Home>Finance>How Much Does Petal Increase Credit Limit After 6 Months

Finance

How Much Does Petal Increase Credit Limit After 6 Months

Modified: February 21, 2024

Discover how Petal can boost your credit limit after just 6 months. Unlock better financing options and take control of your finances with Petal's credit limit increase.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the fascinating world of personal finance where credit cards play a significant role in our daily lives. Credit cards offer convenience, rewards, and the ability to build a credit history. However, getting approved for a credit card and managing your credit limit can sometimes be a challenging endeavor.

In this article, we delve into the world of Petal, a credit card company that offers a unique approach to managing credit. With a focus on financial literacy, Petal aims to help individuals build credit while providing a seamless and user-friendly experience. One aspect of Petal that many users are curious about is how their credit limit increases after six months of responsible card usage.

Understanding Petal’s credit card and its credit limit increase mechanisms is crucial for those wishing to maximize their available credit. In the following sections, we will explore the factors affecting credit limit increases, the process to request a credit limit increase, and provide helpful tips to improve your chances of an increase.

So, if you’re a proud Petal cardholder or considering applying for one, read on to learn about how Petal increases your credit limit after six months.

Understanding Petal Credit Card

Before we dive into the details of credit limit increases with Petal, let’s first understand the basics of the Petal credit card itself. Petal is a financial technology company that aims to redefine the credit card industry by offering a credit card designed for individuals who are new to credit, have limited credit history, or are looking for a fresh start.

What sets Petal apart from traditional credit card issuers is its unique approach to underwriting. Instead of solely relying on a credit score, Petal considers factors such as income, spending patterns, and savings to evaluate an individual’s creditworthiness. This means that even if you have a thin or no credit history, you still have a chance of being approved for a Petal credit card, making it a popular choice among young adults and those who are building credit for the first time.

The Petal credit card offers a range of benefits to its users. There are no annual fees, no late fees, and no international transaction fees. Plus, Petal provides a clean and user-friendly mobile app that helps you track your spending, set budgeting goals, and manage your finances effectively.

One unique feature of the Petal credit card is its cashback rewards program. Cardholders can earn up to 1.5% cash back on eligible purchases, with the potential to increase that percentage over time. This rewards program not only provides an incentive for responsible spending but also adds value to the overall cardholder experience.

Now that we have a basic understanding of the Petal credit card, let’s explore how the credit limit increase process works with Petal after six months of responsible card usage.

Credit Limit Increase with Petal Card

One of the key aspects of managing a credit card is having an appropriate credit limit that meets your financial needs. A higher credit limit not only provides you with more purchasing power but also improves your credit utilization ratio, which is an important factor in determining your credit score.

With the Petal credit card, you have the opportunity to see your credit limit increase after using the card responsibly for a period of six months. This credit limit increase can be a significant milestone on your credit-building journey.

The process of credit limit increase with Petal is not automatic. Petal reviews your account periodically to assess your payment history, usage patterns, and overall financial stability. They take into consideration several factors to determine whether you are eligible for a credit limit increase.

It’s important to note that Petal has its own proprietary algorithm that evaluates your creditworthiness. While having a good credit score is beneficial, Petal also considers other aspects such as your income, banking history, and spending behavior to make their decision. This means that even if your credit score hasn’t improved significantly, you may still be eligible for a credit limit increase if you have demonstrated responsible financial habits.

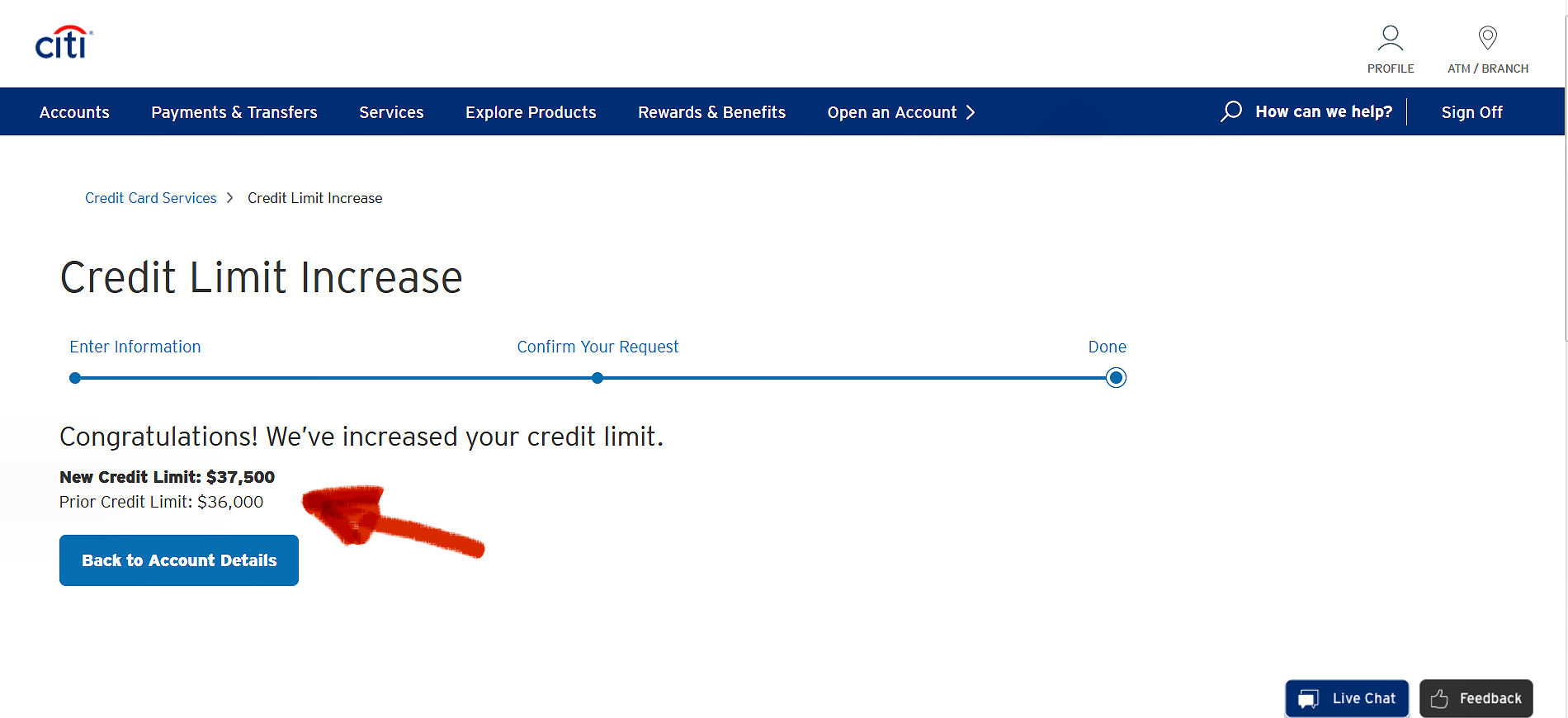

If you are eligible for a credit limit increase, Petal will notify you through their mobile app or via email. They will provide you with the details of the approved increase, including the new credit limit and any additional terms and conditions that may apply.

It’s important to note that the credit limit increase with Petal is not guaranteed, and not all cardholders will qualify. However, by following certain best practices and being a responsible credit user, you can enhance your chances of getting a credit limit increase after six months.

In the next section, we will explore the factors that affect credit limit increases with Petal and how you can improve your chances of receiving one.

Factors Affecting Credit Limit Increase

When it comes to credit limit increases with Petal, several factors come into play. Understanding these factors can help you navigate the credit limit increase process more effectively and increase your chances of a successful increase. Here are some key factors that Petal considers:

- Payment History: Your payment history is a crucial factor in determining your eligibility for a credit limit increase. Making timely and consistent payments on your Petal credit card is essential to showcase your responsible financial behavior.

- Credit Utilization Ratio: Maintaining a low credit utilization ratio can positively impact your chances of receiving a credit limit increase. Aim to keep your credit card balances below 30% of your credit limit.

- Income and Financial Stability: Petal takes into account your income and overall financial stability when evaluating your eligibility for a credit limit increase. A higher income and stable employment can contribute to a higher credit limit.

- Spending Patterns: Petal evaluates your spending patterns to determine your creditworthiness. They consider factors such as the types of purchases you make, the frequency of transactions, and how you manage your expenses.

- Overall Credit Profile: While Petal doesn’t solely rely on your credit score, they do consider your credit history and how it has evolved since you started using the Petal credit card. Demonstrating responsible credit behavior over time can improve your chances of a credit limit increase.

It’s important to note that these factors are not equally weighted, and Petal’s proprietary algorithm takes into account multiple variables to evaluate your creditworthiness. Therefore, focusing on improving these factors and maintaining a responsible financial approach can greatly enhance your chances of receiving a credit limit increase after six months.

In the next section, we will discuss the specific credit limit increase process with Petal after the six-month mark and the steps you can take to request an increase.

Petal Credit Limit Increase After 6 Months

After six months of responsible card usage with Petal, you may be eligible for a credit limit increase. This is an exciting milestone that can provide you with additional purchasing power and help improve your overall credit profile.

Petal reviews your account periodically to determine if you qualify for a credit limit increase. They consider factors such as your payment history, credit utilization ratio, income stability, and spending patterns. If you meet their criteria for a limit increase, Petal will notify you through their mobile app or via email.

If you receive a credit limit increase offer from Petal, it’s important to carefully review the details provided. This includes the new credit limit, any changes to the terms and conditions, and any steps you may need to take to accept the increase. Keep in mind that accepting a credit limit increase is optional, and you can choose to decline it if you prefer to maintain your current limit.

It’s worth noting that if you don’t receive a credit limit increase offer after six months, it doesn’t mean you won’t be eligible in the future. Continue practicing responsible credit habits, such as making on-time payments, keeping your credit utilization low, and managing your finances effectively. Over time, Petal may reassess your account and provide a credit limit increase when they see fit.

If you are interested in requesting a credit limit increase with Petal, follow the steps outlined in the next section.

Remember, a credit limit increase is not guaranteed and is subject to Petal’s evaluation. However, by maintaining good credit habits and demonstrating responsible financial behavior, you can increase your chances of receiving a credit limit increase with Petal after the initial six-month period.

Steps to Request Credit Limit Increase

If you believe you are ready for a credit limit increase with Petal after six months of responsible card usage, you have the option to request an increase. Here are the steps to follow:

- Check your eligibility: Before requesting a credit limit increase, ensure that you have met Petal’s criteria for an increase. This includes maintaining a strong payment history, keeping your credit utilization low, and demonstrating responsible financial habits.

- Log in to your Petal account: Visit the Petal website or open the Petal mobile app and log in to your account using your credentials.

- Find the credit limit increase request option: Navigate to the “Account Settings” or “Manage Account” section of your Petal account. Look for an option related to credit limit increase requests.

- Provide necessary information: Follow the prompts or instructions provided to submit your credit limit increase request. You may be asked to provide details such as your current income, employment information, and any additional documentation that Petal may require.

- Submit your request: Once you have provided all the necessary information, review your request and submit it. Note that submitting a request does not guarantee a credit limit increase, and Petal will evaluate your request based on their internal criteria.

- Wait for a response: After submitting your credit limit increase request, be patient and wait for Petal’s response. They will review your request and notify you through their mobile app or via email regarding the status of your request.

It’s important to note that Petal’s decision regarding a credit limit increase is final and cannot be appealed. If your request is denied, focus on maintaining responsible financial habits and continue using your Petal card responsibly. Petal may reassess your account in the future and provide a credit limit increase when they see fit.

Now that you know the steps to request a credit limit increase with Petal, let’s explore some helpful tips to improve your chances of receiving an increase.

Tips to Improve Your Chances of Credit Limit Increase

If you’re looking to improve your chances of receiving a credit limit increase with Petal, here are some tips to keep in mind:

- Make consistent, on-time payments: Your payment history plays a crucial role in determining your creditworthiness. Always make sure to pay your Petal credit card bill on time to demonstrate responsible financial behavior.

- Keep your credit utilization ratio low: Aim to keep your credit utilization, which is the percentage of available credit you use, below 30%. A lower credit utilization ratio showcases responsible credit management and can increase your chances of a credit limit increase.

- Use your Petal card regularly: Actively using your Petal card for everyday purchases and paying off the balance can show Petal that you are a responsible credit user. Regular usage combined with timely payments can work in your favor when it comes to a credit limit increase.

- Maintain a stable income and financial stability: Having a stable income and a strong financial foundation can improve your chances of receiving a credit limit increase. Petal considers income stability as one of the factors when evaluating your eligibility for an increase.

- Review your credit report regularly: Stay on top of your credit profile by regularly checking your credit report for any discrepancies or errors. Addressing any inaccuracies can help improve your overall creditworthiness and increase your chances of a credit limit increase.

- Engage in responsible financial habits: Beyond using your Petal card responsibly, demonstrate good financial habits in all aspects of your financial life. This includes paying your bills on time, managing your debt effectively, and avoiding excessive credit card applications.

- Be patient and consistent: Building credit and receiving a credit limit increase takes time and consistent effort. Continue practicing responsible financial habits, and over time, you may see your credit limit increase with Petal.

By following these tips, you can improve your chances of receiving a credit limit increase with Petal. Remember, Petal evaluates various factors and uses their proprietary algorithm to assess your creditworthiness. While there is no guaranteed formula, maintaining responsible financial habits increases your likelihood of a credit limit increase.

Now, let’s wrap up our discussion on Petal credit limit increases.

Conclusion

Managing your credit limit is an important aspect of financial responsibility, and with Petal, you have the opportunity to see your credit limit increase after six months of responsible card usage. Petal’s unique approach to credit evaluation, focusing on factors beyond just a credit score, provides individuals with a chance to build their credit history and increase their credit limit.

Remember, a credit limit increase with Petal is not guaranteed, and it is subject to their internal evaluation. However, by practicing responsible credit habits such as making timely payments, maintaining a low credit utilization ratio, and demonstrating good financial stability, you can improve your chances of receiving a credit limit increase after the initial six-month period.

If you believe you’re ready for a credit limit increase, you can request one through the Petal mobile app or website following the specified steps. But even if you don’t receive an increase immediately, don’t get discouraged. Continue using your Petal credit card responsibly, and Petal may reassess your account in the future.

Lastly, remember to regularly check your credit report, review your credit profile, and maintain responsible financial habits. These actions not only improve your chances of a credit limit increase with Petal but also contribute to your overall financial well-being.

As you navigate the world of credit and build your credit history with Petal, keep in mind that responsible credit management goes beyond just credit limit increases. It involves using credit wisely, making on-time payments, and maintaining a healthy financial lifestyle.

We hope this article has provided you with a better understanding of how Petal increases credit limits after six months and has given you valuable insights into the process. Remember, building credit takes time, patience, and consistency. With responsible credit habits and adherence to Petal’s guidelines, your credit limit can increase, providing you with greater financial flexibility and opportunities.