Finance

How To Read HOA Financial Statements

Published: December 23, 2023

Learn how to read HOA financial statements and gain a better understanding of finance in homeowners associations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Homeowners’ associations (HOAs) play a crucial role in managing and maintaining residential communities, ensuring that the needs and interests of homeowners are met. As a member of an HOA, it is essential to have a clear understanding of the financial health and operations of the association. This is where HOA financial statements come into play.

HOA financial statements provide a snapshot of the association’s financial performance, demonstrating how funds are allocated and managed. Analyzing these statements can help homeowners evaluate the financial stability of the HOA, identify potential issues, and make informed decisions about their investment in the community.

In this article, we will delve into the world of HOA financial statements, explaining the key components and how to interpret them. Whether you are a current or prospective homeowner within an HOA, understanding these statements will empower you to actively participate in the financial decision-making process of your community.

It is important to note that HOA financial statements may differ in format and terminology from one association to another, but the underlying principles remain the same. Familiarizing yourself with the fundamental components and concepts will allow you to navigate any financial statements with ease.

So, let’s dive in and uncover the mysteries behind HOA financial statements, enabling you to become a savvy homeowner who feels confident in understanding and analyzing their association’s financial health.

Understanding HOA Financial Statements

HOA financial statements provide a comprehensive overview of the association’s financial activities, including income, expenses, assets, and liabilities. These statements serve as a financial roadmap, showing the current financial position of the HOA and highlighting any trends or patterns that may impact its financial stability.

HOA financial statements typically consist of three primary components: the balance sheet, the income statement (also known as the profit and loss statement), and the cash flow statement. Additionally, there may be accompanying footnotes that provide further details and explanations about specific items on the statements.

The balance sheet provides a snapshot of the HOA’s financial position at a specific point in time. It lists the association’s assets (what it owns), liabilities (what it owes), and shareholder’s equity (the difference between assets and liabilities). The balance sheet helps determine the overall financial health and solvency of the HOA.

The income statement shows the association’s revenue, expenses, and net income or loss over a specific period, usually a fiscal year. It provides insight into the HOA’s ability to generate income, manage expenses, and assess its financial performance.

The cash flow statement outlines how money flows in and out of the HOA during a specific period. It tracks the association’s cash inflows (such as assessments and other revenue) and cash outflows (such as operating expenses and capital expenditures). This statement is crucial for understanding the HOA’s cash flow management and liquidity.

In addition to these three primary financial statements, the HOA financial statements may also include footnotes. These footnotes provide important explanatory information about various transactions, accounting policies, contingent liabilities, and any other significant information that may impact the association’s financial position.

By understanding these fundamental components of HOA financial statements, you will be able to gain insights into the financial health and stability of your association. It will also equip you with the knowledge to assess the association’s financial performance, make better-informed decisions, and advocate for the best interests of your community.

Key Components of HOA Financial Statements

HOA financial statements consist of several key components that provide a comprehensive picture of the association’s financial health. Understanding these components is essential for homeowners to assess the financial stability and performance of their HOA. Let’s explore the key components of HOA financial statements:

- Balance Sheet: The balance sheet is a snapshot of the association’s financial position at a specific date. It presents the HOA’s assets, liabilities, and owner’s equity. Assets typically include cash, investments, accounts receivable, and property owned by the association. Liabilities encompass accounts payable, loans, and any other outstanding obligations. Owner’s equity represents the difference between assets and liabilities, providing a measure of the association’s net worth.

- Income Statement: Also known as the profit and loss statement, the income statement provides an overview of the association’s revenue, expenses, gains, and losses over a specific period. It shows the HOA’s ability to generate income, manage expenses, and ultimately determine whether there is a net profit or loss. Revenue sources may include assessments, fees, fines, and other income generated by the association. Expenses typically include operating costs, maintenance, insurance, utilities, and administrative expenses.

- Cash Flow Statement: The cash flow statement tracks the inflow and outflow of cash within the association during a specific period. It provides insights into how cash is generated and utilized by the HOA. This statement distinguishes between cash flows from operating activities (such as assessments and fees), investing activities (such as purchasing or selling assets), and financing activities (such as obtaining loans or paying off debts). Analyzing cash flow helps assess the association’s liquidity and its ability to meet financial obligations.

- Notes to the Financial Statements: Notes to the financial statements accompany the main statements and provide additional details and explanations about specific items. These notes may include disclosures about the accounting policies used, contingent liabilities, significant transactions, and any relevant information that helps clarify the financial statements. It is important to review these notes to gain a deeper understanding of the association’s financial position and the factors that may impact its financial health.

By analyzing these key components of HOA financial statements, homeowners can gain valuable insights into the association’s financial health, fiscal responsibility, and overall management. This knowledge empowers homeowners to ask critical questions, address any concerns, and actively participate in the financial decision-making process to ensure the long-term stability and success of their HOA.

Balance Sheet

The balance sheet is a crucial component of HOA financial statements as it provides a snapshot of the association’s financial position at a particular point in time. It offers valuable insights into the assets, liabilities, and owner’s equity of the HOA. Let’s explore the key elements of a balance sheet:

- Assets: Assets represent what the association owns and include both current and long-term assets. Current assets are those that can be easily converted into cash within a year, such as cash in the bank, accounts receivable, and prepaid expenses. Long-term assets, on the other hand, are assets that are not expected to be converted into cash within a year and may include land, buildings, investments, and equipment.

- Liabilities: Liabilities represent the association’s financial obligations and debts. Similar to assets, liabilities can be classified as either current or long-term. Current liabilities are debts that need to be settled within a year, such as accounts payable, accrued expenses, and any short-term loans. Long-term liabilities, or non-current liabilities, include obligations that extend beyond a year, like long-term loans or bonds.

- Owner’s Equity: Owner’s equity, also known as shareholders’ equity, represents the net worth of the HOA. It is calculated by subtracting the total liabilities from the total assets. Owner’s equity includes the initial contributions made by homeowners, retained earnings (profits that have not been distributed to homeowners), and any other equity adjustments made over time.

The balance sheet provides important information about the association’s financial health and solvency. It helps homeowners and stakeholders understand the value of the assets owned by the association, the extent of its liabilities, and the association’s net worth. A healthy balance sheet typically exhibits a higher value of assets than liabilities, indicating that the association has the resources to cover its debts and obligations.

By regularly reviewing the balance sheet, homeowners can assess whether the association is effectively managing its finances and maintaining a strong financial position. It allows homeowners to monitor the association’s assets and liabilities, identify any potential red flags or imbalances, and ensure the association is making sound financial decisions for the benefit of all members.

Income Statement

The income statement, also known as the profit and loss statement, is a vital component of HOA financial statements. It provides a summary of the association’s revenue, expenses, gains, and losses over a specific period, typically a fiscal year. The income statement offers valuable insights into the financial performance of the HOA and highlights its ability to generate income and manage expenses. Let’s delve into the key elements of an income statement:

- Revenue: Revenue represents the income generated by the HOA during the specified period. It can come from various sources, including assessments, monthly fees, special assessments, fines, rental income, interest earned, or any other income earned by the association.

- Expenses: Expenses encompass all the costs and expenditures incurred by the association in its day-to-day operations. These expenses can include administrative expenses, maintenance costs, utilities, insurance premiums, legal fees, property management fees, landscaping, repairs, and any other expenses related to the management and maintenance of the community.

- Gains and Losses: Gains and losses are typically associated with non-operating activities of the HOA. This may include gains or losses from the sale of assets, investment income, or any other extraordinary items that affect the association’s overall financial performance.

- Net Income or Loss: The net income or loss is calculated by subtracting the total expenses and losses from the total revenue and gains. A positive net income indicates that the revenue generated exceeds the expenses incurred, resulting in a profit for the association. Conversely, a negative net income indicates that the expenses are higher than the revenue, resulting in a loss for the association.

The income statement allows homeowners to gauge the financial performance of the HOA and ascertain its ability to cover expenses and generate a surplus. It helps homeowners evaluate the efficiency of the association’s financial management, identify any areas of concern, and make informed decisions about the allocation of funds.

Regularly reviewing the income statement enables homeowners to understand the association’s revenue sources, assess the impact of expenses on financial performance, and evaluate the financial feasibility of future projects or initiatives. It also helps homeowners understand how assessments and fees are utilized and whether adjustments may be necessary to ensure the financial stability and sustainability of the association.

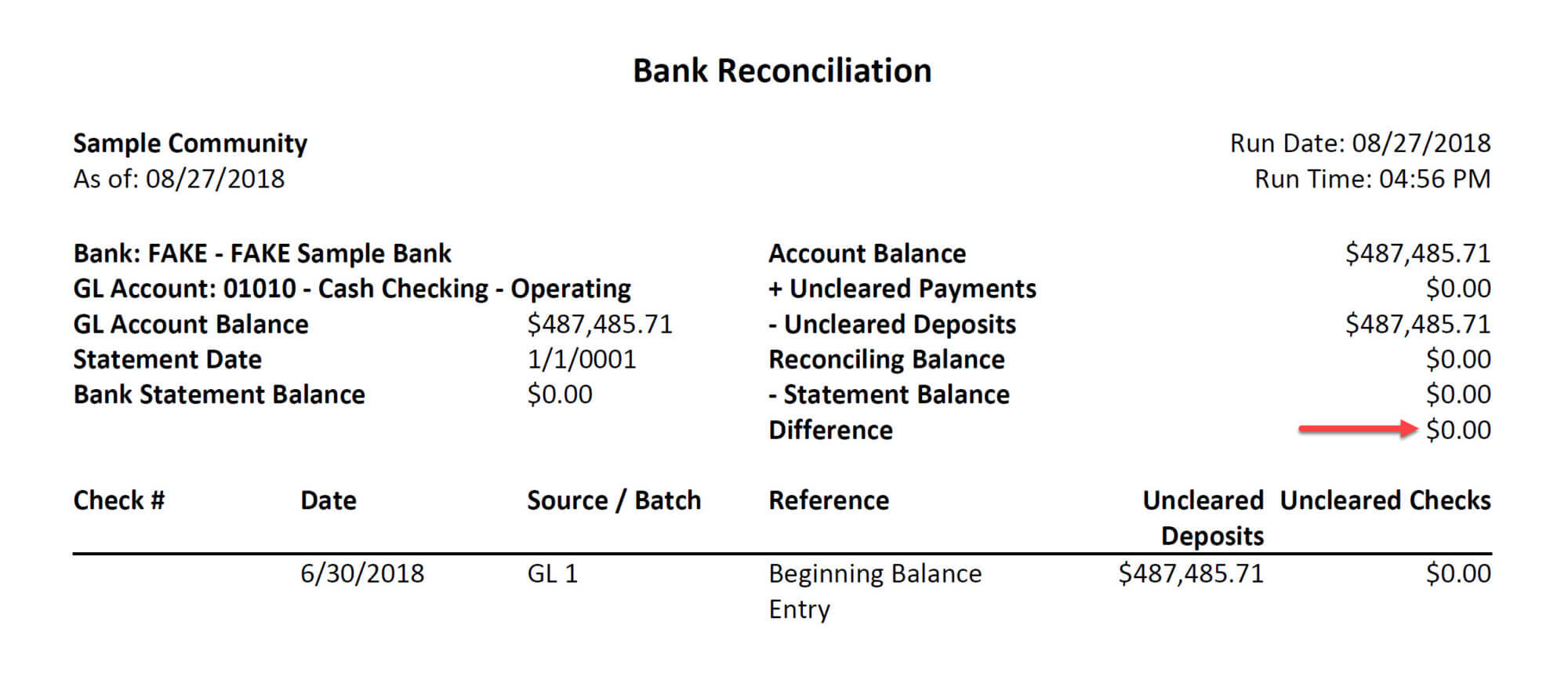

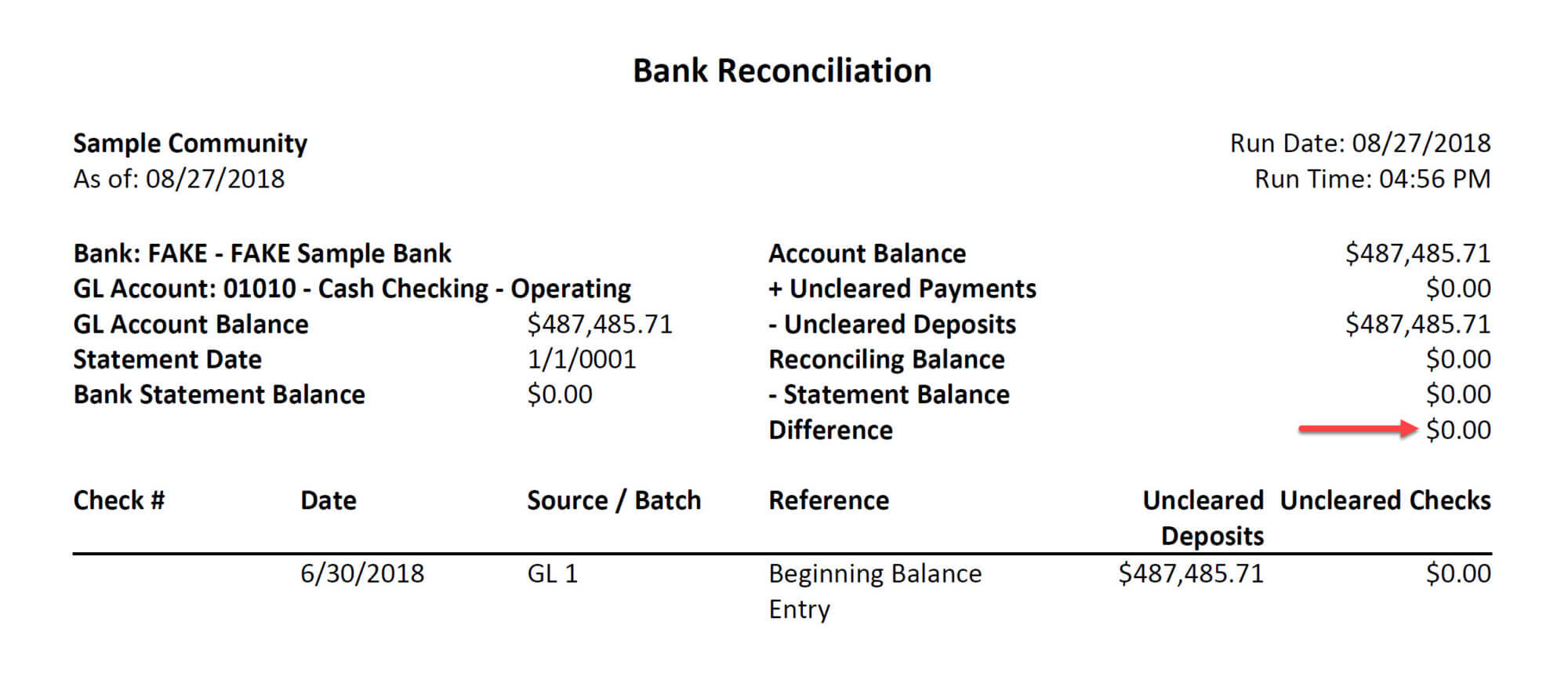

Cash Flow Statement

The cash flow statement is an important component of HOA financial statements as it provides a detailed overview of the inflow and outflow of cash within the association during a specific period. It tracks the association’s cash position and helps homeowners understand how cash is generated and utilized. Let’s explore the key elements of a cash flow statement:

- Cash from Operating Activities: This section focuses on the association’s cash inflows and outflows related to its core operations. It includes cash received from assessments, fees, fines, and other operating income, as well as cash paid for operating expenses, such as maintenance, utilities, insurance, and administrative costs.

- Cash from Investing Activities: This section accounts for the association’s cash inflows and outflows related to investments and capital expenditures. It includes cash received from the sale of assets, interest earned on investments, and any cash paid for the purchase of property, equipment, or other long-term assets.

- Cash from Financing Activities: This section represents the association’s cash inflows and outflows related to financing activities. It includes cash received from loans, lines of credit, or any other financing arrangements, as well as cash paid for loan repayments, dividends, or distributions to homeowners.

- Net Cash Flow: The net cash flow is calculated by summing up the cash inflows and outflows from operating, investing, and financing activities. It represents the overall change in the association’s cash position during the specified period. It is important to monitor the net cash flow to ensure that the association has a positive cash flow, indicating that it is generating enough cash to cover its expenses and financial obligations.

The cash flow statement provides valuable insights into the association’s liquidity, cash management, and ability to meet financial obligations. By analyzing the cash flow statement, homeowners can understand how cash is being generated and used within the association. It allows homeowners to identify any potential cash flow issues, such as cash shortages or excessive cash outflows, and take proactive measures to address them.

Understanding the association’s cash flow helps homeowners make informed decisions about budgeting, reserve funding, and determining the appropriateness of future assessments. It also provides transparency and accountability in terms of how the association is managing its financial resources and ensures the long-term financial stability of the HOA.

Notes to the Financial Statements

Notes to the financial statements are an important component of HOA financial statements as they provide additional details and explanations about specific items on the main statements. These notes offer valuable insights into the association’s accounting policies, significant transactions, contingent liabilities, and other important information that may impact the interpretation of the financial statements. Let’s explore the key aspects of the notes to the financial statements:

Accounting Policies: The notes to the financial statements often provide a summary of the accounting policies adopted by the association. This includes information about the methods used for recognizing revenue, valuing assets, and recording expenses. Understanding the accounting policies helps homeowners interpret the financial statements consistently and accurately.

Significant Transactions: The notes may highlight any significant transactions that have occurred during the period covered by the financial statements. This could include the acquisition or sale of property, long-term contracts, major capital improvements, or any other important financial activities that may impact the association’s financial position.

Contingent Liabilities: Contingent liabilities refer to potential liabilities that may arise in the future, depending on the occurrence of certain events. The notes to the financial statements may disclose any significant contingent liabilities that the association may have. These could include pending lawsuits, potential warranty claims, or environmental liabilities that may impact the association’s financial position and require further attention.

Other Disclosures: The notes may contain other important disclosures, such as related party transactions, lease agreements, changes in accounting standards, or any other information that may be relevant to understanding the financial statements. These disclosures provide homeowners with a comprehensive view of the association’s financial activities and ensure transparency and accountability.

Reviewing the notes to the financial statements is essential for gaining a deeper understanding of the association’s financial position and the factors that may impact its financial health. Homeowners should pay particular attention to any significant disclosures or contingencies that may have a material impact on the association’s financial stability and decision-making processes.

By carefully reviewing the notes to the financial statements, homeowners can gain valuable insights into the association’s financial activities, identify any potential risks or areas of concern, and make informed decisions that contribute to the long-term success and sustainability of the HOA.

Analyzing HOA Financial Statements

Analyzing HOA financial statements is a crucial step in assessing the financial health and performance of the association. By understanding and interpreting these statements, homeowners can gain valuable insights into the association’s financial position, evaluate its financial stability, and make informed decisions about the management of their community. Let’s explore key considerations for analyzing HOA financial statements:

- Compare Year-to-Year Performance: One effective way to assess an association’s financial health is by comparing financial statements from multiple years. Analyzing trends in revenue, expenses, and net income over time can provide insights into the association’s financial stability and how it has managed its funds. Look for patterns or significant changes that may require further investigation.

- Calculate and Analyze Financial Ratios: Financial ratios are useful tools for evaluating an association’s financial performance. Key ratios include the current ratio (current assets divided by current liabilities), which measures the association’s ability to cover short-term obligations, and the reserve ratio (reserves divided by total assets), which assesses the level of reserve funds relative to the association’s overall financial position.

- Assess Reserve Fund Adequacy: The reserve fund is crucial for covering major repair and replacement costs of shared community assets. Analyzing the reserve fund balance and comparing it to recommended funding levels can provide insights into the association’s ability to maintain and repair common areas. Look for any significant discrepancies or potential funding shortfalls.

- Review Assessments and Delinquencies: Assessments are a primary source of revenue for HOAs. Analyzing the collection rate of assessments and assessing the level of delinquencies can help determine the association’s financial stability. High delinquency rates may affect the association’s ability to meet its financial obligations and fund necessary expenses.

- Seek Professional Assistance: If analyzing financial statements feels overwhelming, seeking professional assistance from a financial advisor or accountant with expertise in HOA finances can be valuable. They can provide insights, help with financial analysis, and offer guidance on understanding complex financial data.

Remember that financial statements should be considered within the context of your specific association and its governing documents. Additionally, it is crucial to consult with the HOA board or management to obtain further clarification and context regarding the financial statements.

By taking the time to analyze HOA financial statements, homeowners can gain a better understanding of the association’s financial health, identify areas that require attention, and ensure the long-term financial stability and success of the HOA. It allows homeowners to actively participate in the financial management of their community and make informed decisions that benefit all members.

Common Financial Ratios for HOAs

Financial ratios are key tools that can help homeowners and stakeholders assess the financial health and performance of homeowners’ associations (HOAs). These ratios provide insights into various aspects of the association’s financial position, allowing for a more comprehensive analysis. Here are some common financial ratios used for evaluating HOAs:

- Current Ratio: The current ratio is a measure of the association’s short-term liquidity and its ability to cover its immediate obligations. It is calculated by dividing current assets by current liabilities. A ratio above 1 indicates that the association has sufficient current assets to cover its current liabilities.

- Reserve Ratio: The reserve ratio assesses the adequacy of the HOA’s reserve fund. It is calculated by dividing the reserve balance by total assets. A higher reserve ratio indicates that the association has a larger proportion of reserve funds relative to its overall asset value. This ratio helps determine if the association has sufficient reserves to cover major repairs and replacements.

- Operating Ratio: The operating ratio evaluates the association’s financial efficiency by measuring the percentage of operating expenses compared to revenue. It is calculated by dividing operating expenses by total revenue and multiplying by 100. A lower ratio indicates that the association is effectively managing its operating expenses and generating more revenue relative to its expenses.

- Collection Ratio: The collection ratio assesses the association’s ability to collect assessments from homeowners. It is calculated by dividing the total assessments collected by the total assessments due, multiplied by 100. A higher collection ratio indicates a strong collection process, ensuring a consistent flow of revenue for the association.

- Debt Ratio: The debt ratio measures the proportion of the association’s total assets financed by debt. It is calculated by dividing total liabilities by total assets. A lower debt ratio indicates a lower reliance on debt financing and suggests a more favorable financial position for the association.

These financial ratios provide a snapshot of the association’s financial health and performance, allowing homeowners to evaluate its financial stability and management practices. It is important to note that the optimal range for each ratio may vary depending on the specific circumstances of the association and industry benchmarks.

When analyzing these ratios, it is essential to consider trends over time and compare them to industry standards or associations of similar size and scope. Additionally, it is crucial to review the association’s governing documents and consult with financial professionals to gain a comprehensive understanding of the financial ratios and their implications for the HOA.

By regularly monitoring these financial ratios, homeowners can identify potential areas of concern, make informed decisions about the association’s financial management, and contribute to the long-term financial stability and success of their HOA.

Tips for Interpreting HOA Financial Statements

Interpreting HOA financial statements is essential for homeowners to fully understand the association’s financial health and make informed decisions. Here are some helpful tips to consider when reviewing and analyzing HOA financial statements:

- Review Year-to-Year Comparisons: Comparing financial statements from multiple years can provide insights into trends and changes in the association’s financial performance. Analyze revenue, expenses, and net income over time to identify any significant variations that may require further investigation.

- Consider Industry Benchmarks: It can be useful to compare the association’s financial ratios and performance to industry benchmarks or similar HOAs in terms of size and scope. This can help provide context and identify areas where the association may be underperforming or excelling compared to its peers.

- Pay Attention to Reserve Funds: Evaluate the adequacy of the association’s reserve funds by reviewing the reserve balance and comparing it to the recommended reserve study. Determine if the reserves are being adequately funded to cover future maintenance, repairs, or replacements of common assets.

- Assess Collection and Delinquency Rates: Examine the collection ratio and delinquency rates to gauge the association’s ability to collect assessments and manage homeowner dues. A high collection ratio and low delinquency rates indicate a healthy financial process, while the opposite may suggest potential red flags or financial challenges.

- Review Notes to the Financial Statements: Take the time to review the notes section of the financial statements. These footnotes provide additional explanations, disclosures, and important information that can help provide context and a deeper understanding of the association’s financial activities.

- Seek Professional Assistance: If needed, consider consulting with financial professionals or accountants experienced in HOA finances. They can provide valuable insights and guidance in interpreting the financial statements, understanding complex data, and identifying potential issues or areas for improvement.

Remember that understanding the association’s governing documents and financial policies is crucial for proper interpretation of the financial statements. Each community may have specific requirements and accounting practices that should be considered when analyzing the financial statements.

By following these tips and taking a proactive approach to understanding HOA financial statements, homeowners can make informed decisions, identify potential financial concerns or opportunities, and actively contribute to the financial well-being of their HOA.

Conclusion

HOA financial statements are vital tools that provide homeowners with valuable insights into the financial health and performance of their association. By understanding and analyzing these statements, homeowners can make informed decisions, advocate for their community’s best interests, and ensure the long-term financial stability of their HOA.

Throughout this article, we have explored the various components of HOA financial statements, including the balance sheet, income statement, cash flow statement, and notes. We have also discussed common financial ratios and provided tips for interpreting the statements effectively.

Interpreting HOA financial statements requires careful consideration of year-to-year comparisons, industry benchmarks, reserve fund adequacy, collection and delinquency rates, and review of the notes section. Seeking professional assistance, when necessary, can further enhance homeowners’ understanding of complex financial data and ensure accurate interpretation.

By actively engaging with HOA financial statements, homeowners can gain a clear understanding of the association’s financial health, identify potential areas of concern, and actively participate in financial decision-making processes. This knowledge empowers homeowners to advocate for effective financial management, transparent communication, and the overall well-being of their community.

Remember, HOA financial statements are not just numbers on a page – they are a reflection of the association’s financial stability, and they impact the quality of life and property values for every homeowner. So, take the time to review and understand your HOA’s financial statements, ask questions, and work together with fellow homeowners and the HOA board to ensure a financially sound and thriving community for all.