefit plan, affect the equity section of the statement of changes in equity. Dividends reduce equity, while contributions increase equity.

Accurate and transparent disclosure of the components that impact equity related to defined benefit plans is crucial. This transparency allows stakeholders to understand the changes in the company’s equity position and evaluate the long-term financial implications of these plans.

The statement of changes in equity provides insights into a company’s financial position and the movement of equity accounts during a specific period. Understanding the impact of defined benefit plans on this statement helps investors, analysts, and other stakeholders assess the overall financial health and stability of the company, taking into account the effects of pension obligations on equity.

Now that we have explored the impact on the statement of changes in equity, let’s conclude our discussion on how defined benefit plans influence financial statements.

Conclusion

Defined benefit plans have a significant impact on a company’s financial statements. Understanding how these plans influence the balance sheet, income statement, statement of comprehensive income, statement of cash flows, and statement of changes in equity is essential for accurate financial reporting and analysis.

The balance sheet reflects the fair value of plan assets as non-current assets and the net defined benefit liability (or asset) as a non-current liability (or asset). These items indicate the funds set aside for future pension obligations and the employer’s obligation to cover these benefits.

The income statement captures the net interest expense (or income) and actuarial gains or losses, which can significantly affect reported earnings. Past service cost and plan settlements also impact the income statement when there are changes to the plan affecting past periods.

The statement of comprehensive income provides a more comprehensive view by including actuarial gains or losses not recognized in the income statement. This helps stakeholders assess the financial impact of defined benefit plans on a company’s overall financial position.

The statement of cash flows reflects the pension contributions and interest payments, while the net interest expense is added back as a non-cash item. This statement provides insights into the company’s cash flow management and its ability to meet pension obligations.

The statement of changes in equity captures the actuarial gains or losses, as well as adjustments to retained earnings and the impact of dividends and contributions. It reflects the movement in equity accounts, influenced by defined benefit plans.

Accurate and transparent disclosure of defined benefit plans in financial statements is crucial for stakeholders to assess a company’s financial health and evaluate the risks and costs associated with providing retirement benefits. Compliance with accounting standards ensures comparability and reliable reporting across different companies and industries.

As professionals in the finance industry, understanding the impact of defined benefit plans on financial statements equips us with the knowledge and insights needed to analyze a company’s financial position, profitability, cash flows, and overall financial health. By incorporating the complexities of these plans into our analysis, we can provide meaningful insights and guidance to stakeholders.

Overall, financial statements play a vital role in communicating the financial impact of defined benefit plans. By considering their influence on these statements, we can make informed decisions, accurately assess a company’s financial position, and mitigate the potential risks associated with providing retirement benefits.