Finance

How To Get A Small Business Loan In Arizona

Modified: December 30, 2023

Looking for finance options for your small business in Arizona? Learn how to get a small business loan to fuel your entrepreneurial dreams.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Small Business Loans

- Types of Small Business Loans

- Eligibility Criteria for Small Business Loans

- How to Prepare Your Business for a Loan Application

- Finding Small Business Loan Options in Arizona

- Documentation Required for a Small Business Loan Application

- Tips for a Successful Small Business Loan Application

- Choosing the Right Small Business Loan for Your Arizona Business

- Conclusion

Introduction

Starting or growing a small business requires capital, and one of the most common ways to secure funding is through a small business loan. However, navigating the loan application process can be overwhelming, especially for entrepreneurs who are new to the world of finance.

In this article, we will guide you through the process of obtaining a small business loan in Arizona. We will discuss the different types of loans available, the eligibility criteria, and the documentation required for a loan application. Additionally, we will provide valuable tips on how to prepare your business for a loan application and increase your chances of success.

Arizona offers a thriving business environment, with a strong entrepreneurial spirit and a range of resources and support. Whether you’re starting a new venture or looking to expand your existing business, securing a small business loan can provide the necessary funds to fuel your growth.

With the right knowledge and preparation, you can confidently navigate the loan application process and secure the financing you need to take your business to the next level. So, let’s dive in and explore the world of small business loans in Arizona.

Understanding Small Business Loans

Small business loans are financial products designed to provide capital for entrepreneurs and small business owners. These loans can be used for a variety of purposes, such as starting a business, purchasing inventory or equipment, expanding operations, or covering day-to-day expenses.

There are several important factors to consider when understanding small business loans:

- Loan Amount: Small business loans can range from a few thousand dollars to several million, depending on the lender and the specific needs of the business.

- Interest Rate: The interest rate on a small business loan varies based on factors such as the borrower’s credit score, the loan amount, and the term of the loan. It’s important to compare interest rates from different lenders to find the best option for your business.

- Repayment Term: Small business loans typically have repayment terms ranging from a few months to several years. Short-term loans are usually repaid within a year, while long-term loans can have repayment periods of up to 25 years.

- Secured vs. Unsecured Loans: Small business loans can be secured or unsecured. Secured loans require collateral, such as real estate or equipment, to secure the loan, while unsecured loans do not require collateral but often have higher interest rates.

- Use of Funds: It’s important to have a clear plan for how you will use the loan funds and how they will benefit your business. This can help lenders determine the viability of your loan application.

Understanding these key aspects of small business loans will help you make informed decisions when applying for financing. It’s important to carefully evaluate your business’s needs and financial situation before determining the type of loan that best suits your requirements.

Types of Small Business Loans

When seeking a small business loan in Arizona, it’s important to understand the various types of loans that are available. Each type of loan has its own requirements, terms, and benefits, so it’s crucial to choose the option that best aligns with your business’s needs. Here are some common types of small business loans:

- Term Loans: Term loans are the most traditional type of small business loan, where the borrower receives a lump sum of money upfront and repays it over a set term with interest. These loans are typically used for long-term investments, such as buying equipment or expanding operations. Term loans can be secured or unsecured, and repayment terms vary.

- SBA Loans: Small Business Administration (SBA) loans are partially guaranteed by the government, making them a popular choice for small businesses. SBA loans offer longer repayment terms and lower interest rates compared to traditional loans. There are different types of SBA loans, including the 7(a) Loan Program, SBA Express Loans, and CDC/504 Loan Program.

- Business Line of Credit: A business line of credit provides a flexible source of funding that you can access as needed. It functions similarly to a credit card in that you can borrow up to a certain limit and only pay interest on the amount you use. This type of loan is ideal for meeting short-term cash flow needs.

- Equipment Financing: If your business requires new equipment or machinery, you can opt for an equipment financing loan. This type of loan is secured by the equipment itself and helps spread out the cost over a specific term. The equipment serves as collateral, which reduces the risk for lenders and often results in lower interest rates.

- Invoice Financing: Invoice financing, also known as accounts receivable financing, allows businesses to borrow against their outstanding invoices. Lenders provide a percentage of the invoice amount upfront, and once the customer pays, the lender takes a fee and returns the remaining balance to the business. This helps businesses maintain their cash flow without waiting for invoice payments.

These are just a few of the many types of small business loans available. Other options include merchant cash advances, microloans, and personal loans. It’s essential to research and compare the terms, interest rates, and eligibility criteria for each loan type to find the best fit for your business.

Eligibility Criteria for Small Business Loans

When applying for a small business loan in Arizona, you will need to meet certain eligibility criteria set by lenders. While specific requirements may vary depending on the lender, here are some common factors that lenders consider when evaluating loan applications:

- Credit Score: Your personal and/or business credit score is a significant factor that lenders consider. A higher credit score demonstrates your ability to manage debt responsibly and increases your chances of loan approval.

- Business Age and Revenue: Lenders often have minimum requirements for the age of your business and its annual revenue. Startups and businesses with low revenue may find it more challenging to qualify for certain types of loans.

- Cash Flow: Lenders want to ensure that your business has sufficient cash flow to meet loan repayments. They may analyze your financial statements, including income statements and cash flow projections, to assess your business’s ability to generate revenue.

- Collateral: Some loans, such as secured term loans, may require collateral to secure the loan. Collateral can include real estate, equipment, or other valuable assets that lenders can take possession of in case of default.

- Business Plan: Having a well-structured business plan that outlines your goals, market analysis, and financial projections is crucial for loan applications. A strong business plan showcases your commitment and the viability of your business.

- Industry: Lenders may assess the industry in which your business operates. Some industries are considered higher risk than others, and this may impact your loan eligibility.

It’s important to note that meeting the minimum eligibility criteria does not guarantee loan approval. Lenders will evaluate your overall financial health and assess the risk associated with lending to your business. Additionally, different lenders may have their own specific criteria, so it’s important to research and understand the requirements of each lender before applying.

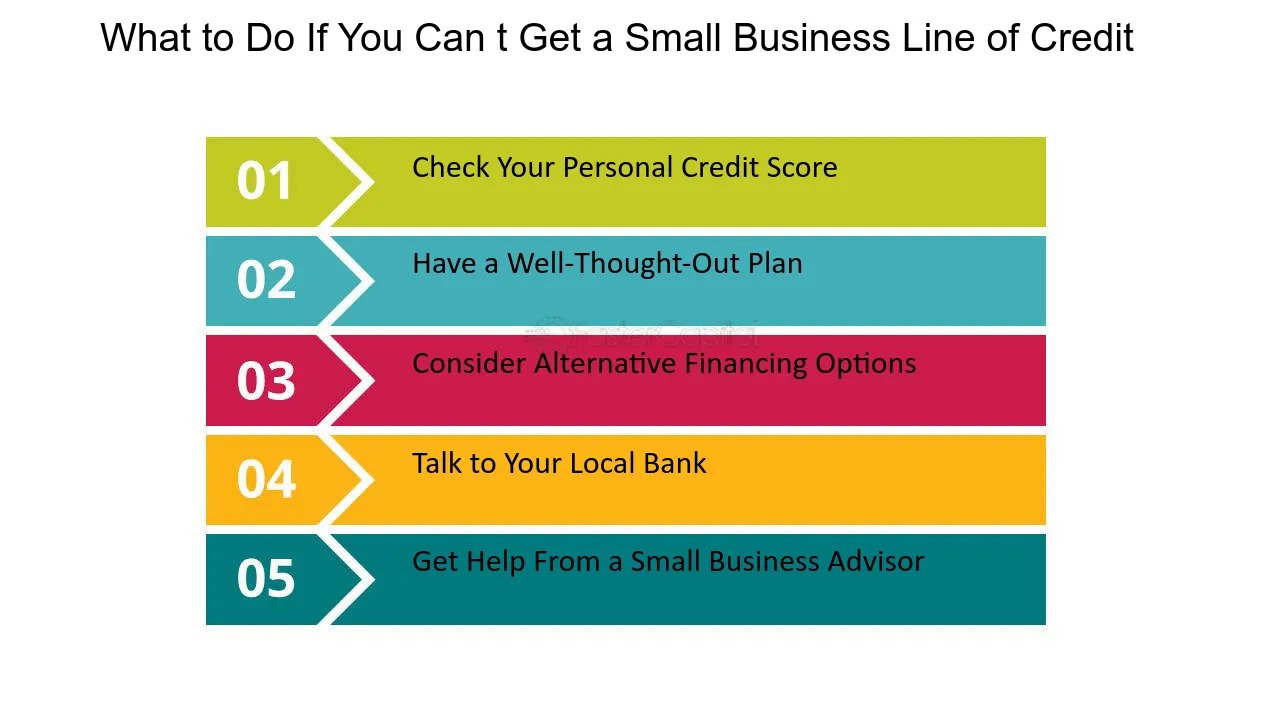

If you find that you don’t meet the eligibility criteria for a traditional small business loan, alternative financing options such as microloans or crowdfunding platforms may be worth exploring. These options often have more flexible requirements and can provide financing for businesses that may not qualify for traditional loans.

How to Prepare Your Business for a Loan Application

Preparing your business for a loan application is essential to increase your chances of approval and secure favorable terms. Here are some steps to help you prepare:

- Review your credit history: Before applying for a loan, it’s crucial to review your personal and business credit reports. Address any errors or discrepancies and take steps to improve your credit score if necessary.

- Create a solid business plan: A comprehensive business plan demonstrates your understanding of your market, competitors, and financial projections. It also provides lenders with confidence in your ability to repay the loan.

- Organize your financial documents: Lenders will require various financial documents, including bank statements, tax returns, financial statements, and inventory records. Ensure all your financial documents are up to date and organized for easy access.

- Improve your cash flow: Lenders want to see that your business can generate consistent cash flow to meet loan repayments. Take steps to improve cash flow, such as reducing expenses, increasing sales, or negotiating better payment terms with suppliers.

- Build relationships with lenders: Establishing relationships with lenders before applying for a loan can be beneficial. Attend networking events, join business associations, and consider working with a local bank or credit union that understands the Arizona business landscape.

- Reduce existing debt: Lenders will assess your business’s debt-to-income ratio, so it’s important to reduce any existing debt before applying for a loan. Pay off outstanding debts or consider refinancing options to lower your monthly payments.

- Prepare strong collateral: If you’re applying for a secured loan, ensure you have valuable assets to use as collateral. Real estate, equipment, and inventory are common forms of collateral that lenders consider.

- Address potential red flags: Before applying for a loan, address any potential red flags that lenders may see. This could include resolving legal issues, tidying up your business’s online presence, or addressing any negative reviews or complaints.

By taking these steps to prepare your business for a loan application, you demonstrate your professionalism and commitment to financial responsibility. Being well-prepared will help you present a strong case to lenders and increase your chances of securing the financing you need.

Finding Small Business Loan Options in Arizona

When searching for small business loan options in Arizona, you have several avenues to explore. Here are some ways to find suitable lenders:

- Local Banks and Credit Unions: Start your search by contacting local banks and credit unions that operate in your area. These financial institutions often have a good understanding of the local business environment and may offer competitive loan options.

- Small Business Administration (SBA): The Small Business Administration provides loan guarantee programs that make it easier for small businesses to secure financing. The SBA works with approved lenders to offer loans under various programs, including the 7(a) Loan Program and the CDC/504 Loan Program.

- Online Lenders: Online lenders have become increasingly popular due to their quick application processes and flexible loan options. Platforms such as LendingClub, OnDeck, and Kabbage offer small business loans and lines of credit tailored to the needs of entrepreneurs.

- Business Development Organizations: Look for local business development organizations and economic development agencies in Arizona. These organizations often provide resources, grants, and loan programs to support small businesses in the state.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms may offer loans with competitive rates and unique repayment structures.

- Networking and Referrals: Don’t underestimate the power of networking. Attend business events and join industry associations to connect with fellow entrepreneurs who may have insights or recommendations on lenders they have worked with.

When considering various lenders, pay attention to factors like interest rates, repayment terms, fees, and customer reviews. Comparing multiple options will enable you to make an informed decision based on your business’s specific needs and financial situation.

Additionally, take advantage of online resources and loan comparison websites that allow you to evaluate loan options from different lenders side by side. This can streamline your research process and help you find the best small business loan options in Arizona.

Documentation Required for a Small Business Loan Application

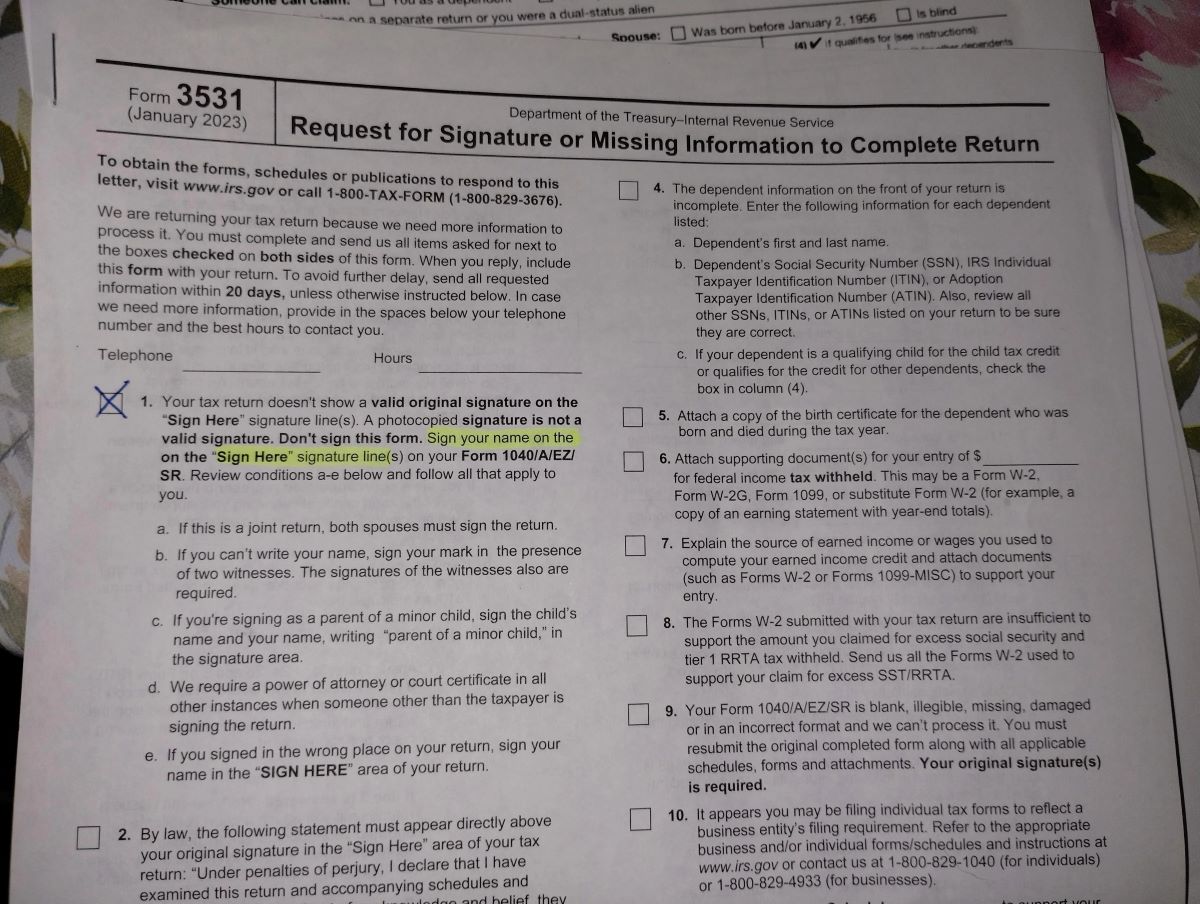

When applying for a small business loan in Arizona, it’s essential to gather and organize the necessary documentation to support your loan application. While the specific requirements may vary depending on the lender and the type of loan you are applying for, here are some common documents that you may need to provide:

- Business Plan: A comprehensive business plan outlines your business’s mission, market analysis, financial projections, and growth strategies. Lenders use this document to evaluate the viability of your business and its potential for success.

- Personal and Business Tax Returns: Lenders typically request personal and business tax returns for the past two to three years. This helps determine your income, expenses, and overall financial health.

- Bank Statements: Lenders will require recent bank statements to assess your business’s cash flow and financial stability. Aim to provide at least three to six months of business bank statements.

- Financial Statements: These include income statements, balance sheets, and cash flow statements. These documents provide a snapshot of your business’s financial health and performance.

- Business Licenses and Permits: Proof of any required licenses, permits, or certifications related to your industry or business operations.

- Proof of Collateral: If you’re applying for a secured loan, you may need to provide documentation, such as property deeds or appraisal reports, to prove the value of the collateral.

- Legal Documents: This may include articles of incorporation, partnership agreements, trademarks or patents, and any other legal documents that demonstrate the ownership and structure of your business.

- Personal Identification: Valid identification documents, such as driver’s license or passport, for all business owners or key individuals involved in the loan application.

- References: Some lenders may request references, such as professional contacts or past clients, to vouch for your business’s credibility and reliability.

It’s crucial to check with your specific lender to understand their documentation requirements. Prepare these documents in advance and ensure they are up to date and accurate. Keeping your financial records organized not only simplifies the loan application process but also showcases your professionalism and commitment to responsible financial management.

Tips for a Successful Small Business Loan Application

Securing a small business loan in Arizona requires careful preparation and attention to detail. To increase your chances of a successful loan application, consider the following tips:

- Research and Select the Right Loan: Understand the specific financing needs of your business and select the loan type that aligns with those needs. Research different lenders, compare interest rates and terms, and choose a lender that best suits your business goals.

- Prepare a Strong Business Plan: Craft a well-structured and detailed business plan that highlights your market analysis, competitive advantage, financial projections, and growth strategies. A solid business plan showcases your understanding of your industry and your ability to manage the business.

- Improve Your Credit Score: Lenders often evaluate personal and business credit scores. Take steps to improve your credit score by paying bills on time, reducing credit card balances, and addressing any errors on your credit report. A higher credit score enhances your credibility to lenders.

- Organize Financial Documents: Gather all the necessary financial documents, such as bank statements, tax returns, and financial statements. Ensure they are accurate, up to date, and neatly organized for easy access during the loan application process.

- Show Stable Cash Flow: Lenders want to see that your business can generate consistent cash flow. Take steps to improve your cash flow by reducing expenses, increasing sales, and staying on top of accounts receivable.

- Build Relationships with Lenders: Establishing relationships with lenders before applying for a loan can be advantageous. Attend networking events, join business associations, and engage with local banks or credit unions. Building relationships can increase your chances of getting approved and securing favorable terms.

- Prioritize Collateral: If you’re applying for a secured loan, ensure you have valuable assets that can serve as collateral. Having substantial collateral can provide lenders with increased confidence in your loan application.

- Be Realistic: Set realistic expectations for loan terms, interest rates, and repayment structures. Understanding the financial position of your business and demonstrating a responsible approach can help build trust with lenders.

- Seek Professional Advice: Consider consulting with a financial advisor or accountant who specializes in small business financing. Their expertise can help you navigate the loan application process, understand the terms and conditions, and ensure you make informed decisions.

Remember, each lender has specific requirements and criteria. Take the time to understand their guidelines and tailor your loan application accordingly. By following these tips, you can present a strong application and increase your chances of obtaining the small business loan you need to fuel the growth and success of your Arizona business.

Choosing the Right Small Business Loan for Your Arizona Business

When seeking a small business loan for your Arizona business, it’s crucial to choose the right loan that aligns with your specific needs and financial circumstances. Here are important considerations to help you make an informed decision:

- Loan Purpose: Determine the purpose of the loan and identify the type of financing that suits your business’s needs. Whether you require funds for working capital, equipment purchase, or expansion, there are various loan options available.

- Loan Amount: Assess your borrowing needs and identify the appropriate loan amount. Consider your business’s financial health, cash flow, and repayment capacity.

- Interest Rates and Terms: Compare interest rates, repayment terms, and fees offered by different lenders. Consider the total cost of the loan over its term to understand the financial impact on your business.

- Collateral Requirements: Evaluate whether you have valuable assets to provide as collateral for a secured loan, which may help you secure a lower interest rate. If you prefer an unsecured loan, be prepared for potentially higher interest rates.

- Repayment Flexibility: Consider the repayment structure that best suits your business’s cash flow. Some loans may offer fixed monthly payments, while others may have variable or seasonal payment options.

- Lender Reputation: Research and choose lenders with a solid reputation, good customer service, and positive reviews. Look for lenders experienced in working with small businesses and those familiar with the Arizona business environment.

- Eligibility Requirements: Evaluate the eligibility criteria and determine if you meet the lender’s requirements in terms of credit score, business revenue, and other factors. Be realistic about your chances of approval.

- Loan Application Process: Understand the application process, documentation requirements, and the expected timeline for receiving funds. Consider the ease and convenience of the lender’s application process.

- Additional Benefits: Some lenders may offer additional benefits such as business advisory services, educational resources, or networking opportunities. Assess these additional benefits as they can contribute to your business’s growth and success.

It’s important to thoroughly research and compare loan options before making a decision. Consult with financial advisors or industry experts who can provide guidance based on your specific business needs.

Remember, choosing the right small business loan is key to funding your business’s growth and ensuring financial stability. Take your time, analyze your options, and select the loan that best positions your Arizona business for success.

Conclusion

Securing a small business loan in Arizona is an important step in fueling the growth and success of your business. By understanding the loan application process, exploring different loan options, and preparing your business accordingly, you can increase your chances of approval and secure favorable terms.

When applying for a small business loan, take the time to research and evaluate lenders, understanding their requirements, interest rates, and repayment terms. Ensure that you have a solid business plan, organized financial documents, and a strong credit profile. Additionally, building relationships with lenders and seeking professional advice can provide valuable support throughout the loan application process.

Consider the specific needs of your business when selecting the right loan type. Assess factors such as loan purpose, loan amount, interest rates, collateral requirements, and repayment flexibility. By choosing the right loan, you can effectively meet your business’s financial requirements while managing cash flow and ensuring long-term financial sustainability.

Ultimately, a successful small business loan application will provide your Arizona business with the capital it needs to flourish. Whether you’re starting a new venture, expanding an existing business, or navigating challenging times, securing the right loan can be instrumental in achieving your goals.

Remember, the world of small business loans can be complex, but with careful preparation, research, and a strategic approach, you can navigate through the process with confidence. Take the necessary steps to present your business in the best possible light, choose the right loan for your needs, and seize the opportunities that come with securing financing for your Arizona business.