Finance

How Much Are Afterpay’s Merchant Fees?

Published: February 24, 2024

Learn about Afterpay's merchant fees and how they can impact your finances. Understand the costs and make informed decisions for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of modern commerce, where innovative payment solutions have revolutionized the way consumers shop and merchants conduct business. In this digital era, convenience and flexibility are paramount, driving the widespread adoption of buy now, pay later (BNPL) services. Among the prominent players in the BNPL landscape, Afterpay has garnered significant attention for its user-friendly approach and seamless integration with online and offline retail platforms.

As a merchant exploring the potential of Afterpay, it's crucial to grasp the intricacies of the platform's fee structure. Understanding Afterpay's merchant fees is essential for making informed decisions about incorporating this payment option into your business model. In this comprehensive guide, we will delve into the specifics of Afterpay's merchant fees, unraveling the factors that influence these fees and providing valuable insights to help you optimize your utilization of this popular payment solution.

Whether you're a seasoned e-commerce entrepreneur or a brick-and-mortar retailer venturing into the digital realm, navigating the realm of merchant fees is a pivotal aspect of managing your operational costs. By gaining a deeper understanding of Afterpay's fee framework and exploring strategies to mitigate these expenses, you can harness the full potential of this payment platform while maximizing your profitability.

Join us on this enlightening journey as we demystify Afterpay's merchant fees, empowering you to make informed choices that align with your business objectives and enhance the overall shopping experience for your customers. Let's embark on this exploration of Afterpay's fee structure, uncovering valuable insights that can elevate your merchant endeavors in the dynamic landscape of modern commerce.

What are Afterpay’s Merchant Fees?

Before integrating Afterpay into your business, it’s essential to comprehend the nature of the merchant fees associated with this popular buy now, pay later service. Afterpay’s merchant fees encompass a combination of fixed charges and variable components, designed to facilitate seamless transactions while ensuring sustainable revenue for the platform.

At the core of Afterpay’s fee structure lies the initial merchant setup fee, which is a one-time payment to establish the integration of Afterpay’s services with your retail operations. Additionally, for each transaction conducted through Afterpay, merchants are subject to a predetermined fixed fee, reflecting the processing costs and administrative overheads associated with facilitating the payment. This fixed fee serves as a fundamental component of Afterpay’s revenue model, enabling the platform to sustain its operations and provide a user-friendly payment solution to consumers.

Besides the fixed charges, Afterpay’s merchant fees also encompass variable components, such as a percentage-based fee applied to the total transaction value. This percentage fee, commonly referred to as the merchant fee rate, accounts for a proportion of the transaction amount and contributes to Afterpay’s revenue stream while aligning with the value of the services rendered to both merchants and customers.

Understanding the intricacies of Afterpay’s merchant fees is paramount for merchants seeking to optimize their cost structures and effectively incorporate this payment option into their sales channels. By gaining clarity on the composition of these fees and the factors influencing their magnitude, you can make informed decisions that harmonize with your business objectives and financial considerations.

As we delve deeper into the realm of Afterpay’s fee structure, we will unravel the dynamics of these merchant fees, shedding light on the factors that influence their magnitude and exploring strategies to manage and optimize these expenses effectively. Join us on this enlightening journey as we demystify Afterpay’s merchant fees, empowering you with valuable insights to navigate the evolving landscape of modern commerce.

Understanding Afterpay’s Fee Structure

Delving into the intricacies of Afterpay’s fee structure unveils a multifaceted framework designed to balance the needs of merchants, consumers, and the platform itself. At the heart of this structure lies a harmonious blend of fixed and variable fees, meticulously crafted to ensure equitable transactions while sustaining the operational vitality of Afterpay’s services.

The fixed component of Afterpay’s fee structure encompasses the initial merchant setup fee, which serves as a foundational investment for integrating Afterpay’s payment solution into your retail ecosystem. This one-time fee reflects the administrative and technical efforts involved in onboarding merchants and establishing the seamless functionality of Afterpay’s services within their sales channels.

Complementing the fixed setup fee, Afterpay imposes a predetermined fixed charge for each transaction processed through its platform. This fixed transaction fee accounts for the processing costs and operational overheads associated with facilitating secure and convenient payments, underpinning the reliability and efficiency of Afterpay’s service delivery.

Furthermore, Afterpay’s fee structure incorporates variable elements, with the merchant fee rate standing as a pivotal component. The merchant fee rate represents a percentage of the total transaction value, aligning with the scalability and value-driven nature of Afterpay’s buy now, pay later model. This variable fee component enables Afterpay to sustain its operations while offering merchants a flexible and transparent pricing mechanism that adapts to the volume and value of their transactions.

By comprehensively understanding Afterpay’s fee structure, merchants can strategically navigate the dynamics of these fees, optimizing their utilization of the platform while managing their cost structures effectively. This nuanced understanding empowers merchants to make informed decisions regarding product pricing, sales strategies, and the integration of Afterpay into their customer offerings, fostering a symbiotic relationship between business sustainability and customer satisfaction.

As we unravel the layers of Afterpay’s fee structure, we will delve into the factors influencing the magnitude of these fees and provide actionable insights to help you leverage Afterpay’s services as a catalyst for growth and profitability. Join us as we embark on this enlightening exploration, equipping you with the knowledge and strategies to navigate the realm of Afterpay’s fee structure with confidence and clarity.

Factors Affecting Afterpay’s Merchant Fees

Understanding the determinants that influence Afterpay’s merchant fees is crucial for merchants seeking to optimize their cost structures and enhance the value proposition of this popular payment solution. Several key factors play a pivotal role in shaping the magnitude and dynamics of Afterpay’s merchant fees, reflecting the nuanced interplay of operational, financial, and strategic considerations within the platform’s fee framework.

- Transaction Volume and Value: The volume and value of transactions processed through Afterpay directly impact the merchant fees incurred. Higher transaction volumes and larger transaction values may lead to proportionally higher fees, reflecting the scalable nature of Afterpay’s pricing model.

- Merchant Industry and Risk Profile: The industry in which a merchant operates and their associated risk profile can influence the merchant fees imposed by Afterpay. Industries with higher perceived risk or distinct market dynamics may experience varying fee structures to align with the platform’s risk management strategies.

- Integration and Customization: The extent of integration and customization of Afterpay’s services within a merchant’s sales channels can influence the fee structure. Tailored integrations and enhanced customization may entail additional costs or unique fee arrangements to accommodate specific merchant requirements.

- Compliance and Regulatory Considerations: Evolving regulatory requirements and compliance standards can impact Afterpay’s fee structure, with adjustments made to align with industry regulations, consumer protection mandates, and financial governance frameworks.

- Market Dynamics and Competitive Landscape: The prevailing market dynamics and competitive landscape within the retail and e-commerce sectors can indirectly influence Afterpay’s merchant fees. Shifts in market trends, competitive pricing strategies, and consumer behavior may prompt adjustments in fee structures to maintain Afterpay’s relevance and value proposition.

By conscientiously evaluating these factors, merchants can gain valuable insights into the dynamics of Afterpay’s merchant fees, enabling them to make informed decisions that optimize their cost structures and leverage the platform’s services effectively. Navigating the realm of Afterpay’s fee structure with a comprehensive understanding of these influencing factors empowers merchants to align their business strategies with the evolving landscape of modern commerce, fostering sustainable growth and enduring success.

As we delve deeper into the realm of Afterpay’s merchant fees, we will continue to explore the interplay of these factors, providing actionable guidance to help you manage and optimize your utilization of Afterpay’s services while strategically mitigating the impact of merchant fees on your operational expenses. Join us on this enlightening journey as we unravel the complexities of Afterpay’s fee dynamics, equipping you with the knowledge and strategies to navigate this pivotal aspect of modern retail with confidence and acumen.

Comparing Afterpay’s Merchant Fees with Other Payment Methods

When evaluating the viability of integrating Afterpay into your payment ecosystem, it’s essential to compare the platform’s merchant fees with those associated with other payment methods. This comparative analysis provides valuable insights into the cost-effectiveness, value proposition, and strategic implications of leveraging Afterpay alongside traditional and alternative payment solutions.

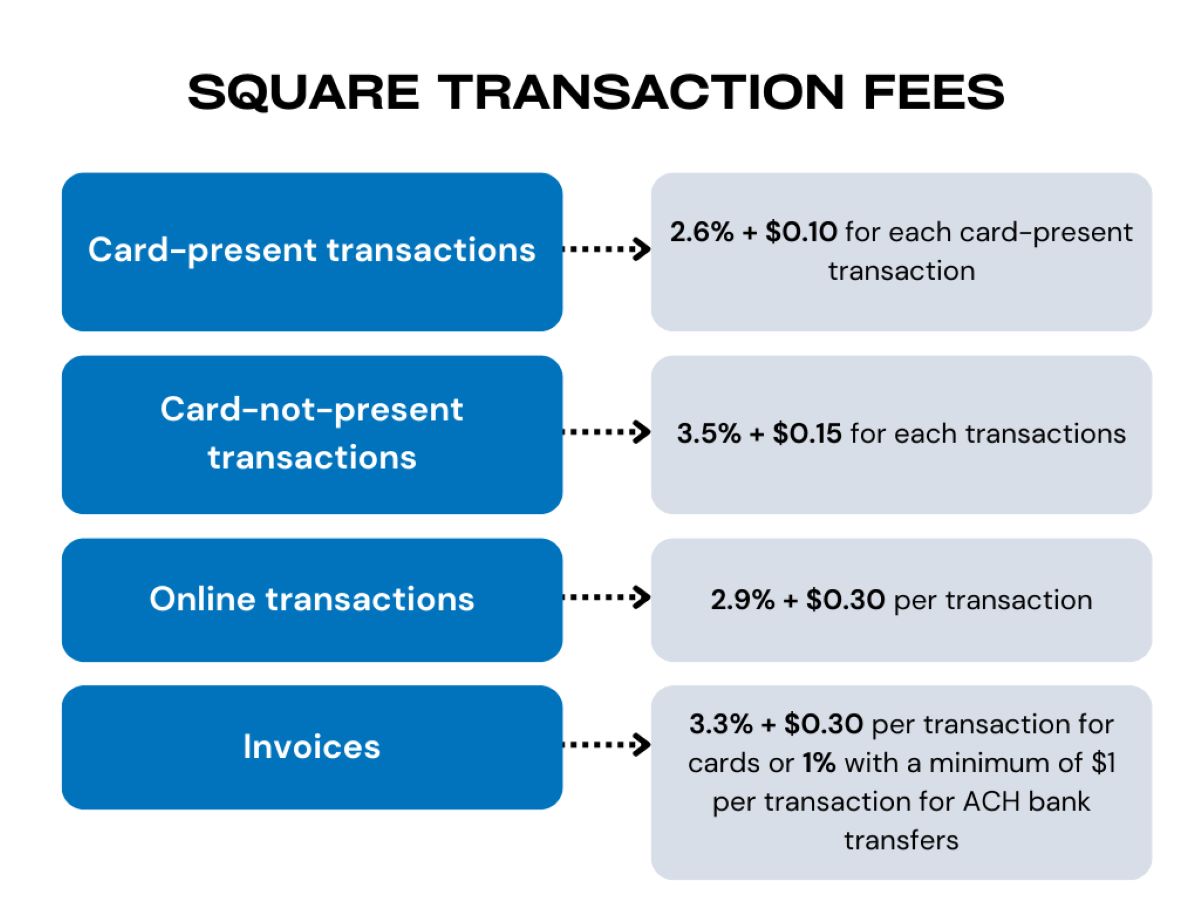

Traditional payment methods, such as credit card transactions and direct bank transfers, often entail distinct fee structures that encompass interchange fees, processing fees, and potential chargeback costs. These conventional payment mechanisms may impose relatively higher fixed and variable fees on merchants, impacting their profit margins and cost structures.

Comparatively, Afterpay’s merchant fees present a unique blend of fixed setup charges, transaction-based fees, and variable components, offering merchants a transparent and scalable pricing model. While the initial setup fee and fixed transaction charges form the foundation of Afterpay’s fee structure, the platform’s variable merchant fee rate aligns with the value-driven nature of its buy now, pay later model, providing merchants with a dynamic and adaptable pricing mechanism.

Moreover, the appeal of Afterpay’s merchant fees extends beyond their comparative cost-effectiveness. By integrating Afterpay into their payment options, merchants gain access to a diverse consumer base seeking flexible and interest-free payment solutions. This expanded reach and enhanced customer engagement can offset the impact of merchant fees, positioning Afterpay as a strategic enabler of revenue growth and customer loyalty.

When juxtaposed with other buy now, pay later services and emerging payment technologies, Afterpay’s merchant fees exhibit competitive advantages in terms of transparency, scalability, and consumer appeal. The platform’s commitment to fostering mutually beneficial relationships between merchants and consumers is reflected in its fee structure, which balances operational sustainability with value-driven pricing mechanisms.

By conducting a comprehensive comparison of Afterpay’s merchant fees with other payment methods, merchants can discern the strategic implications of integrating Afterpay into their sales channels. This discernment empowers them to optimize their cost structures, capitalize on consumer trends, and harness the inherent benefits of Afterpay’s payment solution within the dynamic landscape of modern commerce.

As we delve deeper into this comparative exploration, we will continue to unravel the nuanced dynamics of Afterpay’s merchant fees, providing actionable insights to help you make informed decisions about your payment strategy. Join us on this enlightening journey as we dissect the comparative landscape of merchant fees, equipping you with the knowledge and strategic acumen to navigate this pivotal aspect of modern retail with confidence and clarity.

Tips for Managing Afterpay’s Merchant Fees

Effectively managing Afterpay’s merchant fees is pivotal for merchants aiming to optimize their cost structures and maximize the value derived from this popular buy now, pay later service. By implementing strategic approaches and leveraging the inherent flexibility of Afterpay’s fee framework, merchants can navigate the dynamics of these fees while enhancing the overall profitability and sustainability of their business operations.

- Strategic Product Pricing: Tailoring your product pricing to accommodate the cost of merchant fees associated with Afterpay can help maintain your profit margins while offering transparent and competitive pricing to consumers.

- Consumer Education: Educating your customers about the benefits of using Afterpay and highlighting its interest-free nature can encourage its adoption, offsetting the impact of merchant fees through increased transaction volumes.

- Optimized Checkout Experience: Streamlining the checkout process and prominently featuring Afterpay as a payment option can drive higher conversion rates, amplifying the revenue generated through Afterpay transactions and mitigating the relative impact of merchant fees.

- Strategic Marketing Initiatives: Integrating Afterpay promotions and exclusive offers into your marketing campaigns can incentivize customers to choose Afterpay, fostering increased transaction values and customer retention to counterbalance merchant fees.

- Efficient Inventory Management: Aligning your inventory management strategies with Afterpay’s payment cycles can enhance cash flow management, mitigating the impact of merchant fees on your working capital and operational expenses.

- Customized Integration: Collaborating with Afterpay to explore tailored integration options and fee structures that align with your business model can optimize the cost-effectiveness of leveraging Afterpay as a payment solution.

- Proactive Customer Support: Providing responsive and empathetic customer support for Afterpay-related inquiries can foster trust and confidence among your customers, encouraging them to utilize Afterpay for their purchases and offsetting the impact of merchant fees through increased customer loyalty.

By implementing these strategic tips and leveraging the inherent flexibility of Afterpay’s fee framework, merchants can effectively manage their merchant fees while harnessing the full potential of this popular payment solution. Navigating the realm of Afterpay’s fee structure with a proactive and informed approach empowers merchants to optimize their utilization of the platform, fostering sustainable growth and enduring success within the dynamic landscape of modern commerce.

As we delve deeper into the realm of managing Afterpay’s merchant fees, we will continue to provide actionable guidance and strategic insights to help you navigate this pivotal aspect of modern retail with confidence and acumen. Join us on this enlightening journey as we unravel the dynamics of managing merchant fees, equipping you with the knowledge and strategies to optimize your utilization of Afterpay’s services while effectively managing your cost structures.

Conclusion

In the dynamic landscape of modern commerce, Afterpay has emerged as a prominent facilitator of seamless and flexible payment solutions, catering to the evolving needs of both merchants and consumers. Throughout this comprehensive exploration of Afterpay’s merchant fees, we have delved into the intricacies of its fee structure, unraveled the factors influencing these fees, and provided valuable insights and strategies for managing and optimizing the utilization of this popular buy now, pay later service.

By comprehensively understanding Afterpay’s fee framework and the determinants that shape its merchant fees, merchants can make informed decisions that harmonize with their business objectives and financial considerations. The strategic comparison of Afterpay’s merchant fees with other payment methods has highlighted the platform’s competitive advantages in terms of transparency, scalability, and consumer appeal, positioning it as a strategic enabler of revenue growth and customer loyalty.

Moreover, the actionable tips for managing Afterpay’s merchant fees underscore the significance of proactive approaches, strategic marketing initiatives, and optimized customer experiences in mitigating the impact of these fees on merchants’ operational expenses. By leveraging these tips and the inherent flexibility of Afterpay’s fee framework, merchants can navigate the dynamics of these fees while enhancing the overall profitability and sustainability of their business operations.

As merchants continue to harness the full potential of Afterpay’s payment solution, it is imperative to approach the realm of merchant fees with a proactive and informed mindset, leveraging the platform as a catalyst for growth and customer engagement. By embracing the strategic insights and actionable guidance provided in this guide, merchants can navigate the complexities of managing Afterpay’s merchant fees with confidence and acumen, fostering sustainable growth and enduring success within the dynamic landscape of modern commerce.

Join us in embracing the transformative potential of Afterpay’s payment solution, harnessing its value as a strategic enabler of customer-centric commerce and sustainable business growth. As we navigate the evolving terrain of modern retail, the proactive management of merchant fees and the strategic utilization of Afterpay’s services will undoubtedly pave the way for enhanced profitability, customer satisfaction, and enduring relevance in the digital marketplace.