Finance

How To Freeze Credit Card Payments

Published: November 9, 2023

Learn how to freeze credit card payments and regain control of your finances. Discover effective strategies to manage your financial obligations and reduce stress.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Freezing Credit Card Payments

- Reasons to Freeze Credit Card Payments

- Steps to Freeze Credit Card Payments

- Contacting Credit Card Issuers

- Negotiating Payment Options

- Documenting Communication

- Credit Card Freeze Period

- Resuming Credit Card Payments

- Monitoring Credit Reports

- Conclusion

Introduction

Managing credit card payments can be challenging, especially during times of financial hardship. Whether you’re facing unexpected expenses, job loss, or other financial difficulties, it can be overwhelming to keep up with your credit card payments. Fortunately, there is an option available to help alleviate some of the financial burden – freezing credit card payments.

Freezing credit card payments essentially allows you to temporarily suspend making payments on your credit card debt. This can provide you with some much-needed relief and breathing room to better manage your finances. However, it’s important to understand the process and implications of freezing your credit card payments before taking this step.

In this article, we will delve into the ins and outs of freezing credit card payments. We’ll explore the reasons why someone may choose to freeze their payments, the steps involved in the process, and how to resume payments once the freeze period is over. Additionally, we’ll outline the importance of monitoring your credit reports during this time to ensure the freeze doesn’t negatively impact your credit score.

Before we dive deeper into the subject, it’s important to note that freezing credit card payments is not a solution to eliminate debt. It’s merely a temporary measure to provide financial relief. If you’re struggling with overwhelming credit card debt, it’s advisable to seek professional advice from a credit counselor or financial advisor to explore comprehensive debt management options.

Now, let’s explore the concept of freezing credit card payments and the steps involved in successfully implementing this strategy.

Understanding Freezing Credit Card Payments

Freezing credit card payments is a temporary arrangement that allows cardholders to pause their monthly payments on their credit card debt. This can be a helpful option for individuals facing financial hardships such as job loss, medical emergencies, or other unexpected expenses. By temporarily freezing payments, cardholders can alleviate some of the financial strain and focus on stabilizing their overall financial situation.

It’s important to understand that freezing credit card payments does not mean the debt disappears. It simply means that for a specified period, typically a few months, you will not be required to make monthly payments. However, interest and fees may continue to accrue during this period, so it’s advisable to clarify the terms of the freeze with your credit card issuer to fully understand the implications.

When considering freezing credit card payments, it’s crucial to assess your financial situation carefully. Evaluate your income, expenses, and overall debt to determine if freezing payments is a viable solution for your current circumstances. Keep in mind that while freezing payments can provide temporary relief, it may extend the overall duration of your debt repayment period and potentially increase the amount of interest paid over time.

Additionally, it’s important to note that each credit card issuer may have its own policies and procedures regarding freezing payments. Some issuers may offer this option directly to cardholders, while others may require you to go through a separate process or provide documentation to prove financial hardship. Understanding these requirements can help you navigate the freezing process more effectively.

It’s essential to be proactive and communicate with your credit card issuer as soon as you anticipate difficulty in making payments. Many credit card companies are willing to work with customers facing financial challenges and may offer alternative payment arrangements or hardship programs. By reaching out early and explaining your situation, you increase the chances of finding a suitable solution that aligns with your needs.

Remember, freezing credit card payments is only a temporary solution and should be used as a last resort when other options have been exhausted. It’s crucial to weigh the pros and cons, assess your financial situation, and explore all available alternatives before opting to freeze your credit card payments.

Reasons to Freeze Credit Card Payments

Freezing credit card payments can be a beneficial strategy for individuals facing various financial challenges. Here are some common reasons why you may consider freezing your credit card payments:

- Financial Hardship: If you are experiencing a period of financial hardship due to unexpected circumstances such as job loss, illness, or a major life event, freezing credit card payments can provide temporary relief and help you navigate through the difficult times.

- Temporary Income Reduction: If your income has been significantly reduced due to a temporary setback, freezing credit card payments can alleviate the immediate financial burden and allow you to redirect your funds towards essential expenses.

- Emergency Expenses: Sometimes, unforeseen expenses like medical bills, car repairs, or home repairs can put a strain on your finances. Freezing credit card payments can provide you with breathing room to prioritize these urgent expenses without the added stress of making monthly credit card payments.

- Job Transition: If you are transitioning between jobs or starting a new venture, freezing credit card payments can help you manage your cash flow during the initial period of uncertainty and reduce financial stress.

- Temporary Financial Reprieve: There may be instances where you simply need a temporary break from your credit card payments to regroup and reorganize your financial situation. Freezing credit card payments can provide you with the opportunity to reassess your budget, explore other payment options, and regain control over your finances.

It’s essential to evaluate your specific circumstances and determine if any of these reasons apply to your current financial situation. Remember, freezing credit card payments should not be seen as a long-term solution but rather as a temporary measure to mitigate immediate financial challenges. It’s advisable to explore other debt management options and seek professional financial guidance for a comprehensive approach to your financial well-being.

Steps to Freeze Credit Card Payments

Freezing credit card payments typically involves several steps that cardholders need to follow to initiate the process. While these steps may vary depending on the credit card issuer, here are some general guidelines to help you navigate through freezing your credit card payments:

- Evaluate your financial situation: Before taking any action, assess your current financial situation and determine if freezing credit card payments is the best option for you. Consider factors such as income, expenses, and overall debt to make an informed decision.

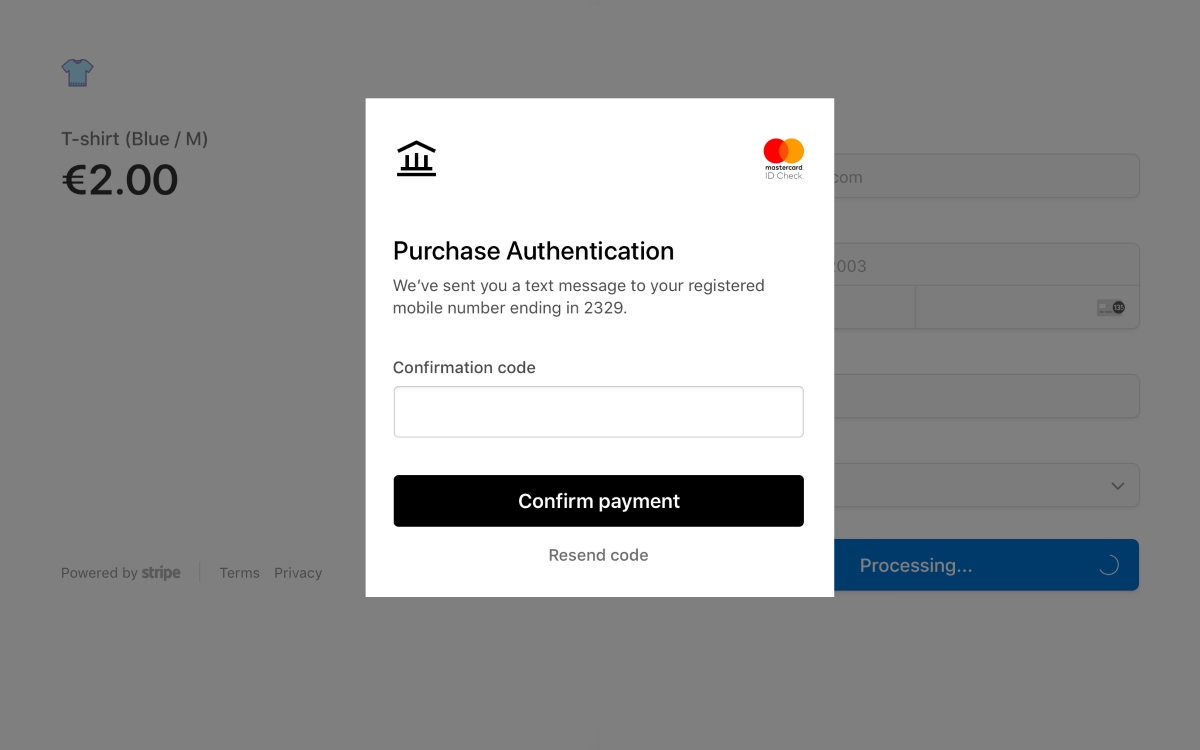

- Contact your credit card issuer: Reach out to your credit card issuer through their customer service hotline or online portal. Inform them about your intention to freeze your credit card payments and inquire about their specific procedures and requirements.

- Explain your financial hardship: When communicating with your credit card issuer, clearly articulate your financial hardship, explaining the reasons behind your request to freeze payments. Be prepared to provide any documentation or evidence that supports your case.

- Explore alternative payment options: While discussing freezing payments with your card issuer, inquire about alternative payment arrangements or hardship programs they might offer. Some issuers may provide flexibility by reducing interest rates, waiving late fees, or creating customized payment plans to help you manage your debt.

- Document all communication: It’s crucial to keep a record of all interactions with your credit card issuer. Take note of the date, time, and the name of the representative you spoke with. Keep copies of any written communication or confirmation emails you receive.

- Confirm the freeze period: Once your credit card issuer approves your request, clarify the specific duration of the freeze period. Understand whether this is a set timeframe or if it will be reviewed on a case-by-case basis. It’s essential to have a clear understanding of when payments will resume.

- Make note of any ongoing interest or fees: During the freeze period, it’s important to determine if interest will continue to accrue and if any additional fees will be applied to your account. Understanding these details will help you manage your debt effectively and plan for the future.

Remember that these steps serve as general guidelines, and it’s crucial to follow the specific instructions provided by your credit card issuer. Being proactive, thorough, and maintaining communication throughout the process will enhance your chances of successfully freezing your credit card payments and managing your financial situation.

Contacting Credit Card Issuers

When you decide to freeze your credit card payments, one of the crucial steps is to contact your credit card issuers. By reaching out to them directly, you can initiate the process and gain clarity on their specific procedures and requirements. Here are some essential tips to keep in mind when contacting your credit card issuers:

- Collect relevant account information: Before making the call, gather your credit card statements and any other pertinent account information. This will help you provide accurate details and ensure a smooth conversation with the customer service representative.

- Use the official customer service channels: Contact your credit card issuers using their official customer service hotline. You can find the phone number on the back of your credit card or on the issuer’s website. Avoid sharing sensitive information or discussing your situation through unofficial channels.

- Be prepared to explain your financial hardship: When speaking with a representative, clearly communicate the reasons behind your request to freeze your credit card payments. Explain your financial hardship and provide any documentation or evidence that supports your case, such as medical bills or job loss notices.

- Ask about hardship programs or alternative payment arrangements: Inquire about any hardship programs or alternative payment arrangements available through your credit card issuer. Some issuers offer options such as reduced interest rates, waived fees, or customized payment plans to assist customers facing financial challenges.

- Document all communication: During your conversation, make note of the date, time, and the name of the representative you spoke with. Keep copies of any written communication or confirmation emails you receive. This documentation will serve as evidence and help resolve any potential discrepancies in the future.

- Clarify the freeze period: Ensure you have a clear understanding of the duration of the freeze period. Ask if it is a set period or if it will be reviewed on a case-by-case basis. This information will help you plan your budget and manage your finances effectively.

- Ask about any ongoing interest or fees: It’s important to inquire about any interest that will continue to accrue or fees that may be applied during the freeze period. Understanding these details will help you assess the impact on your overall debt and make informed decisions.

- Stay in communication: Throughout the freeze period, maintain regular communication with your credit card issuers. Keep them updated on any changes in your financial situation and be proactive in resolving any issues that may arise. This will help strengthen your relationship and ensure a smoother transition back to regular payments.

Remember, each credit card issuer may have its own specific policies and procedures when it comes to freezing credit card payments. By contacting them directly and following these steps, you can effectively navigate the process and obtain the information you need to manage your credit card debt during periods of financial hardship.

Negotiating Payment Options

When facing financial difficulties and considering freezing credit card payments, it’s important to explore all available options with your credit card issuers. Negotiating payment options can provide you with alternative arrangements that cater to your specific financial situation. Here are some strategies to consider when negotiating payment options:

- Explain your financial hardship: Clearly communicate your financial hardship and the reasons behind your request for alternative payment options. Providing a detailed explanation of your situation can help your credit card issuer understand the challenges you are facing and be more willing to work with you.

- Explore hardship programs: Inquire about any hardship programs offered by your credit card issuer. These programs are designed to assist customers in difficult financial situations. They may include reduced interest rates, waived fees, or even temporary payment suspensions to help you manage your debt more effectively.

- Propose a realistic payment plan: If a temporary freeze is not an option or does not address your financial needs, propose a realistic payment plan that works within your current means. Consider how much you can afford to pay each month and present this as a feasible alternative to freezing payments. Outline the proposed plan in detail to demonstrate your commitment to repaying your debt.

- Negotiate lower interest rates: High interest rates can significantly impact your ability to pay off your credit card debt. When negotiating payment options, ask if your credit card issuer is willing to lower the interest rate on your account. A lower interest rate can make your payments more manageable and help you pay off your debt faster.

- Request the waiver of late fees or penalties: Late fees and penalties can quickly add up and make it even more challenging to resolve your debt. When discussing payment options, ask if your credit card issuer is willing to waive any late fees or penalties associated with your account. This can help reduce the financial burden and enable you to focus on paying down your balance.

- Consider debt consolidation: If you have multiple credit card debts, consolidating them into a single loan or balance transfer credit card may be a viable option. This can simplify your payments and potentially reduce your interest rates. Explore the possibility of consolidating your debts with the guidance of a financial advisor or credit counselor.

Remember, negotiating payment options requires open and honest communication with your credit card issuer. Be prepared to provide evidence of your financial hardship and present your proposed payment plan in a professional and concise manner. Patience, persistence, and a willingness to explore different options will help increase the likelihood of finding a payment arrangement that suits your needs and helps you regain control of your finances.

Documenting Communication

When dealing with credit card issuers and negotiating payment options, it is crucial to document all communication. Keeping accurate records of your discussions and correspondence can help protect your interests and provide evidence if any disputes or discrepancies arise. Here are some key reasons why documenting communication is essential:

- Record keeping: Documenting all communication ensures that you have a clear record of the details discussed during your conversations with credit card issuers. This includes the date, time, and specific topics covered. It provides a reliable reference point if you need to refer back to the information later.

- Evidence of agreements: Having written documentation serves as evidence of any agreements or arrangements made. If you reach an agreement with your credit card issuer regarding payment options, capturing the details in writing will help prevent misunderstandings and ensure that both parties are on the same page.

- Dispute resolution: In the event of a dispute or discrepancy, having a documented record of communication can be instrumental in resolving the issue. It provides a solid foundation to present your case and support any claims or assertions you need to make.

- Confirmation of information: Keeping records of communication can help you verify the accuracy of information provided by your credit card issuer. If there are any discrepancies or inconsistencies, you can refer back to your documentation to ensure that the correct information is being used for decision-making.

- Protection against predatory practices: Unfortunately, there have been cases of fraudulent or unethical practices by certain credit card issuers. By documenting all communication, you have an added layer of protection against predatory practices. If any unfair practices are suspected, you have a record to support your claim and seek appropriate recourse.

To effectively document communication, follow these guidelines:

- Keep organized records in a dedicated folder or virtual storage system.

- Note the date, time, and relevant details of each communication.

- Save copies of any written communication, such as emails or letters.

- Take notes during phone conversations and summarize them afterward.

- Include the name or identification of the representative you interacted with.

By documenting all communication with your credit card issuers, you can protect yourself, establish a clear record of agreements or discussions, and have the necessary evidence if any disputes or issues arise throughout the negotiation process.

Credit Card Freeze Period

When you freeze your credit card payments, there will be a designated freeze period during which you are not required to make monthly payments. The duration of the freeze period can vary depending on your agreement with the credit card issuer. Here are some important points to understand about the credit card freeze period:

- Length of the freeze period: The length of the freeze period will be determined by your credit card issuer. It can range from a few months to a specific end date. Make sure you clearly understand the duration of the freeze and when payments are expected to resume.

- Accrued interest and fees: During the freeze period, it’s important to note whether interest and fees will continue to accumulate. Depending on your agreement with the credit card issuer, interest may still be charged on the outstanding balance, and additional fees may be applied. Be aware of the potential impact on your overall debt during this period.

- Additional charges and spending: While your payments may be frozen, it’s important to remember that your credit card may still be active for new purchases. Any charges you make during the freeze period will still need to be paid off once the freeze ends, along with any accrued interest and fees.

- Communication with the credit card issuer: Throughout the freeze period, it’s essential to maintain open communication with your credit card issuer. Any changes in your financial situation or further assistance needed should be communicated promptly. This will help ensure that both parties are aware of each other’s expectations and can address any issues that may arise.

- Reviewing your credit card statements: Even though you are not making payments during the freeze period, it’s crucial to regularly review your credit card statements. This will enable you to track any charges, monitor interest and fees, and ensure that there are no errors or fraudulent activities on your account.

- Resisting additional spending: It can be tempting to continue using your credit card during the freeze period, especially when payments are not required. However, it is advisable to avoid unnecessary spending and focus on stabilizing your financial situation. Remember that any additional charges will add to your debt and may increase the challenges you face once the freeze period ends.

It’s important to stay informed and understand the terms of the credit card freeze period. Communicate with your credit card issuer regularly, monitor your statements, and use this time wisely to reassess your financial situation and develop a plan for resuming payments once the freeze period is over.

Resuming Credit Card Payments

After the designated freeze period, it’s time to resume making regular credit card payments. Here are some key steps to consider when transitioning back to your normal payment routine:

- Review the agreed-upon end date: Confirm the end date of the freeze period with your credit card issuer. Make sure you mark this date on your calendar or set a reminder to ensure you resume payments in a timely manner.

- Evaluate your financial situation: Before the freeze period ends, take a moment to assess your financial position. Review your income, expenses, and any changes in your circumstances. This will help you determine if any adjustments or modifications to your budget are necessary to accommodate the resumption of credit card payments.

- Update your payment method: If you had set up automatic payments before the freeze period, ensure that your chosen payment method is still valid and active. If any changes are needed, contact your credit card issuer to update your payment information.

- Calculate the outstanding balance: Determine the outstanding balance on your credit card account, including any interest or fees that may have accrued during the freeze period. This will give you a clear understanding of the amount owed and help you plan your payments accordingly.

- Confirm the payment due date: Verify the upcoming payment due date with your credit card issuer. Ensure you are aware of the due date and the minimum payment required. If possible, consider paying more than the minimum to expedite debt repayment.

- Make on-time payments: Once the freeze period ends, resume making regular and timely credit card payments. Set reminders or establish automatic payments to ensure you do not miss any due dates. Consistent, on-time payments will help rebuild your credit and manage your debt effectively.

- Monitor your credit card statements: Continue monitoring your credit card statements after resuming payments. Review each statement to check for any errors, unauthorized charges, or unexpected fees. Promptly report any discrepancies to your credit card issuer for resolution.

- Reassess your financial goals: Take this opportunity to reevaluate your financial goals and create a plan to manage your credit card debt. Consider strategies such as debt repayment methods, budgeting, and seeking professional financial advice to help you regain control of your finances.

Remember, resuming credit card payments is a crucial step in your financial journey. It’s essential to stay disciplined, make timely payments, and reassess your financial habits to avoid falling into excessive debt again. By implementing responsible financial practices, you can regain control of your credit card debt and work towards a healthier financial future.

Monitoring Credit Reports

While you navigate through freezing and resuming credit card payments, it is important to monitor your credit reports regularly. Your credit report is a detailed record of your credit history and plays a significant role in your overall financial well-being. Here’s why monitoring your credit reports is essential:

- Identifying errors or inaccuracies: Monitoring your credit reports allows you to identify any errors or inaccuracies that may negatively impact your credit score. Mistakes can happen, and incorrect information on your credit report can lead to lower creditworthiness. By staying vigilant, you can address any inaccuracies promptly and ensure that your credit report reflects accurate information.

- Detecting fraudulent activity: Regularly monitoring your credit reports helps you detect any signs of fraudulent activity. If you notice unfamiliar accounts, suspicious inquiries, or unexplained changes, it could be an indication of identity theft. Taking swift action to address any fraudulent activity can minimize the potential damage to your credit and financial reputation.

- Tracking the impact of the credit card freeze: During the credit card freeze period, it’s crucial to monitor your credit reports to observe any impact on your credit history. Confirm that the freeze has been accurately reported and that it does not have any negative implications on your credit score. If you notice any discrepancies or negative marks related to the freeze period, contact the credit bureaus and your credit card issuers to rectify the situation.

- Tracking your credit rebuilding progress: If you faced financial hardships that necessitated freezing your credit card payments, consistently monitoring your credit reports allows you to track your progress in rebuilding your credit. As you resume regular payments and implement responsible financial habits, you can see how your credit score and overall creditworthiness improve over time.

- Accessing free annual credit reports: Under the Fair Credit Reporting Act, you are entitled to receive free annual credit reports from each of the major credit reporting agencies – Equifax, Experian, and TransUnion. Monitoring your credit reports regularly enables you to take advantage of this benefit and stay informed about your credit status.

- Utilizing credit monitoring services: Consider using credit monitoring services or subscribing to credit monitoring programs provided by credit bureaus or third-party companies. These services can help you keep a close eye on your credit reports, providing alerts for any significant changes or suspicious activities that may require your attention.

Remember, monitoring your credit reports is an ongoing responsibility. Make it a habit to review your credit reports at least once a year and consider using credit monitoring services for real-time updates. By staying proactive and attentive to your credit, you can effectively manage your financial health and protect yourself against potential credit-related issues.

Conclusion

Freezing credit card payments can serve as a valuable tool for individuals facing financial hardships. It provides temporary relief by allowing you to pause your credit card payments during challenging times. However, it’s crucial to understand the process, communicate effectively with your credit card issuers, and explore all available options for managing your debt.

Throughout the journey of freezing and resuming credit card payments, several key steps need to be followed. Evaluating your financial situation, contacting your credit card issuers, negotiating payment options, and documenting all communication are essential elements of successfully navigating this process.

Remember, freezing credit card payments is not a long-term solution to eliminate debt. It is a temporary measure to alleviate immediate financial pressures. It’s important to reassess your budget, explore other payment options, and seek professional financial guidance to develop a comprehensive debt management plan.

Monitoring your credit reports regularly is also vital during this time. It helps you detect errors, identify fraudulent activity, track the impact of the credit card freeze, and monitor your credit rebuilding progress. Stay attentive to your credit health and take advantage of free annual credit reports and credit monitoring services to stay informed.

In conclusion, freezing credit card payments can provide temporary relief and help individuals facing financial challenges regain control of their finances. By following the necessary steps, staying proactive, and being diligent in your financial management, you can navigate through this period successfully and work towards a healthier financial future.