Finance

How Good Is A 790 Credit Score

Modified: March 6, 2024

Find out how a 790 credit score can impact your financial situation and opportunities. Discover the benefits and advantages of having a high credit score in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scores. In today’s financial landscape, credit scores play a crucial role in determining an individual’s creditworthiness and financial health. A good credit score not only opens doors to better financing options but also reflects responsible financial management. One such respectable credit score is 790, which is considered excellent by industry standards.

In this article, we will delve into the significance of a 790 credit score, explore its benefits, and discuss ways to maintain and improve it. Whether you’re a newbie to the world of credit or a seasoned borrower looking to boost your credit score, understanding the ins and outs of a 790 credit score is essential.

Before diving into the details of what a 790 credit score entails, let’s take a moment to understand the basics of credit scores.

Understanding Credit Scores

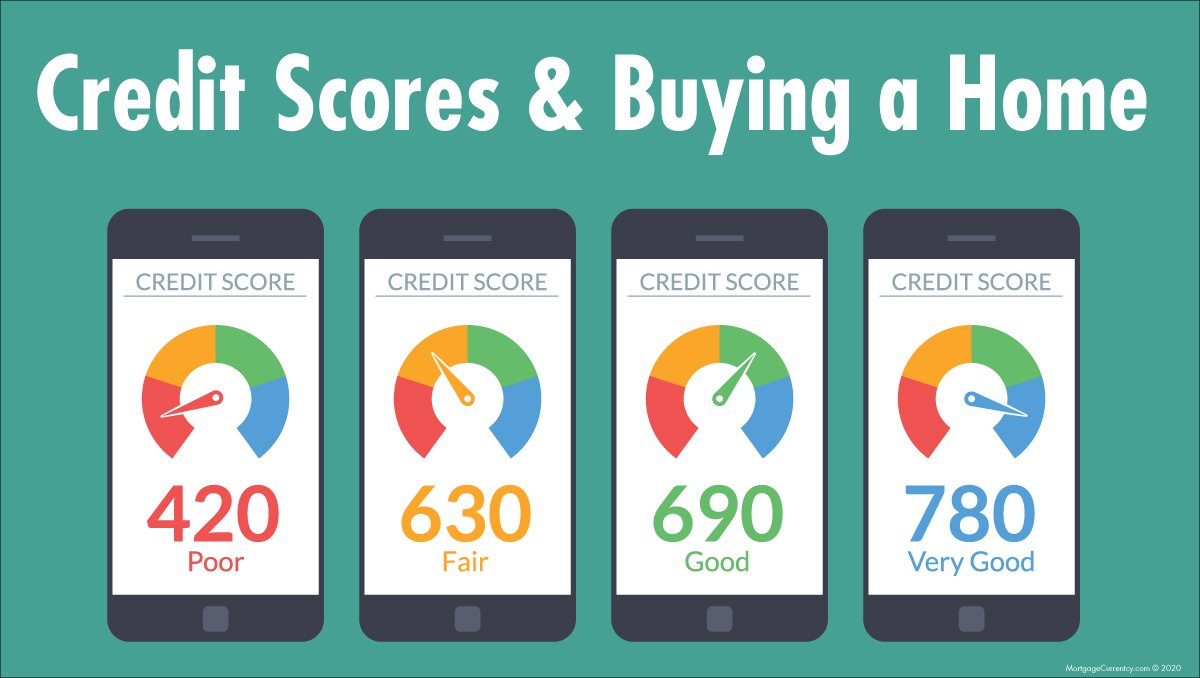

A credit score is a numerical representation of an individual’s creditworthiness. It is typically calculated based on various factors, including payment history, credit utilization, length of credit history, credit mix, and new credit applications. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850.

A credit score of 790 falls within the upper range of the FICO score scale, indicating a borrower with a strong credit profile. Lenders and financial institutions usually consider individuals with a 790 credit score as low-risk borrowers, making them favorable candidates for attractive loan terms, credit cards with competitive rates, and other financial products.

What is a 790 Credit Score?

A 790 credit score reflects a borrowing history characterized by responsible financial management. It indicates that the individual has consistently made on-time payments, kept credit card balances low, and managed credit effectively. Achieving a 790 credit score requires discipline, financial prudence, and a solid understanding of credit management.

In the next section, we will explore the importance of a 790 credit score and how it can impact your financial opportunities and goals.

Understanding Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness. They are calculated based on various factors related to their credit history and financial behavior. Understanding how credit scores work is essential for anyone looking to borrow money or manage credit effectively.

The most widely used credit scoring model is the FICO score, which ranges from 300 to 850. The higher the credit score, the better the borrower’s creditworthiness is considered. Here are the key factors that influence credit scores:

- Payment History: This is the most significant factor in determining a credit score. Lenders want to see a track record of on-time payments. Late payments, defaults, and bankruptcies can negatively impact credit scores.

- Credit Utilization: This factor measures how much of your available credit you are using. Keeping credit card balances low is important as high credit utilization can signal financial instability.

- Length of Credit History: The length of time you have had credit accounts plays a role in determining your credit score. Having a longer credit history shows your ability to manage credit over time.

- Credit Mix: Lenders prefer to see a mix of different types of credit, such as credit cards, mortgages, and car loans. Having a diverse credit portfolio can positively impact credit scores.

- New Credit Applications: Applying for new credit accounts can temporarily lower credit scores. Lenders may interpret multiple credit applications as a sign of financial instability or desperation.

It’s important to note that different credit scoring models may weigh these factors differently. However, the underlying principle remains the same: responsible financial behavior leads to higher credit scores.

Now that we have a basic understanding of how credit scores are calculated, let’s explore what a 790 credit score means and why it is considered excellent in the next section.

What is a 790 Credit Score?

A 790 credit score is considered excellent by industry standards. It indicates a borrower who has demonstrated a high level of creditworthiness and responsible financial management. With a credit score of 790, individuals are likely to enjoy favorable terms and conditions when applying for loans, credit cards, and other financial products.

To better understand what a 790 credit score represents, let’s take a closer look at the FICO score scale:

- Poor (300-579): This range indicates a high-risk borrower with a history of late payments, defaults, or bankruptcy.

- Fair (580-669): Borrowers in this range may have experienced financial setbacks but are still considered eligible for credit products with less favorable terms.

- Good (670-739): This range signifies responsible credit behavior and shows that borrowers are likely to be approved for credit at fair interest rates.

- Very Good (740-799): Individuals with credit scores in this range are seen as low-risk borrowers and qualify for attractive interest rates and advantageous credit terms.

- Excellent (800+): Those with credit scores of 800 or higher are considered exceptional borrowers with an impeccable credit history and are likely to qualify for the best loan terms and rates available.

With a 790 credit score, individuals fall into the upper echelon of the credit score scale. Lenders view them as highly creditworthy and are more confident in their ability to repay borrowed funds responsibly.

It’s important to note that credit scores can vary slightly depending on the credit reporting agency and the scoring model used. However, a 790 credit score is generally regarded as an outstanding achievement that opens doors to a wide range of financial opportunities.

Now that we understand what a 790 credit score represents, the next section will explore the importance of maintaining this credit score and the benefits it provides to borrowers.

Importance of a 790 Credit Score

A 790 credit score holds significant importance in the financial world. It is a testament to your responsible financial management and can have a positive impact on various aspects of your financial life. Let’s explore why a 790 credit score is crucial:

Access to Better Financing Options: With a 790 credit score, you are more likely to be approved for loans, mortgages, and credit cards with favorable terms, such as lower interest rates and higher credit limits. Lenders are more willing to extend credit to individuals with high credit scores, as they are seen as low-risk borrowers. This provides you with the opportunity to access the best financing options available and potentially save money on interest payments.

Lower Interest Rates: Having a 790 credit score can translate into lower interest rates on loans and credit cards. Lenders offer lower interest rates to borrowers with excellent credit scores, as they have a proven track record of responsibly managing their debts. This means that you can save a significant amount of money over the long term by paying less interest on your borrowed funds.

Increased Credit Card Benefits: Credit card issuers often reserve their best rewards programs, cashback offers, and promotional offers for customers with high credit scores. With a 790 credit score, you may have access to premium credit cards and enjoy perks such as travel rewards, cashback on purchases, and exclusive access to events or discounts. This can enhance your overall financial flexibility and provide added value in your daily expenses.

Improved Chance of Approval: When applying for loans or credit, having a 790 credit score significantly improves your chances of approval. Lenders consider individuals with high credit scores as trustworthy and reliable borrowers, making them more likely to extend credit. This can be particularly beneficial when seeking larger loans, such as a mortgage, where the approval process is more stringent.

Enhanced Financial Security: A 790 credit score indicates responsible financial behavior and good money management skills. As a result, you are likely to have a more stable financial position and greater financial security. Lenders, landlords, and employers often consider credit histories as part of their decision-making process. With a strong credit score, you are more likely to pass these assessments and gain access to housing, employment, and financial opportunities.

Overall, a 790 credit score holds immense importance in your financial journey. It opens doors to better financing options, lower interest rates, and enhanced financial security. Maintaining this high credit score is crucial, and the next section will provide tips on how to achieve that.

Benefits of Having a 790 Credit Score

Holding a credit score of 790 comes with numerous benefits that can positively impact your financial life. Let’s explore some of the major advantages of having a 790 credit score:

1. Lower Interest Rates: One of the significant benefits of a 790 credit score is qualifying for loans and credit cards with lower interest rates. Lenders offer better interest rates to borrowers with higher credit scores as they are deemed less risky. This means that you can save a substantial amount of money over time by paying less interest on your debts.

2. Access to Premium Credit Cards: With a 790 credit score, you become an attractive candidate for premium credit cards that offer exclusive benefits like cashback rewards, airline miles, and concierge services. These cards often come with valuable perks and enhanced features that can elevate your financial flexibility and provide added convenience in your everyday expenses.

3. Greater Loan Approval: When it comes to applying for loans, having a 790 credit score significantly improves your chances of approval. Banks and financial institutions prefer lending to individuals with higher credit scores as they demonstrate a history of responsible financial behavior. This means that you can secure loans for major expenses such as a new car or a home with more ease.

4. Negotiating Power: A high credit score grants you more negotiating power when dealing with lenders and financial institutions. With a 790 credit score, you can negotiate for better terms, such as lower interest rates or higher credit limits. This can result in substantial savings and greater financial flexibility in the long run.

5. Renting a Home: Many landlords conduct credit checks as part of their screening process for potential tenants. Having a 790 credit score puts you in a favorable position to rent the home or apartment of your choice. Landlords consider a high credit score as an indicator of financial responsibility, making them more confident in your ability to pay rent on time.

6. Potential Employment Opportunities: Some employers may request access to your credit report as part of their hiring process, particularly for positions that involve financial responsibilities. A 790 credit score reflects positively on your financial management skills and can increase your chances of being hired for these roles.

7. Peace of Mind: Lastly, having a 790 credit score provides you with peace of mind and financial confidence. You know that you have maintained excellent credit, which can give you a sense of security in your financial life. It also gives you the flexibility to pursue your financial goals and take advantage of opportunities that come your way.

Overall, a 790 credit score offers a range of benefits, from lower interest rates and better credit card options to increased loan approval and financial security. It is the result of responsible credit management and demonstrates your strong financial standing.

Credit Options Available with a 790 Credit Score

Having a 790 credit score opens up a world of credit options and provides access to favorable terms and conditions. Lenders and financial institutions see individuals with high credit scores as low-risk borrowers, increasing their chances of being approved for various credit products. Let’s explore some of the credit options available to those with a 790 credit score:

1. Personal Loans: With a 790 credit score, you have a wide range of personal loan options available to you. Personal loans can be used for various purposes, such as consolidating debt, financing home improvements, or covering unexpected expenses. Lenders are more likely to offer personal loans at competitive interest rates and with flexible repayment terms to individuals with excellent credit scores.

2. Mortgage Loans: Buying a home is a significant financial decision, and having a 790 credit score puts you in a favorable position when applying for a mortgage loan. Mortgage lenders typically offer the best interest rates and loan terms to borrowers with high credit scores. With a 790 credit score, you may qualify for lower interest rates, allowing you to save a substantial amount of money over the life of your mortgage.

3. Auto Loans: Whether you’re looking to purchase a new car or finance a used vehicle, a 790 credit score will give you access to attractive auto loan options. Lenders consider individuals with high credit scores as low-risk borrowers, resulting in lower interest rates and more favorable loan terms. This allows you to secure an auto loan with affordable monthly payments.

4. Credit Cards: Credit card options abound for individuals with a 790 credit score. You can qualify for credit cards with generous rewards programs, cashback offers, and low interest rates. Lenders may also offer higher credit limits, giving you greater financial flexibility. Be sure to choose credit cards that align with your financial goals, whether it’s earning rewards or establishing credit history.

5. Balance Transfer Cards: Balance transfer credit cards are an excellent option to consolidate high-interest credit card debt and save on interest payments. With a 790 credit score, you’re likely to qualify for balance transfer cards with promotional offers such as 0% introductory APR for a specified period. This can provide a valuable opportunity to pay off existing debt more efficiently.

6. Business Loans: If you’re an entrepreneur or small business owner, a 790 credit score can open doors to favorable business loan options. Banks and lenders often offer business loans at competitive interest rates to individuals with strong credit profiles. This can help you fund business expansion, purchase equipment, or meet working capital needs.

It’s important to explore the terms and conditions of each credit option and select the ones that align with your financial goals. Remember to borrow responsibly and use credit as a tool to improve your financial situation rather than accumulate unnecessary debt.

The next section will provide valuable tips to help you maintain and improve your 790 credit score.

Tips to Maintain and Improve a 790 Credit Score

While having a 790 credit score is an achievement, it’s important to maintain and improve it over time. Here are some valuable tips to help you maintain a high credit score or work towards improving it:

1. Pay bills on time: Consistently making timely payments is crucial in maintaining a good credit score. Set up payment reminders or automate payments to ensure you never miss a due date.

2. Keep credit card balances low: High credit card balances can negatively impact your credit utilization ratio. Aim to keep your credit card balances below 30% of your available credit limit to maintain a healthy credit score.

3. Avoid unnecessary credit applications: Every credit application can result in a hard inquiry on your credit report, which can temporarily lower your score. Only apply for credit when necessary and shop around for the best rates within a short period to minimize the impact on your score.

4. Maintain a diverse credit mix: Having a mix of credit accounts, such as credit cards, installment loans, and a mortgage, can positively impact your credit score. However, only take on credit types that you can manage responsibly.

5. Regularly review your credit report: Request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. Review it for any errors or inaccuracies and report them immediately to the credit reporting agency.

6. Limit credit inquiries: Minimize the number of credit inquiries made on your credit report. Multiple inquiries can signal to lenders that you are actively seeking credit, which may raise concerns about your financial stability.

7. Keep old accounts open: Closing old credit accounts can negatively impact your credit history and potentially shorten the average length of your credit history. If the account has no annual fees and is not costing you anything, consider keeping it open to maintain a longer credit history.

8. Communicate with lenders in times of financial hardship: If you’re facing financial difficulties, reach out to your lenders and creditors to discuss possible options. They may be willing to offer temporary payment arrangements or adjust your repayment terms to help you through challenging times.

9. Practice responsible debt management: Avoid accumulating excessive debt and only borrow what you can comfortably repay. Paying down debt consistently demonstrates responsible financial behavior and can positively impact your credit score over time.

10. Be patient: Building and improving a credit score takes time and discipline. Maintain good credit practices over an extended period, and you will see the positive effects reflected in your credit score.

By following these tips, you can maintain a 790 credit score or work towards improving it even further. Remember that responsible credit behavior is key, and maintaining a high credit score can provide you with numerous financial opportunities and peace of mind.

Factors that Can Impact a 790 Credit Score

A 790 credit score is considered excellent, but it’s important to understand that various factors can impact your credit score, potentially causing it to fluctuate. While maintaining responsible financial habits is crucial, it’s also important to be aware of the factors that can influence your credit score. Let’s explore some of the key elements that can impact a 790 credit score:

1. Payment History: Your payment history has the most significant impact on your credit score. Making consistent, on-time payments positively affects your score, while late payments or defaults can have a detrimental impact. Even a single missed payment can lower your score, so it’s vital to prioritize paying your bills on time.

2. Credit Utilization: Credit utilization refers to the amount of available credit you use. Maxing out your credit cards or carrying high balances can negatively affect your credit score. Aim to keep your credit utilization ratio below 30% to maintain a healthy credit score. For example, if you have a total credit limit of $10,000, try to keep your combined balances below $3,000.

3. Credit History Length: The length of your credit history also impacts your credit score. Generally, a longer credit history is seen as more favorable. If you’re new to credit, it may take some time to establish a solid credit history. However, responsible credit management over time will help improve your score.

4. New Credit Applications: Applying for multiple new credit accounts within a short period can lead to a decrease in your credit score. Each credit application typically results in a hard inquiry on your credit report, which can stay on your record for up to two years. It’s important to be judicious when applying for new credit and only do so when necessary.

5. Credit Mix: Having a healthy mix of credit accounts can positively impact your credit score. This includes a combination of credit cards, loans, and mortgages. Lenders look for a diverse credit portfolio, indicating that you can manage different types of credit responsibly.

6. Public Records and Collections: Negative public records, such as bankruptcies, tax liens, and civil judgments, can have a significant adverse effect on your credit score. Similarly, accounts in collections can also lower your score. It’s crucial to address any outstanding debts promptly and work towards resolving them.

7. Credit Inquiries: While a single credit inquiry may have a minimal impact, multiple credit inquiries within a short period can negatively affect your credit score. This is because it may indicate that you are actively seeking credit, leading lenders to perceive you as a higher-risk borrower.

8. Errors on Credit Reports: Mistakes can happen, and errors on your credit report can negatively impact your credit score. It’s essential to regularly review your credit reports from the major credit bureaus and address any inaccuracies promptly. Disputing errors and ensuring that your credit report is accurate can help maintain a strong credit score.

By understanding the factors that can impact your credit score, you can take proactive steps to maintain a 790 credit score or work towards improving it. It’s crucial to practice responsible financial habits, monitor your credit reports regularly, and take the necessary actions to address any issues that may arise.

Conclusion

In conclusion, a 790 credit score is a significant achievement that indicates excellent creditworthiness and responsible financial management. It opens doors to a range of benefits, including access to better financing options, lower interest rates, and increased financial opportunities.

Understanding the factors that impact your credit score is crucial in maintaining and improving it over time. Consistently making on-time payments, keeping credit card balances low, and managing credit responsibly are key to maintaining a high credit score.

It’s important to remember that credit scores are not fixed and can fluctuate based on various factors. Monitoring your credit report regularly and addressing any inaccuracies or issues promptly can help safeguard your credit score and financial well-being.

Whether you currently have a 790 credit score or are working towards achieving it, the benefits of maintaining excellent credit go beyond just financial flexibility. A strong credit score provides peace of mind, improved chances of approval for loans and rental applications, and better employment opportunities in certain fields.

Remember to practice responsible credit management, communicate with lenders during times of financial hardship, and be patient. Building and maintaining a high credit score is a journey that requires discipline and consistency.

By utilizing the tips provided in this article and staying proactive in your financial habits, you can continue to enjoy the benefits that come with a 790 credit score and work towards even greater financial opportunities in the future.