Finance

How To Determine My Revolving Credit

Modified: March 5, 2024

Learn how to calculate your revolving credit and manage your finances effectively. Understand the impact of revolving credit on your financial health. Discover expert tips and advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Revolving credit plays a pivotal role in personal finance and can significantly impact an individual's financial well-being. Understanding and effectively managing revolving credit is essential for maintaining a healthy credit profile and achieving financial goals. In this article, we will delve into the concept of revolving credit, its significance, and the methods to determine and manage it effectively.

Revolving credit is a versatile financial tool that allows individuals to borrow funds up to a certain limit and make regular payments based on the outstanding balance. Unlike installment credit, which involves fixed payments over a predetermined period, revolving credit offers flexibility in repayment, making it a popular choice for various financial needs. Whether it's utilizing a credit card for everyday purchases, managing unexpected expenses, or funding larger purchases, revolving credit provides a convenient and accessible means of borrowing.

Understanding the nuances of revolving credit is crucial for individuals seeking to make informed financial decisions. By comprehending the factors that influence revolving credit and employing effective management strategies, individuals can optimize their credit utilization and bolster their financial stability. This article aims to provide valuable insights into determining and managing revolving credit, empowering readers to take control of their financial well-being.

As we explore the intricacies of revolving credit, we will uncover the methods for evaluating one's revolving credit, the factors that influence it, and essential tips for its prudent management. By gaining a comprehensive understanding of revolving credit, individuals can navigate the financial landscape with confidence, leveraging this financial tool to their advantage while safeguarding their fiscal health.

What is Revolving Credit?

Revolving credit is a form of credit that provides borrowers with a pre-approved limit and the flexibility to utilize funds as needed, up to the specified limit. Unlike installment credit, which involves borrowing a specific amount and repaying it in fixed installments over a predetermined period, revolving credit allows borrowers to repeatedly access funds as long as the outstanding balance does not exceed the approved limit.

The most common form of revolving credit is the credit card, which enables cardholders to make purchases or obtain cash advances up to a certain credit limit. Each month, the cardholder receives a statement detailing the outstanding balance and the minimum amount due. While the minimum payment must be made to keep the account in good standing, the cardholder has the option to carry the remaining balance forward, incurring interest charges on the unpaid amount.

Another prevalent type of revolving credit is the home equity line of credit (HELOC), which allows homeowners to borrow against the equity in their property. Similar to a credit card, a HELOC provides a revolving line of credit with a predetermined limit, affording homeowners the flexibility to draw funds as necessary and repay the outstanding balance over time.

Revolving credit offers convenience and flexibility, making it an attractive option for individuals and businesses with fluctuating financial needs. Whether used for managing day-to-day expenses, covering unexpected costs, or funding larger purchases, revolving credit provides a readily available source of funds, offering greater financial agility compared to traditional installment loans.

Understanding the nature of revolving credit is essential for individuals seeking to leverage this financial tool effectively. By grasping the fundamental characteristics of revolving credit and its implications for personal finance, borrowers can make informed decisions regarding credit utilization and repayment strategies. Moreover, being mindful of the terms and conditions governing revolving credit can empower individuals to manage their credit responsibly and avoid potential pitfalls associated with excessive borrowing and high-interest costs.

Importance of Knowing Your Revolving Credit

Understanding your revolving credit is crucial for maintaining a healthy financial profile and achieving long-term fiscal stability. By being aware of your revolving credit status, you gain valuable insights into your borrowing capacity, credit utilization, and overall financial health. This awareness empowers you to make informed decisions regarding credit utilization, repayment strategies, and financial planning, ultimately contributing to a sound financial future.

One of the primary reasons for knowing your revolving credit is to effectively manage your overall credit utilization. Credit utilization, or the ratio of your outstanding credit balances to your credit limits, is a key factor influencing your credit score. By monitoring your revolving credit, you can assess your credit utilization and take proactive measures to keep it within optimal limits, thereby safeguarding your credit score and enhancing your creditworthiness.

Furthermore, understanding your revolving credit enables you to assess your financial obligations and plan your budget effectively. By knowing the outstanding balances, payment due dates, and interest rates associated with your revolving credit accounts, you can prioritize payments, avoid late fees, and allocate funds strategically to meet your financial commitments. This proactive approach to managing revolving credit fosters financial discipline and reduces the risk of accumulating excessive debt.

Moreover, being cognizant of your revolving credit status allows you to identify any discrepancies or unauthorized activities promptly. Regularly reviewing your credit card statements, credit reports, and account balances empowers you to detect and address any fraudulent transactions or errors, mitigating potential financial losses and safeguarding your credit reputation.

Additionally, knowing your revolving credit is essential for making informed borrowing decisions. Whether considering additional credit applications, evaluating balance transfer options, or assessing the need for credit limit increases, a comprehensive understanding of your revolving credit position enables you to weigh the potential impact on your financial well-being and make prudent choices aligned with your long-term goals.

In essence, the importance of knowing your revolving credit cannot be overstated. By staying informed about your credit utilization, financial obligations, and creditworthiness, you are better equipped to navigate the complexities of personal finance, optimize your borrowing capacity, and cultivate a responsible and sustainable approach to managing credit.

How to Determine Your Revolving Credit

Determining your revolving credit involves assessing various factors, including your outstanding balances, available credit limits, and credit utilization across your revolving credit accounts. By conducting a thorough evaluation of these elements, you can gain a comprehensive understanding of your revolving credit position and make informed decisions regarding credit management and financial planning.

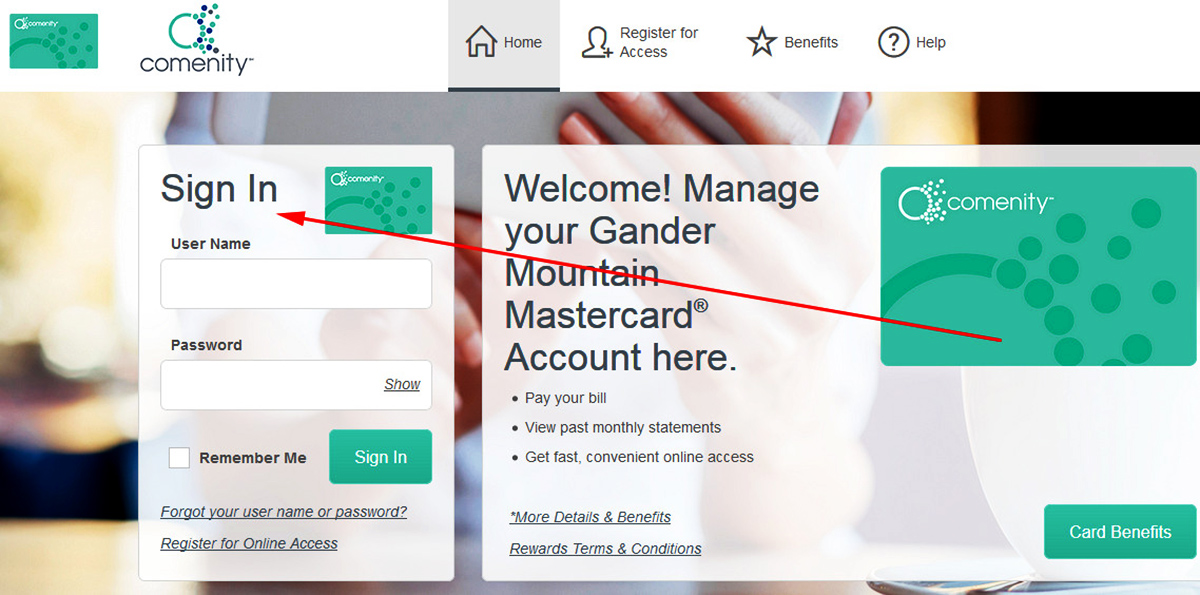

The first step in determining your revolving credit is to gather information about your existing credit accounts, including credit cards, lines of credit, and other revolving credit facilities. Review your latest account statements, online banking portals, or credit reports to compile a comprehensive list of your revolving credit accounts, along with their respective outstanding balances and available credit limits.

Once you have compiled this information, calculate the total outstanding balances across all your revolving credit accounts. This cumulative amount represents your current revolving credit debt, reflecting the total funds you have utilized from your available credit lines.

Next, determine the aggregate credit limits for all your revolving credit accounts. Summing up the individual credit limits provides you with the total available credit at your disposal, representing the maximum borrowing capacity across your revolving credit facilities.

With the outstanding balances and available credit limits in hand, you can calculate your overall credit utilization ratio. This ratio is derived by dividing the total outstanding balances by the total available credit limits and is expressed as a percentage. A lower credit utilization ratio indicates responsible credit management, while a higher ratio may raise concerns about excessive borrowing and potential credit risks.

Furthermore, consider reviewing your credit reports from major credit bureaus, as they provide a comprehensive overview of your revolving credit accounts, payment history, and credit utilization. By examining these reports, you can verify the accuracy of the reported information, identify any discrepancies, and gain valuable insights into your credit standing.

Regularly assessing your revolving credit position is essential for monitoring your credit utilization, identifying potential areas for improvement, and making informed decisions to optimize your credit management. By staying proactive in determining your revolving credit, you can cultivate a responsible approach to borrowing, maintain a healthy credit profile, and work towards achieving your financial objectives.

Factors Affecting Your Revolving Credit

Several key factors influence your revolving credit and play a significant role in shaping your overall credit profile and financial well-being. Understanding these factors is essential for effectively managing your revolving credit and optimizing your borrowing capacity while maintaining a healthy credit standing.

Credit Utilization Ratio

One of the primary factors affecting your revolving credit is the credit utilization ratio, which measures the proportion of your outstanding credit balances to your available credit limits. A lower credit utilization ratio is indicative of responsible credit management and can positively impact your credit score, whereas a higher ratio may raise concerns about overleveraging and potential credit risks.

Payment History

Your payment history, encompassing the timeliness and consistency of your credit payments, significantly influences your revolving credit. A history of on-time payments reflects positively on your creditworthiness and can contribute to a strong credit profile. Conversely, late payments, defaults, or delinquencies can have adverse effects on your revolving credit and overall credit score.

Credit Account Age

The age of your revolving credit accounts also affects your credit standing. Long-standing accounts with a positive payment history can enhance your creditworthiness, whereas a limited credit history or a high frequency of new credit accounts may raise concerns for potential lenders and impact your revolving credit.

Credit Inquiries and New Accounts

The frequency of credit inquiries and the opening of new credit accounts can impact your revolving credit. Multiple credit inquiries within a short period may signal higher credit risk, while opening numerous new accounts in a short timeframe can affect the average age of your credit accounts and potentially raise concerns for lenders.

Credit Mix and Diversity

The diversity of credit accounts in your portfolio, including a mix of revolving credit and installment loans, can influence your credit profile. A balanced credit mix, demonstrating responsible management of different credit types, can positively impact your credit standing and revolving credit assessment.

By being mindful of these factors and their impact on your revolving credit, you can proactively manage your credit utilization, payment behavior, and overall credit portfolio to maintain a healthy credit profile and optimize your borrowing capacity.

Tips for Managing Your Revolving Credit

Effectively managing your revolving credit is essential for maintaining a healthy credit profile and optimizing your financial well-being. By implementing prudent strategies and exercising financial discipline, you can leverage revolving credit to your advantage while safeguarding your credit standing. Here are some valuable tips for managing your revolving credit responsibly:

Monitor Your Credit Utilization

Regularly assess your credit utilization ratio and strive to keep it within optimal limits. Aim to utilize a lower percentage of your available credit, as this demonstrates responsible credit management and can positively impact your credit score.

Pay on Time, Every Time

Ensure timely payments on your revolving credit accounts, as your payment history significantly influences your credit standing. Late payments can adversely affect your credit score and may result in additional fees and higher interest charges.

Avoid Carrying High Balances

Try to avoid carrying high balances on your revolving credit accounts, especially if it results in a high credit utilization ratio. Paying more than the minimum amount due can help reduce the outstanding balances and minimize interest costs.

Strategically Manage Credit Inquiries

Be mindful of the frequency of credit inquiries, as multiple inquiries within a short period can impact your credit score. Limit unnecessary credit applications and inquiries, and consider the potential implications on your credit standing before seeking new credit.

Review and Understand Terms and Conditions

Thoroughly review the terms and conditions of your revolving credit accounts, including interest rates, fees, and repayment terms. Understanding these details can help you make informed borrowing decisions and avoid potential pitfalls associated with high-cost credit.

Regularly Review Your Credit Reports

Obtain and review your credit reports from major credit bureaus to ensure the accuracy of reported information. Promptly address any discrepancies or inaccuracies, and monitor your credit standing to detect any unauthorized activities or potential signs of identity theft.

Consider Credit Limit Increases Wisely

Exercise caution when seeking credit limit increases, as these can impact your credit utilization ratio and borrowing capacity. Evaluate the potential benefits and implications of a higher credit limit before requesting an increase.

By implementing these tips and adopting sound financial practices, you can effectively manage your revolving credit, maintain a healthy credit profile, and work towards achieving your long-term financial goals.

Conclusion

Understanding and managing your revolving credit is a fundamental aspect of personal finance that directly impacts your creditworthiness and financial stability. By gaining insights into the intricacies of revolving credit and implementing prudent management strategies, individuals can optimize their borrowing capacity and cultivate a responsible approach to credit utilization.

Throughout this article, we have explored the concept of revolving credit, its significance in personal finance, and the methods for determining and managing it effectively. From assessing credit utilization and payment behavior to monitoring credit reports and understanding the factors influencing revolving credit, individuals have been equipped with valuable knowledge to navigate the complexities of credit management.

It is essential for individuals to recognize the pivotal role of revolving credit in shaping their credit profiles and financial well-being. By staying informed about their credit utilization, payment history, and creditworthiness, individuals can make informed decisions regarding credit management, borrowing strategies, and financial planning.

Moreover, the proactive management of revolving credit empowers individuals to maintain a healthy credit profile, optimize their borrowing capacity, and work towards achieving their financial objectives. By monitoring credit utilization, making timely payments, and being mindful of credit inquiries and new accounts, individuals can foster financial discipline and mitigate potential credit risks.

In essence, the knowledge and application of effective revolving credit management are integral to achieving long-term financial success. By leveraging revolving credit responsibly and staying attuned to the factors influencing credit standing, individuals can navigate the financial landscape with confidence, harnessing the benefits of credit while safeguarding their fiscal health.

Ultimately, by embracing the insights and tips presented in this article, individuals can embark on a journey towards prudent credit management, empowered decision-making, and a secure financial future.