Home>Finance>What Is The Relationship Between An Emergency Fund And Credit/Loans?

Finance

What Is The Relationship Between An Emergency Fund And Credit/Loans?

Published: January 12, 2024

Discover the vital connection between having an emergency fund and managing your credit and loans effectively. Boost your financial security with smart finance choices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of an Emergency Fund

- Definition and Purpose of an Emergency Fund

- Benefits of Having an Emergency Fund

- Credit and Loans

- Relationship Between an Emergency Fund and Credit/Loans

- Emergency Fund as a Safety Net for Credit/Loans

- How an Emergency Fund Helps in Avoiding Debt

- Role of Emergency Fund in Managing Loan Repayments

- Emergency Fund as a Means to Maintain Good Credit Score

- Conclusion

Introduction

An emergency fund and credit/loans are two financial concepts that are often discussed in personal finance. Both play crucial roles in managing one’s financial situation, but they serve different purposes and have different relationships. Understanding the connection between an emergency fund and credit/loans can help individuals make informed decisions about their financial well-being.

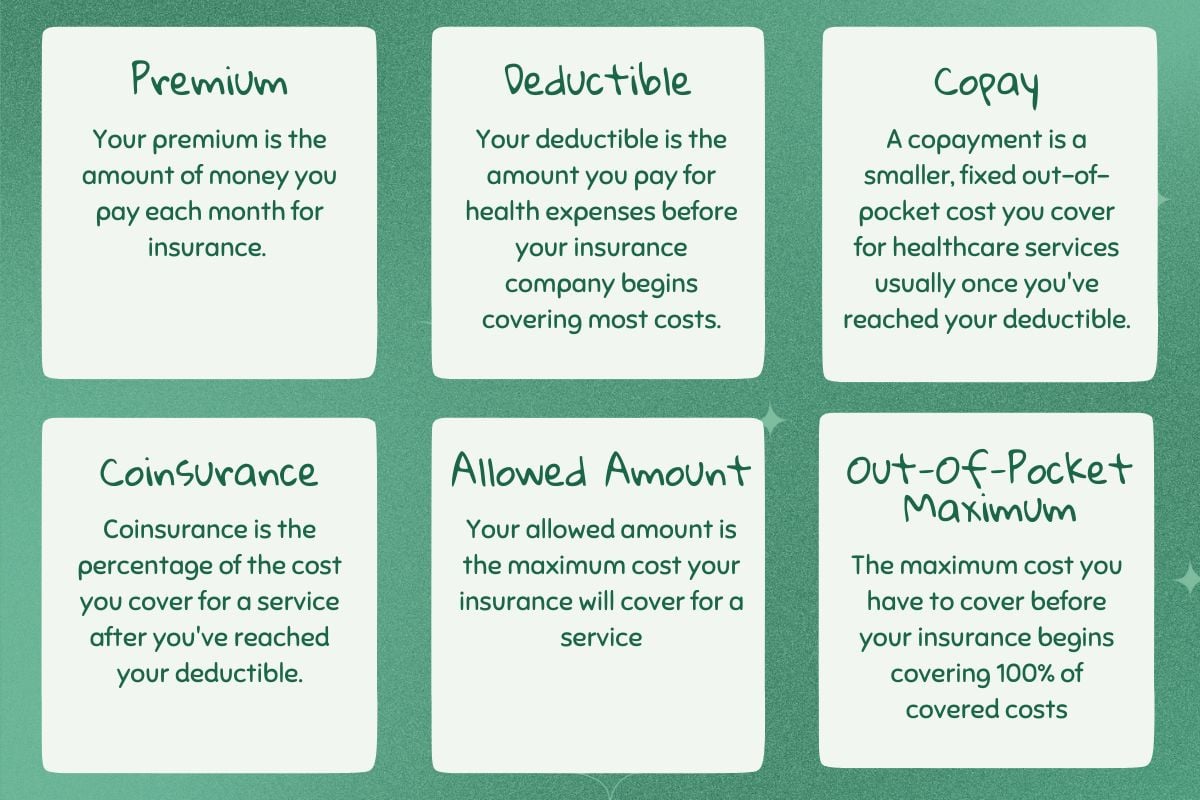

An emergency fund refers to a savings account specifically designed to cover unexpected expenses or financial emergencies. It acts as a safety net to protect individuals from unforeseen circumstances such as medical emergencies, car repairs, job loss, or any other unexpected expense that may arise. On the other hand, credit and loans refer to borrowed money that individuals can use to make purchases or cover expenses, with the obligation to repay the borrowed amount plus interest over a specified period.

While an emergency fund and credit/loans may seem unrelated, they are interconnected in various ways. An emergency fund can serve as a safety net for credit/loans, as it allows individuals to cover unexpected expenses without relying solely on borrowed funds. Additionally, having an emergency fund can help individuals avoid falling into debt and manage loan repayments effectively, ultimately maintaining a good credit score. In this article, we will explore the relationship between an emergency fund and credit/loans, highlighting the benefits of having an emergency fund and its impact on credit/loan management. Let’s dive in!

Importance of an Emergency Fund

An emergency fund plays a crucial role in personal finance and is often considered a financial cornerstone. Here are a few reasons why having an emergency fund is important:

- Financial Security: Life is full of uncertainties, and unexpected expenses can arise at any time. Having an emergency fund provides a financial safety net that can help individuals navigate through challenging times without relying on credit or loans. It offers peace of mind, knowing that there is a cushion to fall back on in case of emergencies.

- Handle Unexpected Expenses: From medical emergencies to sudden car repairs or home maintenance, unexpected expenses can quickly derail a person’s financial stability. With an emergency fund, individuals can cover these expenses without disrupting their budget or resorting to taking on debt. It allows them to handle financial emergencies without compromising other aspects of their financial life.

- Job Loss or Income Interruptions: Losing a job or experiencing a significant reduction in income can be devastating without proper financial preparation. An emergency fund acts as a buffer during such situations. It provides individuals with a temporary source of income to cover essential expenses while they search for a new job or evaluate alternative sources of income. It offers a sense of financial security and reduces stress during periods of uncertainty.

- Opportunity to Invest: Having an emergency fund in place can also open up opportunities for investment and financial growth. With a safety net in place, individuals can take calculated risks in pursuing investments that can potentially yield higher returns. It allows them to leverage their financial stability to explore avenues for wealth creation without jeopardizing their financial security.

- Break the Cycle of Debt: Many people turn to credit cards or loans to cover unexpected expenses. Relying on debt can create a cycle of borrowing, interest payments, and financial stress. An emergency fund provides an alternative to this cycle. It allows individuals to avoid incurring debt for unexpected expenses and maintain financial stability without relying on borrowed funds.

In summary, an emergency fund is essential for financial security and peace of mind. It provides individuals with the means to handle unexpected expenses, navigate through challenging times, and avoid falling into debt. It is a fundamental component of a healthy and robust personal finance plan.

Definition and Purpose of an Emergency Fund

An emergency fund is a savings account specifically set aside for unforeseen expenses or financial emergencies. It is a financial cushion that individuals can rely on when unexpected situations arise, helping them avoid resorting to credit cards or loans to cover these expenses. The primary purpose of an emergency fund is to provide financial stability and security during times of uncertainty.

The purpose of an emergency fund goes beyond just covering immediate expenses. It is designed to protect individuals from the financial impact of unexpected events, such as job loss, medical emergencies, car repairs, or home repairs. These unforeseen expenses can quickly derail a person’s financial well-being and lead to the accumulation of debt.

One of the key aspects of an emergency fund is its accessibility. It should be readily available when needed, without any restrictions or penalties for withdrawal. Typically, individuals are advised to keep their emergency fund in a separate savings account that is easily accessible, such as a high-yield savings account or a money market account.

The ideal size of an emergency fund varies based on individual circumstances and financial goals. Financial experts often recommend saving three to six months’ worth of living expenses. This provides a sufficient buffer to navigate through unexpected financial challenges. However, individuals with more unstable income or higher expenses may consider saving even more.

Having an emergency fund offers several advantages. Firstly, it provides a sense of financial security and peace of mind, knowing that there is a safety net to fall back on during times of uncertainty. It also allows individuals to handle unexpected expenses and emergencies without derailing their financial plans or incurring debt. Moreover, an emergency fund offers the flexibility to pursue opportunities or make important life transitions without financial stress or setbacks.

In summary, an emergency fund is a dedicated savings account that serves as a financial cushion for unexpected expenses or emergencies. Its purpose is to provide financial stability, protect against unforeseen events, and prevent individuals from relying on credit or loans during challenging times. Building and maintaining an adequate emergency fund is an essential component of a solid personal finance strategy.

Benefits of Having an Emergency Fund

Having an emergency fund offers numerous benefits that contribute to a person’s financial well-being and overall peace of mind. Let’s explore some of the key advantages of having an emergency fund:

- Financial Security: One of the primary benefits of having an emergency fund is the sense of financial security it provides. Knowing that there is a dedicated fund to handle unexpected expenses or emergencies can alleviate stress and anxiety about financial stability.

- Quick Access to Funds: Emergencies often require immediate access to funds. With an emergency fund in place, individuals have the peace of mind knowing that they can quickly withdraw the necessary funds without going through lengthy approval processes or relying on credit.

- Avoiding Debt: Having an emergency fund allows individuals to cover unforeseen expenses without relying on credit cards or loans. By using their own savings, they can avoid accumulating debt, save on interest charges, and maintain their financial well-being.

- Stress Reduction: Financial emergencies can be highly stressful. With an emergency fund, individuals can face unexpected circumstances with more confidence and less anxiety. They can focus on resolving the situation rather than worrying about the financial implications.

- Protecting Long-Term Financial Goals: An emergency fund acts as a safety net, protecting long-term financial goals such as retirement savings or education funds. By having a separate fund for emergencies, individuals can ensure that their other savings and investments remain intact, even during turbulent times.

- Flexibility and Independence: With an emergency fund, individuals have the flexibility to handle financial challenges on their own terms. They are not dependent on others or forced to seek financial assistance from family, friends, or creditors.

- Better Decision-Making: Financial emergencies often require quick decision-making. With an emergency fund, individuals can make well-informed choices without being driven solely by the urgency of the situation. They can consider various options and select the most appropriate course of action.

- Reduced Financial Stress: Having an emergency fund significantly reduces financial stress. Individuals can face unexpected expenses or emergencies with confidence, knowing that they have the resources to handle them. This leads to improved mental well-being and overall quality of life.

Overall, the benefits of having an emergency fund are numerous and impactful. It provides financial security, peace of mind, and the ability to handle unexpected expenses without resorting to debt. Building and maintaining an emergency fund is a wise financial decision that can have a positive and lasting impact on a person’s financial well-being.

Credit and Loans

Credit and loans are essential financial tools that allow individuals to make purchases or cover expenses when they do not have immediate access to sufficient funds. Understanding the basics of credit and loans is crucial for managing personal finances effectively.

Credit: Credit refers to the borrowing capacity of an individual or entity. It is a financial arrangement that allows the borrower to use funds provided by a lender with the promise to repay the borrowed amount, typically with interest, within a specified timeframe. Common forms of credit include credit cards, lines of credit, and personal loans.

Loans: Loans are a specific type of credit where a fixed amount is borrowed from a lender, and the borrower agrees to repay the amount plus interest over a set period. Loans can be secured, meaning they are backed by collateral such as a house or car, or unsecured, where no collateral is required.

Credit and loans provide individuals with the ability to make significant purchases or cover expenses that may be beyond their immediate financial capabilities. They can be used to buy a home, finance education, start a business, or handle unexpected expenses. However, it is important to use credit and loans responsibly to avoid ending up in a cycle of debt.

Credit and loans typically involve an application process that assesses the borrower’s creditworthiness, including factors such as credit history, income, employment stability, and debt-to-income ratio. Interest rates and loan terms are determined based on these factors, with borrowers who demonstrate a higher level of creditworthiness typically receiving more favorable terms.

Repaying credit and loans on time is vital for maintaining a good credit score. Late or missed payments can negatively impact a person’s creditworthiness and make it more challenging to secure future credit or loans at favorable rates. It is crucial to manage credit and loans responsibly, making payments on time and keeping a close eye on overall debt levels.

Understanding the different types of credit and loans available, as well as their associated risks and benefits, is essential for making informed financial decisions. By using credit and loans wisely, individuals can access necessary funds while maintaining their financial stability and cultivating a positive credit history.

Relationship Between an Emergency Fund and Credit/Loans

The relationship between an emergency fund and credit/loans is intertwined, as both play significant roles in managing one’s financial situation. Let’s explore the relationship between these two financial concepts:

Emergency Fund as a Safety Net for Credit/Loans: An emergency fund serves as a safety net that can help individuals cover unexpected expenses without relying solely on credit or loans. When financial emergencies arise, individuals can tap into their emergency fund rather than immediately turning to borrowed funds. This can help reduce reliance on credit and loans, saving individuals from unnecessary interest charges or the added burden of debt.

How an Emergency Fund Helps in Avoiding Debt: Having an emergency fund can help individuals avoid falling into the debt trap. When unexpected expenses occur, using savings from an emergency fund instead of relying on credit or loans allows individuals to maintain their financial stability. By minimizing unnecessary debt, individuals can better focus on building their financial future and avoiding financial stress.

Role of Emergency Fund in Managing Loan Repayments: An emergency fund can also play a crucial role in managing loan repayments. If individuals experience a temporary loss of income or unexpected expenses while repaying a loan, they can rely on their emergency fund to make timely payments. This helps protect their creditworthiness and avoids defaulting on loan obligations, which could have significant consequences for their financial well-being.

Emergency Fund as a Means to Maintain Good Credit Score: A good credit score is essential for accessing favorable credit and loan terms. An emergency fund can contribute to maintaining a good credit score by providing a financial safety net. By having funds available to cover unexpected expenses, individuals can avoid missing loan payments or resorting to high-interest credit card debt. This responsible financial management strengthens their creditworthiness and helps maintain a positive credit score.

In summary, an emergency fund and credit/loans are interconnected in various ways. An emergency fund serves as a safety net that can help individuals avoid the need for immediate credit or loans when unexpected expenses arise. It plays a vital role in managing loan repayments, maintaining a good credit score, and overall financial stability. By building and maintaining an emergency fund, individuals can become more financially resilient and reduce their reliance on credit and loans.

Emergency Fund as a Safety Net for Credit/Loans

An emergency fund serves as a crucial safety net for individuals when it comes to managing credit and loans. Having an emergency fund in place can provide a buffer against unexpected financial challenges, reducing the reliance on borrowed funds. Let’s delve into how an emergency fund acts as a safety net for credit and loans.

When faced with unexpected expenses or emergencies, many individuals turn to credit cards or loans to cover the costs. However, relying solely on borrowed funds can lead to high-interest payments, debt accumulation, and financial stress. This is where an emergency fund becomes invaluable.

With an emergency fund, individuals have their own savings to fall back on when unforeseen circumstances arise. They have a dedicated pool of funds set aside specifically for emergency situations, such as medical emergencies, car repairs, or job loss. By using the money from the emergency fund instead of relying on credit or loans, individuals can navigate these unexpected expenses more effectively without incurring debt or paying high interest charges.

Having an emergency fund as a safety net for credit and loans provides several advantages. Firstly, it allows individuals to avoid the immediate financial strain of borrowing money. Instead, they can dip into their emergency fund, alleviating the pressure of repayment deadlines and accumulating interest charges.

Moreover, relying on an emergency fund instead of credit or loans helps individuals maintain control over their financial situation. They can make decisions based on their own savings and circumstances rather than relying on external sources of funding. This empowers individuals to take charge of their finances and avoid falling into a cycle of debt.

Additionally, using an emergency fund as a safety net helps individuals preserve their creditworthiness. By avoiding excessive reliance on credit or loans, individuals can ensure that their credit utilization ratio remains low and their credit history remains favorable. This can have a positive impact on their credit score, making it easier to access credit and loans on more favorable terms in the future.

In summary, an emergency fund acts as a safety net that protects individuals from relying solely on credit or loans during unexpected financial challenges. It provides a cushion of savings that can be used to cover unforeseen expenses, reducing the need for immediate borrowing and its associated costs. By having an emergency fund in place, individuals gain greater financial control, preserve their creditworthiness, and reduce their reliance on borrowed funds.

How an Emergency Fund Helps in Avoiding Debt

One of the significant advantages of having an emergency fund is its role in helping individuals avoid falling into debt. An emergency fund acts as a financial buffer, allowing individuals to cover unexpected expenses without resorting to borrowing or relying on credit cards. Let’s explore how an emergency fund helps in avoiding debt.

Unexpected expenses are a common part of life, whether it’s a medical emergency, car repair, or home maintenance issue. Without an emergency fund, individuals may be tempted to use credit cards or take out loans to cover these expenses. However, relying on borrowed funds can lead to high-interest charges and the accumulation of debt over time.

Having an emergency fund provides individuals with a dedicated pool of savings specifically designated for unforeseen events. When faced with unexpected expenses, individuals can tap into their emergency fund rather than relying on credit or loans. By using their own savings, they avoid the burden of debt and the financial strain that comes with it.

An emergency fund acts as a safety net, preventing individuals from falling into a cycle of borrowing. It helps break the cycle of using credit cards to pay for immediate expenses and then struggling to pay off the balance, leading to interest charges and potentially increasing debt. Instead, individuals can use their emergency fund to cover these expenses, maintaining their financial stability.

Moreover, having an emergency fund promotes responsible financial management. It encourages individuals to prioritize saving for unexpected expenses, ensuring that they are prepared for financial challenges. By actively contributing to an emergency fund, individuals develop healthy financial habits and become more adept at managing their finances effectively.

By having an emergency fund in place to handle unexpected expenses, individuals have greater control over their financial well-being. They can proactively address financial challenges without relying on external sources of funding or accumulating debt. This ultimately leads to reduced stress and anxiety related to financial matters, improving overall financial well-being and peace of mind.

Additiona

Role of Emergency Fund in Managing Loan Repayments

An emergency fund plays a crucial role in managing loan repayments and ensuring financial stability. Unexpected circumstances such as a job loss, medical emergency, or other financial setbacks can make it challenging for individuals to meet their loan obligations. Let’s explore how an emergency fund can help individuals effectively manage loan repayments.

1. Covering Temporary Loss of Income: During a period of unemployment or income interruption, an emergency fund can provide individuals with a temporary source of income to cover their loan repayments. It serves as a financial safety net, allowing individuals to continue making timely payments without defaulting on their loans.

2. Preventing Late Payment Penalties: Late payment penalties can be significant and add to the overall cost of the loan. By having an emergency fund in place, individuals can avoid missing loan payments due to unexpected expenses or emergencies. They can use the savings from their emergency fund to make the payments on time, helping them avoid unnecessary penalties.

3. Maintaining Creditworthiness: Timely loan repayments are crucial for maintaining a good credit score. A good credit score opens up opportunities for more favorable interest rates and loan terms in the future. By using an emergency fund to manage loan repayments during challenging times, individuals can protect their creditworthiness and ensure their credit score remains strong.

4. Reducing Stress and Financial Burden: Financial difficulties can be stressful, especially when it comes to meeting loan obligations. Having an emergency fund can alleviate some of that stress by providing individuals with the means to make loan payments on time, even when facing unexpected financial challenges. This reduces the financial burden and allows individuals to focus on finding solutions rather than worrying about defaulting on their loans.

5. Flexibility in Loan Repayment Options: In certain circumstances, individuals may need to negotiate alternative repayment options with their lenders, such as deferment or restructuring. Having an emergency fund can provide individuals with flexibility in exploring these options. They can use their savings to continue making some level of loan payments or negotiate new terms with lenders, helping to manage their loans effectively.

It is important to note that while an emergency fund can help manage loan repayments, it should not be seen as a replacement for a consistent and responsible repayment plan. It is meant to provide temporary relief during unforeseen circumstances. Individuals should continue to budget and plan for loan repayments as part of their overall financial strategy.

In summary, an emergency fund serves as a valuable resource in handling unexpected financial challenges that could impact loan repayments. By providing a safety net, it allows individuals to cover temporary income setbacks and maintain their creditworthiness. Having an emergency fund promotes financial stability and helps individuals effectively manage their loan repayments during difficult times.

Emergency Fund as a Means to Maintain Good Credit Score

An emergency fund not only provides financial security for unexpected expenses but also plays a crucial role in maintaining a good credit score. Your credit score is a significant factor in determining your creditworthiness, and it affects your ability to secure favorable interest rates and loan terms. Let’s explore how an emergency fund can help individuals maintain a good credit score.

1. Timely Loan Repayments: One of the fundamental factors that contribute to a good credit score is making loan repayments on time. Having an emergency fund ensures that individuals have the necessary funds to make their loan payments promptly, even during unforeseen financial setbacks. This helps maintain a positive payment history, a key component of credit scores.

2. Preventing Default and Delinquency: An emergency fund acts as a safety net, helping individuals avoid defaulting on their loans or becoming delinquent in their payments. When faced with unexpected expenses or income disruptions, individuals with an emergency fund can use those savings to continue making timely loan payments. This not only protects their creditworthiness but also avoids negative entries on their credit reports.

3. Reducing Credit Utilization: Credit utilization, or the amount of available credit that individuals use, is an essential factor in credit scoring models. Maintaining a low credit utilization ratio is key to a good credit score. By having an emergency fund to cover unexpected expenses, individuals can avoid relying heavily on credit cards or maxing out their available credit. This helps keep their credit utilization low, which positively impacts their credit score.

4. Avoiding Excessive New Credit Applications: Multiple credit inquiries within a short period can have a negative impact on credit scores. By having an emergency fund, individuals are better prepared to handle unexpected expenses without resorting to new credit applications. This reduces the need for opening new accounts and minimizes the potential negative impact on credit scores.

5. Financial Stability: Lenders often look for financial stability when assessing creditworthiness. An emergency fund demonstrates responsible financial management and the ability to handle unexpected expenses. This stability is reflected in credit reports and can positively influence lenders’ perception of an individual’s creditworthiness.

By having an emergency fund, individuals can navigate through financial challenges without relying heavily on credit or accumulating debt. This responsible financial behavior is reflected in credit reports and contributes to maintaining a good credit score. It illustrates a level of financial preparedness that lenders value when assessing creditworthiness.

It is essential to note that an emergency fund alone does not guarantee a good credit score. Other factors such as payment history, credit mix, length of credit history, and avoiding negative marks on credit reports also play significant roles. However, an emergency fund strengthens an individual’s financial position, promotes responsible credit management, and contributes to maintaining a good credit score over time.

In summary, an emergency fund serves as a means to maintain a good credit score by ensuring timely loan repayments, preventing default, reducing credit utilization, and promoting financial stability. By having savings to handle unexpected expenses, individuals demonstrate responsible financial behavior and create a solid foundation for maintaining good creditworthiness.

Conclusion

An emergency fund and credit/loans are both significant aspects of personal finance, and understanding their relationship is crucial for financial stability. An emergency fund acts as a safety net, providing individuals with the means to handle unexpected expenses without relying solely on credit or loans. It serves as a financial cushion that protects individuals from falling into debt due to unforeseen circumstances.

Having an emergency fund offers numerous benefits, including financial security, the ability to handle unexpected expenses, and avoiding the cycle of debt. It provides individuals with peace of mind, knowing that they have a dedicated savings account specifically for emergencies. An emergency fund also plays a vital role in managing loan repayments, allowing individuals to continue making timely payments even during income disruptions or financial setbacks.

By relying on an emergency fund rather than credit or loans, individuals can maintain a good credit score. It helps ensure that loan repayments are made on time, reducing the risk of default or delinquency. Additionally, an emergency fund can help individuals maintain a low credit utilization ratio, avoid excessive credit applications, and demonstrate financial stability, all of which contribute to a positive credit history.

In conclusion, an emergency fund and credit/loans are intertwined in personal finance. Building and maintaining an emergency fund is essential for financial stability, providing individuals with a safety net for unexpected expenses and helping them avoid unnecessary debt. By utilizing an emergency fund effectively, individuals can protect their creditworthiness, manage loan repayments, and maintain a good credit score. It is a powerful financial tool that offers peace of mind and enables individuals to weather financial storms with confidence.