Finance

How To Pay Off Business Credit Card

Published: October 27, 2023

Looking for effective ways to pay off your business credit card? Learn valuable finance strategies to take control of your debt and achieve financial freedom.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Assess Your Current Financial Situation

- Step 2: Create a Budget and Set a Repayment Goal

- Step 3: Prioritize and Consolidate Your Debts

- Step 4: Negotiate with Credit Card Companies

- Step 5: Increase Your Income

- Step 6: Cut Expenses

- Step 7: Utilize Balance Transfers

- Step 8: Pay More Than the Minimum Payment

- Step 9: Consider Debt Snowball or Debt Avalanche Methods

- Step 10: Seek Professional Advice if Needed

- Conclusion

Introduction

Running a business often involves the use of credit cards to manage expenses and cash flow. While credit cards can be convenient, they can also become a burden if not managed properly. High-interest rates and accumulating balances can quickly lead to financial stress and hinder business growth.

If you find yourself struggling to pay off your business credit card debt, you’re not alone. Many business owners face this challenge at some point. However, with proper planning and strategies, you can regain control of your finances and work towards becoming debt-free. In this article, we will explore ten steps to help you effectively pay off your business credit cards.

Before diving into these steps, it’s essential to understand the importance of paying off your credit card debt. By clearing your outstanding balances, you will reduce interest charges and free up funds that can be reinvested into your business or used to achieve personal financial goals.

Remember, paying off business credit card debt requires commitment, discipline, and a solid repayment plan. It may take time, but by following these steps, you’ll be on your way to financial freedom and a stronger financial foundation for your business.

Step 1: Assess Your Current Financial Situation

The first step to paying off your business credit card debt is to assess your current financial situation. This involves taking a close look at your credit card statements, outstanding balances, interest rates, and minimum payments. It’s crucial to have a clear understanding of how much debt you have and the specifics of each credit card account.

Additionally, examine your business’s cash flow and revenue. Determine how much money is coming in and going out each month. Evaluate your business’s profitability and identify areas where you can cut expenses or increase revenue to free up additional funds for debt repayment.

During this assessment, it’s also important to review your personal finances. Separate your business and personal finances to gain a clearer picture of your overall financial health. This will help you avoid using personal funds to cover business credit card debt and vice versa.

Once you have a comprehensive understanding of your financial situation, you can move on to the next step of creating a budget and setting a repayment goal.

Step 2: Create a Budget and Set a Repayment Goal

Creating a budget is a crucial step in paying off your business credit card debt. It allows you to gain control over your finances and allocate funds towards debt repayment systematically. Start by listing all of your monthly income sources and expenses, both business and personal.

Identify areas where you can reduce expenses and reallocate those savings towards paying down your credit card debt. This might involve cutting unnecessary business expenses, negotiating lower rates with suppliers, or finding more cost-effective ways to operate your business.

Set a realistic repayment goal based on your budget and financial capability. Determine how much you can reasonably afford to pay towards your credit card debt each month. Ideally, aim to pay more than just the minimum payment to expedite the debt payoff process.

Consider using the debt snowball or debt avalanche method to guide your repayment strategy. With the snowball method, you prioritize paying off the credit card with the smallest balance first while making minimum payments on the rest. Once the smallest balance is paid off, you move on to the next smallest balance, and so on. The avalanche method, on the other hand, prioritizes paying off credit cards with the highest interest rates first.

Remember to track your progress regularly and make adjustments to your budget and repayment goal as needed. Celebrate milestones along the way to stay motivated and committed to becoming debt-free.

Step 3: Prioritize and Consolidate Your Debts

When facing multiple credit card debts, it’s essential to prioritize your payments. Take into account factors such as interest rates, outstanding balances, and any penalties or fees associated with each credit card. By focusing on paying off high-interest debts first, you can minimize the overall interest charges and reduce the time it takes to become debt-free.

Consider consolidating your credit card debts into a single loan or balance transfer credit card with a lower interest rate. This can simplify your repayment process by combining all your debts into one manageable payment and potentially save you money on interest charges. However, before consolidating, carefully review the terms and conditions, including any balance transfer fees and the interest rate after the introductory period.

If consolidation is not an option, explore the possibility of negotiating with your credit card companies for lower interest rates or more favorable repayment terms. Contact your credit card providers and explain your situation. They may be willing to work with you to create a repayment plan that better suits your financial needs.

By prioritizing your debts and potentially consolidating them, you can streamline your repayment process and make it more manageable.

Step 4: Negotiate with Credit Card Companies

If you’re struggling to repay your business credit card debt, it’s worth reaching out to your credit card companies to negotiate for more favorable terms. While not guaranteed, many credit card companies are willing to work with customers facing financial difficulties.

Start by contacting the customer service department of each credit card company. Explain your current financial situation, the challenges you’re facing, and your commitment to repaying the debt. Request a lower interest rate, possible fee waivers, or a repayment plan that better aligns with your financial capabilities.

When negotiating, it’s essential to be prepared and present your case professionally. Highlight any positive factors such as your previous payment history and the potential for long-term business growth. Emphasize your willingness to work together towards a mutually acceptable solution.

Consider seeking the assistance of a credit counseling agency to help with the negotiation process. These agencies have experience working with credit card companies and can provide guidance on how to best approach the negotiation and increase your chances of success.

Remember, not all negotiations will result in favorable outcomes. However, it’s worth making the effort to explore these options and potentially reduce the financial burden of your credit card debt.

Step 5: Increase Your Income

To accelerate the repayment of your business credit card debt, consider finding ways to increase your income. Generating additional revenue can provide you with more funds to allocate towards debt repayment, helping you pay off your balances more quickly.

Here are a few strategies to increase your income:

- Expand your product or service offerings: Look for opportunities to diversify and expand your business’s offerings. Consider introducing new products or services that can bring in additional revenue streams.

- Enhance your marketing efforts: Invest in marketing strategies to attract new customers and increase sales. This could involve optimizing your website, leveraging social media platforms, or running targeted advertising campaigns.

- Offer promotions or discounts: Temporarily reduce prices or offer special deals to attract more customers. While this may impact your profit margin in the short term, acquiring new customers can lead to long-term growth.

- Explore partnerships or collaborations: Consider collaborating with other businesses or influencers in your industry to expand your reach and tap into new customer bases.

- Start a side business or freelance: If possible, explore opportunities to generate income outside of your main business. This could involve freelancing in your area of expertise or starting a small side business.

- Maximize existing customer relationships: Look for opportunities to upsell or cross-sell to your existing customer base. Offer additional products or services that complement what they have already purchased.

By increasing your income, you’ll have more resources available to tackle your credit card debt and achieve your financial goals.

Step 6: Cut Expenses

Reducing your expenses is a crucial step in freeing up more funds to pay off your business credit card debt. By identifying areas where you can cut costs, you can save money that can be redirected towards debt repayment. Here are some strategies to consider:

- Review your monthly expenses: Go through your business and personal expenses carefully. Look for any unnecessary or excessive spending that can be eliminated or reduced.

- Negotiate with vendors and suppliers: Reach out to your suppliers or vendors and try to negotiate better deals or lower prices. They may be open to adjusting their rates to retain your business.

- Optimize your inventory management: Analyze your inventory and find ways to minimize waste and excess stock. This can help reduce storage costs and improve cash flow.

- Reduce utility expenses: Take steps to conserve energy and minimize utility bills. Switch to energy-efficient appliances, turn off lights when not in use, and adjust thermostat settings.

- Cancel unnecessary subscriptions or memberships: Review your subscriptions and memberships and cancel those that you no longer need or can do without. This can include software subscriptions, gym memberships, or streaming services.

- Save on office supplies: Look for ways to cut costs on office supplies and equipment. Consider purchasing in bulk, shopping for deals, or exploring alternatives to expensive brand-name items.

- Control business travel expenses: If your business involves frequent travel, look for opportunities to reduce travel-related expenses. Consider virtual meetings or explore more cost-effective travel options.

Remember, small savings can add up over time, so even modest expense reductions can make a significant impact on your ability to pay off your credit card debt.

Step 7: Utilize Balance Transfers

One effective strategy for managing and paying off your business credit card debt is to utilize balance transfers. A balance transfer involves transferring the balances from your high-interest credit cards to a new credit card with a lower interest rate or promotional 0% APR. This can help you save money on interest charges and accelerate your debt repayment.

Here’s how to make the most of balance transfers:

- Research and compare balance transfer offers: Look for credit cards that offer low or 0% introductory APRs on balance transfers. Compare the terms and fees associated with each offer to determine which one best suits your needs.

- Calculate the potential savings: Assess how much you can save by transferring your balances to a lower-interest credit card. Consider any balance transfer fees and make sure the savings outweigh the costs.

- Pay attention to the introductory period: Take note of how long the promotional APR will last. Plan to pay off your balance before the introductory period ends to avoid higher interest rates afterwards.

- Make timely payments: Ensure that you make the minimum payments on time to maintain the benefits of the balance transfer offer. Late payments may result in losing the promotional APR and incurring penalty fees.

- Avoid new purchases: While you’re focused on paying off your credit card debt, refrain from making new purchases on your balance transfer card. Instead, use the card exclusively for debt repayment.

Balance transfers can be an effective tool for consolidating your debts and reducing interest charges. However, it’s crucial to read the terms and conditions carefully and understand any potential risks or fees involved.

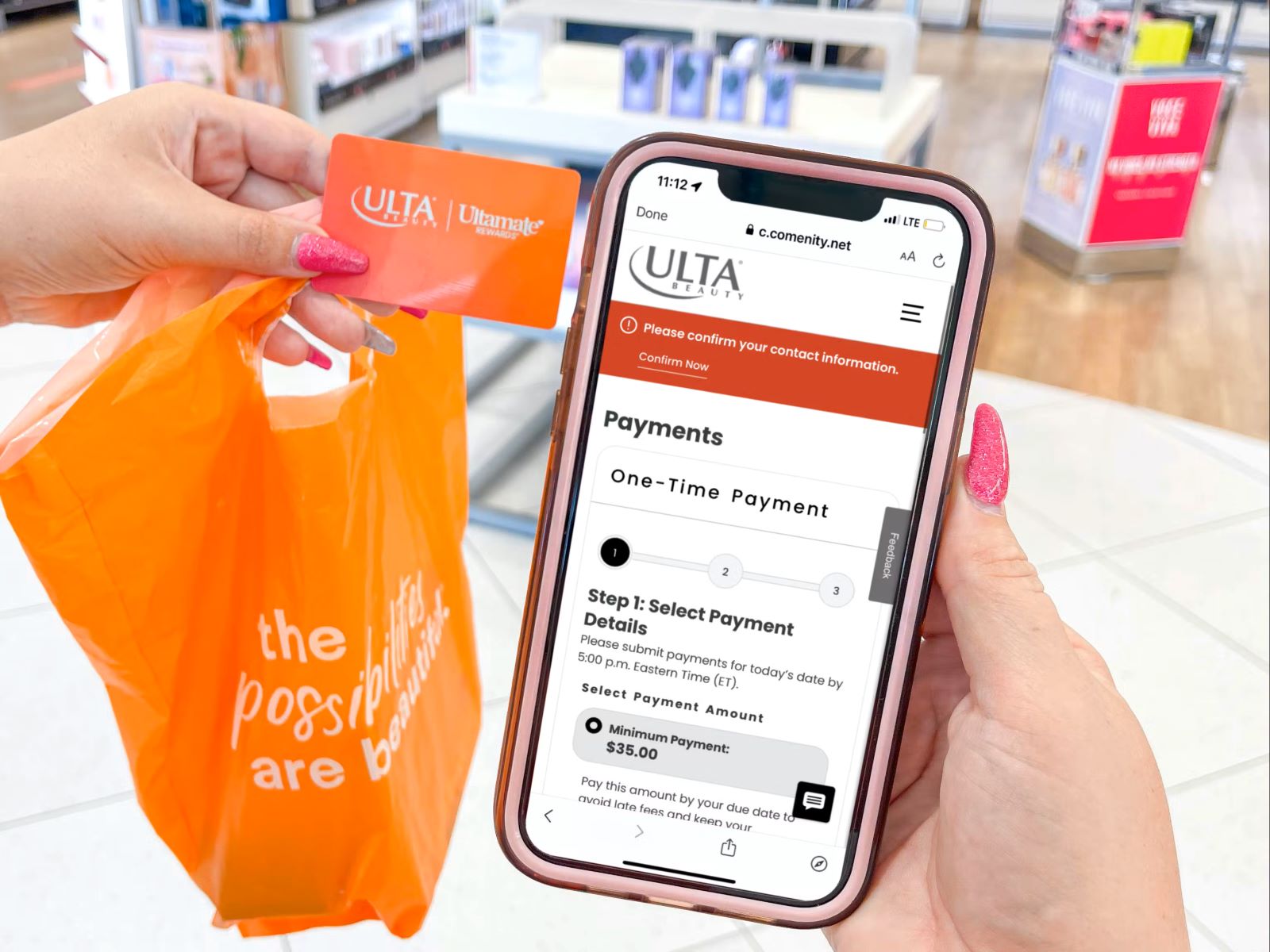

Step 8: Pay More Than the Minimum Payment

When paying off your business credit card debt, it’s important to avoid falling into the minimum payment trap. Paying only the minimum required amount each month can significantly prolong your debt repayment and increase the total interest paid over time. Instead, strive to pay more than the minimum payment to expedite your journey to becoming debt-free.

Here’s why paying more than the minimum payment is crucial:

1. Reduce Interest Charges: By making larger payments, you can minimize the amount of interest that accrues on your outstanding balances. This can save you a substantial amount of money over the course of your debt repayment.

2. Pay Off Debt Faster: Increasing your payments allows you to make faster progress in paying down your credit card debt. It can help you gain momentum and stay motivated as you see your balances decrease more quickly.

3. Improve Credit Utilization Ratio: Your credit utilization ratio, which is the amount of credit you’re using compared to your credit limit, plays a significant role in your credit score. By paying more than the minimum payment and reducing your balances, you can improve your credit utilization ratio, which can have a positive impact on your credit score.

4. Build Financial Discipline: Committing to paying more than the minimum payment requires discipline and financial responsibility. It can help you develop good money management habits and set a solid foundation for future financial success.

When allocating your budget towards debt repayment, aim to pay as much as you can comfortably afford above the minimum payment. Even a small increase can make a significant difference in your journey towards debt freedom.

Consider adjusting your budget, cutting expenses, or finding ways to increase your income to free up more funds for larger debt payments. Every extra dollar you put towards your credit card debt brings you closer to achieving your goal of being debt-free.

Step 9: Consider Debt Snowball or Debt Avalanche Methods

When tackling multiple credit card debts, considering a structured approach such as the debt snowball or debt avalanche methods can provide you with a clear roadmap for paying off your business credit card debt.

Debt Snowball Method:

The debt snowball method involves prioritizing your debts based on the balance amount, regardless of the interest rates. You start by paying off the credit card with the smallest balance first while making minimum payments on the rest. Once the smallest balance is paid off, you move on to the next smallest balance, and so on. The idea behind this method is to create small wins early on, which can provide motivation and build momentum as you move towards tackling larger debts.

Debt Avalanche Method:

The debt avalanche method, on the other hand, prioritizes debts based on the interest rate, regardless of the balance amount. You start by paying off the credit card with the highest interest rate first while making minimum payments on the rest. Once the highest interest rate debt is paid off, you move on to the one with the next highest interest rate, and so on. This method helps you minimize the total interest paid over time and can potentially lead to faster debt repayment.

Choosing between these methods comes down to personal preference and financial situation. The debt snowball method emphasizes psychological wins, while the debt avalanche method focuses on saving money on interest charges. Assess your priorities and decide which method aligns best with your goals and motivates you to stay committed to paying off your credit card debt.

Remember, both methods require dedicating as much of your budget as possible towards making extra payments on the prioritized debt while making minimum payments on the others. As you pay off one debt, allocate those funds towards the remaining debts, accelerating your progress towards becoming debt-free.

Step 10: Seek Professional Advice if Needed

While you can take many steps on your own to pay off your business credit card debt, it’s important to recognize when professional advice might be beneficial. Seeking guidance from a financial advisor or credit counselor can provide you with expert insights and personalized strategies to effectively manage your debt.

Here are a few reasons why you might consider seeking professional advice:

1. Expert Knowledge: Financial advisors and credit counselors are well-versed in debt management and have extensive knowledge of various strategies and tools to help individuals and businesses get out of debt.

2. Tailored Solutions: Professionals can analyze your specific financial situation and provide tailored recommendations based on your unique circumstances. They can help you create a customized debt repayment plan that fits your needs and goals.

3. Negotiation Assistance: If you’re struggling to negotiate with credit card companies, professionals can step in and help you communicate effectively, potentially securing better terms and saving you money in the process.

4. Financial Education: Alongside debt repayment strategies, professionals can provide valuable education and guidance on budgeting, money management, and improving your overall financial health. This can equip you with the knowledge and skills to avoid falling into debt again in the future.

5. Emotional Support: Dealing with debt can be emotionally challenging. Professionals can provide emotional support throughout the process, helping you stay motivated and focused on your goal of becoming debt-free.

When seeking professional advice, research and choose a reputable financial advisor or credit counseling agency. Look for credentials, certifications, and positive reviews from previous clients to ensure you’re working with a trusted and experienced professional.

Remember, consulting with a professional doesn’t mean you’re incapable of managing your debt on your own. It simply means you’re taking advantage of their expertise to gain additional guidance and support as you work towards paying off your business credit card debt.

Conclusion

Paying off your business credit card debt requires a combination of careful planning, discipline, and strategic decision-making. By following the ten steps outlined in this article, you can regain control of your finances and work towards becoming debt-free.

Assessing your current financial situation, creating a budget, and setting a repayment goal are foundational steps that provide clarity and direction. Prioritizing and consolidating your debts, negotiating with credit card companies, and increasing your income can help you free up more funds to allocate towards debt repayment.

Additionally, cutting expenses, utilizing balance transfers, paying more than the minimum payment, and considering debt snowball or debt avalanche methods provide practical approaches to accelerating your debt payoff journey. Finally, if needed, seeking professional advice ensures that you are well-supported and guided throughout the process.

Remember, paying off your business credit card debt takes time and commitment. Stay focused on your goals, celebrate milestones along the way, and keep a long-term perspective. With perseverance and determination, you will overcome your debt and achieve financial freedom for your business.

Take the first step today and start implementing these strategies. Your business deserves a solid financial foundation, and by paying off your credit card debt, you’ll be one step closer to achieving lasting success.