Finance

How Long Is Ford Credit Approval Good For

Published: January 9, 2024

Discover how long your Ford Credit approval is valid for and stay on top of your finance game. Ensure your understanding of the expiration date and take control of your financial plans.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Ford Credit, where you can turn your dreams of owning a new Ford vehicle into a reality. But before you hit the road in your shiny new car, it is important to understand the process of Ford Credit approval and how long it lasts.

For potential car buyers, the approval of credit is a critical step in the purchasing journey. Your credit worthiness will determine whether or not you are eligible for a loan to finance your vehicle. Ford Credit, the financing arm of Ford Motor Company, offers attractive options to make buying your dream car easier.

In this article, we will delve into the details of Ford Credit approval and answer the burning question: How long is Ford Credit Approval good for?

Whether you’re looking to buy a Ford Mustang, a Ford Explorer, or any other Ford vehicle, understanding the process and timeline of Ford Credit approval will help you plan your purchase with confidence.

So, let’s dive into the world of Ford Credit and explore what you need to know about the duration of Ford Credit Approval and how you can maximize its benefits.

Understanding Ford Credit Approval

When you apply for Ford Credit, the financing division of Ford Motor Company evaluates your creditworthiness to determine whether or not you qualify for a loan or lease for your desired Ford vehicle. They take into consideration various factors such as your credit history, income, employment status, and other financial obligations.

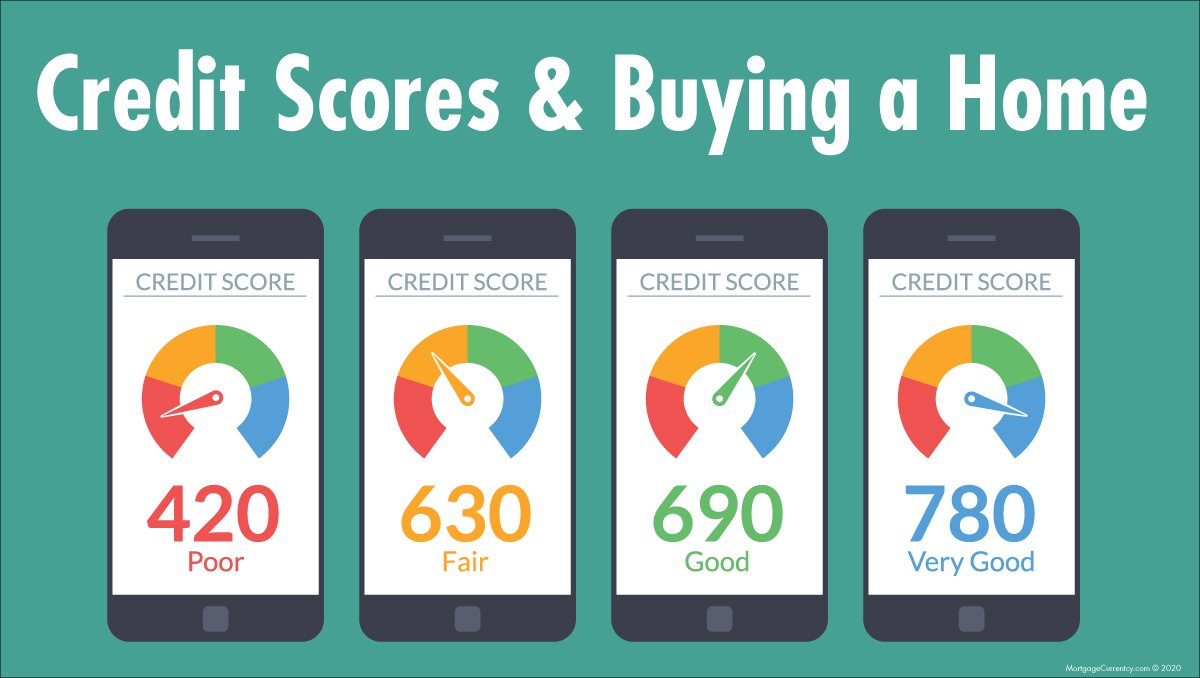

The approval process involves a thorough review of your credit profile, including your credit score and credit report. A higher credit score and a strong credit history increase your chances of securing Ford Credit approval.

Ford Credit offers competitive interest rates and flexible financing options tailored to meet the diverse needs of car buyers. The terms and conditions of the loan or lease agreement will be based on your creditworthiness, as assessed during the approval process.

It’s important to note that Ford Credit also takes into consideration the specific Ford vehicle you wish to purchase. Some models may have different credit requirements or eligibility criteria, so it’s wise to research and understand these details before making your final decision.

Once your Ford Credit application is approved, you’ll be provided with the loan terms, which include the interest rate, monthly payment amount, and the duration of the loan. Understanding these terms is crucial to ensure you can comfortably afford the monthly payments and successfully complete the loan.

Now that we have a basic understanding of Ford Credit approval, let’s explore the factors that can affect your chances of approval in the next section.

Factors Affecting Ford Credit Approval

While Ford Credit uses a holistic approach to evaluate your creditworthiness, there are several key factors that can significantly impact your chances of approval. Understanding these factors will help you better prepare for the application process and increase your likelihood of being approved for Ford Credit.

1. Credit Score: Your credit score is a numerical representation of your creditworthiness, based on your credit history. Ford Credit typically looks for a good credit score, indicating a strong track record of managing credit responsibly. A higher credit score increases your chances of approval and may also result in more favorable loan terms.

2. Income and Debt-to-Income Ratio: Ford Credit assesses your income and compares it to your debts to determine your debt-to-income ratio (DTI). A lower DTI indicates better financial stability and a higher likelihood of being able to afford loan payments. It’s important to have a steady income and keep your debts in check to improve your chances of approval.

3. Employment History: Ford Credit considers your employment history as an indicator of financial stability and repayment capacity. Having a stable job and a consistent income stream can positively influence the approval decision.

4. Down Payment: Making a larger down payment reduces the amount you need to finance, thereby reducing the risk for the lender. This can improve your chances of approval, as it shows your commitment to the purchase and lowers the overall loan amount.

5. Loan Term: The term of the loan also plays a role in the approval decision. Ford Credit may have specific requirements or limitations on the maximum loan term based on the vehicle you wish to purchase.

These factors are not exhaustive but provide a general overview of the key aspects that Ford Credit considers when reviewing your application. It’s important to note that each individual’s financial situation is unique, and meeting these factors does not guarantee approval. It’s always recommended to maintain a healthy credit profile and be mindful of your financial responsibilities to improve your chances of success.

Now, let’s explore the validity period of Ford Credit approval in the next section.

Validity Period of Ford Credit Approval

Once your Ford Credit application is approved, you may be wondering how long that approval is valid for. The validity period of Ford Credit approval can vary depending on various factors, including the specific terms and conditions of your loan or lease agreement.

In most cases, Ford Credit approval is typically valid for a period of 30 days. This means that you have 30 days from the date of approval to finalize your vehicle purchase or lease. During this time, you can confidently visit a Ford dealership and proceed with the purchase process.

It’s important to note that the validity period of Ford Credit approval is not set in stone and can differ based on individual circumstances. Some factors that may impact the duration of the approval include any changes in your financial situation, credit score, or loan terms.

If you need more time beyond the initial 30-day period, it’s advisable to reach out to your Ford dealership or Ford Credit directly. They may be able to provide further guidance and potentially extend the validity of the approval on a case-by-case basis.

Keep in mind that extending the validity of Ford Credit approval is not guaranteed and will depend on various factors. It’s always best to communicate with the appropriate parties involved to explore your options and ensure that you can complete the purchase within the given timeframe.

Now that we’ve discussed the validity period of Ford Credit approval, let’s explore how you can extend its duration in the next section.

Extending the Validity of Ford Credit Approval

If you find yourself needing more time to finalize your vehicle purchase after the initial 30-day validity period of your Ford Credit approval, there are a few options to consider for extending its duration.

1. Communicate with Ford Credit: Reach out to the Ford Credit customer service team and explain your situation. They may be able to work with you and provide an extension on the validity period, allowing you additional time to complete the purchase process. It’s important to be transparent about your circumstances and provide any necessary documents or information they may require.

2. Contact your Ford Dealership: Get in touch with the dealership where you plan to make your purchase and explain the situation. They may have options available to help you extend the validity of the approval. The dealership can work closely with Ford Credit to explore possibilities and find a solution that works for both parties.

3. Consider Loan Pre-Approval: If you anticipate needing a longer time frame to decide on a specific vehicle, you can explore the option of getting pre-approved for a loan from Ford Credit. Loan pre-approval provides a longer validity period, typically ranging from 60 to 90 days. This gives you more flexibility and time to shop around for the perfect Ford vehicle that fits your needs and budget.

Remember, extending the validity of Ford Credit approval is not guaranteed and is subject to the discretion of Ford Credit and the dealership. It’s always recommended to proactively communicate with them and provide any necessary documentation or information to support your request.

By being proactive and staying in touch with the relevant parties, you can increase the chances of extending the validity period and ensure a smoother vehicle purchasing experience.

Now, let’s conclude our journey through Ford Credit approval in the final section.

Conclusion

In conclusion, Ford Credit approval is a crucial step in the process of purchasing a Ford vehicle. Understanding the ins and outs of Ford Credit approval can help you navigate the financing process with confidence and maximize your chances of approval.

During the application process, various factors such as your credit score, income, employment history, and down payment amount are taken into consideration. These factors play a significant role in determining your eligibility for a loan or lease from Ford Credit.

The validity period of Ford Credit approval is typically 30 days, giving you ample time to finalize your vehicle purchase or lease. If you need more time, it’s important to communicate and work closely with Ford Credit and your chosen dealership to explore options for extending the validity period.

Remember to stay proactive and provide any necessary documentation or information to support your request for an extension. Additionally, considering loan pre-approval can also provide a longer validity period, giving you more flexibility to find the perfect Ford vehicle.

By understanding the process and timelines of Ford Credit approval, you can approach the financing process with confidence and make informed decisions about your purchase. Whether you’re eyeing a Ford Mustang, Ford Explorer, or any other Ford vehicle, Ford Credit offers flexible financing options to help you drive away in your dream car.

So, when it comes to Ford Credit approval, take the time to understand the factors at play, be proactive in your communication, and make sure to explore options for extending the validity period if needed. With the right information and a little preparation, you’ll be cruising down the road in your new Ford in no time.