Finance

How Good Is A 690 Credit Score

Modified: March 6, 2024

Discover how a 690 credit score affects your financial options and opportunities. Learn about the implications and strategies to maximize your financial capabilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit score is a numerical representation of an individual’s creditworthiness, indicating the likelihood of them repaying their debts. Lenders, such as banks and credit card companies, utilize credit scores to assess the risk of lending money to borrowers. A higher credit score signifies a lower risk, making it easier to obtain loans, favorable interest rates, and better financial opportunities.

In this article, we will delve into the intricacies of a 690 credit score. A credit score of 690 falls within the “good” range, indicating that the individual has managed their finances responsibly but still has room for improvement. We will explore what a credit score entails, the factors influencing a 690 score, its advantages, drawbacks, and strategies to enhance and maintain a healthy credit score.

Understanding the importance of credit scores and how they impact financial prospects is crucial in today’s world. From applying for a mortgage or car loan to obtaining a rental agreement or even securing a job, credit scores play a significant role in various aspects of our lives.

Whether you have a credit score of 690 or are looking to improve your creditworthiness, this article will provide valuable insights and guidance to help you navigate the credit landscape.

What is a Credit Score?

A credit score is a three-digit number that represents an individual’s creditworthiness and financial responsibility. It is a numerical assessment generated by credit bureaus based on various factors, such as payment history, credit utilization, length of credit history, types of credit used, and new credit applications. These factors provide lenders with insights into an individual’s creditworthiness and the likelihood of repaying debts in a timely manner.

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. The higher your credit score, the more likely you are to be approved for loans and receive favorable interest rates. On the other hand, lower credit scores may result in higher interest rates or even loan denials.

There are several credit scoring models available, with the FICO score and VantageScore being the most commonly used. The FICO score is the industry standard and is used by most lenders to assess creditworthiness. Generally, a good credit score is considered to be around 670 to 850 for the FICO score and 661 to 850 for the VantageScore.

It’s important to note that each lender may have different criteria and weightings for evaluating credit scores. Therefore, it’s essential to strive for a high credit score to increase your chances of obtaining credit at favorable terms.

Credit scores are not permanent and can fluctuate based on your financial behavior. Regularly monitoring your credit score, reviewing your credit reports for errors, and maintaining responsible financial habits can help improve or maintain a good credit score.

Now that we have a general understanding of credit scores, let’s explore the specific credit score range of 690 and what it signifies.

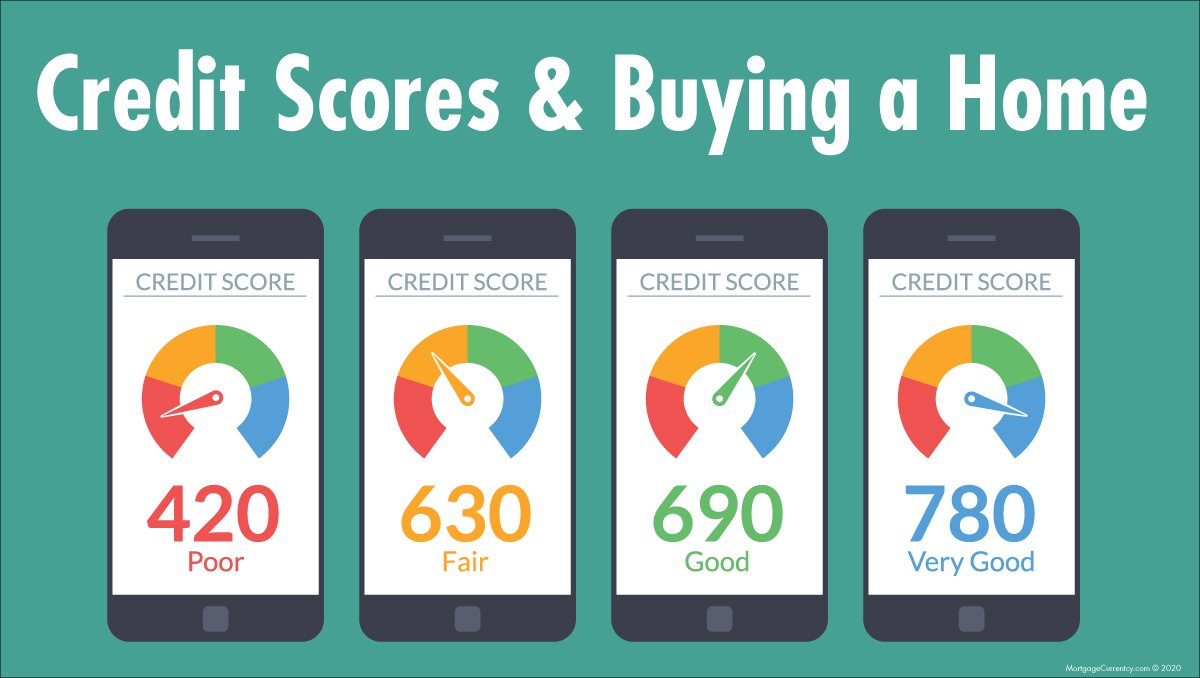

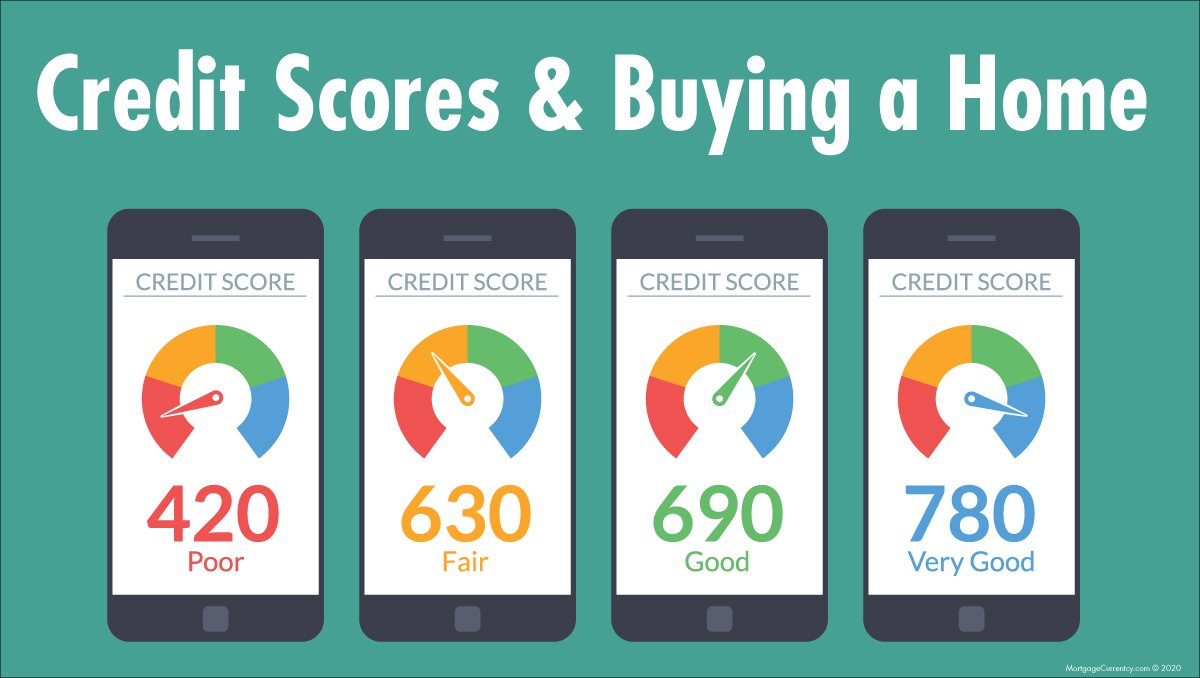

Understanding Credit Score Ranges

When it comes to credit scores, they are typically categorized into different ranges to provide a quick assessment of an individual’s creditworthiness. Understanding these ranges can help you gauge where your credit score stands and what it means in terms of your financial health and access to credit.

Although the specific credit score ranges may vary slightly depending on the scoring model being used, we will focus on the commonly used FICO score range:

- Poor: 300 – 579

- Fair: 580 – 669

- Good: 670 – 739

- Very Good: 740 – 799

- Excellent: 800 – 850

A credit score of 690 falls within the “good” credit score range. This indicates that the individual has demonstrated a responsible financial behavior and has a good chance of being approved for credit. While it may not be the highest credit score possible, a 690 score still provides access to various financial opportunities, such as loans, credit cards, and favorable interest rates.

It’s important to note that credit score requirements may vary depending on the type of credit you are seeking. For example, certain mortgage or auto lenders may have stricter requirements and may prefer borrowers with higher credit scores. On the other hand, credit card issuers may be more lenient and approve applicants with slightly lower credit scores.

Regardless of the specific credit score range, maintaining a good credit score is essential. Not only does it increase your chances of being approved for credit, but it also allows you to qualify for better interest rates and terms, potentially saving you a significant amount of money in the long run.

Now that we have a clear understanding of credit score ranges, let’s dive into the details of what a 690 credit score entails and what factors contribute to this score.

Exploring the 690 Credit Score

A credit score of 690 falls within the “good” range, indicating that the individual has managed their finances well and demonstrated responsible credit behavior. Let’s take a closer look at what this credit score signifies and what it means for borrowers.

A 690 credit score suggests that you have a demonstrated history of making timely debt repayments and managing your credit responsibly. Lenders perceive you as a relatively low-risk borrower, increasing your chances of being approved for credit cards, personal loans, auto loans, and even mortgages. However, it’s important to note that each lender may have their own specific credit score requirements, and other factors, such as income and employment history, may also be considered during the application process.

With a 690 credit score, you are likely to qualify for credit cards with reasonable interest rates and favorable terms. Some credit card companies may even offer rewards programs or other perks. However, it’s crucial to use credit responsibly and maintain a low credit utilization ratio to maximize the benefits of having a good credit score.

When it comes to loans, a 690 credit score may make you eligible for competitive interest rates, especially for personal loans and auto loans. However, it’s essential to shop around and compare offers from multiple lenders to ensure you receive the most favorable terms.

While a 690 credit score is a positive indication of your creditworthiness, there is still room for improvement. With continued responsible credit behavior, such as making payments on time, keeping credit card balances low, and avoiding new credit applications unless necessary, you have the potential to raise your credit score even higher.

In the next section, we will explore the various factors that contribute to a credit score of 690 and how they can impact your overall creditworthiness.

Factors Affecting a 690 Credit Score

Several key factors contribute to a credit score of 690. Understanding these factors can help you assess your current credit standing and identify areas for improvement. Let’s explore the main factors that impact a 690 credit score:

- Payment History: Your payment history has the most significant impact on your credit score. Making timely payments on credit cards, loans, and other debts demonstrates responsible financial behavior.

- Credit Utilization: Credit utilization refers to the percentage of your available credit that you are currently using. Keeping credit card balances low relative to their limits can positively impact your credit score.

- Length of Credit History: The length of your credit history plays a role in your credit score. Having a longer credit history indicates more experience managing credit and can contribute to a higher score.

- Types of Credit: The types of credit you have also impact your credit score. A mix of revolving credit (e.g., credit cards) and installment loans (e.g., mortgages, car loans) can be beneficial for your score.

- New Credit Applications: Applying for multiple new credit accounts within a short period can negatively impact your credit score. It’s advisable to be selective and only apply for credit when necessary.

While these factors have varying degrees of impact on your credit score, it’s essential to pay attention to each aspect to maintain a healthy credit profile. Simply understanding these factors can empower you to take control of your financial habits and make informed decisions.

Now that we have explored the factors that can influence your 690 credit score, let’s examine the advantages and drawbacks of having this credit score.

Advantages of a 690 Credit Score

Holding a credit score of 690 comes with several advantages that can positively impact your financial life. While it may not be the highest credit score range, a 690 score still places you in the “good” credit category and opens doors to various opportunities. Let’s explore the advantages of having a 690 credit score:

- Easier Loan Approval: With a credit score of 690, you are more likely to be approved for loans, such as personal loans, auto loans, and even mortgages. Lenders see you as a responsible borrower, reducing the risk associated with lending you money.

- Favorable Interest Rates: A higher credit score enables you to secure loans and credit cards with better interest rates. This can save you a significant amount of money over time, as lower interest rates translate into lower monthly payments and less interest paid over the life of the loan.

- Access to Credit Cards: With a 690 credit score, you can qualify for credit cards with reasonable interest rates and favorable terms. Credit cards provide convenience, flexibility, and the opportunity to build a positive credit history when used responsibly.

- Potential Rewards and Perks: Depending on the credit cards you qualify for, you may have access to reward programs, cashback offers, and other perks to enhance your spending experience.

- Higher Credit Limits: Lenders may be more inclined to offer you higher credit limits with a 690 credit score. This increased available credit can provide you with more financial flexibility and can be advantageous in emergency situations.

Having a credit score of 690 demonstrates financial responsibility and allows you to enjoy the benefits of good credit. It’s important to maintain this score and continue practicing responsible credit habits to maximize these advantages.

In the next section, we will explore the drawbacks associated with a 690 credit score and how you can work towards improving it.

Drawbacks of a 690 Credit Score

While a credit score of 690 is considered “good,” it is important to be aware of the potential drawbacks that come with this score. Understanding the limitations can help you make informed financial decisions and work towards improving your creditworthiness. Here are some of the drawbacks associated with a 690 credit score:

- Limited Access to Lower Interest Rates: While a 690 credit score qualifies you for credit and loans, you may not have access to the lowest interest rates available. Lenders may offer slightly higher rates compared to borrowers with higher credit scores, which can result in higher interest payments over time.

- Reduced Loan Options: Some lenders, such as mortgage or auto loan providers, may have stricter requirements and prefer borrowers with higher credit scores. This means that you might have limited options when it comes to certain types of loans or may need to settle for less favorable terms.

- Higher Insurance Premiums: Insurance companies often consider credit scores when determining premiums. With a 690 credit score, you may face higher insurance rates compared to those with excellent credit, affecting your overall expenses.

- Potential Credit Limit Restrictions: While a 690 credit score allows you access to credit cards, you may face restrictions on the credit limits offered to you. Lenders may be cautious in extending higher credit limits, which could limit your spending power.

- Challenges with Negative Credit Events: A 690 credit score may not provide as much leeway in recovering from negative credit events, such as missed payments or collections. It’s important to continue practicing responsible credit habits to avoid setbacks.

Although there are some drawbacks, having a 690 credit score still provides you with an array of financial opportunities. By maintaining responsible financial habits and working towards improving your credit score, you can overcome these limitations and continue to enhance your creditworthiness.

Now let’s explore strategies to improve and maintain a 690 credit score.

Improving a 690 Credit Score

While a credit score of 690 is already considered good, there is always room for improvement. Raising your credit score can help you access better loan terms, lower interest rates, and further improve your financial prospects. Here are some strategies to help you improve and maintain a 690 credit score:

- Pay Bills on Time: Consistently making on-time payments is one of the most important factors in improving your credit score. Set up payment reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: Paying down credit card debt helps lower your credit utilization ratio, which is a significant factor in determining your credit score. Aim to keep your balances below 30% of your credit limits.

- Avoid Opening Unnecessary Accounts: Limit new credit applications unless necessary. Each new credit inquiry can temporarily lower your score, so only apply for credit when you genuinely need it.

- Monitor Your Credit Reports: Regularly review your credit reports for errors, inaccuracies, or fraudulent accounts. Dispute any mistakes to have them corrected, as they can have a negative impact on your credit score.

- Keep Old Accounts Open: Closing old accounts can shorten your credit history and negatively impact your credit score. Instead, keep them open and occasionally use them to maintain a longer credit history.

- Diversify Credit Types: Having a mix of credit types, such as credit cards, installment loans, and a mortgage, can positively impact your credit score. If you don’t have much credit history, consider responsibly opening additional credit accounts to diversify your credit profile.

- Monitor Credit Utilization: Regularly monitor your credit utilization ratio and aim to keep it as low as possible. Pay off credit card balances in full each month or make multiple payments throughout the month to keep your utilization ratio low.

- Be Patient: Improving your credit score takes time and consistent responsible credit behavior. Practice good financial habits, and over time, your credit score will gradually rise.

By implementing these strategies, you have the power to improve your credit score and strengthen your financial standing. Remember, the goal is not just to reach a higher credit score but to develop and maintain healthy credit habits for long-term financial success.

Now, let’s wrap up our discussion.

Conclusion

A credit score of 690 places you in the “good” credit range and signifies responsible financial behavior. While there may be room for improvement, a 690 credit score opens doors to various financial opportunities and advantages. It indicates to lenders that you are a relatively low-risk borrower, increasing your chances of loan approval and favorable interest rates.

However, it’s important to be aware of the potential drawbacks and limitations associated with a 690 credit score. You may face slightly higher interest rates, reduced loan options, and credit limit restrictions compared to those with higher scores. It’s crucial to continue practicing responsible credit habits, such as paying bills on time and keeping credit card balances low, to maintain or improve your credit score.

If you are looking to improve your 690 credit score, focus on reducing credit card balances, making timely payments, and avoiding unnecessary credit applications. Regularly monitor your credit reports for errors and maintain a diverse mix of credit types to enhance your credit profile.

Remember, developing and maintaining good financial habits is a long-term commitment. It takes time and patience to improve your credit score. By consistently practicing responsible credit behavior, you can not only increase your credit score but also improve your overall financial well-being.

Whether you have a 690 credit score or aspire to achieve one, understanding the factors that impact your creditworthiness and taking proactive steps to maintain a healthy credit profile will serve you well in navigating the world of credit and finance.