Finance

How Do I Find Out My Pin For The IRS?

Published: October 31, 2023

Looking for your IRS PIN? Discover how to find out your PIN for the IRS and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of taxes, where a tiny four-digit number holds significant importance – your PIN for the Internal Revenue Service (IRS). Whether you’re a seasoned taxpayer or new to the filing process, understanding the significance of your IRS PIN is crucial.

The IRS PIN serves as a unique identifier, providing an added layer of security to your tax return. It helps protect your sensitive information and prevents fraudsters from filing false returns using your Social Security number. Your PIN is required when filing your taxes electronically, and without it, your return may be rejected.

But what if you can’t remember your IRS PIN? Don’t worry; there are several methods in place to help you retrieve it. In this article, we will explore different ways to find out your PIN for the IRS, ensuring a smooth and secure tax filing experience.

Remember, your PIN is as important as your Social Security number, so it’s essential to keep it secure and easily accessible when needed.

Understanding the Importance of PIN for the IRS

Before we delve into the various methods of retrieving your IRS PIN, let’s take a moment to understand why it holds such importance. The IRS PIN serves as a safeguard against identity theft and fraud, ensuring that only you can access and file your tax return.

Here are a few key reasons why your IRS PIN is crucial:

- Fraud Prevention: Your PIN adds an extra layer of security to your tax return. It helps verify your identity, reducing the risk of someone else filing a fraudulent return using your information.

- E-filing Requirement: If you choose to file your taxes electronically, which is the most common method nowadays, you will need your PIN to complete the process. Without it, your return may be rejected.

- Taxpayer Authentication: The IRS uses your PIN to authenticate your identity when accessing certain online services or when contacting them for assistance. It ensures that only authorized individuals can access your tax information.

It’s important to note that your IRS PIN is different from your e-file signature PIN, which is used specifically for signing your return electronically. The IRS PIN is a separate code designed to protect your tax information and prevent unauthorized access.

Now that we understand the significance of your IRS PIN, let’s explore the different methods available to retrieve it and ensure a hassle-free tax filing experience.

Methods to Retrieve Your IRS PIN

If you’ve misplaced or forgotten your IRS PIN, don’t panic. The IRS provides several options for retrieving it. Let’s explore these methods below:

Option 1: Retrieve Your PIN Online

The IRS offers an online tool called the “Get an IP PIN” service, which allows you to retrieve your PIN quickly and conveniently. To use this option, you will need to go to the IRS website and follow the instructions provided. The online process will require you to provide certain personal information to verify your identity, ensuring the protection of your sensitive data.

Option 2: Request Your PIN via Mail

Another method to retrieve your IRS PIN is by requesting it through mail. You can submit Form 4506, “Request for Copy of Tax Return,” to the IRS. Be sure to fill out the form correctly, providing accurate and up-to-date information. Once the IRS receives and processes your request, they will mail your PIN to the address on record. It’s important to note that this process may take several weeks, so plan accordingly if you choose this option.

Option 3: Contact the IRS for PIN Assistance

If you encounter difficulties using the online tool or prefer to speak with a representative directly, you can contact the IRS for PIN assistance. The IRS has dedicated helpline numbers specifically for PIN-related queries. By calling the appropriate helpline, you can speak with an IRS representative who will guide you through the process of retrieving your PIN over the phone.

When contacting the IRS, it’s essential to have all relevant information readily available, such as your social security number, date of birth, and other personal identification details. This will help the IRS representative verify your identity and assist you effectively.

It’s important to note that the availability of these methods may vary based on your individual circumstances. The IRS provides detailed instructions and guidance on their official website, so be sure to refer to their resources for the most accurate and up-to-date information.

Now that you are familiar with the methods available for retrieving your IRS PIN, let’s discuss a few crucial points to consider during this process.

Option 1: Retrieve Your PIN Online

If you prefer a convenient and instant method, retrieving your IRS PIN online is the way to go. The IRS offers an easy-to-use online tool called the “Get an IP PIN” service, which allows you to retrieve your PIN quickly and securely.

To begin the process, you will need to visit the IRS website and navigate to the appropriate section for retrieving your PIN. The website will guide you through a series of prompts and instructions to verify your identity and retrieve your PIN.

It’s important to have certain information readily available, such as your Social Security number, date of birth, and mailing address. This information is crucial for the online verification process, ensuring the security of your personal data.

Once you have successfully completed the online verification process, the IRS will provide you with your PIN. Make sure to keep it in a safe place, as you will need it when filing your taxes electronically.

It’s worth mentioning that the IRS may require additional identity verification measures, such as answering a series of questions based on your credit history or using a mobile phone app for two-factor authentication. These measures are in place to protect your sensitive information and prevent unauthorized access.

Keep in mind that the online retrieval option may not be available to everyone. The IRS has specific eligibility requirements for using this service. If you are ineligible or encounter any issues during the online process, don’t worry; there are alternative methods available to retrieve your PIN.

Now that you are familiar with retrieving your IRS PIN online, let’s explore another option – requesting your PIN via mail.

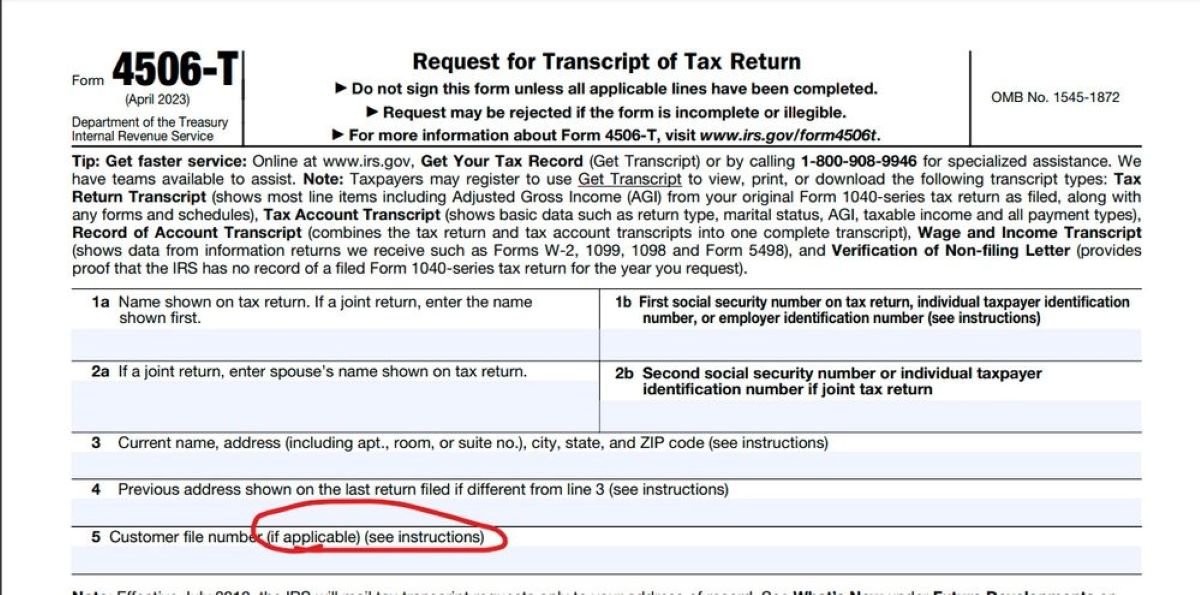

Option 2: Request Your PIN via Mail

If you prefer a more traditional method or do not have access to the internet, you can request your IRS PIN via mail. This option allows you to fill out a form and have your PIN sent to you at your registered mailing address.

To request your PIN via mail, you will need to fill out Form 4506, “Request for Copy of Tax Return.” This form is available on the IRS website and can be downloaded and printed for your convenience.

When filling out the form, make sure to provide accurate and up-to-date information, including your name, Social Security number, and mailing address. Double-check the information to avoid any delays in receiving your PIN.

Once you have completed the form, you can mail it to the appropriate IRS address mentioned in the instructions. It’s crucial to use the correct address to ensure your request reaches the right department and is processed promptly.

Keep in mind that requesting your PIN via mail may take longer than other methods. The IRS needs to process your request, verify your information, and then send your PIN to your registered mailing address. This process may take several weeks, so it’s advisable to plan ahead and allow for sufficient time to receive your PIN before the tax filing deadline.

Additionally, it’s important to update your mailing address with the IRS if there have been any recent changes. Failure to do so may result in your PIN being sent to the wrong address, causing further delays and potential complications.

Now that you are familiar with requesting your IRS PIN via mail, let’s move on to the third option – contacting the IRS for PIN assistance.

Option 3: Contact the IRS for PIN Assistance

If you prefer a more personalized approach or encounter difficulties using the online tool or requesting your PIN via mail, you can directly contact the IRS for PIN assistance. The IRS has dedicated helpline numbers specifically designed to assist taxpayers with PIN-related queries.

To contact the IRS for PIN assistance, you will need to call the appropriate helpline number provided by the IRS. It’s essential to have all relevant information readily available when making the call, such as your Social Security number, date of birth, and other personal identification details. This information will help the IRS representative verify your identity and assist you effectively.

When speaking with the IRS representative, explain that you need assistance retrieving your PIN. The representative will guide you through the necessary steps and help you retrieve your PIN over the phone. They may ask additional identity verification questions to ensure your information remains secure.

It’s important to note that contacting the IRS for PIN assistance may require some patience, as wait times can vary depending on call volumes. It’s advisable to call during non-peak hours to minimize wait times and maximize the chances of speaking with a representative promptly.

If you choose this option, be prepared to follow the instructions provided by the IRS representative accurately. They will guide you through the process, ensuring that you can retrieve your PIN and continue with your tax filing without any further issues.

Remember to keep your retrieved PIN in a secure location, as you will need it when filing your taxes electronically.

Now that we have explored the different methods of retrieving your IRS PIN, let’s discuss a few important points to consider.

Important Points to Consider

As you navigate the process of retrieving your IRS PIN, there are a few important points to keep in mind:

- Stay Updated: The IRS regularly updates its processes and methods for retrieving PINs. It’s crucial to visit the official IRS website or consult their resources for the most accurate and up-to-date information.

- Verify Eligibility: Some methods, such as retrieving your PIN online, may have eligibility requirements. Make sure to check if you meet the criteria before attempting to use a specific method.

- Protected Information: When retrieving your PIN, be cautious about providing your personal information. Ensure that you are on a secure and official IRS website or speaking with a verified IRS representative when sharing sensitive details.

- Keep the PIN Secure: Once you have retrieved your PIN, it is important to keep it in a secure location. Treat your PIN with the same level of confidentiality and protection as you would your Social Security number.

- Plan Ahead: If you choose the option to request your PIN via mail, be prepared for the potential delay in receiving it. Plan your tax filing accordingly and allow sufficient time for your PIN to arrive before the deadline.

- Update Information: Ensure that your mailing address and other contact information are up to date with the IRS. This will help avoid any delays or complications in receiving your PIN.

By considering these important points, you can navigate the process of retrieving your IRS PIN smoothly and securely.

Now that we have covered the essential points, let’s conclude this article.

Conclusion

Securing and retrieving your IRS PIN is essential for a smooth and secure tax filing experience. Whether you misplaced it or simply forgot, the IRS has provided various methods to help you retrieve your PIN.

From the convenience of retrieving it online to the more traditional route of requesting it via mail, you have options to suit your preferences and circumstances. If you encounter any difficulties, contacting the IRS directly for PIN assistance is also a viable solution.

Throughout this article, we emphasized the importance of your IRS PIN in preventing identity theft and fraud. It serves as a vital safeguard for your tax return and ensures that only you can access and file your taxes electronically.

As you navigate the process of retrieving your IRS PIN, remember to stay updated with the latest information from the IRS, verify your eligibility for specific methods, protect your personal information, and keep your PIN secure once retrieved. Planning ahead and updating your information with the IRS will also help ensure a smooth experience.

By following these guidelines and considering the important points discussed, you can retrieve your IRS PIN efficiently and confidently. With your PIN in hand, you can proceed with filing your taxes electronically, knowing that you have taken the necessary steps to protect your sensitive information.

Remember, if you have any questions or need further assistance, consult the official IRS resources or reach out to their dedicated helpline numbers for support.

So go ahead, retrieve your IRS PIN, and experience a hassle-free tax filing process while ensuring the security of your taxpayer information.