Finance

How To Add Authorized User To Citi Credit Card

Modified: March 1, 2024

Learn how to add an authorized user to your Citi credit card and manage your finances more effectively. Boost your credit score and enjoy the benefits of sharing your credit with trusted individuals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Adding an authorized user to your Citibank credit card can be a convenient way to share the benefits and privileges of your card with someone you trust. Whether it’s a spouse, family member, or a close friend, adding an authorized user allows them to make purchases using your credit card account.

Being an authorized user can provide several advantages, such as access to a higher credit limit, building credit history, and potentially earning rewards on their purchases. However, it’s crucial to understand the process and requirements to add an authorized user to your Citibank credit card.

In this guide, we will walk you through the step-by-step process of adding an authorized user to your Citibank credit card to ensure a seamless experience. It’s essential to follow these steps accurately to avoid any complications and ensure that the authorized user can enjoy the benefits of your credit card.

Note that these instructions are specific to Citibank and may not apply to other credit card providers. It’s always best to consult your credit card issuer for their specific guidelines and procedures.

Step 1: Check Eligibility

Before adding an authorized user to your Citibank credit card, it’s important to ensure that you meet the eligibility requirements set by your credit card issuer. Here are the key factors to consider:

- Age Requirement: The authorized user must be at least 18 years old. Some credit card issuers may require a minimum age of 21.

- Relationship: Typically, authorized users are immediate family members or individuals with whom you have a close relationship. This includes spouses, children, parents, siblings, and sometimes domestic partners.

- Trustworthiness: Make sure you only add individuals whom you trust to handle your credit responsibly. Remember that as the primary cardholder, you are ultimately responsible for all charges made by the authorized user.

- Understand the Impact: Adding an authorized user will allow them to use the credit card account, but it can also impact their credit score and your credit score. Be aware of the potential consequences before proceeding.

Once you have confirmed that you meet the eligibility requirements and are comfortable with the implications, you can proceed to the next step of adding an authorized user to your Citibank credit card.

Step 2: Gather Information

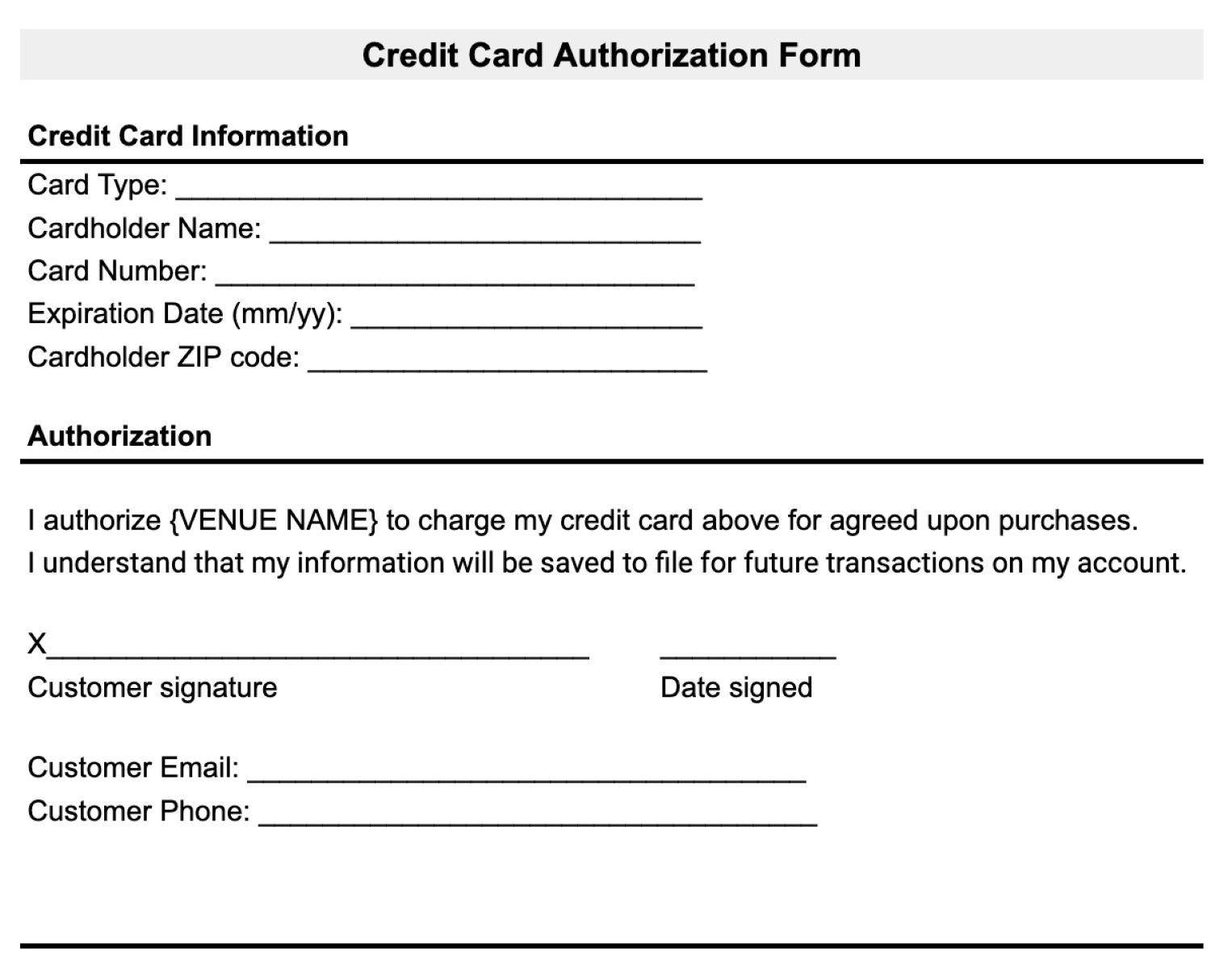

Before contacting Citibank to add an authorized user to your credit card, it’s important to gather all the necessary information to streamline the process. Here’s what you’ll need:

- Authorized User’s Information: Collect the authorized user’s full name, date of birth, and contact information. This includes their address, phone number, and email address.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): You will typically need the authorized user’s SSN or ITIN to add them to your credit card account. This is necessary for identity verification and credit reporting purposes.

- Relationship to Authorized User: Be prepared to provide your relationship with the authorized user, as some credit card issuers may ask for this information during the process.

- Account Details: Gather your Citibank credit card account information, including the card number, expiration date, and CVV (the three-digit security code on the back of the card). Having this information readily available will help expedite the process.

- Primary Cardholder Verification: Citibank may require additional verification to ensure that you are the primary cardholder. This could include answering security questions or providing your account username and password.

By gathering all the necessary information beforehand, you can save time and ensure a smooth interaction with Citibank when requesting to add an authorized user to your credit card.

Step 3: Contact Citibank

Once you have gathered all the necessary information, it’s time to contact Citibank to initiate the process of adding an authorized user to your credit card. There are several ways to get in touch with Citibank:

- Customer Service Phone Number: Call Citibank’s customer service helpline, which can usually be found on the back of your credit card. Follow the prompts to speak with a representative who can assist you with adding an authorized user.

- Online Chat: If Citibank offers an online chat feature on their website or mobile app, you can use this option to communicate with a representative and request to add an authorized user.

- Secure Message: Consider sending a secure message through Citibank’s online banking platform. This option allows you to communicate with customer service representatives at your convenience, providing the necessary information for adding an authorized user.

- In-Person Visit: If you prefer face-to-face interaction, you can visit a Citibank branch and speak with a representative in person. They will guide you through the process and assist you in adding an authorized user to your credit card.

Choose the method that is most convenient for you and initiate contact with Citibank. Remember to have your card and the gathered information readily available to provide accurate details to the customer service representative. Be prepared to answer any additional questions they may have to verify your identity and authorize the addition of an authorized user.

During the call or conversation, it’s a good idea to inquire about any fees or restrictions associated with adding an authorized user to your Citibank credit card. This will help you understand the potential costs and limitations involved.

Once Citibank has verified the necessary information and authorized the addition of the user, they will guide you through the remaining steps of the process, ensuring that the authorized user receives their card and understands their responsibilities.

Step 4: Provide Required Details

After initiating contact with Citibank and verifying your identity, you will need to provide the required details to add an authorized user to your Citibank credit card. Here’s what you’ll need to do:

- Provide Authorized User Information: Share the authorized user’s full name, date of birth, contact information, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) as requested by the Citibank representative. This information is essential for identity verification and credit reporting.

- Confirm Relationship: Reiterate your relationship with the authorized user, such as spouse, family member, or friend, to ensure accuracy in the records.

- Agree to Responsibility: Understand that as the primary cardholder, you are responsible for all charges made by the authorized user. Confirm your willingness to assume this responsibility and that you trust the authorized user to use the card responsibly.

- Provide Account Details: Furnish your Citibank credit card account details, including the card number, expiration date, and CVV (the three-digit security code on the back of the card). This information allows Citibank to link the authorized user to your credit card account.

- Authorizations and Notifications: Citibank may request your consent on certain authorizations and notifications related to the authorized user’s activities on the credit card. Make sure to review and provide the necessary approvals or preferences.

It’s crucial to provide accurate and up-to-date information during this step to ensure a seamless addition of the authorized user to your Citibank credit card account. Double-check the details you provide to avoid any delays or complications in the process.

The Citibank representative will guide you through the information submission process during the call, chat, secure message, or in-person visit, ensuring that all required details are accurately recorded for the addition of the authorized user.

Step 5: Confirm Authorization

Once you have provided all the necessary details to Citibank for adding an authorized user to your credit card, it’s important to confirm and verify the authorization. This step ensures that the authorized user has been officially added to your Citibank credit card account. Here’s what you can expect:

- Confirmation Message: After providing the required details, the Citibank representative will typically provide you with a confirmation message or reference number as proof of the authorized user’s addition.

- Review Details: Take a moment to review the information provided by the representative to ensure its accuracy. Confirm that the authorized user’s name, contact information, and additional account details are correct.

- Clarify Doubts: If you have any concerns or questions regarding the addition of the authorized user, now is the time to seek clarification. Ask the representative about any fees, limitations, or responsibilities associated with having an authorized user on your credit card account.

- Follow-Up Procedures: The Citibank representative will guide you through any additional steps required to finalize the process. This may include signing any necessary documents, agreeing to terms and conditions, or confirming the delivery of the authorized user’s card.

- Keep Documentation: It’s important to keep a record of the confirmation message or reference number provided by Citibank. This documentation can serve as proof of the authorized user’s addition to your credit card account in case of any future disputes or inquiries.

By confirming the authorization, you ensure that all parties involved are on the same page and understand the terms and responsibilities associated with adding an authorized user to your Citibank credit card account.

Once the authorization is confirmed, you and the authorized user can proceed to the next step of receiving the authorized user’s card and discussing the specifics of their usage and responsibilities.

Step 6: Receive Authorized User Card

After confirming the authorization and finalizing the details with Citibank, it’s time to receive the authorized user card. This step involves the delivery of a separate credit card for the authorized user to use under your credit card account. Here’s what you need to know:

- Delivery Timeframe: Citibank will provide an estimate of when the authorized user card will be delivered. It typically takes a few business days to a couple of weeks for the card to arrive at the mailing address provided.

- Activate the Card: Once the authorized user card arrives, ensure that the authorized user activates it following the provided instructions. Activation may require calling a dedicated phone number or registering the card online.

- Discuss Usage Limitations: It’s important to have a conversation with the authorized user about the limitations and guidelines for card usage. Set expectations regarding spending limits, types of purchases allowed, and whether there are any specific restrictions or conditions.

- Monitor Transactions: As the primary cardholder, it’s crucial to monitor the transactions made by the authorized user regularly. Reviewing the activity on the account will help identify any unauthorized charges and ensure that the authorized user is using the card responsibly.

- Review Statements: When you receive your credit card statements, carefully review the charges made by the authorized user. Address any discrepancies or concerns promptly with Citibank’s customer service.

- Communication and Trust: Maintain open lines of communication with the authorized user regarding the card’s usage and responsibilities. Trust and transparency are key to a successful authorized user arrangement, ensuring that both parties understand and respect their roles.

By following these steps and actively managing the authorized user card, you can ensure a smooth experience and reap the benefits of adding an authorized user to your Citibank credit card account.

Remember that you, as the primary cardholder, are responsible for all charges made by the authorized user. It’s important to monitor the card’s usage and address any issues or concerns promptly to maintain the integrity of your credit card account.

Conclusion

Adding an authorized user to your Citibank credit card can be a convenient way to share the benefits of your card and help someone build their credit history. By following the steps outlined in this guide, you can successfully add an authorized user to your credit card account:

- Check eligibility to ensure you meet the requirements set by Citibank.

- Gather all the necessary information, including the authorized user’s details and your account information.

- Contact Citibank through their customer service phone number, online chat, secure message, or in-person visit.

- Provide the required details, such as the authorized user’s information and your account details, accurately and completely.

- Confirm the authorization by reviewing the provided information and seeking any necessary clarifications.

- Receive the authorized user card and discuss usage limitations and responsibilities.

Remember that as the primary cardholder, you are responsible for all charges made by the authorized user. It’s important to monitor the card’s usage regularly and maintain open communication to ensure a successful authorized user arrangement.

Before adding an authorized user, it’s essential to understand the potential impact on your credit score and the authorized user’s credit history. Consider the financial implications and ensure that you choose someone you trust and who will use the card responsibly.

Adding an authorized user to your Citibank credit card can be a beneficial arrangement for both parties. It allows you to share the advantages of your credit card while helping someone establish or improve their credit history. By following the steps outlined in this guide, you can confidently navigate the process and enjoy the benefits of having an authorized user on your Citibank credit card account.