Finance

Credit Card Authorization Key Definition

Modified: December 29, 2023

Get a clear understanding of the credit card authorization key definition and how it relates to finance. Learn more about this crucial aspect of financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Credit Card Authorization Key?

Welcome to our “FINANCE” category where we delve into all things financial to help you make better informed decisions. Today, we are going to discuss the topic of Credit Card Authorization Key, a crucial element in the world of credit card processing. Curious to know what it is and how it works? Let’s dive in!

Key Takeaways:

- A credit card authorization key is a unique code generated by the payment processor to authenticate and authorize credit card transactions.

- This key acts as a digital seal of approval, ensuring that the transaction is valid and the funds will be transferred from the cardholder to the merchant.

Now, let’s dig a little deeper into understanding what a credit card authorization key is and how it functions.

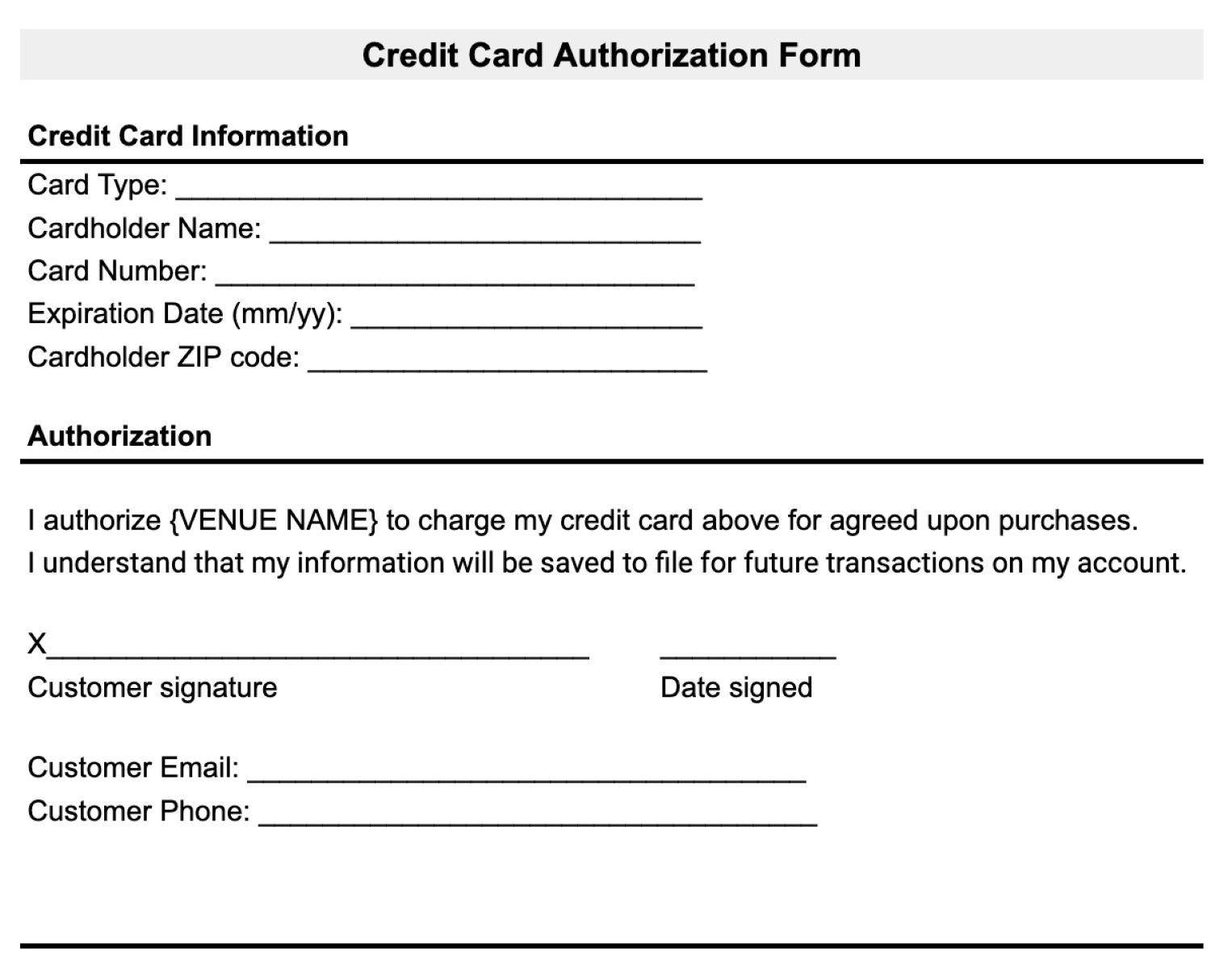

A credit card authorization key can be thought of as a virtual lock and key mechanism that safeguards the transaction process. When a customer makes a purchase using a credit card, their information is sent electronically to the payment processor for validation. The processor then generates a unique authorization key to confirm the legitimacy of the transaction.

The credit card authorization key serves two main purposes:

- Authentication: The key verifies the authenticity of the credit card by ensuring it belongs to the rightful owner and is not stolen or fraudulent.

- Authorization: The key acts as the merchant’s permission slip to charge the customer’s credit card and transfer funds from the cardholder’s account to the merchant’s account.

Without a valid authorization key, the transaction cannot be processed, and the payment will be declined. This additional layer of security helps protect both the customer and the merchant from potential fraud.

As a merchant, it is crucial to have a secure credit card authorization key system in place to ensure the smooth processing of transactions. This involves implementing measures such as tokenization and encryption to protect sensitive cardholder data and prevent unauthorized access.

Summary

In summary, a credit card authorization key is a unique code generated by payment processors to authenticate and authorize credit card transactions. It verifies the authenticity of the card and acts as the merchant’s permission to charge the customer’s account. By understanding the role of the credit card authorization key, merchants can better protect themselves and their customers from potential fraud.

We hope this blog post has shed some light on the topic of credit card authorization keys. Stay tuned for more informative articles in our “FINANCE” category. Have any questions or topics you’d like us to cover? Let us know in the comments below!