Home>Finance>Which Is Better: Debt Consolidation Or Personal Loan

Finance

Which Is Better: Debt Consolidation Or Personal Loan

Modified: March 5, 2024

Compare the benefits of debt consolidation and personal loans in finance. Find out which option suits your needs and helps you achieve your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing debt, two common options that individuals often consider are debt consolidation and personal loans. Both of these financial solutions can provide potential benefits in terms of simplifying repayments and reducing overall interest rates. However, it’s important to understand the differences between these two options, as well as their respective advantages and disadvantages.

Debt consolidation involves combining multiple outstanding debts into a single loan or payment. This can be done through various methods, such as taking out a new loan, using a balance transfer credit card, or working with a debt consolidation company. The goal is to streamline payments and potentially secure a lower interest rate, making it easier to manage and pay off debt over time.

On the other hand, personal loans are unsecured loans that can be used for various purposes, including debt consolidation. Personal loans typically have fixed interest rates and repayment terms, which can make it easier to budget and plan for monthly payments. They can also be obtained from a bank, credit union, or online lender, depending on the individual’s creditworthiness.

In this article, we will explore the pros and cons of both debt consolidation and personal loans, allowing you to make an informed decision based on your financial situation and goals. We will also compare these two options to help you determine which one may be more suitable for your needs. It’s essential to consider several factors, such as interest rates, fees, repayment terms, and your credit score, to make a well-informed decision that aligns with your financial objectives.

So, whether you’re looking to simplify your debt repayment strategy or need additional funds for a specific purpose, read on to discover the key aspects of debt consolidation and personal loans that will aid you in making a smart financial choice.

Understanding Debt Consolidation

Debt consolidation is a strategy that combines multiple debts into a single loan or payment, making it easier to manage overall debt. The primary goal of debt consolidation is to simplify the repayment process and potentially reduce interest rates, ultimately helping individuals become debt-free more efficiently.

There are several methods of debt consolidation, each with its own advantages and considerations:

1. Consolidation Loan: This involves taking out a new loan to pay off existing debts. The new loan typically has a lower interest rate and a more manageable repayment term than the original debts, making it easier to pay off over time. By consolidating high-interest debts, such as credit card balances, into a single loan, individuals can save money on interest and simplify their monthly payments.

2. Balance Transfer: Another common method of debt consolidation is using a balance transfer credit card. With this approach, individuals can transfer their existing credit card balances onto a new credit card with a low or 0% introductory interest rate. By consolidating debts onto a single card, individuals can save on interest and focus on paying off their balances without accumulating additional debt.

3. Debt Consolidation Company: Working with a reputable debt consolidation company is another option. These companies negotiate with creditors on behalf of individuals, aiming to reduce interest rates and monthly payments. They typically consolidate debts into a single payment, which is then distributed to the creditors each month. While this can be an effective solution, it’s important to carefully research and choose a reputable debt consolidation company to ensure that your best interests are being served.

Debt consolidation offers several benefits, including:

- Simplified Repayments: Combining multiple debts into a single payment makes it easier to manage and track your repayments. Rather than juggling multiple due dates and amounts, you only need to focus on one monthly payment.

- Potential Interest Savings: Debt consolidation can potentially lower the overall interest rates on your debts. By securing a lower interest rate through a consolidation loan, balance transfer, or negotiation with a consolidation company, you can save money on interest charges, allowing more of your payments to go towards reducing the principal amount of your debt.

- Improved Credit Score: Consistently making on-time payments towards your consolidated debt can have a positive impact on your credit score. This can provide long-term benefits when applying for future loans or credit.

However, it’s important to be aware of the potential downsides of debt consolidation as well:

- Possible Fees: Some consolidation methods, such as taking out a loan or working with a consolidation company, may have associated fees. These fees can include loan origination fees, balance transfer fees, or fees charged by the consolidation company for their services. It’s essential to factor in these costs when considering the overall savings and benefits of debt consolidation.

- Problems with Discipline: Debt consolidation can provide a fresh start and an opportunity to improve your financial habits. However, it’s crucial to address the underlying issues that led to the accumulation of debt in the first place. Without addressing those habits, there is a risk of falling back into old spending patterns and accumulating new debt alongside the consolidated loan.

- Potential Longer Repayment Term: While debt consolidation can simplify repayments, it may also result in a longer repayment term. This means that you may be paying off your debts for a longer period, potentially incurring more interest over time. It’s important to weigh the potential interest savings against the extended repayment period to determine if debt consolidation is the right choice for you.

By understanding the basics of debt consolidation and weighing the pros and cons, you can make an informed decision regarding its suitability for your specific financial situation. The next section will focus on understanding personal loans as an alternative option for managing debt.

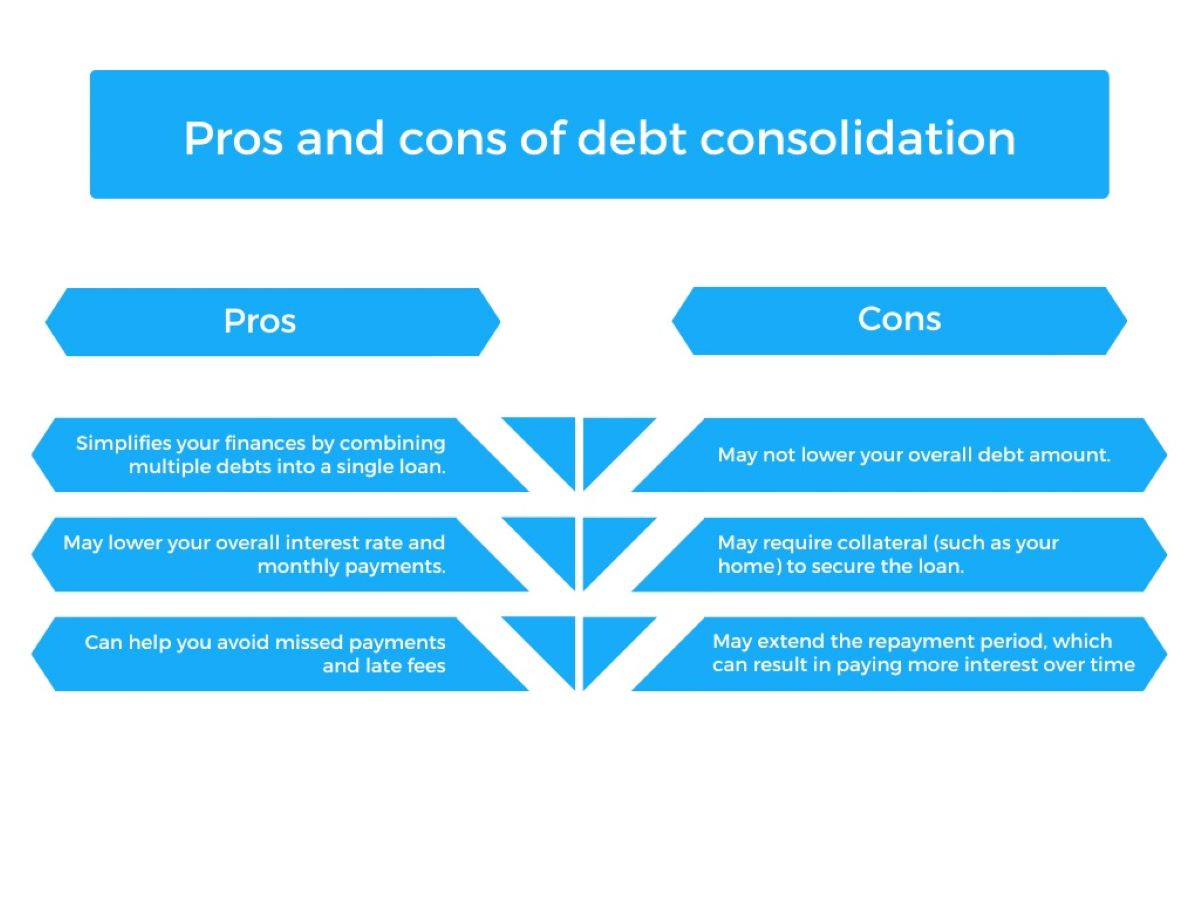

Pros and Cons of Debt Consolidation

Debt consolidation can be an effective tool for managing and reducing your overall debt burden. However, it’s essential to consider the pros and cons to determine if it’s the right solution for you. Let’s explore the advantages and potential drawbacks of debt consolidation:

Pros of Debt Consolidation:

- Simplifies Repayment: One of the biggest advantages of debt consolidation is that it simplifies your repayment process. Instead of keeping track of multiple debts with varying interest rates and due dates, you only need to focus on one monthly payment. This can alleviate stress and make it easier to stay organized.

- Reduces Interest Rates: Consolidating your debts into a single loan or payment can potentially lead to lower interest rates. By securing a new loan with a lower interest rate or negotiating lower rates with your creditors, you can save money on interest charges over time. This can help you pay off your debt faster and save on overall interest payments.

- Improves Cash Flow: Debt consolidation can free up cash flow by reducing your total monthly debt repayment. With lower interest rates and a more manageable repayment term, you may have more disposable income to use towards other financial goals or expenses.

- Potential for Credit Score Improvement: Consistently making on-time payments towards your consolidated debt can positively impact your credit score. As you repay your debts according to the new consolidation terms, it demonstrates financial responsibility and can help improve your creditworthiness over time.

Cons of Debt Consolidation:

- May Extend Repayment Period: While debt consolidation can lower your monthly repayments, it may also extend the overall repayment period. This means you could be paying off your debts for a longer time, potentially incurring more interest. It’s important to consider the trade-off between lower monthly payments and an extended repayment period.

- Possible Fees: Debt consolidation methods, such as taking out a new loan or working with a consolidation company, may involve associated fees. These can include loan origination fees, balance transfer fees, or fees for the services provided by the consolidation company. It’s crucial to factor in these costs and compare them to the overall savings and benefits of consolidation.

- Needs Financial Discipline: Debt consolidation is not a magic solution; it requires financial discipline and responsible money management. To benefit from debt consolidation, it’s important to address the underlying spending habits and avoid accumulating new debt alongside the consolidated loan. Without proper financial discipline, you may find yourself in a worse financial situation.

- Potential Impact on Credit: Debt consolidation can initially have a negative impact on your credit score. When you apply for a new loan or credit card for consolidation purposes, it may result in a temporary dip in your credit score due to the hard inquiries and new credit lines. However, as you make consistent on-time payments, your credit score can gradually improve.

Overall, debt consolidation can be a valuable strategy to simplify debt repayment and potentially reduce interest rates. However, it’s essential to carefully weigh the pros and cons, considering factors such as interest rates, fees, repayment terms, and your own financial discipline. Understanding both the benefits and drawbacks will help you determine if debt consolidation is the right choice for your specific financial circumstances.

Understanding Personal Loans

Personal loans are unsecured loans that can provide individuals with a lump sum of money for various purposes, including debt consolidation. Unlike other types of loans, such as mortgage or auto loans, personal loans do not require collateral. Instead, approval is based on factors such as creditworthiness, income, and repayment capacity.

Here’s what you need to know about personal loans:

1. Loan Amount and Repayment Terms: Personal loans typically have a fixed loan amount that can range from a few thousand dollars to tens of thousands of dollars. The repayment terms can vary, typically ranging from one to seven years, with fixed monthly payments over the loan term.

2. Interest Rates and Fees: Personal loans come with interest rates that can be fixed or variable. Fixed interest rates remain the same throughout the loan term, while variable rates may fluctuate based on market conditions. It’s important to compare interest rates from different lenders to ensure you’re getting the most competitive rate. Additionally, personal loans may also have origination fees or other associated fees, so it’s essential to consider these costs.

3. Creditworthiness and Eligibility: Personal loans rely heavily on an individual’s creditworthiness. Lenders will assess credit scores, income, and employment history to determine eligibility. Those with higher credit scores and stable income are more likely to secure a loan with favorable terms and interest rates.

4. Application Process: Applying for a personal loan typically involves completing an application with personal and financial information. This may include details such as your income, employment history, outstanding debts, and the purpose of the loan. Lenders will review your application and conduct a credit check to assess your eligibility.

Personal loans offer several advantages:

- Flexibility: Personal loans can be used for various purposes, including debt consolidation, home improvements, medical expenses, or other financial needs. The flexibility in how you use the loan proceeds gives you control over your finances.

- No Collateral Required: As personal loans are unsecured, they do not require collateral, such as a house or car. This means you don’t have to put your assets on the line, making personal loans accessible to a wide range of individuals.

- Predictable Repayment: Personal loans have fixed interest rates and monthly payments, making it easier to budget and plan for repayment. This predictability allows you to know exactly how much you need to pay each month, making it easier to manage your finances.

- Potential for Lower Interest Rates: If you have good credit, you may qualify for a personal loan with lower interest rates compared to other forms of debt, such as credit cards. By consolidating high-interest debts into a personal loan, you may save money on interest charges and pay off your debt faster.

However, it’s important to consider the potential disadvantages of personal loans as well:

- Higher Interest Rates for Riskier Borrowers: If you have a lower credit score or limited credit history, you may be offered higher interest rates on personal loans. It’s important to carefully compare offers and consider the overall cost of borrowing before committing to a loan.

- Impact on Credit Score: Applying for a personal loan requires a hard inquiry on your credit report, which may temporarily lower your credit score. However, making timely payments towards the loan can have a positive impact on your credit score over time.

- Potential for Overborrowing: Easy access to funds can sometimes tempt individuals to borrow more than they need. It’s important to have a clear purpose for the loan and only borrow the amount necessary to avoid unnecessary debt.

By understanding the basics of personal loans and considering the advantages and disadvantages, you can determine if a personal loan is the right solution for your financial needs. In the next section, we will compare debt consolidation and personal loans to help you make a well-informed decision.

Pros and Cons of Personal Loans

Personal loans can be a useful financial tool for various purposes, including debt consolidation. While they offer flexibility and accessibility, it’s essential to understand the pros and cons of personal loans to make an informed decision. Let’s explore the advantages and potential drawbacks of personal loans:

Pros of Personal Loans:

- Flexibility: Personal loans offer flexibility in terms of how you can use the funds. Whether you need to consolidate debt, cover medical expenses, or make home improvements, personal loans can be used for a variety of financial needs.

- No Collateral Required: Personal loans are typically unsecured, meaning you don’t need to provide collateral such as your home or car. This makes personal loans accessible to individuals who may not have significant assets to offer as security.

- Predictable Repayment: Personal loans come with fixed interest rates and fixed monthly payments. This predictability allows you to budget and plan your repayment, making it easier to manage your finances and stay on track.

- Potential for Lower Interest Rates: If you have a good credit score, you may qualify for a personal loan with lower interest rates compared to other forms of debt, such as credit cards. By consolidating high-interest debts into a personal loan, you may save money on interest charges and pay off your debt faster.

- Quick Access to Funds: Personal loans often have a relatively quick application and approval process, allowing you to access funds when you need them. This can be beneficial in emergency situations or when time is of the essence.

Cons of Personal Loans:

- Higher Interest Rates for Riskier Borrowers: Individuals with lower credit scores or limited credit history may be offered personal loans with higher interest rates. It’s important to carefully compare loan offers and consider the overall cost of borrowing before committing to a personal loan.

- Possible Fees and Charges: Personal loans may come with origination fees, prepayment penalties, or other associated charges. It’s vital to read the loan agreement carefully and understand all the fees involved to avoid any surprises.

- Impact on Credit Score: When you apply for a personal loan, there will be a hard inquiry on your credit report, which may temporarily lower your credit score. However, making timely payments towards the loan can have a positive impact on your credit score over time.

- Potential for Overborrowing: Because personal loans can provide a significant amount of funds, there is a risk of overborrowing. Having a clear purpose for the loan and borrowing only what you need is essential to avoid unnecessary debt.

- Repayment Obligations: Personal loans come with a responsibility to repay the borrowed amount. Failing to make timely payments can negatively impact your credit score and make it challenging to borrow in the future. It’s crucial to assess your ability to meet the repayment obligations before taking on a personal loan.

Considering the pros and cons of personal loans will enable you to make an informed decision based on your financial situation and needs. It’s important to carefully evaluate interest rates, fees, repayment terms, and your creditworthiness to determine if a personal loan is the right solution for you.

Comparing Debt Consolidation and Personal Loans

Debt consolidation and personal loans are two common options for managing debt and achieving financial stability. While both options aim to simplify repayment and potentially reduce interest rates, there are key differences to consider. Let’s compare debt consolidation and personal loans to help you determine which option may be more suitable for your needs:

1. Purpose:

Debt consolidation focuses specifically on combining multiple debts into a single loan or payment. It is ideal for individuals who have multiple debts and want to streamline their repayments. On the other hand, personal loans can be used for various purposes, including debt consolidation, home improvements, or other financial needs. Personal loans offer more flexibility in how you use the funds.

2. Collateral:

Debt consolidation can be both secured and unsecured, depending on the method chosen. For example, a consolidation loan may require collateral, such as a home or car, while working with a debt consolidation company may not require collateral. Personal loans, on the other hand, are typically unsecured and do not require collateral. This makes personal loans more accessible to a wider range of individuals who may not have significant assets.

3. Interest Rates:

When it comes to interest rates, both debt consolidation and personal loans offer potential savings. Debt consolidation aims to secure a lower interest rate on the consolidated loan compared to the original debts. This can reduce the overall interest charges and potentially help you pay off your debt faster. Personal loans, especially for borrowers with good credit, may also offer competitive interest rates, allowing you to potentially save money on interest charges.

4. Repayment Terms:

Debt consolidation often involves extending the repayment period to lower monthly payments. While this can provide short-term relief, it means you may be paying off your debts for a longer period and potentially incurring more interest over time. Personal loans typically have fixed repayment terms, ranging from one to seven years, depending on the loan amount and lender. This allows for a more predictable repayment schedule, making it easier to budget and plan your finances.

5. Credit Impact:

Both debt consolidation and personal loans can impact your credit score. When you apply for a loan, there will typically be a hard inquiry on your credit report, which may temporarily lower your credit score. However, consistently making on-time payments towards the consolidated loan or personal loan can have a positive impact on your credit score over time. It’s important to prioritize making timely payments to protect and improve your creditworthiness.

Ultimately, the best option for you depends on your specific financial situation and goals. Debt consolidation may be a suitable choice if you have multiple debts and want to simplify your repayment process. Personal loans provide more flexibility in how you use the funds and can be a good option for various financial needs, including debt consolidation. It’s important to carefully evaluate factors such as interest rates, fees, repayment terms, and your creditworthiness to make an informed decision.

Consider seeking advice from a financial professional or doing further research to ensure that the chosen option aligns with your long-term financial objectives. By taking the time to compare and evaluate these options, you can make a well-informed decision and pave the way towards a debt-free future.

Factors to Consider when Choosing between Debt Consolidation and Personal Loans

Choosing between debt consolidation and personal loans requires careful consideration of various factors to determine which option is the most suitable for your specific financial needs. Here are some important factors to evaluate:

1. Total Debt Amount:

The total amount of your outstanding debt is an essential factor to consider. Debt consolidation is typically recommended for individuals with multiple debts, making it easier to manage and streamline repayments. If you have only one or a few smaller debts, a personal loan may suffice in consolidating your debt into a single monthly payment.

2. Interest Rates:

Comparing the interest rates between debt consolidation and personal loans is crucial. If your existing debts have high-interest rates, consolidating them into a single loan with a lower interest rate can save you money and potentially help you pay off your debt faster. However, it’s important to compare interest rates from different lenders to ensure you’re getting the most competitive rate for your personal loan.

3. Repayment Terms:

The repayment terms differ between debt consolidation and personal loans. Debt consolidation often extends the repayment period to lower monthly payments, providing short-term relief. However, be mindful that extending the repayment period may result in more interest charges over the long run. Personal loans, on the other hand, typically have fixed repayment terms, allowing for more predictable and structured monthly payments.

4. Credit Score:

Your credit score plays a vital role in determining the availability and terms of both debt consolidation and personal loans. If you have a good credit score, you may have more options for obtaining a personal loan with favorable interest rates. However, if your credit score is low, debt consolidation may be a better option, as it focuses on negotiating lower interest rates and simplifying repayments.

5. Financial Discipline:

Consider your financial discipline and commitment to change your spending habits. Debt consolidation helps streamline your repayments, but it’s crucial to address the root cause of your debt accumulation. Without improving your financial habits, there’s a risk of falling into the same cycle of debt in the future. Personal loans require responsible money management to ensure you can make consistent monthly payments.

6. Fees and Charges:

It’s essential to consider any fees or charges associated with both debt consolidation and personal loans. Debt consolidation methods such as consolidation loans or working with a consolidation company may have origination fees or service charges. Personal loans can also have associated fees, such as origination fees or prepayment penalties. Carefully review the loan terms and factor in these costs when assessing the overall value of the loan.

7. Financial Goals:

Your financial goals and priorities should be taken into account when choosing between debt consolidation and personal loans. If your primary objective is to simplify repayments and reduce interest rates, debt consolidation may be the better choice. However, if you require more flexibility in using the funds or have other financial needs outside of debt consolidation, a personal loan may meet your specific goals more effectively.

By considering these factors, you can evaluate the advantages and disadvantages of debt consolidation and personal loans in relation to your own financial situation. It’s recommended to conduct thorough research, seek advice from financial professionals, and compare different loan offers to make an educated decision that aligns with your long-term financial objectives.

Conclusion

Choosing between debt consolidation and personal loans is a decision that requires careful consideration of your individual financial circumstances and goals. Both options offer advantages and disadvantages, and it’s important to weigh them against your specific needs to make an informed choice.

Debt consolidation can be an effective strategy for simplifying repayments and potentially reducing interest rates. It is particularly beneficial if you have multiple debts and want to streamline your payment process. By consolidating your debts into a single loan or payment, you can potentially save money on interest charges and pay off your debt faster. However, it’s important to be aware of the potential fees, the possibility of an extended repayment period, and the need for financial discipline to avoid accumulating new debt alongside the consolidated loan.

Personal loans offer flexibility and can be used for a variety of purposes, including debt consolidation. They provide a lump sum of money with predictable monthly payments and fixed interest rates. Personal loans may offer competitive interest rates, especially for individuals with good credit scores. However, it’s essential to consider the potential impact on your credit score, the possibility of higher interest rates for riskier borrowers, and the need for responsible financial management to avoid overborrowing.

In making your decision, it is important to assess factors such as total debt amount, interest rates, repayment terms, credit score, financial discipline, fees and charges, and your overall financial goals. Evaluating these factors will help you determine which option aligns best with your immediate needs and long-term financial objectives.

Ultimately, the goal is to choose a solution that helps you effectively manage your debt, reduce financial stress, and work towards achieving your financial goals. Regardless of which option you choose, it’s important to have a plan in place to stay on track with your repayments and make progress towards becoming debt-free.

Consider consulting with a financial advisor or loan specialist to explore your options further and receive personalized guidance based on your circumstances. By taking the time to research, compare, and evaluate your choices, you can make a well-informed decision that paves the way towards financial stability and success.