Finance

How To Categorize Merchant Fees

Published: February 24, 2024

Learn how to categorize and understand merchant fees in finance to optimize your business expenses and improve financial management. Discover key strategies for effectively managing and categorizing merchant fees.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the complex landscape of merchant fees is a crucial aspect of managing finances for businesses of all sizes. Understanding the various types of fees and how to categorize them effectively is essential for maintaining financial health and making informed decisions. In this comprehensive guide, we will delve into the intricacies of merchant fees, exploring the key factors to consider when categorizing them. By gaining a deeper understanding of this topic, businesses can optimize their financial strategies and mitigate unnecessary costs.

Merchant fees encompass a wide array of charges imposed by financial institutions and payment processing entities. These fees can significantly impact a company's bottom line, making it imperative to categorize and analyze them meticulously. From interchange fees to processing charges, each type of merchant fee plays a distinct role in the overall financial ecosystem of a business.

By unraveling the complexities of merchant fees and providing actionable insights, this guide aims to empower businesses to make well-informed decisions regarding their financial operations. Whether you are a seasoned financial professional or a business owner seeking to enhance your understanding of merchant fees, this guide will equip you with the knowledge and tools necessary to navigate this intricate terrain with confidence. Let's embark on this enlightening journey to demystify merchant fees and unlock the potential for financial optimization.

Understanding Merchant Fees

Merchant fees encompass a broad spectrum of charges that businesses incur when processing electronic payments, such as credit card transactions. These fees are typically imposed by payment processors, card networks, and acquiring banks as compensation for facilitating secure and efficient payment processing services. It is essential for businesses to comprehend the various types of merchant fees to effectively manage their financial resources and optimize their operational costs.

One of the primary components of merchant fees is the interchange fee, which is the amount paid by the merchant’s acquiring bank to the customer’s issuing bank for each transaction. This fee is determined based on factors such as the type of card used, the transaction method, and the level of risk associated with the transaction. Understanding the intricacies of interchange fees is crucial for businesses, as it directly impacts the overall cost of processing payments.

Another significant aspect of merchant fees is the assessment fee, which is charged by card networks such as Visa and Mastercard. These fees contribute to the operational expenses of the card networks and are passed on to the merchant as a cost of accepting their payment cards. Additionally, businesses may encounter various other fees, including authorization fees, batch processing fees, and monthly service charges, all of which contribute to the overall cost of processing electronic payments.

By comprehensively understanding the structure and components of merchant fees, businesses can make informed decisions regarding their payment processing strategies. Moreover, gaining insights into the underlying mechanisms of these fees enables businesses to negotiate more favorable terms with payment processors and financial institutions, ultimately reducing their operational expenses and enhancing their bottom line.

Categorizing Merchant Fees

Effectively categorizing merchant fees is vital for financial clarity and strategic decision-making. By organizing these fees into distinct categories, businesses can gain a comprehensive overview of their payment processing expenses and identify areas for optimization. While the specific categorization may vary based on the nature of the business and its payment processing activities, several common classifications can be applied to streamline the analysis of merchant fees.

1. Transaction-Based Fees: This category encompasses fees that are directly tied to individual transactions, such as interchange fees and assessment fees. These charges are incurred for each payment processed and play a fundamental role in the overall cost structure of electronic payment acceptance. By isolating transaction-based fees, businesses can assess the impact of each transaction on their financial performance and implement targeted strategies to manage these expenses.

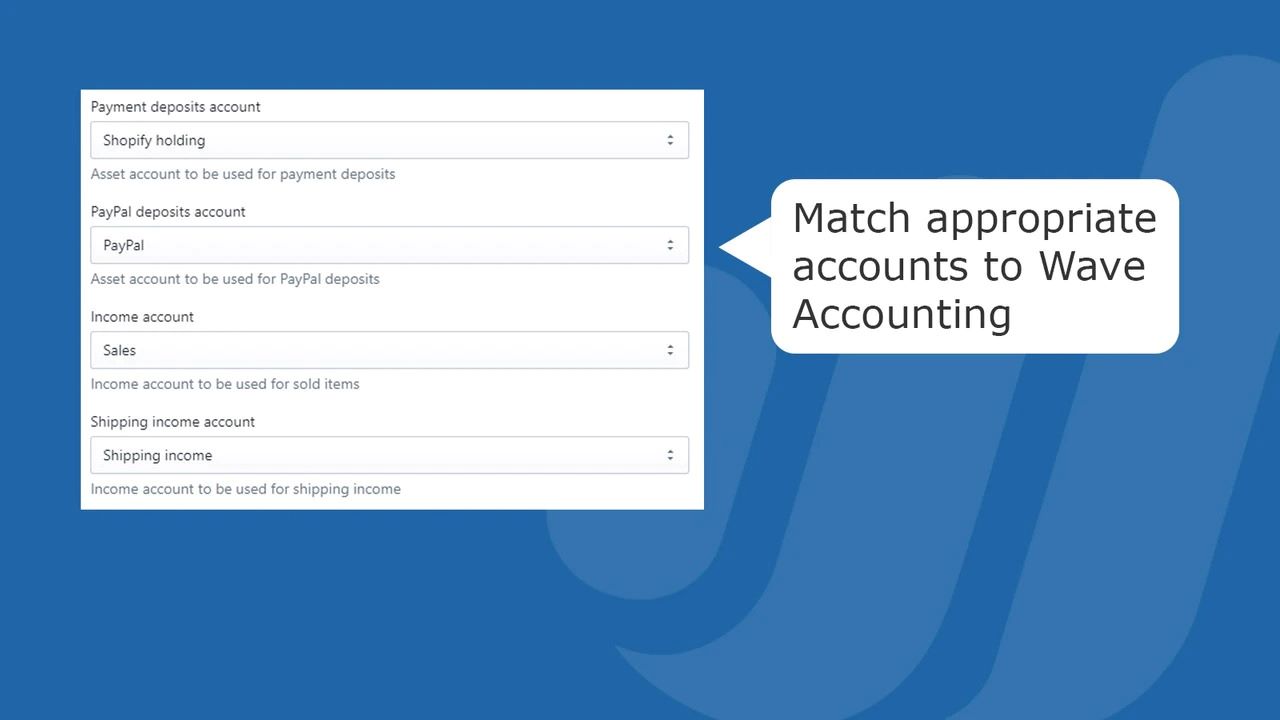

2. Fixed Fees: Fixed fees include recurring charges that remain constant regardless of the transaction volume, such as monthly service fees and equipment rental fees. Categorizing these fees separately allows businesses to evaluate their baseline operating costs related to payment processing, facilitating more accurate financial forecasting and budgeting.

3. Incidental Fees: This category encompasses sporadic or ad-hoc fees that may arise from specific circumstances, such as chargeback fees and non-compliance penalties. By categorizing incidental fees, businesses can monitor and address potential areas of risk and non-compliance, thereby minimizing unexpected financial impacts.

4. Ancillary Fees: Ancillary fees encompass additional charges related to value-added services or specialized payment processing features, such as gateway fees for online transactions or fees for premium customer support. By categorizing these fees, businesses can assess the cost-benefit ratio of utilizing specific payment processing enhancements and make informed decisions regarding their adoption.

By systematically categorizing merchant fees based on their nature and impact, businesses can gain a nuanced understanding of their payment processing expenses and identify opportunities for optimization. This structured approach enables businesses to allocate resources efficiently, negotiate favorable terms with payment processors, and ultimately enhance their financial performance in the realm of electronic payment acceptance.

Factors to Consider

When categorizing and analyzing merchant fees, several key factors warrant careful consideration to ensure a comprehensive and strategic approach to managing payment processing expenses. By taking these factors into account, businesses can gain valuable insights and make informed decisions to optimize their financial operations.

1. Transaction Volume and Value: The volume and value of transactions processed by a business directly influence the impact of merchant fees on its financial performance. High transaction volumes may result in significant transaction-based fees, while high-value transactions can lead to higher interchange fees. Understanding the correlation between transaction metrics and fee structures is essential for accurate cost projections and revenue management.

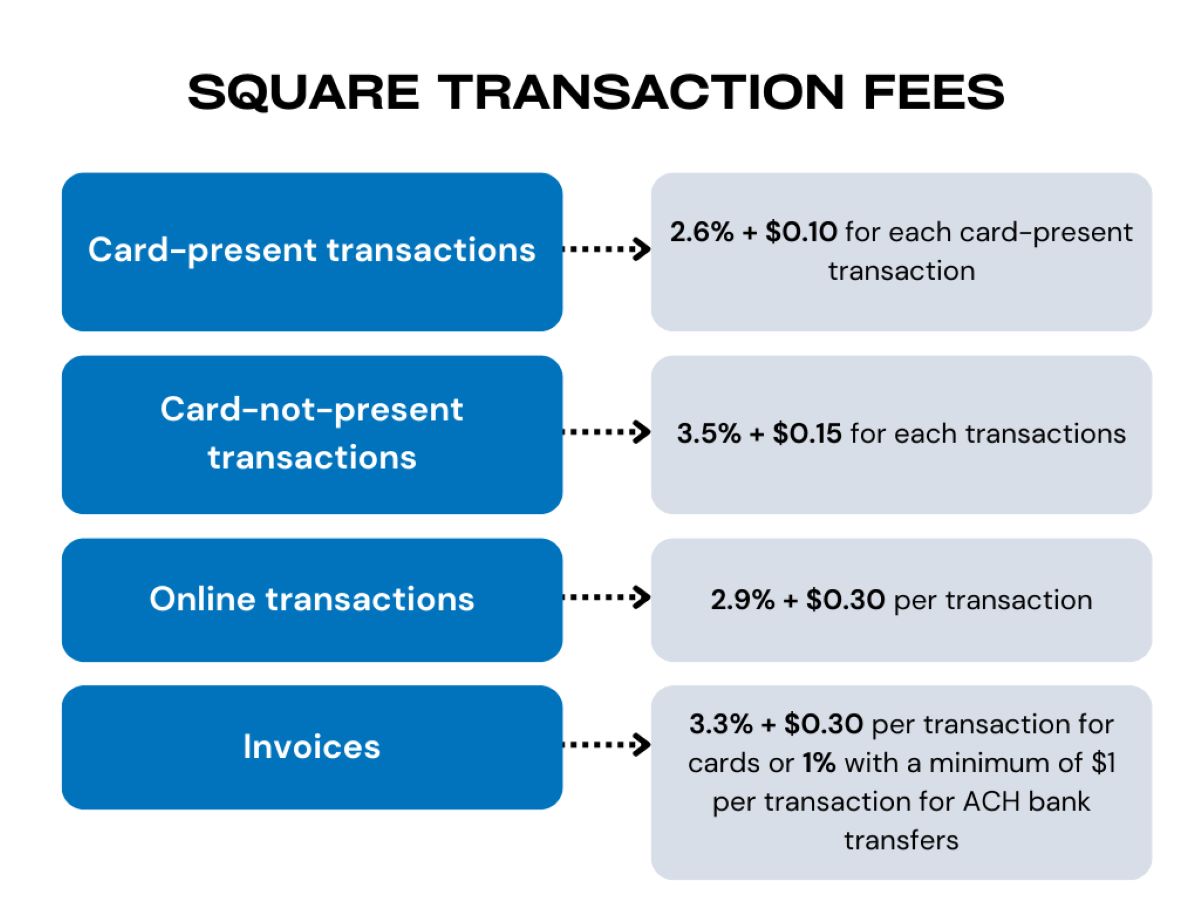

2. Industry and Business Model: The specific industry and business model of a company can influence the prevalence and structure of merchant fees. For instance, businesses operating in the e-commerce sector may encounter distinct fee components related to online transactions and card-not-present scenarios. By considering industry-specific dynamics, businesses can tailor their fee categorization and optimization strategies to align with their operational nuances.

3. Payment Processing Methods: The diversity of payment processing methods utilized by a business, such as in-store card present transactions, online payments, and mobile commerce, can impact the composition of merchant fees. Different processing methods may incur varying fee structures, necessitating a nuanced approach to categorizing and managing these expenses effectively.

4. Regulatory Compliance and Security Standards: Compliance requirements and security standards mandated by regulatory bodies and card networks can give rise to specific fees related to data security, compliance assessments, and non-compliance penalties. Businesses must consider these factors when categorizing merchant fees to ensure adherence to industry regulations and mitigate potential financial liabilities.

5. Payment Processor Relationships: The nature of the relationships with payment processors and acquiring banks can significantly influence the fee structures and terms imposed on businesses. Understanding the contractual agreements, service level agreements, and negotiation levers with payment processing entities is crucial for optimizing fee categorization and exploring opportunities for cost savings.

By meticulously evaluating these factors and integrating them into the categorization and analysis of merchant fees, businesses can develop a holistic understanding of their payment processing expenses. This proactive approach empowers businesses to proactively manage their financial resources, identify areas for optimization, and foster sustainable growth in an increasingly digital and interconnected commerce landscape.

Conclusion

Effectively managing and categorizing merchant fees is a fundamental aspect of financial stewardship for businesses across diverse industries. By gaining a comprehensive understanding of the intricacies of merchant fees and the factors that influence their composition, businesses can optimize their payment processing expenses and bolster their financial health.

Through the categorization of merchant fees into distinct classifications such as transaction-based fees, fixed fees, incidental fees, and ancillary fees, businesses can streamline their analysis and gain valuable insights into their payment processing costs. This structured approach enables businesses to identify areas for optimization, negotiate favorable terms with payment processors, and enhance their overall financial performance.

Moreover, by considering key factors such as transaction volume, industry dynamics, payment processing methods, regulatory compliance, and payment processor relationships, businesses can develop a nuanced and strategic approach to categorizing and managing merchant fees. This proactive consideration of influential factors empowers businesses to make informed decisions, mitigate financial risks, and capitalize on opportunities for cost savings.

As the landscape of electronic payments continues to evolve, businesses must remain vigilant in their approach to understanding and categorizing merchant fees. By staying abreast of industry developments, regulatory changes, and emerging payment technologies, businesses can adapt their fee categorization strategies to align with the evolving demands of the market, ensuring financial resilience and agility.

In conclusion, the effective categorization of merchant fees is not merely a financial exercise; it is a strategic imperative that empowers businesses to navigate the complexities of payment processing, optimize their operational costs, and drive sustainable growth. By embracing a proactive and meticulous approach to fee categorization, businesses can position themselves for success in an increasingly dynamic and competitive commercial landscape.