Finance

How Much Are Merchant Fees For Refunds?

Published: February 24, 2024

Find out the costs involved in processing refunds and managing merchant fees in the finance industry. Learn how to optimize your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the intricate world of finance can be a daunting task, especially when it comes to understanding the various fees associated with merchant services. One such fee that often raises questions is the cost of processing refunds. As a merchant, it's crucial to comprehend the factors that influence refund fees, as well as strategies for managing these costs effectively.

In this comprehensive guide, we will delve into the realm of merchant fees for refunds, shedding light on the intricacies of these charges and providing valuable insights for merchants seeking to optimize their financial operations. By the end of this article, you will have a deeper understanding of the average costs associated with refunds, the factors that impact these fees, and actionable tips for mitigating refund expenses. Whether you're a seasoned merchant or just dipping your toes into the world of commerce, this guide will equip you with the knowledge needed to make informed decisions regarding refund fees.

Join us as we unravel the complexities of refund fees, empowering you to navigate the financial landscape with confidence and clarity. Let's embark on this enlightening journey to demystify the world of merchant fees for refunds and pave the way for smarter financial management.

Understanding Merchant Fees

Merchant fees encompass a spectrum of charges that businesses incur for accepting electronic payments, including credit and debit card transactions. These fees are a fundamental aspect of conducting commerce in the modern digital age, serving as the cost of leveraging electronic payment systems to facilitate transactions with customers. Within the realm of merchant fees, the cost of processing refunds holds a significant place, as it directly impacts a merchant’s bottom line.

When a customer requests a refund for a purchase, the merchant is typically obligated to reimburse the funds. However, this process incurs expenses in the form of refund fees, which are incurred by the merchant when processing the return of funds to the customer’s account. Understanding these fees is essential for merchants, as they directly impact the profitability of each transaction and the overall financial health of the business.

Merchant fees for refunds are often structured to account for various factors, including the type of transaction, the payment processor used, and the specific terms outlined in the merchant agreement. These fees can vary widely, making it crucial for merchants to grasp the underlying principles that govern refund charges and the nuances that influence their magnitude.

By comprehending the intricacies of merchant fees, including those associated with refunds, merchants can make informed decisions regarding their payment processing strategies, optimize their financial operations, and ultimately enhance their bottom line. In the following sections, we will explore the factors that affect refund fees and provide actionable tips for managing these costs effectively.

Factors Affecting Refund Fees

Several key factors influence the magnitude of refund fees incurred by merchants. Understanding these factors is essential for effectively managing refund expenses and optimizing financial operations. Below are the primary elements that contribute to the determination of refund fees:

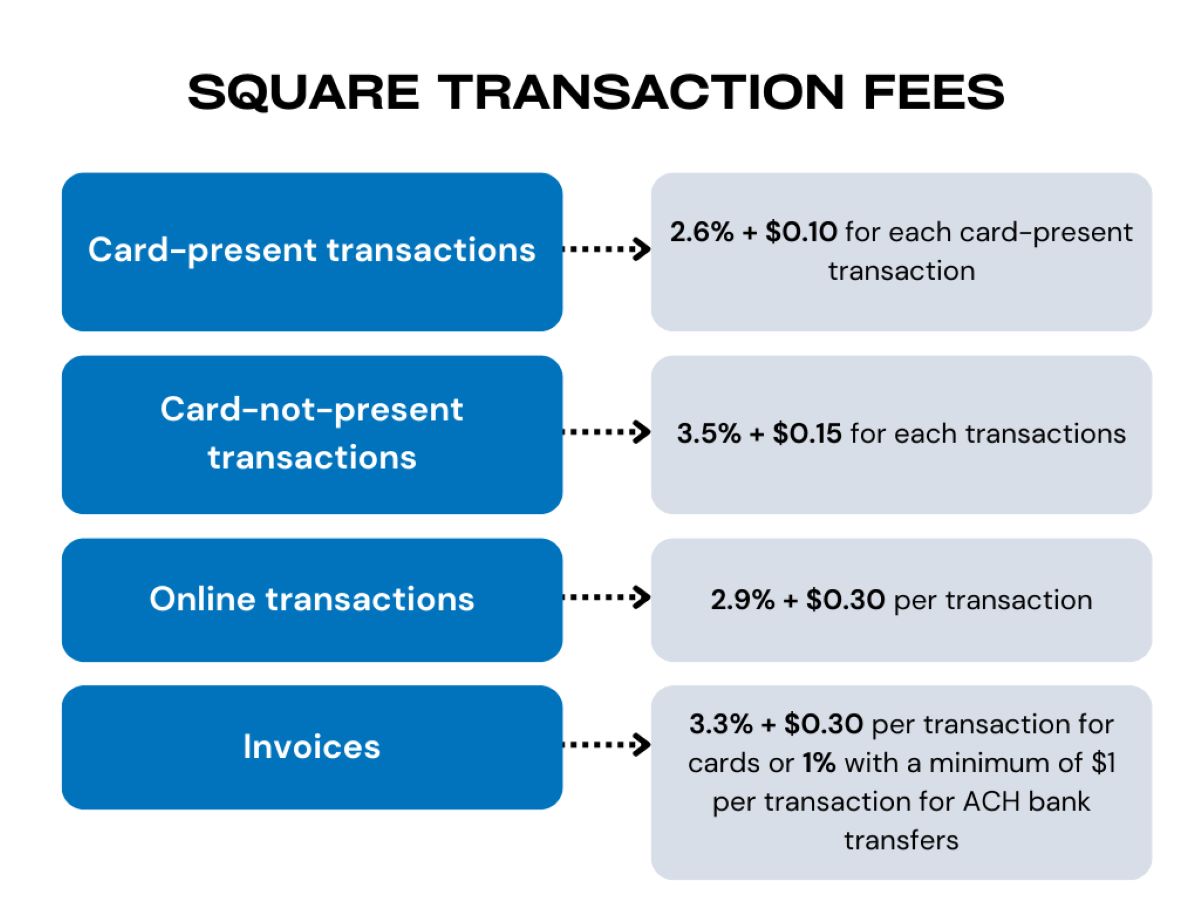

- Payment Processor Policies: Different payment processors have varying policies regarding refund fees. Some processors may charge a flat fee for each refund, while others calculate the fee as a percentage of the refunded amount. It’s crucial for merchants to familiarize themselves with the specific refund policies of their payment processor to anticipate and manage these costs effectively.

- Transaction Volume: The volume of transactions processed by a merchant can impact refund fees. Merchants with higher transaction volumes may have the leverage to negotiate lower refund fees with their payment processor, especially if they have a strong track record of reliable and consistent transaction processing.

- Merchant Category: The industry or category in which a merchant operates can influence refund fees. Certain high-risk industries may incur higher refund fees due to the elevated potential for chargebacks and refunds. Understanding the implications of the merchant category on refund fees is crucial for managing costs proactively.

- Card Type: The type of card used for the original transaction can impact refund fees. Credit cards, debit cards, and premium cards may carry different fee structures for refunds. Merchants should be mindful of these distinctions and consider them when assessing the potential impact on their refund costs.

- Compliance and Chargeback History: Merchants’ compliance with payment industry regulations and their historical chargeback rates can influence refund fees. Maintaining a strong record of compliance and minimizing chargebacks can positively impact refund fee negotiations with payment processors.

By recognizing and analyzing these factors, merchants can gain valuable insights into the dynamics of refund fees and implement strategies to mitigate these costs. In the subsequent section, we will delve into the average costs associated with refunds, providing merchants with a comprehensive understanding of the financial implications of processing returns.

Average Costs of Refunds

Understanding the average costs associated with processing refunds is pivotal for merchants seeking to manage their financial resources effectively. While refund fees can vary based on a multitude of factors, having a general idea of the typical expenses involved in refund processing can provide merchants with a baseline for budgeting and financial planning.

Refund fees typically encompass a combination of fixed charges and variable percentages, depending on the policies of the payment processor and the specifics of the merchant agreement. On average, merchants may encounter refund fees ranging from a few dollars to a percentage of the refunded amount, with the exact figures contingent on the factors outlined in the previous section.

It’s important for merchants to assess their typical refund volumes and the associated costs to gauge the financial impact of refund processing on their operations. By analyzing historical refund data and the corresponding fees, merchants can derive insights into the average costs of refunds and incorporate these expenses into their financial forecasts.

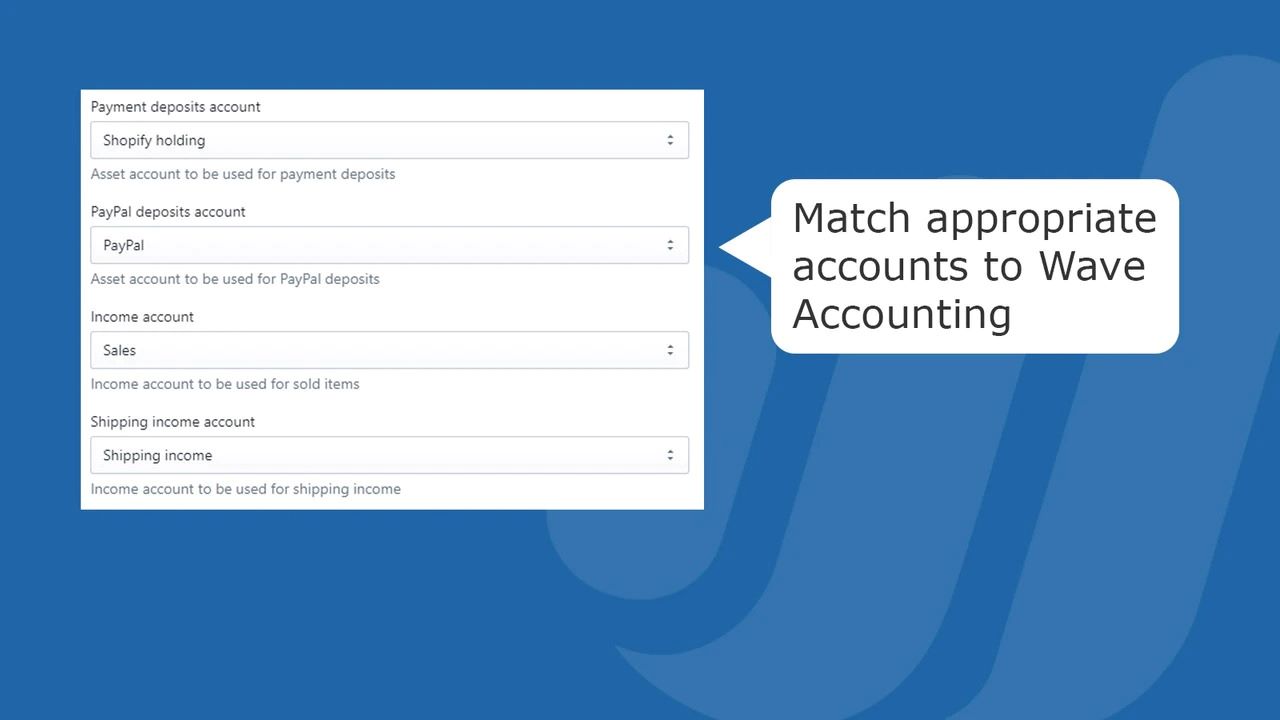

Moreover, merchants should proactively engage with their payment processor to gain clarity on the specific refund fee structures applicable to their accounts. This proactive approach can facilitate transparent communication with the payment processor and potentially lead to negotiations aimed at optimizing refund fees to better align with the merchant’s business needs.

By familiarizing themselves with the average costs of refunds and engaging in strategic discussions with their payment processor, merchants can position themselves to make informed decisions regarding refund processing. In the subsequent section, we will delve into actionable tips for managing refund fees, empowering merchants to optimize their financial strategies and enhance their bottom line.

Tips for Managing Refund Fees

Effectively managing refund fees is essential for merchants aiming to streamline their financial operations and maximize profitability. By implementing strategic measures and proactive approaches, merchants can mitigate the impact of refund fees on their bottom line. Here are actionable tips for managing refund fees:

- Optimize Customer Service: Providing exceptional customer service can help reduce the frequency of refund requests. By addressing customer concerns promptly and effectively, merchants can minimize the need for refunds, thereby lowering associated fees.

- Implement Robust Fraud Prevention Measures: Proactively safeguarding against fraudulent transactions can reduce chargebacks and refund requests. Employing robust fraud prevention tools and practices can help mitigate the financial impact of refunds on the business.

- Negotiate with Payment Processors: Engage in open discussions with payment processors to negotiate favorable refund fee structures. Leverage transaction volume and a strong processing history to secure competitive refund rates that align with the business’s financial objectives.

- Monitor and Analyze Refund Data: Regularly analyze refund data to identify trends and patterns. Understanding the reasons behind refund requests can inform strategic decisions aimed at minimizing future refund occurrences and optimizing operational processes.

- Offer Store Credits or Exchanges: Providing alternatives to monetary refunds, such as store credits or product exchanges, can mitigate refund fees while fostering customer retention and satisfaction.

- Review and Update Merchant Agreements: Periodically review and update merchant agreements to ensure that the terms align with the business’s evolving needs. Clarity on refund fee structures and policies can empower merchants to make informed decisions and proactively manage refund expenses.

- Utilize Automated Refund Processing: Implementing automated refund processing solutions can streamline the refund workflow, reducing manual efforts and potentially minimizing associated costs.

By integrating these tips into their operational strategies, merchants can proactively manage refund fees and optimize their financial performance. Nurturing a customer-centric approach, fortifying fraud prevention measures, and engaging in transparent negotiations with payment processors are pivotal steps in mitigating the financial impact of refund fees.

Armed with these actionable tips, merchants can navigate the realm of refund fees with confidence, ensuring that their financial resources are utilized efficiently and their bottom line is bolstered. In the concluding section, we will encapsulate the insights presented in this guide and emphasize the significance of proactive financial management in the context of refund fees.

Conclusion

As we conclude this insightful exploration into the realm of merchant fees for refunds, it is evident that understanding and effectively managing refund fees are integral components of prudent financial management for merchants. The intricate interplay of factors influencing refund fees, coupled with the average costs associated with processing refunds, underscores the need for merchants to approach refund management with a strategic mindset.

By comprehending the nuances of refund fees and the underlying factors that shape these costs, merchants can proactively optimize their financial operations and bolster their bottom line. The actionable tips presented in this guide serve as a compass for merchants, guiding them toward proactive measures aimed at mitigating the financial impact of refund fees and fostering a resilient financial framework.

It is imperative for merchants to cultivate a customer-centric approach, fortify fraud prevention measures, and engage in transparent negotiations with payment processors to navigate the landscape of refund fees effectively. Furthermore, the proactive analysis of refund data and the periodic review of merchant agreements are pivotal in ensuring that refund expenses are managed judiciously.

Armed with a comprehensive understanding of refund fees and equipped with actionable strategies for managing these costs, merchants can navigate the financial intricacies of refund processing with confidence and foresight. By integrating these insights into their operational framework, merchants can optimize their financial performance, fortify customer relationships, and foster sustainable growth in an increasingly competitive marketplace.

As merchants strive to navigate the dynamic terrain of commerce, the astute management of refund fees stands as a testament to their commitment to financial prudence and operational excellence. By embracing the insights presented in this guide, merchants can chart a course toward financial resilience and sustainable success in an ever-evolving business landscape.