Finance

How To Add A Tradeline To Your Credit

Published: January 11, 2024

Learn how to add a tradeline to your credit and boost your financial standing. Gain valuable insights and tips to improve your credit score with Finance-focused guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Adding a tradeline to your credit profile can be a valuable strategy to improve your creditworthiness and financial standing. Tradelines are credit accounts that appear on your credit report, showcasing your credit history and payment behavior.

Understanding the importance and impact of tradelines is crucial for anyone looking to enhance their credit score and increase their chances of qualifying for loans, mortgages, and other forms of credit. In this article, we will delve into the world of tradelines, explore the reasons why you should consider adding them to your credit profile, and provide you with the necessary guidance to manage them effectively.

Tradelines play a significant role in determining your creditworthiness because they reflect your borrowing history and how you handle credit obligations. Lenders rely on this information to assess your creditworthiness before extending credit to you. By strategically adding positive tradelines to your credit report, you can demonstrate responsible financial behavior and potentially raise your credit score.

In the following sections, we will walk you through the process of researching and selecting appropriate tradelines, as well as the steps involved in applying for them. We will also discuss the importance of monitoring your credit report and provide tips on managing your tradelines for optimal results.

While adding tradelines can have significant benefits, it is important to keep certain factors in mind. We will guide you through the potential advantages and considerations associated with adding tradelines to your credit profile. Additionally, we will share some tips for success to ensure that you make the most out of this strategy and achieve your financial goals.

So, if you’re ready to take control of your credit and enhance your financial standing, let’s dive into the world of tradelines and discover the power they hold in shaping your creditworthiness.

Understanding Tradelines

Tradelines are essentially credit accounts that appear on your credit report, providing a comprehensive snapshot of your credit history. These accounts can include credit cards, loans, mortgages, and other lines of credit. Each tradeline contains detailed information about the lender, the credit limit or loan amount, the current balance, and your payment history.

The primary purpose of tradelines is to provide lenders with an overview of your creditworthiness and financial responsibility. They serve as a crucial factor in determining whether you are a reliable borrower and can be trusted to repay debts on time. Lenders analyze the information displayed in tradelines to assess your credit risk and make informed decisions about extending credit to you.

Tradelines can be classified into two types: primary tradelines and authorized user tradelines. Primary tradelines are credit accounts that are opened and managed by the individual listed as the primary account holder. These tradelines have a direct impact on the account owner’s credit report and score.

On the other hand, authorized user tradelines are credit accounts that are owned by someone else, but the individual is granted permission to be listed as an authorized user. The credit history and payment behavior of the primary account holder will be reflected on the authorized user’s credit report. This can be beneficial for individuals looking to build or improve their credit history.

It’s important to note that adding tradelines to your credit report does not guarantee an immediate boost in your credit score. The impact of tradelines on your creditworthiness depends on various factors, including the length of the credit history, the type of tradelines, the payment history associated with them, and the overall utilization of credit.

Understanding how tradelines work is essential before diving into the process of adding them to your credit profile. By gaining a clear understanding of the role tradelines play in shaping your creditworthiness, you can make informed decisions and effectively utilize this strategy to achieve your financial goals.

Reasons to Add a Tradeline

Adding a tradeline to your credit profile can have several benefits and can be a strategic move to improve your creditworthiness. Here are some compelling reasons why you should consider adding a tradeline:

- Building Credit History: If you have a limited or thin credit history, adding a tradeline can help establish a positive credit record. By adding a tradeline with a good payment history and low utilization, you can demonstrate responsible borrowing behavior to potential lenders.

- Improving Credit Score: Tradelines can have a significant impact on your credit score. By adding a tradeline with a long history of on-time payments and a low credit utilization ratio, you can potentially increase your credit score and make yourself more attractive to lenders.

- Diversifying Credit Mix: Lenders not only look at your credit score but also consider the diversity of your credit accounts. Adding a different type of tradeline, such as a mortgage or an auto loan, can help diversify your credit mix and show that you can handle different types of credit responsibly.

- Overcoming Negative History: If you have a history of late payments or other negative marks on your credit report, adding a positive tradeline can help offset the impact. By demonstrating recent responsible and on-time payments, you can show that you have changed your financial behavior and are now more creditworthy.

- Increasing Credit Limits: If you have multiple credit cards with low credit limits, adding a tradeline with a higher credit limit can increase your overall credit availability and reduce your credit utilization ratio. This can have a positive impact on your credit score.

It’s important to note that while adding a tradeline can have its benefits, it’s crucial to choose the right tradeline that aligns with your goals and financial situation. Before adding a tradeline, research and consider factors such as the tradeline’s payment history, age, and credit limit to ensure that it will positively impact your credit profile.

By strategically adding and managing tradelines, you can enhance your creditworthiness, improve your credit score, and increase your chances of obtaining favorable loan terms and interest rates from lenders.

Researching and Selecting Tradelines

When it comes to researching and selecting tradelines to add to your credit profile, it’s essential to approach the process with careful consideration and diligence. Here are some steps to guide you in finding the right tradelines:

- Evaluate Your Credit Profile: Start by reviewing your credit report and identifying areas for improvement. Look for any negative marks or gaps in your credit history that may benefit from the addition of positive tradelines.

- Identify Your Goals: Determine what you want to achieve by adding tradelines to your credit profile. Are you looking to build your credit history, increase your credit score, or diversify your credit mix? Clarifying your goals will help you narrow down your options.

- Research Reputable Tradeline Providers: Look for reputable tradeline providers that offer legitimate and ethical services. Read reviews, check their track record, and ensure they comply with industry regulations and standards.

- Consider the Age and Payment History: Pay attention to the age and payment history of the tradelines you are considering. Older tradelines with a long history of on-time payments may have a stronger positive impact on your credit profile.

- Assess the Credit Limit and Utilization: Analyze the credit limits and utilization rates of potential tradelines. Adding a tradeline with a higher credit limit and low utilization can positively impact your credit utilization ratio and improve your credit score.

- Compare Costs and Terms: Review the costs and terms associated with adding a tradeline. Understand any fees, terms of service, and the duration for which the tradeline will be active on your credit report.

- Seek Professional Advice: If you are unsure about the process or the potential impact of adding a tradeline, consider consulting with a financial advisor or credit expert. They can provide personalized guidance and help you make informed decisions.

Remember, due diligence is crucial when selecting a tradeline to add to your credit profile. Take the time to research and compare your options, ensuring they align with your goals and financial situation.

Once you have selected a tradeline, follow the provider’s application process and provide the necessary information to complete the addition. Stay proactive in monitoring your credit report to ensure that the tradeline is accurately reflected and is positively impacting your credit profile.

By conducting thorough research and selecting the right tradelines, you can strategically enhance your creditworthiness and achieve your financial objectives.

Applying for Tradelines

Once you have conducted your research and selected the appropriate tradelines to add to your credit profile, the next step is to apply for them. Here are some key steps to follow when applying for tradelines:

- Contact the Tradeline Provider: Reach out to the tradeline provider you have chosen and inquire about the application process. They will guide you through the necessary steps and provide you with the required documentation.

- Provide Personal Information: The tradeline provider will ask for your personal information, such as your name, address, date of birth, and Social Security number. This information is needed to verify your identity and complete the application process.

- Submit Supporting Documents: Depending on the provider’s requirements, you may need to submit supporting documents, such as proof of income or proof of address. These documents help establish your financial capacity and credibility.

- Agree to the Terms and Conditions: Review and understand the terms and conditions set by the tradeline provider. Ensure that you agree to the terms before proceeding with the application process.

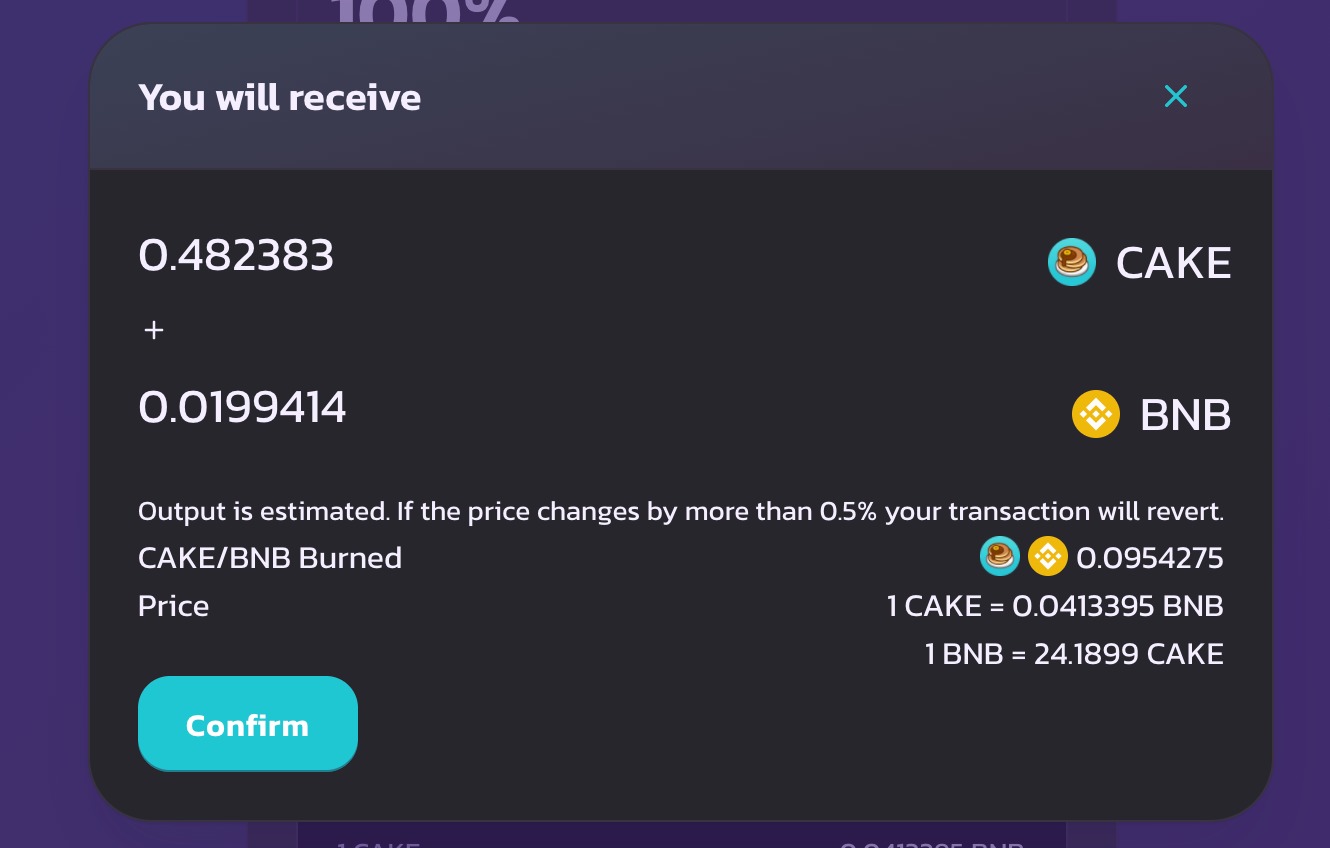

- Pay the Required Fees: Tradeline providers typically charge a fee for adding a tradeline to your credit profile. Make sure to pay the required fees promptly and securely, following the instructions provided by the provider.

- Monitor Progress: Stay in touch with the tradeline provider to monitor the progress of your application. They will provide updates on the status of the tradeline addition and any associated timelines.

- Confirm the Addition: Once the tradeline has been successfully added to your credit profile, verify its inclusion by checking your credit report. Ensure that all the details are accurate and up-to-date.

It’s important to note that the process of adding a tradeline may vary depending on the provider and your specific circumstances. Be sure to follow the instructions provided by the tradeline provider and promptly address any questions or concerns that may arise during the application process.

Remember, transparency and communication are key throughout the application process. By adhering to the guidelines provided by the tradeline provider and maintaining open lines of communication, you can successfully add tradelines to your credit profile and positively impact your creditworthiness.

Monitoring Your Credit Report

Once you have added tradelines to your credit profile, it’s crucial to consistently monitor your credit report to ensure accuracy and stay vigilant against fraudulent activity. Here are some important steps to consider when monitoring your credit report:

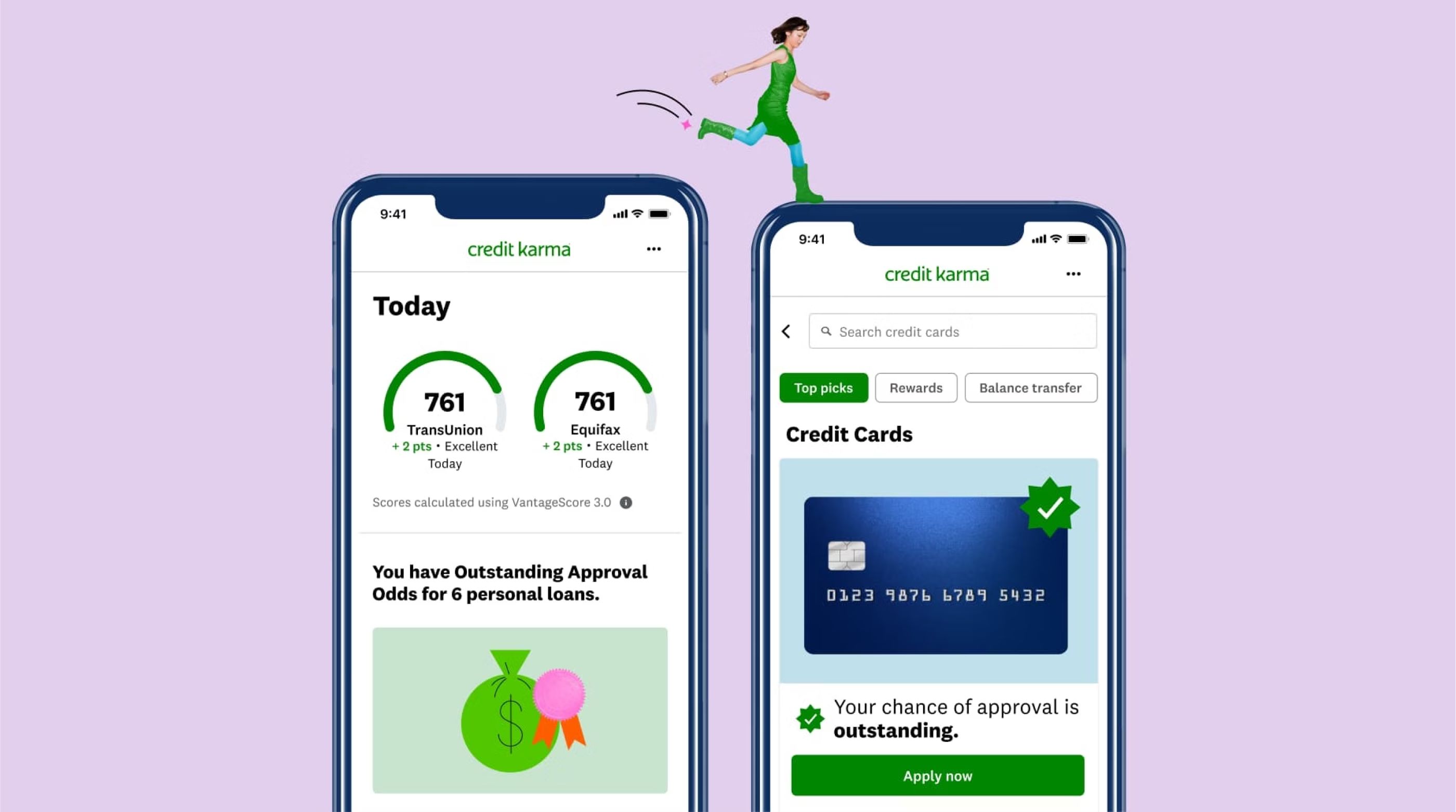

- Check Your Credit Report Regularly: Obtain copies of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion) and review them regularly. You are entitled to a free copy of your credit report from each bureau once a year through AnnualCreditReport.com.

- Verify Tradeline Inclusion: Confirm that the tradelines you added are accurately reflected in your credit report. Verify that the details, such as the account name, payment history, credit limit, and balance, match the information provided by the tradeline provider.

- Monitor for Errors: Look out for any errors or inaccuracies on your credit report. Common errors can include incorrect personal information, duplicate entries, or accounts that do not belong to you. If you find any errors, file a dispute with the respective credit bureau to have them corrected.

- Stay Alert for Identity Theft: Monitor your credit report for any suspicious activity that could be indicative of identity theft. Look for unfamiliar accounts, inquiries, or other signs of fraudulent activity. If you suspect identity theft, take immediate action by contacting the credit bureaus and placing fraud alerts on your credit file.

- Utilize Credit Monitoring Services: Consider utilizing credit monitoring services that provide real-time alerts to any changes or updates on your credit report. These services can notify you of new tradelines, credit inquiries, or potential signs of identity theft.

- Review Account Statements: Regularly review the statements of your active credit accounts to ensure that all transactions are accurate and authorized. Report any suspicious or unauthorized activity to the respective financial institution immediately.

- Keep Track of Payment Due Dates: Stay organized and ensure that you make timely payments on your tradelines. Late payments can have a negative impact on your credit score, so it is essential to manage your payments effectively.

By actively monitoring your credit report and taking swift action to address any errors or suspicious activity, you can maintain the accuracy of your credit profile and protect yourself from potential identity theft.

Remember, the responsibility of monitoring your credit report lies with you. By staying diligent, you can ensure that your credit profile remains accurate, up-to-date, and reflects your true creditworthiness.

Managing Your Tradelines

Once you have added tradelines to your credit profile, it is important to actively manage them to maximize their positive impact on your creditworthiness. Here are some key steps for effectively managing your tradelines:

- Prompt Payment: Make timely payments on your tradelines and ensure that all obligations are met by their due dates. Late or missed payments can have a negative impact on your credit score and reflect poorly on your financial management.

- Monitor Credit Utilization: Keep an eye on your overall credit utilization ratio, which is the amount of credit you are using compared to the total credit available to you. Aim to keep your credit utilization below 30% to demonstrate responsible usage of credit.

- Avoid Opening Too Many Accounts: While it can be tempting to open multiple tradelines, it is important to be cautious. Opening too many accounts within a short period may trigger red flags for lenders and can potentially lower your credit score.

- Regularly Review Statements: Take the time to review your statements for each tradeline regularly. Look for any discrepancies, unauthorized charges, or errors in billing. Report any concerns or issues to the respective financial institution immediately.

- Consider Closing Unused Tradelines: If you have tradelines that you no longer use or need, you may consider closing them. However, before doing so, evaluate the potential impact on your credit score and consult with a financial advisor if necessary.

- Be Aware of Changes in Terms: Stay informed about any changes in terms or conditions of your tradelines. Pay attention to notifications from the tradeline provider regarding adjustments to interest rates, fees, or credit limits.

- Maintain Communication with Providers: Establish open lines of communication with the tradeline provider. If you encounter any issues or have questions regarding your tradelines, reach out to the provider for clarification and assistance.

- Stay Informed about Credit Reports: Educate yourself about credit reports and the factors that influence your credit score. Stay updated on changes in credit reporting policies and regulations to ensure you are making informed decisions regarding your tradelines.

Remember, effective management of your tradelines involves practicing responsible financial habits and staying engaged in your credit profile. By actively monitoring and maintaining your tradelines, you can continue to improve your creditworthiness and set yourself up for future financial success.

Benefits and Considerations

Adding tradelines to your credit profile can offer several benefits, but it’s important to consider some key factors before incorporating them into your financial strategy. Let’s explore the benefits and considerations associated with adding tradelines:

Benefits:

- Improved Creditworthiness: Adding positive tradelines can demonstrate responsible credit management, potentially raising your credit score and making you more attractive to lenders.

- Expanded Credit Options: A strong credit profile with positive tradelines can open up more credit opportunities and qualify you for better loan terms, lower interest rates, and higher credit limits.

- Diversified Credit Mix: Adding different types of tradelines can diversify your credit mix, showing lenders that you can handle a variety of credit responsibly. This can positively impact your credit score.

- Overcoming Negative History: By adding positive tradelines, you can offset the impact of past negative credit history, showcasing recent responsible and on-time payments.

- Building Credit History: Adding tradelines can help establish a positive credit history for individuals with limited or thin credit profiles, providing a foundation for future credit opportunities.

Considerations:

- Costs: Adding tradelines may come with associated fees, such as application fees or fees charged by the tradeline provider. Evaluate the costs and consider whether the potential benefits outweigh the expenses.

- Credibility of Providers: Do thorough research and select reputable and legitimate tradeline providers to ensure you are working with reputable sources. Be cautious of scams or unethical practices in the tradelines market.

- Impact on Credit Score: While adding positive tradelines can improve your credit score, it is important to understand that the impact may vary based on individual credit histories and other factors. Adding tradelines is not a guaranteed solution for increasing your credit score.

- Responsibility and Management: Adding tradelines comes with the responsibility of managing them effectively. This includes making timely payments, monitoring credit utilization, and staying informed of any changes in terms or conditions.

- Potential Risks: Adding tradelines may come with certain risks, such as identity theft or fraudulent activities by unscrupulous tradeline providers. Stay vigilant and be cautious of sharing sensitive personal and financial information.

It is important to carefully weigh the benefits and considerations before adding tradelines to your credit profile. Remember to evaluate your specific financial situation and objectives to determine whether adding tradelines aligns with your long-term goals.

Consulting with a financial advisor or credit expert can provide valuable insights and guidance to help you make informed decisions and navigate the complexities of adding tradelines to your credit profile.

Tips for Success

Adding tradelines to your credit profile can be a strategic move to improve your creditworthiness and financial standing. To make the most out of this strategy, consider the following tips for success:

- Know Your Credit Goals: Clearly define your credit goals and objectives. Whether you want to build credit history, increase your credit score, or qualify for specific loans, having a clear goal in mind will help you select the right tradelines and focus your efforts.

- Research and Due Diligence: Take the time to research and thoroughly evaluate tradeline providers. Look for reputable sources and read reviews to ensure you are working with legitimate providers who adhere to industry regulations.

- Choose Tradelines Wisely: Select tradelines that align with your credit goals and financial situation. Consider factors such as payment history, age, credit limit, and type of credit to ensure the tradeline will have a positive impact on your credit profile.

- Monitor Your Credit Report Regularly: Stay proactive in monitoring your credit report for accuracy and to detect any suspicious activity or errors. Regularly review your tradelines to ensure they are accurately reflected and positively impacting your credit profile.

- Practice Responsible Financial Habits: Adding tradelines alone is not enough to improve your creditworthiness. It is essential to practice responsible financial habits such as making timely payments, keeping credit utilization low, and managing your overall debt responsibly.

- Communicate with Tradeline Providers: Establish open lines of communication with the tradeline provider. Reach out to them if you have any questions or concerns about your tradelines. Clear communication can help resolve any issues and ensure a smooth process.

- Stay Consistent: Building credit takes time and consistency. Make on-time payments, maintain low credit utilization, and manage your finances responsibly to consistently demonstrate your creditworthiness to lenders.

- Educate Yourself: Stay informed about credit, credit scores, and credit reports. Understand the factors that influence your credit score and how tradelines can impact your creditworthiness. This knowledge will empower you to make informed decisions and take control of your financial future.

- Be Patient: Improving your credit profile is a gradual process. Don’t expect overnight results. Stay committed to your financial goals and be patient as you work towards building a strong credit history and improving your credit score.

By following these tips and staying proactive in managing your tradelines and overall credit profile, you can increase your chances of success and achieve your desired financial outcomes.

Conclusion

Adding tradelines to your credit profile can be an effective strategy to improve your creditworthiness and create a solid foundation for your financial future. Tradelines provide lenders with a snapshot of your credit history and payment behavior, influencing their decision when extending credit to you. By strategically adding positive tradelines, you can demonstrate responsible financial habits and potentially increase your credit score.

Throughout this article, we have explored the key aspects of understanding, researching, selecting, and managing tradelines. We discussed the benefits they offer, such as improved creditworthiness, expanded credit options, and the ability to overcome past negative history. However, it is important to consider the associated costs, credibility of providers, and potential risks involved.

To make the most out of adding tradelines, it is essential to stay proactive in monitoring your credit report and practicing responsible financial habits. Regularly review your credit report for accuracy, pay bills on time, keep credit utilization low, and communicate with your tradeline providers when needed.

Remember to set clear credit goals, conduct thorough research on tradeline providers, and choose tradelines that align with your objectives and financial situation. Stay informed about credit reports, credit scores, and factors that influence your creditworthiness.

Lastly, be patient and consistent in managing your tradelines. Building a strong credit profile takes time and effort. By following the tips and strategies outlined in this article, you can take control of your credit and increase your chances of qualifying for better loan terms, lower interest rates, and overall financial success in the long run.

So, start exploring your options, make informed decisions, and embark on the journey of adding tradelines to boost your creditworthiness and achieve your financial goals.