Finance

How To Get A Small Business Loan In Michigan

Modified: December 30, 2023

Looking for finance options for your small business in Michigan? Learn how to easily get a small business loan in Michigan and secure the funding you need.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Small Business Loans

- Types of Small Business Loans

- Requirements for Getting a Small Business Loan

- Steps to Take Before Applying for a Small Business Loan

- Researching Small Business Loan Options in Michigan

- Choosing the Right Small Business Loan Provider

- Preparing Your Small Business Loan Application

- Submitting Your Small Business Loan Application

- What to Expect After Applying for a Small Business Loan

- Conclusion

Introduction

Welcome to our comprehensive guide on how to get a small business loan in Michigan. As an entrepreneur in the state of Michigan, securing the necessary funding to start or expand your small business can be a daunting task. However, with the right information and preparation, obtaining a small business loan can become a reality.

A small business loan can provide the financial resources needed to invest in equipment, hire employees, expand operations, or fulfill other business needs. Whether you’re a Michigan native looking to start a new venture or an existing business owner seeking additional working capital, understanding the process and requirements for obtaining a small business loan is crucial.

Throughout this guide, we’ll delve into the different types of small business loans available, the requirements for obtaining a loan, the steps you should take before applying, and how to choose the right loan provider for your needs. We’ll also provide insights into the application process and what you can expect after applying for a small business loan in Michigan.

By the end of this guide, you’ll be equipped with the knowledge and understanding necessary to navigate the world of small business loans and increase your chances of securing the funding you need to grow your business.

Let’s get started by exploring the different types of small business loans available in Michigan.

Understanding Small Business Loans

Before diving into the process of obtaining a small business loan in Michigan, it’s important to have a solid understanding of what exactly a small business loan is and how it can benefit your business.

A small business loan is a financial tool designed to provide funding for businesses that may not have access to traditional sources of financing, such as banks or investors. This type of loan can be used for a variety of purposes, including starting a new business, expanding an existing business, purchasing equipment, or managing cash flow.

One of the key benefits of a small business loan is that it provides the necessary capital to fuel growth and stability. Whether you’re looking to hire more employees, invest in new technologies, or increase your marketing efforts, a small business loan can provide the boost you need.

Small business loans typically come with a repayment period and interest rates. The terms and conditions of the loan will vary depending on the lender, the amount borrowed, and your business’s financial situation. It’s important to carefully review the terms before accepting a loan to ensure it aligns with your business goals and financial capabilities.

There are various types of small business loans available, each with its own set of qualifications, repayment terms, and interest rates. Some common types of small business loans include:

- Term Loans: These loans provide a lump sum of money that is repaid over a fixed term, typically with regular monthly payments of principal and interest.

- Business Lines of Credit: Similar to a credit card, a business line of credit allows you to borrow funds up to a certain limit and only pay interest on the amount used.

- SBA Loans: Small Business Administration (SBA) loans are government-backed loans that offer more favorable terms and lower interest rates than traditional loans.

- Equipment Financing: This type of loan is specifically designed to help businesses purchase new or used equipment needed to operate or expand.

- Invoice Financing: Also known as accounts receivable financing, this option allows you to borrow against unpaid invoices to improve cash flow.

Understanding the different types of small business loans available is essential in determining which option best suits your specific needs. Now that we have a solid understanding of small business loans, let’s proceed to explore the requirements for obtaining a small business loan in Michigan.

Types of Small Business Loans

When it comes to small business loans, there are several options available to entrepreneurs in Michigan. Each type of loan is designed to meet different business needs and comes with its own set of terms and requirements. Understanding the various types of small business loans will help you determine which one is most suitable for your specific situation.

1. Traditional Bank Loans: Traditional bank loans are the most common type of small business loans. These loans are offered by commercial banks and require a thorough application process, including a detailed business plan, financial statements, and collateral. Traditional bank loans generally have competitive interest rates but can be more challenging to qualify for, especially for startups or businesses with less established credit histories.

2. Small Business Administration (SBA) Loans: SBA loans are government-backed loans that are administered by banks and other lenders. The SBA guarantees a portion of the loan, which reduces the lender’s risk and allows for more favorable terms. There are different types of SBA loans, including 7(a) loans for general business purposes, microloans for small capital needs, and CDC/504 loans for real estate or equipment purchases. SBA loans often have longer repayment terms and lower interest rates, but the application process can be more time-consuming.

3. Business Lines of Credit: A business line of credit is a flexible financing option that provides you access to a certain amount of funds that you can draw from as needed. Similar to a credit card, you only pay interest on the amount you borrow. This type of loan is useful for managing short-term cash flow fluctuations or financing immediate business needs.

4. Equipment Financing: If your business requires specific machinery, vehicles, or equipment, you can opt for equipment financing. This type of loan is used to purchase or lease equipment and is secured by the equipment itself. Equipment financing typically has lower interest rates and longer terms, making it easier for businesses to acquire the necessary assets without depleting their cash reserves.

5. Invoice Financing: If you have outstanding customer invoices, invoice financing allows you to borrow against those invoices before they are paid. This provides you with immediate cash flow to cover expenses or invest in growth opportunities. Invoice financing can be particularly helpful for businesses with long payment cycles or clients that consistently delay payment.

These are just a few examples of the types of small business loans available in Michigan. It’s important to research and evaluate each option based on your business needs, financial situation, and long-term goals. In the next section, we will discuss the requirements for obtaining a small business loan in Michigan.

Requirements for Getting a Small Business Loan

Obtaining a small business loan in Michigan requires meeting certain requirements set by lenders. While the specific criteria may vary depending on the lender and the type of loan you’re applying for, there are a few common requirements that most lenders look for. Being aware of these requirements will help you prepare your application and increase your chances of securing a loan.

1. Business Plan: A well-developed business plan is essential when applying for a small business loan. This document outlines your business’s goals, market analysis, competitive advantage, and financial projections. Lenders want to see that you have a solid plan in place and that you can generate sufficient revenue to repay the loan.

2. Credit History: Lenders will evaluate your personal and business credit history to assess your creditworthiness. A strong credit history demonstrates your ability to manage debt responsibly and increases your chances of loan approval. It’s important to review your credit reports, address any errors or discrepancies, and ensure your credit score is as high as possible before applying for a loan.

3. Collateral: Many lenders require collateral to secure the loan. Collateral can be in the form of business assets, personal assets, or both. Having valuable assets to offer as collateral gives lenders added security and increases your chances of loan approval. It’s important to have a clear understanding of what assets you can use as collateral and their value.

4. Financial Statements: Lenders will also assess your business’s financial health by reviewing financial statements, such as profit and loss statements, balance sheets, and cash flow statements. These documents provide insights into your business’s revenue, expenses, and overall financial stability. It’s crucial to maintain accurate and up-to-date financial records to present to lenders.

5. Business Experience: Lenders often consider the business owner’s experience and industry knowledge when evaluating loan applications. Demonstrating expertise and a track record of success in your industry can reassure lenders that you have the skills necessary to manage and grow your business effectively.

6. Down Payment: Some lenders may require a down payment or a certain percentage of the loan amount to be paid upfront. This shows your commitment to the loan and reduces the risk for the lender. It’s important to have the funds available to cover the down payment if required.

These are just a few of the common requirements for obtaining a small business loan in Michigan. It’s important to note that each lender may have additional criteria specific to their institution. Researching and understanding the requirements of your chosen lender will help you prepare a strong loan application.

Next, we’ll discuss the steps you should take before applying for a small business loan to increase your chances of approval.

Steps to Take Before Applying for a Small Business Loan

Before submitting your small business loan application in Michigan, it’s important to take several steps to ensure you’re well-prepared and increase your chances of approval. The following steps will help you navigate the application process and present a strong case to lenders:

1. Evaluate Your Financial Situation: Conduct a thorough assessment of your business’s financial health. Review your cash flow, profit margins, and overall financial stability. Lenders want to see that you can manage debt and have the ability to repay the loan. Consider seeking professional advice to help analyze your financials if needed.

2. Pull Your Credit Reports: Obtain your personal and business credit reports from major credit bureaus. Review them for any errors or discrepancies that may negatively impact your credit score. Address any issues and work on improving your credit score before applying for the loan.

3. Create a Solid Business Plan: Craft a comprehensive business plan that outlines your business’s goals, target market, competitive analysis, marketing strategies, and financial projections. Your business plan should demonstrate not only your understanding of the industry but also your ability to generate revenue and repay the loan.

4. Prepare Necessary Documentation: Gather all the required documents, such as financial statements, tax returns, bank statements, and legal documents. Ensure that all financial records are accurate, up-to-date, and organized. Having these documents readily available will expedite the application process.

5. Research Loan Options: Explore various lenders and loan programs available in Michigan. Compare interest rates, repayment terms, and eligibility criteria to find the best fit for your business. Consider the reputation and reliability of the lender to ensure that they align with your business needs.

6. Strengthen Your Collateral: If collateral is required for the loan, assess the value and condition of your assets. Maintain proper documentation and appraisals to prove the worth of your collateral. Improving the quality or quantity of collateral can improve your chances of loan approval.

7. Build Relationships: Establish relationships with potential lenders before applying for the loan. Attend networking events, join business organizations, or participate in loan programs designed to help small businesses in Michigan. Building rapport with lenders can increase your credibility and create a favorable impression.

8. Improve Cash Flow: Take steps to improve your business’s cash flow before applying for a loan. Reduce unnecessary expenses, negotiate better terms with suppliers, or explore options to increase revenue. Demonstrating a healthy cash flow can strengthen your loan application.

By following these steps, you’ll be well-prepared to apply for a small business loan in Michigan. Taking the time to evaluate your financial situation, gather necessary documentation, and strengthen your loan application will improve your chances of approval. The next section will focus on researching small business loan options specifically in Michigan.

Researching Small Business Loan Options in Michigan

When it comes to obtaining a small business loan in Michigan, it’s crucial to conduct thorough research to find the right loan options for your specific needs. Here are some key steps to help you in your research:

1. Identify Your Loan Purpose: Determine the specific purpose for which you need the loan. Whether it’s purchasing equipment, expanding your business, managing cash flow, or starting a new venture, understanding your loan purpose will help narrow down your options.

2. Research Local Banks and Credit Unions: Start your research by looking into local banks and credit unions in Michigan. These financial institutions often offer specific loan programs tailored for small businesses in the area. Check their websites or visit their branches to gather information about their loan products, interest rates, and eligibility criteria.

3. Explore Small Business Administration (SBA) Loans: The Small Business Administration (SBA) provides various loan programs to assist small businesses. Visit the SBA website or connect with local SBA offices in Michigan to learn about their loan options. SBA loans often have favorable terms, lower interest rates, and longer repayment periods.

4. Consider Non-Bank Lenders: Non-bank lenders, such as online lenders or alternative financing platforms, can offer additional loan options for small businesses in Michigan. These lenders may have more flexible requirements, quicker approval processes, and tailored loan programs to suit various business needs.

5. Networking and Local Resources: Tap into the local business community by attending networking events, joining business organizations, and connecting with other small business owners in Michigan. They can provide valuable insights and recommendations based on their own experiences with lenders and loan options.

6. Consult with a Financial Advisor: If you need guidance in navigating the loan options and selecting the best fit for your business, consider consulting with a financial advisor or small business consultant. They can provide personalized advice based on your specific financial situation and long-term goals.

7. Read Reviews and Testimonials: Look for reviews and testimonials from other small business owners who have obtained loans in Michigan. Online platforms, business directories, and industry-specific forums can be great sources of information to gauge the reputation and reliability of lenders.

8. Compare Interest Rates and Terms: Finally, compare the interest rates, repayment terms, fees, and any additional requirements of the loan options you’ve researched. While the interest rate is important, it’s also crucial to consider the overall cost and suitability of the loan for your specific business goals.

By conducting thorough research and considering these factors, you’ll be better equipped to make informed decisions about the small business loan options available to you in Michigan. In the next section, we will discuss how to choose the right small business loan provider for your needs.

Choosing the Right Small Business Loan Provider

When it comes to obtaining a small business loan in Michigan, choosing the right loan provider is crucial for the success of your business. The right loan provider will offer favorable terms, competitive interest rates, and exceptional customer service. Here are some key factors to consider when choosing a small business loan provider:

1. Reputation and Reliability: Research the reputation of the loan provider by reading reviews, testimonials, and checking their track record. Look for lenders with positive feedback from other small business owners in Michigan. A reliable loan provider should have transparent policies, excellent customer service, and a history of successfully assisting businesses.

2. Loan Options: Consider whether the loan provider offers a variety of loan options that cater to different business needs. Having a diverse range of loan programs ensures that you can find the right financing solution for your specific circumstances.

3. Interest Rates and Fees: Compare the interest rates and fees offered by different loan providers. While interest rates may vary based on the type of loan and your business’s financial health, it’s important to find a loan provider that offers competitive rates and manageable fees.

4. Eligibility Requirements: Review the eligibility criteria set by each loan provider. Some lenders may have stricter requirements compared to others. Choose a loan provider whose criteria align with your business’s financial situation, credit history, and industry expertise.

5. Flexibility: Assess the flexibility of the loan provider in terms of repayment terms, loan amounts, and repayment schedules. Look for a loan provider that can accommodate your specific needs and offer options that work well with your business’s cash flow and projected revenue.

6. Application Process and Turnaround Time: Consider the loan provider’s application process and the anticipated turnaround time. A streamlined and efficient application process ensures that you receive a prompt response and can move forward with your business plans in a timely manner.

7. Customer Support: Evaluate the level of customer support provided by the loan provider. Prompt and helpful customer service can make a significant difference, especially if you need assistance during the application process or have questions regarding loan terms and conditions.

8. Additional Resources and Support: Some loan providers offer additional resources and support to help small businesses succeed. Look for providers who offer educational resources, business mentoring, or networking opportunities that can further contribute to the growth and success of your business.

By considering these factors, you’ll be able to choose the right small business loan provider in Michigan. Remember to weigh the pros and cons, assess your business’s specific needs, and ensure that the loan provider aligns with your long-term goals. In the next section, we will discuss how to properly prepare your small business loan application.

Preparing Your Small Business Loan Application

When it comes to applying for a small business loan in Michigan, proper preparation is key to increase your chances of approval. Taking the time to gather and organize the necessary documents and present a strong case for your loan will significantly improve your application’s chances of success. Here are some important steps to help you prepare your small business loan application:

1. Review the Loan Requirements: Carefully review the loan requirements provided by the lender. Understand the eligibility criteria, loan terms, and required documentation. Ensure that you meet all the necessary prerequisites before proceeding with the application process.

2. Gather Essential Documents: Collect all the required documents, such as financial statements, tax returns, bank statements, business licenses, and legal documents. Ensure that these documents are up-to-date, organized, and accurately reflect your business’s financial health. Having these documents readily available will make the application process smoother.

3. Prepare a Well-Crafted Business Plan: Develop a comprehensive business plan that highlights your business’s goals, market analysis, competitive advantage, financial projections, and repayment strategy. Tailor your business plan to showcase why your business is a good candidate for the loan and how you plan to use the funds to grow and succeed.

4. Showcase your Financial Stability: Provide evidence of your business’s financial stability through financial statements, cash flow analysis, and profitability. Emphasize any positive trends or growth potential that reflects your ability to repay the loan. If your business has faced financial challenges, be prepared to explain the circumstances and provide a recovery plan.

5. Highlight your Industry Expertise: Demonstrate your knowledge and experience in your industry to showcase your ability to successfully manage your business. Explain how your expertise contributes to the growth and sustainability of your business, and how it positions you as a reliable borrower.

6. Prepare a Loan Repayment Plan: Outline a solid loan repayment plan in your application. Clearly illustrate how you will generate sufficient revenue to make timely loan payments. Include financial projections and cash flow analysis to demonstrate your business’s capacity to handle loan repayments.

7. Address any Credit Concerns: Provide explanations for any credit issues or inconsistencies in your credit history. If you have taken steps to rectify past credit problems or have a valid reason for any negative marks, ensure that you address them in your application. Emphasize any recent positive credit activities or improvements.

8. Edit and Proofread: Review your application thoroughly for errors, typos, and inconsistencies. Ensure that all information is accurate and presented in a clear and professional manner. A well-polished application reflects your attention to detail and professionalism.

By following these steps and preparing a strong small business loan application, you increase your chances of obtaining the funding you need. Take the time to gather the necessary documents, craft a robust business plan, and present your financial stability and industry expertise in a compelling way. In the next section, we will discuss how to submit your small business loan application.

Submitting Your Small Business Loan Application

After carefully preparing your small business loan application, it’s time to submit it to the lender. Submitting your application correctly and efficiently is crucial to ensure that your loan request is processed promptly. Here are some important steps to follow when submitting your small business loan application:

1. Contact the Lender: Prior to submitting your application, reach out to the lender and inquire about their preferred method of submission. Some lenders have an online application process, while others may require you to submit physical copies of the application forms and documents. Clarify any requirements or questions you may have with the lender.

2. Double-Check Your Application: Before submitting your application, meticulously review all the information provided. Ensure that every section is filled out accurately and completely. Double-check that all supporting documents are included and properly organized. Mistakes or missing information could cause delays or even result in a rejection of your application.

3. Submit the Application: Follow the lender’s guidelines for submitting your application. If submitting online, carefully follow the instructions provided on their website. If you need to submit physical copies, make copies of your application and supporting documents. Label each document clearly and securely package them for submission.

4. Keep Copies for your Records: Before submitting your application, make copies of all documents for your records. This will ensure that you have a complete set of information in case of any questions or discrepancies that may arise later in the process. These copies can also serve as a reference for future loan applications or when dealing with other lenders.

5. Follow Up with the Lender: After submitting your application, it’s a good practice to follow up with the lender to confirm that they have received your application. This will provide you with peace of mind and allow you to address any potential issues or missing documents promptly. It also shows your commitment and proactive approach to securing the loan.

6. Be Patient: Once your application is submitted, be prepared to wait for a response from the lender. The timeline for approval can vary depending on the lender’s process and workload. Practice patience and resist the urge to repeatedly contact the lender for updates. Instead, use this time to focus on other aspects of your business and continue exploring alternative financing options.

7. Respond to Requests for Additional Information: During the review process, the lender may request additional information or clarification about certain aspects of your application. Promptly respond to these requests in a timely manner and provide the requested information. This cooperative approach will demonstrate your commitment and responsiveness to the lender.

Remember, each lender may have their own unique process for submission and review, so it’s important to follow their guidelines and communicate effectively. By carefully submitting your small business loan application, you position yourself for a smoother review process and increase your chances of approval. In the final section, we will discuss what to expect after applying for a small business loan in Michigan.

What to Expect After Applying for a Small Business Loan

After you’ve submitted your small business loan application in Michigan, it’s important to understand what to expect during the post-application phase. While the exact timeline and process can vary depending on the lender, here are some common scenarios and steps to anticipate:

1. Application Review: The lender will review your application, including all the supporting documents and information provided. This review process may take several days or weeks, depending on the lender’s workload and the complexity of your application.

2. Validation and Verification: During the review process, the lender may validate the information you’ve provided. They may verify the accuracy of financial statements, conduct credit checks, contact references, or request additional documentation. Promptly respond to any such requests to ensure a smooth process.

3. Underwriting: If your application passes the initial review and verification stage, it will move to the underwriting phase. During underwriting, the lender assesses the risk associated with your loan and evaluates whether it aligns with their lending criteria. This process involves a careful analysis of your business’s financial health and creditworthiness.

4. Loan Approval or Denial: Based on their evaluation, the lender will either approve or deny your loan application. If approved, you will receive a loan offer outlining the terms, conditions, and loan amount. If denied, the lender will provide a detailed explanation of the reasons for the denial.

5. Loan Acceptance and Documentation: If you accept the loan offer, you will need to review and sign the loan agreement. Read the terms and conditions carefully, ensuring that you understand the repayment structure, interest rates, and any other applicable fees. Provide any additional documentation or information requested by the lender.

6. Funding: Once all the required documentation is completed and submitted, the lender will initiate the funding process. The time it takes to receive the funds can vary depending on the lender and the method of disbursement. Some lenders may offer direct deposit, while others may issue a physical check or transfer the funds to your designated bank account.

7. Loan Repayment: After receiving the funds, it’s essential to manage your loan repayment responsibly. Familiarize yourself with the repayment schedule, including due dates and the preferred method of payment. Set up systems to ensure timely payments, and maintain open communication with the lender if any challenges or changes arise.

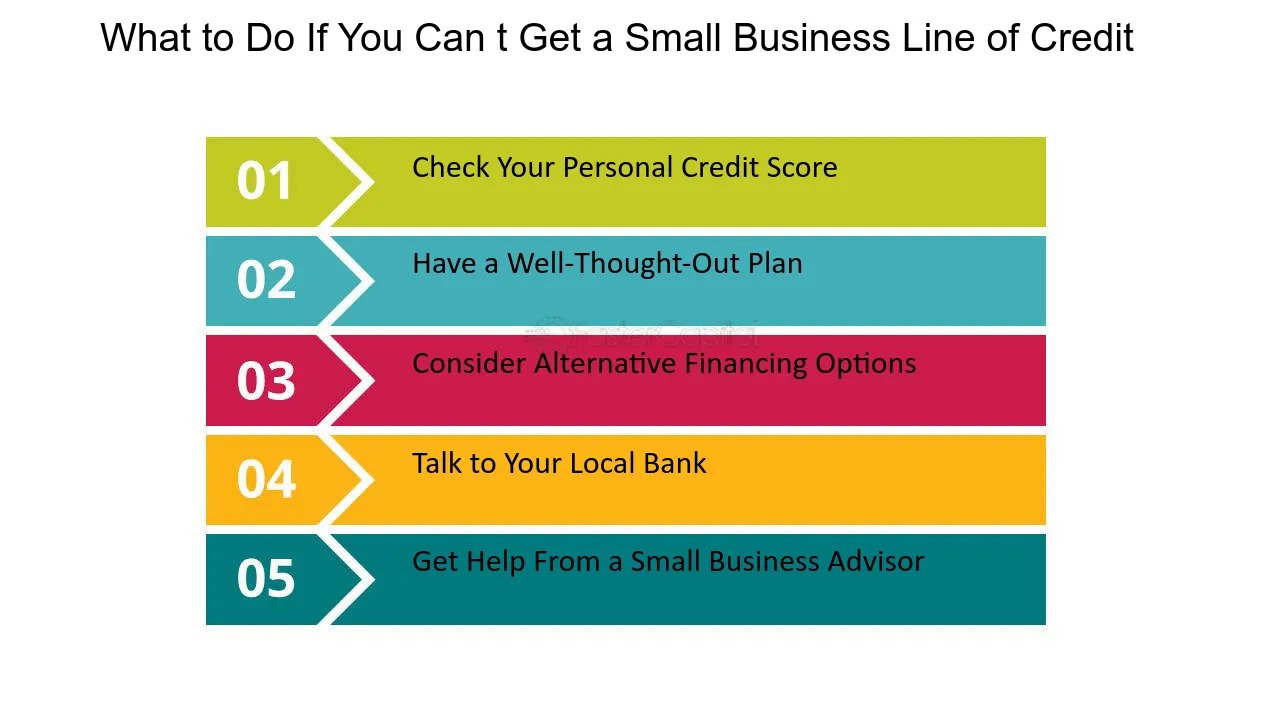

Throughout the process, it’s important to maintain open communication with the lender. If you have any questions or concerns, don’t hesitate to reach out to them directly. Remember, the loan process can take time, so practice patience while awaiting a response. In the event of a loan denial, use the feedback provided to assess your options and consider alternative financing solutions that may better fit your business’s needs.

By understanding what to expect after applying for a small business loan in Michigan, you can navigate the process more confidently and anticipate the next steps in securing the funding your business requires. Congratulations on taking this significant step toward fulfilling your business goals!

Conclusion

Congratulations! You’ve reached the end of our comprehensive guide on how to get a small business loan in Michigan. We’ve covered a lot of ground, from understanding small business loans to preparing and submitting your loan application. Securing the necessary funding for your business is undoubtedly a significant milestone, and the information provided in this guide will help you navigate the process with confidence.

Remember, the journey to obtaining a small business loan involves careful preparation, research, and strategic decision-making. Take the time to evaluate your business’s financial health, gather the necessary documentation, and develop a strong business plan that showcases your vision and potential for growth. Research different loan providers and compare their terms and conditions to find the right fit for your specific needs.

Throughout the application process, maintain open communication with lenders, promptly respond to their requests, and follow up accordingly. Understand that the loan approval process may take time, and be patient while awaiting a response. In the event of a loan denial, use the feedback provided as an opportunity to reassess and strengthen your loan application for the future.

Remember, securing a small business loan is just one aspect of growing and managing your business. Once you receive the funds, utilize them wisely and responsibly, with a clear plan for repayment. Continuously evaluate your business’s financial health and adjust your strategies as necessary to ensure long-term success.

We hope this guide has provided you with valuable insights and actionable information to help you navigate the process of obtaining a small business loan in Michigan. Remember to leverage the resources available to you, such as financial advisors, business organizations, and networking events, to further support and guide you on your entrepreneurial journey.

Best of luck in your pursuit of securing a small business loan, and may your business thrive and prosper in the vibrant landscape of Michigan.