Finance

How Often Does Kohl’s Increase Credit Limit?

Modified: January 15, 2024

Learn about how often Kohl's increases credit limits and get valuable insights into managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors Influencing Kohl’s Credit Limit Increases

- Kohl’s Credit Limit Increase Frequency

- Qualifications for a Credit Limit Increase at Kohl’s

- How to Request a Credit Limit Increase at Kohl’s

- Benefits of an Increased Credit Limit at Kohl’s

- Tips for Maximizing Your Chances of a Credit Limit Increase at Kohl’s

- Conclusion

Introduction

When it comes to managing your finances, having access to a credit card with a suitable credit limit can be crucial. Whether you’re looking to make a big purchase or need some extra funds for unexpected expenses, a higher credit limit can provide you with the flexibility and security you need.

One popular retail credit card that offers its customers the opportunity to increase their credit limit is Kohl’s. As a leading department store chain in the United States, Kohl’s provides customers with a range of products and services, as well as a co-branded store credit card – the Kohl’s Charge Card.

So, how often does Kohl’s increase credit limits? And what factors influence this decision? In this article, we will explore the factors that influence the frequency of credit limit increases at Kohl’s, the qualifications required to be considered for an increase, and how to request one. We will also delve into the benefits of having an increased credit limit and offer some tips on how to maximize your chances of successfully obtaining a credit limit increase.

Having a solid understanding of the credit limit increase process at Kohl’s can help you make informed financial decisions and potentially improve your credit score over time. Let’s dive in and explore how you can make the most of your Kohl’s credit card!

Factors Influencing Kohl’s Credit Limit Increases

When it comes to credit limit increases, Kohl’s takes several factors into consideration. These factors help determine whether you are eligible for a credit limit increase and the amount by which your credit limit may be increased. Here are the key factors that influence credit limit increases at Kohl’s:

- Payment History: Your payment history is one of the most important factors that Kohl’s considers when evaluating whether to increase your credit limit. Consistently making on-time payments and paying at least the minimum amount due will demonstrate responsible financial behavior and increase your chances of a credit limit increase.

- Credit Utilization Ratio: Kohl’s also looks at your credit utilization ratio, which is the percentage of your available credit that you are using. Keeping your credit card balances low in relation to your credit limit shows that you are managing your credit responsibly and can increase your likelihood of a credit limit increase.

- Length of Credit History: The length of time you have held your Kohl’s credit card and your overall credit history are also taken into account. A longer credit history with responsible credit usage can demonstrate your ability to handle credit and may increase your chances of a credit limit increase.

- Income and Debt Level: While Kohl’s does not disclose specific income requirements for a credit limit increase, your income and debt level might be taken into consideration. A higher income and lower debt level can indicate your ability to handle a higher credit limit.

- Overall Creditworthiness: Kohl’s also considers your overall creditworthiness, including your credit score and any negative marks on your credit report. A higher credit score and a clean credit report can increase your chances of a credit limit increase.

It’s important to note that the specific weight given to each factor may vary, and Kohl’s uses a proprietary algorithm to assess credit limit increase eligibility. Therefore, meeting these criteria does not guarantee a credit limit increase, but they do play a significant role in the decision-making process.

Now that we understand the factors influencing credit limit increases at Kohl’s, let’s explore how often these increases typically occur.

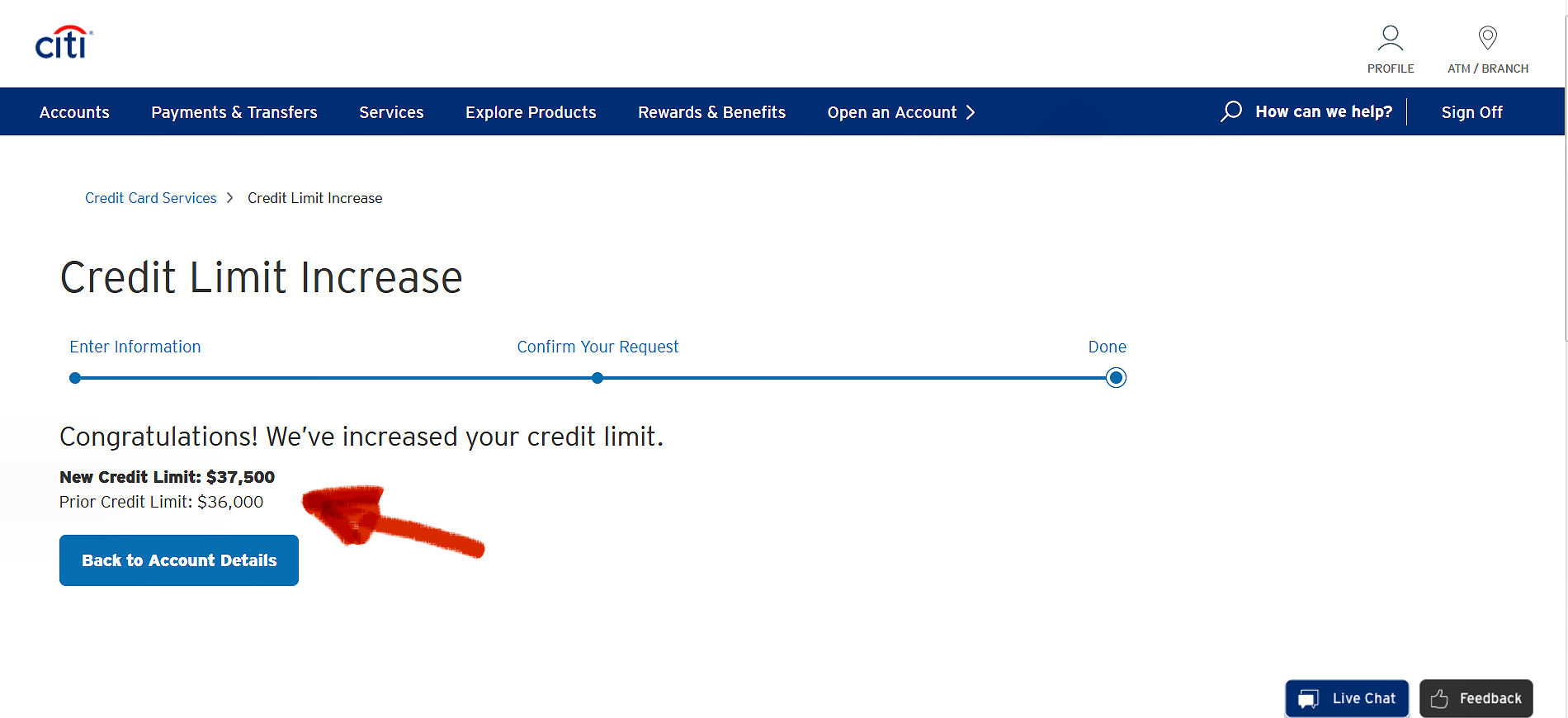

Kohl’s Credit Limit Increase Frequency

One common question that Kohl’s credit cardholders have is how often they can expect a credit limit increase. The frequency of credit limit increases at Kohl’s can vary depending on various factors, including your credit usage and payment history. It is important to note that Kohl’s does not have a set timeline for credit limit increases, and they are not guaranteed.

Typically, Kohl’s reviews accounts periodically to determine whether a credit limit increase is warranted. Some cardholders may see an increase in their credit limit within the first few months of responsible credit card usage, while others may need to wait longer. It is important to establish a positive payment history and demonstrate responsible credit usage to increase the likelihood of a credit limit increase.

If you have been consistently making on-time payments, keeping your credit utilization low, and maintaining a positive credit history, you may be eligible for a credit limit increase. However, the actual increase amount and frequency will depend on your individual circumstances and creditworthiness as determined by Kohl’s.

It is important to note that requesting a credit limit increase too frequently may have a negative impact on your credit profile. It is recommended to allow enough time to pass before requesting an increase to avoid appearing desperate for additional credit or creating multiple hard inquiries on your credit report.

To increase your chances of receiving a credit limit increase, it is advisable to continue practicing responsible credit habits and regularly reviewing your account. You may receive notification from Kohl’s if you are eligible for a credit limit increase, or you can proactively reach out to their customer service to inquire about the possibility of an increase.

Now that we have explored the frequency of credit limit increases at Kohl’s, let’s move on to the qualifications required to be considered for an increase.

Qualifications for a Credit Limit Increase at Kohl’s

In order to be considered for a credit limit increase at Kohl’s, there are certain qualifications you should meet. While these qualifications are not set in stone and may vary depending on individual circumstances, they can give you a general idea of what Kohl’s looks for when evaluating credit limit increase requests. Here are some common qualifications:

- Positive Payment History: Having a consistent history of on-time payments is crucial. Kohl’s wants to see that you are responsible in managing your credit and capable of meeting your financial obligations.

- Account Age: Generally, Kohl’s prefers to see a minimum account age before considering a credit limit increase. This shows that you have established a history with them and have proven your ability to handle credit responsibly.

- Usage and Payment Behavior: Kohl’s looks at how you use your credit card and your payment behavior. They want to see that you are actively using the card and making regular payments. Consistently paying off your balance or keeping your utilization ratio low can work in your favor.

- Income and Financial Stability: While Kohl’s does not specify income requirements, having a stable income and overall financial stability can improve your chances of receiving a credit limit increase. This demonstrates your ability to handle a higher credit limit and take on additional financial responsibility.

- Creditworthiness: Kohl’s assesses your overall creditworthiness, which includes factors such as your credit score, credit history, and any negative marks on your credit report. A higher credit score and a clean credit report can enhance your eligibility for a credit limit increase.

It’s important to note that meeting these qualifications does not guarantee a credit limit increase at Kohl’s. The final decision is at the discretion of the company and based on their proprietary evaluation process. However, by staying on top of your payments, maintaining a positive credit history, and demonstrating responsible credit usage, you can increase your chances of being considered for a credit limit increase.

Now that we understand the qualifications for a credit limit increase, let’s explore how you can request one at Kohl’s.

How to Request a Credit Limit Increase at Kohl’s

If you believe you meet the qualifications and are ready to request a credit limit increase at Kohl’s, there are a few steps you can follow to submit your request. Here’s how to go about it:

- Check Your Eligibility: Before requesting a credit limit increase, it’s important to review your account and assess whether you meet the qualifications we discussed earlier. Ensure that you have a positive payment history, a reasonable credit utilization ratio, and a good overall credit profile.

- Contact Kohl’s Customer Service: Reach out to Kohl’s customer service to inquire about the process for requesting a credit limit increase. You can find the contact information on the back of your Kohl’s credit card or on their website. They will guide you through the specific steps and requirements for submitting your request.

- Prepare Necessary Documentation: Be ready to provide any documentation or information that Kohl’s may require to review your request. This may include details about your income, employment, and any other relevant financial information they may need to evaluate your request.

- Submit Your Request: Once you have gathered the necessary information, contact Kohl’s customer service again to formally submit your request for a credit limit increase. Follow their instructions on how to provide the required documentation and be prepared to answer any additional questions they may have.

- Be Patient: After submitting your request, it’s important to be patient and allow time for Kohl’s to review and process it. Credit limit increase decisions may take a few weeks, so avoid requesting frequent updates or submitting multiple requests within a short period of time.

Remember, the final decision to grant a credit limit increase lies with Kohl’s, and meeting the qualifications does not guarantee approval. However, by following these steps and demonstrating responsible credit behavior, you maximize your chances of a successful credit limit increase request.

With a credit limit increase, you can enjoy the benefits that come with a higher credit line at Kohl’s. Let’s explore some of these advantages in the next section.

Benefits of an Increased Credit Limit at Kohl’s

Obtaining an increased credit limit at Kohl’s can offer several benefits for cardholders. Here are some advantages of having a higher credit limit:

- Greater Purchasing Power: With a higher credit limit, you have more flexibility when it comes to making purchases at Kohl’s. It allows you to buy more expensive items or make multiple purchases without reaching your limit.

- Enhanced Shopping Experience: A higher credit limit can make your shopping experience at Kohl’s more enjoyable. You can take advantage of sales, promotions, and exclusive offers without worrying about reaching your credit limit.

- Improved Credit Utilization Ratio: Increasing your credit limit can lower your credit utilization ratio, which is the percentage of your available credit that you are using. A lower ratio can positively impact your credit score and demonstrate responsible credit management.

- Emergency Needs: Having a higher credit limit can provide a safety net for unexpected emergencies. Whether it’s a car repair, medical expense, or home repair, you’ll have the flexibility to cover these costs without resorting to high-interest loans or maxing out other credit cards.

- Better Rewards Opportunities: Many rewards programs are tied to credit spending. By increasing your credit limit, you may have the chance to earn more rewards points or cashback on your Kohl’s purchases, allowing you to take advantage of the benefits offered by the store’s loyalty program.

- Building Credit History: Responsible credit usage and a higher credit limit can contribute positively to your credit history. It shows lenders that you can effectively manage larger credit lines and increases your chances of qualifying for favorable interest rates or higher credit limits in the future.

It’s important to use your increased credit limit responsibly and avoid excessive spending. Remember to pay your bills on time and keep your credit utilization ratio low to maintain a healthy credit profile.

Now that we’ve explored the benefits of an increased credit limit, let’s move on to some tips to maximize your chances of a credit limit increase at Kohl’s.

Tips for Maximizing Your Chances of a Credit Limit Increase at Kohl’s

If you’re looking to increase your chances of obtaining a credit limit increase at Kohl’s, there are several tips and strategies you can employ. By following these recommendations, you can demonstrate responsible credit usage and improve your likelihood of a credit limit increase:

- Make Timely Payments: Consistently make your payments on time to establish a positive payment history. Late payments or missed payments can have a negative impact on your creditworthiness and reduce your chances of a credit limit increase.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum payment due. This demonstrates that you are actively managing your credit and can handle a higher credit limit.

- Keep Your Credit Utilization Low: It’s advisable to keep your credit utilization ratio below 30% – that is, using less than 30% of your available credit. Lower utilization shows responsible credit management and can increase your chances of a credit limit increase.

- Use Your Card Regularly: Regularly using your Kohl’s credit card and making timely payments can show that you are an active and responsible cardholder. Avoid long periods of inactivity, as it may give the impression that you don’t need a credit limit increase.

- Monitor Your Credit Score: Keep track of your credit score and credit report. By identifying areas for improvement, you can take action to enhance your creditworthiness. Regular monitoring also helps you catch any errors or discrepancies that may be negatively affecting your credit profile.

- Maintain a Positive Credit History: Your overall credit history plays a role in credit limit increase decisions. Continue to practice responsible credit habits, such as avoiding excessive debt, limiting credit inquiries, and managing other credit accounts responsibly.

- Apply for Credit Limit Increases Sparingly: Avoid requesting credit limit increases too frequently, as it can give the impression that you are financially dependent on additional credit. Space out your requests and allow sufficient time to demonstrate consistent responsible credit behavior.

- Engage with Kohl’s Customer Service: Regularly communicate with Kohl’s customer service to stay informed about your credit limit increase eligibility. They can provide guidance, answer any questions you may have, and offer insights into the best practices for securing an increase.

Remember, these tips are not guarantees but can significantly improve your chances of a credit limit increase at Kohl’s. By demonstrating responsible financial behavior and building a positive credit profile, you can increase your chances of obtaining a higher credit limit.

Now that we’ve covered these tips, let’s summarize what we’ve learned about Kohl’s credit limit increases.

Conclusion

Managing your credit limit effectively is an important aspect of maintaining a healthy financial life, and Kohl’s provides its customers with opportunities to increase their credit limits. While the frequency of credit limit increases at Kohl’s may vary, factors such as payment history, credit utilization ratio, and overall creditworthiness play significant roles in the decision-making process.

To increase your chances of a credit limit increase, it’s crucial to maintain a positive payment history, use your card responsibly, and demonstrate good financial habits. By doing so, you can enhance your eligibility for a credit limit increase at Kohl’s.

Remember to check your eligibility, contact Kohl’s customer service to understand the process, and be patient during the review period. Furthermore, using an increased credit limit responsibly can provide various benefits, including greater purchasing power, improved credit utilization ratio, and the potential for better rewards opportunities.

To maximize your chances of obtaining a credit limit increase at Kohl’s, it’s essential to make timely payments, keep your credit utilization low, use your card regularly, and engage with Kohl’s customer service for guidance. Avoid requesting credit limit increases too frequently to maintain a positive image of financial stability.

By following these tips and practicing responsible credit management, you can position yourself favorably for a credit limit increase and reap the benefits that come with it. Remember, each individual’s situation may vary, so it’s important to review your specific circumstances and work towards achieving your credit goals.

Now that you have a better understanding of how credit limit increases work at Kohl’s, you can make informed decisions and navigate the process to potentially secure a higher credit limit. Use your increased credit wisely to enhance your shopping experience and build a stronger credit profile for the future.