Home>Finance>How Long Does An Insurance Company Have To Investigate A Claim

Finance

How Long Does An Insurance Company Have To Investigate A Claim

Published: November 16, 2023

The investigation process for insurance claims can vary, but insurance companies typically have a specific timeframe to conduct their investigations. Learn more about the time limit for insurance claim investigations in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of an Insurance Claim

- Importance of Insurance Claim Investigation

- Legal Requirements for Insurance Claim Investigation

- Time Limits for Insurance Claim Investigation

- Factors Affecting the Duration of Insurance Claim Investigation

- Consequences of Delayed Claim Investigation

- Typical Steps Involved in an Insurance Claim Investigation

- Documentation and Evidence Gathering in Insurance Claim Investigation

- Role of Insurance Adjusters in Claim Investigation

- Strategies to Expedite the Claim Investigation Process

- Conclusion

Introduction

Welcome to the world of insurance claims, where a thorough investigation plays a pivotal role in ensuring a fair and accurate resolution. Insurance claims exist to provide financial protection in the event of unforeseen circumstances, such as accidents, property damage, or medical emergencies. When filing an insurance claim, individuals depend on their providers to investigate the circumstances surrounding the claim and determine the extent of coverage.

Insurance claim investigation is a crucial step in the claims process, as it helps insurers validate the genuineness of the claim, assess the amount of compensation, and mitigate the risk of fraudulent activities. It involves carefully assessing the evidence, gathering relevant information, and conducting interviews to make well-informed decisions.

While the primary aim of insurance claim investigation is to ensure an accurate and fair resolution, it is also driven by legal requirements and industry regulations. Insurance companies have a legal obligation to thoroughly investigate every claim before making a final decision, and the time frame for investigation varies depending on the jurisdiction and the nature of the claim.

Understanding the importance of insurance claim investigations and the factors that influence their duration is crucial for both policyholders and insurance companies. In this article, we will delve deeper into the world of insurance claim investigations, exploring the legal requirements, time limits, consequences of delays, and strategies to expedite the process. Whether you are a policyholder seeking compensation or an insurance professional looking to streamline operations, this comprehensive guide aims to provide you with valuable insights and actionable information.

Definition of an Insurance Claim

An insurance claim is a formal request submitted by an individual or business to their insurance provider, seeking financial reimbursement or coverage for a loss, damage, or incurred expenses as outlined in their insurance policy. It is the process through which policyholders seek compensation for covered losses, enabling them to recover financially from unexpected events.

Insurance claims can encompass a wide range of categories, including but not limited to:

- Auto accidents

- Property damage

- Water or fire damage

- Medical expenses

- Personal injury

- Business interruption

- Disability

When individuals purchase insurance policies, they enter into a contract with the insurance company. In the event of a covered loss or occurrence, the policyholder has the right to file a claim to receive the promised coverage or compensation.

Once a claim is filed, it initiates the insurance claim process, which involves an investigation into the circumstances surrounding the claim. This investigation is essential for insurers to assess the validity of the claim, determine the coverage amount, and prevent fraudulent activities.

It is important to note that not all losses or damages may be covered by insurance policies. Coverage is typically outlined in the insurance policy document, specifying the events, conditions, and limits under which the insurer will compensate the policyholder. Understanding the terms and conditions of the insurance policy is crucial when filing an insurance claim to ensure that the loss or damage falls within the coverage parameters.

Overall, an insurance claim serves as a mechanism to provide individuals and businesses with financial protection and peace of mind in the face of unforeseen events. By clearly documenting the loss or damage and following the proper claims process, individuals can secure the compensation they are entitled to.

Importance of Insurance Claim Investigation

Insurance claim investigation is a critical step in the claims process, serving several important purposes for both insurance providers and policyholders. Let’s explore the key reasons why insurance claim investigation is of great importance:

- Verification of Claim Validity: Insurance claim investigations are conducted to validate the authenticity and legitimacy of the claim. This helps insurance providers ensure that the claim is not fraudulent and that the policyholder is entitled to the claimed benefits.

- Accurate Assessment of Compensation: The investigation process enables insurers to assess the extent of damage or loss, calculate the appropriate compensation, and determine if it falls within the coverage limits of the policy. This ensures that the policyholder receives fair and adequate compensation.

- Deterrence of Fraudulent Activities: Insurance claim fraud is a significant concern for insurance companies, leading to financial losses and increased premiums for policyholders. Investigation plays a crucial role in detecting and preventing insurance fraud by identifying suspicious claims and gathering evidence to support or refute them.

- Mitigation of Risk: Insurance claim investigation helps insurers evaluate the risks associated with different claims and determine whether there are any potential liability issues. This allows them to make informed decisions regarding denial or settlement of the claim, protecting their financial interests.

- Protection of Policyholders: Thorough claim investigation ensures that policyholders are treated fairly and in accordance with the terms of their insurance policies. It helps prevent wrongful claim denials and ensures that genuine claims are processed promptly, providing the necessary financial support during challenging times.

Effective claim investigation is crucial for maintaining the integrity of the insurance industry and building trust between insurers and policyholders. By conducting comprehensive investigations, insurance companies can demonstrate their commitment to accurate assessments, fraud prevention, and prompt claims resolution.

For policyholders, insurance claim investigation offers a sense of security knowing that their claims will be thoroughly evaluated. It helps protect them from fraudulent activities and ensures that their financial losses are properly compensated, allowing them to recover and rebuild.

In summary, insurance claim investigation plays a vital role in maintaining fairness, reducing fraud, and providing accurate compensation for policyholders. By conducting diligent investigations, insurance companies can uphold their commitments while protecting themselves, their clients, and the overall integrity of the insurance industry.

Legal Requirements for Insurance Claim Investigation

Insurance claim investigation is not only driven by operational needs and best practices but also by legal requirements and regulations set forth by governing bodies. These legal obligations ensure that the insurance claim process is fair, transparent, and compliant with the law. Let’s explore some of the key legal requirements for insurance claim investigation:

- Good Faith: Insurance companies are legally obligated to handle claims in good faith. This means they must act honestly, fairly, and without deceptive practices when investigating claims.

- Duty to Investigate: Insurance companies have a duty to promptly and thoroughly investigate all claims filed by policyholders. They must conduct a reasonable investigation to determine the coverage, validity, and payment of the claim.

- Timely Response: Insurance companies are required to acknowledge receipt of a claim within a specific time frame, which may vary by jurisdiction. They must also provide regular updates and communicate any requests for additional information promptly.

- Privacy Laws: Insurance claim investigations must comply with applicable privacy laws and regulations to protect sensitive information obtained during the investigation. Insurers must handle personal data responsibly and securely.

- Anti-Fraud Measures: Insurance companies are mandated to implement anti-fraud measures as part of their claim investigation processes. This includes detecting and preventing fraudulent activities, such as misrepresentation of facts or intentional damage to property.

- Disclosure Obligations: Insurers have an obligation to disclose the terms, conditions, and limitations of the insurance policy to the policyholder. This ensures transparency and helps policyholders make informed decisions when filing a claim.

- Non-Retaliation: It is illegal for insurance companies to retaliate against policyholders who exercise their rights to file a claim, cooperate in an investigation, or question the insurer’s actions. Policyholders should feel protected when engaging in the claim process.

It is important for insurance companies to remain up to date with the laws and regulations that govern their operations to ensure compliance and avoid legal repercussions. Failure to meet legal requirements for insurance claim investigations can result in penalties, reputational damage, and potential lawsuits.

Policyholders should also be aware of their rights and the legal obligations of insurance companies during the claim investigation process. Understanding the legal framework can help them navigate the process more effectively and confidently, knowing that their rights are protected.

By adhering to the legal requirements and regulations governing insurance claim investigations, both insurance companies and policyholders can ensure a fair and compliant claims process that upholds the integrity of the insurance industry.

Time Limits for Insurance Claim Investigation

When it comes to insurance claim investigations, time is of the essence. Insurance companies are generally expected to conduct investigations promptly and efficiently to provide swift resolution for policyholders. While the specific time limits for insurance claim investigation can vary depending on the jurisdiction and the nature of the claim, there are certain general guidelines to consider.

First and foremost, insurance companies are required to acknowledge the receipt of a claim within a specified time frame, typically within a few days. This initial acknowledgement serves as a confirmation that the claim has been received and is being processed. It may include information about the assigned claims adjuster and any additional documentation or steps required from the policyholder.

The actual investigation process begins following the initial acknowledgment. The duration of the investigation can vary significantly depending on several factors, such as the complexity of the claim, the availability of information and evidence, and the cooperation of all parties involved.

While there is no fixed rule for the maximum duration of an insurance claim investigation, insurance companies are generally expected to complete their investigations within a reasonable timeframe. In many jurisdictions, this is considered to be around 30-60 days. However, certain types of claims, such as complex liability cases or claims involving multiple parties, may require a longer investigation period.

It is essential for insurance companies to communicate with policyholders throughout the investigation process, providing regular updates on the progress of the investigation and any necessary extensions to the timeframe. Transparency and clear communication help build trust and ensure that policyholders are aware of the status of their claims.

It is worth noting that some jurisdictions may have specific legal requirements or regulations in place regarding the time limits for insurance claim investigations. These requirements may vary depending on the type of claim, such as property damage, personal injury, or auto accidents. Insurance companies must adhere to these legal obligations to avoid any potential penalties or legal consequences.

Policyholders should familiarize themselves with the applicable laws and regulations in their jurisdiction to understand their rights and expectations regarding the duration of claim investigations. In case of excessive delays or non-compliance with time limits, policyholders may have the right to escalate their concerns, file a complaint, or seek legal recourse.

In summary, while the duration of insurance claim investigations can vary, insurance companies are generally expected to conduct investigations promptly and efficiently. Open communication between insurers and policyholders is crucial to ensure transparency and manage expectations throughout the investigation process.

Factors Affecting the Duration of Insurance Claim Investigation

The duration of an insurance claim investigation can vary depending on several factors. Understanding these factors can provide insight into why some investigations may take longer than others. Let’s explore some of the key factors that can affect the duration of an insurance claim investigation:

- Claim Complexity: The complexity of the claim is a significant factor in determining the duration of an investigation. Claims involving multiple parties, extensive damages, or complex legal issues may require more time to gather all the necessary information and assess the coverage and liability accurately.

- Availability of Information: The availability and accessibility of information can significantly impact the length of an investigation. If the required documentation, reports, or evidence are readily available, it can expedite the process. On the other hand, if crucial information is difficult to obtain or requires collaboration from external sources, such as medical records or police reports, it can prolong the investigation.

- Cooperation of Parties: The cooperation of all parties involved, including the policyholder, witnesses, and third parties, is crucial in expediting the investigation process. Delays in obtaining statements, medical records, or other necessary information can lengthen the investigation timeline.

- Complexity of Coverage Analysis: Assessing the coverage under the insurance policy can be a complex task, especially if there are multiple coverages, endorsements, or exclusions to consider. Policy language interpretation and evaluation can take time, particularly for specialized or unique cases.

- Extent of Damage or Loss: The severity and extent of the damage or loss can impact the duration of the investigation. Evaluating the scope of the damage, estimating repair or replacement costs, and assessing the impact on the policyholder’s finances or business operations can require additional time and expertise.

- Limits on Resources: Insurance companies have finite resources, including claims adjusters, investigators, and support staff. High caseloads and limited resources can lead to longer investigation times as the available personnel must prioritize and manage multiple claims simultaneously.

- Third-Party Involvement: In claims involving third parties, such as accidents or liability cases, coordination and communication with external individuals or organizations can slow down the investigation process. Factors such as their availability, response times, and willingness to cooperate can affect the investigation timeline.

It is important to note that while these factors can influence the duration of an insurance claim investigation, insurance companies are still expected to conduct the investigation within a reasonable timeframe. Open communication between insurers and policyholders, along with regular updates, can help manage expectations and ensure transparency throughout the process.

By understanding the factors that can affect the duration of an investigation, policyholders can be better prepared for the potential timelines involved in resolving their claims. Maintaining cooperation and providing any requested information promptly can help expedite the investigation process.

Insurance companies, on the other hand, should continuously review internal processes, allocate appropriate resources, and leverage technology to streamline investigations and provide efficient and timely resolutions for their policyholders.

Consequences of Delayed Claim Investigation

Delayed claim investigations can have significant consequences for both insurance companies and policyholders. Timely and efficient investigations are essential to ensure fair and prompt resolution of claims. Let’s explore the consequences of delayed claim investigations:

- Prolonged Financial Burden: For policyholders, delayed claim investigations can prolong the financial burden caused by the loss or damage. Without timely compensation, policyholders may struggle to cover repair costs, medical expenses, or other financial obligations related to the claim.

- Loss of Trust and Dissatisfaction: Delayed investigations can erode policyholder trust and satisfaction with their insurance company. A lack of progress updates and unclear timelines can lead to frustration, negatively impacting the overall customer experience.

- Reputational Damage for Insurers: Insurance companies that consistently experience delays in claim investigations may suffer reputational damage. Negative reviews, customer complaints, and social media backlash can harm the company’s image and credibility, impacting its ability to attract and retain customers.

- Increased Costs for Insurers: Delayed investigations can result in increased costs for insurance companies. Additional expenses may arise from legal fees, potential claims settlement negotiation, interest on overdue payments, or penalties for non-compliance with legal requirements.

- Potential Legal Consequences: Policyholders who experience excessive delays in claim investigations may resort to legal action against their insurance company. Lawsuits can lead to further financial losses, damage to the insurer’s reputation, and potential regulatory sanctions.

- Negative Impact on Claims Adjusters: Excessive caseloads and delays in investigations can negatively impact claims adjusters. Increased stress, burnout, and turnover within the claims department can lead to decreased productivity, decreased job satisfaction, and increased training costs for insurers.

- Missed Opportunities for Fraud Detection: Delayed investigations can provide opportunities for fraudsters to exploit the system. Fraudulent claims may go undetected or become more challenging to investigate with the passage of time, resulting in financial losses for insurance companies.

It is crucial for insurance companies to prioritize timely and efficient claim investigations to avoid these consequences. By investing in streamlined processes, leveraging technology, and properly allocating resources, insurers can provide faster claim resolutions and ensure better customer satisfaction.

For policyholders, understanding their rights and the expected timelines for claim investigations can help them manage expectations and take appropriate action if their claim experiences undue delays. Promptly communicating with their insurer and seeking regular updates can help mitigate the negative impact of delayed investigations.

In summary, delayed claim investigations can lead to financial burdens, erode trust, and incur reputational, legal, and financial consequences for both insurance companies and policyholders. By prioritizing timely investigations and implementing efficient processes, insurers can minimize these risks and provide a positive claims experience for their policyholders.

Typical Steps Involved in an Insurance Claim Investigation

Insurance claim investigations follow a structured process to gather relevant information, assess the validity of the claim, and determine the appropriate compensation. While specific steps may vary depending on the nature of the claim and the insurance company’s policies, here are the typical stages involved in an insurance claim investigation:

- Claim Intake and Documentation: The first step is for the policyholder to report the claim to the insurance company. This involves providing detailed information about the incident, including the date, time, location, individuals involved, and any relevant documents or evidence. The insurance company will create a formal record of the claim.

- Initial Assessment: The insurance company will assign a claims adjuster to review the claim and assess its potential coverage. The adjuster may request additional information or documentation to support the claim and determine if it falls within the policy’s coverage parameters.

- Investigation Planning: Based on the initial assessment, the claims adjuster will develop an investigation plan. This plan outlines the steps and resources required to investigate the claim thoroughly. Factors such as the complexity and nature of the claim will influence the extent of the investigation.

- Evidence Gathering: The claims adjuster will gather evidence relevant to the claim. This may involve reviewing police reports, interviewing witnesses, obtaining photographs or videos, collecting medical records, or consulting experts, depending on the nature of the claim. The purpose is to gather objective information to assess the validity and extent of the claim.

- Policy Review: The claims adjuster will review the insurance policy to understand the coverage limits, endorsements, exclusions, and other relevant terms and conditions. This analysis helps determine if the claim is within the coverage parameters and the extent of compensation the policyholder is entitled to receive.

- Interviews: The claims adjuster may conduct interviews with the involved parties, including the policyholder, witnesses, and any other relevant individuals. These interviews aim to gather first-hand information, clarify any ambiguities, and assess the credibility of the claim.

- Document Review: The claims adjuster will review relevant documents, such as medical records, repair estimates, invoices, or receipts. This evaluation ensures that the expenses claimed are reasonable and directly related to the loss or damage incurred.

- Claim Estimation: Based on the gathered information, the claims adjuster will assess the extent of the damage or loss and estimate the appropriate compensation amount. This estimation considers the policy coverage, policy limits, deductibles, and any applicable depreciation or market value calculations.

- Final Decision and Resolution: After completing the investigation and reviewing all the available evidence, the claims adjuster will make a final decision regarding the claim. They will communicate the decision, along with the rationale, to the policyholder. If the claim is approved, the insurance company will initiate the compensation or settlement process.

- Claim Closure and Follow-Up: Once the claim is resolved, the insurance company will close the claim file. However, in some cases, follow-up actions may be required, such as monitoring the progress of property repairs, ongoing medical treatment, or any ongoing legal proceedings.

It is important to note that these steps are not exhaustive and may vary depending on the specific circumstances of each claim. Insurance companies follow these steps to ensure a thorough investigation, fair decision-making, and compliance with legal requirements.

By following this structured process, insurance claim investigations aim to provide a fair, accurate, and timely resolution for policyholders, promoting trust and confidence in the insurance industry.

Documentation and Evidence Gathering in Insurance Claim Investigation

Documentation and evidence gathering are critical components of an insurance claim investigation. Properly documenting the incident and gathering relevant evidence helps insurance companies assess the validity of the claim, determine the extent of coverage, and prevent fraudulent activities. Let’s explore the importance of documentation and evidence gathering in an insurance claim investigation:

1. Establishing the Facts: Documentation plays a key role in recording the facts surrounding the incident. Policyholders are encouraged to promptly document the details of the incident, including the date, time, location, parties involved, and any relevant circumstances. This initial documentation serves as a starting point for the investigation.

2. Providing Objective Information: Objective information helps in evaluating the authenticity of the claim. This can include police reports, accident reports, or incident reports filed at the scene. These documents provide unbiased accounts of the event and can corroborate the policyholder’s claim.

3. Collecting Supporting Documentation: Insurance companies often require supporting documentation to validate the claim. This can include invoices, receipts, repair estimates, medical records, or any other relevant documents. These documents help establish the connection between the claim and the loss or damage incurred.

4. Gathering Photographs or Videos: Visual documentation, such as photographs or videos, provides tangible evidence of the incident. Policyholders are encouraged to take pictures or record videos of the damage or loss as soon as possible after the incident occurs. These visual records can help assess the extent of the damage and provide valuable evidence during the investigation.

5. Obtaining Witness Statements: Witness statements can provide additional perspectives and insights into the incident. Insurance companies may request statements from individuals who witnessed the event or have relevant information to contribute. These statements can help corroborate the policyholder’s account and strengthen the claim.

6. Consulting Experts: In complex or specialized claims, insurance companies may seek the expertise of professionals or subject matter experts. These experts can provide technical analysis, opinions, or evaluations related to the incident, helping insurance adjusters understand the circumstances and make informed decisions.

7. Protecting Sensitive Information: Insurance companies have a responsibility to handle personal and sensitive information with care. They must adhere to privacy laws and regulations when collecting, storing, and sharing documentation and evidence obtained during the investigation process. Proper data security measures should be implemented to protect the confidentiality of policyholders’ information.

8. Maintaining a Comprehensive Record: Throughout the investigation, insurance companies maintain a comprehensive record of all documentation and evidence gathered. This record helps ensure transparency, allows for easy reference, and facilitates efficient communication between claims adjusters, policyholders, and other parties involved.

9. Continuous Review and Evaluation: Documentation and evidence gathering are ongoing processes during the investigation. As new information or evidence becomes available, insurance adjusters review and evaluate it to further assess the validity of the claim and make well-informed decisions.

Proper documentation and evidence gathering are essential to support fair and accurate claim assessments. Policyholders should provide the required documentation promptly and cooperate with the insurance company’s requests throughout the investigation process. By doing so, they can contribute to a thorough and efficient investigation, ensuring a fair resolution to their insurance claim.

Role of Insurance Adjusters in Claim Investigation

Insurance adjusters play a vital role in the claim investigation process. They are trained professionals who are responsible for evaluating insurance claims, investigating the circumstances surrounding the claim, and making informed decisions regarding coverage and compensation. Let’s explore the key roles and responsibilities of insurance adjusters in claim investigation:

1. Initial Claim Assessment: Insurance adjusters are often the first point of contact for policyholders when a claim is filed. They review the initial information provided by the policyholder, assess the claim’s potential coverage, and determine the appropriate course of action based on company policies and legal obligations.

2. Investigation Planning: Insurance adjusters develop investigation plans tailored to each claim. They determine the necessary steps, resources, and timelines for the investigation. Factors such as the nature of the claim, available evidence, and potential liability are considered to ensure a thorough and efficient investigation.

3. Evidence Gathering: Insurance adjusters gather relevant documentation and evidence to support the investigation. This includes reviewing police reports, obtaining medical records or repair estimates, collecting photographs or videos, and conducting interviews with witnesses or other involved parties. The gathered evidence helps assess the validity of the claim and the extent of the loss or damage.

4. Coverage Analysis: Insurance adjusters review the insurance policy to determine the coverage and limitations that apply to the claim. They analyze the policy language, endorsements, exclusions, and any applicable deductibles or limits. This analysis ensures that the claim falls within the coverage parameters and that the appropriate compensation is provided.

5. Claims Estimation: Based on the gathered evidence and policy assessment, insurance adjusters estimate the value of the claim. They consider factors such as repair or replacement costs, medical expenses, lost wages, and any applicable depreciation or market value evaluations. This estimation helps determine the amount of compensation or settlement to offer to the policyholder.

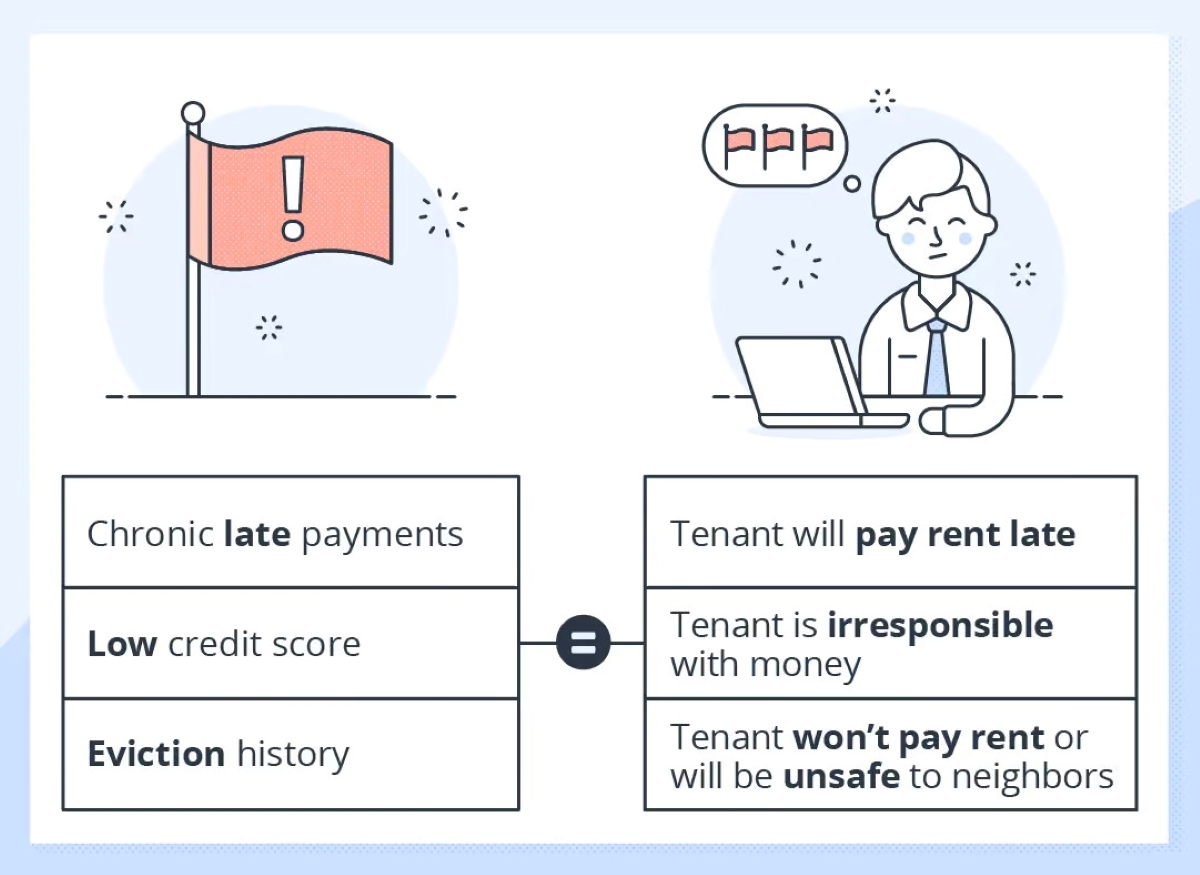

6. Fraud Detection: Insurance adjusters are trained to detect potential fraud or misrepresentation within a claim. They carefully review the information provided, identify any inconsistencies or red flags, and conduct further investigation if necessary. Their role is crucial in preventing fraudulent activities and protecting the integrity of the insurance system.

7. Communication and Documentation: Insurance adjusters maintain regular communication with policyholders, providing updates on the progress of the investigation and any additional information required. They also document their findings, decisions, and any relevant notes throughout the investigation process. Clear, accurate, and comprehensive documentation is essential for transparency, compliance, and future reference.

8. Decision-Making: Based on the gathered evidence, policy review, and estimation, insurance adjusters make informed decisions regarding the claim. They evaluate the validity of the claim, assess liability, and determine if the claim should be approved, denied, or further investigated. Their decisions impact the policyholder’s compensation or settlement, and they must ensure fairness and adherence to policy terms.

9. Resolution and Settlement: Once the investigation is complete and a decision is made, insurance adjusters work to resolve the claim promptly. They communicate the decision to the policyholder, explain the rationale behind it, and initiate the necessary steps for compensation or settlement. They may engage in negotiation or mediation to reach a mutually agreeable resolution.

The role of insurance adjusters is crucial in maintaining the integrity of the claim investigation process. They ensure that claims are evaluated fairly, policy terms are upheld, and policyholders receive the appropriate compensation in a timely manner. Policyholders can rely on insurance adjusters to provide expertise, guidance, and support throughout the claims process.

Strategies to Expedite the Claim Investigation Process

Expedited claim investigations are beneficial for both insurance companies and policyholders. By streamlining the process, insurers can provide prompt resolutions and improve customer satisfaction, while policyholders can receive timely compensation or settlements. Here are some effective strategies to expedite the claim investigation process:

1. Efficient Communication: Establishing clear and open lines of communication between insurance adjusters and policyholders is essential. Promptly responding to inquiries, providing complete and accurate information, and addressing any concerns or questions can significantly speed up the investigation process.

2. Complete Documentation: Policyholders should ensure that all required documentation and evidence are provided promptly and in a thorough manner. This includes gathering all necessary supporting documents, photographs, videos, and witness statements. Complete and well-organized documentation minimizes the need for further information requests and minimizes delays.

3. Proactive Information Sharing: Policyholders should actively communicate any relevant updates or changes in their claim to the insurance adjuster. Transparent communication about medical treatments, property repairs, or other developments related to the claim enables adjusters to make informed decisions more efficiently.

4. Streamlined Claims Process: Insurance companies should strive to simplify and streamline their claims process. Utilizing digital platforms, online claim filing, and automated workflows can reduce administrative burdens and eliminate potential delays caused by manual processes or paperwork.

5. Technology Utilization: Leveraging technology, such as claims management software or data analytics, can expedite the investigation process. These tools can automate routine tasks, facilitate data analysis, and provide better data accessibility, improving efficiency and decision-making speed.

6. Trained and Dedicated Staff: Insurance companies should invest in ongoing training for their claims adjusters to enhance their skills and knowledge. Well-trained adjusters can navigate claims investigations more effectively, spot potential issues, and make informed decisions efficiently.

7. Collaborative Partnerships: Establishing strong partnerships with trusted vendors, medical providers, and experts can expedite the investigation process. Having pre-existing relationships and access to reliable resources allows insurance adjusters to obtain necessary information and expert opinions more efficiently.

8. Prioritization of Claims: Insurance companies should prioritize claims based on their urgency and severity. Implementing systems to identify high-priority claims and allocating appropriate resources accordingly helps ensure that claims are investigated promptly and resolved promptly.

9. Continuous Process Improvement: Insurance companies should regularly evaluate and refine their claim investigation processes. Analyzing data, collecting feedback from adjusters and policyholders, and implementing improvements based on lessons learned can further expedite future investigations.

By implementing these strategies, insurance companies can reduce claim investigation timelines, improve overall efficiency, and enhance customer satisfaction. Policyholders can benefit from faster resolutions, timely compensation, and a smoother claims experience. Ultimately, expedited claim investigations contribute to a more positive and seamless insurance journey for all parties involved.

Conclusion

Insurance claim investigations are a crucial step in the claims process, ensuring fair and accurate resolutions for policyholders. From verifying the authenticity of the claim to assessing the appropriate compensation, insurance companies rely on thorough investigations to make well-informed decisions. Throughout the investigation, the role of insurance adjusters is vital in gathering documentation, evaluating evidence, and facilitating communication between all parties involved.

Understanding the legal requirements, time limits, and consequences of delayed investigations is essential for both insurance companies and policyholders. By adhering to legal obligations, providing timely responses, and conducting efficient investigations, insurers can protect their reputation, mitigate fraud risks, and maintain trust with policyholders.

Policyholders can contribute to expedited investigations by promptly providing complete and accurate documentation, actively participating in the process, and maintaining open communication with insurance adjusters. Recognizing the factors that affect investigation timeframes, such as claim complexity and availability of information, can help manage expectations and advocate for timely resolutions.

Effective strategies, such as efficient communication, streamlined processes, and technology utilization, can further expedite the investigation process. Insurance companies should continuously assess and improve their claims handling procedures to ensure quicker resolutions, enhanced customer satisfaction, and greater operational efficiency.

In conclusion, insurance claim investigations are a critical aspect of the insurance industry, providing policyholders with the assurance that their claims will be evaluated fairly and promptly. By prioritizing timely investigations, implementing strategies to streamline the process, and fostering transparent communication, insurance companies can provide policyholders with the efficient and satisfactory claim experience they deserve. Through collaboration and adherence to legal requirements, insurance claim investigations can continue to protect the interests of both insurance companies and policyholders, ensuring trust and confidence in the insurance industry as a whole.