Finance

How Hard To Get A Small Business Loan

Published: November 25, 2023

Need financing for your small business? Find out how hard it is to get a small business loan and explore your finance options with our expert guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Small Business Loan?

- The Importance of Small Business Loans

- Factors to Consider Before Applying

- Types of Small Business Loans

- Traditional Loan Options

- Alternative Financing Options

- How to Qualify for a Small Business Loan

- Tips for Getting Approved

- Common Challenges and Solutions

- Conclusion

Introduction

Starting and running a small business can be an exciting venture, but it often comes with financial challenges. Whether you need funds to purchase equipment, launch a new product line, or cover day-to-day operating expenses, accessing capital can be crucial for the growth and success of your business. This is where small business loans come into play.

A small business loan is a type of financing specifically designed to provide financial support to entrepreneurs and small business owners. It enables them to secure the necessary funds to start, expand, or sustain their business operations. These loans can be used for various purposes, including purchasing inventory, hiring employees, renovating premises, or marketing activities.

Small business loans are typically offered by traditional financial institutions, like banks, credit unions, and Small Business Administration (SBA)-backed lenders. However, in recent years, alternative financing options have emerged, providing entrepreneurs with additional choices and greater flexibility.

The importance of small business loans cannot be overstated. Access to capital is often crucial for small businesses to survive in competitive markets and seize growth opportunities. Without adequate funding, businesses may struggle to meet expenses, expand their operations, or take advantage of new opportunities. Small business loans can provide the necessary financial cushion, enabling businesses to thrive and achieve their goals.

Before applying for a small business loan, it’s important to consider various factors, such as the specific financial needs of your business, the repayment terms, the interest rates, and any collateral requirements. Additionally, it’s crucial to understand the different types of small business loans and the eligibility criteria for each.

In this article, we will explore the various types of small business loans, both traditional and alternative options, as well as the factors to consider and the qualification process. We will also provide tips and strategies to improve your chances of getting approved for a small business loan. Whether you’re a new entrepreneur looking to fund your startup or an established business owner seeking expansion capital, this article will provide valuable insights to help you navigate the world of small business loans.

What is a Small Business Loan?

A small business loan is a financial tool that provides entrepreneurs and small business owners with the necessary capital to start, operate, or expand their businesses. It is a specific type of loan that caters to the needs of small businesses, which often face challenges in accessing traditional financing due to their size or limited credit history.

Small business loans can be used for various purposes, such as purchasing inventory, equipment, or real estate, hiring employees, marketing and advertising, covering day-to-day operational expenses, or expanding business operations. The funds can be obtained from traditional financial institutions, such as banks or credit unions, or through alternative lending options, such as online lenders or crowdfunding platforms.

One of the key benefits of a small business loan is that it provides entrepreneurs with the necessary working capital to fuel business growth. By obtaining a loan, small business owners can acquire the resources they need to invest in their businesses, seize market opportunities, and stay competitive.

Small business loans typically come with specific terms and conditions, including interest rates, repayment periods, and collateral requirements. The terms can vary depending on the lender and the borrower’s creditworthiness. For instance, loans backed by the Small Business Administration (SBA) often come with favorable terms, such as lower interest rates and longer repayment periods.

It’s important to note that small business loans are not grants or free money. Borrowers are obligated to repay the principal amount along with any interest or fees charged by the lender. The repayment terms are typically structured based on the cash flow of the business or specific collateral provided as security.

Overall, small business loans play a crucial role in supporting the growth and success of small businesses. By providing entrepreneurs with access to capital, they enable businesses to invest in their operations, create jobs, and contribute to the overall economy. Whether you’re a startup or an established business, a small business loan can be a valuable financial tool to help you achieve your business goals.

The Importance of Small Business Loans

Small business loans play a vital role in the success and growth of entrepreneurs and small businesses. They provide access to much-needed capital that can be used for various purposes, ultimately enabling businesses to thrive and achieve their goals. Let’s explore the importance of small business loans in more detail.

1. Funding Business Operations: Small business owners often need funds to cover day-to-day operational expenses, such as rent, utilities, and inventory. A small business loan can provide the necessary working capital to ensure smooth business operations and prevent cash flow issues.

2. Business Expansion: Growing a business requires capital investment. Whether it’s expanding physical locations, hiring additional staff, or launching new product lines, small business loans can provide the funds needed for expansion opportunities. By securing a loan, businesses can take advantage of market demand and scale their operations.

3. Purchasing Equipment and Inventory: In many industries, specialized equipment and inventory are essential for business operations. Small business loans can be used to purchase or upgrade equipment, machinery, or technology, enabling businesses to operate efficiently and meet customer demands.

4. Marketing and Advertising: Effective marketing and advertising are crucial to attract and retain customers. Small business loans can be used to invest in marketing strategies, such as digital marketing campaigns, social media advertising, or traditional advertising methods, allowing businesses to reach a wider audience and generate more sales.

5. Hiring and Training Employees: As businesses grow, there is often a need to hire and train additional employees. Small business loans can provide the funds necessary to recruit and onboard new talent. By having an adequate number of skilled employees, businesses can improve productivity and deliver high-quality products or services.

6. Maintaining Cash Flow: Uneven cash flow is a common challenge for small businesses. Small business loans can help bridge the gap during slow periods and ensure that bills, payroll, and other expenses are covered on time. This allows businesses to maintain financial stability and continue operations smoothly.

7. Seizing Opportunities: Market opportunities can arise unexpectedly, and businesses need to be agile to take advantage of them. Whether it’s acquiring a competitor, expanding into a new market, or investing in research and development, small business loans provide the necessary capital to seize these opportunities and gain a competitive edge.

8. Building Credit History: Successfully managing a small business loan and making timely payments can contribute to building a positive credit history. This can enable businesses to access larger loan amounts, negotiate better terms, and establish credibility with future lenders.

Overall, small business loans are instrumental in supporting the growth, innovation, and sustainability of small businesses. By providing entrepreneurs with the necessary capital, small business loans empower businesses to navigate financial obstacles, fuel growth, and contribute to the overall economy.

Factors to Consider Before Applying

Before applying for a small business loan, it’s important to consider several factors to ensure you make the right decision for your business. Taking the time to evaluate these factors will help you choose the most suitable loan option and increase your chances of securing the necessary funds. Let’s explore the key factors to consider before applying for a small business loan.

1. Business Needs: Evaluate your specific business needs and determine the purpose for which you require the loan. Whether it’s to purchase equipment, expand operations, or bridge short-term cash flow gaps, understanding your business goals will help you identify the most appropriate loan type and loan amount.

2. Loan Amount: Determine the amount of money you need to borrow. Assess your business’s financial requirements and create a detailed budget to understand the precise loan amount necessary for your purposes. Borrowing too much can lead to higher interest costs, while borrowing too little may leave you short of the funds needed.

3. Repayment Terms: Consider the repayment terms that best match your business’s cash flow. Evaluate the interest rates, repayment period, frequency of repayments, and any associated fees. Ensure that the repayment terms are realistic and manageable for your business’s financial situation.

4. Interest Rates: Pay close attention to the interest rates associated with the loan. Different lenders offer varying interest rates, so it’s essential to understand the interest rate structure and how it will impact your overall loan cost. Compare rates from multiple lenders to secure the most favorable terms.

5. Collateral Requirements: Determine if the lender requires collateral to secure the loan. Collateral can be an asset, such as real estate or equipment, that the lender can seize to recover the loan if you default. Assess the potential risks and costs associated with providing collateral before committing to a loan.

6. Creditworthiness: Understand your personal and business credit history. Lenders evaluate creditworthiness when assessing loan applications. A strong credit history increases your chances of loan approval and favorable terms. Review your credit scores and reports to identify any potential issues that may need to be addressed before applying.

7. Financial Statements and Documentation: Prepare necessary financial statements, such as balance sheets, income statements, and cash flow projections. Lenders often require these documents to assess your business’s financial health and repayment ability. Ensure that your financial records are accurate, up-to-date, and organized.

8. Lender’s Reputation and Review: Research the reputation and reviews of the lender you are considering. Look for feedback from other borrowers to get a sense of the lender’s customer service, transparency, and overall experience. Choosing a reputable lender will provide you with peace of mind and a smoother borrowing process.

9. Alternative Financing Options: Consider alternative financing options, such as online lenders, crowdfunding, or grants. These options may offer different terms, faster approval processes, or greater flexibility compared to traditional lenders. Exploring alternative options can help you find a loan solution that best fits your business’s needs.

10. Seeking Professional Advice: If you are unsure about the loan application process or the best financing option for your business, consider seeking professional advice from an accountant, financial advisor, or small business development center (SBDC). They can provide guidance and help you make informed decisions.

Taking the time to carefully evaluate these factors will improve your chances of selecting the right loan and successfully securing the funds needed to support your business’s growth and success.

Types of Small Business Loans

When it comes to small business loans, there are various options available to entrepreneurs and business owners. Understanding the different types of loans will help you choose the most suitable option that aligns with your business’s needs and financial situation. Let’s explore some of the most common types of small business loans.

1. Term Loans: Term loans are the most common type of small business loan. They involve borrowing a specific amount of money and repaying it over a fixed term, typically ranging from one to five years. These loans can be obtained from traditional banks, credit unions, or online lenders. The funds can be used for various purposes, such as working capital, equipment purchase, or business expansion.

2. SBA Loans: Small Business Administration (SBA) loans are government-backed loans designed to support small businesses. The SBA offers a range of loan programs, including the popular 7(a) loan program and the CDC/504 loan program. SBA loans often have more favorable terms, such as longer repayment periods and lower interest rates, making them an attractive option for small businesses.

3. Equipment Loans: Equipment loans are used specifically to finance the purchase or lease of equipment or machinery. The equipment being financed typically acts as collateral for the loan. These loans are favored by businesses that rely heavily on specialized equipment, such as construction companies or medical practices.

4. Business Line of Credit: A business line of credit provides a revolving credit line that can be accessed when needed. It allows businesses to withdraw funds up to a predetermined credit limit and repay the borrowed amount with interest. Business lines of credit provide flexibility and cash flow management, as businesses can use the funds as needed and only pay interest on the amount withdrawn.

5. Invoice Financing: Invoice financing, also known as accounts receivable financing, involves using unpaid invoices as collateral to secure a loan. The lender advances a percentage of the invoice’s value, allowing businesses to access immediate cash flow while waiting for customer payments. Once the customer pays the invoice, the lender deducts their fees and returns the remaining balance to the business.

6. Merchant Cash Advances: Merchant cash advances provide quick access to capital by selling a portion of the business’s future credit card sales to a lender. The lender provides a lump sum payment, and repayment is made through a fixed percentage of daily credit card sales. Merchant cash advances are often used by businesses with high volumes of credit card transactions, such as retail or restaurant establishments.

7. Peer-to-Peer (P2P) Loans: Peer-to-peer loans connect borrowers directly with individual investors through online platforms. These loans eliminate the traditional banking intermediary, allowing borrowers to access funds at potentially lower interest rates. P2P loans can be an alternative option for business owners who may not meet the strict lending criteria of traditional banks.

8. Crowdfunding: Crowdfunding involves raising funds from a large number of individuals, typically through online platforms, in exchange for a product, service, or equity in the business. This option allows businesses to access capital while also generating market validation and building a customer base. Crowdfunding is particularly popular for startups or businesses with a unique product or service offering.

9. Microloans: Microloans provide smaller loan amounts, typically ranging from a few hundred dollars to a few thousand dollars. They are offered by nonprofit organizations or community development financial institutions (CDFIs) and can be used for various business purposes. Microloans are often favored by entrepreneurs who do not qualify for larger loans or need a small amount of capital to start or expand their businesses.

10. Business Grants: Business grants are non-repayable funds provided by government agencies, corporations, or nonprofits to support specific business activities. These grants may have specific eligibility criteria and require businesses to submit proposals outlining how they will use the grant funds. While grants can be highly competitive and have stricter requirements, they can provide valuable financial aid without the burden of repayment.

Each type of small business loan has its own advantages and considerations. Carefully evaluate your business’s needs, repayment abilities, and eligibility criteria to select the most suitable loan option that can help fuel your business’s growth and success.

Traditional Loan Options

When it comes to small business financing, traditional loan options provided by banks, credit unions, and financial institutions remain popular choices. These traditional loan options offer stability and credibility, making them attractive to many entrepreneurs and business owners. Let’s explore some of the common types of traditional small business loans.

1. Bank Loans: Banks are the most traditional source of small business loans. They offer various types of loans, such as term loans, lines of credit, and SBA loans. Bank loans typically come with lower interest rates and longer repayment terms, making them a favorable option for businesses with established credit and collateral.

2. SBA Loans: Small Business Administration (SBA) loans are loans guaranteed by the federal government. They are provided by banks and other lenders but come with favorable terms and lower interest rates. The SBA offers different loan programs, including the 7(a) loan program, CDC/504 loan program, and microloans. These loans are known for their support of small businesses and flexibility in meeting various financing needs.

3. Credit Union Loans: Credit unions are member-owned financial cooperatives that offer a variety of financial services, including small business loans. Credit union loans often provide competitive interest rates and personalized service. They may have less stringent lending requirements compared to traditional banks, making them more accessible to small business owners.

4. Equipment Financing: Equipment financing is specifically designed to help small businesses purchase or lease equipment. The equipment being financed serves as collateral for the loan, reducing the lender’s risk. Traditional lenders and specialized equipment financing companies offer attractive interest rates and terms for businesses looking to acquire essential equipment for their operations.

5. Business Lines of Credit: A business line of credit is a revolving credit account that offers businesses access to a predetermined credit limit. Similar to a credit card, businesses can borrow funds up to the credit limit and repay with interest. Business lines of credit provide flexibility in managing cash flow and can be used for various business purposes, including purchasing inventory, covering unexpected expenses, or managing seasonal fluctuations.

6. Invoice Financing: Invoice financing, also known as accounts receivable financing, involves using unpaid customer invoices as collateral to secure a loan. The lender advances a percentage of the invoice value, providing immediate cash flow to the business. Once the customer pays the invoice, the lender deducts their fees and returns the remaining balance to the business. Invoice financing is particularly beneficial for businesses with a large volume of outstanding invoices.

7. Commercial Mortgages: Commercial mortgages are loans used to finance real estate properties for business use. Whether it’s purchasing a building for office space, a retail store, or a manufacturing facility, commercial mortgages provide long-term financing options. These loans typically have lower interest rates and longer repayment terms compared to other types of small business loans.

8. Traditional Term Loans: Traditional term loans are fixed-sum loans provided by banks and lenders. They have a defined repayment period, interest rate, and monthly installment amount. These loans are often used for long-term investments, growth initiatives, or working capital needs. Traditional term loans are well-suited for established businesses with a solid credit history and collateral.

When considering traditional loan options, it’s important to assess your business’s financial standing, creditworthiness, and collateral availability. Traditional lenders prioritize these factors when evaluating loan applications. By carefully analyzing your business’s needs and capabilities, you can identify the most suitable traditional loan option to fuel your business’s growth and success.

Alternative Financing Options

In addition to traditional loan options provided by banks and credit unions, alternative financing options have emerged in recent years to cater to the diverse needs of small businesses. These alternative financing options provide flexibility, accessibility, and innovative approaches to funding. Let’s explore some of the common alternative financing options available to small business owners.

1. Online Lenders: Online lenders have gained popularity as a convenient and efficient alternative to traditional banks. These lenders operate digitally and offer small business loans with streamlined application processes and quick funding. Online lenders often cater to businesses with less established credit histories or those seeking quicker access to funds. They may offer short-term loans, lines of credit, or invoice financing.

2. Peer-to-Peer (P2P) Lending: Peer-to-peer lending platforms connect borrowers directly with individual investors online. Small business owners can create loan listings, and investors choose which loans to fund based on interest rates, risk profiles, and business details. P2P lending offers accessible funding options, potentially lower interest rates, and more flexible terms compared to traditional lenders.

3. Crowdfunding: Crowdfunding platforms allow businesses to raise funds by soliciting small contributions from a large number of individuals, typically through online campaigns. This alternative financing option can be used for various purposes, such as product development, marketing initiatives, or expansion projects. Crowdfunding not only provides capital but also validates the market appeal of a business or product.

4. Merchant Cash Advances: Merchant cash advances provide businesses with upfront capital in exchange for a portion of future credit or debit card sales. With this option, businesses receive immediate funding that is repaid through a fixed percentage of daily card transactions. Merchant cash advances are beneficial for businesses with fluctuating sales volumes, as repayment amounts adjust based on revenue.

5. Revenue-Based Financing: Revenue-based financing is an alternative financing model in which a lender provides a cash infusion in exchange for a percentage of future revenue. Unlike traditional loans, repayment amounts are tied to business revenues, offering flexibility during lean periods. This financing option is suitable for businesses with consistent revenue streams.

6. Grants: Business grants are non-repayable funds provided by government agencies, corporations, or foundations to support specific business activities. Grants are awarded based on eligibility criteria and proposed projects or initiatives aligned with the grant provider’s objectives. While grants can be highly competitive, they offer the benefit of free capital that can help small businesses mitigate financial burdens.

7. Crowdsourcing: Crowdsourcing involves sourcing funds, resources, or expertise from a community or network. Small businesses can leverage crowdsourcing platforms to raise funds or obtain support for their projects or initiatives. Crowdsourcing can range from seeking donations or sponsorships to collaborating with individuals who provide skills or services.

8. Angel Investors and Venture Capitalists: Angel investors and venture capitalists are individuals or firms that provide capital in exchange for equity or ownership stakes in the business. These investors often seek high-growth potential startups or businesses in innovative industries. They can offer not only financing but also valuable industry expertise, mentorship, and networking opportunities.

9. Community Development Financial Institutions (CDFIs): CDFIs are specialized financial institutions that focus on providing loans and financial services to underserved communities and small businesses. They often have more flexible lending criteria and may offer tailored loan programs to support local economic development and entrepreneurship.

10. Trade Credit and Supplier Financing: Trade credit allows businesses to obtain goods or services from suppliers with deferred payment terms. This form of financing can help businesses manage cash flow by extending the time between purchasing inventory or supplies and making payment. Supplier financing programs may also offer additional financing options, such as inventory financing or supplier loans.

Alternative financing options provide small businesses with more choices and flexibility when it comes to accessing funds. Consider the unique needs of your business, the repayment terms, interest rates, and eligibility criteria to determine the best alternative financing option that aligns with your business’s goals and financial situation.

How to Qualify for a Small Business Loan

Qualifying for a small business loan requires careful preparation and understanding of the lender’s requirements. While specific criteria may vary between lenders and loan types, there are several key factors that play a significant role in whether your loan application will be approved. Here’s a guide on how to increase your chances of qualifying for a small business loan.

1. Creditworthiness: Lenders evaluate the creditworthiness of both the business and the business owner. A strong credit history demonstrates your ability to manage and repay debts responsibly. Work on improving your credit score by making timely payments, reducing outstanding debt, and correcting any errors on your credit report.

2. Business Plan: A well-prepared business plan showcases your understanding of your industry, market, and business operations. Include a detailed financial plan that outlines how you will use the loan proceeds and how you will generate revenue to repay the loan. Lenders want to see that you have a solid strategy in place.

3. Financial Statements: Prepare accurate and up-to-date financial statements, including balance sheets, income statements, and cash flow statements. These documents provide a snapshot of your business’s financial health and help lenders assess its ability to repay the loan. Be prepared to provide financial projections as well.

4. Industry Experience: Lenders may consider your industry experience and expertise when evaluating your loan application. Demonstrating knowledge and experience in your specific industry can give lenders confidence in your ability to navigate challenges and make informed business decisions.

5. Collateral: Some lenders may require collateral to secure the loan. Collateral can be business assets, such as real estate, equipment, or inventory, that can be seized if you default on the loan. Offering collateral can increase your chances of loan approval and potentially result in more favorable loan terms.

6. Cash Flow and Profitability: Lenders assess your business’s cash flow and profitability to determine its ability to generate revenue and repay the loan. Prepare cash flow projections and demonstrate that your business has steady cash flow and the capacity to handle loan repayments.

7. Industry and Market Analysis: Provide a comprehensive analysis of your industry and market. Show that you understand market trends, competition, and potential risks. Lenders want to see that your business is well-positioned to thrive and repay the loan in a competitive market.

8. Personal Investment: Investing your own funds into your business demonstrates your commitment and confidence in its success. Lenders may look for a personal financial contribution to the business, which can include equity investment, personal savings, or personal guarantees.

9. Documentation: Prepare all required documentation, including legal documents, licenses, permits, and tax returns. Ensure that the documents are accurate, up-to-date, and organized. Incomplete or inaccurate documentation can delay the loan application process or even lead to rejection.

10. Relationships: Build relationships with lenders and maintain a positive banking history. Developing a rapport with your bank or lender can enhance your credibility and increase your chances of loan approval. Regularly communicate with your lender and keep them updated on your business’s performance.

Remember that meeting these criteria does not guarantee loan approval, but it improves your chances significantly. Each lender has their own set of qualification criteria, so it’s important to research and choose the right lender that best fits your business’s needs and profile. Being proactive, well-prepared, and maintaining a good business and personal financial record will greatly enhance your chances of qualifying for a small business loan.

Tips for Getting Approved

When applying for a small business loan, getting approved can be a competitive and challenging process. However, there are several strategies you can employ to increase your chances of securing the loan you need. Here are some tips to help improve your chances of getting approved for a small business loan.

1. Maintain a Strong Credit Profile: Establish and maintain a good credit history by making timely payments on existing debts, reducing outstanding balances, and monitoring your credit report. Lenders heavily consider your creditworthiness when evaluating loan applications.

2. Prepare a Compelling Business Plan: Craft a comprehensive and well-researched business plan that highlights your business’s potential, including details on your target market, competition, and financial projections. A strong business plan demonstrates your commitment and knowledge, instilling confidence in lenders.

3. Improve Cash Flow: Focus on building a consistent and positive cash flow by implementing strategies to increase sales, reduce expenses, and manage inventory. Demonstrating a healthy cash flow shows lenders that your business has the ability to generate income and meet loan repayment obligations.

4. Gather and Organize Financial Documents: Prepare and organize all necessary financial documents, including tax returns, bank statements, and financial statements. Keep them accurate, up-to-date, and readily accessible. Well-organized financial records demonstrate financial responsibility and make the loan application process smoother.

5. Understand and Address Potential Concerns: Anticipate potential concerns that lenders may have and address them proactively. This could include explaining any past credit issues, providing context for fluctuations in financial statements, or presenting a plan for mitigating potential risks.

6. Get Professional Assistance: Seek guidance from professionals such as accountants, financial advisors, or business mentors who can provide insights on improving your financials and optimizing your loan application. Their expertise can help you present your business in the most favorable light.

7. Research and Select the Right Lender: Research different lenders and loan options to find the best fit for your business. Understand their criteria, interest rates, terms, and conditions. Choosing a lender that specializes in your industry or offers favorable loan terms can increase your chances of approval.

8. Offer Collateral or Personal Guarantees: Providing collateral or personal guarantees can strengthen your loan application. Collateral provides the lender with an additional source of repayment if your business fails to meet its obligations. Personal guarantees show your commitment to repay the loan using your personal assets if necessary.

9. Build Relationships with Lenders: Cultivate relationships with lenders early on, even before you need a loan. Regularly communicate with your bank or lender, keep them updated on your business’s performance, and foster trust and confidence in your business’s stability and growth potential.

10. Be Transparent and Responsive: Be transparent and provide all requested information promptly. Respond to lender inquiries and requests for additional documentation in a timely manner. Showing professionalism and responsiveness demonstrates your commitment and reliability as a borrower.

Remember, there is no guaranteed formula for loan approval, but these tips can significantly improve your chances. Each lender has their own criteria, so it’s important to tailor your approach to fit their requirements. By presenting a strong application, being well-prepared, and addressing potential concerns, you can enhance your chances of getting approved for the small business loan you need to fuel your business’s growth and success.

Common Challenges and Solutions

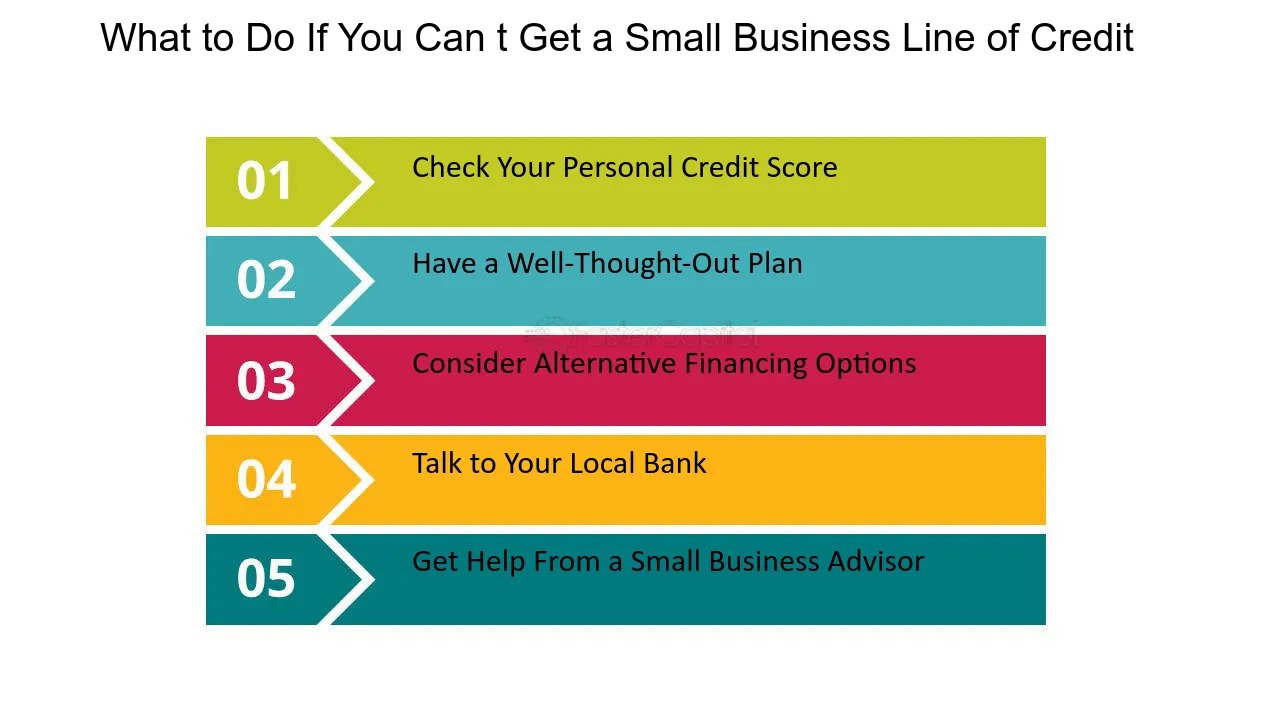

When it comes to obtaining a small business loan, entrepreneurs often face various challenges that can hinder their ability to secure the funding they need. Understanding these challenges and implementing solutions can help overcome obstacles and increase the chances of obtaining a loan. Let’s explore some common challenges faced by small business owners and possible solutions:

1. Insufficient Credit History: Limited or poor credit history can make it difficult to qualify for a small business loan. Solution: Build a strong credit profile by maintaining good personal and business credit habits, making timely payments, and gradually establishing a positive credit history. Consider alternative lenders who may be more lenient with credit requirements.

2. Lack of Collateral: Some lenders require collateral to secure a loan, which can be a challenge for businesses without significant assets. Solution: Seek lenders who offer unsecured loan options or explore alternative financing options, such as crowdfunding or peer-to-peer lending, that may not require collateral.

3. Inadequate Cash Flow: Lenders assess a business’s cash flow to evaluate its ability to repay the loan. Insufficient cash flow can be a barrier to loan approval. Solution: Implement strategies to improve cash flow, such as optimizing inventory management, renegotiating supplier terms, or diversifying revenue streams. Provide a comprehensive cash flow projection to demonstrate future repayment ability.

4. High Debt-to-Income Ratio: A high debt-to-income ratio may indicate to lenders that your business has too much existing debt. Solution: Prioritize paying down existing debts to decrease the debt-to-income ratio. Consider refinancing existing loans to reduce monthly payments and improve cash flow.

5. Lack of Business Experience: Lenders may be hesitant to approve loans for businesses without sufficient industry experience or track record. Solution: Highlight the expertise and qualifications of your management team or seek a business partner with a strong industry background. Prepare a comprehensive business plan that outlines your strategy and demonstrates your understanding of the market.

6. Inaccurate or Incomplete Documentation: Incomplete or inaccurate financial documentation can cause delays or rejections in the loan application process. Solution: Ensure that all required documents, such as tax returns, financial statements, and business licenses, are complete, accurate, and organized. Double-check the application to make sure all information is entered correctly.

7. Small Loan Amounts: Some businesses may require smaller loan amounts that are not as attractive to traditional lenders. Solution: Explore alternative financing options, microloans, or community development financial institutions (CDFIs) that specialize in smaller loan amounts. Peer-to-peer lending platforms may also offer more flexibility in loan sizes.

8. Limited Time in Business: Lenders often prefer to provide loans to well-established businesses with a proven track record. Solution: Research lenders who are more open to working with startups and newer businesses. Highlight your qualifications, industry expertise, and unique value proposition in your loan application.

9. Economic Volatility or Industry Challenges: Uncertain economic conditions or industry-specific challenges can make lenders hesitant to release funds. Solution: Mitigate risk by thoroughly researching and understanding your market and competitors. Show lenders how your business is prepared to adapt and thrive in changing conditions.

10. Lack of Understanding of Loan Options: Many small business owners are not fully aware of the wide range of loan options available to them. Solution: Conduct thorough research or consult with financial advisors who can help you understand the various loan programs and financing options tailored to your specific needs.

Every small business faces unique challenges when it comes to obtaining a loan. By implementing these solutions and seeking alternative financing options, you can overcome obstacles and improve your chances of securing the funding necessary for your business’s success.

Conclusion

Securing a small business loan is a significant milestone for entrepreneurs and business owners. Small business loans provide the funds necessary to start, grow, or sustain a business, fueling innovation, job creation, and economic growth. Whether you choose a traditional bank loan or explore alternative financing options, careful preparation and understanding the loan process are essential to increase your chances of approval.

In this article, we discussed the importance of small business loans in supporting business growth and success. We explored the various types of loans available, including traditional loan options offered by banks and credit unions, as well as alternative financing options like online lenders, crowdfunding, and grants. Each loan option has its own set of benefits and considerations that should be evaluated based on the unique needs of your business.

We provided tips for increasing your chances of approval, such as maintaining a strong credit profile, preparing a compelling business plan, improving cash flow, and providing accurate financial documentation. We also addressed common challenges that entrepreneurs face when applying for a small business loan, and offered potential solutions to overcome these obstacles.

Remember, each business is unique, and what works for one may not work for another. It’s important to do thorough research, assess your business’s needs and financial situation, and carefully select the loan option that best aligns with your goals and circumstances.

While securing a small business loan can be challenging, it’s important to persevere and explore all available options. Seek professional guidance when needed and maintain open communication with potential lenders. Remember that rejection is not the end; it can present an opportunity to reevaluate and strengthen your loan application. By demonstrating your commitment, preparedness, and financial responsibility, you can enhance your eligibility and increase your chances of receiving the funding necessary to propel your business forward.

With proper planning, a clear strategy, and a solid understanding of your business’s financial needs, you can navigate the loan application process successfully. By securing the necessary capital, you can fuel growth, innovate, and achieve your business goals, setting the stage for long-term success and prosperity.