Finance

What Is Ava Credit

Published: January 9, 2024

Discover how Ava Credit can help you with your financial needs. Get personalized finance solutions and flexible repayment options. Start your application today

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

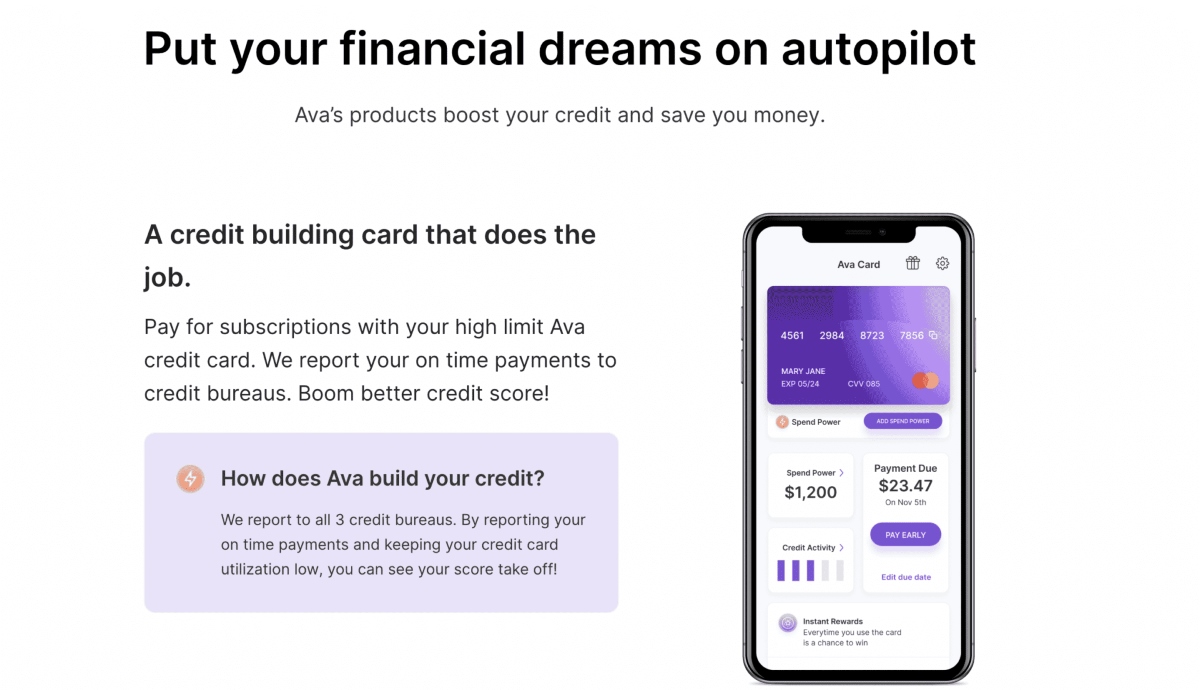

Welcome to our comprehensive guide on Ava Credit, a leading financial tool that provides individuals with access to flexible credit options. In this article, we will delve into the intricacies of Ava Credit, exploring how it works, the eligibility criteria, application process, repayment terms, and more. Whether you’re facing a financial emergency or looking for a way to manage expenses more effectively, Ava Credit could be the solution you’re seeking.

Ava Credit is designed to bridge the gap between traditional bank loans and short-term borrowing options. With Ava Credit, individuals can access funds quickly and conveniently, providing them with the financial assistance they need without the long waiting times often associated with traditional lending institutions. Whether you need to cover unexpected medical expenses, handle car repairs, or simply want some extra cash for a vacation, Ava Credit can help.

What sets Ava Credit apart from other credit options is its emphasis on flexibility. Unlike rigid loan products, Ava Credit allows borrowers to tailor their borrowing experience to suit their individual needs. With customizable repayment terms, competitive interest rates, and a straightforward application process, Ava Credit provides a convenient and user-friendly platform for accessing credit.

In the following sections, we will explore Ava Credit in detail, providing you with the necessary information to make an informed decision. From understanding the application process to evaluating the eligibility requirements and considering the benefits of Ava Credit, we will cover all aspects of this financial tool. By the end of this guide, you will have a comprehensive understanding of Ava Credit and how it can be utilized to meet your financial needs.

Overview of Ava Credit

Ava Credit is a flexible credit option that allows individuals to access funds quickly and conveniently. It offers a bridge between traditional bank loans and short-term borrowing options, providing a way to meet financial needs without the constraints of conventional lending institutions.

One of the key features of Ava Credit is its emphasis on flexibility. Unlike traditional loans that have fixed repayment terms, Ava Credit allows borrowers to customize their borrowing experience. This means you can choose a repayment term that suits your financial situation, whether it’s a few months or a longer period.

Ava Credit also offers competitive interest rates, ensuring that borrowers can access credit at affordable costs. This is particularly advantageous for individuals who may not qualify for low-interest bank loans but still need access to funds.

Furthermore, Ava Credit is accessible to a wide range of individuals. Unlike some credit options that have strict eligibility criteria, Ava Credit considers various factors in assessing applicants. This means that individuals with less-than-perfect credit scores or limited credit history may still be eligible for Ava Credit.

Another notable aspect of Ava Credit is the streamlined application process. Instead of filling out lengthy forms or visiting a physical location, you can apply for Ava Credit online. The application typically involves providing basic personal and financial information, which can be submitted within minutes.

Upon approval, funds can be disbursed quickly, often within a few business days. This fast funding process makes Ava Credit an ideal choice for individuals facing financial emergencies or requiring immediate access to funds.

Overall, Ava Credit provides a convenient and flexible credit option for individuals in need of financial assistance. Whether you need to cover unexpected expenses, manage cash flow, or fund a special project, Ava Credit can help bridge the gap and provide you with the funds you require.

How Ava Credit Works

Ava Credit operates on a simple and transparent system that ensures a seamless borrowing process for individuals. Understanding how Ava Credit works is essential to make the most of this financial tool and access the credit you need.

Here are the key steps involved in the Ava Credit process:

- Application: To start the process, you will need to fill out an online application form. The form typically requires basic personal and financial information, such as your name, address, income details, and employment status. Make sure to provide accurate information to avoid any delays in the application process.

- Assessment: Once you have submitted your application, it will go through a thorough assessment process. This includes verifying the information provided, evaluating your creditworthiness, and determining your eligibility for Ava Credit. This assessment is usually quick, and you will receive a decision within a short period.

- Approval: If your application is approved, you will be notified of the approved credit limit and the terms of the loan. This includes the repayment period, interest rate, and any fees or charges associated with the credit. It is important to review these details carefully before accepting the offer.

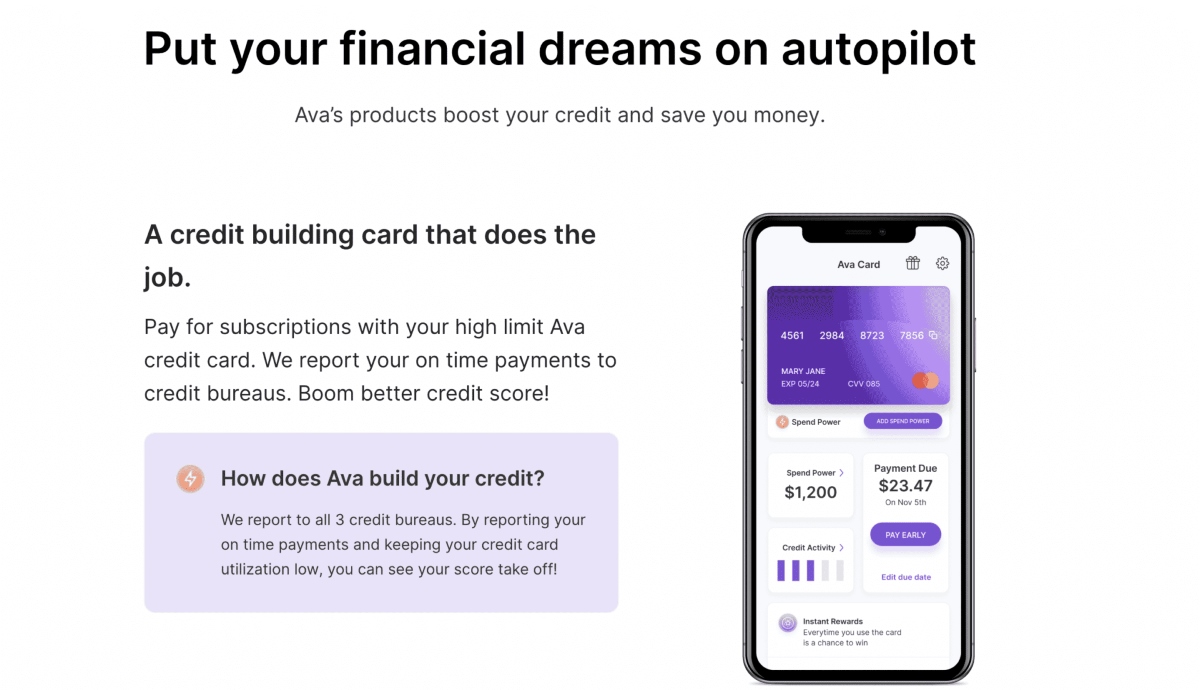

- Accessing Funds: Once you have accepted the offer, you can access the approved credit limit. Ava Credit offers flexibility in how you can access funds, including transfer to your bank account or using a designated Ava Credit card.

- Repayment: Repaying your Ava Credit is structured based on the agreed-upon terms. This typically involves making regular monthly payments towards the outstanding balance, including any accrued interest and fees. It is important to make payments on time to avoid late fees or negative impacts on your credit score.

- Managing Credit Limit: As you repay your Ava Credit, your available credit limit will replenish. This means that you can use the funds again if needed, up to the approved credit limit. Managing your credit responsibly and staying within your means is crucial to maintain a healthy financial balance.

By understanding how Ava Credit works, you can navigate the borrowing process efficiently and make informed decisions. It is important to review the terms and conditions of Ava Credit carefully, particularly regarding interest rates, fees, and repayment obligations. This will help you plan your finances effectively and ensure a successful borrowing experience.

Benefits of Ava Credit

Ava Credit offers numerous benefits that make it a popular choice for individuals seeking flexible credit options. Whether you’re facing unexpected expenses or need to manage cash flow, here are some key advantages of Ava Credit:

- Flexibility: One of the main benefits of Ava Credit is its flexibility. Unlike traditional bank loans with rigid repayment terms, Ava Credit allows you to customize your borrowing experience. You can choose a repayment period that suits your financial situation, whether it’s a few months or a longer term, providing you with the flexibility to manage your repayments.

- Quick Access to Funds: Ava Credit is designed to provide individuals with quick access to funds. The application process is simple and typically takes only a few minutes to complete. Once approved, funds can be disbursed rapidly, often within a few business days. This is particularly beneficial for financial emergencies or when you need funds promptly.

- Competitive Interest Rates: Ava Credit offers competitive interest rates, making it an affordable credit option. This is particularly advantageous for individuals who may not qualify for low-interest bank loans but still need access to funds. The competitive rates allow you to borrow the amount you need without burdening you with excessively high interest charges.

- Accessible to a Wide Range of Individuals: Ava Credit considers various factors during the application process, making it accessible to a wide range of individuals. Even if you have less-than-perfect credit or limited credit history, you may still be eligible to apply. This inclusiveness ensures that individuals who may have difficulty accessing traditional loans have an opportunity to secure the credit they need.

- Convenience: Ava Credit offers a convenient borrowing experience. The entire process can be completed online, from the application to accessing funds and making repayments. This eliminates the need to visit a physical location or fill out extensive paperwork, saving you time and effort.

- Building Credit History: Utilizing Ava Credit responsibly can help you build or improve your credit history. By making timely repayments and managing your credit effectively, you demonstrate to lenders your ability to handle credit responsibly. This can enhance your creditworthiness and open up more opportunities for favorable lending terms in the future.

These benefits make Ava Credit an attractive option for individuals in need of flexible credit. Whether it’s for managing daily expenses, handling emergencies, or funding special projects, Ava Credit provides a convenient and accessible solution tailored to your financial needs.

Eligibility Criteria for Ava Credit

While Ava Credit aims to be inclusive and accessible to a wide range of individuals, there are certain eligibility criteria that applicants must meet. These criteria help ensure responsible lending practices and provide a framework for determining creditworthiness. Here are the key factors considered when assessing eligibility for Ava Credit:

- Age: Applicants must be at least 18 years old to be eligible for Ava Credit. This is the legal age requirement for entering into a financial agreement.

- Income: Ava Credit takes into account the applicant’s income to assess their ability to make repayments. While there is no specific income threshold, having a regular source of income is important to demonstrate financial stability and the capacity to manage credit.

- Credit History: While Ava Credit is accessible to individuals with less-than-perfect credit, credit history is still a factor considered during the application process. A positive credit history can increase the chances of approval and may result in more favorable terms, such as lower interest rates.

- Residency: Applicants must be residents of the country or region where Ava Credit operates. Proof of residency, such as a valid ID or utility bill, may be required during the application process.

- Identification: To verify the applicant’s identity, Ava Credit typically requires a valid government-issued identification document. This can be a passport, driver’s license, or national ID card.

- Ability to Repay: Ava Credit assesses the applicant’s ability to repay the borrowed amount by considering their income and financial commitments. It is important to demonstrate sufficient disposable income after accounting for essential expenses.

Meeting these eligibility criteria does not guarantee approval, as Ava Credit evaluates each application on a case-by-case basis. Other factors, such as employment history and overall financial stability, may also be considered. It is essential to provide accurate and up-to-date information during the application process to ensure a fair assessment.

It is worth noting that Ava Credit’s eligibility criteria may vary slightly depending on the region or country in which it operates. Therefore, it is important to consult the specific eligibility requirements outlined by Ava Credit in your respective location.

By meeting the eligibility criteria, you increase your chances of being approved for Ava Credit and gaining access to the flexible credit options it offers.

Application Process for Ava Credit

The application process for Ava Credit is designed to be simple and user-friendly, allowing individuals to apply for credit quickly and conveniently. Here are the key steps involved in the application process:

- Online Application: To begin the application process, visit the Ava Credit website or mobile app. Fill out the online application form, providing accurate and up-to-date personal and financial information. This typically includes your name, address, employment details, income, and identification documents.

- Information Verification: Once you have submitted your application, Ava Credit will review and verify the information provided. This may involve conducting identity checks and income verification to ensure the accuracy of the details provided. It’s essential to ensure that the information you provide is correct to avoid any delays in the application process.

- Application Assessment: After the verification process, Ava Credit will assess your application based on various factors, such as credit history, income, and ability to repay. This evaluation is typically quick, and you will receive a decision regarding your application within a short period.

- Approval and Offer: If your application is approved, Ava Credit will provide you with an offer outlining the approved credit limit, repayment terms, and any associated fees or charges. It is crucial to review the offer carefully, ensuring that you understand the terms and conditions before accepting the credit offer.

- Acceptance: If you are satisfied with the offer, you can accept it by electronically signing the agreement provided by Ava Credit. This acceptance indicates your agreement to the terms and your commitment to repay the borrowed amount within the agreed-upon timeframe.

- Funds Disbursement: Once you have accepted the offer, the approved credit limit will be made available to you. Ava Credit offers various methods to access the funds, such as a direct transfer to your bank account or through a designated Ava Credit card. Choose the option that suits your preferences and needs.

- Repayment: Repayment of Ava Credit is structured based on the agreed terms. This typically involves making regular monthly payments, including the principal amount, interest, and any applicable fees. It’s important to make payments on time to maintain a positive credit history and avoid any late fees or penalties.

The application process for Ava Credit is designed to be efficient and convenient, allowing you to access credit without the hassle of lengthy paperwork or physical visits to a lender. By providing accurate information and carefully reviewing the terms and conditions, you can ensure a smooth and successful borrowing experience with Ava Credit.

Repayment Terms and Conditions

Understanding the repayment terms and conditions of Ava Credit is crucial to ensure that you can manage your borrowing responsibly. Here are the key aspects to consider when it comes to repaying your Ava Credit:

- Repayment Period: Ava Credit offers flexible repayment periods, allowing you to choose a timeframe that suits your financial situation. The repayment period can vary from a few months to several years, depending on your preferences and the amount borrowed. It’s important to select a repayment period that aligns with your ability to make regular payments.

- Repayment Amount: The repayment amount consists of the principal amount borrowed, accrued interest, and any applicable fees or charges. The total repayment amount will depend on the approved credit limit and the interest rate provided in your offer. It’s important to calculate the total repayment amount to plan your budget and ensure affordability.

- Payment Frequency: Ava Credit typically requires borrowers to make monthly payments towards the outstanding balance. This means that you will need to make a payment every month on or before the due date specified in your agreement. It’s essential to keep track of the payment schedule and ensure timely repayments to maintain a good credit standing.

- Interest Rate: The interest rate offered by Ava Credit will depend on various factors, including your creditworthiness and the prevailing market conditions. It’s important to review the interest rate provided in your offer, as it will impact the overall cost of borrowing. Understanding the interest rate will help you evaluate the affordability of the credit and plan your repayments accordingly.

- Prepayment and Early Repayment: Ava Credit may offer flexibility when it comes to prepayment or early repayment. This means that you may have the option to pay off the outstanding balance before the agreed-upon term ends, potentially saving on interest charges. It’s important to review the prepayment terms and conditions provided in your agreement to understand any fees or conditions associated with early repayment.

- Late Payment Fees: Failure to make payments on time may result in late payment fees. Ava Credit typically imposes a fee for late payments, which adds to the overall cost of borrowing. It’s important to prioritize your repayments and ensure that you make payments by the due date to avoid any additional charges.

It is crucial to carefully review the repayment terms and conditions provided by Ava Credit before accepting the credit offer. Understanding the repayment schedule, interest rate, and any associated fees or charges will help you plan your finances effectively and ensure a successful repayment journey.

If you encounter any difficulties with repayment or need assistance, it is recommended to reach out to Ava Credit’s customer service for guidance and support. They can provide you with information on available options such as payment extensions or restructuring, which can help you manage your obligations effectively.

Fees and Charges Associated with Ava Credit

When considering Ava Credit as a borrowing option, it’s important to understand the fees and charges associated with the credit. While the specific fees may vary depending on the region or country of operation, here are some common fees and charges you may encounter:

- Interest Charges: Like any form of credit, Ava Credit may charge interest on the outstanding balance. The interest rate will depend on various factors, including your creditworthiness and the prevailing market conditions. It’s essential to review the interest rate provided in your offer to understand the cost of borrowing and plan your repayments accordingly.

- Origination Fee: Some credit providers charge an origination fee, which is a one-time fee for processing your application and setting up your Ava Credit account. The origination fee is typically a percentage of the approved credit limit and is deducted from the funds disbursed to you.

- Late Payment Fee: If you fail to make your payments on time, Ava Credit may charge a late payment fee. This fee is imposed as a penalty for overdue payments and can increase the cost of borrowing. It’s crucial to prioritize timely payments to avoid incurring unnecessary charges.

- Annual Fee: Some credit providers may charge an annual fee for maintaining your Ava Credit account. This fee is usually charged on a yearly basis and helps cover administrative costs associated with managing your credit account.

- Transaction Fees: Ava Credit may charge transaction fees for certain activities, such as balance transfers or cash advances. These fees are typically calculated as a percentage of the transaction amount and are added to the outstanding balance.

- Prepayment Fee: While Ava Credit may offer flexibility when it comes to prepayment or early repayment, there may be a prepayment fee associated with settling the outstanding balance before the agreed-upon term ends. This fee is intended to compensate the lender for potential interest income that would have been gained if the credit was repaid as originally scheduled.

It’s important to review the fees and charges specific to your Ava Credit offer before accepting the credit. Understanding these costs will give you a clear picture of the total expenses associated with borrowing and help you make informed decisions about your financial obligations.

If you have any questions about the fees and charges or would like clarification on any specific item, it is recommended to reach out to Ava Credit’s customer service. They can provide you with the necessary information and ensure that you have a complete understanding of the cost structure associated with Ava Credit.

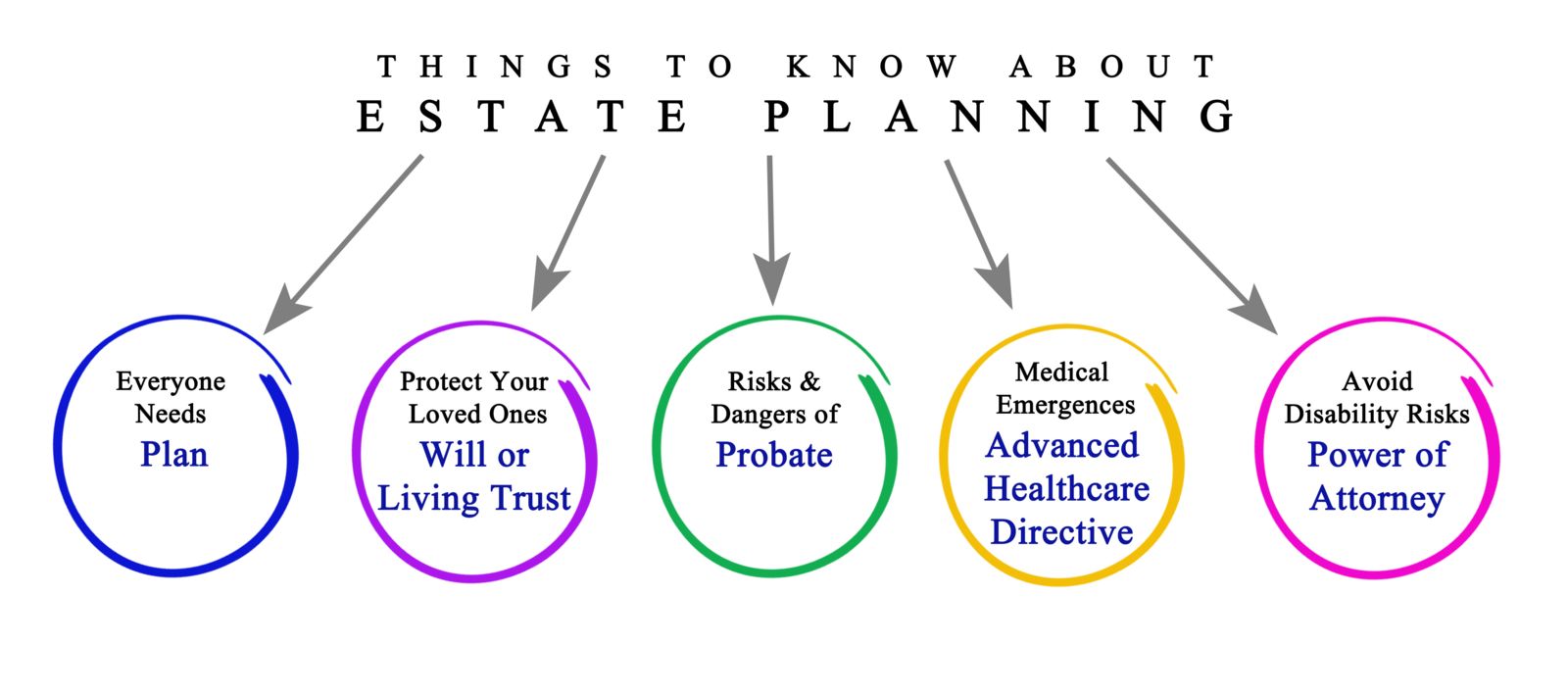

Comparison with Other Credit Options

When considering Ava Credit as a borrowing option, it’s essential to compare it with other credit options available in the market. Here is a comparison of Ava Credit with other common credit options:

- Traditional Bank Loans: Compared to traditional bank loans, Ava Credit offers more flexibility in terms of repayment periods. Traditional bank loans often have fixed repayment terms, which may not suit every individual’s financial situation. Additionally, bank loans generally involve a lengthier application process and stricter eligibility criteria. Ava Credit, on the other hand, offers a streamlined online application process and considers a wider range of individuals for credit approval.

- Credit Cards: Ava Credit provides an alternative credit option to credit cards. While credit cards offer revolving credit and a line of credit that can be used repeatedly, Ava Credit provides a similar flexibility with customizable repayment terms. However, Ava Credit may have lower interest rates and more transparent fees compared to credit cards, making it a potentially more cost-effective borrowing option for certain individuals.

- Payday Loans: Payday loans are short-term loans intended to cover immediate expenses until the borrower’s next paycheck. While payday loans offer quick access to funds, they often come with high-interest rates and short repayment periods. Ava Credit, on the other hand, provides a more flexible repayment schedule and potentially lower interest rates. It is important to compare the interest rates and terms of both options to make an informed decision.

- Personal Lines of Credit: Personal lines of credit function similarly to Ava Credit, offering individuals access to a predetermined credit limit that can be borrowed and repaid as needed. However, personal lines of credit may require collateral or a higher credit score to qualify. Ava Credit, on the other hand, is designed to be accessible to a wider range of individuals with varying credit histories.

- P2P Lending: Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. P2P loans may offer competitive interest rates, but the application process may involve additional steps, such as creating a borrower profile and waiting for lenders to fund the loan. Ava Credit offers a more streamlined application process, typically with a quicker decision-making time.

When comparing credit options, it’s important to consider factors such as interest rates, repayment terms, eligibility criteria, and fees. Each individual’s financial situation is unique, and it is important to choose the credit option that best aligns with your needs and financial goals.

By evaluating the features and terms of Ava Credit alongside other credit options, you can make an informed decision and select the credit option that suits your borrowing needs and financial circumstances.

Frequently Asked Questions

Here are some frequently asked questions about Ava Credit:

- 1. Is Ava Credit available in my country?

- 2. How long does the application process take?

- 3. What is the maximum credit limit I can obtain?

- 4. What are the eligibility criteria for Ava Credit?

- 5. Can I repay Ava Credit early?

- 6. Can I access funds from Ava Credit immediately?

- 7. What happens if I miss a payment?

Ava Credit operates in select countries and regions. It’s important to check the availability of Ava Credit in your specific location by visiting their official website or contacting their customer service.

The application process for Ava Credit is typically quick. You can complete the online application within minutes, and the assessment process is usually completed within a short period. The decision on your application will be communicated to you promptly.

The maximum credit limit for Ava Credit may vary depending on factors such as your income, creditworthiness, and the specific lending policies in your region. The approved credit limit will be communicated to you in your offer.

Eligibility criteria for Ava Credit include factors such as age, income, credit history, and residency. While Ava Credit aims to be inclusive, specific eligibility requirements may vary depending on the region. It’s essential to review the eligibility criteria outlined by Ava Credit for your respective location.

Ava Credit may offer flexibility for early repayment or prepayment. However, there may be prepayment fees or conditions associated with settling the outstanding balance before the agreed-upon term ends. It’s important to review the prepayment terms and conditions in your agreement to understand any fees or penalties.

Once your Ava Credit application is approved, funds are typically disbursed quickly, often within a few business days. The exact time frame may depend on factors such as the banking system and your specific location.

If you miss a payment, Ava Credit may charge a late payment fee. It’s essential to make payments on time to avoid any additional charges and maintain a good credit standing. If you’re experiencing difficulties with repayment, it is recommended to contact Ava Credit’s customer service to discuss potential solutions.

If you have any specific questions or concerns regarding Ava Credit, it is best to reach out to their customer service directly. They will be able to provide you with the most accurate and up-to-date information based on your individual circumstances.

Conclusion

Ava Credit offers individuals a flexible and convenient credit option that bridges the gap between traditional bank loans and short-term borrowing options. With customizable repayment terms, competitive interest rates, and a streamlined online application process, Ava Credit provides a user-friendly platform for accessing credit quickly and conveniently.

Throughout this guide, we explored the various aspects of Ava Credit, including its overview, how it works, eligibility criteria, application process, repayment terms, fees, and charges. By understanding the details and comparing Ava Credit with other credit options, you can make an informed decision about whether Ava Credit is the right choice for your borrowing needs.

One of the key advantages of Ava Credit is its flexibility. By allowing borrowers to customize their repayment terms, Ava Credit ensures that individuals can access credit in a way that suits their financial situation. This flexibility, combined with competitive interest rates, makes Ava Credit an attractive choice compared to other credit options.

However, it’s important to note that responsible borrowing is crucial when utilizing Ava Credit or any other credit option. It’s important to carefully review the terms and conditions, plan your repayments, and ensure timely repayment to maintain a positive credit history.

In conclusion, Ava Credit offers a convenient and flexible borrowing option for individuals in need of quick access to funds. By providing a seamless online application process, customizable repayment terms, and competitive interest rates, Ava Credit can help you meet your financial goals and manage your expenses effectively. Consider your financial needs, compare Ava Credit with other credit options, and make an informed decision that aligns with your unique circumstances and goals.