Finance

How Often Does Avant Increase Credit Limit

Published: March 5, 2024

Find out how often Avant increases credit limits and manage your finances effectively. Learn more about credit limit increases and their impact on your financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Avant is a leading online lending platform that provides access to personal loans and credit products for individuals across the credit spectrum. One of the key concerns for credit card users is the potential for credit limit increases, as this can significantly impact their purchasing power and financial flexibility. In this article, we will delve into the frequency of credit limit increases from Avant, shedding light on the factors that influence these increments and providing valuable insights on how to navigate the process effectively.

Understanding the dynamics of credit limit increases is crucial for individuals seeking to optimize their credit utilization and enhance their financial well-being. Whether you are a seasoned credit card user or new to the world of personal finance, the prospect of a credit limit increase can have a tangible impact on your financial management strategies. By exploring the nuances of this process, we aim to empower readers with the knowledge and strategies necessary to navigate credit limit increases with confidence and proficiency.

In the following sections, we will explore the factors that influence Avant's credit limit increases, elucidate the steps involved in requesting a credit limit increase, and provide actionable tips for increasing the likelihood of a favorable outcome. By delving into these aspects, readers will gain a comprehensive understanding of the mechanisms at play and the proactive measures they can undertake to optimize their credit limit management with Avant. Let's embark on this insightful journey to unravel the intricacies of credit limit increases with Avant, empowering individuals to make informed financial decisions and leverage their credit products effectively.

Factors that Influence Avant’s Credit Limit Increases

Avant’s decision to increase a customer’s credit limit is influenced by a range of factors that collectively reflect the individual’s creditworthiness and financial behavior. Understanding these factors is essential for customers seeking to optimize their chances of securing a credit limit increase. One of the primary determinants is the customer’s payment history. Consistently making on-time payments and managing the credit account responsibly signals to Avant that the customer is a reliable borrower, thereby increasing the likelihood of a credit limit increment.

Another pivotal factor is the customer’s credit utilization ratio, which represents the proportion of available credit being utilized. Maintaining a low credit utilization ratio demonstrates prudent financial management and can bolster the case for a credit limit increase. Additionally, Avant considers the customer’s income and employment status. A steady income and stable employment can instill confidence in the customer’s ability to manage a higher credit limit effectively.

Furthermore, the length of the customer’s credit history and their overall credit profile play a significant role in Avant’s decision-making process. A longer credit history with a record of responsible credit usage can enhance the prospects of a credit limit increase. Moreover, customers who have successfully improved their credit score since opening their Avant credit account may be viewed favorably for a credit limit increase.

Other factors that may influence Avant’s credit limit increases include the customer’s overall debt load, recent credit inquiries, and any derogatory marks on their credit report. By comprehensively assessing these factors, Avant strives to make informed decisions that align with the customer’s financial circumstances and credit management behavior.

Understanding these influencing factors empowers customers to proactively manage their credit accounts in a manner that enhances their eligibility for credit limit increases. By cultivating positive financial habits and maintaining a sound credit profile, customers can position themselves favorably for potential credit limit increments from Avant.

How to Request a Credit Limit Increase from Avant

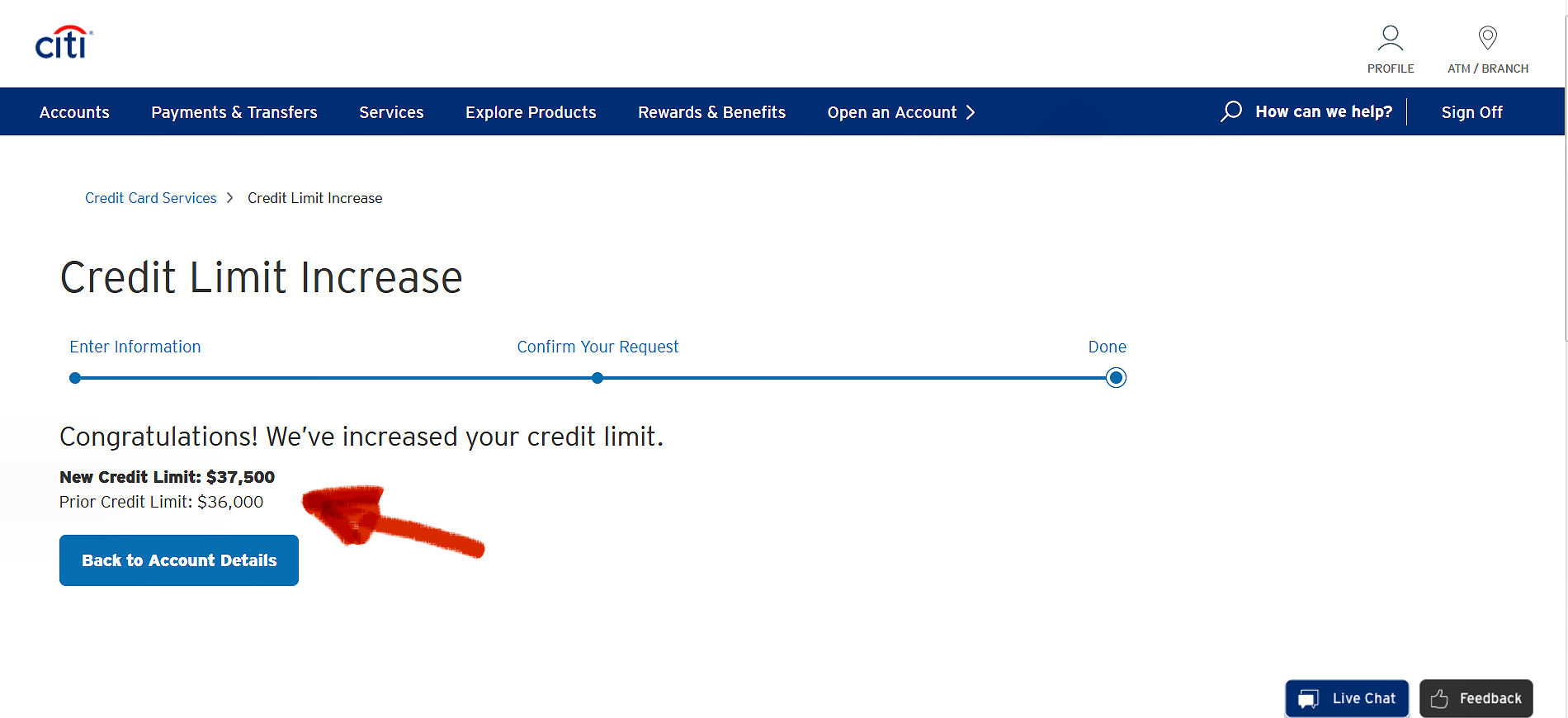

Requesting a credit limit increase from Avant involves a straightforward process that allows customers to present their case for a higher credit limit based on their financial progress and credit management behavior. To initiate the request, customers can typically log into their Avant account through the online portal or mobile app, where they will find the option to request a credit limit increase. This feature may be accessible within the account management section, providing a seamless avenue for customers to express their desire for a higher credit limit.

When submitting a request for a credit limit increase, customers may be required to provide updated financial information, such as their current income and employment details. This information enables Avant to assess the customer’s financial stability and capacity to manage a higher credit limit effectively. Additionally, customers may have the opportunity to include a brief statement outlining their rationale for seeking a credit limit increase, emphasizing their responsible credit usage and improved financial standing.

It’s important for customers to approach the request for a credit limit increase with a proactive mindset, highlighting any positive changes in their financial circumstances and credit management practices. By articulating a compelling case supported by concrete evidence of responsible credit utilization and improved financial stability, customers can enhance their prospects of securing a credit limit increase from Avant.

Upon submitting the request, Avant will review the customer’s account history, credit profile, and the provided information to make an informed decision regarding the credit limit increase. The timeline for a response may vary, but customers can typically expect to receive a notification regarding the outcome of their request within a reasonable timeframe.

By understanding the process of requesting a credit limit increase from Avant and approaching it with a strategic and well-documented approach, customers can navigate this aspect of credit management with confidence and increase their chances of securing a higher credit limit that aligns with their financial needs and goals.

Frequency of Credit Limit Increases from Avant

Avant’s approach to credit limit increases involves a dynamic evaluation of each customer’s creditworthiness and financial behavior, with the frequency of these increments varying based on individual circumstances. While there isn’t a predetermined timeline for credit limit increases, Avant periodically reviews eligible accounts to assess the potential for higher credit limits based on the customer’s credit management performance and overall financial standing.

Customers who demonstrate responsible credit usage, maintain a positive payment history, and exhibit improved financial stability may be considered for credit limit increases at strategic intervals. These increments are often contingent on the customer’s proactive efforts to manage their credit account prudently and showcase positive financial progress.

It’s important for customers to note that Avant’s approach to credit limit increases is designed to align with each customer’s unique financial journey, and as such, the frequency of these increments may vary from one account to another. Factors such as the customer’s payment history, credit utilization ratio, income stability, and overall credit management behavior collectively inform Avant’s decisions regarding credit limit increases.

Customers who have undergone significant improvements in their credit profile and financial circumstances may find themselves well-positioned for credit limit increases from Avant. By consistently exhibiting responsible credit behavior and actively managing their credit account, customers can enhance their prospects of securing periodic credit limit increments that reflect their evolving financial needs and capabilities.

Understanding the dynamics of credit limit increases with Avant empowers customers to approach their credit management with a long-term perspective, focusing on sustained financial progress and responsible credit utilization. While the frequency of credit limit increases is not set in stone, customers can proactively cultivate positive financial habits and maintain a sound credit profile to optimize their eligibility for these increments.

Tips for Increasing Your Chances of a Credit Limit Increase from Avant

Maximizing the likelihood of securing a credit limit increase from Avant entails a strategic approach to credit management and proactive measures that reflect responsible financial behavior. By implementing the following tips, customers can enhance their eligibility for credit limit increases and align their credit management practices with Avant’s criteria for evaluating these increments:

- Maintain a Positive Payment History: Consistently making on-time payments on your Avant credit account is crucial for demonstrating responsible credit behavior and enhancing your eligibility for a credit limit increase.

- Manage Credit Utilization Prudently: Keeping your credit utilization ratio low by utilizing only a small portion of your available credit can signal responsible credit management and bolster your case for a credit limit increase.

- Update Your Income and Employment Details: Providing accurate and updated income and employment information can showcase your financial stability and capacity to manage a higher credit limit effectively.

- Regularly Monitor Your Credit Profile: Stay informed about your credit score, credit report, and overall credit health to address any discrepancies or areas for improvement that could impact your eligibility for a credit limit increase.

- Showcase Financial Progress: If you’ve experienced positive changes in your financial circumstances, such as increased income or reduced debt, highlighting these advancements can strengthen your case for a credit limit increase.

- Utilize Credit Responsibly: Demonstrate prudent credit usage by avoiding maxing out your credit limit and managing your credit account judiciously, reflecting a disciplined approach to credit management.

- Submit a Well-Documented Request: When requesting a credit limit increase, provide a clear and concise statement outlining your rationale, supported by evidence of responsible credit utilization and financial stability.

By incorporating these tips into their credit management strategy, customers can proactively position themselves for potential credit limit increases from Avant. Engaging in responsible financial practices and maintaining a sound credit profile can significantly enhance the likelihood of securing higher credit limits that align with their evolving financial needs and goals.

Conclusion

Navigating the landscape of credit limit increases with Avant requires a comprehensive understanding of the influencing factors, the process of requesting an increment, and the proactive measures that can bolster one’s eligibility. By recognizing the pivotal role of responsible credit management and financial stability, customers can strategically position themselves for potential credit limit increases that align with their evolving financial needs.

Understanding the dynamic interplay of factors that influence Avant’s credit limit increases empowers individuals to cultivate positive financial habits and manage their credit accounts with a long-term perspective. Consistently showcasing responsible credit behavior, maintaining a positive payment history, and managing credit utilization prudently are fundamental elements that can enhance eligibility for credit limit increases.

By proactively updating their financial information, monitoring their credit profile, and submitting well-documented requests for credit limit increases, customers can engage with Avant in a manner that reflects their commitment to responsible credit utilization and financial progress. While the frequency of credit limit increases may vary based on individual circumstances, the proactive adoption of these strategies can significantly increase the likelihood of securing higher credit limits from Avant.

Ultimately, the journey toward optimizing credit limit increases with Avant encompasses a proactive and informed approach to credit management, underpinned by a commitment to responsible financial behavior and sustained progress. By leveraging the insights and strategies outlined in this article, individuals can navigate the process of credit limit increases with confidence, positioning themselves for enhanced financial flexibility and empowered credit utilization.

Empowered with the knowledge and proactive measures detailed in this article, customers can embark on their credit management journey with a comprehensive understanding of the dynamics at play, ultimately optimizing their prospects for securing favorable credit limit increases from Avant.