Finance

How Much Is The E-Bike Insurance

Published: November 12, 2023

Get a clear understanding of how much e-bike insurance costs and how it fits into your finance. Ensure you are fully covered with the right policy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

As the popularity of e-bikes continues to soar, it’s important for riders to understand the significance of having proper insurance coverage. E-bikes, also known as electric bicycles, offer an eco-friendly and cost-effective transportation option that is quickly gaining traction in urban areas and beyond. With their electric motors, e-bikes provide an extra boost to riders, making commutes easier and more enjoyable.

However, despite their many benefits, e-bikes are not immune to accidents or theft. Just like any other mode of transportation, there are risks involved. This is where e-bike insurance comes into play. E-bike insurance provides financial protection in case of accidents, damage to the bike, theft, or third-party liability.

It’s important to note that e-bike insurance is not the same as traditional bicycle insurance. While regular bikes can also be insured, e-bikes have additional components such as the electrical motor and battery that require specific coverage. E-bike insurance covers these unique components, as well as other aspects associated with e-bike ownership.

Whether you use your e-bike for commuting, recreational purposes, or both, having insurance gives you peace of mind and safeguards your investment. In the event of an accident or theft, insurance can help cover the costs of repairs or replacement, ensuring that you can get back on your e-bike as soon as possible.

Now that we understand the importance of e-bike insurance, let’s delve deeper into the factors that can affect the premiums, the available coverage options, and how to choose the right insurance provider.

Importance of E-Bike Insurance

E-bike insurance plays a crucial role in protecting both you and your e-bike from potential financial hardships. Here are a few reasons why having e-bike insurance is important:

- Accidents and Liability Coverage: Accidents happen, and when they involve e-bikes, they can lead to costly damages and medical expenses. E-bike insurance provides coverage for the repair or replacement of your bike in case of an accident, as well as liability coverage in case you cause injury to someone else or damage their property.

- Protection Against Theft: E-bikes are valuable assets that can be targeted by thieves. With e-bike insurance, you can ensure that you are financially protected in case your e-bike is stolen. The insurance will help cover the cost of a replacement or repairs if your e-bike is recovered with damages.

- Damage Coverage: From minor scratches to major structural damages, e-bike insurance provides coverage for repairs needed due to accidents, vandalism, or any other unforeseen events. This coverage can save you from expensive out-of-pocket expenses.

- Peace of Mind: Riding your e-bike should be a stress-free experience. By having insurance, you can ride with the peace of mind that comes with knowing you are financially protected. You won’t have to worry about the potential financial burden of accidents or theft.

- Legal Requirement: Depending on your jurisdiction, having insurance for your e-bike may be a legal requirement. It’s important to check the local regulations and ensure that you comply with the necessary insurance obligations.

Overall, the importance of e-bike insurance cannot be overstated. It provides vital coverage for accidents, theft, liability, and damages, allowing you to enjoy your e-bike without unnecessary worry. Plus, with various coverage options available, you can customize your insurance policy to suit your specific needs and budget.

Now that we understand the significance of e-bike insurance, let’s explore the various factors that can affect the premiums and help you navigate through the coverage options available.

Factors Affecting E-Bike Insurance Premiums

When it comes to determining the cost of e-bike insurance, several factors come into play. Insurance providers consider these factors to assess the risk associated with insuring your e-bike. Here are the key factors that can affect your e-bike insurance premiums:

- Value of the E-Bike: The higher the value of your e-bike, the more it will cost to insure. Insurance providers take into account the purchase price of the e-bike, as well as any modifications or upgrades that may have been made.

- Type of E-Bike: Different types of e-bikes have varying risk factors. For example, e-bikes with higher top speeds or off-road capabilities may be considered riskier to insure compared to standard urban e-bikes. The type of e-bike you own will influence your insurance premiums.

- Usage and Mileage: How often and where you ride your e-bike can impact your insurance premiums. If you primarily use it for commuting on busy city streets during rush hour, the risk of accidents may be higher compared to leisurely rides in quieter areas. Higher mileage and extensive usage can also increase the likelihood of wear and tear or potential accidents.

- Location: The area where you live or regularly ride your e-bike can impact your insurance premiums. Urban areas with higher traffic volumes and theft rates may result in higher insurance costs compared to rural or low-crime areas.

- Security Measures: Installing security features can help lower your e-bike insurance premiums. Insurance providers often reward policyholders who take proactive measures, such as using sturdy locks, GPS trackers, or storing the e-bike in a secure location when not in use.

- Insurance Coverage: The level of coverage and deductible you choose will affect your premiums. Higher coverage limits or lower deductibles will generally result in higher premiums. It’s essential to strike a balance between the coverage you need and what you can comfortably afford.

These factors can vary between insurance providers, so it’s crucial to shop around and compare quotes from different companies to find the most competitive premiums for your specific situation. Now that we have explored the factors that impact e-bike insurance premiums, let’s move on to understanding the coverage options available.

Coverage Options for E-Bike Insurance

When it comes to e-bike insurance, there are various coverage options available to suit your needs and budget. Here are some common coverage options offered by insurance providers:

- Liability Coverage: This coverage protects you if you cause injury to someone else or damage someone’s property while riding your e-bike. It covers legal fees, medical expenses, and compensation for the affected party.

- Comprehensive Coverage: Comprehensive coverage provides protection against damages to your e-bike that result from incidents other than accidents, such as theft, vandalism, fire, or natural disasters.

- Collision Coverage: Collision coverage reimburses you for the cost of repairs or replacement if your e-bike is damaged in a collision with another vehicle or object.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you in the event of an accident caused by an uninsured or underinsured motorist. It helps cover the costs of injuries or damages if the responsible party does not have adequate insurance coverage.

- Accessories Coverage: E-bike accessories can be expensive, so it’s important to ensure they are adequately covered. Accessories coverage protects against theft or damage to items such as lights, racks, additional batteries, or smartphone mounts.

- Medical Payments Coverage: Medical payments coverage provides financial assistance for medical expenses resulting from e-bike accidents, regardless of fault. It can cover hospital bills, doctor visits, and rehabilitation costs.

These coverage options can usually be customized and combined to create a policy tailored to your specific needs. It’s important to carefully review the policy terms and understand the coverage limits, deductibles, and exclusions before making a decision.

Now that we have explored the coverage options available, let’s shift our focus to understanding the cost of e-bike insurance and how to compare providers.

Cost of E-Bike Insurance

The cost of e-bike insurance varies depending on several factors, including the value of the e-bike, the coverage options selected, the deductible amount, and your location. While it’s difficult to provide an exact cost, it’s helpful to understand the factors that can influence the price you’ll pay for e-bike insurance.

The value of your e-bike is a significant factor in determining the insurance premium. Higher-priced e-bikes will generally have higher premiums since the cost to replace or repair them is more expensive. Additionally, the coverage options you choose will impact the cost. More extensive coverage, such as comprehensive coverage or higher liability limits, will result in higher premiums.

Your location also plays a role in the cost of e-bike insurance. Urban areas with higher theft rates and more traffic congestion may have higher premiums compared to rural or low-crime areas.

Another factor to consider is the deductible amount. The deductible is the portion you must pay out of pocket when making a claim. A higher deductible will result in lower premiums, but it also means you’ll have a higher financial responsibility if you need to make a claim.

Finally, shopping around and comparing quotes from different insurance providers is essential. Premiums can vary significantly between companies, so it’s beneficial to obtain multiple quotes to find the most competitive rate for your e-bike insurance.

It’s important to note that while e-bike insurance adds an extra expense, it can save you from significant financial burdens in the event of theft, accidents, or damages. By considering the value of your e-bike, the coverage options, the deductible, and comparing quotes, you can find the right balance between adequate coverage and affordable premiums.

Now that we have covered the cost of e-bike insurance, let’s move on to the next section, which covers tips for choosing the right e-bike insurance provider.

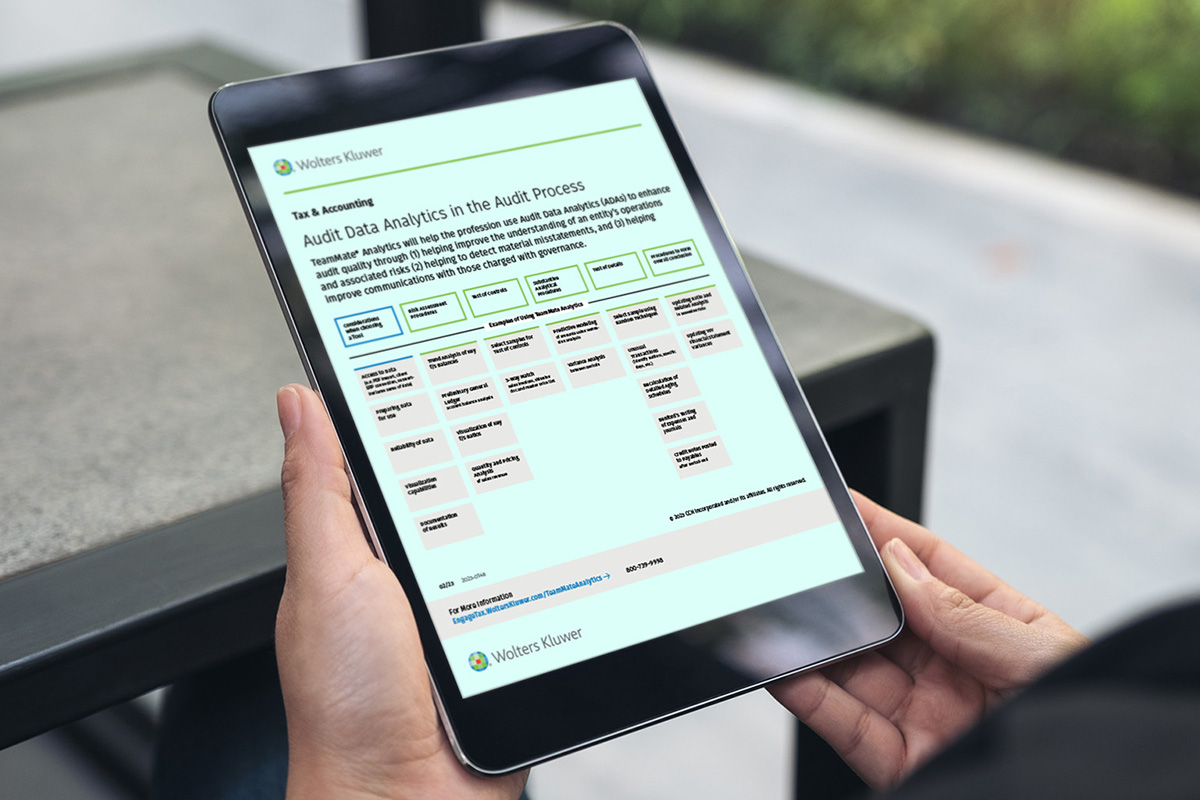

Comparing E-Bike Insurance Providers

Choosing the right e-bike insurance provider is crucial to ensure you receive the coverage you need at a fair price. Here are some key factors to consider when comparing e-bike insurance providers:

- Coverage Options: Evaluate the coverage options offered by different providers. Look for a provider that offers the specific coverage options you need, such as liability coverage, theft protection, and comprehensive coverage.

- Policy Limits: Review the policy limits set by each provider. Ensure that the limits are sufficient to cover the potential costs of repairs, replacement, or any liability claims. Assess your individual needs and consider the value of your e-bike when determining the appropriate coverage limits.

- Premiums and Deductibles: Compare the premiums and deductibles offered by different insurance providers. Keep in mind that while lower premiums may be appealing, they may come with higher deductibles. Consider your budget and the financial responsibility you are comfortable with in case you need to make a claim.

- Customer Reviews: Research the reputation of insurance providers by reading customer reviews and testimonials. Look for feedback regarding the provider’s claims process, customer service, and overall satisfaction. A company with positive customer reviews is likely to offer a better experience when it comes to filing claims and resolving issues.

- Additional Benefits and Discounts: Inquire about any additional benefits or discounts offered by the insurance providers. Some insurers offer perks such as roadside assistance, free or discounted accessory coverage, or multi-policy discounts if you have other insurance policies with them.

- Financial Stability: It’s essential to choose a financially stable insurance provider. Check the financial strength ratings of the companies you are considering. A financially stable insurer is more likely to be able to fulfill their obligations in the event of a claim.

By considering these factors and comparing e-bike insurance providers, you can make an informed decision that aligns with your needs and priorities. Remember to carefully read the policy documents and ask any questions you may have before committing to a specific provider.

Now that we have discussed how to compare e-bike insurance providers, let’s move on to the final section, which provides valuable tips for buying e-bike insurance.

Tips for Buying E-Bike Insurance

When it comes to buying e-bike insurance, it’s important to make an informed decision that meets your specific needs. Here are some valuable tips to consider:

- Evaluate Your Coverage Needs: Assess your individual requirements and determine the coverage options you need. Consider factors such as the value of your e-bike, your riding habits, and the level of financial protection you desire. This will help you choose appropriate coverage limits and policy options.

- Shop Around and Compare Quotes: Obtain quotes from multiple insurance providers to compare premiums, deductibles, and coverage options. Remember that the cheapest option may not always provide adequate coverage or quality service. Balance affordability with the level of protection you require.

- Check Policy Exclusions: Review the policy exclusions carefully. Ensure that you understand what is and is not covered by the insurance policy. Look for any restrictions or limitations that may affect your coverage.

- Consider Additional Accessories: If you have valuable accessories, such as an expensive helmet or specialized e-bike clothing, check if they are covered by the insurance policy. If not, consider adding them as additional coverage.

- Assess the Insurer’s Reputation: Research the reputation of the insurance provider. Look for customer reviews, ratings, and feedback on their claims process, customer service, and overall satisfaction. A reputable insurer with positive reviews is more likely to provide a smooth experience in case of a claim.

- Think About Security Measures: Taking steps to secure your e-bike, such as using strong locks or GPS trackers, can lower your insurance premiums. Check if the insurance provider offers any discounts for implementing such security measures.

- Review the Policy Terms and Conditions: Carefully read the policy terms and conditions. Pay attention to details such as the claims process, any waiting periods, cancellation policies, and renewal terms. Understand the responsibilities of both the insurer and yourself.

- Consider Bundling Insurance Policies: If you have other insurance policies, such as auto or home insurance, check if the same provider offers e-bike insurance. Bundling your policies with the same insurer may result in discounts.

- Review and Update Your Policy Annually: Regularly review your policy and coverage needs. As your e-bike’s value, usage patterns, or personal circumstances change, make sure your insurance policy reflects these changes. Update your policy as needed.

By following these tips, you can make a well-informed decision when purchasing e-bike insurance. Remember, each individual’s needs may vary, so it’s important to find the right balance between coverage, cost, and peace of mind.

Now that we have covered the tips for buying e-bike insurance, it’s time to wrap up this comprehensive guide.

Conclusion

E-bike insurance provides essential coverage and financial protection for e-bike riders. Whether you use your e-bike for commuting, leisurely rides, or both, having insurance ensures that you are prepared for any unforeseen circumstances. From accidents and theft to liability and damage, e-bike insurance helps mitigate the financial risks associated with owning and riding an e-bike.

Throughout this guide, we have explored the importance of e-bike insurance and discussed the factors that can affect your insurance premiums. We have also delved into the coverage options available, the cost of e-bike insurance, and how to compare different insurance providers. Furthermore, we provided valuable tips for buying e-bike insurance, emphasizing the significance of evaluating your coverage needs, shopping around for quotes, and considering the reputation and policy terms of the insurance providers.

Remember, e-bike insurance is not one-size-fits-all. The coverage you choose should align with your specific needs, budget, and personal circumstances. It’s important to review your policy periodically and make updates as necessary to ensure that you have adequate coverage as your situation evolves.

By investing in e-bike insurance, you can ride with peace of mind, knowing that you are financially protected against accidents, theft, liability, and damages. So, as you embark on your e-bike adventures, don’t forget to protect your investment and yourself with the right e-bike insurance policy.