Finance

How To Cancel Kaiser Health Insurance

Modified: December 30, 2023

Learn how to cancel your Kaiser health insurance plan and manage your finances effectively with helpful tips and guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Choosing the right health insurance plan is an important decision that can have a significant impact on your well-being and financial stability. However, life circumstances can change, and you may find yourself in a situation where you need to cancel your current health insurance policy. In this article, we will focus specifically on how to cancel Kaiser Health Insurance.

Kaiser Health Insurance is a well-known provider with a strong reputation for providing comprehensive coverage and excellent healthcare services. However, there may be various reasons why you might need to cancel your Kaiser Health Insurance plan. Whether you have found a better insurance option, experienced a change in employment or financial circumstances, or simply no longer require the coverage, it is essential to understand the process and steps involved in cancelling your policy.

In the following sections, we will guide you through the process of cancelling Kaiser Health Insurance, providing you with the necessary information and considerations to make the procedure as smooth and hassle-free as possible. It is crucial to follow the correct steps and guidelines to ensure that your cancellation is processed correctly and that you avoid any unnecessary fees or penalties.

Please note that the specific cancellation process may vary depending on the type of Kaiser Health Insurance plan you have and the region in which you reside. It is always recommended to refer to your policy documents or contact Kaiser Health Insurance directly to get accurate and up-to-date information regarding your individual circumstances.

Now, let’s dive into the details and explore the steps required to cancel Kaiser Health Insurance.

Understanding Kaiser Health Insurance

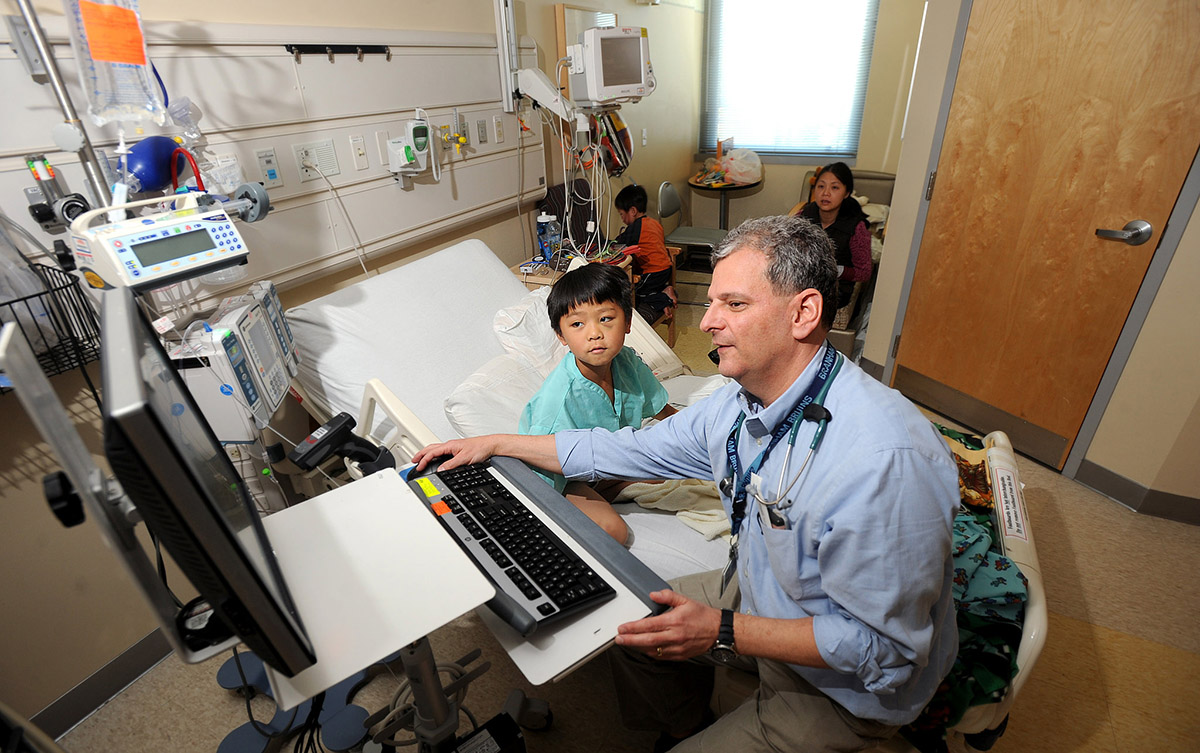

Before we delve into the cancellation process for Kaiser Health Insurance, it is crucial to have a clear understanding of what the insurance provider offers and how their policies work. Kaiser Health Insurance operates as a managed care organization, providing comprehensive health coverage to individuals and families.

Kaiser Health Insurance is known for its unique integrated healthcare delivery model. They not only provide insurance coverage but also operate their own network of healthcare facilities and employ a team of healthcare professionals. This integrated approach allows for seamless coordination of care and a focus on preventive services.

When you enroll in a Kaiser Health Insurance plan, you become a member of their healthcare system. This means that you will receive care from doctors, specialists, and other healthcare providers within the Kaiser network. Kaiser Health Insurance typically operates on a closed network model, meaning that you will be required to see healthcare providers within their network to receive coverage.

One of the distinguishing features of Kaiser Health Insurance is their emphasis on preventive care and wellness. Their integrated approach includes various preventive services such as screenings, vaccinations, and routine health check-ups. Kaiser Health Insurance also offers a range of other services, including hospitalization coverage, prescription drug coverage, and access to specialists.

Understanding the specifics of your Kaiser Health Insurance policy is crucial when considering cancellation. Take the time to review your policy documents and familiarize yourself with the coverage, deductibles, copayments, and any other relevant details. This will help you determine if cancellation is the right decision for your current situation.

Next, let’s explore the reasons why you might consider cancelling your Kaiser Health Insurance policy.

Reasons for Cancelling Kaiser Health Insurance

While Kaiser Health Insurance offers comprehensive coverage and a range of benefits, there can be circumstances where cancelling your policy becomes necessary. Here are some common reasons why individuals may choose to cancel their Kaiser Health Insurance:

- Change in Employment: If you have recently changed jobs and your new employer provides a different health insurance plan, you may opt to cancel your Kaiser Health Insurance to enroll in the new plan.

- Financial Considerations: In some cases, the cost of maintaining Kaiser Health Insurance may become burdensome. If your financial circumstances have changed, and you need to reduce your expenses, cancelling your policy might be a viable option.

- Relocation: If you are moving to an area where Kaiser Health Insurance is not available or does not have a strong network of healthcare providers, you may need to cancel your policy to switch to a different health insurance provider that better serves your new location.

- Better Coverage Options: You might find that another health insurance provider offers more suitable coverage for your specific healthcare needs. Whether it’s access to certain specialists, preferred hospitals, or specific treatments, you may choose to cancel Kaiser Health Insurance to obtain coverage that better meets your requirements.

- Government Programs: If you become eligible for government-sponsored healthcare programs such as Medicaid or Medicare, you may no longer need your Kaiser Health Insurance and may opt to cancel the policy.

- Life Circumstances: Significant life events such as marriage, divorce, or the birth of a child may also prompt the need to cancel Kaiser Health Insurance to adjust coverage or explore different options that better align with your changing needs.

It is important to assess your current situation and carefully evaluate whether cancelling Kaiser Health Insurance is the right choice for you. Additionally, it is recommended to consider alternative insurance options before making a final decision.

Next, let’s explore the steps involved in cancelling your Kaiser Health Insurance policy.

Steps to Cancel Kaiser Health Insurance

When considering cancelling your Kaiser Health Insurance policy, it is essential to follow the proper steps to ensure a smooth and successful cancellation process. Here is a step-by-step guide to help you cancel your Kaiser Health Insurance:

- Review Your Policy: Carefully review your Kaiser Health Insurance policy documents to understand the terms and conditions related to cancellation. Take note of any specific requirements or timeframes for cancellation.

- Contact Kaiser Health Insurance: Reach out to Kaiser Health Insurance directly to inform them of your decision to cancel your policy. You can contact them either by phone or through their online customer service portal. Be prepared to provide your policy details and any necessary identification or verification.

- Provide Written Notification: In most cases, Kaiser Health Insurance will require written notification of your cancellation request. Prepare a written letter stating your intention to cancel your policy, including your policy number, full name, contact information, and the effective date of cancellation. Make sure to include your signature and keep a copy of the letter for your records.

- Submit the Cancellation Letter: Send the written cancellation letter to the designated address provided by Kaiser Health Insurance. Consider using certified mail or a similar method to ensure that the letter is received and documented by the insurance provider.

- Confirm Cancellation: After submitting the cancellation letter, contact Kaiser Health Insurance to confirm that they have received it and that the cancellation process has been initiated. Keep track of any reference numbers or confirmation emails for future reference.

- Pay Outstanding Balances: If you have any outstanding balances or premiums due, make sure to settle them before cancelling your policy. Ensure that you have paid all necessary fees and charges to avoid any potential complications or penalties.

- Return Membership Cards: If you received membership cards or any physical materials from Kaiser Health Insurance, return them to the company as part of the cancellation process. This will help finalize the termination of your policy.

Please note that these steps serve as a general guide, and the specific cancellation process for Kaiser Health Insurance may vary depending on your policy and location. It is recommended to reach out to Kaiser Health Insurance directly for accurate and up-to-date information.

Next, we will discuss the importance of contacting Kaiser Health Insurance during the cancellation process.

Contacting Kaiser Health Insurance

When it comes to cancelling your Kaiser Health Insurance policy, it is crucial to have direct communication with the insurance provider to ensure a smooth process and address any potential concerns or questions. Here are a few important considerations when contacting Kaiser Health Insurance:

1. Customer Service: Kaiser Health Insurance has a dedicated customer service department that can assist you with the cancellation process. Contact their customer service line or visit their website to find the appropriate contact information. Be prepared to provide your policy details and any necessary identification or verification.

2. Written Communication: In some instances, Kaiser Health Insurance may require written notification for the cancellation request. This can be in the form of a written letter or an online form provided by the insurance company. Follow their instructions precisely and provide all required information accurately.

3. Effective Date: When communicating with Kaiser Health Insurance, specify the desired effective date of cancellation. This is the date from which you no longer wish to have coverage. Ensure that you provide this information clearly during your conversation or in your written notification.

4. Confirmation of Cancellation: It is essential to request confirmation of your cancellation from Kaiser Health Insurance. This will serve as proof that you have initiated the cancellation process and will provide you with peace of mind. Keep any confirmation emails, reference numbers, or documentation for your records.

5. Consider Follow-Up: If you have not received confirmation of your cancellation within a reasonable timeframe, it may be necessary to follow up with Kaiser Health Insurance. Contact their customer service department again to inquire about the status of your cancellation and to ensure that it is being processed accordingly.

Remember to always be courteous and professional when communicating with Kaiser Health Insurance representatives. They are there to assist you, and maintaining a positive rapport can help expedite the cancellation process and address any concerns effectively.

Next, let’s discuss important considerations you should be aware of before cancelling your Kaiser Health Insurance policy.

Important Considerations Before Cancelling

Before finalizing the decision to cancel your Kaiser Health Insurance policy, it is crucial to carefully consider a few important factors. These considerations will help ensure that you make an informed decision that aligns with your healthcare needs and financial circumstances:

1. Alternative Coverage Options: Evaluate whether there are alternative health insurance options available to you that may better suit your current needs. Research other insurance providers, compare coverage plans, and assess the associated costs and benefits. Make sure that you have a viable alternative in place before cancelling your Kaiser Health Insurance.

2. Qualifying Life Event: If you are cancelling your Kaiser Health Insurance outside of the open enrollment period, ensure that you have a qualifying life event that allows for a special enrollment period. Examples of qualifying events include marriage, divorce, having a child, or losing existing coverage. Consult the guidelines provided by the insurance provider or seek assistance from a healthcare navigator to understand if you qualify.

3. Cost-Benefit Analysis: Consider the financial implications of cancelling your Kaiser Health Insurance. Assess the premiums, deductibles, and out-of-pocket costs associated with your current policy and compare them to other insurance options. Take into account your projected healthcare needs and evaluate the total cost of coverage to determine if cancelling is financially prudent.

4. Employer-Sponsored Coverage: If you are considering cancelling your Kaiser Health Insurance due to a change in employment, explore the health insurance coverage provided by your new employer. Understand the terms, coverage options, and any waiting periods associated with the employer-sponsored plan. This will help you make an informed decision regarding cancellation.

5. Future Healthcare Needs: Assess your future healthcare needs and consider whether the coverage provided by Kaiser Health Insurance may still be beneficial. Evaluate factors such as the availability of specific healthcare providers, access to specialists, and the quality of healthcare services within Kaiser’s network. Consider if cancelling your policy may limit your options in the future.

6. Consult with an Expert: If you have any doubts or concerns regarding cancelling your Kaiser Health Insurance, it can be helpful to consult with a healthcare insurance expert or a financial advisor. They can provide personalized guidance based on your specific situation and help weigh the pros and cons of cancellation.

Taking the time to carefully consider these factors will help ensure that you make an informed decision about cancelling your Kaiser Health Insurance. Remember to review and fully understand the terms and conditions of your policy before proceeding with the cancellation process.

Next, let’s recap the main points covered in this article.

Conclusion

Cancelling your Kaiser Health Insurance policy is a significant decision that requires careful consideration and proper steps to ensure a smooth process. Understanding the details of your policy, reasons for cancellation, and the necessary steps involved are key to successfully terminating your coverage.

In this article, we discussed the importance of understanding Kaiser Health Insurance and its integrated healthcare model before deciding to cancel. We explored various reasons why individuals might choose to cancel their policy, such as changes in employment, financial considerations, or better coverage options.

We then outlined the steps involved in cancelling Kaiser Health Insurance, which include reviewing your policy, contacting the insurance provider, providing written notification, submitting the cancellation letter, and confirming the cancellation. We also emphasized the importance of paying outstanding balances and returning membership cards, if applicable.

Contacting Kaiser Health Insurance directly and maintaining effective communication plays a crucial role in ensuring a smooth cancellation process. Whether you need to reach out for information, clarification, or confirmation, their customer service department is there to assist you.

Before cancelling your Kaiser Health Insurance, we highlighted the importance of considering alternative coverage options, potential qualifying life events, cost-benefit analysis, employer-sponsored coverage, future healthcare needs, and seeking expert advice if needed. By considering these factors, you can make an informed decision that aligns with your specific circumstances.

Remember that the cancellation process may vary based on your individual policy and location. Always refer to your policy documents or reach out directly to Kaiser Health insurance for accurate and up-to-date information.

Finally, make sure to keep copies of all correspondence and documentation related to your cancellation for future reference. By following the proper steps and considering all relevant factors, you can successfully cancel your Kaiser Health Insurance policy and explore other options that better suit your needs.