Home>Finance>Where Do You Use Discount Rate In Defined Benefit Plans

Finance

Where Do You Use Discount Rate In Defined Benefit Plans

Modified: December 29, 2023

Learn how discount rate is used in defined benefit plans and its importance in finance. Find out where it applies and its impact on retirement benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Defined Benefit Plan?

- Understanding Discount Rate

- Where is the Discount Rate Used in Defined Benefit Plans?

- Discount Rate and Calculating Pension Liabilities

- Discount Rate and Pension Plan Actuarial Valuation

- Discount Rate and Pension Plan Funding

- Importance of Selecting the Appropriate Discount Rate

- Conclusion

Introduction

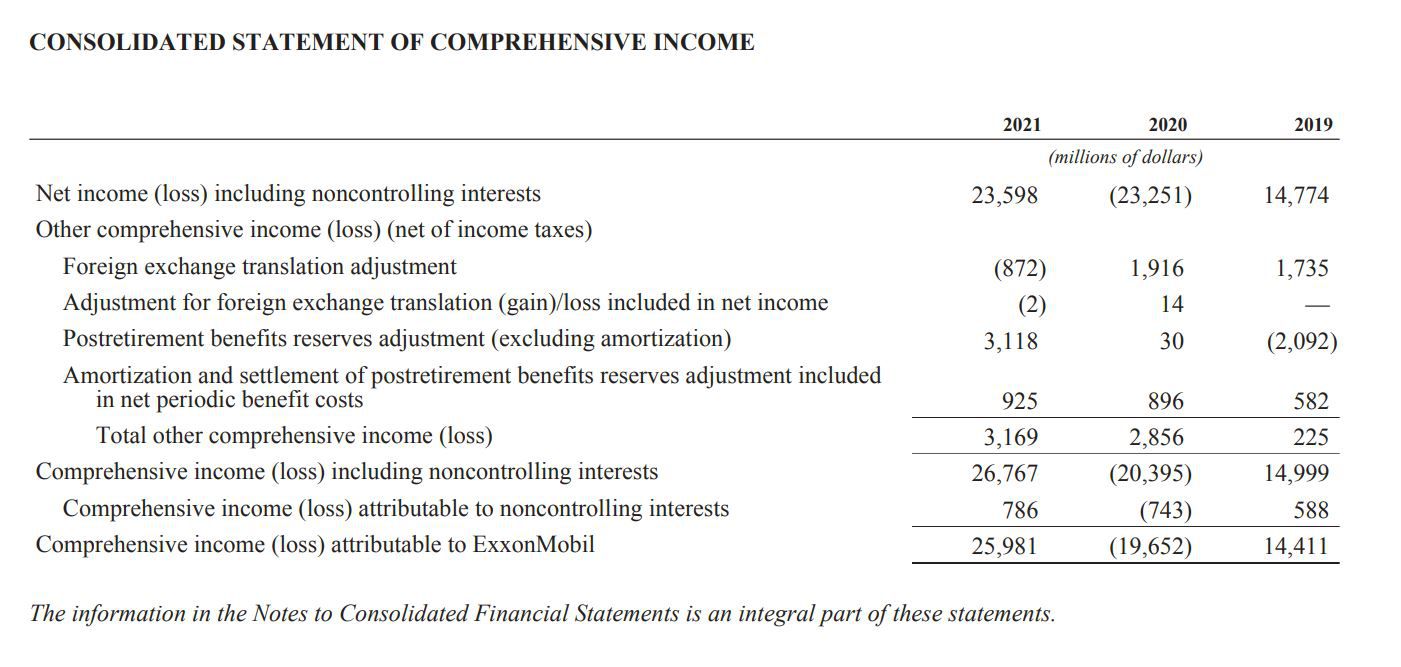

Defined Benefit (DB) plans are a type of retirement plan that provide employees with a guaranteed income during their retirement years. Unlike Defined Contribution plans where the retirement benefits are based on the amount contributed, DB plans calculate the benefits based on a formula that considers factors such as salary, years of service, and a crucial factor known as the discount rate.

The discount rate plays a vital role in determining the present value of future pension obligations and is a key component in calculating the funding requirements and actuarial valuation of defined benefit plans. Understanding where and how the discount rate is used in DB plans is essential for plan sponsors, actuaries, and participants alike.

This article aims to shed light on the importance of the discount rate in defined benefit plans, its role in calculating pension liabilities, actuarial valuations, and the funding process. By gaining a better understanding of the discount rate and its significance, stakeholders can make informed decisions to ensure the financial integrity and sustainability of defined benefit plans.

What is a Defined Benefit Plan?

A Defined Benefit (DB) plan is a type of employer-sponsored retirement plan that guarantees a specific retirement benefit to eligible employees. In a DB plan, the retirement benefit is typically based on a formula that takes into account factors such as the employee’s years of service and final average salary. Unlike Defined Contribution plans where the retirement benefit depends on the contributions made and the investment returns, DB plans provide employees with a predetermined benefit.

One of the key features of a DB plan is the promise of a secure and predictable income stream during retirement. This means that the employer is responsible for bearing the investment risk and ensuring that the plan has sufficient assets to fulfill its future obligations. The calculation of these future obligations is crucial and heavily relies on the concept of the discount rate.

The discount rate reflects the assumed rate of return on the plan’s assets to discount the future pension obligations to their present value. By discounting the future obligations, the plan can determine the amount of money that needs to be set aside today to meet the projected retirement benefits in the future.

It is important to note that DB plans can be sponsored by governments, private companies, or unions, and they typically offer higher retirement benefits compared to Defined Contribution plans. However, the financial responsibility for funding and managing the plan rests primarily with the employer or plan sponsor.

Now that we have an understanding of what a defined benefit plan is, let’s explore the role of the discount rate in these plans and where it is used.

Understanding Discount Rate

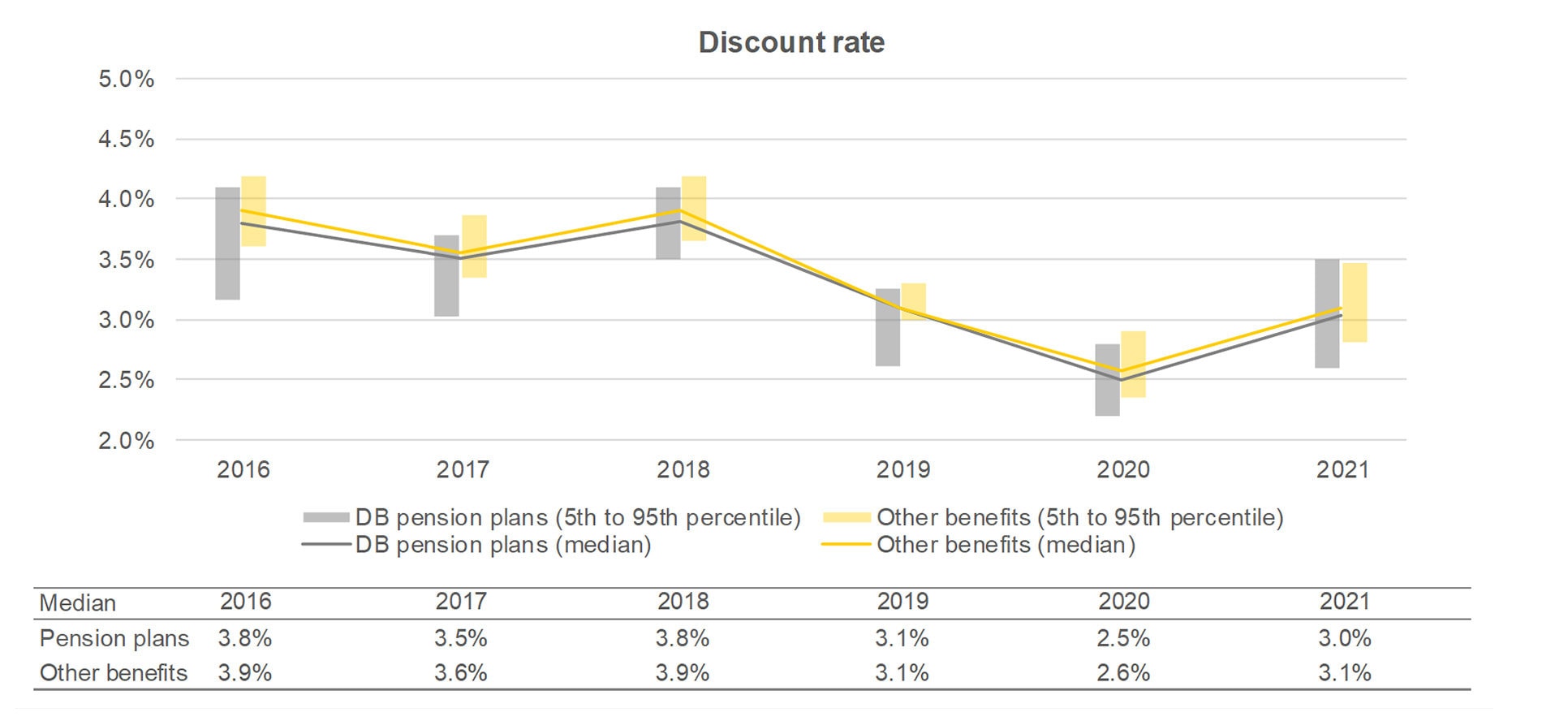

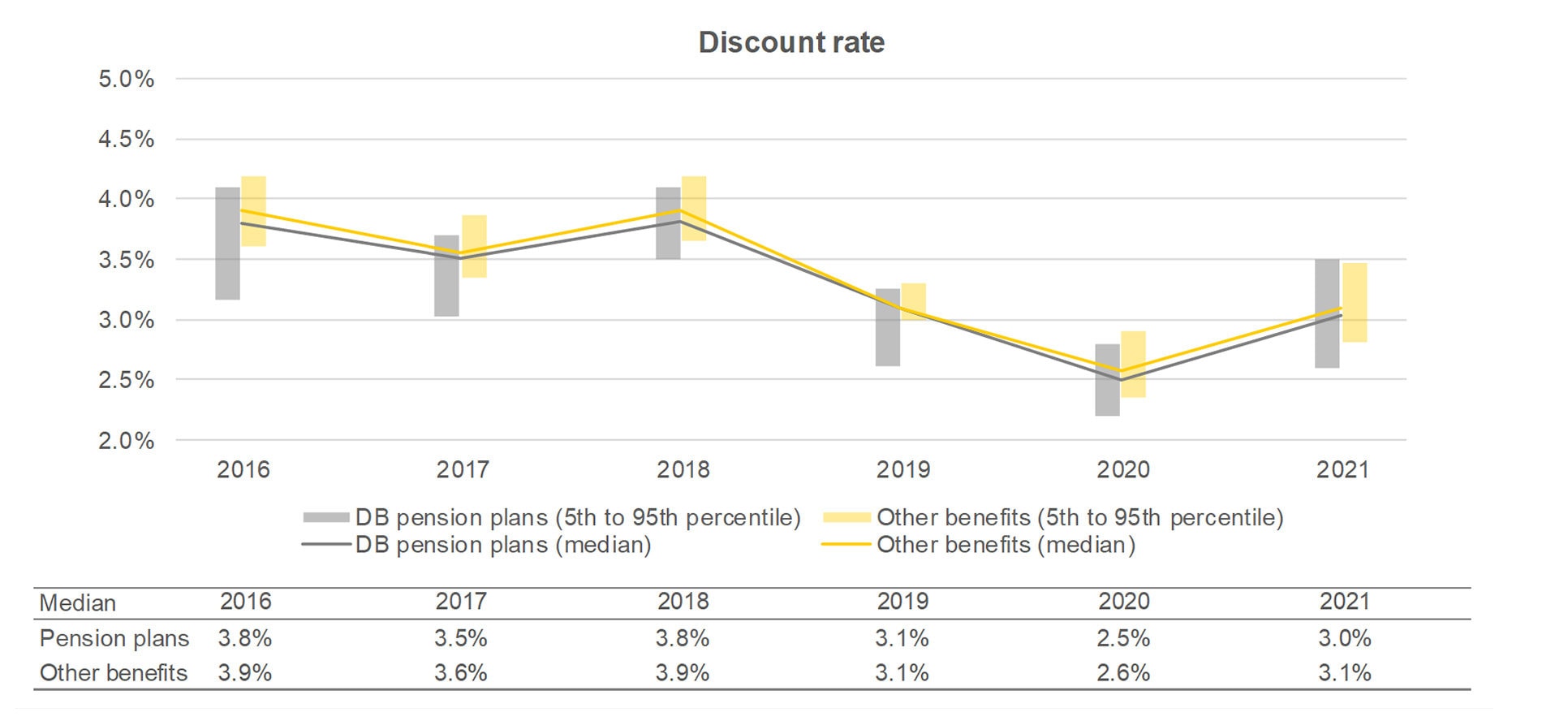

The discount rate is a crucial factor in the calculation of pension liabilities and actuarial valuations in defined benefit plans. It represents the assumed rate of return that the plan’s assets will earn over time.

The discount rate serves two main purposes in a DB plan:

- Discounting future pension obligations: The discount rate is used to convert the projected future pension payments into their present value. This is necessary because money received in the future is worth less than money received today due to factors such as inflation and the opportunity cost of capital. By using a discount rate, the plan can determine the amount of money that needs to be set aside today to meet the future pension obligations.

- Evaluating plan funding adequacy: The discount rate also helps in assessing the funding adequacy of the plan. By comparing the value of the plan’s assets to the present value of its projected liabilities, plan sponsors can evaluate if the plan has enough assets to cover its future pension obligations. This analysis is critical for understanding the financial health of the plan and making informed decisions about contributions and investments.

It is important to select an appropriate discount rate for these calculations. The choice of discount rate depends on multiple factors, including the time horizon, the risk profile of the plan’s investments, and economic conditions. Generally, the discount rate used in DB plans is based on the expected long-term return on the plan’s assets. It is important to strike a balance between using a conservative discount rate that ensures the plan’s solvency and using an overly optimistic discount rate that may overstate the plan’s funding position.

Additionally, it is worth noting that the discount rate is not static and may be subject to change over time. Factors such as market conditions, changes in investment strategy, or updates to actuarial standards may require adjustments to the discount rate. These changes can have significant implications for the plan’s funding requirements and financial reporting.

Now that we have a grasp on the concept of the discount rate, let’s delve into where it is specifically used in defined benefit plans.

Where is the Discount Rate Used in Defined Benefit Plans?

The discount rate in defined benefit plans is used in various aspects of plan management, including the calculation of pension liabilities, actuarial valuations, and the funding process. Let’s examine each of these areas in more detail:

- Calculating Pension Liabilities: The discount rate plays a critical role in determining the present value of future pension obligations. By discounting the projected future payments, the plan can estimate the amount of money that needs to be set aside today to fulfill those future pension obligations. This calculation helps the plan sponsor understand the financial liability associated with the pension plan and ensure that sufficient funds are allocated for future benefits.

- Pension Plan Actuarial Valuation: Actuarial valuations are conducted periodically to assess the financial health of the defined benefit plan. The discount rate is used in these valuations to determine the present value of the plan’s liabilities. By comparing the value of the plan’s assets to the present value of its projected liabilities, the actuarial valuation provides insights into the plan’s funding status, funding requirements, and whether any adjustments are necessary to ensure the plan remains adequately funded.

- Pension Plan Funding: The funding process of a defined benefit plan involves making contributions to the plan to ensure there are sufficient assets to cover projected pension obligations. The discount rate is used to calculate the present value of the plan’s liabilities, which helps in determining the required contribution amounts. A higher discount rate would result in lower present value and lower funding requirements, while a lower discount rate would lead to a higher present value and higher funding requirements.

It is important for plan sponsors and actuaries to carefully consider the selection of the discount rate in these various aspects. The discount rate should reasonably reflect the expected rate of return on the plan’s assets, taking into account factors such as the plan’s investment strategy, risk tolerance, and economic conditions. Additionally, regulatory guidelines and accounting standards may provide specific requirements or guidance on the selection of the discount rate.

By understanding where the discount rate is used in defined benefit plans, stakeholders can appreciate the significance of this key factor in managing the financial aspects of the plan. Next, let’s explore the relationship between the discount rate and calculating pension liabilities.

Discount Rate and Calculating Pension Liabilities

The discount rate plays a crucial role in the calculation of pension liabilities in defined benefit plans. It helps determine the present value of the plan’s projected future pension obligations, enabling plan sponsors to assess the funding requirements and financial obligations associated with the plan.

When calculating pension liabilities, the discount rate is used to discount the estimated future pension payments to their present value. This is necessary because money received in the future is worth less than money received today due to factors such as inflation and the time value of money.

Here’s an example to illustrate the calculation process:

Let’s say a defined benefit plan has projected future pension payments of $50,000 per year for a particular retiree for the next 20 years. If the discount rate is assumed to be 5%, the present value of these future pension payments would be calculated as follows:

Present value = $50,000 / (1 + 0.05)^1 + $50,000 / (1 + 0.05)^2 + … + $50,000 / (1 + 0.05)^20

By discounting each future payment at the assumed discount rate, the calculation yields the present value of the projected pension obligations. This present value represents the current amount of money that would need to be set aside to fund these future pension payments.

It is important to note that the choice of discount rate significantly impacts the calculated pension liabilities. A higher discount rate would result in a lower present value, indicating lower funding requirements. Conversely, a lower discount rate would lead to a higher present value, indicating higher funding requirements.

Furthermore, the selection of the discount rate involves a balance between being realistic about the plan’s investment returns and ensuring the plan’s solvency. It is common practice to base the discount rate on the expected long-term return on the plan’s assets. However, it is crucial to consider the plan’s investment strategy, risk tolerance, and economic conditions when determining an appropriate discount rate.

By accurately calculating pension liabilities using an appropriate discount rate, plan sponsors can make informed decisions regarding funding requirements, budgeting, and managing the financial obligations of the defined benefit plan.

Discount Rate and Pension Plan Actuarial Valuation

In defined benefit plans, the discount rate also plays a significant role in the actuarial valuation process. Actuarial valuations are conducted periodically to assess the financial health of the plan and determine its funding status.

The discount rate is used in the actuarial valuation to determine the present value of the plan’s projected future pension obligations. By comparing the present value of the projected liabilities to the value of the plan’s assets, the actuarial valuation provides insights into the financial position and funding requirements of the plan.

During the actuarial valuation, the same discount rate that is used to calculate pension liabilities is also applied to discount the projected future cash flows associated with the pension plan. The projected cash flows typically include the pension benefits to be paid to plan participants, considering factors such as retirement age, mortality rates, and expected service periods.

The actuarial valuation takes into account several factors, including the current plan demographics, investment performance, changes in estimated member life expectancies, salary growth rates, and regulatory requirements. These factors, combined with the discount rate, help in determining the present value of the projected future pension obligations.

The actuarial valuation provides a comprehensive financial snapshot of the defined benefit plan, including information on the plan’s funded status and funding requirements. It also sheds light on the plan’s ability to meet its future benefit payments and identifies any funding shortfalls.

Given the importance of the discount rate in the actuarial valuation, it is crucial to select an appropriate discount rate that reflects the plan’s investment strategy, risk tolerance, and economic conditions. A discount rate that is too high may underestimate the plan’s liabilities, while a discount rate that is too low may overstate the liabilities.

Regulatory bodies and accounting standards may provide guidance on the selection of the discount rate for actuarial valuations. Plan sponsors and actuaries must consider these guidelines and exercise professional judgment to determine the most suitable discount rate for their specific plan.

By incorporating the appropriate discount rate in the actuarial valuation process, stakeholders can gain valuable insights into the current financial position of the defined benefit plan, assess the funding requirements, and make informed decisions regarding funding, investment strategy, and plan management.

Discount Rate and Pension Plan Funding

The discount rate in defined benefit plans also plays a crucial role in the funding process. Funding a pension plan involves making contributions to ensure that there are sufficient assets to cover the projected pension obligations.

The discount rate is used in the funding process to calculate the present value of the plan’s liabilities. By discounting the projected future pension payments at the assumed discount rate, the plan sponsor can determine the funding requirements and the amount of money that needs to be contributed to the plan.

A higher discount rate leads to a lower present value of the liabilities, resulting in lower required funding amounts. Conversely, a lower discount rate increases the present value of the liabilities, necessitating higher funding amounts. Therefore, the selection of an appropriate discount rate is crucial in determining the funding needs of the plan.

In addition, the funding process also considers various regulatory requirements and guidelines. These may include minimum funding requirements imposed by government authorities, such as the Pension Protection Act (PPA) in the United States, which mandates that pension plans maintain certain funding levels.

The discount rate used for funding purposes should align with any requirements set by regulatory bodies and accurately reflect the plan’s investment strategy and risk profile. It is essential to strike a balance between adopting a conservative discount rate that ensures the plan’s solvency and avoids underfunding, while also avoiding an excessively high discount rate that may create funding shortfalls in the future.

Successful pension plan funding involves regularly assessing the plan’s funding position and making appropriate contributions based on the calculations using the discount rate. This ensures that the plan has sufficient assets to meet its projected future pension obligations and provides financial security for plan participants.

It is worth noting that the funding process goes beyond calculating and making contributions. Plan sponsors need to monitor investment performance, market conditions, and demographic changes to ensure that the plan remains adequately funded over time. Regular financial reporting and actuarial valuations play a crucial role in assessing the ongoing funding requirements of the plan.

By considering the appropriate discount rate in the funding process, plan sponsors can make informed decisions about contribution amounts, monitor the plan’s funding trajectory, and take proactive steps to meet their pension obligations.

Importance of Selecting the Appropriate Discount Rate

The selection of the appropriate discount rate in defined benefit plans is of utmost importance as it has significant implications for the financial health and sustainability of the plan. Here are several reasons why choosing the right discount rate is crucial:

- Accurate Pension Liability Calculation: The discount rate is used to calculate the present value of pension liabilities. Selecting an appropriate discount rate ensures that the calculated liabilities accurately reflect the plan’s future pension obligations. This accuracy is vital for assessing the funding requirements, budgeting, and making informed decisions regarding the plan’s financial management.

- Plan Funding Adequacy: The discount rate influences the determination of the plan’s funding requirements. A higher discount rate reduces the present value of the plan’s liabilities, potentially leading to lower funding requirements. On the other hand, a lower discount rate increases the present value, indicating higher funding requirements. By selecting an appropriate discount rate, plan sponsors can ensure that the plan remains adequately funded to meet its future pension obligations.

- Financial Reporting and Compliance: Regulatory bodies and accounting standards often provide guidelines or requirements for selecting the discount rate in defined benefit plans. Adhering to these guidelines ensures compliance with the reporting and disclosure requirements, maintaining transparency and accountability in financial statements related to the plan.

- Risk Management: The discount rate reflects the expected rate of return on the plan’s assets. Selecting a reasonable discount rate enables proper risk management by aligning it with the plan’s investment strategy and risk tolerance. An overly optimistic discount rate may lead to underestimated liabilities, posing a risk of underfunding, while an excessively conservative discount rate may result in overfunding and potential missed investment opportunities.

- Participant Confidence: Participants in defined benefit plans rely on the promised pension benefits for their retirement security. By using an appropriate discount rate, plan sponsors can instill confidence in participants that the plan is adequately funded and has the financial means to fulfill its obligations. This helps maintain trust and satisfaction among plan participants.

It is important to note that the selection of the appropriate discount rate requires careful consideration. Factors such as the plan’s investment strategy, risk appetite, economic conditions, and regulatory guidelines should be taken into account. Actuarial expertise and professional judgment are essential in making an informed decision regarding the discount rate that aligns with the specific characteristics and goals of the defined benefit plan.

By selecting the appropriate discount rate, plan sponsors can accurately assess their funding obligations, ensure compliance with regulations, manage investment risks effectively, and provide long-term financial security for plan participants.

Conclusion

The discount rate is a fundamental component in the management of defined benefit plans. It plays a vital role in calculating pension liabilities, conducting actuarial valuations, determining funding requirements, and ensuring the financial health and sustainability of the plan.

By discounting the projected future pension obligations, the discount rate enables plan sponsors to determine the present value of these liabilities and make informed decisions regarding funding, investment strategy, and risk management.

Choosing the appropriate discount rate is crucial as it impacts the accuracy of pension liability calculations, ensures plan funding adequacy, meets regulatory requirements, manages investment risks, and instills confidence in plan participants.

Plan sponsors and actuaries must carefully consider factors such as the plan’s investment strategy, risk tolerance, economic conditions, and regulatory guidelines when selecting the discount rate. Striking the right balance between conservatism and realism is essential for maintaining the financial integrity and long-term viability of the defined benefit plan.

Regular monitoring and review of the discount rate, along with actuarial valuations and financial reporting, help plan sponsors adjust funding strategies, assess the plan’s funding status, and make necessary contributions to meet future pension obligations.

In conclusion, the discount rate is a critical component in the financial management of defined benefit plans. By understanding its role, importance, and the considerations involved, stakeholders can navigate the complexities of pension funding, enhance plan sustainability, and fulfill their commitments to plan participants.