Finance

How Much Should I Pay For Gap Insurance?

Published: November 10, 2023

Learn how much you should pay for gap insurance and protect your finances. Get expert advice on finding the best rates and coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Gap Insurance?

- Why is Gap Insurance Important?

- Factors to Consider When Determining Gap Insurance Cost

- Determining the Value of Your Vehicle

- Gap Insurance Cost Calculation Methods

- Shopping Around for Gap Insurance Quotes

- Additional Coverage Options and Their Costs

- Tips for Getting the Best Gap Insurance Deal

- Conclusion

Introduction

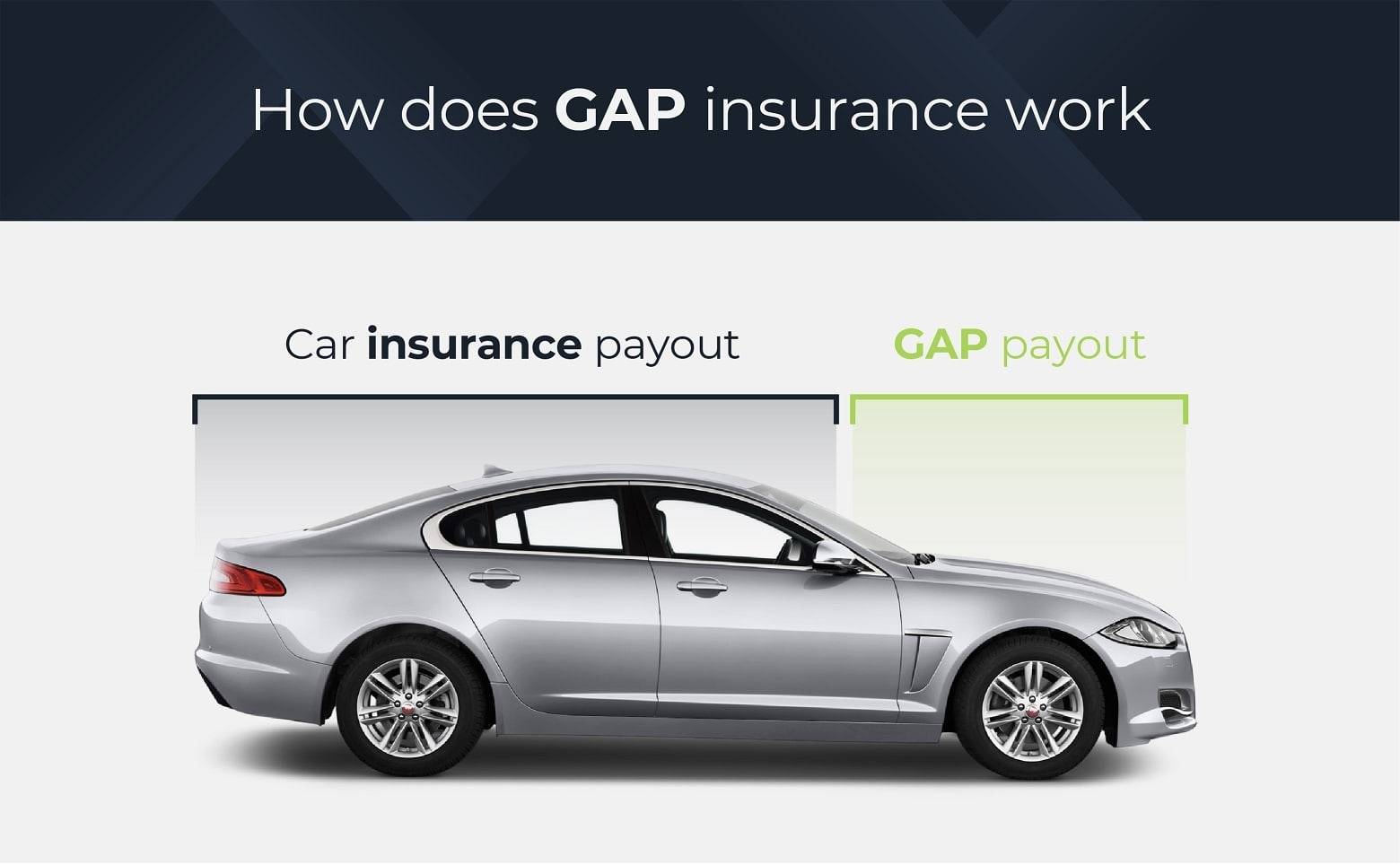

When purchasing a new or used car, one of the important considerations is deciding whether or not to opt for gap insurance. Gap insurance, also known as guaranteed asset protection insurance, is a type of coverage that protects you from financial loss if your vehicle is totaled or stolen and the payout from your regular auto insurance isn’t enough to cover the remaining balance on your car loan or lease. In such situations, gap insurance steps in to bridge the “gap” between what you owe on the vehicle and what your insurance company is willing to pay.

While gap insurance can provide valuable protection and peace of mind, it does come at a cost. The amount you pay for gap insurance will depend on various factors, including the value of your vehicle, your financial situation, and the options you choose for coverage.

In this article, we will explore the factors that determine the cost of gap insurance and provide tips on finding the best deal. By understanding how gap insurance is priced and what options are available, you can make an informed decision and ensure that you are adequately protected without breaking the bank.

What is Gap Insurance?

Gap insurance is a type of auto insurance that covers the “gap” between the actual cash value of your vehicle and the remaining balance on your car loan or lease. This coverage is especially important for individuals who have financed their vehicles or are leasing them, as it can protect them from substantial financial loss in the event of an accident or theft.

When you purchase a new vehicle, its value begins to depreciate as soon as you drive it off the lot. If your car is then totaled in an accident or stolen, your insurance company will typically only reimburse you for the current market value of the vehicle, which may be significantly less than the amount you still owe on your auto loan or lease. This is where gap insurance comes in.

Gap insurance pays the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease. It ensures that you are not left with a hefty debt if your car is declared a total loss and the insurance payout falls short.

It’s important to note that gap insurance coverage is typically optional and not required by law. However, it is highly recommended for those who are financing their vehicles, as the gap between the car’s value and the loan balance is often the largest in the early years of ownership, when depreciation is at its highest.

In addition to covering the difference between the vehicle’s value and the loan balance, some gap insurance policies may also cover the deductible on your regular auto insurance policy. This can provide additional financial relief in the event of a total loss, as you won’t have to pay the deductible out of pocket.

It’s important to understand that gap insurance only covers the financial gap and does not provide coverage for other damages or liabilities. Therefore, it should be seen as a supplement to your regular auto insurance policy rather than a replacement.

Why is Gap Insurance Important?

Gap insurance is an essential coverage for individuals who finance their vehicles or lease them. It provides valuable protection and peace of mind in case of a total loss or theft of their car. Here are a few key reasons why gap insurance is important:

- Protection against negative equity: Vehicles depreciate rapidly, and their value can decrease significantly in the first few years of ownership. If your car is totaled or stolen during this time, your insurance company will typically only reimburse you for the actual cash value, which may be lower than your outstanding loan or lease balance. Without gap insurance, you would have to pay the difference out of pocket, leaving you in a situation of negative equity.

- Loan/lease payoff: Gap insurance ensures that you are not burdened with a car loan or lease payment for a vehicle you no longer have. If your car is deemed a total loss, gap insurance covers the remaining balance on your loan or lease, preventing you from being held responsible for paying off a vehicle you can no longer use.

- Financial security: When you finance a vehicle, you become financially obligated to repay the loan even if the car is no longer drivable. Gap insurance provides financial security by protecting you from potentially significant out-of-pocket expenses.

- Potential savings: Choosing gap insurance can potentially save you money in the long run. Without it, you may be left with a substantial balance to pay off, especially if the vehicle depreciates faster than you are paying down the loan. Gap insurance ensures that you are not caught off guard by unexpected expenses.

Overall, gap insurance is important because it protects you from potential financial hardship in the event of a total loss or theft. It provides a safety net so that you can move forward with confidence, knowing that you won’t be left with a significant debt or financial burden. While it may be an additional expense, the peace of mind and financial security it offers make it well worth the investment.

Factors to Consider When Determining Gap Insurance Cost

When determining the cost of gap insurance, several factors come into play. Understanding these factors can help you estimate the cost and make an informed decision. Here are some key considerations:

- Vehicle value: The value of your vehicle is one of the main factors that influence the cost of gap insurance. The higher the value of your car, the higher the potential gap between its value and the remaining loan balance. Newer and more expensive vehicles generally have higher gap insurance costs.

- Loan or lease terms: The terms of your car loan or lease can impact the cost of gap insurance. Longer loan terms or higher lease payments may result in higher gap insurance premiums. Similarly, if you have a higher loan balance, the cost of gap insurance will be higher to cover the potential gap between the vehicle’s value and the loan amount.

- Insurance company: Different insurance companies may offer gap insurance at different rates. It’s important to shop around and compare quotes from multiple insurers to find the best deal. Consider factors such as their reputation, customer service, and the coverage options they offer.

- Deductible: Some gap insurance policies may have a deductible that you need to pay in the event of a total loss. A higher deductible could result in a lower gap insurance premium, but it also means you will have to pay more out of pocket if you need to file a claim.

- Driving record and location: Your driving record and the location where your vehicle is primarily parked can also affect the cost of gap insurance. If you have a history of accidents or traffic violations, you may face higher premiums. Likewise, if you live in an area with higher rates of theft or accidents, the cost of gap insurance may be higher.

It’s important to remember that each insurance company has its own method of determining gap insurance costs. Therefore, it’s recommended to obtain quotes from multiple providers and compare their offerings to find the most affordable and suitable coverage for your needs.

Determining the Value of Your Vehicle

When it comes to calculating the cost of gap insurance, one crucial factor is the value of your vehicle. The value of your car is used as a reference point to determine the potential gap between the vehicle’s value and the remaining loan or lease balance. Here are some common methods to determine the value of your vehicle:

- Actual Cash Value (ACV): Insurance companies often use the Actual Cash Value to determine the worth of your vehicle. ACV takes into account the age, condition, mileage, and market factors to estimate the fair market value of the car at the time of the accident or theft.

- Online Valuation Tools: There are various online valuation tools available that can help you estimate the value of your vehicle. These tools consider factors such as the make, model, year, condition, and mileage of your car to provide a rough valuation. However, it’s important to note that these tools are not always 100% accurate and should be used as a starting point for estimation.

- Appraisals: For more accurate valuation, you can hire a professional appraiser who can assess your vehicle’s condition, history, and unique features to provide a comprehensive appraisal report. This is especially beneficial for classic cars or vehicles with modifications.

- Dealer Trade-in Value: If you’re considering trading in your vehicle at a dealership, the dealer will assess the value of your car based on factors such as demand, condition, and market trends. While this may not be the exact value for gap insurance purposes, it can give you a general idea of how your car is valued in the market.

Keep in mind that the value of your vehicle will change over time due to depreciation and other factors. It’s important to reassess the value periodically and adjust your gap insurance coverage accordingly, especially if you’ve made significant loan payments or if the value of your vehicle has significantly decreased.

Gap Insurance Cost Calculation Methods

The cost of gap insurance can vary depending on the calculation method used by insurance providers. While the specific formulas may differ, here are some common methods used to calculate the cost of gap insurance:

- Percentage of Vehicle’s Value: One popular method is to calculate the cost of gap insurance as a percentage of the vehicle’s value. For example, the premium may be set at 5% of the car’s value. The higher the value of the vehicle, the higher the premium. This method is simple and straightforward, providing a predictable cost based on the car’s worth.

- Flat Rate: Some insurers offer gap insurance at a fixed flat rate, regardless of the value of the vehicle. This is often seen with policies offered by car dealerships. While this method may be convenient, it may not necessarily provide the most accurate reflection of the potential gap between the vehicle’s value and the remaining balance.

- Loan-to-Value (LTV) Ratio: Another approach is to calculate the gap insurance cost based on the Loan-to-Value (LTV) ratio, which considers the remaining loan balance as a percentage of the vehicle’s value. The higher the LTV ratio, the higher the gap insurance premium. This method takes into account the specific financial situation of the borrower and provides a more personalized cost estimate.

- Insurance Company Algorithms: Some insurance companies use proprietary algorithms to determine the cost of gap insurance. These algorithms consider various factors such as the make and model of the vehicle, the borrower’s credit score, and the length of the loan or lease. The exact variables used and the weighting assigned to each can vary among insurance providers.

It’s important to note that while these methods provide a basis for estimating the cost, insurance companies may also consider additional factors specific to their underwriting process when calculating the final premium. Therefore, it’s recommended to request quotes from different insurers to compare their rates and coverage options.

Shopping Around for Gap Insurance Quotes

When it comes to purchasing gap insurance, shopping around for quotes is crucial to ensure that you get the best coverage at the most affordable price. Here are some tips for effectively comparing and obtaining gap insurance quotes:

- Research Multiple Insurance Providers: Start by researching and compiling a list of reputable insurance companies that offer gap insurance. Look for companies with a strong financial reputation, positive customer reviews, and a track record of excellent customer service.

- Compare Coverage Options: Not all gap insurance policies are the same, so it’s important to review the coverage options offered by each insurer. Compare the terms, conditions, and limits of coverage to ensure that they align with your needs and preferences.

- Request Quotes: Reach out to the insurance providers on your list and request gap insurance quotes. Provide accurate and detailed information about your vehicle, loan or lease terms, and any other relevant details that may impact the cost of coverage.

- Review and Compare Quotes: Once you receive the quotes, carefully review each one. Pay attention to the coverage limits, deductibles, premiums, and any additional features or benefits included in the policy. Use this information to make an informed decision about which quote offers the best value for your specific situation.

- Consider Bundle Discounts: If you already have an auto insurance policy with a particular company, inquire about potential discounts for bundling gap insurance with your existing coverage. Many insurers offer discounts when multiple policies are purchased from them.

- Ask about Discounts: Inquire about any other discounts that may be available to you. Some common discounts for gap insurance include discounts for safe driving records, loyalty discounts for staying with the same insurer, or discounts for being a member of certain organizations.

- Read the Fine Print: Before making a final decision, carefully read the terms and conditions of the policy. Pay attention to any exclusions, limitations, or conditions that may affect your coverage. Ensure that you understand the claims process and the steps required to file a claim if the need arises.

- Seek Advice or Consult an Agent: If you are unsure about any aspect of gap insurance or need assistance understanding the quotes, consider seeking advice from a knowledgeable insurance agent. They can guide you through the process and help you make an informed decision.

Remember, finding the best gap insurance coverage involves more than just comparing prices. It’s crucial to consider the reputation, coverage options, and customer service of the insurance providers. By taking the time to shop around and evaluate your options, you can secure the right gap insurance coverage at a competitive price.

Additional Coverage Options and Their Costs

In addition to standard gap insurance coverage, there may be additional coverage options available to enhance your protection. It’s important to understand these options and their associated costs before making a decision. Here are some common additional coverage options to consider:

- Excess Wear and Tear Coverage: This coverage is typically available for leased vehicles and protects you from excessive wear and tear charges at the end of your lease term. It covers damages such as dents, scratches, and interior wear beyond normal usage. The cost of this coverage will vary depending on the lease terms, the condition of the vehicle at the beginning of the lease, and the specific policy terms.

- Vehicle Replacement Coverage: Vehicle replacement coverage provides the additional benefit of replacing your totaled car with a brand new vehicle of the same make and model. This coverage can be particularly beneficial for newer vehicles as it ensures that you don’t have to settle for a less valuable replacement. The cost for this coverage will depend on factors such as the vehicle’s value, its make and model, and the policy terms.

- Lease Gap Coverage: Lease gap coverage specifically addresses the gap between the vehicle’s actual cash value and the remaining lease balance. It protects you from having to pay out of pocket if your leased car is declared a total loss. The cost of lease gap coverage may be different from traditional gap insurance, as it is tailored to the unique terms and conditions of leasing.

- Extra Liability Coverage: While gap insurance primarily focuses on covering the outstanding loan or lease balance, you may also consider additional liability coverage. This can provide additional protection from potential lawsuits if you cause an accident resulting in significant property damage or bodily injuries. The cost of extra liability coverage will depend on the coverage limits and your driving history.

The cost of these additional coverage options can vary greatly depending on several factors, including the coverage limits, the value of the vehicle, your driving history, and the insurance provider. It’s essential to carefully consider your needs, evaluate the associated costs, and weigh them against the potential benefits before deciding to add any additional coverage options to your policy.

Tips for Getting the Best Gap Insurance Deal

When seeking the best gap insurance deal, it’s important to approach the process strategically. By following these tips, you can maximize your chances of finding affordable and comprehensive coverage:

- Shop around and compare quotes: Obtain quotes from multiple insurance providers and compare coverage options and premiums. This allows you to find the most competitive rates for the coverage you need.

- Consider deductibles: Analyze the impact of different deductible options on the cost of gap insurance. Opting for a higher deductible can lower your premium but remember to choose a deductible that you can comfortably afford if you need to file a claim.

- Bundle your policies: Consider bundling your gap insurance with your auto insurance policy or other insurance policies you have with the same provider. Many insurers offer bundle discounts, potentially reducing your overall insurance costs.

- Maintain a good credit score: Your credit score can influence the cost of gap insurance. By maintaining good credit, you may be eligible for lower premiums, as insurers often consider creditworthiness when setting rates.

- Ask about discounts: Inquire about any available discounts that you may qualify for, such as safe driver discounts or loyalty discounts. By asking about potential savings, you can ensure you are receiving the best possible rate.

- Review and understand the policy: Read through the policy carefully to understand the coverage, terms, and conditions. Ensure that the policy adequately covers the gap between your car’s value and the remaining loan or lease balance.

- Consider the reputation and customer service: Research the insurance provider’s reputation and customer service. Look for reviews and ratings to ensure that they have a solid track record of handling claims and providing excellent customer support.

- Reassess your coverage periodically: As your vehicle depreciates and loan or lease balances decrease, reassess your gap insurance coverage needs. Adjust your coverage accordingly to avoid overpaying for coverage you no longer need.

By employing these tips, you can increase the likelihood of finding the best gap insurance deal that offers the right balance of coverage and affordability. Remember, it’s not just about finding the lowest price but also ensuring that the policy meets your specific needs and provides the necessary protection in case of a total loss.

Conclusion

Gap insurance is a valuable form of coverage that provides financial protection and peace of mind for individuals who finance their vehicles or lease them. It bridges the gap between the actual cash value of the vehicle and the remaining balance on the loan or lease in the event of a total loss or theft. While the cost of gap insurance varies depending on factors such as the value of the vehicle, loan terms, insurance company, and coverage options, there are ways to secure the best deal.

When considering gap insurance, it is essential to thoroughly research and compare quotes from multiple insurance providers. Make sure to carefully review the coverage options, policy terms, deductibles, and any additional features or benefits offered. It’s also crucial to consider factors such as the provider’s reputation, customer service, and available discounts. Additionally, periodically reassess your coverage to align it with the changing value of your vehicle and loan or lease balance.

By understanding how gap insurance works and following the tips outlined in this article, you can make an informed decision and select the best gap insurance coverage for your needs. While it is an additional expense, the protection and financial security it offers can save you from potential financial hardships in the unfortunate event of a total loss or theft.

Remember, gap insurance should be seen as a supplement to your regular auto insurance policy, providing an added layer of protection. Be proactive, take the time to explore your options, and ensure that you have adequate coverage that fits within your budget. With the right gap insurance coverage in place, you can drive with confidence and peace of mind, knowing that you’re financially protected no matter what happens to your vehicle.