Finance

How Often Does Target Increase Credit Limit

Modified: January 15, 2024

Discover how often Target increases credit limits and manage your finances effectively. Learn tips and strategies to maximize your credit limit at Target through this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit limits! If you’ve ever had a credit card, you may have wondered how often your credit limit can increase. In this article, we will focus specifically on Target’s credit limit increase policy. Target is a popular retailer that offers its own credit card, known as the Target REDcard. Having a higher credit limit can provide certain advantages, such as increased purchasing power and the ability to handle unexpected expenses. Understanding the factors that influence credit limit increases and Target’s policy on this matter can help you make informed decisions.

Before we delve into the details, let’s briefly clarify what a credit limit is. A credit limit is the maximum amount of money that you can borrow using a credit card. When you apply for a credit card, the issuer sets a starting credit limit based on a variety of factors, including your credit history, income, and creditworthiness. However, credit card companies often review and adjust credit limits over time based on your financial behavior and creditworthiness.

Keeping this in mind, it’s important to note that not all credit card issuers have the same approach when it comes to increasing credit limits. Each issuer has its own policy and criteria for determining whether or not to grant a credit limit increase. In the case of Target, they have specific guidelines in place which we will explore further in this article.

What is a credit limit?

A credit limit is a predetermined amount of money that a credit card issuer allows cardholders to borrow. It represents the maximum amount of credit that can be used on a credit card account. Think of it as a spending cap that is set by the issuer, defining the boundary of how much you can charge to your credit card.

When you are approved for a credit card, the issuer assigns you a starting credit limit based on various factors such as your credit history, income, and creditworthiness. This starting limit acts as a safeguard for the issuer, ensuring that you don’t accumulate excessive debt right off the bat.

It’s important to note that a credit limit is not a direct reflection of your financial health or stability. Instead, it serves as an indicator of the issuer’s trust in your ability to manage credit responsibly. Having a higher credit limit can offer several advantages, including increased purchasing power, the ability to handle emergencies, and more flexibility in managing larger expenses.

However, exceeding your credit limit can have negative consequences, such as overdraft fees, penalties, and potentially damaging your credit score. It’s crucial to understand your credit limit and use your credit card responsibly to maintain a healthy financial profile.

It’s worth mentioning that credit limits are not set in stone. Credit card issuers regularly review their cardholder accounts to assess their creditworthiness and may increase or decrease credit limits accordingly. This review process allows issuers to evaluate your payment history, credit utilization ratio, income, and overall financial behavior to determine whether you qualify for a credit limit increase.

Now that we have a solid understanding of what a credit limit is, let’s explore the factors that influence credit limit increases and how Target’s credit limit increase policy comes into play.

Factors that influence credit limit increases

When it comes to determining whether or not to grant a credit limit increase, credit card issuers consider a variety of factors. These factors help them assess your creditworthiness and determine if you can handle an increased borrowing capacity. While the specific criteria may vary from one issuer to another, here are some common factors that influence credit limit increases:

- Payment history: Your payment history is a critical factor in determining whether you qualify for a credit limit increase. Consistently making on-time payments and paying at least the minimum amount due shows responsibility and demonstrates your ability to manage credit effectively.

- Credit utilization ratio: Your credit utilization ratio is the percentage of your available credit that you are currently using. A lower credit utilization ratio indicates responsible credit management and can positively impact your chances of receiving a credit limit increase.

- Income and financial stability: Credit card issuers may consider your income and overall financial stability when reviewing your request for a credit limit increase. Higher income and a stable financial situation can boost your chances of getting an increased credit limit.

- Credit score: Your credit score is a numerical representation of your creditworthiness. A higher credit score suggests that you are a reliable borrower, which can increase your chances of qualifying for a credit limit increase.

- Length of credit history: The length of your credit history plays a role in determining whether you receive a credit limit increase. A longer credit history demonstrates a track record of responsible credit management, which can work in your favor.

It’s important to note that these factors are not the only ones considered, and each credit card issuer may prioritize them differently. Additionally, meeting these criteria does not guarantee a credit limit increase, as each issuer has its own internal policies and guidelines.

With these factors in mind, let’s explore how Target, specifically, approaches credit limit increases and how often they occur.

Target’s credit limit increase policy

Target, like other credit card issuers, has its own policy and guidelines when it comes to granting credit limit increases. While the exact specifics of their policy are not publicly disclosed, there are some key aspects to be aware of if you are a Target REDcard holder and interested in increasing your credit limit.

Target evaluates credit limit increase requests periodically as part of their ongoing review process. This means that they don’t have a specific timeframe for when credit limit increases occur. Instead, they assess accounts based on several factors such as payment history, credit utilization, and creditworthiness.

They may also take into consideration your account activity, including how frequently you use your Target REDcard, the amount of your average purchase, and your overall spending habits. Maintaining a positive payment history and using your Target REDcard responsibly by making regular payments and keeping your balances low can increase your chances of being eligible for a credit limit increase.

It’s important to note that Target may proactively initiate a credit limit increase on your account if they determine that you meet their criteria. This means that you don’t necessarily have to request a credit limit increase directly. However, if you believe you are eligible for a higher credit limit, you can reach out to Target’s customer service and inquire about the possibility.

Remember, meeting the eligibility criteria does not guarantee a credit limit increase from Target. Each credit card issuer has its own internal policies, and it ultimately comes down to their assessment of your creditworthiness and risk as a borrower.

Now that we understand Target’s credit limit increase policy, let’s explore how often you can expect credit limit increases from Target.

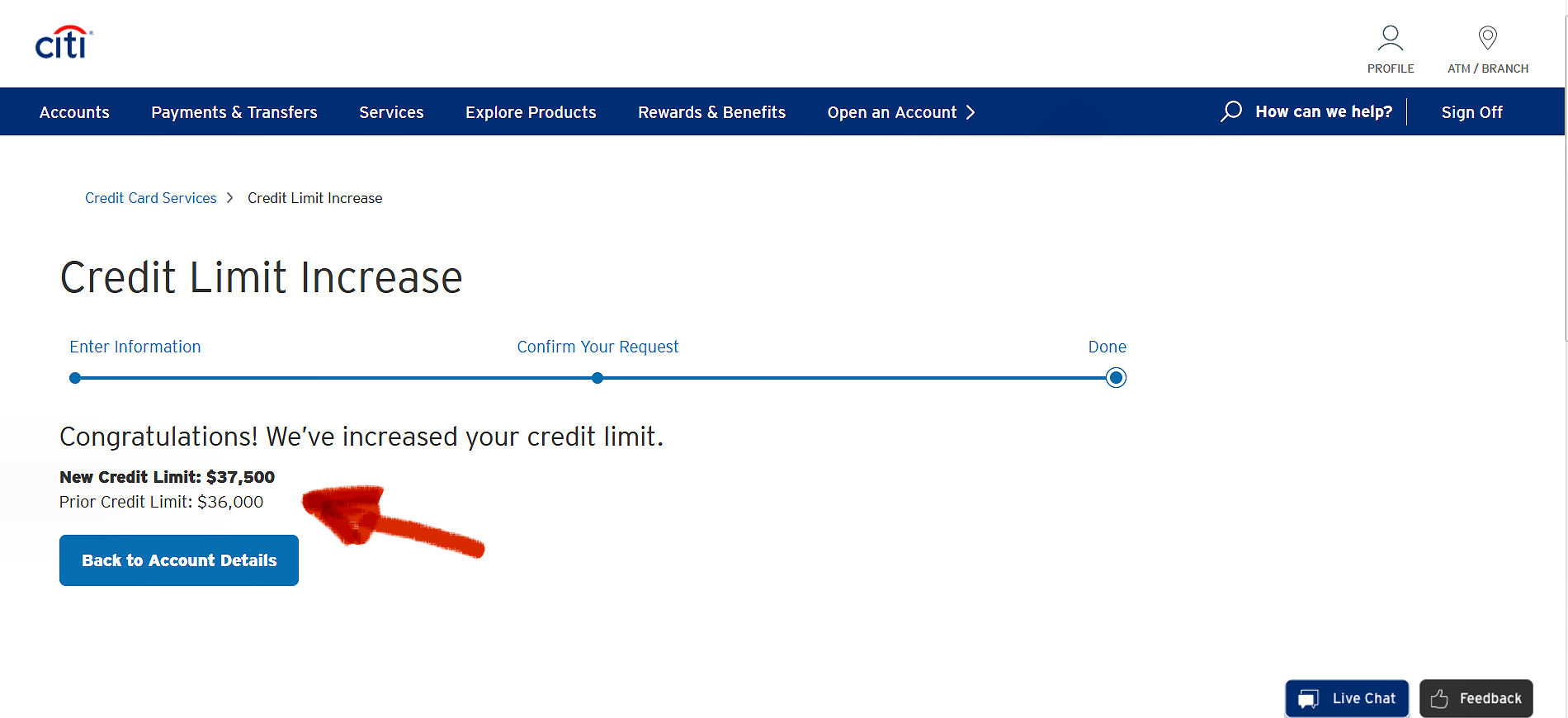

How often does Target increase credit limits?

The frequency at which Target increases credit limits can vary, as it depends on several factors, including individual account performance and creditworthiness. Target evaluates credit limit increase requests periodically, typically as part of their ongoing review process. However, they do not have a specific timeframe for when these increases occur.

Target assesses various aspects of the account when considering a credit limit increase. They review factors such as payment history, credit utilization, and creditworthiness to determine if a cardholder is eligible for an increase. Additionally, they may analyze account activity, including usage patterns and spending habits, to evaluate creditworthiness and the need for a higher credit limit.

It’s important to note that Target may also proactively initiate a credit limit increase if they determine that a cardholder meets their criteria. This means that you do not necessarily have to request a credit limit increase directly. However, if you feel that you meet the eligibility requirements and believe you are ready for a higher credit limit, you can contact Target’s customer service and inquire about the possibility.

While there is no definitive answer to how often Target increases credit limits, many cardholders report that credit limit increases can occur every six months to a year. However, it ultimately depends on your individual account performance and Target’s assessment of your creditworthiness.

To improve your chances of receiving a credit limit increase from Target, focus on responsibly managing your account. Make on-time payments, keep your credit utilization ratio low, and maintain a positive credit history. Regularly monitor your credit score and address any negative factors that may be impacting your creditworthiness.

It’s important to note that credit limit increases are not guaranteed, and Target’s decision is ultimately based on their assessment of your financial behavior and creditworthiness. While a higher credit limit can provide benefits, it’s essential to use credit responsibly and avoid exceeding your means to prevent unnecessary debt.

Now that we know how often Target increases credit limits, let’s explore some tips for increasing your chances of getting a credit limit increase from Target.

Tips for getting a credit limit increase from Target

If you’re eager to increase your credit limit with Target, there are several proactive steps you can take to improve your chances. While Target’s decision ultimately depends on their assessment of your creditworthiness, following these tips can help you demonstrate responsible credit behavior and increase your eligibility for a credit limit increase:

- Pay on time: Consistently making on-time payments is crucial for building a positive payment history. Late payments can negatively impact your creditworthiness and decrease your chances of a credit limit increase.

- Keep a low credit utilization ratio: Aim to keep your credit card balances as low as possible in relation to your credit limit. A low credit utilization ratio demonstrates responsible credit management and increases your eligibility for a credit limit increase.

- Use your Target REDcard regularly: Regularly using your Target REDcard and making consistent payments can show Target that you are an active and responsible cardholder.

- Monitor and maintain a strong credit score: Keeping an eye on your credit score can help you gauge your creditworthiness. Focus on improving your credit score by paying bills on time, reducing debt, and addressing any negative factors on your credit report.

- Keep your income and financial stability in check: Target may consider your income and overall financial stability when evaluating your credit limit increase eligibility. Ensuring a stable income and financial situation can strengthen your case.

- Contact Target’s customer service: If you believe you meet the eligibility criteria for a credit limit increase and have a good track record with your Target REDcard, consider contacting Target’s customer service to inquire about the possibility. They may be able to provide you with more information specific to your account.

While these tips can improve your chances, it’s important to remember that credit limit increases are not guaranteed. Each individual’s circumstances and creditworthiness are assessed on a case-by-case basis by Target. Additionally, be cautious not to overspend or take on debt beyond your means, even with a higher credit limit.

By implementing these suggestions, you can demonstrate responsible credit management and improve your chances of a credit limit increase from Target. Remember to review your account periodically to monitor any changes and adjust your strategy accordingly.

Now that we’ve explored some tips for getting a credit limit increase from Target, let’s wrap up with a concluding thought.

Conclusion

Understanding Target’s credit limit increase policy is essential for maximizing the benefits of your Target REDcard. While the specific timing and frequency of credit limit increases from Target may vary, there are steps you can take to increase your eligibility and improve your chances.

Factors such as payment history, credit utilization ratio, account activity, income, and creditworthiness all play a role in Target’s decision-making process. By making on-time payments, keeping your credit utilization low, using your Target REDcard regularly, and maintaining a positive credit history, you can demonstrate responsible credit behavior and increase your chances of a credit limit increase.

Remember, credit limit increases are not guaranteed, and each individual’s circumstances are evaluated on a case-by-case basis. It’s important to use credit responsibly and avoid exceeding your means, even with a higher credit limit.

If you believe you meet the eligibility criteria and have a good track record with your Target REDcard, consider reaching out to Target’s customer service to inquire about the possibility of a credit limit increase. They can provide you with more information specific to your account.

Ultimately, maintaining a good credit profile and demonstrating responsible credit management will benefit you not only with Target but also with other credit card issuers. By staying on top of your financial health, you can increase your chances of qualifying for credit limit increases in the future and enjoy the advantages that come with a higher credit limit.

Now armed with knowledge about credit limit increases and Target’s policy, you can make informed decisions and work towards increasing your credit limit, giving you greater financial flexibility and peace of mind.