Finance

How Hard To Get A Small Business Loan

Modified: December 30, 2023

Looking to finance your small business? Learn how hard it is to get a small business loan and find the best financing options for your needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Small Business Loans

- Factors That Determine Loan Eligibility

- Preparing Your Small Business Loan Application

- Types of Small Business Loans

- Alternative Financing Options for Small Businesses

- The Application Process for Small Business Loans

- Tips for Increasing Your Chances of Approval

- Common Challenges and Pitfalls to Avoid

- Conclusion

Introduction

Starting and growing a small business requires a significant amount of capital. Whether you need funds to buy equipment, hire employees, or expand your operations, a small business loan can provide the financial boost you need. However, obtaining a small business loan is not always an easy task.

In this article, we will explore the intricacies of getting a small business loan. We will discuss the factors that lenders consider when evaluating loan applications, the steps you can take to prepare your business for a loan, and the different types of loans available. Additionally, we will explore alternative financing options and provide insights into the application process. We will also offer tips for increasing your chances of approval and highlight common challenges to watch out for.

Understanding the small business loan landscape is crucial for entrepreneurs and business owners. By familiarizing yourself with the loan process and the factors that lenders focus on, you can put your business in the best position to secure the funds you need to thrive.

While obtaining a small business loan might seem daunting, it is important to remember that lenders are not just looking for businesses with perfect credit or extensive operating history. By presenting a strong case for your business and demonstrating your ability to repay the loan, you can increase your chances of success.

Whether you are a new entrepreneur looking for startup capital or an established business owner in need of expansion funds, this article will serve as a comprehensive guide to help you navigate the world of small business loans. So let’s dive in and discover how to make the loan application process smoother and more successful.

Understanding Small Business Loans

Small business loans are specifically designed to provide financial assistance to entrepreneurs and business owners. These loans can be used for various purposes, such as purchasing inventory, expanding operations, or covering day-to-day expenses.

Unlike personal loans, small business loans are tailored to the unique needs of businesses. They come with specific terms, interest rates, and repayment schedules that are often more favorable for business purposes.

One important aspect to understand is that small business loans can be either secured or unsecured. Secured loans require collateral, such as property or equipment, which serves as a guarantee for the lender in case of default. Unsecured loans, on the other hand, do not require collateral but might have higher interest rates to compensate for the increased risk.

Another key concept to grasp is that small business loans can be obtained from various sources, including traditional banks, credit unions, online lenders, and government-backed programs. Each source has its own requirements and application processes, so it is essential to research and compare options to find the best fit for your business.

When applying for a small business loan, lenders evaluate several factors to determine your eligibility. These factors typically include your credit score, business viability, cash flow, collateral, and industry experience. Lenders want to ensure that your business has a strong chance of success and that you will be able to repay the loan within the specified terms.

Understanding the different types of small business loans available is also crucial. Some common types include term loans, lines of credit, equipment financing, invoice financing, and SBA loans. Each type has its own purpose and advantages, depending on your specific business needs.

By understanding the fundamentals of small business loans, including the various sources, eligibility criteria, and loan types, you can approach the loan application process with confidence and increase your chances of securing the funding your business requires to thrive and grow.

Factors That Determine Loan Eligibility

When applying for a small business loan, there are several key factors that lenders consider to determine your eligibility. Understanding these factors can help you prepare your business and improve your chances of obtaining financing.

1. Credit Score: Your personal and business credit scores play a significant role in loan approval. Lenders use credit scores to assess the risk of lending to you. Higher credit scores indicate a lower risk of default, making you a more attractive borrower.

2. Business Viability: Lenders want to ensure that your business is financially healthy and has the potential to generate enough revenue to repay the loan. They will assess your business’s financial statements, including income statements and balance sheets, to evaluate its viability.

3. Cash Flow: Positive cash flow is crucial for loan eligibility. Lenders look at your business’s cash flow statements to determine if you have enough incoming cash to cover ongoing expenses and repay the loan. A steady and consistent cash flow demonstrates your ability to manage your finances effectively.

4. Collateral: For secured loans, lenders may require collateral to secure their investment. Collateral can be assets like real estate, equipment, or inventory. The value and quality of the collateral can affect the loan amount and interest rate offered.

5. Industry Experience: Lenders may consider your experience in the industry when evaluating loan applications. Having relevant industry knowledge and experience can give lenders confidence in your ability to successfully run your business and repay the loan.

6. Debt-to-Income Ratio: Lenders analyze your business’s debt-to-income ratio, which compares your monthly debt obligations to your income. A lower debt-to-income ratio indicates less financial strain and a higher ability to repay the loan.

7. Business Plan: A well-crafted business plan demonstrates your understanding of your industry, market, and competitors. Lenders will assess your business plan to ensure your strategies align with your loan purpose and show potential for growth and profitability.

8. Legal and Regulatory Compliance: Lenders want to ensure that your business operates within the legal framework. They will check if your business has all the necessary permits, licenses, and compliance with local, state, and federal regulations.

It’s important to note that different lenders may prioritize these factors differently. Some lenders may place more emphasis on credit history, while others may focus more on cash flow or collateral value. Understanding these factors and preparing your business accordingly will improve your chances of meeting the lender’s criteria and securing the small business loan you need.

Preparing Your Small Business Loan Application

When applying for a small business loan, proper preparation is essential to increase your chances of approval. Here are some key steps to help you prepare a strong loan application:

1. Review Your Credit: Obtain your personal and business credit reports and review them carefully. Look for any errors or discrepancies and address them promptly. If your credit score is less than stellar, take steps to improve it before applying for a loan.

2. Gather Financial Documents: Lenders will require various financial documents to assess your business’s financial health. These may include income statements, balance sheets, tax returns, bank statements, and cash flow projections. Organize and compile these documents to present a clear picture of your business’s financial performance.

3. Develop a Solid Business Plan: A well-crafted business plan is an essential component of a loan application. Outline your business’s mission, goals, market analysis, sales and marketing strategies, and financial projections. Demonstrate to lenders that you have a clear roadmap for success and a strong understanding of your industry.

4. Determine the Loan Amount and Purpose: Calculate the exact amount you need and clearly state how you will utilize the funds. Whether you need the loan for inventory, equipment purchase, working capital, or expansion, be specific in your loan application. Lenders want to understand why you need the funds and how it will improve your business.

5. Improve Cash Flow and Financial Stability: Lenders assess your business’s ability to generate sufficient cash flow to repay the loan. Take steps to enhance your cash flow by reducing expenses, increasing sales, or improving your collection process. Demonstrating strong financial stability will boost your chances of loan approval.

6. Explore Collateral and Guarantees: If you are applying for a secured loan, identify suitable assets that can serve as collateral. Gather documentation and appraisals for these assets to support your loan application. Additionally, consider providing personal guarantees or obtaining co-signers if necessary.

7. Understand and Compare Lender Requirements: Different lenders have varying eligibility criteria and application processes. Research and understand the requirements of each lender you are considering. Compare interest rates, terms, and fees to find the best fit for your business.

8. Seek Professional Guidance: Engage the services of a financial advisor or accountant who specializes in small business loans. They can provide valuable insights, assist in preparing your financial statements, and guide you through the loan application process.

Remember, a well-prepared and organized application gives lenders confidence in your business’s ability to succeed and repay the loan. By following these steps and putting in the effort to present your business in the best possible light, you increase your chances of securing the small business loan you need to achieve your goals.

Types of Small Business Loans

When seeking a small business loan, it’s important to understand the various types available to determine which one best suits your needs. Here are some common types of small business loans:

1. Term Loans: Term loans are one of the most common types of loans for small businesses. They provide a lump sum of money that is repaid over a specific term, typically with fixed monthly payments. These loans are often used for long-term investments, such as purchasing equipment, renovating a facility, or expanding operations.

2. Lines of Credit: A line of credit provides businesses with access to funds that can be drawn upon as needed. It is a flexible financing option that allows you to borrow up to a predetermined limit. You only pay interest on the amount borrowed, and the credit line replenishes as you repay the principal. Lines of credit are ideal for managing cash flow fluctuations, covering short-term expenses, or seizing immediate business opportunities.

3. SBA Loans: Small Business Administration (SBA) loans are government-backed loans designed to support small businesses. These loans offer favorable terms and longer repayment periods, as they are partially guaranteed by the SBA. SBA loans are typically used for working capital, equipment purchase, real estate acquisition, or business expansion.

4. Equipment Financing: If your business needs to acquire or upgrade equipment, equipment financing can be a suitable option. With this type of loan, the equipment itself serves as collateral. Equipment loans often have competitive interest rates and flexible repayment terms, making them a popular choice among businesses in need of machinery, vehicles, or other equipment.

5. Invoice Financing: Invoice financing, also known as accounts receivable financing, allows businesses to get immediate cash by using their outstanding invoices as collateral. Lenders provide a percentage of the invoice value upfront, and the remaining balance (minus fees) is paid once the customer has settled the invoice. Invoice financing is ideal for businesses with outstanding invoices and short-term cash flow needs.

6. Merchant Cash Advances: Merchant cash advances are a type of financing where lenders advance businesses a lump sum in exchange for a percentage of their future credit card sales. Repayment is made through daily or weekly deductions from the business’s credit card transactions. This option provides quick access to funds for businesses with consistent credit card sales but may come with higher fees and interest rates.

These are just a few examples of the types of small business loans available. Each loan type has its own advantages and considerations, so it’s crucial to evaluate your business’s specific needs and financial situation to choose the most appropriate loan option.

Alternative Financing Options for Small Businesses

While traditional small business loans from banks and financial institutions are widely used, there are alternative financing options that can provide funding for businesses that may not meet the strict requirements of traditional lenders. Here are some alternative financing options for small businesses:

1. Crowdfunding: Crowdfunding platforms allow businesses to raise funds from a large number of individuals who contribute small amounts of money. This option is beneficial for startups and businesses with innovative or creative ideas that can attract a wide audience. Crowdfunding can involve rewards-based campaigns where backers receive perks or equity-based funding where investors receive a share of the business.

2. Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. These platforms eliminate the need for traditional financial institutions and often offer more flexible terms and lower interest rates. P2P lending can be a viable option for businesses that may not qualify for traditional loans due to limited credit history or other factors.

3. Microloans: Microloans are small loans typically offered by non-profit organizations or community development financial institutions (CDFIs). These loans are specifically designed to support entrepreneurs and small businesses in underserved communities. Microloans have shorter terms and lower loan amounts, making them suitable for startups and businesses with limited financing needs.

4. Angel Investors: Angel investors are high-net-worth individuals who invest their own money into businesses in exchange for equity or convertible debt. These investors often provide not only capital but also mentorship and valuable industry connections. Angel investors are particularly interested in startups and businesses with high growth potential.

5. Venture Capital: Venture capital firms invest in high-growth potential businesses in exchange for equity ownership. These firms provide significant capital and expertise to help businesses scale rapidly. Venture capital is typically sought by startups and businesses in technology, healthcare, and other industries that have the potential for rapid growth.

6. Grants: Various government agencies, non-profit organizations, and private foundations offer grants to support specific industries, research, or community development. Unlike loans, grants do not need to be repaid, making them an attractive funding option. However, grants often have strict eligibility requirements and may require businesses to fulfill specific objectives or meet certain criteria.

7. Factoring and Invoice Financing: Factoring companies purchase your outstanding invoices at a discounted rate, providing immediate cash flow. Invoice financing platforms offer similar services by advancing a percentage of your outstanding invoices. These options can help businesses bridge gaps in cash flow and access working capital.

When exploring alternative financing options, it’s important to carefully evaluate the terms, fees, and requirements associated with each option. Consider your business’s unique needs, goals, and financial situation to determine which alternative financing option aligns best with your objectives.

The Application Process for Small Business Loans

The application process for small business loans can vary depending on the lender and loan type. However, there are common steps involved in most loan applications. Understanding the process can help you better prepare and increase your chances of a successful application. Here are the key steps in the application process:

1. Research and Preparation: Start by researching different lenders and loan options to find the best fit for your business. Understand their eligibility criteria, interest rates, repayment terms, and application requirements. Gather the necessary documents, such as financial statements, tax returns, and business plans, to have them ready for submission.

2. Loan Application: Begin by filling out the loan application form provided by the lender. The form typically requires information about your business, including its legal structure, industry, revenue, and purpose of the loan. Be accurate and thorough when providing this information.

3. Supporting Documents: Along with the application form, you will need to submit various supporting documents. These may include financial statements, tax returns, bank statements, business licenses, and legal documents. Each lender may have specific document requirements, so be sure to provide all requested information.

4. Loan Proposal: In some cases, lenders may request a loan proposal. This document outlines the purpose of the loan, the amount requested, repayment plans, and expected outcomes. A well-prepared loan proposal can demonstrate your business’s viability and help convince lenders of its potential success.

5. Review and Underwriting: Once you have submitted your application and supporting documents, the lender will review them. This process, known as underwriting, involves evaluating your creditworthiness, business financials, and other relevant factors. The lender may also conduct additional checks, such as verifying credit history and contacting references.

6. Loan Decision: After the underwriting process, the lender will make a decision on your loan application. They may approve the loan, deny it, or provide a conditional approval with specific requirements or limitations. If approved, you will receive a loan offer, including details on interest rates, loan amount, repayment terms, and any associated fees.

7. Loan Acceptance and Disbursement: If you are satisfied with the loan offer, accept the terms and conditions provided by the lender. Some lenders may require additional paperwork or collateral before finalizing the loan. Once all requirements are met, the funds will be disbursed to your business account.

8. Loan Repayment: Make regular, timely repayments as agreed upon in the loan terms. Establish a system to keep track of payment deadlines and ensure proper cash flow management to meet repayment obligations.

Remember, each lender may have its own unique application process, timelines, and requirements. It is crucial to work closely with the lender, follow their instructions carefully, and provide accurate and complete information to facilitate a smooth application process.

Tips for Increasing Your Chances of Approval

Securing a small business loan can be a competitive process, but there are steps you can take to increase your chances of approval. Here are some tips to help improve your likelihood of obtaining the financing your business needs:

1. Maintain a Good Credit History: Lenders place significant importance on credit history. Work on improving your personal and business credit scores by making timely payments, managing debt responsibly, and reducing credit utilization. Regularly monitor your credit reports and address any errors or discrepancies promptly.

2. Prepare a Strong Business Plan: A well-crafted business plan demonstrates your understanding of your industry, market, and competitive landscape. Include a detailed financial projection, clearly outlining how the loan will contribute to your business’s growth and profitability. A comprehensive business plan enhances your credibility as a borrower.

3. Optimize Your Cash Flow: Lenders want to see that your business has sufficient cash flow to repay the loan. Take steps to improve cash flow by reducing unnecessary expenses, negotiating favorable terms with suppliers, and implementing effective cash flow management strategies. Demonstrating a healthy cash flow increases your chances of loan approval.

4. Provide Collateral or Guarantees: Offering collateral or personal guarantees can increase your chances of loan approval, especially for secured loans. Collateral provides additional security for the lender, reducing the risk associated with the loan. Evaluate your assets and determine if you can use them as collateral to strengthen your loan application.

5. Strengthen Your Industry Knowledge: Lenders may assess your industry experience and expertise to evaluate your ability to manage and grow your business. Stay updated with industry trends, regulations, and best practices. Attend industry conferences or workshops, participate in relevant networking events, and continuously seek opportunities to enhance your knowledge and skills.

6. Build Relationships with Lenders: Establishing relationships with lenders before applying for a loan can be beneficial. Attend industry events or lender-specific events to meet and connect with potential lenders. Building relationships and maintaining open lines of communication can help you gain insights into their lending criteria and increase their confidence in your business.

7. Minimize Existing Debt: High levels of existing debt can raise concerns for lenders. Before applying for a loan, work on reducing your existing debt load. Pay off outstanding balances and consider refinancing existing loans to improve your debt-to-income ratio. This demonstrates a lower financial burden and improved ability to repay the loan.

8. Be Prepared and Organized: Submitting a complete and well-organized loan application increases your chances of approval. Ensure that you have all the required documents and information ready when applying. Present a clear and concise case for your loan, addressing the lender’s specific criteria and requirements.

Remember, each lender may have different criteria and priorities. Research their requirements and tailor your loan application accordingly. By following these tips and presenting your business in the best light possible, you can significantly improve your chances of getting the small business loan you need to grow and succeed.

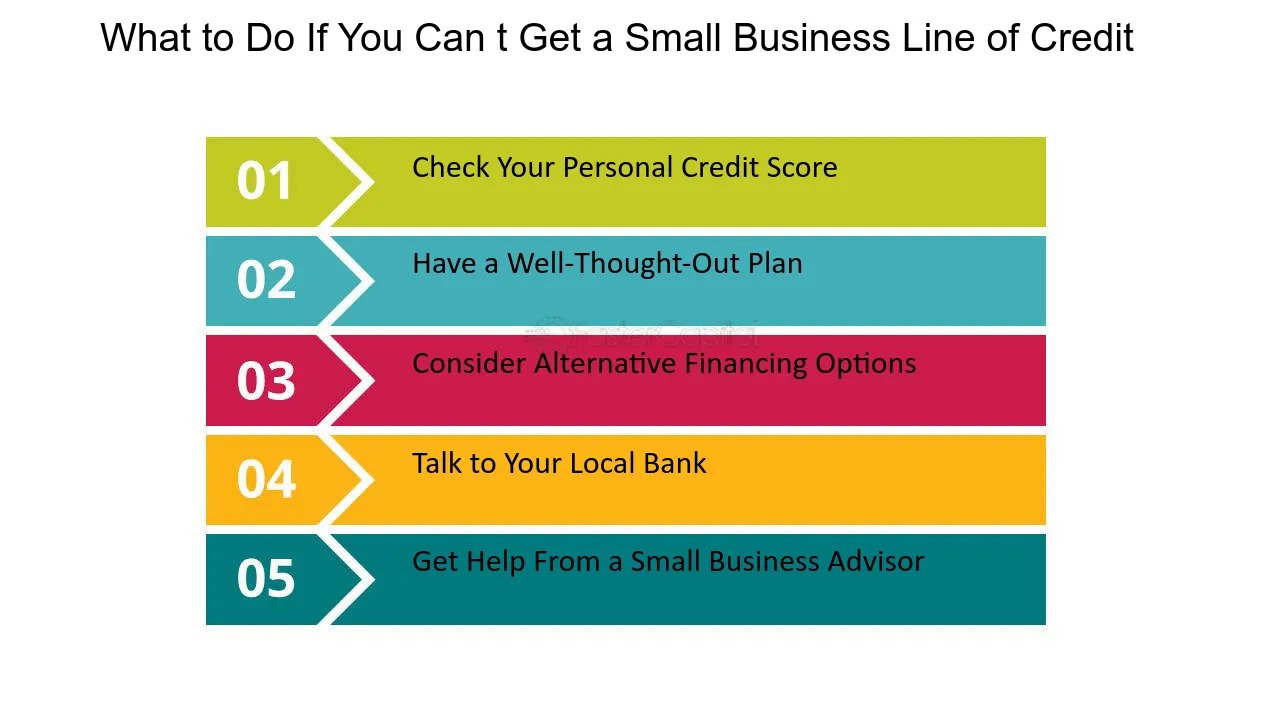

Common Challenges and Pitfalls to Avoid

When applying for a small business loan, there are several common challenges and pitfalls to be aware of. By understanding and avoiding these hurdles, you can increase your chances of a successful loan application. Here are some key challenges and pitfalls to watch out for:

1. Insufficient Preparation: Failing to adequately prepare for the loan application process can hinder your chances of approval. Take the time to gather all necessary documents, review your credit history, and develop a solid business plan. Being well-prepared demonstrates professionalism and increases your credibility as a borrower.

2. Lack of Cash Flow Management: Inadequate cash flow management is a red flag for lenders. Make sure to carefully monitor and manage your cash flow, ensuring that you have sufficient funds to meet loan repayments. Demonstrating strong cash flow management skills increases your chances of being approved for a loan.

3. Poor Credit History: A poor personal or business credit history can significantly impact your loan eligibility. Take steps to improve your credit score by making timely payments, reducing debt, and resolving any outstanding issues. If your credit history is less than stellar, consider working with lenders who specialize in serving borrowers with imperfect credit.

4. Overreliance on Debt Financing: Relying too heavily on debt financing can be risky for your business’s financial health. When applying for a loan, carefully consider your ability to manage repayments and the impact it will have on your overall financial situation. Exploring alternative financing options or seeking equity investors may be a more sustainable option for your business.

5. Lack of Collateral or Guarantees: Some lenders may require collateral or personal guarantees to secure a loan. Failing to provide sufficient collateral or guarantees can limit your loan options or result in higher interest rates. Carefully evaluate your assets and consider offering collateral or seeking a co-signer if necessary.

6. Ignoring Alternative Financing Options: Many business owners solely focus on traditional banks for loans, overlooking alternative financing options. Research and explore alternative options such as crowdfunding, peer-to-peer lending, or microloans. These options may offer more flexibility and better terms that are well-suited for your business’s unique needs.

7. Inadequate Documentation: Errors or omissions in loan application documentation can lead to delays or even rejection. Be meticulous in preparing your application, ensuring that all required documents are accurate, complete, and up to date. Double-check your financial statements, tax returns, and any other supporting materials before submission.

8. Failure to Communicate with Lenders: Open and effective communication with lenders is crucial throughout the loan application process. Respond promptly to any inquiries or requests for additional information. If you encounter challenges or changes in circumstances, communicate with your lender and work together to find solutions.

By being aware of these common challenges and pitfalls, you can proactively address them and position yourself for a successful loan application. Take the time to prepare, seek guidance from financial professionals if needed, and stay engaged with your potential lenders throughout the process. This will increase your chances of obtaining the financing your business needs to thrive.

Conclusion

Securing a small business loan is a key milestone for entrepreneurs and business owners looking to grow and expand their ventures. However, the loan application process can be challenging and competitive. By understanding the various factors that lenders consider and taking proactive steps to prepare your application, you can enhance your chances of success.

Start by familiarizing yourself with the different types of small business loans available, including traditional loans, government-backed options, and alternative financing sources. Evaluate each option based on your specific business needs and eligibility criteria.

Preparing a strong loan application is crucial. Take the time to gather all necessary documentation, such as financial statements, tax returns, and a comprehensive business plan. Ensure that your credit history is in good shape and that you have a clear understanding of your business’s cash flow and financial stability.

When submitting your loan application, be thorough and accurate. Address the lender’s specific requirements and demonstrate your industry knowledge and experience. Consider offering collateral or guarantees to strengthen your application and increase your chances of approval.

Throughout the process, be proactive and responsive in your communication with lenders. Seek guidance from financial professionals when needed and explore alternative financing options if traditional loans are not feasible for your business.

Remember, the loan application process can be competitive, and there may be challenges and pitfalls along the way. However, by understanding these challenges and taking the necessary steps to address them, you can position yourself for success.

In conclusion, obtaining a small business loan requires careful preparation, attention to detail, and a strong understanding of your business’s financials and needs. By following the tips outlined in this article, you can increase your chances of securing the funding your business needs to thrive and reach new heights of success.