Finance

How To Check FICO Score On Bank Of America App

Published: March 6, 2024

Learn how to easily check your FICO score using the Bank of America app. Take control of your finances and stay informed with just a few simple steps.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today's world, where financial awareness is paramount, understanding your FICO score is a crucial aspect of managing your financial well-being. Your FICO score, a three-digit number ranging from 300 to 850, serves as a key indicator of your creditworthiness. It is used by lenders to evaluate the risk of extending credit to you and plays a pivotal role in determining the interest rates on loans and credit cards. With the advancement of technology, checking your FICO score has become more convenient than ever, especially through mobile banking apps.

Bank of America, one of the leading financial institutions globally, offers its customers the opportunity to monitor their FICO scores through its mobile app. This feature empowers users to stay informed about their credit standing, identify areas for improvement, and take proactive steps to enhance their financial health.

In this comprehensive guide, we will walk you through the process of checking your FICO score on the Bank of America app. Whether you're a seasoned Bank of America customer or new to the platform, this step-by-step tutorial will equip you with the knowledge and confidence to navigate the app seamlessly and gain valuable insights into your FICO score. Let's embark on this journey to demystify the world of credit scoring and empower you to take control of your financial future.

Step 1: Downloading the Bank of America App

Before you can access your FICO score through the Bank of America app, you need to have the app installed on your mobile device. The app is available for both iOS and Android platforms, making it accessible to a wide range of users.

If you are using an iOS device, you can download the Bank of America app from the App Store. Simply open the App Store, search for “Bank of America,” and tap the “Download” or “Get” button next to the app icon. Once the app is downloaded and installed, you can proceed to the next step.

For Android users, the Bank of America app is available on the Google Play Store. Open the Play Store, search for “Bank of America,” and select the app from the search results. Tap the “Install” button to download and install the app on your device.

After the installation is complete, launch the Bank of America app and follow the on-screen instructions to log in to your account or create a new account if you are a first-time user. Once you have successfully logged in, you are ready to move on to the next step and begin exploring the features of the app, including accessing your FICO score.

Downloading the Bank of America app is the first step towards gaining convenient access to your FICO score and other essential banking tools. With the app installed on your mobile device, you can take advantage of a wide range of financial management features, all within a user-friendly and secure platform.

Step 2: Logging in to Your Bank of America Account

Once you have downloaded and installed the Bank of America app on your mobile device, the next step is to log in to your Bank of America account. If you already have online banking credentials for Bank of America, you can use the same username and password to log in to the app. If you are a new user, you can easily create a new account directly within the app.

To log in, open the Bank of America app and locate the login section. Enter your username or the email address associated with your account, followed by your password. If you prefer a more secure login process, you can enable fingerprint or facial recognition authentication if your device supports these features.

Once you have entered your credentials, tap the “Sign In” button to access your Bank of America account. If the information you provided is accurate, you will be successfully logged in and directed to the app’s home screen. From here, you can explore various features and services offered by Bank of America, including the option to view your FICO score.

Logging in to the Bank of America app grants you access to a multitude of banking tools and resources, all conveniently accessible from your mobile device. Whether you need to check your account balances, transfer funds, pay bills, or monitor your credit score, the app provides a seamless and secure platform to manage your finances on the go.

Step 3: Navigating to the FICO Score Feature

After successfully logging in to your Bank of America account through the mobile app, accessing your FICO score is just a few taps away. Bank of America provides a user-friendly interface that makes it easy to find and review your FICO score within the app.

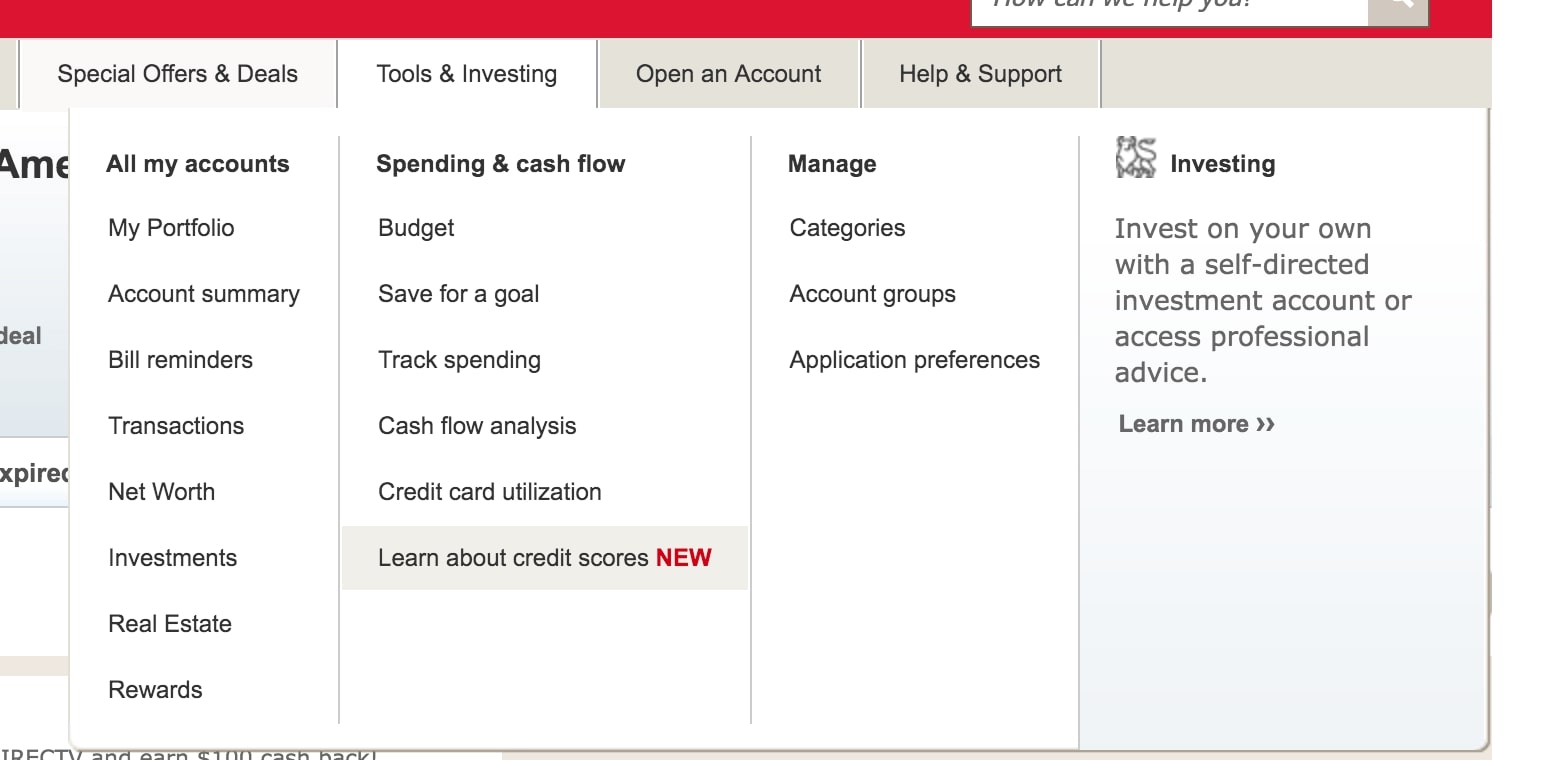

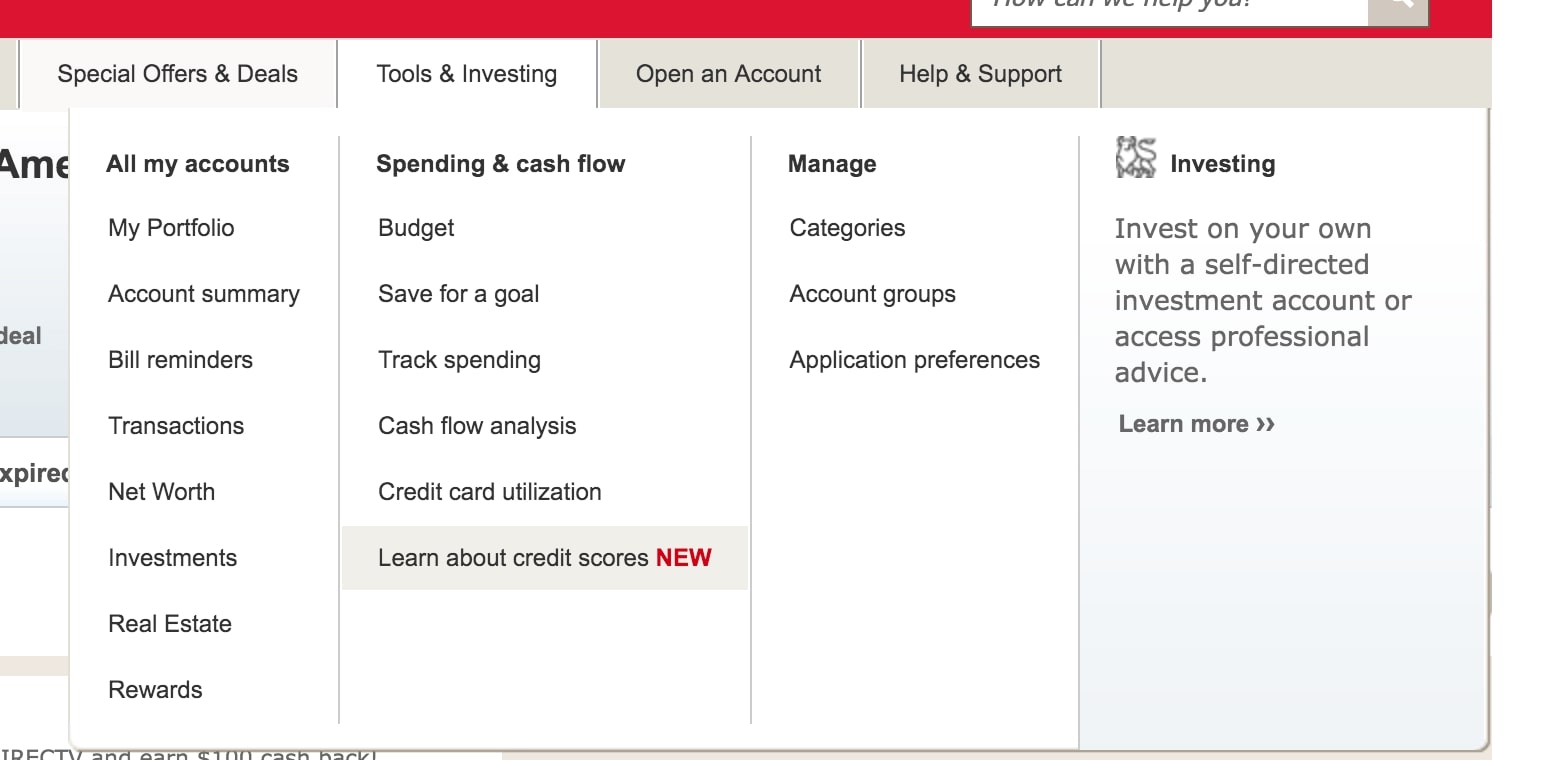

Once you are logged in, navigate to the app’s home screen, where you will find a menu or navigation bar typically located at the bottom of the screen. Look for an option labeled “Credit Score” or “FICO Score.” This may vary slightly depending on the app version and updates, but it is generally located within the “Accounts” or “More” section.

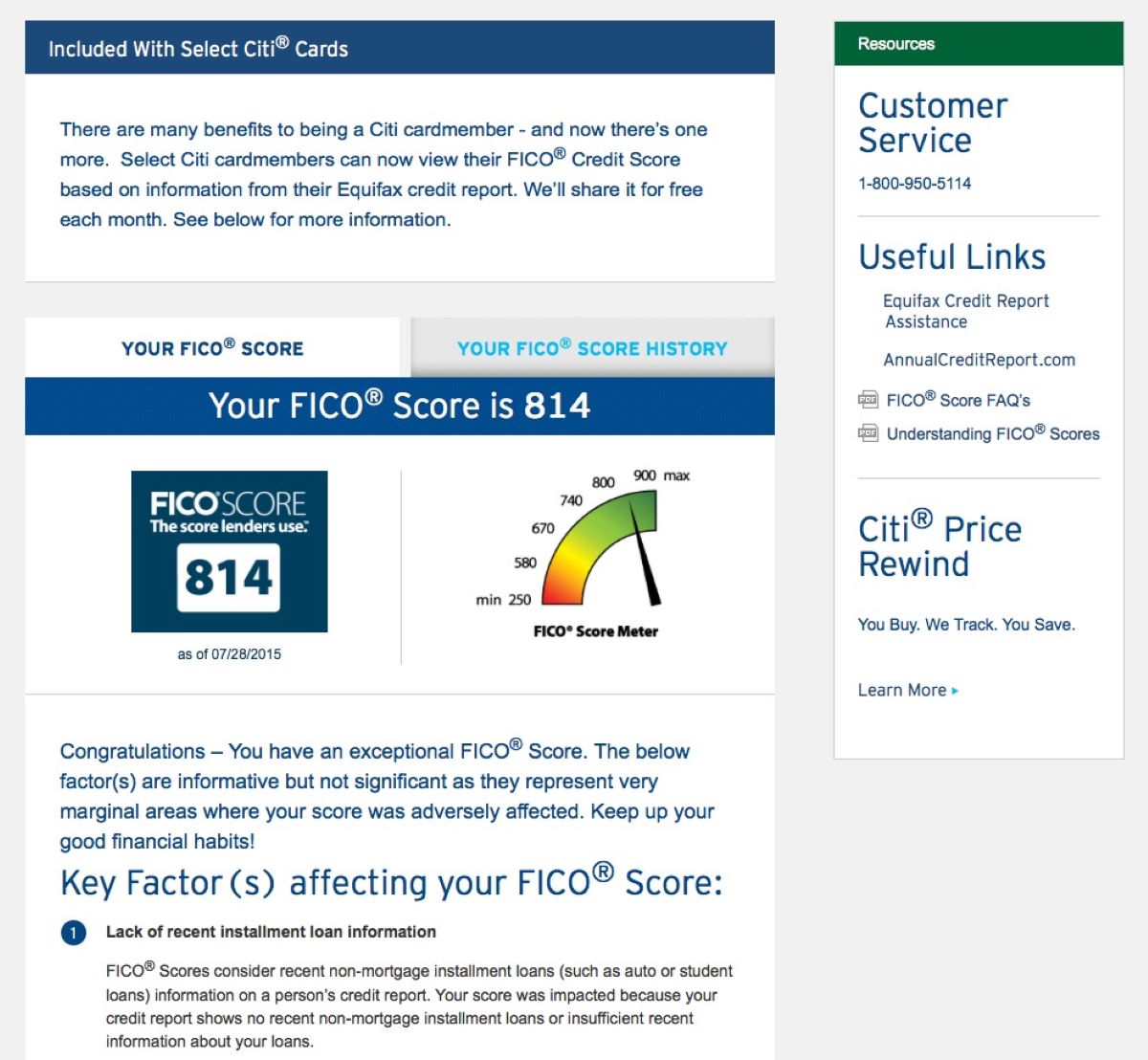

Upon selecting the “Credit Score” or “FICO Score” option, you will be directed to a new screen displaying your current FICO score, along with additional details such as the factors influencing your score and a historical view of your score over time. Bank of America often provides educational resources and tips to help you understand the significance of your FICO score and how it impacts your financial well-being.

It’s important to note that accessing your FICO score through the Bank of America app is a seamless and secure process. The app leverages advanced security measures to protect your personal and financial information, ensuring a safe and reliable experience as you explore your credit score and related insights.

By effortlessly navigating to the FICO score feature within the Bank of America app, you gain valuable visibility into your credit standing, empowering you to make informed decisions about your financial future and take proactive steps to improve your creditworthiness.

Step 4: Understanding Your FICO Score

Once you have accessed your FICO score through the Bank of America app, it’s essential to comprehend the significance of this three-digit number and its implications for your financial well-being. Your FICO score is a reflection of your credit history and provides lenders with a snapshot of your creditworthiness.

A FICO score typically ranges from 300 to 850, with higher scores indicating lower credit risk and greater creditworthiness. Understanding the following score ranges can provide valuable insights into how lenders may perceive your credit profile:

- Poor (300-579): Individuals with scores in this range may encounter challenges when seeking credit, often facing higher interest rates and limited approval options.

- Fair (580-669): While individuals in this range may qualify for credit, they may still face higher interest rates and less favorable terms compared to those with higher scores.

- Good (670-739): This range indicates a solid credit history and may lead to more favorable terms and interest rates on credit products.

- Very Good (740-799): Individuals with scores in this range are likely to receive better-than-average terms and interest rates, reflecting a strong credit profile.

- Excellent (800-850): Scores in this range are indicative of exceptional credit management and often result in the most favorable terms and interest rates on credit products.

Aside from the numerical score, the Bank of America app may provide insights into the factors influencing your FICO score. These factors typically include payment history, credit utilization, length of credit history, new credit accounts, and credit mix. Understanding these factors can empower you to make informed decisions to positively impact your credit score over time.

By comprehending your FICO score and the factors that contribute to it, you can gain a deeper understanding of your credit standing and take proactive steps to improve or maintain a healthy credit profile. The insights provided through the Bank of America app’s FICO score feature serve as a valuable tool in your journey toward financial empowerment and stability.

Step 5: Utilizing FICO Score Monitoring and Alerts

One of the valuable features offered by the Bank of America app is the ability to monitor your FICO score regularly and receive alerts regarding changes to your score. This proactive approach to credit monitoring empowers you to stay informed about fluctuations in your credit profile and take prompt action when necessary.

Within the app, you may find options to enable FICO score monitoring and receive alerts when significant changes occur. These alerts can notify you of factors such as new credit inquiries, changes in account balances, or updates to your credit report. By staying informed about these changes, you can promptly address any discrepancies, identify potential fraud, and maintain a vigilant stance regarding your credit health.

Additionally, the Bank of America app may offer educational resources and personalized tips based on your FICO score and credit history. These insights can help you understand the impact of various financial decisions on your credit profile and guide you toward actions that may positively influence your score over time.

Utilizing the FICO score monitoring and alert features within the Bank of America app provides a proactive approach to managing your credit health. By staying informed and leveraging the resources available through the app, you can take control of your financial well-being and make informed decisions to safeguard and enhance your creditworthiness.

Overall, the FICO score monitoring and alert capabilities offered by the Bank of America app serve as valuable tools in your journey toward financial empowerment and stability, offering convenience, security, and actionable insights to support your credit management efforts.

Conclusion

Checking your FICO score through the Bank of America app provides a gateway to understanding and managing your credit health with ease and convenience. The app’s intuitive interface and robust features empower you to access your FICO score, gain insights into your credit profile, and take proactive steps toward financial well-being.

By following the step-by-step process outlined in this guide, you can seamlessly navigate the Bank of America app to view your FICO score, understand the factors influencing it, and leverage monitoring and alert features to stay informed about changes to your credit profile. This level of visibility and control fosters financial awareness and positions you to make informed decisions regarding credit and financial management.

Moreover, the Bank of America app’s commitment to providing educational resources and personalized tips further enhances the value of monitoring your FICO score through the platform. These insights offer guidance on improving your credit standing and making informed financial choices, ultimately contributing to your long-term financial stability and well-being.

As technology continues to shape the landscape of personal finance, the accessibility of FICO scores through mobile banking apps represents a pivotal advancement in empowering individuals to actively engage with their credit health. The Bank of America app exemplifies this commitment by offering a seamless and secure platform for users to monitor and understand their FICO scores, ultimately fostering a culture of financial empowerment and responsibility.

In conclusion, the ability to check your FICO score on the Bank of America app not only provides a window into your credit standing but also signifies a proactive approach to managing your financial future. By embracing the tools and resources available through the app, you can embark on a journey toward greater financial literacy, stability, and empowerment, setting the stage for informed and confident financial decision-making.