Finance

How Good Is A 710 Credit Score

Published: October 22, 2023

Learn how having a 710 credit score can impact your finances. Discover the benefits and opportunities that come with a strong credit rating.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, having a good credit score is crucial. Your credit score is a numerical representation of your creditworthiness and is used by lenders, landlords, and even potential employers to gauge your financial responsibility. One credit score that falls within the range of good credit is a 710 credit score.

In this article, we will explore what a 710 credit score means, its significance in the world of finance, and provide insights into the factors that contribute to this credit score. Additionally, we will discuss the benefits that come with having a 710 credit score, as well as some potential limitations. Lastly, we will provide tips on how to improve and maintain a 710 credit score.

Whether you are a seasoned credit user or just starting your financial journey, understanding the nuances of credit scores can help you make more informed decisions when it comes to managing your finances and taking advantage of beneficial financial opportunities.

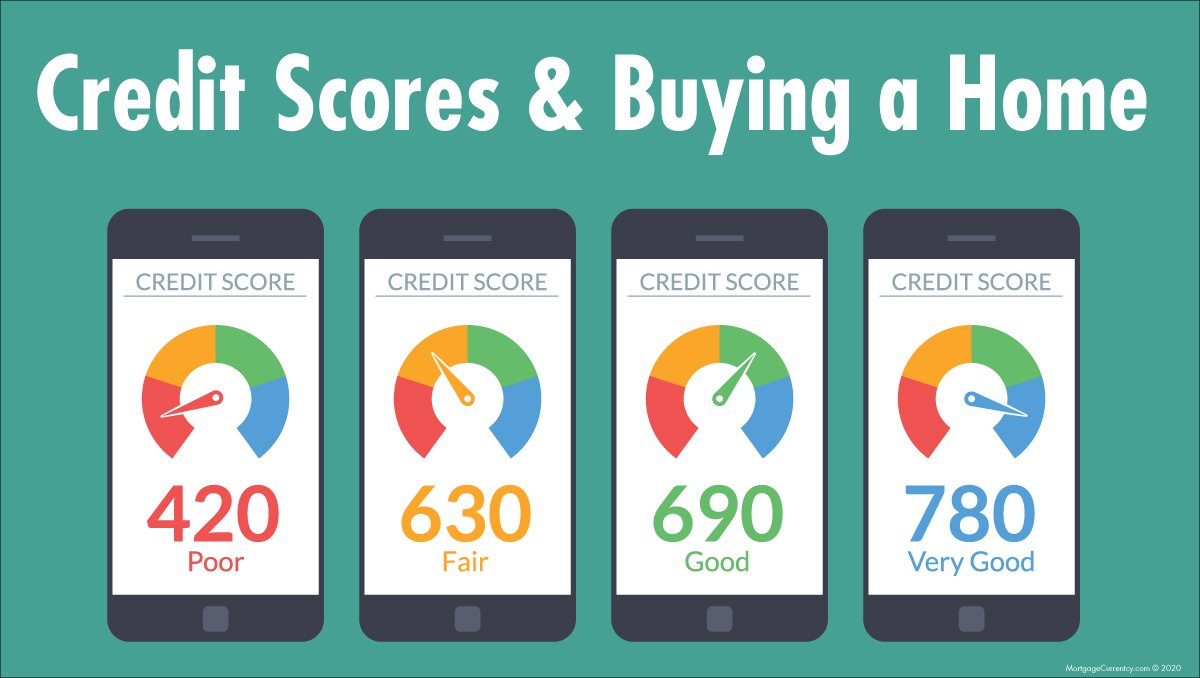

Understanding Credit Scores

Credit scores are three-digit numbers that lenders use as a tool to assess a borrower’s creditworthiness. There are several credit scoring models available, with the most widely used being the FICO® Score and the VantageScore®. These scores range from 300 to 850, with higher scores indicating a lower credit risk.

Credit scores are calculated based on various factors related to your credit history, including your payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Each factor carries a different level of importance in determining your credit score.

Having a good credit score is important because it opens up financial opportunities and can result in more favorable terms when applying for loans, credit cards, or even renting an apartment. Lenders consider individuals with good credit scores as more reliable and less likely to default on their financial obligations.

It’s also worth mentioning that having a good credit score not only benefits you financially but can also improve other aspects of your life. For example, a good credit score may lead to lower insurance premiums, better job prospects, and potential savings on utility deposits.

However, it’s important to note that credit scores are not the only deciding factor when it comes to loan approvals or other financial decisions. Lenders may also consider your income, employment history, and debt-to-income ratio, among other factors, before making a final decision.

Now that we have a basic understanding of credit scores, let’s dive deeper into what a 710 credit score signifies and how it can impact your financial journey.

What is a 710 Credit Score?

A 710 credit score is considered a good credit score and falls within the range of scores that indicate responsible credit management. It suggests to lenders that you have a solid credit history and are likely to repay your debts on time. However, it’s important to note that credit score ranges can vary slightly depending on the credit scoring model being used.

With a 710 credit score, you are in a favorable position to qualify for various financial products and services, including credit cards, personal loans, and mortgages. Lenders consider individuals with a 710 credit score as relatively low-risk borrowers and may offer them more competitive interest rates and favorable terms.

To maintain a 710 credit score, it’s essential to continue practicing good credit habits, such as making payments on time, keeping credit card balances low, and avoiding excessive credit applications. These habits contribute to a positive credit history and demonstrate your ability to manage credit responsibly.

It’s important to regularly monitor your credit report to ensure its accuracy and address any potential errors promptly. You can request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year through AnnualCreditReport.com.

If your credit score is currently below 710, don’t worry. It’s never too late to improve your credit score. By adopting good credit habits, paying off existing debts, and reducing your credit utilization ratio, you can gradually increase your score and reach the 710 milestone.

Now that we understand what a 710 credit score means, let’s explore the various factors that contribute to achieving and maintaining this credit score.

Factors That Contribute to a 710 Credit Score

Several key factors contribute to achieving and maintaining a 710 credit score. Understanding these factors can help you make informed decisions and take action to improve your credit standing. Here are some of the main factors that play a role in a 710 credit score:

- Payment History: Your payment history is the most crucial factor in determining your credit score. Consistently making on-time payments, including credit card bills, loan installments, and other obligations, positively impacts your credit score. A 710 credit score suggests that you have a history of making timely payments.

- Credit Utilization: Credit utilization refers to the percentage of your available credit that you are currently using. Keeping your credit utilization ratio low, ideally below 30%, demonstrates responsible credit management. A 710 credit score indicates that you likely have a reasonable credit utilization ratio.

- Length of Credit History: The length of your credit history also influences your credit score. The longer you have a well-managed credit history, the more positively it impacts your score. A 710 credit score suggests that you have a decent credit history.

- Credit Mix: Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can positively impact your credit score. A diverse credit portfolio shows that you can manage different types of credit responsibly. A 710 credit score suggests that you likely have a varied credit mix.

- New Credit Applications: Applying for multiple lines of credit within a short period can have a negative impact on your credit score. A 710 credit score suggests that you have been moderate in applying for new credit and have not acquired excessive inquiries on your credit report.

These are just some of the main factors that contribute to a 710 credit score. It’s important to note that each individual’s credit profile is unique, and the importance of these factors may vary for different individuals.

In the following section, we will explore the benefits that come with having a 710 credit score and how it can positively impact your financial journey.

Benefits of Having a 710 Credit Score

Having a 710 credit score comes with several benefits that can greatly enhance your financial well-being. This solid credit standing opens up various opportunities and can save you money in the long run. Here are some key benefits of having a 710 credit score:

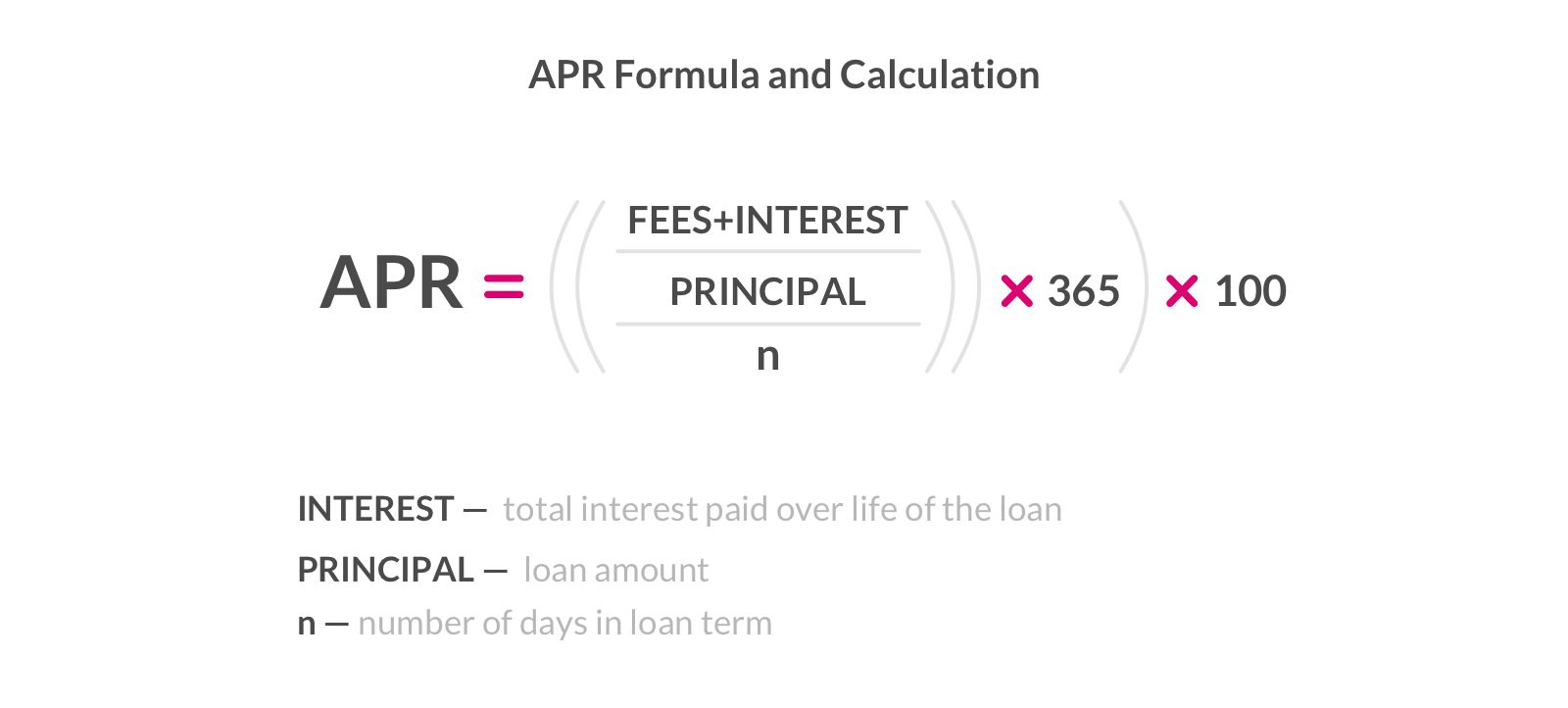

- Access to Better Interest Rates: With a 710 credit score, you are likely to qualify for loans, credit cards, and mortgages with more favorable interest rates. Lenders see you as a low-risk borrower, which makes you eligible for competitive loan terms and can save you thousands of dollars in interest payments over time.

- Higher Credit Limits: Lenders are more inclined to offer higher credit limits to individuals with good credit scores. With a 710 credit score, you may have access to higher credit limits, providing you with more flexibility and purchasing power. This can be particularly useful for major expenses or emergencies.

- Approval for Rental Applications: Landlords and property management companies often check credit scores when considering rental applications. A 710 credit score demonstrates financial responsibility and may increase your chances of getting approved for a rental property. It can help you secure the apartment or house you desire.

- Favorable Insurance Premiums: Some insurance companies take credit scores into account when determining insurance premiums. A 710 credit score can result in lower premiums for auto insurance, homeowner’s insurance, or other types of insurance policies, saving you money in the long term.

- Improved Job Prospects: While not all employers check credit scores, some industries, such as finance or government positions, may consider credit history as part of the hiring process. A 710 credit score demonstrates financial responsibility and can positively impact your chances of landing a job, especially if the role involves handling finances or sensitive information.

These benefits illustrate the importance of maintaining a good credit score, like a 710 credit score. It not only opens up financial opportunities but also saves you money and improves various aspects of your life.

However, it’s essential to be aware of the potential limitations of a 710 credit score, which we will explore in the next section.

Potential Limitations of a 710 Credit Score

While a 710 credit score indicates responsible credit management and comes with several benefits, it’s important to be aware of its potential limitations. Understanding these limitations can help you make informed decisions and navigate the financial landscape more effectively. Here are some potential limitations of a 710 credit score:

- Approval for Certain Loans: While a 710 credit score is considered good, it may not be sufficient to qualify for certain types of loans with strict credit requirements. For example, some lenders may require higher credit scores for specialized loans or more competitive interest rates.

- Higher Interest Rates: While a 710 credit score can qualify you for better interest rates than lower credit scores, you might not be eligible for the lowest rates available in the market. Lenders often offer the lowest rates to individuals with exceptional credit scores, typically above 750.

- Limited Negotiation Power: While a 710 credit score demonstrates creditworthiness, it may limit your negotiation power when it comes to certain financial products or services. Lenders may be less willing to offer customized terms or make exceptions compared to individuals with higher credit scores.

- Competitive Job Market: While some employers consider credit history during the hiring process, a 710 credit score might not give you a significant advantage in a highly competitive job market. Other factors, such as qualifications, experience, and interview performance, play a more significant role in securing employment.

- Financial goals: Depending on your financial goals, a 710 credit score might be sufficient or require further improvement. If you aim to secure the best interest rates or access premium financial products, working towards a higher credit score may be necessary.

While these limitations exist, it’s important to remember that a 710 credit score still positions you favorably in the world of credit and finance. With responsible credit management and continued efforts to improve your credit profile, you can overcome these limitations and continue on a path of financial success.

Next, we will explore practical tips on how to improve a 710 credit score and maintain a strong credit standing.

How to Improve a 710 Credit Score

Even though a 710 credit score is considered good, there is always room for improvement. By implementing some key strategies, you can work towards obtaining an even higher credit score. Here are some tips on how to improve a 710 credit score:

- Pay Bills on Time: Consistently making on-time payments is crucial for a good credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Reduce Credit Utilization: Aim to keep your credit card balances below 30% of your available credit limits. Lower credit utilization demonstrates responsible credit management and can positively impact your credit score.

- Monitor Your Credit Report: Regularly review your credit report to ensure its accuracy and address any errors or discrepancies promptly. You can dispute inaccurate information with the credit bureaus to improve your credit score.

- Avoid Opening Too Many New Accounts: Each time you apply for new credit, it can result in a hard inquiry on your credit report, which can temporarily lower your credit score. Limit new credit applications to avoid negatively impacting your score.

- Lengthen Your Credit History: Time is an essential factor in building a strong credit history. Keep your oldest accounts open and active to increase the average age of your credit accounts over time.

- Diversify Your Credit Mix: Having a mix of credit types, such as credit cards, loans, and a mortgage, can positively impact your credit score. If you only have one type of credit, consider diversifying to improve your score.

- Pay Off Debt: Reducing your overall debt load can improve your credit score. Focus on paying off high-interest debts or consolidating them into more manageable loans.

- Limit Credit Applications: Applying for multiple lines of credit within a short period can negatively impact your credit score. Only apply for credit when necessary and avoid excessive credit inquiries.

Improving your credit score takes time and discipline. However, by following these tips consistently, you can gradually raise your credit score and improve your overall financial profile.

Lastly, let’s recap the key points discussed in this article.

Conclusion

A 710 credit score is considered a good credit score and indicates responsible credit management. It opens up various financial opportunities and comes with several benefits. With a 710 credit score, you are likely to qualify for loans, credit cards, and mortgages with more favorable interest rates, higher credit limits, and improved chances of rental approvals.

However, it’s important to be aware of the potential limitations of a 710 credit score. While it positions you favorably, there may be stricter credit requirements for certain loans, and you may not qualify for the lowest interest rates available in the market. It’s crucial to continue working towards improving your credit score and maintaining a strong credit standing.

To improve and maintain a 710 credit score, focus on making on-time payments, reducing credit utilization, monitoring your credit report, and avoiding excessive credit applications. Additionally, lengthening your credit history, diversifying your credit mix, paying off debt, and limiting credit inquiries can positively impact your credit score.

Remember, credit scores are dynamic and can change over time. With consistent effort and responsible credit management, you can continue to improve your credit score and unlock even greater financial opportunities.

By understanding credit scores and taking proactive steps to improve and maintain a good credit score like 710, you are better equipped to make informed financial decisions, achieve your goals, and enjoy greater financial freedom.