Home>Finance>How To Accept Credit Card Payments For Personal Use

Finance

How To Accept Credit Card Payments For Personal Use

Published: November 3, 2023

Learn how to accept credit card payments for personal use and manage your finances effectively. Boost your financial flexibility and convenience today with our easy-to-follow guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Payments

- Benefits of Accepting Credit Card Payments

- Setting Up a Merchant Account

- Choosing a Payment Gateway

- Integrating Credit Card Payment Options

- Ensuring Security and Compliance

- Tracking and Managing Payments

- Fees and Costs Associated with Credit Card Payments

- Alternative Payment Methods

- Conclusion

Introduction

Accepting credit card payments has become an essential component of personal finance management. Whether you’re a freelancer, a small business owner, or simply someone looking to streamline their personal financial transactions, enabling credit card payments can offer numerous benefits. In today’s digital age, where cash transactions are becoming less common, providing the option to accept credit card payments is crucial for convenience and customer satisfaction.

Traditionally, credit card payments were associated with large retailers and businesses. However, advancements in technology and the rise of e-commerce platforms have made it easier than ever for individuals to accept credit card payments for their personal use. Whether you want to sell handmade crafts online, offer consulting services, or even collect payments for personal debts, accepting credit card payments can simplify and expedite the entire process.

But what exactly are credit card payments, and how can they benefit you? In this article, we will explore the ins and outs of accepting credit card payments for personal use. We will discuss the advantages of allowing credit card transactions, the necessary steps to set up a merchant account, and the different options available for payment gateways. We will also delve into security and compliance considerations, as well as tracking and managing payments efficiently. Additionally, we will touch on the fees and costs associated with credit card payments and explore alternative payment methods.

By the end of this article, you’ll have a comprehensive understanding of how to accept credit card payments for personal use, empowering you to maximize the potential of your financial transactions and ensure a seamless payment experience for your customers or clients. So, let’s dive in and explore the world of credit card payments!

Understanding Credit Card Payments

Credit card payments are a popular and convenient method of conducting financial transactions. When a customer makes a purchase using a credit card, the payment is processed through a network of financial institutions, including the cardholder’s issuing bank, the merchant’s acquiring bank, and various payment processors.

When a credit card is swiped, dipped, or used for online transactions, the cardholder’s information, including the card number, expiration date, and security code, is securely transmitted to the payment processor. The payment processor then communicates with the issuing bank to verify the card’s validity and the availability of funds. Once the payment is authorized, the funds are transferred from the cardholder’s account to the merchant’s account.

Understanding the basic components of credit card payments is essential for individuals looking to accept credit card payments for personal use. There are a few key terms to familiarize yourself with:

- Cardholder: The individual who owns and uses the credit card to make purchases.

- Merchant: The entity or individual selling goods or services and accepting credit card payments.

- Issuing Bank: The financial institution that issues the credit card to the cardholder.

- Acquiring Bank: The financial institution that establishes and maintains the relationship with the merchant to process credit card payments.

- Payment Processor: An intermediary service that facilitates the transfer of funds between the cardholder’s account and the merchant’s account.

It’s important to note that credit card payments are subject to specific regulations and security standards to protect both the cardholder’s information and the merchant’s financial interests. Compliance with these standards, such as the Payment Card Industry Data Security Standard (PCI DSS), is crucial to maintaining a secure payment environment.

By understanding the fundamentals of credit card payments, individuals can make informed decisions when it comes to accepting credit card payments for their personal use. Now that we have a grasp of the basics, let’s explore the benefits of integrating credit card payment options into our personal finance management.

Benefits of Accepting Credit Card Payments

Accepting credit card payments offers numerous benefits for individuals looking to streamline their personal finance management. Here are some key advantages:

- Convenience for Customers: Credit card payments provide convenience and flexibility for customers. Many individuals prefer the ease of using a credit card over carrying cash or writing checks. By accepting credit card payments, you can cater to a wider range of customers and offer a seamless and hassle-free payment experience.

- Increased Sales Potential: Accepting credit card payments can lead to increased sales. Customers tend to spend more when using credit cards compared to other payment methods. By providing this option, you can tap into a larger market and capitalize on impulse purchases or larger-ticket items.

- Improved Cash Flow: Credit card payments are typically processed faster than other forms of payment. This means you can access funds more quickly, improving your cash flow and allowing you to reinvest in your business or personal finances sooner.

- Enhanced Professionalism: Accepting credit card payments adds an air of professionalism to your business or personal transactions. It signals that you are serious about providing top-notch service and are willing to leverage modern technology to meet customer needs.

- Reduced Risk of Fraud: Credit card payments offer enhanced security measures, such as encryption and fraud detection tools, that can help protect you against unauthorized transactions and minimize the risk of fraudulent activities. This can give both you and your customers peace of mind when conducting transactions.

- Streamlined Record-Keeping: Accepting credit card payments simplifies your record-keeping processes. With digital payment systems, you can easily track and manage transactions, eliminating the need for manual entry and reducing the chance of errors. This can save you time and effort when it comes to financial management.

- Competitive Advantage: In today’s digital landscape, offering credit card payment options has become a standard practice. By accepting credit card payments, you can stay competitive in your industry and attract customers who may choose your business over others that only accept cash or checks.

These benefits highlight the importance of accepting credit card payments for personal use. By incorporating this payment option into your financial management strategy, you can enhance the overall customer experience, increase sales potential, and streamline your financial processes. Now that we understand the advantages, let’s move on to the practical steps of setting up a merchant account.

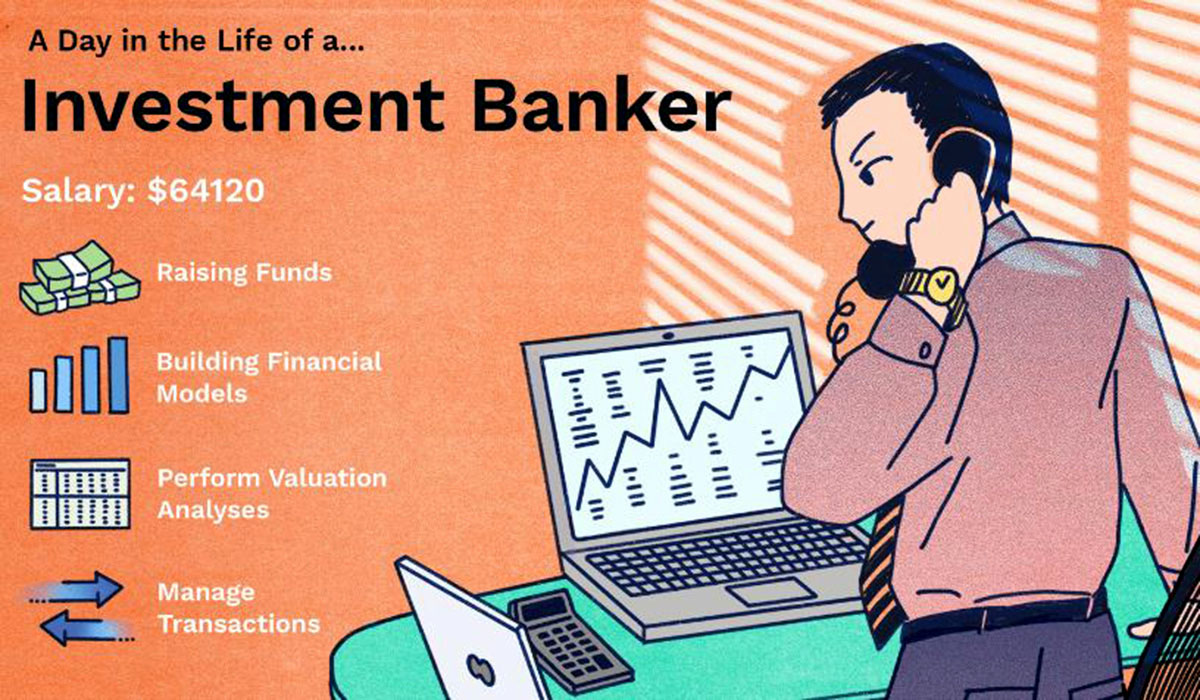

Setting Up a Merchant Account

In order to accept credit card payments for personal use, you will need to set up a merchant account. A merchant account acts as a gateway between your business or personal finances and the payment processing system. Here are the essential steps to get started:

- Research Merchant Account Providers: Begin by researching and comparing different merchant account providers. Look for reputable companies that offer competitive rates, excellent customer service, and a user-friendly interface. Consider factors such as transaction fees, contract terms, and integration options with your website or payment platform.

- Gather Required Documents: Once you’ve chosen a provider, you’ll need to gather the necessary documents to apply for a merchant account. This typically includes identification documents, proof of business ownership (such as a business license or tax ID), and financial statements.

- Submit the Application: Complete the merchant account application provided by your chosen provider. Be prepared to provide detailed information about your business or personal finances, such as the nature of your products or services, anticipated transaction volume, and average ticket size.

- Undergo Underwriting: After submitting your application, the merchant account provider will review your information and conduct underwriting. This process involves assessing your creditworthiness and potential risk factors. If approved, you will receive an agreement outlining the terms and conditions of your merchant account.

- Choose Payment Processing Equipment: Depending on your needs and preferences, you may need to select payment processing equipment. Options include physical credit card terminals, mobile payment solutions, or virtual terminals for online transactions. Your merchant account provider will guide you through the selection process.

- Integrate with Your Website or Payment Platform: If you plan to accept online payments, you will need to integrate the payment gateway provided by your merchant account with your website or payment platform. This allows customers to securely enter their credit card information and complete transactions.

- Test and Launch: Before officially launching your credit card payment option, it’s crucial to thoroughly test the system to ensure everything is functioning smoothly. Conduct test transactions and verify that funds are being properly deposited into your designated bank account.

Setting up a merchant account may seem daunting, but with the right provider and proper preparation, it can be a straightforward process. Once your merchant account is established, you can begin accepting credit card payments and reap the benefits of enhanced financial management.

Choosing a Payment Gateway

When accepting credit card payments, choosing the right payment gateway is crucial. A payment gateway is a technology that securely facilitates the transfer of credit card information between the customer, the merchant, and the payment processor. It acts as the link that enables seamless and secure transactions. Here are important factors to consider when selecting a payment gateway:

- Security: Security is paramount when it comes to credit card transactions. Look for a payment gateway that adheres to Payment Card Industry Data Security Standard (PCI DSS) compliance and offers advanced encryption and fraud prevention measures. This will protect both your customers’ sensitive data and your business from potential security breaches.

- Compatibility: Ensure that the payment gateway is compatible with your website or preferred platform for conducting transactions. It should seamlessly integrate and provide a smooth checkout experience for your customers.

- User Experience: A user-friendly payment gateway is essential to enhance the customer experience. Look for features such as easy navigation, clear instructions, and the ability to save customer payment information for future purchases. A streamlined checkout process can reduce cart abandonment rates and improve customer satisfaction.

- Accepted Payment Methods: Consider the variety of payment methods the gateway allows. Different customers may have different preferences, so it’s beneficial to offer a range of options, including major credit cards, debit cards, and digital wallets.

- Transaction Fees: Compare the transaction fees charged by different payment gateways. Some may have a flat fee per transaction, while others have a percentage-based fee. Take into account the anticipated volume and value of your transactions to choose the most cost-effective option.

- Customer Support: Look for a payment gateway provider that offers reliable and responsive customer support. In case of any issues or technical difficulties, having prompt assistance can save time and minimize disruptions to your payment processes.

- Integration with Other Services: Consider whether the payment gateway integrates with other services or tools that you use, such as accounting software or customer relationship management (CRM) systems. Seamless integration can streamline your overall business operations.

By carefully evaluating these factors, you can select a payment gateway that aligns with your specific needs and offers a secure, user-friendly, and cost-effective solution. Keep in mind that it’s beneficial to regularly review and reassess your payment gateway choice as your business or personal circumstances evolve. Now, let’s explore how to seamlessly integrate credit card payment options into your financial operations.

Integrating Credit Card Payment Options

Integrating credit card payment options into your personal finance management is a key step in streamlining your payment processes. This ensures a seamless and convenient experience for both you and your customers. Here are some important considerations for successfully integrating credit card payment options:

- Website Integration: If you have a website where you offer products or services, integrating credit card payment options is crucial. This typically involves integrating a payment gateway provided by your merchant account provider. Consult with your web developer or utilize website builder platforms that offer built-in payment integration.

- Mobile Payment Solutions: With the increasing use of mobile devices, it’s essential to provide mobile payment solutions for customers who prefer to make purchases on their smartphones or tablets. Explore mobile payment apps or platforms that are compatible with your merchant account and integrate seamlessly with your existing systems.

- Point of Sale (POS) Systems: If you have a brick-and-mortar store or offer in-person services, integrating a POS system that supports credit card payments is vital. There are various POS systems available, ranging from traditional countertop terminals to mobile card readers that can be used with smartphones or tablets.

- Virtual Terminals: Virtual terminals are online platforms that allow you to manually enter and process credit card payments from your computer. This is particularly useful for businesses or individuals who receive payment information over the phone or through other offline channels. Virtual terminals simplify the process of accepting credit card payments without the need for physical equipment.

- Recurring Billing: If you offer subscription-based services or accept recurring payments, it’s important to have a system that supports recurring billing. This enables automatic recurring payments, reducing administrative work and ensuring a seamless payment experience for your customers.

- Shopping Cart Integration: For e-commerce websites, integrating a shopping cart system that supports credit card payments is crucial for a smooth checkout process. Look for shopping cart solutions that are compatible with your payment gateway and offer features such as order management, inventory tracking, and shipping integration.

- Optimized Checkout Process: Streamline your checkout process to minimize cart abandonment and improve conversion rates. Optimize your website or platform for a user-friendly experience, reducing the number of steps required to complete a purchase and removing any unnecessary hurdles or distractions.

By integrating credit card payment options using the appropriate tools and systems, you can provide a variety of convenient payment methods to your customers and streamline your personal finance management. Remember to test the integration thoroughly to ensure everything is working smoothly before offering credit card payment options to customers. With a seamless integration in place, you can enjoy the benefits of efficient processing and enhanced financial operations.

Ensuring Security and Compliance

When accepting credit card payments, ensuring the security of your customers’ sensitive information and complying with industry regulations are of utmost importance. Failing to prioritize security and compliance can lead to data breaches, financial loss, and damage to your reputation. Here are essential steps to ensure security and compliance:

- PCI DSS Compliance: Familiarize yourself with the Payment Card Industry Data Security Standard (PCI DSS) requirements. This set of security standards outlines the necessary measures to protect cardholder data. Ensure that your payment processing systems and practices comply with these requirements.

- Implement Encryption: Use encryption technologies to protect the transmission and storage of credit card information. This prevents unauthorized access to sensitive data. Ensure that your payment gateway and systems support secure socket layer (SSL) encryption for secure data transmission.

- Tokenization: Consider implementing tokenization, which replaces sensitive credit card information with non-sensitive tokens. Tokenization adds an extra layer of security by storing the actual card data in a secure vault, reducing the risk of unauthorized access.

- Regular Security Audits: Conduct regular security audits to identify vulnerabilities in your systems and processes. Engage professional security firms or consider utilizing automated scanning tools to identify potential weaknesses and address them promptly.

- Employee Training: Train your employees on security best practices and the importance of safeguarding customer data. Educate them on how to handle credit card information securely, recognize phishing attempts, and maintain strict access control to sensitive data.

- Secure Network Infrastructure: Implement strong network security measures, including firewalls, intrusion detection systems, and regular security patches and updates. Maintain a secure network infrastructure to prevent unauthorized access to your systems.

- Compliance with Legal Regulations: Stay informed and comply with applicable data protection laws and regulations specific to your region or industry. This includes laws such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Protection Act (CCPA) in the United States, among others.

By prioritizing security and compliance, you can build trust with your customers and protect their sensitive data. Implementing robust security measures, staying up to date with industry regulations, and regularly assessing and updating your systems and practices will help safeguard both your customers and your business. Remember, security and compliance should be an ongoing commitment and not a one-time effort. Continuously monitor and improve your security posture to stay ahead of potential threats.

Tracking and Managing Payments

Tracking and managing payments efficiently is essential when accepting credit card payments for personal use. Proper management ensures accurate record-keeping, simplifies reconciliation, and helps maintain your financial stability. Here are some important steps to effectively track and manage payments:

- Use Payment Software: Utilize payment software or accounting tools that integrate with your payment gateway. This allows you to automatically track and record payments, generate invoices, and reconcile transactions easily.

- Automate Payment Notifications: Set up automated email notifications to customers for successful payments or transaction updates. This helps provide transparency and maintains a strong line of communication with your customers.

- Reconcile Accounts Regularly: Regularly reconcile your bank statements with your payment records to identify any discrepancies or potential errors. This ensures that all transactions are accounted for and helps detect any fraudulent activities.

- Generate Reports: Generate reports to gain insights into your payment history and financial performance. These reports can help you analyze trends, identify your most profitable products or services, and make data-driven decisions to enhance your personal finance management.

- Keep Customer Records: Maintain an organized system for storing customer records, including contact information and transaction history. This makes it easier to provide support, handle returns or refunds, and track customer loyalty.

- Monitor Outstanding Payments: Regularly review and monitor outstanding payments to ensure timely follow-up and minimize the risk of late or missed payments. Consider sending payment reminders to customers who have overdue invoices to maintain a healthy cash flow.

- Implement Dispute Resolution Process: Establish a clear process for handling payment disputes or chargebacks. Familiarize yourself with your merchant account provider’s policies and guidelines to efficiently manage and resolve any disputes that may arise.

By implementing these practices, you can effectively track and manage payments, maintain accurate financial records, and ensure a smooth payment experience for both you and your customers. Taking a proactive approach to payment management helps you stay on top of your personal finances and maintain healthy cash flow.

Fees and Costs Associated with Credit Card Payments

When accepting credit card payments, it’s important to understand the fees and costs associated with this payment method. While credit card payments offer convenience and potential sales growth, they also come with certain expenses. Here are key fees and costs to consider:

- Transaction Fees: Each credit card transaction typically incurs a transaction fee. This fee is usually a small percentage of the total transaction amount, ranging from 1% to 3% or more. Transaction fees can vary depending on factors such as the type of credit card (e.g., rewards cards may have higher fees) and the volume of transactions processed.

- Flat Fees: In addition to transaction fees, some payment processors may charge flat fees for certain services. For example, there may be a monthly or annual fee for the use of the payment gateway or the merchant account.

- Chargeback Fees: If a customer disputes a transaction or files a chargeback, there may be associated fees. Chargeback fees are typically charged by the payment processor to cover the administrative costs of handling the dispute.

- Cancellation or Termination Fees: Some merchant account providers impose cancellation or termination fees if you decide to end your contract before the agreed-upon term. Be sure to review the terms and conditions of your agreement to understand any potential fees associated with early termination.

- PCI Compliance Fees: To ensure the security of credit card transactions, businesses may be required to maintain Payment Card Industry (PCI) compliance. Some providers charge fees for PCI compliance, which may include security scans, vulnerability assessments, or assistance with compliance documentation.

- Equipment and Hardware Costs: If you require physical equipment, such as credit card terminals or card readers, there may be upfront costs or rental fees involved. Additionally, upgrading or replacing outdated equipment may incur additional expenses.

- International Transaction Fees: If you conduct transactions with customers outside of your home country, be aware of additional fees associated with international transactions. These fees are typically a percentage of the transaction amount and cover currency conversion and processing international payments.

- Third-Party Integration Fees: If you integrate your payment gateway with third-party services, such as e-commerce platforms or accounting software, there may be additional fees for those integrations. Consider these fees when evaluating the total cost of accepting credit card payments.

It’s essential to carefully review the fee structure and terms of your merchant account and payment processor. Different providers have varying fee schedules and cost structures, so compare options to find the most suitable and cost-effective solution for your personal finance management.

Keep in mind that while credit card payment fees do add to your costs, it’s important to consider the potential benefits, such as increased sales and improved customer satisfaction. Conduct a thorough analysis of your overall profitability and the value that accepting credit card payments brings to your personal financial transactions.

Alternative Payment Methods

While credit card payments are widely used and offer convenience, it’s essential to consider alternative payment methods to cater to a broader range of customers. Offering diverse payment options can accommodate various preferences and increase customer satisfaction. Here are some popular alternative payment methods to consider:

- Debit Cards: In addition to credit cards, accepting debit cards allows customers to make direct payments from their bank accounts. Debit card transactions are often faster and have lower fees compared to credit card transactions.

- Digital Wallets: Digital wallets, such as Apple Pay, Google Pay, or PayPal, have gained popularity as a convenient and secure way to make payments. These wallets store customers’ payment information, allowing for quick and contactless transactions via a mobile device or online platform.

- Bank Transfers: Bank transfer payments enable customers to directly transfer funds from their bank accounts to yours. This method is particularly useful for larger transactions or recurring payments, as it minimizes the need for processing fees.

- Cryptocurrencies: With the rise of cryptocurrencies like Bitcoin and Ethereum, accepting digital currencies as a form of payment has become increasingly popular. Cryptocurrency transactions offer fast and borderless payments, appealing to tech-savvy customers and those seeking enhanced privacy.

- ACH Payments: Automated Clearing House (ACH) payments allow customers to make electronic payments directly from their bank accounts. ACH payments are commonly used for recurring payments, such as monthly subscriptions or utility bills.

- Mobile Payment Apps: Mobile payment apps, such as Venmo or Zelle, enable peer-to-peer payments and money transfers. These apps are particularly popular among younger customers who prefer a social payment experience and seamless money transfers between friends and family.

- Prepaid Cards: Prepaid cards offer a convenient alternative for customers who prefer to have control over their spending. These cards are loaded with a specific amount of funds and can be used for one-time or recurring payments.

- Checks and Money Orders: While less common in today’s digital world, some customers may still prefer to pay by check or money order. Accepting these payment methods can cater to customers who are more comfortable with traditional forms of payment.

By offering alternative payment methods, you can accommodate a broader customer base, enhance the shopping experience, and increase the likelihood of completing transactions. Keep in mind that integrating these options may require additional setup and potential fees, so carefully evaluate the costs and benefits before deciding which methods to offer.

It’s important to regularly assess and adapt your accepted payment methods to meet the evolving needs of your customers and keep up with emerging trends in the payment industry. By staying flexible and offering a variety of payment options, you can ensure a seamless and convenient payment experience for your customers and optimize your personal finance management processes.

Conclusion

Accepting credit card payments for personal use is an essential step in modern financial management. It offers convenience, increases sales potential, and enhances the overall customer experience. By understanding credit card payments, setting up a merchant account, choosing the right payment gateway, and integrating credit card payment options, individuals can streamline their personal finance management and unlock the benefits of accepting credit card payments.

In addition to credit card payments, considering alternative payment methods can further expand your customer base and cater to diverse preferences. Options such as debit cards, digital wallets, bank transfers, cryptocurrencies, and mobile payment apps offer flexibility and convenience, ensuring a seamless payment experience for your customers.

However, as you embark on this journey, it’s crucial to prioritize security and compliance. Implementing robust security measures, complying with industry standards, and safeguarding customer data are paramount to building trust and maintaining a secure payment environment.

Lastly, be conscious of the fees and costs associated with credit card payments. While they impact your bottom line, the added convenience, increased sales potential, and improved financial operations often outweigh the costs. Carefully review fee structures and consider the overall value that accepting credit card payments brings to your personal finances.

By embracing credit card payments, integrating alternative payment methods, ensuring security and compliance, and effectively managing payments, you can pave the way for a streamlined and efficient financial journey. Remember, ongoing evaluation, adaptation, and staying abreast of emerging trends will enable you to optimize your payment processes and provide a seamless and convenient experience for you and your customers.

So, embrace the power of credit card payments and embark on a journey towards financial efficiency and customer satisfaction.