Home>Finance>Customer Information File (CIF): Definition And Uses In Banking

Finance

Customer Information File (CIF): Definition And Uses In Banking

Published: November 7, 2023

Learn about customer information file (CIF), its definition, and uses in the finance industry. Explore how CIFs are utilized in banking for efficient customer management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Customer Information File (CIF) in Banking

When it comes to banking, the use of technology has greatly revolutionized the industry. Banks and financial institutions are leveraging advanced systems to manage customer data effectively. One such system is the Customer Information File, also known as CIF. In this article, we will dive deep into the definition and uses of CIF in banking.

Key Takeaways:

- CIF is a digital repository that stores essential information about bank customers.

- Banks use CIF to create a comprehensive profile of each customer, enabling them to provide personalized services.

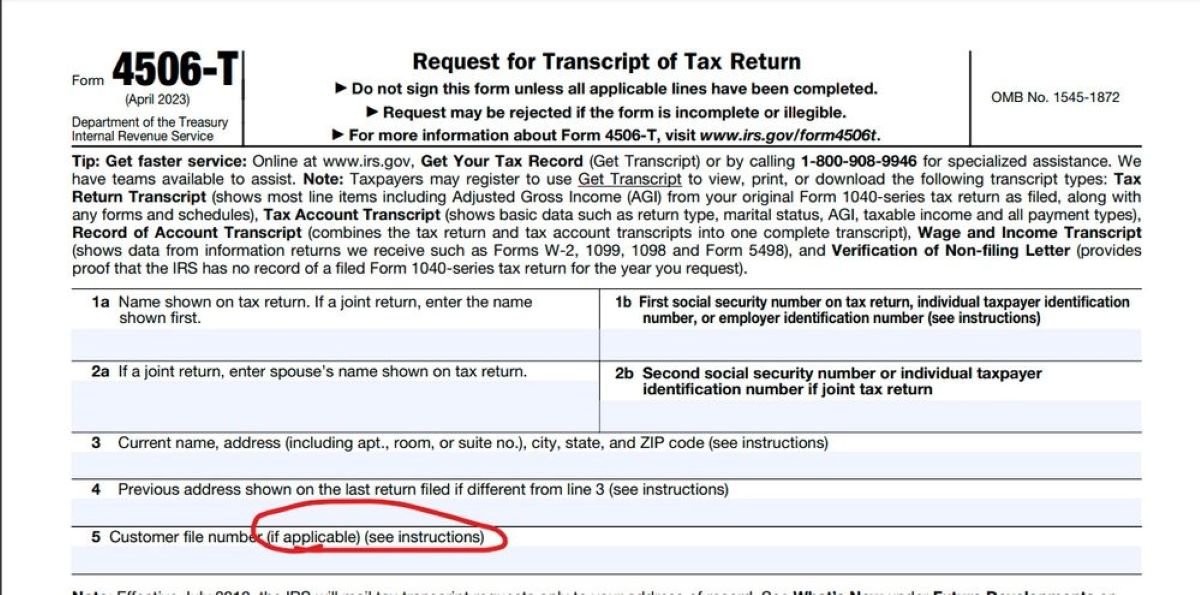

What is a Customer Information File (CIF)?

A Customer Information File (CIF) is a digital repository that stores crucial information about bank customers. It acts as a centralized database that gathers and organizes customer data, allowing banks to have a comprehensive view of each customer.

When a customer opens an account with a bank, the bank creates a unique CIF for that customer. This CIF becomes the primary source of information for the bank to manage the customer’s account, track transactions, and maintain essential records. It contains a wealth of data, including personal details, financial history, account balances, transaction history, and more.

Uses of CIF in Banking

Now that we understand what CIF is, let’s explore its applications in the banking industry:

1. Efficient Customer Management:

CIF plays a vital role in efficient customer management for banks. It helps create a comprehensive profile of each customer, allowing banks to gather insights into their financial behavior, preferences, and needs. This information enables banks to offer personalized services and tailored financial solutions to enhance the customer experience.

2. Regulatory Compliance:

Regulatory compliance is critical for banks to operate within legal guidelines. CIF systems help banks maintain compliance by storing all essential customer information, transaction history, and documentation in a centralized location. This ensures that banks are able to promptly respond to regulatory inquiries and audits.

3. Risk Management:

Banks face various risks, including credit risk, fraud risk, and operational risk. CIF aids in effective risk management by providing a comprehensive view of each customer’s financial profile. Banks can analyze customer data stored in CIF to identify potential risks, monitor suspicious activities, and take necessary precautions to mitigate financial risks.

4. Enhanced Customer Service:

With CIF, banks can enhance their customer service by having a holistic view of each customer’s relationship with the bank. The customer service representatives can access the CIF to quickly retrieve and verify customer information, address queries and concerns promptly, and provide personalized assistance to meet customer expectations.

5. Cross-Selling and Upselling Opportunities:

By leveraging the data stored in CIF, banks can identify cross-selling and upselling opportunities. They can analyze customers’ financial behavior, preferences, and patterns to offer them relevant financial products and services. This not only helps banks increase their revenue but also enables customers to explore suitable options that meet their financial goals.

Conclusion

Customer Information File (CIF) is an essential tool for banks to manage customer data effectively. By creating a comprehensive profile of each customer, CIF enables banks to provide personalized services, maintain regulatory compliance, manage risks, enhance customer service, and identify cross-selling opportunities. With technology-driven solutions like CIF, banks can continue to improve their operations and cater to their customers’ evolving financial needs.