Home>Finance>How Long To Pay Off Credit Card With Minimum Payment

Finance

How Long To Pay Off Credit Card With Minimum Payment

Published: February 25, 2024

Learn how to manage your finances by understanding how long it takes to pay off a credit card with minimum payments. Take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing credit card debt can be a challenging endeavor, especially when faced with the prospect of making only minimum payments. For many individuals, the allure of minimum payments lies in their apparent affordability, as they provide temporary relief by requiring only a small fraction of the outstanding balance to be paid each month. However, it’s crucial to understand the long-term implications of sticking to minimum payments, as they can significantly extend the duration and cost of repaying credit card debt.

In this article, we will delve into the concept of minimum payments on credit cards, exploring how they affect the time required to pay off the balance and the overall interest accrued. By gaining a deeper understanding of these factors, individuals can make informed decisions about managing their credit card debt effectively.

Throughout this discussion, we will also explore strategies to expedite the repayment process, empowering readers with actionable insights to take control of their financial well-being. Whether you’re currently grappling with credit card debt or aiming to fortify your financial knowledge, this article will equip you with the essential information needed to navigate the realm of minimum payments and credit card debt repayment.

Understanding Minimum Payments

Minimum payments represent the lowest amount that a credit card holder must pay each month to keep the account in good standing. While the specific calculation method can vary among credit card issuers, minimum payments typically encompass a small percentage of the outstanding balance, along with any interest and fees accrued during the billing cycle. This seemingly modest obligation can, however, have profound implications for the overall cost and duration of repaying credit card debt.

It’s important to recognize that minimum payments are designed to serve the interests of the credit card issuer, as they enable the accumulation of interest on the remaining balance. By adhering solely to minimum payments, cardholders may find themselves locked in a cycle of debt, where a significant portion of their monthly payment goes toward interest rather than reducing the principal balance.

Additionally, the allure of minimum payments can lull individuals into a false sense of security, fostering the misconception that they are effectively managing their debt. In reality, minimum payments often prolong the repayment period, resulting in a substantial increase in the total interest paid over time. This can significantly impede financial progress and strain long-term financial stability.

Understanding the implications of minimum payments is crucial for individuals seeking to navigate the complexities of credit card debt. By gaining insight into the mechanics of minimum payments and their impact on debt repayment, individuals can make informed decisions about their financial strategies, empowering them to take proactive steps toward achieving financial freedom.

Calculating Time to Pay Off Credit Card

When making only the minimum payment on a credit card, the time required to pay off the balance can extend significantly, often far beyond what cardholders may anticipate. This is primarily due to the interplay between the minimum payment amount, the outstanding balance, and the accruing interest. Understanding how to calculate the time to pay off a credit card under these conditions is essential for gaining clarity on the long-term implications of minimum payments.

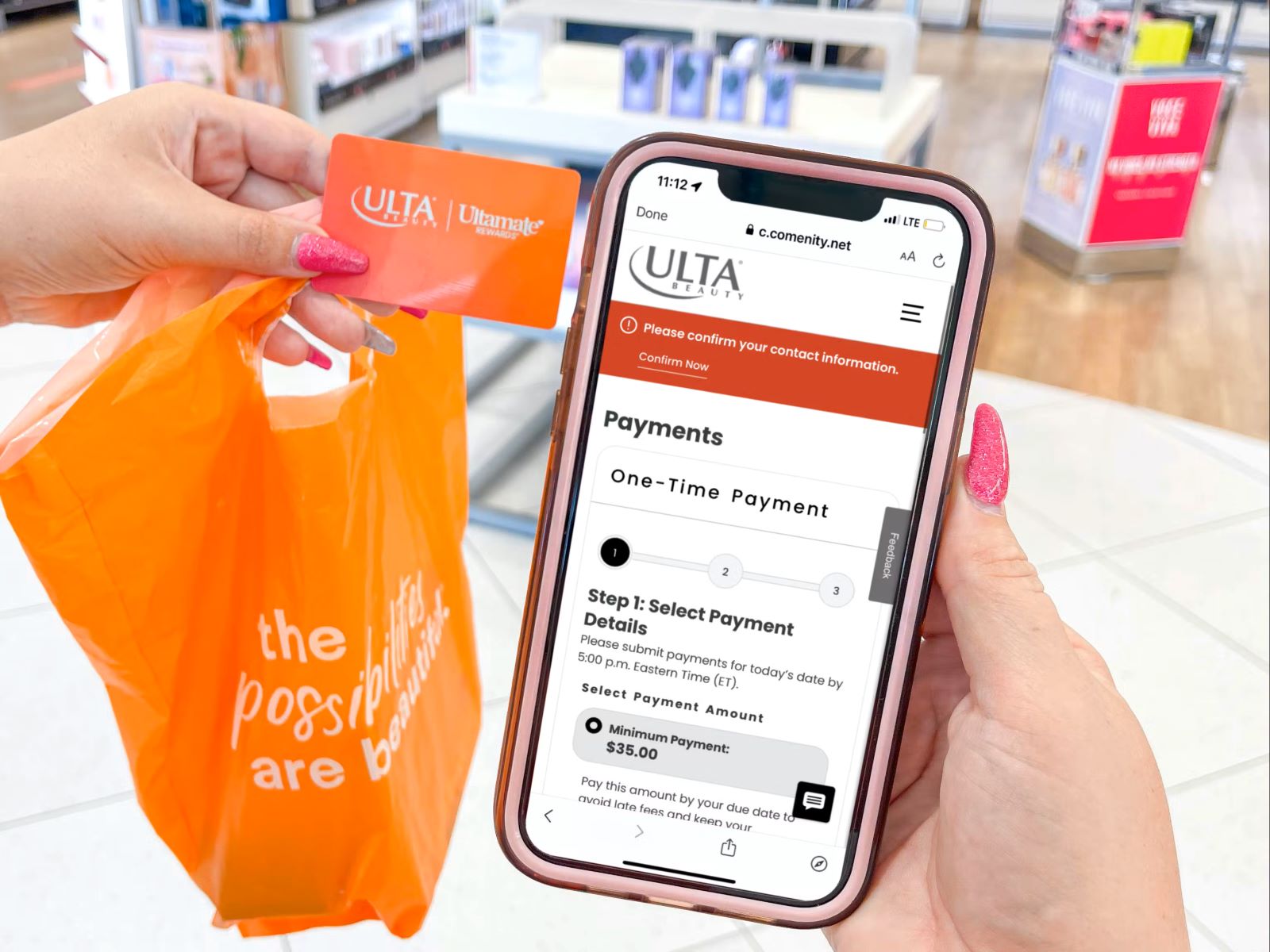

One approach to estimating the time needed to pay off a credit card with minimum payments is to utilize a credit card repayment calculator. These tools allow individuals to input their outstanding balance, interest rate, and minimum payment percentage, providing an estimate of the time required to fully repay the debt. By leveraging such calculators, individuals can gain valuable insights into the timeline for debt elimination, empowering them to make informed decisions about their repayment strategy.

Furthermore, understanding the factors that influence the time to pay off a credit card can shed light on the dynamics of debt repayment. For instance, as the outstanding balance decreases, the portion of the minimum payment allocated to interest diminishes, accelerating the reduction of the principal balance. This underscores the significance of consistent and strategic payments, as they play a pivotal role in expediting the debt repayment process.

By comprehending the nuances of calculating the time to pay off a credit card with minimum payments, individuals can develop a clearer perspective on the implications of their current repayment approach. Armed with this knowledge, they can explore alternative strategies to expedite debt elimination and minimize the overall interest paid, ultimately paving the way toward improved financial health and stability.

Impact of Minimum Payments on Total Interest

Minimum payments exert a substantial impact on the total interest accrued during the repayment of credit card debt. By adhering solely to minimum payments, individuals may find themselves ensnared in a cycle of prolonged indebtedness, leading to a significant escalation in the overall interest paid over time.

One of the key factors contributing to the augmented total interest is the extended duration of debt repayment associated with minimum payments. As the repayment period lengthens, the cumulative effect of interest accumulation becomes more pronounced, resulting in a substantial augmentation of the total interest paid. This protracted timeline can substantially inflate the cost of credit card debt, potentially impeding individuals’ financial progress and undermining their long-term financial well-being.

Furthermore, the composition of minimum payments, which often allocates a substantial portion to interest rather than the principal balance, exacerbates the impact on total interest. This perpetuates a cycle where a significant portion of each payment is absorbed by interest, impeding the reduction of the principal balance and perpetuating the burden of debt.

Understanding the impact of minimum payments on total interest is crucial for individuals seeking to navigate the complexities of credit card debt. By gaining insight into the mechanisms through which minimum payments contribute to the escalation of total interest, individuals can make informed decisions about their repayment strategies. This awareness empowers them to explore alternative approaches aimed at minimizing the overall interest paid, ultimately fostering improved financial stability and accelerating their journey toward debt freedom.

Strategies to Pay Off Credit Card Debt Faster

While the prospect of grappling with credit card debt can seem daunting, there are several effective strategies that individuals can employ to expedite the repayment process and achieve financial freedom more rapidly. By implementing these proactive approaches, individuals can mitigate the impact of minimum payments and make significant strides toward eliminating their credit card debt.

1. Increase Monthly Payments: By allocating a higher amount toward monthly payments, individuals can accelerate the reduction of their outstanding balance, thereby diminishing the total interest accrued over time. Even a modest increase in monthly payments can yield substantial long-term savings and expedite the journey toward debt freedom.

2. Prioritize High-Interest Debts: If holding multiple credit card balances, prioritizing the repayment of high-interest debts can yield significant interest savings. By focusing on extinguishing high-interest balances first, individuals can curtail the overall interest paid and expedite their progress toward debt elimination.

3. Avoid New Purchases: Temporarily refraining from new purchases on credit cards can prevent the escalation of existing debt. By exercising restraint and focusing on reducing the outstanding balance, individuals can fortify their commitment to debt repayment and avert the accumulation of additional financial obligations.

4. Explore Balance Transfer Options: Transferring high-interest credit card balances to cards with lower or zero introductory interest rates can offer respite from interest accumulation, enabling individuals to channel more funds toward reducing the principal balance. However, it’s crucial to assess associated fees and the long-term viability of this approach.

5. Generate Additional Income: Supplementing regular income with additional sources, such as freelance work or part-time employment, can furnish individuals with extra resources to bolster their debt repayment efforts. Even modest increments in income can yield substantial benefits in expediting the elimination of credit card debt.

By integrating these strategic approaches into their financial management, individuals can proactively address credit card debt and cultivate a path toward enhanced financial stability. These strategies not only mitigate the impact of minimum payments but also empower individuals to reclaim control of their financial well-being and embark on a trajectory toward long-term financial prosperity.

Conclusion

Navigating the realm of credit card debt and minimum payments necessitates a comprehensive understanding of their implications and the strategic approaches available to individuals. By shedding light on the dynamics of minimum payments and their impact on debt repayment, this article has equipped readers with valuable insights to fortify their financial acumen and empower them to make informed decisions about managing credit card debt.

It is imperative for individuals to recognize that while minimum payments offer temporary relief, they can significantly prolong the duration and escalate the cost of repaying credit card debt. By comprehending the interplay between minimum payments, outstanding balances, and interest accumulation, individuals can gain clarity on the long-term implications of their repayment approach and explore alternative strategies to expedite debt elimination.

Moreover, the strategic approaches outlined in this article provide individuals with actionable steps to mitigate the impact of minimum payments and accelerate their journey toward financial freedom. By increasing monthly payments, prioritizing high-interest debts, exercising financial restraint, exploring balance transfer options, and augmenting income, individuals can proactively address credit card debt and pave the way toward enhanced financial stability.

Ultimately, by integrating these insights and strategies into their financial management, individuals can transcend the constraints of minimum payments and embark on a trajectory toward long-term financial prosperity. Armed with a deeper understanding of credit card debt and minimum payments, readers are empowered to navigate the complexities of debt repayment with confidence, resilience, and a steadfast commitment to achieving financial well-being.