Finance

What Is A Superseded Tax Return

Published: October 28, 2023

Learn about superseded tax returns in finance and understand its implications. Discover why it's important to stay updated with your tax filings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Superseded Tax Return

- Reasons for Filing a Superseded Tax Return

- Differences Between an Amended Tax Return and a Superseded Tax Return

- How to File a Superseded Tax Return

- Consequences of Filing a Superseded Tax Return

- Frequently Asked Questions about Superseded Tax Returns

- Conclusion

Introduction

When it comes to managing our finances, one area that often elicits anxiety and confusion is filing our tax returns. The process can be complicated, with various rules and regulations to navigate. Sometimes, after submitting our tax return, we may realize that we made a mistake or forgot to include crucial information. In such cases, it is necessary to make corrections to ensure accurate reporting of our income and deductions. That’s where superseded tax returns come into the picture.

In this article, we will explore the concept of a superseded tax return and its significance in the world of taxation. We will discuss the reasons why individuals may need to file a superseded tax return, the key differences between a superseded tax return and an amended tax return, the process of filing a superseded tax return, and the potential consequences of doing so. So, let’s dive in and gain a better understanding of this important aspect of tax filing.

Definition of a Superseded Tax Return

A superseded tax return is a revised version of a previously filed tax return. It is used to correct errors or add missing information that was initially reported incorrectly or omitted entirely. When individuals file their tax returns, they are expected to provide accurate and complete information about their income, expenses, deductions, credits, and other relevant details. However, mistakes can happen, leading to the need for a superseded tax return.

Essentially, a superseded tax return replaces the original return and reflects the correct information that should have been reported initially. This allows individuals to rectify any errors or oversights and ensure the accuracy and completeness of their tax filings. By filing a superseded tax return, taxpayers can update their financial records with the appropriate information and avoid potential penalties or audits resulting from inaccurate reporting.

It’s important to note that a superseded tax return can only be filed if the original return has not yet been processed by the tax authorities. Once the original return is processed and accepted, it cannot be changed through a superseded tax return. In such cases, individuals would need to file an amended tax return instead.

Now that we have a clear understanding of what a superseded tax return entails, let’s explore the reasons why individuals may need to file one.

Reasons for Filing a Superseded Tax Return

There are several reasons why individuals may need to file a superseded tax return. Let’s explore some common scenarios where filing a superseded tax return becomes necessary:

- Correction of errors: One of the primary reasons for filing a superseded tax return is to rectify errors made on the original tax return. These errors could include mistakes in reporting income, deductions, credits, or any other relevant information that affects the accuracy of the tax return. Filing a superseded tax return allows individuals to make necessary corrections and ensure accurate reporting to the tax authorities.

- Inclusion of missing information: Sometimes, individuals may realize that they left out important information while filing their original tax return. This could be an overlooked source of income, a missed deduction, or any other crucial detail that impacts the overall tax liability. By filing a superseded tax return, individuals can provide the missing information and avoid potential penalties for underreporting.

- Change in filing status: Individuals may need to file a superseded tax return if there has been a change in their filing status. For example, they may have initially filed as single but later got married or divorced, which affects their tax filing requirements. In such cases, individuals can file a superseded tax return to reflect the updated filing status and ensure compliance with the tax laws.

- Updates to financial information: Another common reason for filing a superseded tax return is to update financial information that has changed since the original filing. This could include adjustments in investment incomes, capital gains or losses, retirement contributions, or any other relevant financial transactions that need to be accurately reported. Filing a superseded tax return helps individuals maintain accurate financial records and avoid potential discrepancies.

- Rectifying omissions: In some cases, individuals may have unintentionally omitted certain details from their original tax return. This could be an oversight in reporting rental income, self-employment earnings, or any other income-generating activities. By filing a superseded tax return, individuals can rectify these omissions and ensure compliance with the tax laws.

These are just a few examples of why individuals may need to file a superseded tax return. It is important to assess your specific situation and consult with a tax professional to determine if filing a superseded tax return is necessary and appropriate for your circumstances. Now that we understand the reasons for filing a superseded tax return, let’s explore the key differences between a superseded tax return and an amended tax return.

Differences Between an Amended Tax Return and a Superseded Tax Return

While both amended tax returns and superseded tax returns serve the purpose of correcting errors or updating information on a previously filed tax return, there are key differences between the two. Understanding these differences can help individuals determine the appropriate course of action when they need to make changes to their tax filings. Let’s explore the main distinctions between an amended tax return and a superseded tax return:

- Timing: The timing of filing is a crucial difference between the two. An amended tax return can be filed after the original return has been processed and accepted by the tax authorities. On the other hand, a superseded tax return must be filed before the original return has been processed. Once the original return is processed, it cannot be changed through a superseded tax return.

- Process: The process of filing is also different for amended tax returns and superseded tax returns. To file an amended tax return, individuals must fill out Form 1040X, which is specifically designed for making changes to a previously filed return. They must provide explanations for the changes being made and attach any necessary supporting documents. However, to file a superseded tax return, individuals simply need to submit a new, complete tax return with the correct information. They do not need to include any explanations or supporting documents unless specifically requested by the tax authorities.

- Record-keeping: Another difference relates to record-keeping. When individuals file an amended tax return, they are required to keep a copy of both the original return and the amended return for their records. This allows them to have a documented history of the changes made. On the other hand, when filing a superseded tax return, individuals are only required to retain a copy of the superseded tax return with the correct information.

- Tax Authority processing: Amended tax returns go through a specific process with the tax authorities. They are reviewed separately from the original return, and an amended return may trigger additional scrutiny or an audit depending on the nature and extent of the changes made. In contrast, when a superseded tax return is filed, the tax authorities simply disregard the original return and process the superseded return as though it were the original filing.

- Deadline: The deadline for filing an amended tax return is usually within three years of the original filing date or within two years of the date the tax was paid, whichever is later. However, there is no specific deadline for filing a superseded tax return since it must be filed before the original return is processed.

Understanding these differences can help individuals determine the appropriate method to correct errors or update information on their tax returns. It’s important to consult with a tax professional or utilize tax software to ensure compliance with the relevant rules and regulations when filing either an amended tax return or a superseded tax return. Now that we understand the differences between the two, let’s delve into the process of filing a superseded tax return.

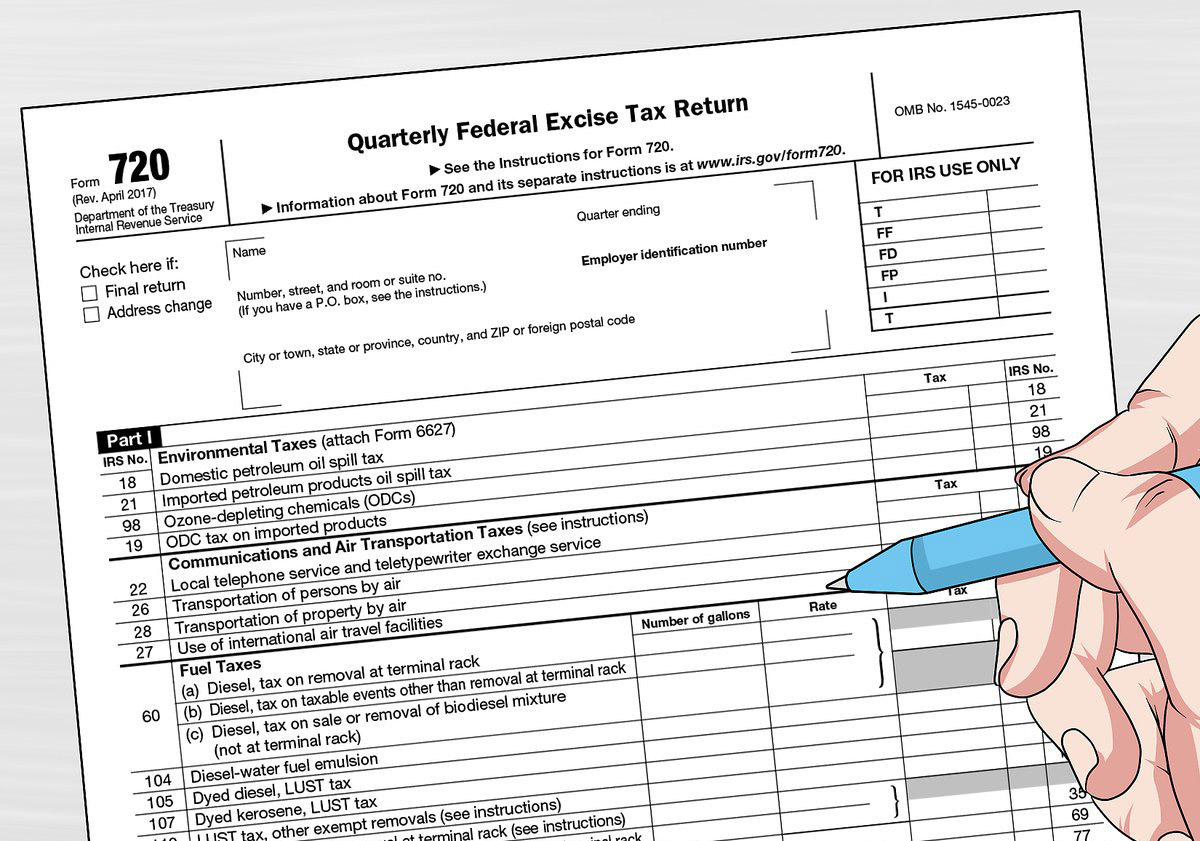

How to File a Superseded Tax Return

Filing a superseded tax return involves a straightforward process that allows individuals to correct errors or update information on their previously filed tax return. Here are the steps to file a superseded tax return:

- Gather the necessary documents: Before you begin, gather all the relevant documents, including your original tax return and any supporting documentation, such as W-2 forms, 1099 forms, receipts, and records of deductions or credits.

- Prepare a new, complete tax return: Using the correct and updated information, prepare a new and complete tax return reflecting the changes or additions that need to be made. You can use tax software or consult with a tax professional to ensure accurate reporting.

- Include all necessary forms and schedules: Make sure to include all necessary forms and schedules related to your tax situation. This may include forms like Schedule A for itemized deductions or Schedule C for self-employment income. Ensure that you provide all required information accurately and completely.

- Double-check your work: Before submitting your superseded tax return, carefully review all the details to ensure accuracy. Check for any errors, omissions, or inconsistencies that could potentially affect your tax liability or refund.

- Submit the superseded tax return: Once you are confident that your superseded tax return is accurate, send it to the tax authorities. Depending on your country’s tax regulations, you may need to mail the return or file it electronically through an online platform.

- Keep a copy for your records: It’s crucial to keep a copy of the superseded tax return for your records. This will serve as documentation of the changes or updates made to your original tax return.

Remember, the process of filing a superseded tax return should be done in a timely manner, ideally before your original return is processed. If the original return has already been processed, filing an amended tax return would be necessary. It’s always a good idea to consult with a tax professional or utilize tax software to ensure compliance with the specific rules and regulations in your jurisdiction.

Now that we know how to file a superseded tax return, let’s explore the potential consequences of filing one.

Consequences of Filing a Superseded Tax Return

Filing a superseded tax return can have certain consequences that individuals should be aware of. While it is important to rectify errors or update information, it’s crucial to understand the potential implications. Here are some of the consequences of filing a superseded tax return:

- Extended processing time: Filing a superseded tax return may result in an extended processing time compared to a regular tax return. The tax authorities need to review the new information provided and ensure its accuracy before processing it.

- Increased scrutiny: Since a superseded tax return often involves corrections or additions to previously reported information, it may attract increased scrutiny from the tax authorities. They may conduct a more detailed review of the revised return to ensure compliance with tax regulations.

- Potential penalties and interest: Depending on the nature of the corrections or updates made in the superseded tax return, there may be potential penalties and interest imposed by the tax authorities. These penalties could be due to underreported income, overstated deductions, or other errors in the original return.

- Audit risk: Filing a superseded tax return can increase the risk of being selected for an audit. The tax authorities may choose to conduct an audit or review of the revised return to ensure accuracy and compliance with tax laws.

- Delay in refunds: If you are expecting a tax refund, filing a superseded tax return may delay the processing and issuance of your refund. The tax authorities will need to review the revised return thoroughly before processing any refunds.

- Amended returns may be required: In some cases, if the original return has already been processed by the tax authorities, filing a superseded tax return may not be possible. Instead, individuals may be required to file an amended tax return to correct any errors or update information.

It is essential to consider these potential consequences before filing a superseded tax return. It’s advisable to consult with a tax professional or utilize tax software to ensure compliance with tax regulations and minimize any negative impact on your tax situation. While it is important to rectify mistakes, it is equally important to understand the potential repercussions and take necessary precautions.

Now that we’ve explored the potential consequences, let’s address some frequently asked questions about superseded tax returns.

Frequently Asked Questions about Superseded Tax Returns

Here are some commonly asked questions regarding superseded tax returns:

-

Can I file a superseded tax return if my original return has already been processed?

No, if your original tax return has already been processed by the tax authorities, you cannot file a superseded tax return. In such cases, you would need to file an amended tax return to correct any errors or update information. -

Is there a deadline for filing a superseded tax return?

Unlike an amended tax return, which has specific deadlines, there is no specific deadline for filing a superseded tax return. However, it is recommended to file it as soon as possible before your original return is processed. -

Do I need to attach supporting documents with a superseded tax return?

In most cases, you do not need to attach supporting documents with a superseded tax return unless specifically requested by the tax authorities. However, it is important to keep all relevant supporting documents for your records in case of any future inquiries. -

Can I e-file a superseded tax return?

The ability to e-file a superseded tax return depends on the regulations of your tax jurisdiction. In some cases, e-filing may be available, while in others, you may be required to file a paper return. Check with the tax authorities or consult with a tax professional for guidance on the filing method for superseded returns. -

Will filing a superseded tax return trigger an audit?

While filing a superseded tax return may increase the chances of being selected for an audit, it does not automatically trigger an audit. The likelihood of an audit depends on various factors, including the nature and extent of the changes made in the revised return. However, it is important to ensure the accuracy and completeness of your tax filings to minimize the risk of an audit. -

What happens if I owe additional taxes after filing a superseded tax return?

If you owe additional taxes as a result of filing a superseded tax return, it is important to pay the balance as soon as possible. Failure to pay the taxes owed may result in penalties and interest being imposed by the tax authorities. Consult with a tax professional to understand your options for payment if you find yourself in this situation.

Remember, each tax jurisdiction may have different rules and guidelines regarding superseded tax returns. It is recommended to consult with a tax professional or utilize tax software to ensure compliance with the specific regulations in your country.

Now that we have addressed some frequently asked questions about superseded tax returns, let’s wrap up this article.

Conclusion

Filing a tax return can be a complex and overwhelming process, and sometimes mistakes happen. However, it’s important to rectify those errors and ensure accurate reporting of your income and deductions. This is where the concept of a superseded tax return comes into play.

A superseded tax return allows individuals to correct errors or update information on a previously filed tax return. It is crucial to file a superseded tax return before the original return is processed by the tax authorities. By doing so, you can ensure the accuracy and completeness of your tax filings and avoid potential penalties or audits resulting from inaccurate reporting.

When filing a superseded tax return, it’s important to gather all necessary documents, prepare a new and complete tax return with the correct information, and submit it to the tax authorities. You should also keep a copy of the superseded tax return for your records.

While filing a superseded tax return can have potential consequences, such as extended processing time, increased scrutiny, potential penalties and interest, and a risk of audit, it is crucial to rectify errors and update information accurately. By consulting with a tax professional or utilizing tax software, you can ensure compliance with tax regulations and minimize any negative impact on your tax situation.

Remember, each tax jurisdiction may have different rules and guidelines regarding superseded tax returns. It’s important to understand the specific regulations in your country and seek professional advice when necessary.

By understanding the concept of a superseded tax return and its purpose, individuals can navigate the tax filing process more effectively and ensure accurate reporting of their financial information. It is always better to correct mistakes and provide complete information to maintain transparency and compliance in tax matters.

We hope this article has provided you with a clear understanding of superseded tax returns and their significance in the world of taxation. Remember, when in doubt, consult with a tax professional to ensure you are meeting all your tax obligations and making the necessary corrections to your filings.