Finance

What Are Interim Financial Statements

Published: December 22, 2023

Learn about interim financial statements in finance and how they provide a snapshot of a company's financial position, performance, and cash flows during a specific period.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Interim Financial Statements

- Purpose and Importance of Interim Financial Statements

- Components of Interim Financial Statements

- Key Differences between Interim Financial Statements and Annual Financial Statements

- Best Practices for Preparing Interim Financial Statements

- Limitations and Challenges of Interim Financial Statements

- Importance of Accurate and Reliable Interim Financial Statements

- Conclusion

Introduction

When it comes to assessing the financial health and performance of a company, financial statements play a crucial role. While annual financial statements provide a comprehensive overview of a company’s financial position, interim financial statements offer a more frequent snapshot of its financial performance during the course of a year.

Interim financial statements are essentially the financial reports issued by a company between its annual reporting periods. These statements are generally prepared on a quarterly basis, but can also be issued on a monthly or semi-annual basis.

The purpose of interim financial statements is to provide timely and relevant information to shareholders, investors, creditors, and other stakeholders. These statements are essential for making informed decisions and understanding the ongoing financial performance of the company.

In this article, we will delve into the definition, purpose, and components of interim financial statements. We will also explore the key differences between interim financial statements and annual financial statements, as well as the best practices for preparing them.

Lastly, we will discuss the limitations and challenges associated with interim financial statements, emphasizing the importance of accuracy and reliability in financial reporting.

Definition of Interim Financial Statements

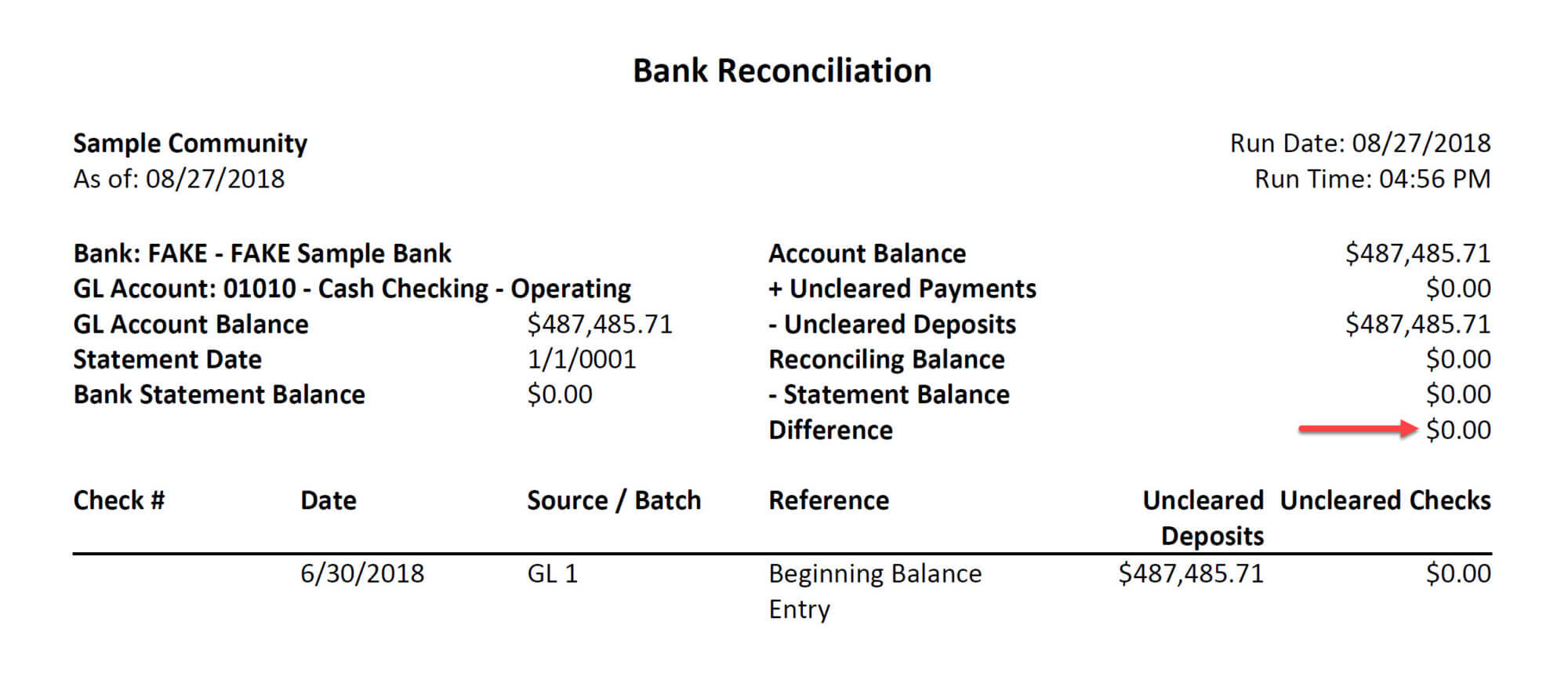

Interim financial statements, also known as interim financial reports or unaudited financial statements, are the financial reports prepared and presented by a company for a period shorter than a year. These statements provide a snapshot of the company’s financial performance and position during a specific period, such as a quarter or a month.

Interim financial statements typically include the same components as annual financial statements, including the statement of financial position (balance sheet), income statement (profit and loss statement), cash flow statement, and statement of changes in equity. However, unlike annual financial statements, interim financial statements are unaudited, meaning they have not been reviewed by external auditors.

The purpose of interim financial statements is to provide timely and relevant information to shareholders, investors, creditors, and other stakeholders. This allows them to have a better understanding of the company’s financial performance and trends between the annual reporting periods.

Interim financial statements are particularly important for publicly traded companies, as they are required to provide regular updates on their financial performance to comply with regulatory requirements and keep shareholders informed. These statements help investors make more informed decisions and assess the company’s ongoing financial health.

It is important to note that while interim financial statements provide valuable insights, they are not intended to replace annual financial statements. Rather, they serve as interim updates to complement the annual reports and provide a more frequent view of the company’s financial position.

Purpose and Importance of Interim Financial Statements

Interim financial statements serve several key purposes and play a crucial role in the financial reporting of a company. Let’s explore the purpose and importance of these statements:

1. Timely and Relevant Information: The primary purpose of interim financial statements is to provide timely and relevant information to shareholders, investors, and creditors. By issuing these statements on a regular basis, usually quarterly, the company ensures that stakeholders have access to up-to-date financial data. This enables them to make informed decisions regarding their investments or lending decisions.

2. Monitoring Performance: Interim financial statements allow stakeholders to monitor the company’s financial performance between annual reporting periods. By analyzing the financial results for a specific period, such as a quarter, stakeholders can assess whether the company is meeting its financial goals, identify any challenges or trends, and make necessary adjustments to their investment strategies.

3. Assessing Liquidity and Solvency: Interim financial statements provide insights into a company’s liquidity and solvency positions. The cash flow statement, for example, indicates the flow of cash in and out of the company during the period, giving stakeholders visibility into the company’s ability to meet its short-term financial obligations. This information is valuable for investors and creditors in evaluating the company’s financial stability and creditworthiness.

4. Transparency and Investor Relations: Publishing interim financial statements demonstrates a commitment to transparency and good corporate governance. It shows that the company is willing to provide regular updates on its financial performance and maintain open communication with its stakeholders. This can enhance the company’s credibility and reputation among investors, attracting potential investors and fostering trust with existing shareholders.

5. Regulatory Compliance: For publicly traded companies, issuing interim financial statements is a regulatory requirement. Stock exchanges and regulatory bodies typically mandate companies to release quarterly or semi-annual financial reports to ensure transparency and protect the interests of shareholders and investors. By complying with these regulations, companies demonstrate their commitment to accountability and adherence to industry standards.

Overall, interim financial statements are of utmost importance in providing timely, accurate, and relevant financial information to stakeholders. They enable investors, creditors, and other interested parties to assess the company’s financial performance, make informed decisions, and ensure the company’s ongoing financial health and stability.

Components of Interim Financial Statements

Interim financial statements include several key components that provide a comprehensive view of a company’s financial performance and position during a specific period. Let’s explore the main components of interim financial statements:

1. Statement of Financial Position (Balance Sheet): The statement of financial position presents the company’s assets, liabilities, and shareholders’ equity at a specific point in time. It provides an overview of the company’s financial health, indicating its liquidity, solvency, and overall net worth.

2. Income Statement (Profit and Loss Statement): The income statement showcases the company’s revenues, expenses, and net income (or loss) for the period. It helps stakeholders understand the company’s operational performance and profitability during the specified timeframe.

3. Cash Flow Statement: The cash flow statement outlines the company’s cash inflows and outflows during the period, categorizing them into operating, investing, and financing activities. This statement provides insights into the company’s cash position and its ability to generate and manage cash flow effectively.

4. Statement of Changes in Equity: The statement of changes in equity illustrates the changes in the company’s equity accounts, including retained earnings and shareholders’ contributions, during the period. It captures the impact of certain transactions, such as dividends or stock issuances, on the company’s shareholders’ equity.

5. Notes to the Financial Statements: The notes to the financial statements provide additional details and explanations for the numbers presented in the main financial statements. They disclose significant accounting policies, contingent liabilities, events after the reporting period, and other relevant information that helps stakeholders better understand the financial statement figures.

In addition to these main components, interim financial statements may also include management commentary, which provides an analysis and explanation of the financial results, key performance indicators (KPIs), and any significant events or trends affecting the company’s performance during the period.

It is important for companies to present these components in a clear and concise manner, ensuring that the financial statements adhere to relevant accounting frameworks and standards to maintain credibility and transparency.

Key Differences between Interim Financial Statements and Annual Financial Statements

While interim financial statements and annual financial statements serve the same purpose of providing information about a company’s financial performance, there are several key differences between the two. Let’s examine these differences:

1. Reporting Period: The most significant difference is the reporting period covered by the statements. Interim financial statements are prepared for shorter periods, such as a quarter or a month, while annual financial statements cover a full fiscal year.

2. Auditing and Review: Annual financial statements are typically subject to external audit, where independent auditors review and validate the accuracy and reliability of the financial information. Interim financial statements, on the other hand, are usually unaudited and may not undergo the same level of scrutiny.

3. Level of Detail: Annual financial statements provide a more comprehensive view of a company’s financial performance and position. They include detailed information on various financial metrics, such as profitability, liquidity, solvency, and cash flow. Interim financial statements, while still informative, may provide a more condensed view, focusing on key financial figures for the period.

4. Timing and Frequency: Interim financial statements are issued at regular intervals throughout the year, often quarterly. They provide stakeholders with more frequent updates on the company’s financial performance. Annual financial statements, on the other hand, are typically published once a year, providing a comprehensive snapshot of the company’s financials for the entire fiscal year.

5. Level of Assurance: Annual financial statements, with their external audit and more extensive disclosures, provide a higher level of assurance to stakeholders regarding the accuracy and reliability of the information. Interim financial statements, being unaudited and potentially less detailed, carry a lower level of assurance.

6. Regulatory Requirements: Interim financial statements may be required by regulatory bodies for publicly traded companies to ensure timely disclosure of financial information. Annual financial statements, however, are legally required for both publicly traded and privately held companies to meet reporting obligations.

Despite these differences, both interim and annual financial statements play vital roles in financial reporting. Interim financial statements provide stakeholders with more frequent updates and insights into a company’s ongoing financial performance, while annual financial statements offer a comprehensive view of the company’s financial position at the end of a fiscal year.

Best Practices for Preparing Interim Financial Statements

Preparing accurate and reliable interim financial statements is crucial for providing stakeholders with useful information to make informed decisions. Here are some best practices to follow when preparing interim financial statements:

1. Consistency: Maintain consistency in accounting policies and practices between interim and annual financial statements. This ensures comparability and allows stakeholders to accurately analyze the company’s financial performance over different periods.

2. Timeliness: Issue interim financial statements in a timely manner to provide up-to-date information. Adhere to a regular reporting schedule, such as a quarterly or monthly basis, to ensure stakeholders receive the financial information promptly.

3. Accurate Revenue Recognition: Ensure accurate and appropriate recognition of revenue during the interim period. Follow the relevant accounting standards and guidelines to recognize revenue based on the stage of completion, collectability, and other criteria defined by the standard.

4. Prudent Expense Recognition: Recognize expenses in a prudent manner, matching them with the revenue they generate to provide a realistic reflection of the company’s financial performance during the interim period.

5. Adequate Disclosures: Include appropriate disclosures in the interim financial statements to provide sufficient context and explanations. Disclose significant events, changes in accounting policies, contingent liabilities, and any other information necessary for stakeholders to understand the financial statements.

6. Management Commentary: Include a management commentary section to provide an analysis and explanation of the financial results. This commentary should highlight the key drivers of performance, significant trends, and any other relevant information that may impact stakeholders’ understanding of the financial statements.

7. Internal Controls: Implement strong internal controls to ensure the accuracy and reliability of the financial information reported in the interim financial statements. Regularly assess and update these controls to mitigate the risks of misstatement or fraud.

8. Compliance with Reporting Standards: Follow the applicable reporting standards and guidelines, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), to ensure consistency and comparability in financial reporting.

9. Independent Review: Consider engaging an independent third party, such as internal or external auditors, to review the interim financial statements. While unaudited, an independent review can provide additional assurance and credibility to the financial information presented.

10. Stakeholder Communication: Communicate the availability of the interim financial statements to stakeholders through appropriate channels, such as investor relations websites or regulatory filings. Provide access to the financial statements in a user-friendly format to facilitate ease of understanding for stakeholders.

By following these best practices, companies can ensure the accuracy, transparency, and usefulness of their interim financial statements, ultimately fostering trust and confidence among stakeholders.

Limitations and Challenges of Interim Financial Statements

While interim financial statements provide valuable insights into a company’s financial performance during a specified period, they also have limitations and face certain challenges. It is essential to be aware of these factors when analyzing and interpreting interim financial statements. Here are some key limitations and challenges:

1. Limited Timeframe: Interim financial statements cover a shorter timeframe compared to annual financial statements. This limited timeframe may not fully reflect the long-term trends and patterns in a company’s financial performance, making it challenging to assess overall financial health accurately.

2. Uncertainties in Seasonal Businesses: For businesses that are subject to seasonal fluctuations, interim financial statements may not provide a complete picture of the company’s performance. Seasonal variations can significantly impact the results reported for a specific period, potentially leading to distorted interpretations.

3. Incomplete Auditing and Review: Interim financial statements are often unaudited or subject to limited review compared to annual financial statements. The absence of a comprehensive audit can result in reduced assurance regarding the accuracy and reliability of the financial information presented.

4. Relying on Estimations: In certain cases, interim financial statements may rely on estimates and assumptions more heavily than annual financial statements. This can introduce additional uncertainties and make it challenging to determine the exact financial position and performance of the company.

5. Potential Timing Issues: As interim financial statements are prepared and released at regular intervals, there may be timing issues in capturing certain transactions or events that occur near the end of the reporting period. This can affect the accuracy and completeness of the reported financial information.

6. Limited Disclosures: Interim financial statements may have fewer disclosures compared to annual financial statements. This can result in limited information about contingent liabilities, subsequent events, and other important details, which may impact stakeholders’ ability to make fully informed decisions.

7. Lack of Context: Interim financial statements can lack the necessary contextual information, such as market trends, economic conditions, or specific business developments that may influence the financial results. This can make it challenging to interpret the financial statements accurately.

8. Prevalence of Short-Termism: Interim financial statements may contribute to a short-term focus on quarterly or monthly results, potentially overshadowing the importance of long-term value creation and sustainable growth strategies.

Despite these limitations and challenges, interim financial statements still provide valuable information for stakeholders, offering insights into a company’s financial performance between annual reporting periods. To overcome these limitations, it is important to consider additional sources of information and analyze the interim financial statements within the broader context of the company’s business and industry environment.

Importance of Accurate and Reliable Interim Financial Statements

Accurate and reliable interim financial statements are of paramount importance for both companies and their stakeholders. Here are some reasons why these statements play a crucial role:

1. Informed Decision Making: Interim financial statements provide stakeholders with timely information that helps them make informed decisions. Investors, shareholders, and creditors rely on these statements to assess a company’s financial performance and position, enabling them to make sound investment, lending, and business partnership decisions.

2. Assessing Financial Health: Accurate interim financial statements allow stakeholders to evaluate a company’s financial health during a specific period. These statements provide insights into key financial metrics, such as profitability, liquidity, solvency, and cash flow, helping stakeholders gauge the company’s operational efficiency and overall financial stability.

3. Monitoring Performance: Interim financial statements enable stakeholders to track a company’s performance over time. By comparing the financial results across different periods, stakeholders can identify trends, assess growth prospects, and evaluate the effectiveness of management strategies.

4. Compliance with Regulations: Publicly traded companies are required by regulatory bodies, such as financial market authorities and stock exchanges, to issue regular interim financial statements. Compliance with these regulations ensures transparency and accountability, fostering investor confidence and maintaining the integrity of the financial markets.

5. Investor Relations and Trust: Publishing accurate and reliable interim financial statements is crucial for building and maintaining trust with shareholders and investors. Transparent and credible financial reporting enhances the company’s reputation, investor relations, and the likelihood of attracting new investors.

6. Creditworthiness Evaluation: Creditors and lenders rely on interim financial statements to assess the creditworthiness of a company. These statements provide crucial information about a company’s ability to meet its financial obligations, such as loan repayments, interest payments, and dividends.

7. Early Identification of Issues: Accurate interim financial statements allow stakeholders to identify potential issues and address them promptly. By monitoring the company’s financial performance on a regular basis, stakeholders can identify any early warning signs, take corrective actions, and mitigate risks before they escalate.

8. Compliance with Accounting Standards: Preparing accurate and reliable interim financial statements in accordance with established accounting standards ensures consistency and comparability of financial information. This enables stakeholders to make meaningful comparisons and evaluations across different companies within the same industry.

Overall, accurate and reliable interim financial statements provide stakeholders with a clear and up-to-date view of a company’s financial performance, aiding decision making, fostering transparency, and maintaining the trust of investors, creditors, and other stakeholders.

Conclusion

Interim financial statements serve as valuable tools in assessing a company’s financial performance and position between annual reporting periods. While they have some limitations and challenges, these statements provide stakeholders with timely and relevant information for making informed decisions.

By understanding the components of interim financial statements, the key differences between them and annual financial statements, and the best practices for their preparation, stakeholders can effectively analyze and interpret these statements. Accurate and reliable interim financial statements are crucial for evaluating a company’s financial health, monitoring its performance, and complying with regulatory requirements.

It is important to recognize the significance of accurate and transparent financial reporting. Stakeholders rely on interim financial statements to assess a company’s viability, make investment decisions, and evaluate its creditworthiness. To maintain trust and credibility, companies must adhere to accounting standards, disclose relevant information, and present their financial statements in a timely manner.

In conclusion, interim financial statements provide stakeholders with vital insights into a company’s financial performance and position during specific reporting periods. These statements enable stakeholders to make informed decisions, monitor performance, and assess a company’s financial health. While they are not a substitute for annual financial statements, they serve as a valuable tool in maintaining transparency and providing timely information to stakeholders.